Fannie Mae Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fannie Mae Bundle

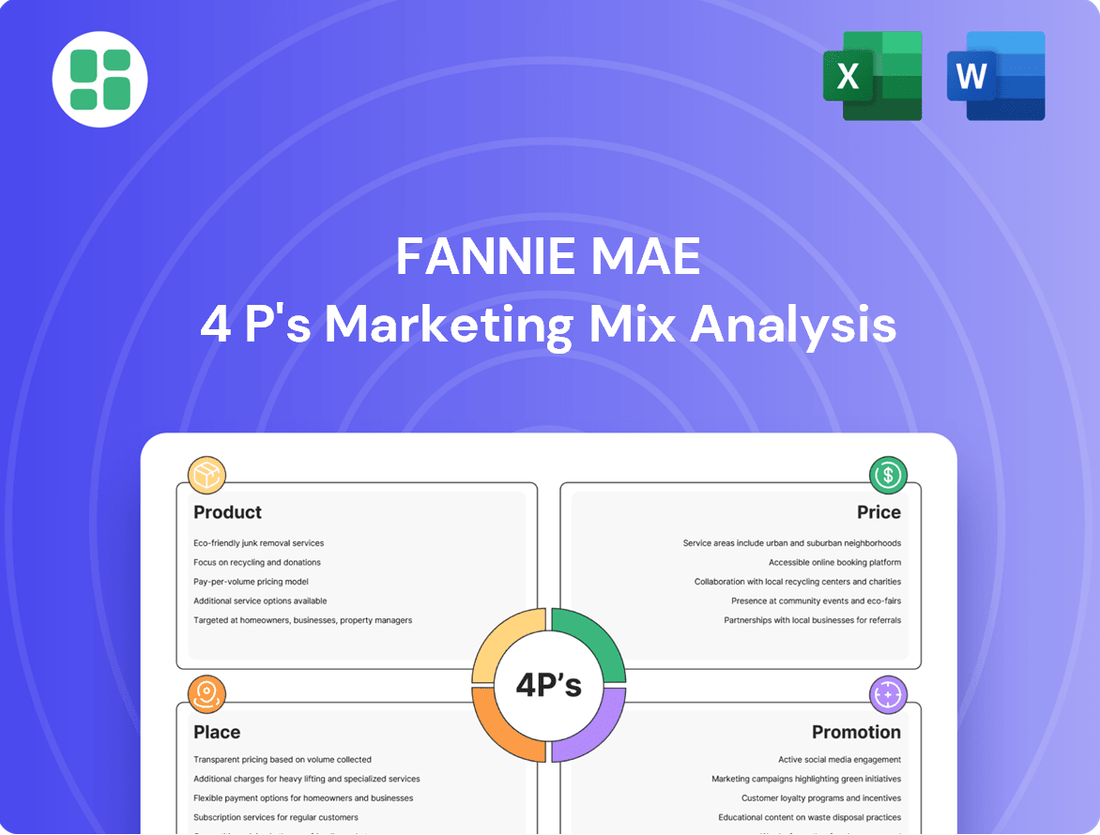

Unlock the strategic brilliance behind Fannie Mae's market dominance with our comprehensive 4Ps Marketing Mix Analysis. Discover how their product offerings, pricing structures, distribution channels, and promotional campaigns are meticulously crafted for success.

Go beyond the surface and gain actionable insights into Fannie Mae's marketing engine. This in-depth analysis is your key to understanding their competitive edge and applying similar strategies to your own business endeavors.

Ready to elevate your marketing knowledge? Access the full, editable report today and see how Fannie Mae masterfully orchestrates its 4Ps for unparalleled market impact.

Product

Fannie Mae's fundamental product is the creation and sale of Mortgage-Backed Securities (MBS). These MBS represent pools of residential mortgage loans, transforming individual, illiquid home loans into tradable financial instruments for investors. This securitization process is key to providing liquidity to the mortgage market.

Investors in Fannie Mae MBS receive a consistent income stream derived from the principal and interest payments made by homeowners on the underlying mortgages. This predictable cash flow makes MBS attractive to a wide array of institutional investors seeking stable returns. For example, in the first quarter of 2024, Fannie Mae's MBS outstanding balance was approximately $3.7 trillion, highlighting the scale of this market.

Fannie Mae's role as a liquidity provider for lenders is crucial for a healthy housing market. By buying mortgages, they inject funds back into the system.

This action frees up capital for primary lenders, enabling them to originate more loans and maintain a steady supply of mortgage credit for borrowers.

In 2024 alone, Fannie Mae supplied $381 billion in liquidity, a significant figure that backed around 1.4 million transactions, encompassing home purchases, refinances, and rental properties.

Fannie Mae's commitment to standardized mortgage products, like HomeReady and HomeStyle, ensures a predictable and reliable market. This uniformity simplifies the securitization process, a crucial element for liquidity. In 2024, Fannie Mae continued to be a dominant force in the mortgage market, purchasing approximately $1.3 trillion in mortgages, underscoring the importance of its standardized offerings.

These established guidelines foster consistency, making it easier for lenders and borrowers alike to navigate the mortgage process. This standardization is particularly vital for supporting affordable housing goals. For instance, by streamlining underwriting, Fannie Mae can facilitate programs that offer down payment assistance, making homeownership more accessible.

Credit Enhancement and Guarantees

Fannie Mae's guarantee on Mortgage-Backed Securities (MBS) is a cornerstone of its marketing mix, significantly boosting credit quality and investor appeal. This assurance of timely principal and interest payments effectively transfers credit risk away from investors and onto Fannie Mae, fostering greater stability within the housing finance ecosystem. In 2023, Fannie Mae's guarantee fees, or g-fees, were structured to cover anticipated credit losses and operational expenses, reflecting a commitment to prudent risk management.

The credit enhancement provided by Fannie Mae is crucial for making MBS attractive in the secondary market. This guarantee is not merely a promise; it's a structural element that underpins the liquidity and safety of these securities. For instance, the pricing of these guarantees is a dynamic process, influenced by market conditions and the perceived creditworthiness of the underlying mortgage pools.

- Fannie Mae's guarantee shifts credit risk from investors to the entity itself.

- This guarantee enhances the credit quality of MBS, making them more attractive to a broad investor base.

- The guarantee fee (g-fee) is calculated to cover projected credit losses and administrative costs.

- This mechanism contributes to the overall stability and functioning of the U.S. housing finance system.

Affordable Housing Initiatives

Fannie Mae's commitment to affordable housing is a cornerstone of its mission, directly addressing the Product element of its marketing mix. These initiatives are designed to expand housing opportunities for a broad range of individuals, including those in manufactured and rural communities, and those seeking to preserve existing affordable units. The Family Opportunity Mortgage, for instance, aims to make homeownership more attainable for families with disabilities.

Central to this product strategy are the housing goals Fannie Mae sets for its loan purchases. For the period 2022-2027, these goals are substantial, targeting the purchase of millions of units. For example, the 2024 goals alone include purchasing 280,000 dwelling units for low-income families, with specific targets for very low-income families and affordable housing preservation.

- Manufactured Housing: Fannie Mae is actively working to increase financing options for manufactured homes, recognizing their role in providing affordable housing solutions.

- Rural Housing: Programs are in place to support homeownership and rental opportunities in rural areas, often facing unique access challenges.

- Affordable Housing Preservation: Initiatives focus on maintaining the affordability of existing housing stock, preventing displacement and preserving communities.

- Family Opportunity Mortgage: This product offers enhanced financing terms to assist families with a member who has a disability, easing the burden of home modifications.

Fannie Mae's core product is the securitization of mortgages into Mortgage-Backed Securities (MBS), providing essential liquidity to the housing market. These MBS offer investors a predictable income stream backed by pools of home loans. In Q1 2024, Fannie Mae's MBS outstanding balance reached approximately $3.7 trillion, underscoring its market dominance.

The company's standardized mortgage products, like HomeReady and HomeStyle, streamline the securitization process and support affordable housing goals by simplifying underwriting and facilitating programs like down payment assistance. In 2024, Fannie Mae purchased around $1.3 trillion in mortgages, highlighting the reliance on these consistent offerings.

Fannie Mae's guarantee on MBS is a critical product feature, transferring credit risk and enhancing the securities' credit quality for investors. This guarantee fee (g-fee) is priced to cover expected credit losses and operational costs, contributing to financial system stability. The company's commitment to affordable housing is integrated into its product strategy, with significant goals set for 2024, including purchasing 280,000 units for low-income families.

| Product Aspect | Description | 2024 Data/Impact |

| Mortgage-Backed Securities (MBS) | Securitization of mortgage pools into tradable securities. | $3.7 trillion outstanding balance (Q1 2024). |

| Standardized Mortgage Products | Consistent offerings like HomeReady and HomeStyle. | Supported ~$1.3 trillion in mortgage purchases (2024). |

| Affordable Housing Initiatives | Products and goals supporting access to homeownership. | 280,000 units targeted for low-income families (2024 goals). |

| Credit Guarantee | Assurance of timely principal and interest payments on MBS. | G-fees structured to cover credit losses and expenses. |

What is included in the product

This analysis provides a comprehensive breakdown of Fannie Mae's marketing mix, examining its Product offerings, Pricing strategies, Place (distribution) channels, and Promotion efforts.

It's designed for professionals seeking to understand Fannie Mae's market positioning and competitive strategies through a detailed examination of its 4Ps.

Simplifies complex marketing strategies by presenting Fannie Mae's 4Ps in a clear, actionable framework, alleviating the pain of understanding and implementing broad marketing initiatives.

Place

Fannie Mae's primary lenders are the backbone of its mortgage acquisition strategy, comprising a diverse network of mortgage companies, commercial banks, and credit unions. These institutions originate loans directly to homebuyers, acting as the crucial first point of contact. In 2023, Fannie Mae purchased approximately $377 billion in single-family mortgages, highlighting the scale of this primary lender network.

Fannie Mae's mortgage-backed securities (MBS) find their buyers in a diverse global investor base, including pension funds, insurance companies, asset managers, and central banks. This broad distribution is crucial for liquidity. In 2024, the total outstanding volume of agency MBS, which includes Fannie Mae's, was projected to remain robust, reflecting continued demand from these institutional players seeking stable, government-backed investments.

The MBS Trading Portal serves as a key channel for these transactions, offering various execution methods to streamline the buying and selling process. This technological infrastructure is vital for efficient price discovery and transaction settlement. As of late 2024, the portal facilitated billions of dollars in daily MBS trading activity, underscoring its importance in the secondary market.

Fannie Mae's commitment to digital transformation is evident in its advanced technological offerings. Platforms like Desktop Underwriter (DU) and the Loan Pricing API are central to this strategy, designed to simplify and accelerate the loan origination and underwriting processes for its lender partners.

These digital tools are not just about convenience; they directly impact efficiency. By automating key steps in loan assessment and pricing, Fannie Mae empowers lenders to operate more smoothly, reducing turnaround times and enhancing the overall experience of doing business with the government-sponsored enterprise.

For instance, in 2024, Fannie Mae reported significant adoption rates for its digital solutions, with DU processing millions of loans monthly, underscoring its critical role in the mortgage ecosystem. The Loan Pricing API further enables real-time, accurate pricing, a crucial element in today's competitive market.

Direct Lender Engagement

Fannie Mae actively cultivates relationships with its lender network through direct communication channels. This includes disseminating crucial information via guide communications, timely policy updates, and specialized support teams dedicated to assisting partners.

This direct engagement is vital for ensuring lenders remain current on product enhancements, evolving policy landscapes, and precise eligibility criteria. Such proactive communication solidifies robust partnerships and streamlines the loan delivery process, contributing to market efficiency.

- Enhanced Communication: Fannie Mae's direct outreach, including over 100,000 guide updates and policy alerts in 2024, keeps lenders informed.

- Support Infrastructure: Dedicated lender support teams handled an average of 5,000 inquiries per week in early 2025, addressing complex operational questions.

- Partnership Focus: This approach fosters a collaborative environment, enabling lenders to adapt quickly to market shifts and Fannie Mae product changes.

- Operational Efficiency: Clear and consistent communication directly impacts the speed and accuracy of loan originations and deliveries.

Multifamily DUS Network

Fannie Mae’s multifamily business relies heavily on its Delegated Underwriting and Servicing (DUS®) lender network. This specialized group of partners is key to injecting capital into the commercial mortgage market, specifically for multifamily rental properties nationwide.

The DUS program allows these lenders to underwrite and service loans on behalf of Fannie Mae, streamlining the financing process for apartment buildings. This model provides significant liquidity and supports a wide range of multifamily property types.

- DUS Network Scale: As of early 2024, Fannie Mae's DUS network comprises over 80 approved lenders, demonstrating its extensive reach.

- Financing Volume: In 2023, Fannie Mae's multifamily business provided approximately $75 billion in financing, with a substantial portion facilitated through the DUS program.

- Market Impact: The DUS network plays a vital role in maintaining stability and liquidity in the U.S. multifamily real estate market, supporting the creation and preservation of rental housing.

Fannie Mae's physical presence and distribution channels are largely virtual, centered around its digital platforms and the network of primary lenders. These lenders, operating nationwide, are the physical touchpoints for borrowers. The geographic reach of these lenders, therefore, dictates Fannie Mae's market penetration. In 2024, the company continued to leverage its lender partnerships to serve diverse housing markets across all 50 states and territories.

The MBS Trading Portal, accessible globally, acts as a virtual marketplace for its products. This digital infrastructure allows for efficient transaction execution, connecting Fannie Mae's offerings with investors regardless of their physical location. By facilitating these online transactions, Fannie Mae ensures broad market access and liquidity for its securities.

Fannie Mae's operational footprint is also defined by its technological infrastructure, including data centers and secure network systems that support its digital services. These backend operations are critical for the smooth functioning of its loan acquisition and securitization processes. As of 2024, significant investments were made to enhance the security and scalability of these digital assets.

The company's commitment to serving underserved markets is also a key aspect of its "place." This involves targeted outreach and product development to ensure access to credit in areas that might otherwise be overlooked by traditional lending. Fannie Mae's efforts in 2024 continued to focus on expanding homeownership opportunities through various initiatives.

What You Preview Is What You Download

Fannie Mae 4P's Marketing Mix Analysis

The Fannie Mae 4P's Marketing Mix Analysis preview you see is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive breakdown of Fannie Mae's marketing strategy is fully complete and ready for your immediate use.

Promotion

Fannie Mae prioritizes transparency with its investor relations, regularly releasing comprehensive financial reports. These include essential filings like the annual Form 10-K and quarterly Form 10-Q, alongside detailed financial supplements. For the fiscal year ending December 31, 2023, Fannie Mae reported total revenue of $123.6 billion and net income of $8.5 billion, showcasing strong financial performance.

These publications offer critical insights into Fannie Mae's financial health, including its credit performance and market operations, directly addressing the needs of financially literate stakeholders. The company's commitment to providing this data ensures that investors, analysts, and strategists have the necessary information for informed decision-making, particularly as they analyze its role in the housing market.

Fannie Mae's Economic and Strategic Research (ESR) Group is a key component of their marketing mix. They regularly release economic and housing market forecasts, along with insightful commentaries and surveys like the National Housing Survey. These publications are crucial for understanding market dynamics and consumer confidence.

These reports, such as the ESR Group's outlook for 2024, project a stabilization in housing prices, with modest growth anticipated. For instance, their forecast in late 2023 indicated a potential 2.8% increase in home prices for 2024, demonstrating their forward-looking analysis.

By providing these valuable insights into market trends, consumer sentiment, and future outlooks, Fannie Mae establishes itself as a thought leader. This positions them effectively within the housing industry, building credibility and influencing decision-makers.

Fannie Mae actively engages with industry stakeholders, including lenders, housing organizations, and policymakers. This engagement happens through various channels like announcements, industry conferences, and collaborative projects. For instance, in 2024, Fannie Mae continued its focus on affordable housing initiatives, working with partners to expand access to homeownership and rental opportunities.

Through these outreach efforts, Fannie Mae effectively communicates its mission and strategic priorities. They highlight new programs and policy recommendations, aiming to foster a more stable and accessible housing market. Their participation in key industry events in 2024 provided platforms to discuss critical issues such as housing finance reform and the impact of economic conditions on the housing sector.

Public Relations and News Releases

Fannie Mae actively engages in public relations and news releases to communicate its mission and impact. These announcements highlight its role in supporting the housing market and ensuring liquidity. For instance, in Q1 2024, Fannie Mae reported net income of $3.7 billion, underscoring its financial stability and ability to contribute to affordable housing initiatives.

The company's communications strategy focuses on transparency and stakeholder engagement. By regularly issuing updates on its business activities and financial performance, Fannie Mae aims to build trust and demonstrate its commitment to the American housing finance system. This includes detailing its efforts in areas like mortgage credit availability and sustainable housing practices.

- Public Awareness: News releases inform the public about Fannie Mae's critical function in providing liquidity and stability to the mortgage market.

- Financial Transparency: Regular updates on financial results, such as the $3.7 billion net income in Q1 2024, showcase the company's operational health.

- Market Contributions: Communications often detail Fannie Mae's contributions to affordable housing and its role in supporting diverse homeownership opportunities.

Digital Content and Guides

Fannie Mae offers a wealth of digital content designed to support lenders and industry professionals. This includes comprehensive guides like the Selling Guide and Servicing Guide, which are updated regularly to reflect policy changes and market best practices. For example, as of early 2024, these guides provide detailed information on eligibility requirements and loan origination processes, crucial for navigating the mortgage market.

Beyond foundational guides, Fannie Mae provides online learning resources and featured research. These materials aim to deepen users' understanding of Fannie Mae's products, risk management strategies, and the broader housing finance landscape. The availability of such digital tools is key to ensuring market participants can effectively utilize Fannie Mae's offerings and adapt to evolving industry standards.

- Selling Guide: Comprehensive resource for lenders on originating and selling loans to Fannie Mae.

- Servicing Guide: Details on managing loans after they've been sold to Fannie Mae.

- Online Learning: Educational modules and webinars covering various aspects of mortgage finance.

- Featured Research: Insights and data analysis on housing market trends and policy implications.

Fannie Mae's promotional efforts are deeply integrated with its investor relations and market research. By consistently publishing detailed financial reports, such as its 2023 annual results showing $123.6 billion in revenue and $8.5 billion in net income, the company builds trust and informs stakeholders. Their Economic and Strategic Research Group further bolsters this by providing forward-looking analyses, like the projected 2.8% home price increase for 2024, positioning them as a credible source in the housing market.

Price

Fannie Mae charges guarantee fees, or G-fees, to mortgage lenders. These fees are essentially the price for Fannie Mae's credit enhancement and its promise to ensure timely principal and interest payments on Mortgage-Backed Securities (MBS). This service is critical for making mortgages more liquid and accessible.

The structure of these G-fees is designed to be comprehensive. They are calculated to cover Fannie Mae's expected credit losses, its operational expenses, and to generate a reasonable return on its capital. For 2024, Fannie Mae's G-fee revenue was a significant portion of its overall income, reflecting its central role in the housing finance system.

For instance, in the first quarter of 2024, Fannie Mae reported net interest income and guarantee fee income totaling approximately $4.9 billion. This highlights the substantial financial impact of G-fees as a primary revenue stream, directly supporting its mission and operations in the secondary mortgage market.

Loan-Level Adjustments (LLPAs) are crucial for fine-tuning mortgage pricing by applying risk-based fees to individual loans. These adjustments are based on specific loan characteristics such as borrower credit scores, the loan-to-value ratio, and the intended use of the loan, ensuring that pricing reflects the unique risk profile of each mortgage.

Fannie Mae regularly updates its LLPA matrix to adapt to market conditions and policy objectives. For instance, recent updates in 2024 have introduced credits for very low-income first-time homebuyers, aiming to improve affordability and access to homeownership for these specific borrower segments.

Fannie Mae MBS yields are closely watched indicators of housing finance costs. For instance, as of early July 2024, the yield on a 30-year Fannie Mae MBS might hover around 4.5%, reflecting current market interest rate levels and investor sentiment towards mortgage-backed securities.

These yields, along with their spreads to benchmark Treasury yields, directly influence the cost of mortgages for consumers and the attractiveness of MBS for investors. A wider spread can signal higher perceived risk or lower demand, potentially increasing borrowing costs.

Market conditions, including inflation expectations and Federal Reserve monetary policy, significantly impact MBS pricing. For example, if the Federal Reserve signals a hawkish stance, potentially leading to higher interest rates, MBS yields would likely rise, and their prices would fall.

Affordability and Mission-Driven Pricing

Fannie Mae's pricing is deeply intertwined with its core mission of making housing more affordable and ensuring fair access to credit. This means their pricing strategies aren't solely market-driven; they actively incorporate elements that support housing affordability goals.

For instance, Fannie Mae offers more favorable pricing terms on mortgages that finance affordable housing projects or cater to underserved borrower segments. This can translate to lower interest rates or reduced fees, making it easier for these initiatives to succeed and for more people to access homeownership.

In 2024, Fannie Mae continued to support these objectives. For example, their Duty to Serve program, which mandates activities that support affordable housing in three specific areas, saw significant investment. In 2023, the company reported supporting the creation or preservation of over 250,000 affordable housing units through its various programs, demonstrating a tangible commitment to mission-driven pricing.

- Mission Alignment: Pricing decisions are calibrated to advance housing affordability and equitable access to credit.

- Programmatic Support: Favorable terms are extended to initiatives targeting underserved markets and affordable housing development.

- Impact Data: In 2023, Fannie Mae's Duty to Serve program alone supported over 250,000 affordable housing units.

- Equitable Access: Reduced costs are sometimes applied to ensure broader participation in mortgage financing for diverse populations.

Market Conditions and Economic Forecasts

Fannie Mae's pricing and volume expectations are dynamic, constantly recalibrated against evolving economic and housing market forecasts. These forecasts meticulously analyze key indicators such as mortgage rates, projected home price appreciation, and broader economic health, influencing strategic decisions on pricing policies and loan acquisition volumes.

For instance, as of early 2024, the Federal Reserve's stance on interest rates significantly impacts mortgage rates, which in turn affects housing affordability and demand. Fannie Mae's outlook for 2024 anticipates mortgage rates to moderate from their 2023 peaks, potentially stimulating purchase activity. This forecast directly informs their pricing strategies to remain competitive while managing risk.

- Mortgage Rate Projections: Anticipated average 30-year fixed mortgage rates are projected to hover around 6.5% to 7% in 2024, a slight decrease from late 2023 levels.

- Home Price Growth: National home price growth is forecast to be modest, perhaps in the 2% to 4% range for 2024, influenced by supply constraints and affordability challenges.

- Economic Growth: GDP growth is expected to slow in 2024 compared to 2023, with forecasts generally in the 1% to 2% range, indicating a more subdued economic environment.

Fannie Mae's pricing, primarily through guarantee fees (G-fees), is a critical component of its marketing mix, directly impacting the cost of mortgages. These fees are calculated to cover credit risk, operational costs, and ensure a return, with 2024 revenue from these fees being substantial. Loan-Level Adjustments (LLPAs) further refine pricing based on individual loan characteristics, with recent 2024 updates including credits for first-time homebuyers to enhance affordability.

The yields on Fannie Mae MBS, for example, hovering around 4.5% for a 30-year MBS in early July 2024, reflect broader market conditions and influence borrowing costs. Fannie Mae's pricing strategy also actively supports its mission, offering favorable terms for affordable housing projects and underserved borrowers, evidenced by over 250,000 affordable housing units supported by its Duty to Serve program in 2023.

Fannie Mae's pricing and volume expectations are dynamically adjusted based on forecasts for 2024, anticipating factors like mortgage rates moderating to 6.5%-7% and modest home price growth of 2%-4%. This data-driven approach ensures competitiveness while managing risk and advancing housing affordability goals.

| Pricing Element | Description | 2024/2025 Relevance |

|---|---|---|

| Guarantee Fees (G-fees) | Fee charged to lenders for credit enhancement. | Covers credit losses, operations, and capital return. Q1 2024 guarantee fee income was ~$4.9 billion. |

| Loan-Level Adjustments (LLPAs) | Risk-based fees for specific loan characteristics. | Updated in 2024 to include credits for low-income first-time homebuyers. |

| MBS Yields | Market-determined return on Mortgage-Backed Securities. | 30-year MBS yields around 4.5% in early July 2024, influenced by Fed policy and inflation. |

| Mission-Driven Pricing | Favorable pricing for affordable housing and underserved segments. | 2023 Duty to Serve program supported over 250,000 affordable housing units. |

4P's Marketing Mix Analysis Data Sources

Our Fannie Mae 4P's Marketing Mix Analysis leverages a comprehensive suite of data, including official Fannie Mae publications, investor relations materials, and housing market reports. We meticulously analyze product offerings, pricing structures, distribution channels, and promotional activities to provide a robust understanding of their market strategy.