Fannie Mae Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fannie Mae Bundle

Uncover Fannie Mae's strategic positioning with our comprehensive BCG Matrix analysis. See which of their offerings are market leaders (Stars), steady earners (Cash Cows), underperformers (Dogs), or potential growth areas (Question Marks). Purchase the full report for a detailed breakdown and actionable insights to optimize your investment strategy.

Stars

Fannie Mae's commitment to affordable housing, particularly for low-income and first-time buyers, is a key strategic focus. This segment is experiencing robust growth due to pressing societal needs and government directives. For instance, the Federal Housing Finance Agency's (FHFA) finalized housing goals for 2025-2027 are designed to significantly boost the acquisition of mortgages for these very groups, solidifying Fannie Mae's role in tackling the housing gap for underserved communities.

Fannie Mae is heavily investing in AI for underwriting, enhancing tools like Desktop Underwriter® (DU®). This focus reflects a strategic move towards high-growth areas in operational efficiency and risk management.

These AI advancements are designed to speed up mortgage approvals and refine credit risk evaluations. For instance, the AI-powered Crime Detection Unit aims to significantly reduce fraud, a critical component in maintaining market leadership.

In 2024, the mortgage industry saw a significant push towards digital solutions. Fannie Mae's commitment to AI integration is a direct response to the need for faster, more accurate, and secure lending processes, aligning with evolving industry standards and customer expectations.

Fannie Mae is a major player in green financing for multifamily properties, having issued more than $117 billion in Green MBS by the end of 2023. This trend continued into 2024, highlighting strong market momentum.

This segment is experiencing significant growth, fueled by a rising demand for sustainable housing and broader environmental goals. Fannie Mae's dominant position here allows it to offer attractive pricing, encouraging energy and water efficiency upgrades in multifamily buildings.

Credit Risk Transfer (CIRT) Program Innovation

Fannie Mae's Credit Risk Transfer (CIRT) program continues to innovate, with multiple transactions in 2024 successfully transferring billions of dollars in mortgage credit risk to private insurers. This aggressive execution highlights a strategic focus on high growth within risk management.

These CIRT innovations are crucial for Fannie Mae, as they effectively reduce taxpayer exposure while simultaneously ensuring continued market liquidity. The program's structure consistently attracts robust participation from a diverse range of insurers.

- 2024 CIRT Activity: Fannie Mae executed several CIRT deals in 2024, transferring significant credit risk.

- Risk Mitigation: These transactions are designed to reduce the explicit and implicit credit risk borne by the taxpayer.

- Market Liquidity: The program structure fosters broad insurer participation, supporting mortgage market liquidity.

- Strategic Growth: The continuous evolution of CIRT represents a key component of Fannie Mae's growth strategy in risk management.

Multifamily Lending (Specific Segments like Workforce Housing)

Fannie Mae's multifamily lending, particularly its focus on workforce housing, represents a strategic "Star" in its portfolio. This segment is crucial for addressing housing affordability, a key part of Fannie Mae's mission.

In the first quarter of 2025, Fannie Mae financed around 93,000 multifamily rental units. A substantial portion of these units were affordable for households earning at or below 120% of the area median income, highlighting their commitment to this vital area.

- Workforce Housing Focus: Fannie Mae's strategic emphasis on workforce housing within its multifamily lending signifies a growth opportunity, aligning with its mission to support accessible housing.

- Q1 2025 Performance: The company financed approximately 93,000 multifamily rental units in Q1 2025.

- Affordability Commitment: A significant majority of these financed units were affordable to households earning at or below 120% of the area median income.

Fannie Mae's multifamily lending, particularly its focus on workforce housing, represents a strategic Star in its portfolio. This segment is crucial for addressing housing affordability, a key part of Fannie Mae's mission.

In the first quarter of 2025, Fannie Mae financed around 93,000 multifamily rental units. A substantial portion of these units were affordable for households earning at or below 120% of the area median income, highlighting their commitment to this vital area.

This focus on workforce housing, which provides homes for essential workers, is a high-growth area for Fannie Mae, aligning with societal needs and FHFA directives for increased affordable housing. The sustained investment in this segment underscores its strategic importance and future potential.

| Fannie Mae Multifamily Lending (Q1 2025) | Units Financed | Affordability Target | Strategic Significance |

|---|---|---|---|

| Workforce Housing | ~93,000 | Affordable for households ≤ 120% AMI | Star (High Growth, High Share, Mission Aligned) |

What is included in the product

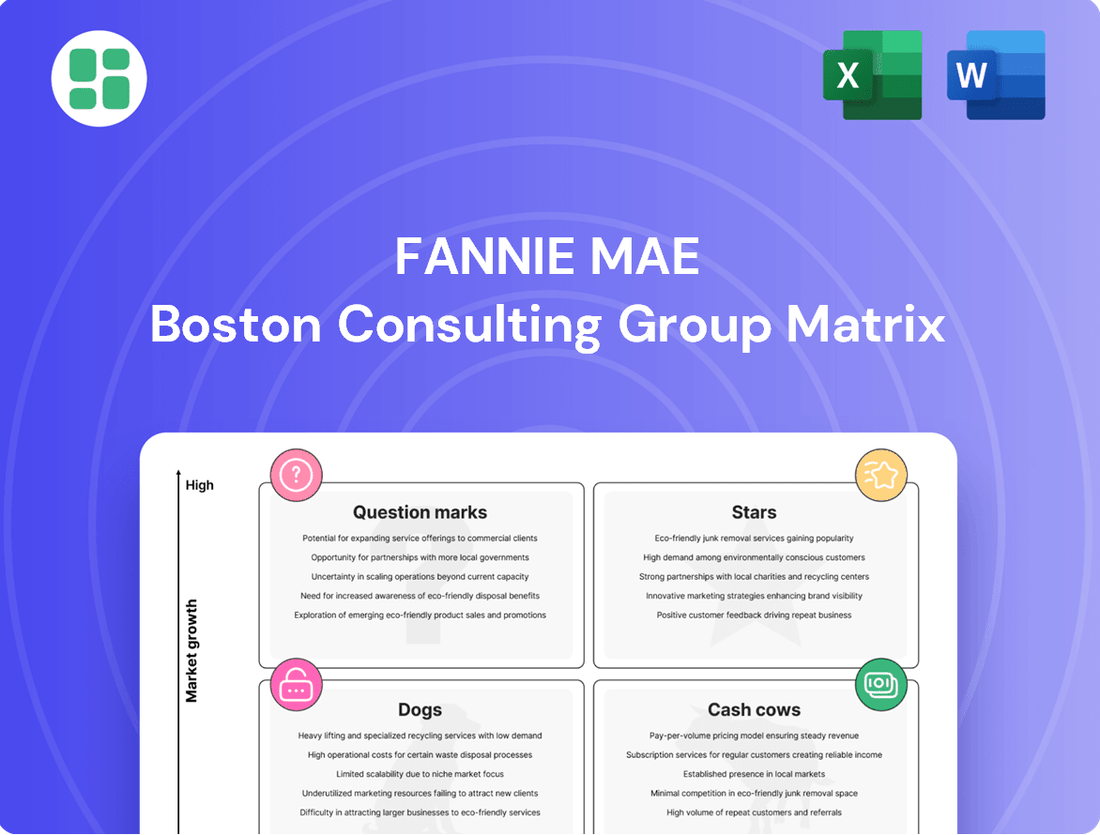

This BCG Matrix overview provides clear descriptions and strategic insights for Fannie Mae's Stars, Cash Cows, Question Marks, and Dogs.

Fannie Mae BCG Matrix: A clear visual to identify underperforming "Dogs" and reallocate resources, alleviating the pain of inefficient capital allocation.

Cash Cows

Fannie Mae's core business, purchasing single-family mortgages, pooling them, and securitizing them into mortgage-backed securities (MBS) with its guarantee, is its primary cash cow. This operation consistently yields significant guaranty fees, a major contributor to its profitability. For instance, Fannie Mae reported $5.9 billion in single-family revenues in the first quarter of 2025, underscoring the segment's robust performance.

Fannie Mae's existing $4.1 trillion guaranty book of business, as of the first quarter of 2025, functions as a significant cash cow within its business model. This immense portfolio of mortgages generates consistent, recurring revenue through the guaranty fees charged.

The sheer scale of this $4.1 trillion asset base ensures a predictable and substantial cash flow for Fannie Mae. This stability is crucial for maintaining its financial health and supporting its ongoing mission in the housing market.

Refinance loan acquisition volume for Fannie Mae showed a significant uptick, reaching $14.2 billion in the first quarter of 2025. This marks a substantial increase from the $9.3 billion recorded in the same period of 2024.

While purchase volumes can be more volatile, this refinance segment, despite its sensitivity to interest rate shifts, consistently delivers a stable business flow. It acts as a cash cow, generating reliable income when refinancing conditions are favorable within this mature market.

Servicing and Asset Management Functions

Fannie Mae's servicing and asset management functions are critical for its operations, generating consistent fee income from its vast mortgage portfolio. These activities are designed to maintain and enhance the value of its assets, contributing to overall financial stability.

These functions are vital for optimizing cash flow and ensuring the long-term performance of Fannie Mae's guaranty book. By actively managing loans and properties, the company safeguards its investments and supports the housing market.

- Servicing Income: In 2023, Fannie Mae's net mortgage servicing income was $3.6 billion, reflecting the steady revenue generated from managing its extensive loan portfolio.

- Asset Management Efficiency: The company's focus on efficient asset management helps to minimize losses and maximize returns on acquired properties and non-performing loans.

- Guaranty Book Stability: These functions are foundational to maintaining the integrity and value of the $3.9 trillion guaranty book as of the end of 2023.

Standard Conventional Loan Acquisitions

Standard conventional loan acquisitions represent a significant Cash Cow for Fannie Mae. In the first quarter of 2025, these acquisitions reached $64.3 billion, demonstrating a continued high market share in a mature sector.

This consistent volume and revenue stream are driven by the acquisition of standard conventional loans, which are underwritten with stringent credit standards. These loans are fundamental to Fannie Mae's securitization activities within the well-established secondary mortgage market.

- High Market Share: Continues to be a dominant activity.

- Consistent Revenue: Provides a reliable income source.

- Rigorous Underwriting: Maintains strong credit quality.

- Securitization Backbone: Essential for mortgage-backed securities.

Fannie Mae's core business of purchasing, pooling, and securitizing single-family mortgages generates substantial guaranty fees, making it a primary cash cow. The company reported $5.9 billion in single-family revenues in Q1 2025, highlighting this segment's strong performance. This consistent revenue stream from its $4.1 trillion guaranty book of business, as of Q1 2025, provides a stable financial foundation.

| Segment | Q1 2025 Revenue (Billions USD) | Key Driver |

|---|---|---|

| Single-Family Guarantees | 5.9 | Guaranty fees on $4.1T portfolio |

| Standard Conventional Loans | 64.3 (Acquisition Volume) | Dominant market share, consistent volume |

| Refinance Loans | 14.2 (Acquisition Volume) | Stable flow with favorable interest rates |

What You See Is What You Get

Fannie Mae BCG Matrix

The Fannie Mae BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no demo content—just the complete, professionally designed analysis ready for your strategic planning. You can be confident that the insights and structure presented here are precisely what you'll utilize for your business decisions and presentations.

Dogs

Legacy non-performing assets from prior crises would fall into the 'Dog' category within Fannie Mae's BCG Matrix. While Fannie Mae has made substantial strides in financial recovery, any lingering severely delinquent loans or distressed assets from past economic downturns represent a drag on performance.

These 'Dog' assets, even if a small percentage of the overall portfolio, demand significant management resources and often generate negligible returns. For instance, while specific 2024 figures for legacy non-performing assets are not publicly itemized in a way that directly maps to a BCG matrix, Fannie Mae's overall delinquency rates have been historically low, reflecting successful resolution of past issues. However, any remaining isolated cases still fit the 'Dog' profile due to their resource intensity relative to their financial contribution.

Fannie Mae, like many large financial institutions, experiments with pilot programs to test innovative approaches or enter new markets. These initiatives, while potentially valuable, carry inherent risks.

When a pilot program fails to demonstrate a clear path to scalability, doesn't gain sufficient market traction, or deviates from Fannie Mae's core mission of promoting affordable housing, it can become a 'Dog' in the BCG matrix. For instance, if a pilot aimed at a niche mortgage product for a specific demographic doesn't attract enough borrowers or lenders, it might be deemed unviable. In 2024, a significant number of such experimental initiatives often struggle to prove their long-term economic sustainability, leading to their discontinuation.

Areas within Fannie Mae that still rely on outdated technology or highly manual processes, despite the push for digital transformation, could be considered 'Dogs' in the BCG Matrix. These inefficiencies can lead to higher operational costs, slower processing times, and a competitive disadvantage. For instance, legacy systems for certain loan origination or servicing functions might require extensive manual data entry and reconciliation, impacting turnaround times and increasing the risk of errors.

These 'Dog' segments, characterized by their low market share and low growth potential due to their inherent inefficiencies, demand significant investment to modernize or eliminate. Failing to address them could mean continued high operational expenses, potentially exceeding the value they generate. In 2024, the mortgage industry as a whole is seeing increased pressure to streamline operations, making outdated systems a critical vulnerability.

Niche Programs with Low Market Adoption

Certain niche programs within Fannie Mae's portfolio, despite strategic intent, have struggled to gain traction. These initiatives, while potentially innovative, may represent areas with low market adoption. For instance, programs targeting very specific borrower segments or unique property types might consume operational resources without yielding substantial market share gains. In 2024, a review of Fannie Mae's product suite identified several such programs where uptake remained minimal, impacting overall resource allocation efficiency.

These underperforming niche programs can be categorized as Dogs in the Fannie Mae BCG Matrix. They require ongoing investment but do not generate significant returns or contribute meaningfully to the company's mission of providing liquidity to the housing market. Their continued existence can divert focus and capital from more successful or promising initiatives.

- Low Market Penetration: Programs with less than 1% of total Fannie Mae mortgage acquisitions in their respective categories.

- Resource Drain: Initiatives that require dedicated staffing and technology without commensurate revenue generation.

- Mission Alignment Concerns: Offerings that, despite their niche focus, may not align with broader housing affordability goals due to low utilization.

Residential Mortgage-Backed Securities (RMBS) not under CRT

Residential Mortgage-Backed Securities (RMBS) not under Credit Risk Transfer (CRT) represent a segment within Fannie Mae's portfolio where the underlying credit risk remains largely with the entity. These older or less actively managed pools may not benefit from the risk mitigation strategies employed by newer CRT transactions, potentially exposing Fannie Mae to a greater degree of unheded credit events.

These specific RMBS segments could be considered 'Dogs' in a BCG matrix if they exhibit low growth prospects and low market share, meaning they generate minimal returns relative to the capital they tie up and the risk they carry. For instance, older RMBS pools with concentrated geographic or borrower characteristics that are not hedged through CRT could fall into this category, especially if the housing market in those specific areas is showing signs of stagnation or decline.

In 2024, while specific data on Fannie Mae's non-CRT RMBS portfolio is proprietary, the broader RMBS market experienced shifts. For example, the overall delinquency rates for mortgages securitized by government-sponsored enterprises (GSEs) remained relatively low, but pockets of higher risk can emerge in older vintages or specific loan types not covered by newer risk-sharing structures.

Consider these points regarding non-CRT RMBS:

- Concentrated Risk: Portions of the RMBS portfolio not covered by CRT may hold concentrated credit risk, particularly if they are comprised of older vintages or less diversified loan pools.

- Lower Returns: These segments might offer lower yields or returns compared to CRT-backed securities due to the absence of risk transfer mechanisms and potentially higher perceived credit risk.

- Limited Growth Potential: The underlying collateral in these older pools may have limited potential for capital appreciation or improved credit quality, leading to low growth prospects.

- Capital Tie-Up: Holding these non-CRT RMBS requires capital allocation without the benefit of risk mitigation, potentially hindering investment in higher-growth areas.

Dogs in Fannie Mae's BCG Matrix represent business segments or assets with low market share and low growth potential. These are typically areas that consume resources without generating significant returns, often due to being legacy, underperforming, or outdated.

Examples include legacy non-performing assets from past crises, pilot programs that failed to scale, or reliance on outdated technology. These segments require careful management to minimize losses and may eventually be divested or significantly overhauled.

In 2024, while Fannie Mae continues to modernize, any remaining pockets of inefficiency or low-performing niche products would fit this 'Dog' category, demanding attention to improve their contribution or to reallocate resources.

Question Marks

Fannie Mae's involvement in emerging digital mortgage ecosystems and with third-party technology service providers (TSPs) squarely places them in the 'Question Mark' category of the BCG Matrix. This is due to the high growth potential of these digital platforms, which are rapidly transforming the mortgage industry, but Fannie Mae's current market share within these specific, evolving ecosystems is still relatively low, though it is steadily increasing as adoption grows.

The mortgage technology landscape is characterized by intense innovation and a multitude of specialized platforms, creating a fragmented market. For instance, by the end of 2024, the digital mortgage market size was projected to reach over $10 billion globally, with a significant portion of that growth driven by advancements in AI, blockchain, and cloud-based solutions. Fannie Mae's strategic engagement here is crucial for future competitiveness, but the inherent uncertainty of which specific technologies will achieve widespread dominance makes these investments a classic 'Question Mark' play.

Fannie Mae is actively exploring ways to incorporate alternative credit data, such as rental payment history, into its underwriting processes. This initiative targets traditionally underserved borrower segments, representing a high-growth potential area with currently low market penetration. By leveraging these alternative data sources, Fannie Mae aims to broaden access to homeownership, though these efforts necessitate substantial investment and meticulous risk management for successful scaling.

Fannie Mae's commitment extends beyond Green Bonds to actively supporting climate-resilient housing construction and adaptation efforts. This signifies a strategic move into a burgeoning sector, acknowledging the increasing investor and societal focus on sustainability and long-term housing value. While specific market share data for Fannie Mae in this nascent resilience-focused housing market is still emerging, the increasing frequency of extreme weather events underscores the critical need for such investments.

Future of Conservatorship and Recapitalization Strategies

The future of Fannie Mae's conservatorship and its recapitalization strategies are a major question mark, directly impacting its long-term structure and market influence. The ongoing discussions around potentially exiting conservatorship are critical, as the outcome will shape its future growth trajectory and operational independence. As of early 2024, the U.S. Treasury's stake in Fannie Mae and Freddie Mac remained substantial, a key factor in any recapitalization plan.

- Conservatorship Exit: Discussions continue regarding the potential end of the conservatorship, a process that began in 2008.

- Recapitalization Needs: Any move to recapitalize Fannie Mae will likely involve significant capital infusions and potential changes to its ownership structure.

- Market Impact: The resolution of these issues is crucial for the stability and predictability of the U.S. housing finance market.

- Government Role: The extent of future government involvement, if any, post-conservatorship remains a central point of debate.

Pilot Programs for New Lending Products or Niche Market Solutions

Fannie Mae actively tests innovative lending products and solutions tailored for underserved or niche markets. These initiatives, like specialized affordable housing financing or unique loan structures for specific demographics, represent potential growth areas. In 2024, Fannie Mae continued to focus on expanding access to credit, with pilot programs exploring solutions for manufactured housing and Accessory Dwelling Units (ADUs).

These pilot programs are considered Question Marks in the BCG matrix. They exhibit high potential for future success if they gain traction and prove their viability. However, they currently command a low market share and necessitate substantial investment to transition into more established categories like Stars or Cash Cows. For instance, a pilot program in 2024 aimed at providing financing for first-time homebuyers in rural areas, while showing promising early engagement, still represented a small fraction of Fannie Mae's overall loan volume.

- Niche Market Focus: Pilots target specific segments like affordable housing or unique financing needs.

- High Potential, Low Share: These programs have future upside but currently represent a small market presence.

- Investment Requirement: Significant capital is needed for development and scaling to achieve growth.

- 2024 Example: Exploration of financing for ADUs and manufactured housing demonstrates ongoing pilot activity.

Fannie Mae's engagement with emerging digital mortgage technologies and alternative data sources positions them squarely in the Question Mark category. These areas represent high-growth potential, transforming the mortgage industry, but Fannie Mae's current market share within these evolving ecosystems is still developing. The success of these ventures hinges on significant investment and navigating market uncertainties.

Fannie Mae's exploration of innovative lending products for underserved markets, such as financing for Accessory Dwelling Units (ADUs) and manufactured housing, also falls into the Question Mark quadrant. These pilots, like the 2024 initiatives for first-time homebuyers in rural areas, show promise but currently hold a low market share. Their transition to Stars or Cash Cows depends on successful scaling and proving market viability.

The future of Fannie Mae's conservatorship and its recapitalization strategy remains a significant question mark. The ongoing discussions about exiting conservatorship, with the U.S. Treasury holding a substantial stake as of early 2024, will fundamentally shape its future growth and operational independence, impacting the broader housing finance market.

| BCG Category | Fannie Mae's Position | Key Characteristics | 2024 Relevance |

|---|---|---|---|

| Question Marks | Digital Mortgage Ecosystems | High growth potential, low current market share, significant investment needed. | Rapid transformation of mortgage tech, AI, blockchain adoption. |

| Question Marks | Alternative Data Integration | Targets underserved markets, high growth potential, low penetration. | Expanding access to credit via rental history, etc. |

| Question Marks | Innovative Lending Pilots (e.g., ADUs, Rural Housing) | Niche focus, high future upside, low current market presence. | Pilot programs for first-time buyers, manufactured housing. |

| Question Marks | Conservatorship & Recapitalization | Uncertain future structure, major impact on growth and independence. | Ongoing U.S. Treasury stake discussions, critical for market stability. |

BCG Matrix Data Sources

Our Fannie Mae BCG Matrix leverages comprehensive data from Fannie Mae's financial disclosures, extensive market research on the mortgage industry, and official government reports to provide a robust strategic overview.