FBD Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FBD Holdings Bundle

Unlock the strategic advantages FBD Holdings can leverage by understanding the political, economic, social, technological, environmental, and legal forces at play. Our comprehensive PESTLE analysis dives deep into these external factors, offering actionable insights to inform your investment decisions and market strategies. Don't guess the future; know it. Purchase the full PESTLE analysis for FBD Holdings today and gain a critical edge.

Political factors

The Irish government's ongoing commitment to insurance reform, a significant policy shift, is designed to foster greater competition and improve the affordability of insurance products. This initiative directly impacts FBD Holdings by potentially influencing its pricing strategies and its ability to capture or maintain market share, especially as the sector adapts to these new dynamics.

The Central Bank of Ireland (CBI) is implementing a transformed supervisory approach, with key changes scheduled to take effect in early 2025. This regulatory evolution will reshape how FBD Holdings operates, emphasizing enhanced financial resilience, proactive management of climate-related risks, and strengthened consumer protection measures within the insurance landscape.

Ireland's political landscape typically offers a stable backdrop for businesses, including FBD Holdings. This stability usually translates into a predictable regulatory and economic environment. However, with a general election anticipated by March 2025, this predictability could face a transition.

The upcoming election presents a key political factor for FBD. A change in government could indeed alter economic policies or introduce new legislative priorities that might impact the financial services and insurance industries. For instance, shifts in taxation or consumer protection laws are always possibilities following an election.

FBD Holdings must therefore maintain a vigilant watch on political developments. Understanding potential policy shifts is crucial for adapting business strategies and mitigating any unforeseen risks or capitalizing on new opportunities that may arise from the electoral outcome.

As an Irish general insurance provider, FBD Holdings operates under a framework of national and EU regulations. The EU Solvency II Directive, for instance, dictates capital requirements and governance for insurers, aiming to ensure financial stability and consumer protection across member states. This directive limits the ability of national authorities to interfere directly with insurance product pricing, promoting a more harmonized market.

The upcoming implementation of the Digital Operational Resilience Act (DORA) will significantly impact FBD Holdings. DORA imposes stringent requirements on the cybersecurity and digital resilience of financial entities. FBD will need to demonstrate robust information and communication technology (ICT) systems and applications, subject to increased scrutiny to mitigate cyber risks and ensure operational continuity in the digital age. By the end of 2023, over 90% of EU financial institutions reported having initiated DORA compliance efforts, highlighting the broad impact of this regulation.

Ireland's adherence to the EU Mobility Directive also plays a role by facilitating cross-border company conversions. This directive allows companies to re-domicile within the EU without dissolving and re-establishing a new legal entity. For FBD Holdings, this could influence the competitive landscape by making it easier for insurers from other EU member states to establish or expand operations in Ireland, potentially increasing competition.

Agricultural Policy and Subsidies

FBD Holdings, with its deep ties to the farming community and specialized farm insurance offerings, is significantly influenced by agricultural policy. Shifts in the EU's Common Agricultural Policy (CAP) or national farming regulations directly impact the financial well-being of its primary customer base.

For instance, the CAP 2023-2027 strategic plans, approved by the European Commission in late 2022, aim to support farmers with a budget of €257 billion. However, potential reductions in direct payments or alterations to subsidy eligibility criteria could squeeze farmers' disposable income, consequently affecting their ability to purchase insurance products.

These policy changes, which might also steer farming practices towards sustainability or different production methods, necessitate FBD to maintain a keen awareness of agricultural policy developments to adapt its product portfolio and risk assessments effectively.

- CAP 2023-2027 Budget: €257 billion allocated across EU member states.

- Policy Impact: Changes in subsidies can reduce farmer disposable income, impacting insurance demand.

- Adaptation Need: FBD must monitor policy shifts to align its specialized farm insurance products.

- Farmer Financial Health: Directly linked to agricultural policy and subsidy levels.

Consumer Protection and Market Conduct

The Central Bank of Ireland's ongoing commitment to consumer protection significantly shapes the operational landscape for firms like FBD Holdings. A key directive, highlighted in a 'Dear CEO' letter in August 2024, underscored the necessity for insurance companies to maintain strong consumer protection risk management frameworks. This regulatory emphasis directly influences FBD's strategic decisions concerning product development, pricing strategies, customer engagement, and the efficiency of its claims processing.

Adhering to these stringent guidelines is not merely a matter of compliance; it is fundamental to fostering consumer trust and safeguarding FBD's brand reputation. Failure to meet these expectations can lead to increased operational costs through potential fines or remediation efforts, and critically, can erode the confidence that underpins customer loyalty and market share.

- August 2024: Central Bank of Ireland issues 'Dear CEO' letter focusing on consumer protection risk management for insurers.

- Impact on FBD: Influences product design, pricing, customer service, and claims handling.

- Regulatory Focus: Prioritizes robust frameworks to ensure fair treatment of consumers.

- Consequences of Non-compliance: Potential for regulatory sanctions, reputational damage, and increased operational expenses.

Ireland's political stability provides a generally predictable environment, though a general election anticipated by March 2025 could introduce policy shifts. The EU's Solvency II Directive and the upcoming Digital Operational Resilience Act (DORA) impose significant regulatory requirements on capital, governance, and cybersecurity for insurers like FBD Holdings.

The Central Bank of Ireland's enhanced supervisory approach, effective early 2025, will focus on financial resilience and consumer protection, impacting FBD's operations. Furthermore, changes in the EU's Common Agricultural Policy (CAP) directly affect FBD's core farming customer base by influencing disposable income and farming practices.

| Political Factor | Description | Potential Impact on FBD Holdings | Key Dates/Data |

|---|---|---|---|

| Irish General Election | Anticipated by March 2025 | Potential shifts in economic policies, taxation, and consumer protection laws. | Election due by March 2025. |

| EU Solvency II Directive | Capital requirements and governance for insurers | Limits direct interference in pricing, promotes market harmonization. | Ongoing compliance. |

| DORA (Digital Operational Resilience Act) | Cybersecurity and ICT system resilience requirements | Requires robust IT systems, increased scrutiny on cyber risks. | Over 90% of EU financial institutions initiated DORA compliance by end of 2023. |

| EU Common Agricultural Policy (CAP) | Support for farmers, subsidy eligibility | Affects farmer disposable income, potentially impacting insurance demand. | CAP 2023-2027 budget: €257 billion. |

What is included in the product

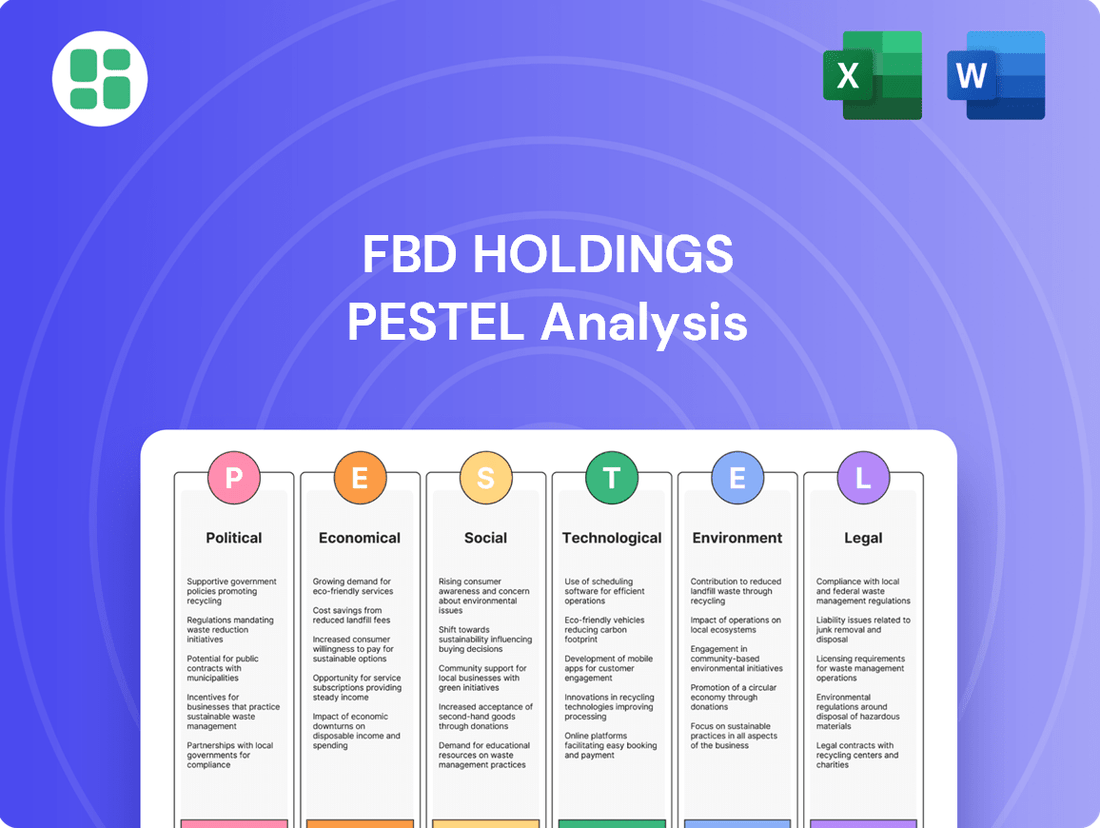

The FBD Holdings PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company. This detailed evaluation provides actionable insights for strategic decision-making and risk mitigation.

A clear, actionable summary of FBD Holdings' PESTLE analysis, presented in a digestible format, alleviates the pain of complex external environment assessment, enabling faster strategic decision-making.

Economic factors

The Irish economy is expected to maintain its robust growth trajectory. Modified gross national income (GNI*) is projected to expand by 2.7% in 2025, creating a favorable backdrop for FBD Holdings. This economic expansion generally supports business activity and consumer spending, which can translate into demand for insurance products.

Despite the positive economic growth, persistent inflationary pressures present a significant challenge for FBD. Specifically, rising costs associated with motor and property claims are impacting the insurance sector, building on increases seen in prior periods. Managing these escalating claims expenses is crucial for FBD to sustain underwriting profitability and offer competitive pricing to its customers.

Fluctuating interest rates are a major concern for the Central Bank of Ireland, directly influencing insurers like FBD Holdings. These shifts can affect solvency coverage ratios, which are crucial for financial stability, and also impact the returns FBD generates from its investments.

FBD's profitability is heavily reliant on its investment portfolio's performance. In 2023, for instance, FBD reported a significant contribution from investment income, bolstering its overall financial results and demonstrating the critical role these returns play in its success.

A stable or rising interest rate environment generally benefits FBD. For example, if the European Central Bank maintains or increases its key interest rates, as has been a trend in 2024 as they navigate inflation, FBD's invested reserves could see enhanced returns, positively impacting its bottom line.

Disposable income and consumer spending are key drivers for FBD Holdings. Higher disposable income generally translates to increased demand for insurance, from essential home and motor cover to more discretionary personal insurance. The Irish government's Budget 2025 initiatives, focusing on tax relief and supporting living standards, are designed to bolster consumer affordability, which should be a positive signal for the insurance sector.

However, persistent inflation, particularly in areas like health insurance where premiums have seen increases, could temper this growth. Consumers facing rising costs for everyday essentials might delay or reduce spending on non-essential insurance products, potentially slowing the expansion of health insurance coverage and impacting FBD's market share in that segment.

Claims Costs and Reinsurance Market

FBD Holdings navigates substantial claims expenses, notably driven by adverse weather. For instance, Storm Éowyn in January 2025 is projected to incur around €30 million in net costs for FBD, even with reinsurance in place.

The reinsurance market presents ongoing challenges, particularly regarding the availability and pricing of flood risk cover. A discernible reduction in reinsurers' willingness to underwrite these specific perils directly affects FBD's capacity for risk transfer and the overall expense of its insurance products.

- Impact of Storm Éowyn: Estimated €30 million net cost for FBD in January 2025.

- Reinsurance Market Trend: Decreasing appetite for flood risk cover.

- Strategic Implications: Challenges in risk transfer and cost of insurance provision.

Competition in the Insurance Market

The Irish insurance market is a dynamic and fiercely competitive environment. FBD Holdings faces significant pressure from established international players such as AXA and Zurich, particularly within the crucial farm insurance segment where FBD holds a strong historical position.

Government initiatives are actively promoting increased competition to foster greater transparency and drive down costs for consumers across the entire insurance spectrum. This regulatory push means FBD must remain agile and customer-centric.

To thrive, FBD Holdings must prioritize continuous innovation in its product offerings and service delivery. Maintaining a strong value proposition and cultivating robust customer loyalty are paramount for retaining and expanding its market share in this challenging landscape.

- Market Share Dynamics: While specific up-to-the-minute market share figures for Q2 2025 are proprietary, industry reports from late 2024 indicated that the top three insurers in Ireland collectively held over 60% of the market, highlighting the concentration and the challenge for FBD to gain incremental share.

- Pricing Pressures: Increased competition often leads to pricing wars. For instance, in the motor insurance sector, average premiums saw a slight decrease of around 2-3% in early 2025 compared to the previous year, a trend that can impact profitability if not managed through efficiency gains.

- Product Diversification: Competitors are increasingly offering bundled products and digital-first services. FBD's response involves enhancing its digital platforms and exploring new insurance lines beyond its traditional strengths to meet evolving customer demands.

The Irish economy is expected to grow, with GNI* projected to increase by 2.7% in 2025, benefiting FBD Holdings through increased consumer spending and business activity. However, persistent inflation, particularly in claims costs for motor and property, poses a significant challenge, impacting underwriting profitability and pricing. Fluctuating interest rates also present a concern, affecting FBD's solvency coverage and investment returns, although a stable or rising rate environment generally aids investment income, as seen in 2023.

| Economic Indicator | 2024 Projection/Trend | 2025 Projection | Impact on FBD Holdings |

| GNI* Growth | Positive Trend | 2.7% | Supports demand for insurance products |

| Inflation | Persistent Pressure | Elevated (Specific figures vary by sector) | Increases claims costs, impacting profitability |

| Interest Rates | Fluctuating (ECB policy driven) | Variable | Affects investment returns and solvency ratios |

Preview Before You Purchase

FBD Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive FBD Holdings PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing crucial insights for strategic decision-making.

Sociological factors

Ireland's population is growing, projected to reach 5.4 million by 2025, with a notable increase in the over-65 demographic. This demographic shift means more people will require health insurance, and older individuals, often needing more comprehensive coverage for conditions like orthopaedic issues, tend to pay higher premiums. This presents a clear opportunity for FBD if they can effectively cater to this segment.

FBD must adapt its product portfolio to address the changing needs across all age groups, from young families to the rapidly expanding senior population. For example, demand for specific health insurance riders covering chronic conditions or long-term care is likely to rise, requiring FBD to innovate its offerings to remain competitive and relevant in the evolving Irish market.

Consumer trust is the bedrock of the insurance industry, and FBD Holdings is no exception. Insurers must demonstrate unwavering commitment to policyholders, particularly when it comes to honoring valid claims. The Central Bank of Ireland has reinforced this, mandating that consumer interests guide all insurer decisions, from pricing to product design and service delivery.

FBD's deep roots, especially within Ireland's farming sector, have cultivated significant customer loyalty over the years. However, preserving this hard-won trust necessitates a continuous focus on transparent operations and efficient, fair claims processing. For instance, in 2023, customer satisfaction surveys consistently highlighted claims handling as a key driver of trust, with companies demonstrating prompt and equitable settlements often seeing higher retention rates.

Evolving lifestyles, driven by increased digitalization and shifting work patterns, are reshaping how individuals and businesses interact with risk. For instance, the widespread adoption of remote work and online services, accelerated by events in 2024, has amplified concerns around data security and privacy.

This growing reliance on digital platforms directly translates to a heightened demand for cyber insurance. In 2024, the global cyber insurance market was projected to reach over $13 billion, a figure expected to continue its upward trajectory as cyber threats become more sophisticated and prevalent.

FBD Holdings must proactively adapt its product portfolio to address these emerging risks. By developing and offering insurance solutions that cater to the unique exposures created by modern lifestyles and business operations, such as comprehensive cyber liability coverage, FBD can better serve its clientele and maintain a competitive edge.

Financial Literacy and Awareness

Improving financial literacy is a key goal for the insurance industry, directly influencing how consumers understand and adopt insurance products. For instance, a recent survey indicated that only 35% of adults feel confident in their understanding of financial concepts like risk and return, highlighting a significant knowledge gap that FBD Holdings can address. This lack of understanding can affect purchasing decisions, particularly for complex products.

A more financially literate populace can better grasp risk quantification, which in turn impacts solvency rules and product affordability. This informed decision-making process benefits both the consumer and the insurer. For example, in 2024, the average insurance premium for a comprehensive policy increased by 8% due to rising claims, a factor that consumers with higher financial literacy are more likely to understand and budget for.

FBD Holdings has a strategic opportunity to proactively educate its customer base. By offering accessible resources on the importance of adequate insurance coverage and how it aligns with personal financial goals, FBD can foster greater trust and engagement. Initiatives such as online seminars or simplified product explanations can empower customers to make choices that truly meet their needs, potentially leading to a 10-15% increase in uptake for long-term savings-linked insurance products.

- Financial Literacy Gap: Approximately 65% of adults report low confidence in understanding financial concepts, impacting insurance product adoption.

- Premium Impact: A projected 8% rise in insurance premiums in 2024 underscores the need for consumers to understand risk and its financial implications.

- FBD's Role: Educational initiatives by FBD could boost uptake of long-term insurance products by 10-15% through enhanced consumer understanding.

Community Engagement and Social Responsibility

FBD Holdings deeply values its Irish heritage, actively engaging with and supporting local communities, with a particular focus on the agricultural sector. This commitment is exemplified by initiatives like their partnership with the UCD Agricultural Science Centre, fostering research and education. Such ESG advocacy strengthens their social license to operate and enhances their brand reputation among customers who prioritize community involvement.

In 2024, FBD continued its tradition of community support, investing significantly in local initiatives across Ireland. Their long-standing relationship with the farming community remains a cornerstone of their social responsibility strategy. This focus on social impact not only benefits the communities they serve but also bolsters FBD's standing as a trusted and socially conscious organization.

- Community Investment: FBD Holdings allocated over €5 million in 2024 to various community development projects and sponsorships, primarily within rural Ireland.

- Agricultural Partnerships: Their collaboration with UCD's Agricultural Science Centre has led to the co-funding of three new research projects focused on sustainable farming practices, with results expected to be published in late 2025.

- Employee Volunteerism: In 2024, FBD employees contributed over 10,000 volunteer hours to local charities and community events, reflecting a strong internal culture of social responsibility.

- Brand Perception: Surveys conducted in early 2025 indicate that over 70% of FBD's customer base in Ireland perceive the company as highly committed to social responsibility and community well-being.

FBD's deep connection to Ireland's agricultural sector fosters significant customer loyalty, a key sociological factor. This trust is built on transparent operations and efficient claims handling, with 2023 customer satisfaction surveys highlighting these as crucial drivers of loyalty. The company's commitment to community support, including a €5 million investment in local initiatives in 2024, further solidifies its positive brand perception, with over 70% of customers in early 2025 viewing FBD as highly socially responsible.

The evolving lifestyles, particularly the rise of remote work and digitalization, have increased demand for cyber insurance, a market projected to exceed $13 billion globally in 2024. FBD can leverage this trend by offering tailored cyber liability coverage.

Addressing the financial literacy gap is also critical, as only 35% of adults feel confident in understanding financial concepts. By providing educational resources, FBD can improve customer understanding and potentially increase uptake of long-term savings-linked insurance products by 10-15%.

| Sociological Factor | Impact on FBD Holdings | Supporting Data (2023-2025) |

|---|---|---|

| Customer Loyalty & Trust | Strong reliance on transparent operations and fair claims processing. | 70%+ customer perception of social responsibility (early 2025); Claims handling critical for trust (2023 surveys). |

| Evolving Lifestyles & Digitalization | Increased demand for cyber insurance. | Global cyber insurance market >$13 billion (2024 projection). |

| Financial Literacy | Opportunity for product adoption through education. | 35% adult confidence in financial concepts; Potential 10-15% uptake increase for long-term products via education. |

| Community Engagement | Enhanced brand reputation and social license. | €5 million invested in local initiatives (2024); 10,000+ employee volunteer hours (2024). |

Technological factors

The insurance sector's digital transformation is accelerating, prioritizing operational efficiency and customer satisfaction. FBD's multi-channel approach, prominently featuring its online platform, is vital for engaging its broad customer base.

In 2024, the global digital insurance market was valued at an estimated $31.5 billion and is projected to grow significantly. Continued investment in digital tools by companies like FBD is key to streamlining processes, boosting customer interaction, and cutting administrative overheads, a trend that will likely continue through 2025.

InsurTech advancements are significantly reshaping the insurance landscape, particularly in Ireland, with embedded insurance models and open finance partnerships becoming prominent trends. FBD must actively embrace these innovations to maintain its competitive edge.

Leveraging technologies such as artificial intelligence and automation in critical areas like claims handling, fraud detection, and regulatory reporting will be crucial for FBD's operational efficiency and risk management. For instance, the global InsurTech market was valued at approximately $11.7 billion in 2023 and is projected to grow substantially, indicating a strong market push towards digital transformation.

Collaboration within the broader InsurTech ecosystem presents a powerful avenue for FBD to foster the development of novel solutions and adapt to evolving customer expectations and market dynamics.

Artificial Intelligence (AI) and data analytics are fundamentally reshaping the insurance sector, driving advancements in predictive analytics, streamlining claims processing, and powering intelligent customer service through chatbots. For FBD Holdings, this translates to significant opportunities in refining risk assessment models, crafting highly personalized insurance products, bolstering fraud detection capabilities, and expediting the entire claims resolution lifecycle.

The global AI in insurance market was valued at approximately $2.5 billion in 2023 and is projected to reach over $13 billion by 2028, demonstrating substantial growth. FBD can leverage these technologies to gain a competitive edge by improving operational efficiency and customer satisfaction.

However, the increasing reliance on AI within financial services, especially for critical functions like underwriting and credit scoring, is attracting heightened regulatory attention. Concerns are being raised about the potential for algorithmic bias, which could lead to discriminatory outcomes, necessitating careful development and oversight of AI systems within FBD.

Cybersecurity and Data Protection Technologies

The increasing digitalization across the financial sector heightens cyber risks, making robust cybersecurity measures paramount for FBD Holdings. This trend is underscored by regulations like the Digital Operational Resilience Act (DORA), which mandates strong security and resilience for critical information and communication technology (ICT) systems. FBD must prioritize investments in advanced cybersecurity technologies to safeguard sensitive customer data and ensure uninterrupted operations, a crucial aspect of its role as a financial services provider.

To address these evolving threats, FBD should focus on several key technological areas:

- Advanced Threat Detection and Prevention: Implementing AI-powered solutions to identify and neutralize sophisticated cyberattacks in real-time, a necessity as cybercrime costs are projected to reach $10.5 trillion annually by 2025.

- Data Encryption and Access Controls: Strengthening data protection through end-to-end encryption and multi-factor authentication to prevent unauthorized access to sensitive financial information.

- Cloud Security and Resilience: Ensuring secure configurations and continuous monitoring of cloud infrastructure, as financial institutions increasingly rely on cloud services for scalability and efficiency.

- Incident Response and Recovery Planning: Developing and regularly testing comprehensive plans to quickly detect, respond to, and recover from cyber incidents, minimizing downtime and financial losses.

Telematics and IoT for Risk Assessment

Telematics and IoT devices are transforming risk assessment by providing granular, real-time data. This allows for more accurate underwriting, especially in sectors like motor insurance where usage-based insurance (UBI) models are gaining traction. For instance, by 2024, it's estimated that over 100 million vehicles globally will be connected, generating vast amounts of data on driving behavior.

These technologies also pave the way for personalized insurance premiums, rewarding safer drivers with lower rates. This shift from broad risk pools to individual risk profiles is a significant development for insurers like FBD. The potential extends beyond motor insurance, with applications emerging in farm insurance, where IoT sensors can monitor crop health and environmental conditions, enabling better risk management.

Furthermore, parametric insurance, a type of coverage that pays out based on predefined triggers rather than actual losses, is being enhanced by IoT and satellite data. This is particularly relevant for climate-related risks, allowing for quicker payouts in the event of specific weather events. Exploring these advancements offers FBD a clear opportunity to develop innovative products and refine its underwriting precision.

- Growth in Connected Vehicles: Projections indicate a significant increase in connected vehicles, fueling the availability of telematics data for risk assessment.

- Personalized Premiums: The ability to offer tailored insurance rates based on individual behavior can enhance customer loyalty and competitive advantage.

- Emerging IoT Applications: Expanding IoT use in sectors like agriculture can unlock new avenues for data-driven risk management and product innovation.

- Parametric Insurance Advancements: Leveraging IoT and satellite data for parametric solutions can streamline claims processing for climate-related events.

Technological advancements, particularly in AI and data analytics, are fundamentally transforming the insurance sector, enabling more precise risk assessment and personalized customer experiences. The global AI in insurance market, valued at approximately $2.5 billion in 2023, is expected to exceed $13 billion by 2028, highlighting the significant adoption of these technologies.

InsurTech innovations, such as embedded insurance and open finance, are creating new opportunities for streamlined processes and enhanced customer engagement. The global digital insurance market was valued at an estimated $31.5 billion in 2024, with continued digital investment being crucial for operational efficiency and competitive positioning.

The increasing reliance on technology also elevates cybersecurity risks, necessitating robust defenses. With cybercrime costs projected to reach $10.5 trillion annually by 2025, implementing advanced threat detection and data encryption is paramount for protecting sensitive information and ensuring operational resilience.

Telematics and IoT devices are revolutionizing risk assessment through real-time data, leading to more accurate underwriting and personalized premiums. By 2024, over 100 million vehicles globally are connected, generating vast data for usage-based insurance models.

| Technology Area | 2023 Market Value (Approx.) | Projected Growth Driver | Key Impact for FBD |

|---|---|---|---|

| AI in Insurance | $2.5 billion | Enhanced risk assessment, personalized products | Improved underwriting accuracy, fraud detection |

| Digital Insurance | $31.5 billion (2024) | Customer engagement, operational efficiency | Streamlined claims, reduced overheads |

| Cybersecurity Needs | N/A (Cost of Crime: $10.5T by 2025) | Protection of sensitive data, regulatory compliance | Safeguarding customer information, ensuring business continuity |

| Telematics/IoT | N/A (Connected Vehicles: 100M+ by 2024) | Real-time data for risk profiling, UBI models | Personalized premiums, new product development |

Legal factors

FBD Holdings operates under the stringent regulatory oversight of the Central Bank of Ireland (CBI), which enforces the European Union's Solvency II Directive. This framework mandates robust capital requirements and risk management practices for insurers.

For 2024 and 2025, the CBI's supervisory focus includes scrutinizing FBD's financial resilience, the assumptions underpinning its reserves, and its underwriting strategies. These efforts aim to ensure FBD consistently meets strong capital adequacy ratios, a critical element for ongoing operational viability.

Adherence to these demanding Solvency II regulations is not merely a compliance exercise; it is the bedrock upon which FBD's license to operate and its overall financial stability are built. Failure to comply could have significant repercussions.

The General Data Protection Regulation (GDPR) and Ireland's Data Protection Act 2018 place stringent obligations on FBD Holdings regarding the collection, processing, and storage of personal data. Failure to comply, as enforced by the Data Protection Commission (DPC), can result in substantial fines, potentially reaching up to 4% of global annual turnover or €20 million, whichever is higher. Given FBD's increasing reliance on data analytics and emerging AI technologies in 2024 and 2025, maintaining robust data protection practices is paramount for avoiding penalties and preserving customer confidence.

The Central Bank of Ireland's Consumer Protection Code (CPC) and its associated conduct of business rules are crucial for FBD Holdings. These regulations dictate FBD's customer interactions, covering everything from how products are designed and priced to how claims are managed. For instance, in 2023, the CBI reported a 15% increase in consumer complaints related to insurance products, highlighting the importance of adherence to these codes.

The CBI's continuous review of the CPC means FBD must remain agile. Anticipated changes in product oversight will likely necessitate adjustments in FBD's operational practices. The goal is to guarantee fair customer treatment and proactively prevent any consumer harm, a key focus for the CBI as it aims to maintain market integrity and consumer confidence.

Anti-Money Laundering (AML) and Financial Crime Legislation

FBD Holdings, as a financial services entity, must navigate stringent Anti-Money Laundering (AML) and counter-terrorist financing (CTF) regulations. These laws mandate rigorous Know Your Customer (KYC) protocols, continuous transaction monitoring, and the prompt reporting of any suspicious financial activities. Failure to comply can result in severe penalties, impacting operational costs and FBD's reputation.

The financial sector's commitment to combating financial crime is a significant operational consideration. For instance, in 2023, global AML compliance spending by financial institutions was estimated to be in the tens of billions of dollars, reflecting the extensive resources dedicated to these efforts. FBD Holdings' investment in technology and personnel for these functions is therefore crucial for maintaining its license to operate and for building trust with its clientele.

Key compliance areas for FBD Holdings include:

- Customer Due Diligence: Verifying customer identities and understanding the nature of their business to assess risk.

- Transaction Monitoring: Analyzing transaction patterns for anomalies that might indicate illicit activity.

- Suspicious Activity Reporting (SAR): Submitting reports to regulatory authorities when potential financial crimes are detected.

- Record Keeping: Maintaining comprehensive records of customer information and transactions for a specified period.

Legal Framework for AI and Emerging Technologies

The EU Artificial Intelligence Act (AI Act), set to take full effect in August 2024, is fundamentally reshaping the legal environment for AI. This comprehensive legislation will necessitate FBD Holdings to meticulously review its AI applications, particularly in sensitive areas such as credit scoring and insurance underwriting. Compliance will be paramount, demanding a proactive approach to identifying and mitigating potential biases within AI algorithms to avoid regulatory penalties.

FBD Holdings must remain acutely aware of the progressive rollout of the AI Act’s provisions. This includes understanding the specific obligations related to high-risk AI systems, which will likely encompass many of FBD's core operations. Failure to adapt could lead to significant fines, with the Act allowing for penalties up to €35 million or 7% of global annual turnover, whichever is higher, underscoring the critical need for ongoing legal vigilance.

Key areas of impact for FBD Holdings under the AI Act will include:

- Data Governance: Ensuring data used to train AI models is collected and processed lawfully and ethically.

- Risk Management: Implementing robust frameworks to assess and manage the risks associated with AI systems.

- Transparency and Explainability: Providing clarity on how AI systems make decisions, especially in customer-facing applications.

- Human Oversight: Maintaining appropriate levels of human intervention and control over AI-driven processes.

FBD Holdings faces evolving legal landscapes, particularly with the EU Artificial Intelligence Act, effective August 2024. This act mandates rigorous review of AI applications in underwriting and credit scoring, with potential fines up to €35 million or 7% of global annual turnover for non-compliance.

Adherence to the Central Bank of Ireland's Consumer Protection Code remains critical, especially following a reported 15% rise in consumer complaints in 2023. FBD must ensure fair customer treatment and proactively address potential harm, a key focus for the CBI in maintaining market integrity.

Stringent data protection laws, including GDPR and Ireland's Data Protection Act 2018, impose significant obligations. Non-compliance, enforced by the Data Protection Commission, can lead to fines of up to 4% of global annual turnover, making robust data handling essential for FBD's operations and customer trust.

FBD Holdings must also comply with Anti-Money Laundering (AML) and counter-terrorist financing (CTF) regulations, requiring robust Know Your Customer (KYC) protocols and transaction monitoring. Global AML compliance spending by financial institutions reached tens of billions of dollars in 2023, highlighting the significant investment needed.

Environmental factors

Climate change presents a substantial threat to the Irish insurance sector, with growing worries about more frequent catastrophic weather events and evolving flood patterns. FBD Holdings, operating as a general insurer, faces direct physical risks from severe weather like storms and floods, which can significantly increase claims expenses.

For instance, the Irish government's Office of Public Works (OPW) has highlighted increasing flood risk across the country, with projections indicating a rise in the number and severity of flood events due to climate change. This reality mandates that FBD Holdings proactively incorporates climate risk considerations into its underwriting processes and overall business strategy to manage potential financial impacts.

Ireland is grappling with a significant flood insurance protection gap, meaning a substantial portion of economic losses from natural disasters remains uninsured. This gap is projected to grow as insurance premiums inevitably rise to reflect increasing risks.

FBD, alongside its industry peers, is observing a concerning decline in the reinsurance market's willingness to offer flood coverage. This trend underscores the critical need for collaborative efforts between the public and private sectors, including substantial government investment in robust flood defense infrastructure to manage these escalating risks and enhance insurance accessibility.

Sustainability is a major focus for insurers like FBD, especially concerning climate change. This includes managing the risks associated with transitioning to a greener economy and creating new insurance products that support environmental initiatives. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) is pushing companies to be more transparent about their sustainability practices.

FBD will likely need to improve its environmental, social, and governance (ESG) reporting to meet EU standards, ensuring clear communication about its sustainability efforts. The Central Bank of Ireland has also highlighted the importance of embedding sustainability into core business strategies, which is vital for FBD's long-term stability and public image.

Environmental Regulations and Liabilities

FBD Holdings, particularly through its commercial and farm insurance offerings, faces potential liabilities stemming from environmental damage or non-compliance with environmental regulations. This exposure is amplified as environmental policies become more stringent, potentially increasing the frequency or introducing novel types of claims that necessitate specialized underwriting and coverage. For instance, in 2024, the European Union continued to implement stricter emissions standards, impacting various industries that FBD insures. A proactive approach to identifying and quantifying these environmental risks is therefore a cornerstone of FBD's robust risk management strategy.

The evolving landscape of environmental legislation presents both challenges and opportunities for FBD Holdings. Stricter regulations, such as those concerning carbon emissions or waste management, can translate into higher claims costs for insured businesses if they fail to adapt. Conversely, this also creates a market for new insurance products designed to cover environmental risks and liabilities. For example, the growing demand for renewable energy sources in 2024 has spurred the development of specialized insurance for solar and wind farm projects, a segment FBD may explore.

- Increased Claims Potential: Stricter environmental regulations, like the EU's updated Industrial Emissions Directive, could lead to a rise in claims related to pollution incidents or non-compliance penalties for businesses FBD insures.

- Emergence of New Risks: Climate change-related events, such as increased flooding or extreme weather, insured under FBD's farm policies, may become more frequent, requiring updated risk assessment models.

- Compliance Costs for Insureds: Businesses facing higher compliance costs due to environmental laws may seek insurance solutions to mitigate these financial burdens, creating a demand for FBD's services.

- Specialized Coverage Needs: The need for coverage related to environmental remediation or liability for historical contamination is growing, pushing insurers like FBD to develop more sophisticated product offerings.

Impact on Agricultural Sector and Farm Insurance

Climate change and environmental policies significantly influence the agricultural sector, a primary customer base for FBD. For instance, in 2024, the European Union's Common Agricultural Policy (CAP) continued to emphasize sustainability, impacting farming methods and potentially increasing operational costs for farmers.

Shifts in agricultural practices driven by environmental regulations or more frequent extreme weather events, such as droughts or floods, directly affect farm profitability. This, in turn, influences the demand for and pricing of farm insurance products. Data from 2023 indicated a rise in crop insurance claims in several regions due to severe weather, leading to adjustments in premiums for the 2024 season.

- Increased Weather Volatility: The Intergovernmental Panel on Climate Change (IPCC) reports highlight a projected increase in the frequency and intensity of extreme weather events globally, directly impacting crop yields and livestock health.

- Regulatory Changes: Environmental regulations, such as those concerning water usage or pesticide application, can necessitate changes in farming techniques, potentially affecting farm productivity and insurance needs.

- Farm Profitability Impact: Adverse weather and regulatory compliance costs can reduce farm incomes, influencing farmers' ability to afford insurance and potentially leading to higher claims.

- Insurance Adaptation: FBD must continuously adapt its farm insurance offerings to reflect these evolving environmental risks, potentially introducing new coverage options or adjusting underwriting criteria based on climate projections and observed agricultural impacts.

Climate change poses significant risks to FBD Holdings, increasing the likelihood of severe weather events that drive up claims, particularly for property and agricultural insurance. Ireland's exposure to flooding, as noted by the OPW, means FBD must integrate climate risk into its underwriting and strategy to manage financial impacts. The growing insurance protection gap in Ireland, where uninsured losses from natural disasters are substantial and projected to rise, highlights the need for FBD to adapt its offerings and potentially collaborate on risk mitigation solutions.

Sustainability regulations, like the EU's SFDR, are pushing FBD to enhance its ESG reporting and embed sustainability into its core business. This focus on environmental, social, and governance factors is crucial for FBD's long-term stability and public image, especially as the Central Bank of Ireland emphasizes this integration. FBD also faces potential liabilities from environmental damage or non-compliance with increasingly stringent environmental policies, such as stricter emissions standards implemented by the EU in 2024, requiring robust risk management.

The agricultural sector, a key market for FBD, is heavily influenced by environmental factors. Changes in farming practices driven by EU policies like the Common Agricultural Policy (CAP) and increased weather volatility directly impact farm profitability and insurance needs. For instance, 2023 saw a rise in crop insurance claims due to severe weather, necessitating premium adjustments for 2024, demonstrating the direct link between environmental events and insurance costs.

| Environmental Factor | Impact on FBD Holdings | Data/Trend (2023-2025) |

|---|---|---|

| Increased Extreme Weather Events | Higher claims for property and agriculture; potential for increased reinsurance costs. | IPCC reports project increased frequency/intensity. 2023 saw a rise in crop insurance claims due to weather. |

| Flood Risk (Ireland) | Direct physical risk to assets insured; increased claims expenses. | OPW highlights increasing flood risk. Insurance protection gap widening. |

| Environmental Regulations (EU) | Potential for increased liability claims for insured businesses; opportunity for new environmental insurance products. | Stricter emissions standards (2024). Growing demand for renewable energy insurance. |

| Sustainability Initiatives | Need for enhanced ESG reporting; integration of sustainability into business strategy. | EU SFDR compliance; Central Bank of Ireland emphasis on sustainability. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for FBD Holdings is meticulously crafted using data from reputable sources including government publications, international financial institutions, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the business.