Fannie Mae Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fannie Mae Bundle

Unlock the strategic core of Fannie Mae's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates their key partners, value propositions, and revenue streams, offering a clear roadmap to their success in the housing finance market. Get the full downloadable file to gain actionable insights for your own business strategy.

Partnerships

Fannie Mae's core business model relies heavily on its partnerships with primary mortgage lenders, which include a wide array of institutions like large commercial banks, regional banks, credit unions, and specialized independent mortgage companies. These originators are the frontline, directly interacting with homebuyers and homeowners to provide the initial mortgage financing.

These primary lenders originate residential mortgages and then sell them to Fannie Mae in the secondary market. This transaction provides essential liquidity to the originators, enabling them to continue lending and serving more borrowers. In 2024, Fannie Mae purchased approximately $800 billion in mortgages, underscoring the sheer volume of this critical partnership.

This symbiotic relationship is the bedrock of Fannie Mae's operations, allowing it to fulfill its mission of providing liquidity and stability to the U.S. housing finance system. Without these originators, Fannie Mae would not have the mortgage assets it needs to securitize and support the broader market.

Fannie Mae's key partnerships include institutional investors like pension funds, asset managers, and central banks. These entities are vital as they purchase the Mortgage-Backed Securities (MBS) that Fannie Mae issues. For instance, in 2023, the total outstanding MBS guaranteed by Fannie Mae remained a significant figure, reflecting the ongoing demand from these institutional players for stable, income-generating assets.

Fannie Mae's operations are fundamentally shaped by its status as a Government-Sponsored Enterprise (GSE), with the Federal Housing Finance Agency (FHFA) serving as its conservator since 2008. This oversight is crucial for maintaining stability and ensuring Fannie Mae fulfills its public mission in the housing market.

The U.S. Department of the Treasury also plays a vital role through a senior preferred stock purchase agreement, which has provided significant financial support. As of the first quarter of 2024, Fannie Mae's net worth stood at $67.5 billion, reflecting the ongoing impact of these governmental partnerships on its financial health and operational capacity.

Mortgage Servicers

Fannie Mae collaborates with a network of approved mortgage servicers who are crucial for the day-to-day management of mortgage loans. These partners handle essential tasks like collecting monthly payments from homeowners and addressing situations where borrowers may be experiencing financial difficulties. This operational partnership is fundamental to Fannie Mae’s ability to manage its vast mortgage portfolio effectively and mitigate associated risks.

These servicers are bound by specific standards set by Fannie Mae, ensuring a consistent approach to loan administration and borrower support across the country. Fannie Mae’s oversight of these servicers is vital for maintaining the quality and performance of the mortgages it guarantees. In 2024, the mortgage servicing industry continued to navigate evolving economic conditions, with servicers playing a key role in borrower retention and loss mitigation efforts.

- Servicer Network: Fannie Mae relies on a broad base of approved mortgage servicers to manage its loan portfolio.

- Operational Oversight: Fannie Mae establishes and enforces servicing standards, ensuring consistent borrower treatment and risk management.

- Risk Mitigation: The effective performance of mortgage servicers directly impacts Fannie Mae's ability to manage credit and operational risks within its book of business.

Technology and Data Providers

Fannie Mae's reliance on technology and data providers is crucial for its operational efficiency and risk management. These partnerships directly fuel key systems like Desktop Underwriter (DU), which streamlines mortgage loan origination, and Collateral Underwriter (CU), which enhances appraisal risk assessment.

These collaborations enable Fannie Mae to continuously improve its offerings and adapt to evolving market demands. For instance, ongoing investments in data analytics by these partners help refine underwriting models, potentially leading to more accurate risk pricing and broader access to credit. In 2024, the housing finance sector continued to see significant advancements in AI and machine learning, areas where technology providers are instrumental in developing new capabilities for Fannie Mae.

- Desktop Underwriter (DU) Enhancements: Partnerships with technology firms allow for continuous updates and improvements to DU, ensuring it remains a leading automated underwriting system.

- Collateral Underwriter (CU) Advancements: Data providers are key to the ongoing development and refinement of CU, improving its ability to assess collateral risk through advanced analytics.

- Data Integration and Analytics: Collaborations facilitate the integration of diverse data sources, enabling more sophisticated risk modeling and market analysis.

- Innovation in Housing Finance: Technology partners help Fannie Mae explore and implement new solutions that support affordability and access to homeownership.

Fannie Mae's key partnerships extend to institutional investors, including pension funds and asset managers, who are essential purchasers of the Mortgage-Backed Securities (MBS) it issues. The demand from these investors for stable, income-generating assets is a critical component of Fannie Mae's market presence. In 2023, the total outstanding MBS guaranteed by Fannie Mae remained substantial, reflecting sustained investor confidence.

Furthermore, Fannie Mae's operational backbone relies on its relationships with a wide network of approved mortgage servicers. These partners are responsible for the crucial tasks of collecting payments and managing borrower interactions, ensuring the smooth administration of its extensive loan portfolio. The effectiveness of these servicers directly impacts Fannie Mae's risk management and its ability to support homeowners.

Crucially, Fannie Mae's technological advancements are powered by collaborations with data and technology providers. These partnerships are fundamental to the continuous improvement of critical systems like Desktop Underwriter (DU) and Collateral Underwriter (CU), which enhance underwriting efficiency and appraisal risk assessment. In 2024, the ongoing integration of AI and machine learning through these partnerships is shaping the future of housing finance.

| Partner Type | Role in Fannie Mae's Business Model | Key Contribution/Impact | 2023/2024 Relevance |

|---|---|---|---|

| Primary Mortgage Lenders | Mortgage Origination | Provide initial financing to homebuyers, feeding the secondary market. | Purchased approx. $800 billion in mortgages in 2024. |

| Institutional Investors | MBS Purchase | Buy Mortgage-Backed Securities, providing liquidity and capital. | Significant demand for MBS continues to underpin Fannie Mae's securitization activities. |

| Mortgage Servicers | Loan Administration | Manage loan portfolios, collect payments, and handle borrower issues. | Essential for operational efficiency and risk mitigation in 2024. |

| Technology & Data Providers | System Development & Enhancement | Improve underwriting (DU) and appraisal (CU) systems, drive innovation. | Crucial for advancements in AI and data analytics in 2024. |

What is included in the product

A comprehensive, pre-written business model tailored to Fannie Mae's role in the secondary mortgage market, detailing its key partners, activities, and revenue streams.

Covers customer segments, channels, and value propositions in full detail, reflecting Fannie Mae's operations in securitizing and guaranteeing mortgages.

Fannie Mae's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of its complex operations, simplifying understanding and strategic alignment for stakeholders.

Activities

Fannie Mae's core activity of mortgage acquisition involves purchasing mortgage loans directly from primary lenders. This crucial step injects immediate liquidity into the lending system, empowering those lenders to originate more mortgages and maintain a steady flow of housing credit.

By acquiring these loans, Fannie Mae facilitates the continuous operation of the mortgage market. This function is vital for ensuring that potential homeowners can access financing, thereby supporting the broader housing economy.

In 2024, Fannie Mae's acquisition volume underscores its ongoing commitment to bolstering both single-family and multifamily mortgage sectors. This consistent activity highlights its indispensable role in the nation's housing finance landscape.

Fannie Mae's core activity involves pooling thousands of individual mortgages, acquired from lenders, and transforming them into Mortgage-Backed Securities (MBS). This process, known as securitization, essentially bundles these home loans into tradable financial products.

These MBS are then sold to a diverse range of investors in the capital markets. This securitization is crucial for creating liquid investment opportunities, thereby channeling much-needed capital into the U.S. housing market, supporting homeownership.

A key element of Fannie Mae's offering is its guarantee on these MBS. Fannie Mae assures investors of the timely payment of both principal and interest on the underlying mortgages. This guarantee significantly reduces the risk for investors, making MBS a more attractive and secure investment option.

In 2024, Fannie Mae continued to be a dominant force in the MBS market. The company issued approximately $1.5 trillion in new MBS during the year, reflecting sustained investor demand and its vital role in housing finance.

Fannie Mae's core activity involves actively managing the credit risk inherent in the mortgages it purchases and bundles into Mortgage-Backed Securities (MBS). It provides a guarantee on these MBS, assuring investors of timely principal and interest payments.

This risk management is achieved through strict underwriting criteria for originating lenders, continuous oversight of their performance, and the strategic deployment of credit risk transfer (CRT) solutions. For instance, in 2024, Fannie Mae continued to utilize CRT transactions like Connecticut Avenue Securities (CAS) and Credit Risk Transfer (CRT) Notes to transfer a portion of its credit risk to private investors, demonstrating a commitment to capital efficiency and risk mitigation.

Maintaining robust credit risk management is paramount for Fannie Mae's financial stability and its ability to foster confidence in the housing finance market. This proactive approach ensures its operational safety and soundness, underpinning its role in providing liquidity to the mortgage market.

Market Analysis and Housing Research

Fannie Mae's market analysis and housing research are crucial for understanding the economic landscape. They provide valuable insights and forecasts, such as their economic forecast for 2025, which highlights key challenges and opportunities within the housing sector. This research is instrumental in shaping housing policy and supporting various industry stakeholders.

These activities foster a deeper comprehension of trends impacting housing affordability and accessibility. For instance, in 2024, Fannie Mae's research indicated a persistent demand for housing, even amidst rising interest rates. Their analysis often includes detailed data on:

- Housing starts and permits: Tracking new construction provides a pulse on market supply.

- Home price appreciation: Monitoring price changes reveals market heat and affordability shifts.

- Mortgage origination volumes: Understanding borrowing activity is key to market liquidity.

- Consumer confidence in housing: Gauging buyer sentiment informs future demand.

Developing and Implementing Housing Initiatives

Fannie Mae actively crafts and refines programs to tackle pressing housing issues, including broadening access to affordable housing and promoting stable homeownership. In 2024, Fannie Mae continued to invest in its Equitable Housing Finance Plan, aiming to close the homeownership gap for minority and low-to-moderate-income families. Their Duty to Serve initiatives also saw continued focus on underserved markets, with specific goals for affordable housing preservation and rental housing development.

These initiatives often involve partnerships and data-driven strategies. For instance, in 2024, Fannie Mae reported significant progress in its efforts to support manufactured housing as an affordable option, working with lenders to streamline financing. The company also emphasized its role in providing liquidity for rental properties, recognizing the growing demand for stable rental options across the nation.

Key activities include:

- Developing and launching new mortgage products designed to be more accessible to first-time homebuyers and those in underserved communities.

- Investing in affordable housing preservation through various financing mechanisms and partnerships.

- Providing data and analytics to identify housing needs and inform policy development.

- Advocating for policy changes that support housing affordability and access to credit.

Fannie Mae's key activities revolve around acquiring mortgages, securitizing them into Mortgage-Backed Securities (MBS), and guaranteeing these securities to investors. This process injects liquidity into the housing market, supporting homeownership and rental housing availability. In 2024, the company issued approximately $1.5 trillion in new MBS, underscoring its significant role.

Risk management is central, with Fannie Mae employing strict underwriting and credit risk transfer solutions, such as CAS and CRT Notes, to mitigate exposure. Their market analysis and housing research, including forecasts for 2025, inform policy and strategy. Furthermore, Fannie Mae actively develops programs to enhance affordable housing and promote stable homeownership, exemplified by its Equitable Housing Finance Plan and Duty to Serve initiatives in 2024.

| Key Activity | Description | 2024 Data/Impact |

| Mortgage Acquisition | Purchasing mortgage loans from lenders. | Facilitates continuous lending and housing credit flow. |

| Securitization | Pooling mortgages into tradable Mortgage-Backed Securities (MBS). | Issued ~$1.5 trillion in new MBS, channeling capital to housing. |

| Guaranteed MBS | Assuring investors of timely principal and interest payments. | Reduces investor risk, enhancing MBS attractiveness. |

| Credit Risk Management | Managing credit risk via underwriting and CRT solutions. | Utilized CAS and CRT Notes for risk transfer and capital efficiency. |

| Housing Research & Policy | Analyzing market trends and developing housing solutions. | Focused on affordability and access, supporting underserved markets. |

Preview Before You Purchase

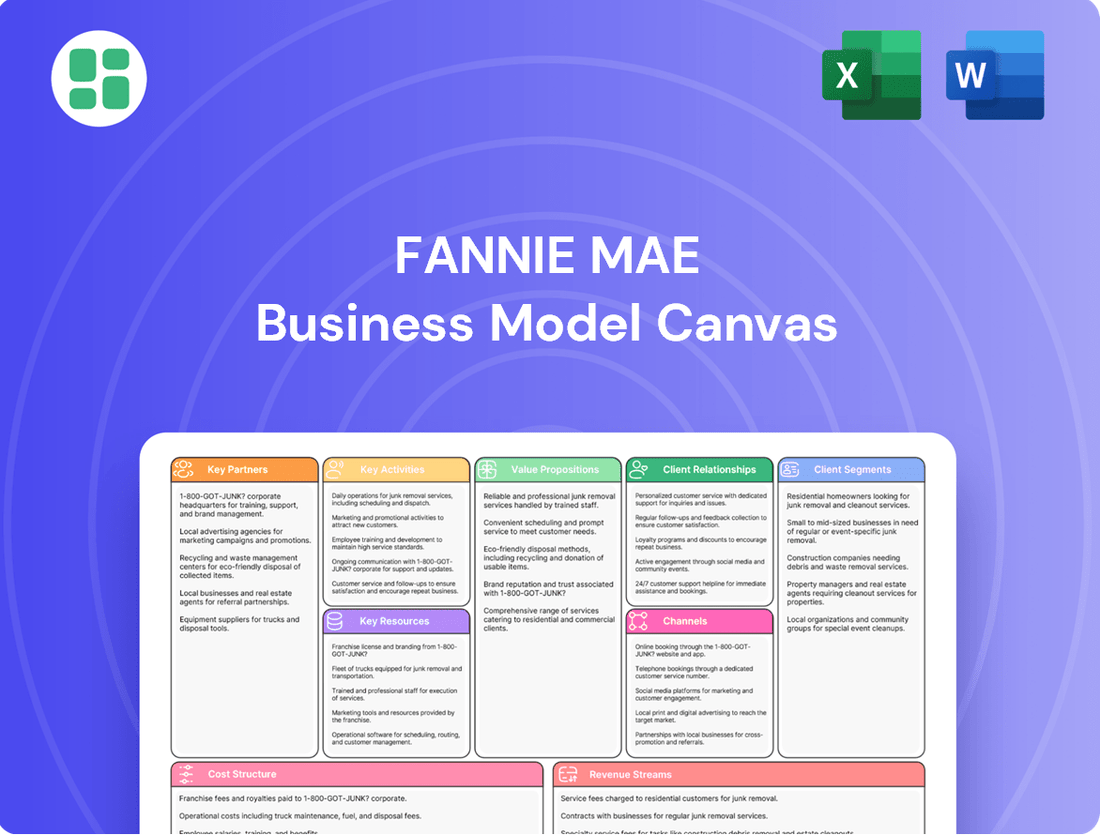

Business Model Canvas

The Fannie Mae Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the complete structure, content, and formatting of the final deliverable, ensuring there are no surprises. Once your order is complete, you'll gain full access to this same professionally prepared business model canvas, ready for your immediate use.

Resources

Fannie Mae's financial capital, including its substantial net worth and direct access to funding from the U.S. Treasury, serves as a cornerstone of its operations. This robust financial backing is essential for its ability to purchase mortgages, issue credit enhancements, and ensure consistent liquidity within the secondary mortgage market.

In 2024, Fannie Mae's financial strength was underscored by its reported net worth, a clear indicator of its solid financial standing. This capital base empowers the company to fulfill its mission of providing liquidity and affordability to the U.S. housing market.

The mortgage portfolio and guarantee book are Fannie Mae's central assets. This extensive collection of single-family and multifamily loans fuels its securitization operations and income streams. As of year-end 2024, single-family mortgages constituted a substantial part of Fannie Mae's overall guarantee book.

Fannie Mae leverages advanced technology and a robust data infrastructure to streamline its core functions. Its proprietary systems like Desktop Underwriter automate loan origination, while Collateral Underwriter enhances appraisal risk assessment. These tools are crucial for efficient loan acquisition and securitization.

The company's Data Dynamics platform provides critical data analytics, enabling sophisticated risk management and operational efficiency. In 2024, Fannie Mae continued to invest in these technological resources to maintain its competitive edge and support the housing market.

Human Capital and Expertise

Fannie Mae relies heavily on its human capital, comprising a diverse range of experts crucial for navigating the complexities of the secondary mortgage market. This includes financial wizards, seasoned risk managers, sharp IT professionals, and insightful market analysts who collectively ensure the company's smooth operation and strategic advancement.

The collective expertise of these teams is the bedrock for Fannie Mae's innovation, enabling the development of new financial products and the refinement of existing processes. Furthermore, their deep understanding is vital for maintaining rigorous compliance with ever-evolving regulations and effectively managing the intricate web of transactions within the secondary mortgage market.

Fannie Mae's commitment to continuous improvement is evident in its focus on empowering its workforce. The company invests in ongoing training and development, fostering an environment where process enhancement and robust risk management are paramount. For instance, in 2024, Fannie Mae continued its focus on talent development, with significant investment in upskilling its IT and cybersecurity teams to address emerging digital threats and opportunities.

- Financial Expertise: Teams of financial analysts and strategists are key to developing and managing Fannie Mae's financial instruments and ensuring market stability.

- Risk Management Prowess: Dedicated risk management professionals identify, assess, and mitigate potential financial and operational risks, safeguarding the company's stability.

- IT and Digital Innovation: Skilled IT professionals drive technological advancements, enhancing operational efficiency and data security in an increasingly digital landscape.

- Market Insight: Market analysts provide crucial intelligence on housing trends, economic indicators, and borrower behavior, informing strategic decision-making.

Government Charter and Support

Fannie Mae's designation as a government-sponsored enterprise (GSE) is a cornerstone of its business model. This status, established by a Congressional charter, allows it to operate with a public mission while functioning as a shareholder-owned company. This unique structure underpins its ability to provide crucial liquidity and stability to the U.S. housing finance system.

The charter explicitly mandates Fannie Mae to promote affordable housing by increasing the supply of mortgage credit. This mission is directly supported by the implicit backing of the U.S. government. This government support is a significant factor in building investor confidence, allowing Fannie Mae to access capital markets more effectively and at favorable rates.

Key resources derived from this government charter and support include:

- Congressional Mandate: A clear directive to foster liquidity and affordability in the mortgage market.

- Implicit Government Guarantee: This backing enhances creditworthiness and lowers borrowing costs.

- Market Stability Role: Facilitates consistent mortgage availability, especially during economic downturns.

- Access to Capital: Enables Fannie Mae to raise substantial funds necessary for its operations.

Fannie Mae's key resources are its robust financial capital, including its net worth and access to Treasury funding, its extensive mortgage portfolio and guarantee book, its advanced technology and data infrastructure, and its skilled human capital. These elements collectively enable Fannie Mae to fulfill its mission of providing liquidity and affordability in the U.S. housing market.

In 2024, Fannie Mae's financial strength was a critical resource. The company's ability to access capital markets efficiently is directly tied to its strong financial position and the implicit backing of the U.S. government, which underpins its entire business model.

The company's technological assets, such as Desktop Underwriter and Collateral Underwriter, are vital for operational efficiency and risk management. These systems, along with the Data Dynamics platform, allow for sophisticated analysis and streamlined processes, crucial for managing its vast portfolio.

Fannie Mae's human capital, encompassing financial experts, risk managers, IT professionals, and market analysts, represents a significant resource. Their collective expertise drives innovation, ensures compliance, and supports strategic decision-making in the complex secondary mortgage market.

| Key Resource Category | Description | 2024 Relevance/Data Point |

|---|---|---|

| Financial Capital | Net worth and access to U.S. Treasury funding. | Underpins liquidity provision and market stability. |

| Mortgage Portfolio & Guarantee Book | Collection of single-family and multifamily mortgages. | Forms the basis for securitization and income generation. |

| Technology & Data Infrastructure | Proprietary systems (e.g., Desktop Underwriter) and data analytics platforms. | Enhances operational efficiency, risk assessment, and data-driven decision-making. |

| Human Capital | Expertise of financial analysts, risk managers, IT professionals, and market analysts. | Drives innovation, regulatory compliance, and strategic planning. |

Value Propositions

Fannie Mae offers primary lenders enhanced liquidity by purchasing their originated mortgages, freeing up capital for new lending. In 2024, Fannie Mae’s mortgage-related purchases and securitizations continued to be a significant source of funding for the housing market, enabling lenders to maintain robust origination pipelines.

By acquiring mortgages, Fannie Mae effectively transfers credit risk away from primary lenders. This risk mitigation allows financial institutions to concentrate on their core competency: originating loans, rather than managing the long-term exposure of holding mortgages on their balance sheets.

This risk transfer and liquidity provision are crucial for the stability of the mortgage market. For instance, in the first half of 2024, Fannie Mae’s activities directly supported the financing of millions of homes, underscoring its role in facilitating borrower access to credit.

For investors, Fannie Mae offers Mortgage-Backed Securities (MBS) that are both highly liquid and guaranteed. These products provide attractive yields, helping investors diversify their portfolios and enhance returns. In 2024, the demand for such stable fixed-income assets remained robust, driven by their perceived safety.

Fannie Mae's guarantee of timely principal and interest payments is a cornerstone of this value proposition. This significantly mitigates credit risk, making MBS a dependable investment choice for a wide range of investors, particularly institutional ones. This assurance is crucial for those seeking secure, predictable income streams.

Fannie Mae's core value proposition for homebuyers is making mortgage financing more accessible and affordable. By purchasing mortgages from lenders, Fannie Mae injects capital back into the market, allowing more people to secure loans. This indirect support helps keep interest rates competitive.

In 2024, Fannie Mae continued its commitment to affordable housing. The company supported the financing of over 2.1 million rental units, many of which are affordable for low- to moderate-income families. This directly contributes to making housing more attainable.

Fannie Mae's standardization of mortgage products also plays a crucial role. This uniformity simplifies the borrowing process for homebuyers and lenders alike, reducing costs and increasing the availability of financing options. Their efforts in promoting equitable housing further broaden access to homeownership.

For the Housing Market: Stability and Efficiency

Fannie Mae acts as a bedrock for the U.S. housing market, ensuring a steady flow of capital. This consistent liquidity is vital, especially when economic conditions become challenging, preventing a freeze in mortgage availability. For instance, in 2023, Fannie Mae purchased approximately $770 billion in mortgages, demonstrating its ongoing commitment to market stability.

By guaranteeing mortgage-backed securities, Fannie Mae enhances market efficiency, making it easier and more predictable for lenders to originate loans. This operational efficiency translates into broader access to credit for homebuyers, fostering a healthier housing ecosystem. The company's role in managing credit risk also contributes significantly to this stability.

- Stabilizing Influence: Fannie Mae's continuous provision of liquidity, even during economic downturns, prevents market volatility.

- Mortgage Credit Availability: It ensures that mortgage credit remains accessible, supporting homeownership and market function.

- Market Efficiency: By standardizing and guaranteeing mortgage-backed securities, Fannie Mae streamlines the housing finance process.

- Ecosystem Benefits: The stability and efficiency fostered by Fannie Mae benefit lenders, borrowers, and the broader economy.

For the U.S. Government: Support for Housing Policy Objectives

Fannie Mae is a key partner for the U.S. government, helping to achieve national housing goals. This includes making homeownership more accessible and supporting the development of affordable rental properties across the nation. In 2024, Fannie Mae continued its commitment to these objectives, facilitating billions in mortgage financing that directly contributed to these policy aims.

The government utilizes Fannie Mae to inject liquidity into the mortgage market, ensuring consistent credit availability. This is particularly vital for expanding access to housing in underserved areas and for low-to-moderate income families. For example, in 2024, Fannie Mae’s multifamily business alone supported financing for over 400,000 rental units, many of which are affordable.

- Facilitating Affordable Housing: Fannie Mae's operations directly support government initiatives aimed at increasing the supply of affordable housing.

- Expanding Homeownership: The company plays a critical role in making mortgages available to a broader range of borrowers, including first-time homebuyers.

- Supporting Underserved Markets: Fannie Mae's programs are designed to address housing needs in communities that may otherwise face financing challenges.

- GSE Mission Alignment: As a Government-Sponsored Enterprise (GSE) under the Federal Housing Finance Agency (FHFA), Fannie Mae's activities are guided by its statutory mission to provide stability and affordability in the housing market.

Fannie Mae's value proposition centers on providing enhanced liquidity to primary lenders by purchasing mortgages, thereby freeing up capital for new lending activities. In the first half of 2024, its mortgage purchases and securitizations significantly bolstered the housing market, enabling lenders to maintain robust origination pipelines and support millions of home financing transactions.

By absorbing credit risk from lenders, Fannie Mae allows financial institutions to focus on loan origination rather than long-term mortgage exposure. This risk transfer is crucial for market stability, as demonstrated by Fannie Mae's consistent support for borrower access to credit throughout 2024.

For investors, Fannie Mae offers highly liquid and guaranteed Mortgage-Backed Securities (MBS), providing attractive yields and portfolio diversification. The demand for these stable, safe fixed-income assets remained strong in 2024, underscoring their appeal to a wide range of investors seeking predictable income streams.

Fannie Mae's guarantee of timely principal and interest payments on MBS is a key differentiator, significantly mitigating credit risk and making these investments dependable. This assurance is particularly valuable for institutional investors prioritizing secure and consistent returns.

Fannie Mae enhances mortgage accessibility and affordability for homebuyers by injecting capital back into the market through its purchasing activities. This indirect support helps maintain competitive interest rates, making homeownership more attainable. In 2024, the company's commitment to affordable housing was evident in its support for over 2.1 million rental units, benefiting low- to moderate-income families.

The standardization of mortgage products by Fannie Mae simplifies the borrowing process for both homebuyers and lenders, reducing costs and increasing financing options. This, coupled with efforts to promote equitable housing, broadens access to homeownership.

Fannie Mae acts as a stabilizing force in the U.S. housing market by ensuring a consistent flow of capital, especially during challenging economic periods. In 2023, Fannie Mae purchased approximately $770 billion in mortgages, highlighting its ongoing role in maintaining market stability.

By guaranteeing MBS, Fannie Mae improves market efficiency, making loan origination more predictable for lenders and expanding credit access for homebuyers. The company's effective credit risk management further contributes to overall market stability.

Fannie Mae is instrumental in achieving national housing goals, including expanding homeownership and supporting affordable rental housing development. In 2024, its financing activities directly contributed to these policy objectives, facilitating billions in mortgage financing.

The government leverages Fannie Mae to inject liquidity into the mortgage market, ensuring consistent credit availability, particularly for underserved areas and low-to-moderate income families. In 2024, Fannie Mae's multifamily business alone supported financing for over 400,000 rental units, many of which are affordable.

| Value Proposition | Description | 2024 Impact/Data Point |

|---|---|---|

| Enhanced Lender Liquidity | Purchasing mortgages from primary lenders frees up capital for new lending. | Enabled robust origination pipelines for lenders, supporting millions of home financing transactions in H1 2024. |

| Credit Risk Transfer | Acquiring mortgages transfers credit risk away from primary lenders. | Allowed financial institutions to focus on origination, bolstering market stability and borrower access to credit. |

| Investor Appeal (MBS) | Offers highly liquid, guaranteed Mortgage-Backed Securities with attractive yields. | Maintained strong investor demand in 2024 due to perceived safety and predictable income streams. |

| Homebuyer Accessibility & Affordability | Injects capital into the market, making mortgages more accessible and affordable. | Supported financing for over 2.1 million rental units in 2024, many affordable for low- to moderate-income families. |

| Market Stability & Efficiency | Provides consistent capital flow and standardizes mortgage products. | Purchased approx. $770 billion in mortgages in 2023, ensuring consistent credit availability and market function. |

Customer Relationships

Fannie Mae engages with a vast network of approved mortgage lenders through highly standardized, automated transactional relationships. This approach, facilitated by its digital platforms and stringent guidelines, ensures efficiency and consistency in the acquisition and securitization of mortgages. In 2024, Fannie Mae continued to process millions of mortgage transactions, underscoring the scale of these standardized interactions.

Fannie Mae cultivates strong connections with major institutional investors through dedicated relationship management. This includes providing comprehensive financial reports and valuable market analysis, ensuring transparency and fostering trust.

The company prioritizes regular, tailored communication to maintain investor confidence, which is crucial for facilitating Mortgage-Backed Securities (MBS) sales. For instance, in 2024, Fannie Mae continued its robust investor relations program, highlighting its commitment to open dialogue.

Investor relations support encompasses detailed quarterly and annual financial results, offering deep dives into performance and strategic direction. This consistent delivery of information underpins their managed relationships with key financial institutions.

Fannie Mae's operations are intrinsically linked to the Federal Housing Finance Agency (FHFA), which provides direct regulatory and supervisory oversight. This means Fannie Mae must adhere to stringent compliance measures and regularly report on its activities to ensure it meets its housing mission and maintains financial stability.

The FHFA's directives are critical, shaping Fannie Mae's adherence to housing goals and safety and soundness standards. For instance, in 2024, FHFA continued to emphasize Fannie Mae's role in providing liquidity to the mortgage market, particularly for affordable housing initiatives, while closely monitoring its capital levels and risk management practices.

Programmatic Engagement with Mortgage Servicers

Fannie Mae cultivates deep relationships with mortgage servicers through its programmatic engagement. This involves setting clear servicing standards and offering essential tools to support their operations.

Performance is actively monitored, with programs like the Servicer Total Achievement and Rewards (STAR) Program playing a key role. In 2024, Fannie Mae continued to emphasize operational excellence, aiming for consistent loan servicing across the market.

- Programmatic Engagement: Fannie Mae establishes ongoing relationships with mortgage servicers, defining operational expectations.

- Servicing Standards & Tools: Providing clear guidelines and resources to ensure efficient and compliant loan servicing.

- Performance Monitoring: Utilizing programs like STAR to track and reward servicer performance.

- Operational Excellence: Driving consistency and high-quality service delivery throughout the mortgage lifecycle.

Indirect and Educational Relationship with Homebuyers/Renters

Fannie Mae's connection with homebuyers and renters is largely indirect, primarily facilitated through its partnerships with mortgage lenders and housing counselors. This approach allows Fannie Mae to extend its reach and impact across the housing market without direct consumer interaction.

To foster a more informed consumer base, Fannie Mae actively engages in providing educational resources. These include tools, guides, and initiatives designed to boost financial literacy and offer clear information on accessing affordable housing options. For instance, as of 2024, Fannie Mae continued to support programs that offer educational materials on credit building and homeownership readiness.

- Indirect Reach: Fannie Mae connects with homebuyers and renters mainly through lenders and housing counselors.

- Educational Empowerment: The company provides resources to enhance financial literacy and access to housing information.

- Consumer Support: This relationship prioritizes empowering individuals with knowledge and support for their housing journeys.

- Initiatives: Fannie Mae's ongoing efforts in 2024 included supporting educational programs for aspiring homeowners.

Fannie Mae's customer relationships are primarily transactional and programmatic, focusing on efficiency and standardization with lenders and servicers. Investor relationships are managed through dedicated outreach and transparent reporting, while consumer engagement is indirect, emphasizing education and support via intermediaries.

| Relationship Type | Key Characteristics | 2024 Focus/Data Point |

|---|---|---|

| Mortgage Lenders | Standardized, automated transactions via digital platforms. | Continued processing of millions of mortgage acquisitions. |

| Institutional Investors | Managed relationships, comprehensive financial reports, market analysis. | Robust investor relations program emphasizing open dialogue. |

| Mortgage Servicers | Programmatic engagement, clear servicing standards, performance monitoring (e.g., STAR Program). | Emphasis on operational excellence and consistent loan servicing. |

| Homebuyers/Renters | Indirect engagement through lenders and housing counselors; educational resources. | Support for programs enhancing financial literacy and homeownership readiness. |

Channels

Fannie Mae's primary channel for acquiring mortgages is through direct relationships with its extensive network of approved lenders. These partnerships are crucial for channeling residential mortgages into the secondary market.

The process relies heavily on sophisticated electronic systems for loan delivery, underwriting, and ongoing communication, ensuring a smooth and efficient workflow. Lenders utilize Fannie Mae's proprietary platforms, such as Desktop Underwriter, to assess the risk and eligibility of mortgage applications.

In 2024, Fannie Mae continued to facilitate trillions of dollars in mortgage financing, with its lender network playing a pivotal role in originating and delivering these loans. The efficiency of these direct channels is paramount to Fannie Mae's mission of providing liquidity and affordability in the housing market.

Fannie Mae leverages sophisticated electronic trading platforms to issue and distribute its Mortgage-Backed Securities (MBS). These platforms are crucial for connecting with institutional investors and broker-dealers, facilitating the efficient flow of capital in the secondary mortgage market.

These electronic channels are designed to foster robust liquidity and market transparency for Fannie Mae MBS. By providing real-time pricing and trading capabilities, they enable a broad investor base to participate, ensuring that securities are widely distributed and priced accurately. For instance, in 2024, the volume traded on these platforms directly impacts the overall efficiency of the mortgage market, reflecting Fannie Mae's pivotal role in housing finance.

Fannie Mae actively engages with investors and the financial community via its dedicated investor relations website and mandatory public filings like Form 10-K and 10-Q. These platforms are crucial for disseminating transparent information regarding the company's financial health, operational activities, and strategic direction.

During 2024, Fannie Mae continued to leverage earnings calls as a key communication tool, offering insights into its performance and future outlook. This direct engagement allows stakeholders to ask questions and gain a deeper understanding of the company's position in the housing finance market.

Industry Conferences and Publications

Fannie Mae actively participates in and sponsors key industry conferences and forums. These events serve as crucial platforms for disseminating market insights, promoting its strategic initiatives, and fostering engagement with housing finance professionals, policymakers, and other stakeholders. For instance, in 2024, Fannie Mae continued its tradition of presenting at major housing finance events, sharing its economic forecasts and analysis of market trends.

Through its publications, including various reports, white papers, and detailed economic forecasts, Fannie Mae provides valuable data and analysis to the broader housing industry. These publications often highlight their role in supporting housing affordability and stability, with recent reports in 2024 detailing the impact of interest rate fluctuations on mortgage origination volumes and the outlook for multifamily housing. This content is vital for shaping industry best practices and informing policy discussions.

- Industry Engagement: Fannie Mae's presence at conferences like the MBA Annual Convention in 2024 allows direct interaction with industry leaders.

- Knowledge Dissemination: Publications such as their 2024 Housing Forecast provide critical data on mortgage market trends.

- Policy Influence: White papers on affordable housing initiatives released in 2024 contribute to policy debates and shape best practices.

- Market Insight: Economic reports regularly published in 2024 offer deep dives into factors influencing the housing finance landscape.

Fannie Mae Website and Digital Resources

The Fannie Mae website acts as a crucial digital gateway, offering a wealth of information, tools, and resources tailored for lenders, investors, and consumers. It provides access to essential guidelines, market research, and the latest news impacting the housing finance industry.

Through its online portals, Fannie Mae delivers vital data, comprehensive training modules, and dedicated support channels to its diverse partner network. This robust digital infrastructure facilitates broad engagement and empowers users with self-service capabilities.

- Centralized Information Hub: Fannie Mae's website (fanniemae.com) aggregates critical data, including mortgage-backed securities (MBS) performance, housing market trends, and policy updates.

- Lender and Investor Tools: Digital resources provide access to loan origination tools, underwriting guidelines, and investment performance analytics, supporting efficient operations.

- Consumer Education: The site offers resources for homebuyers and homeowners, covering topics like mortgage options, affordability calculators, and foreclosure prevention.

- Data Accessibility: In 2023, Fannie Mae's website facilitated access to extensive datasets related to its mortgage credit risk transfer and securitization activities, underpinning market transparency.

Fannie Mae's channels are multifaceted, encompassing direct lender relationships, electronic trading platforms, investor relations, industry engagement, and its comprehensive website. These channels are designed to facilitate mortgage finance, disseminate information, and foster market liquidity.

In 2024, Fannie Mae's direct lender network remained the primary conduit for mortgage acquisition, processing trillions in financing. Its electronic platforms efficiently connect issuers with a broad investor base for Mortgage-Backed Securities (MBS). The company also actively engages stakeholders through investor relations, industry events, and detailed publications, enhancing transparency and market understanding.

The Fannie Mae website serves as a vital digital hub, offering resources for lenders, investors, and consumers alike, providing access to data, tools, and educational materials. This digital presence is crucial for supporting its mission and ensuring broad market participation.

| Channel Type | Primary Function | 2024 Highlight |

|---|---|---|

| Direct Lender Network | Mortgage acquisition and delivery | Facilitated trillions in mortgage financing. |

| Electronic Trading Platforms | MBS issuance and distribution | Ensured robust liquidity and market transparency. |

| Investor Relations & Filings | Information dissemination to stakeholders | Provided insights via earnings calls and public filings. |

| Industry Engagement & Publications | Market insight sharing and policy influence | Presented economic forecasts and affordable housing initiatives. |

| Website & Online Portals | Resource hub for all users | Offered data, tools, and educational content for lenders, investors, and consumers. |

Customer Segments

Primary mortgage lenders, encompassing commercial banks, credit unions, and independent mortgage companies, are crucial partners for Fannie Mae. These institutions originate the residential mortgage loans that form the backbone of Fannie Mae's business. In 2024, the mortgage origination market continued to be robust, with lenders actively seeking ways to manage their capital and risk.

Fannie Mae's role is to provide these primary lenders with a stable and liquid secondary market for their originated loans. This allows lenders to sell off mortgages, freeing up capital to originate new loans, thereby supporting the housing market. For instance, by purchasing loans, Fannie Mae enables lenders to reduce their balance sheet exposure to long-term interest rate risk and credit risk.

Institutional investors, including pension funds, asset managers, and insurance companies, represent a core customer segment for Fannie Mae. These entities are drawn to Fannie Mae's Mortgage-Backed Securities (MBS) for their perceived stability and liquidity, essential components for managing large, long-term portfolios. In 2024, the demand from these sophisticated investors remains a vital driver for the U.S. housing finance system.

Homebuyers and homeowners are crucial, albeit indirect, customer segments for Fannie Mae. By fostering a robust secondary mortgage market, Fannie Mae facilitates greater mortgage availability and affordability, which directly benefits individuals seeking to purchase homes or refinance existing mortgages. This, in turn, supports broader access to homeownership and financial flexibility for homeowners.

In 2024, the U.S. housing market continued to see significant activity, with mortgage rates fluctuating but generally remaining elevated compared to recent years. Fannie Mae's role in providing liquidity is therefore essential for ensuring that these potential buyers and existing homeowners can access the financing they need. For instance, Fannie Mae's purchase of mortgages in 2023 reached hundreds of billions of dollars, a testament to its ongoing support for the primary mortgage market and, by extension, individual consumers.

Multifamily Property Owners and Developers

Fannie Mae's multifamily business is a crucial partner for property owners and developers, offering vital financing for apartment buildings and rental housing nationwide. They work through Delegated Underwriting and Servicing (DUS) lenders to facilitate these transactions.

This segment is instrumental in both creating new rental units and preserving existing affordable housing stock. In 2024 alone, Fannie Mae's commitment to this sector was substantial, demonstrating its ongoing support for the multifamily market.

- Financing Multifamily Properties: Fannie Mae provides essential capital for the acquisition, development, and refinancing of apartment buildings.

- Affordable Housing Focus: A significant portion of their business is dedicated to supporting and expanding the supply of affordable rental housing across the country.

- 2024 Market Impact: In 2024, Fannie Mae continued to be a dominant force in multifamily financing, with their DUS program playing a key role in market liquidity.

Mortgage Servicers

Mortgage servicers are key partners for Fannie Mae, handling the day-to-day management of loans. These institutions, which include banks and credit unions, collect borrower payments, manage escrow accounts, and address delinquencies. Fannie Mae relies on their operational efficiency to maintain the health of the mortgage market.

Fannie Mae establishes rigorous performance standards for its servicers, ensuring consistent and high-quality loan administration. This oversight is crucial for borrower satisfaction and the overall stability of the mortgage-backed securities market. The company provides guidance and resources to help servicers meet these expectations.

The STAR Program, for instance, highlights servicers who demonstrate exceptional performance. In 2024, Fannie Mae continued to emphasize servicer accountability and excellence, with STAR-rated servicers representing a significant portion of the portfolio. This program incentivizes best practices in loan servicing and default management.

- Key Partners: Financial institutions that manage mortgage loan payments and borrower interactions.

- Operational Standards: Fannie Mae sets performance benchmarks for servicers to ensure effective loan administration.

- STAR Program: Recognizes and promotes high-performing servicers, fostering excellence in the industry.

- Market Stability: Servicers play a vital role in maintaining the smooth functioning and stability of the mortgage market.

Fannie Mae's customer segments are diverse, ranging from primary mortgage lenders and institutional investors to multifamily property owners and servicers. Each group plays a distinct role in the housing finance ecosystem. In 2024, the company continued to facilitate access to homeownership and rental housing by supporting these key partners.

Primary mortgage lenders, including banks and credit unions, are fundamental to Fannie Mae's operations. They originate the loans that Fannie Mae purchases, thereby injecting liquidity into the market. Institutional investors, such as pension funds and asset managers, are crucial buyers of Fannie Mae's Mortgage-Backed Securities (MBS), providing a stable demand source.

Multifamily property owners and developers rely on Fannie Mae for financing to build and preserve rental housing. Mortgage servicers, in turn, manage the day-to-day administration of these loans, ensuring efficient operations. The company's 2024 activities underscored its commitment to supporting these varied customer needs.

Cost Structure

Fannie Mae's cost structure prominently features guarantee fee expenses. These are essentially the costs incurred for the credit enhancement Fannie Mae provides on the mortgage-backed securities (MBS) it issues. This function is central to its business, as it absorbs credit risk from the underlying mortgages.

In 2024, managing these guarantee fee expenses remains a critical factor for Fannie Mae's financial health. The company's ability to control and optimize these costs directly impacts its profitability and its overall approach to risk management in the mortgage market.

Operating and administrative expenses are a significant component of Fannie Mae's cost structure, encompassing employee compensation and benefits, technology infrastructure, and general overhead. In 2024, these costs are essential for managing its extensive mortgage portfolio and securitization operations.

Fannie Mae's commitment to its workforce and robust technological systems represents a substantial investment. These expenses are critical for maintaining the operational capacity needed to support the U.S. housing market.

Fannie Mae incurs significant interest expense by issuing debt to finance its mortgage acquisition and securitization activities. This cost of borrowing is a fundamental element of its financial structure, directly impacted by prevailing market interest rates and Fannie Mae's creditworthiness, which influences the rates it pays. For instance, in the first quarter of 2024, Fannie Mae reported interest expense on debt of $5.1 billion, highlighting its substantial financial obligations. Efficient management of this debt portfolio is therefore critical for maintaining profitability and financial stability.

Credit Losses and Loss Allowance Adjustments

Fannie Mae faces costs from credit losses on mortgages it guarantees, even with strong risk management. These losses are partially offset by the fees it collects for providing these guarantees and through credit risk transfer strategies. For instance, in 2023, Fannie Mae's credit-related expenses, which include credit losses, totaled $1.4 billion, a decrease from $2.1 billion in 2022, reflecting improved housing market conditions and effective risk mitigation.

Adjustments to its allowance for credit losses also play a significant role in its financial performance. These adjustments are dynamic, changing based on economic outlooks and the performance of its mortgage portfolio. Changes in this allowance directly impact Fannie Mae's reported earnings. For example, a $0.5 billion increase in the allowance for credit losses in the fourth quarter of 2023 contributed to a reduction in net income for that period.

- Credit Losses: Costs incurred from borrowers defaulting on mortgages guaranteed by Fannie Mae.

- Mitigation Strategies: Guarantee fees charged to lenders and credit risk transfer activities help offset these losses.

- Loss Allowance Adjustments: Changes to the reserve set aside for potential future credit losses, impacting reported earnings.

- 2023 Impact: Credit-related expenses were $1.4 billion, down from $2.1 billion in 2022, showcasing improved portfolio performance.

Regulatory and Compliance Costs

Fannie Mae, operating under the Federal Housing Finance Agency (FHFA) conservatorship, incurs substantial regulatory and compliance costs. These expenses are critical for adhering to stringent housing goals, safety and soundness regulations, and extensive reporting mandates. For instance, in 2023, Fannie Mae's total operating expenses, which include these significant compliance outlays, amounted to $10.7 billion.

- Housing Goals Adherence: Costs associated with meeting government-mandated affordable housing targets.

- Safety and Soundness Regulations: Expenses for maintaining financial stability and risk management frameworks.

- Reporting Requirements: Significant investments in data collection, analysis, and submission to regulatory bodies.

- Continuous Compliance Investment: These costs represent an ongoing and substantial operational expenditure for Fannie Mae.

Fannie Mae's cost structure is heavily influenced by interest expenses on its debt, which funds its mortgage acquisition and securitization activities. In the first quarter of 2024, this interest expense was $5.1 billion, underscoring the significant cost of capital. Credit losses, though mitigated by fees and risk transfer, also represent a key expense. For example, credit-related expenses were $1.4 billion in 2023, down from $2.1 billion in 2022.

Operating and administrative costs, including employee compensation and technology, are vital for managing its vast operations. Regulatory and compliance costs are also substantial, reflecting adherence to FHFA mandates. Total operating expenses in 2023 were $10.7 billion, encompassing these compliance outlays.

| Cost Category | 2023 Data (if available) | 2024 Trend/Impact |

|---|---|---|

| Interest Expense on Debt | Q1 2024: $5.1 billion | Directly tied to market interest rates; efficient portfolio management is key. |

| Credit Losses | 2023: $1.4 billion (down from $2.1 billion in 2022) | Mitigated by fees and risk transfer; portfolio performance influences this cost. |

| Operating & Administrative Expenses | Included in Total Operating Expenses of $10.7 billion (2023) | Essential for managing operations and technology infrastructure. |

| Regulatory & Compliance Costs | Included in Total Operating Expenses of $10.7 billion (2023) | Ongoing investment to meet government housing goals and regulations. |

Revenue Streams

Fannie Mae's primary revenue generator is the guarantee fee income it collects from lenders. These fees are essentially compensation for Fannie Mae taking on the credit risk associated with the mortgages it securitizes into Mortgage-Backed Securities (MBS). In 2023, Fannie Mae reported total guarantee fees of $15.6 billion, a slight increase from $15.3 billion in 2022, reflecting continued activity in the mortgage market.

Fannie Mae generates significant net interest income by holding mortgage loans and mortgage-related securities within its retained portfolio. This income stream is fundamentally the spread between the interest it earns on these assets and the cost of the funds it uses to acquire and hold them.

In 2024, Fannie Mae's net interest income was a substantial driver of its financial performance. For instance, in the first quarter of 2024, the company reported net interest income of $16.4 billion, highlighting its importance to overall profitability.

Fannie Mae’s income from investments is a key revenue stream, primarily derived from its holdings in cash and investment securities. These assets are strategically managed to balance the pursuit of optimal returns with the critical needs for liquidity and capital preservation, directly impacting the company's financial health.

In 2024, Fannie Mae reported a notable increase in its trading securities portfolio, which played a significant role in the overall growth of its assets. This expansion in investment activities demonstrates a proactive approach to generating income beyond its core mortgage business.

Other Fees and Services

Fannie Mae diversifies its revenue through various fees beyond traditional mortgage guarantee income. These include charges for technology solutions and data products, offering valuable insights and tools to industry participants.

The company's commitment to innovation is evident in its development of new products and initiatives. For instance, its Designated Underwriting System (DUS) program generates fees for specialized services within the housing finance sector.

In 2023, Fannie Mae reported significant income from these ancillary services, contributing to its overall financial stability. These revenue streams are crucial for supporting its mission and expanding its reach.

- Technology and Data Services: Revenue generated from providing advanced technology platforms and data analytics to mortgage lenders and other stakeholders.

- DUS Program Fees: Income derived from the administrative and servicing fees associated with its Designated Underwriting System program, a key part of its multifamily business.

- Specialized Product Fees: Earnings from fees related to unique or niche housing finance products and programs designed to address specific market needs.

- New Initiative Revenue: Income streams from recently launched or expanded services and creative financial solutions aimed at enhancing the housing market.

Credit Risk Transfer (CRT) Proceeds

Credit Risk Transfer (CRT) transactions, while primarily a risk management strategy, also serve as a revenue stream by reducing potential losses and optimizing capital. Fannie Mae actively engages in these transactions to offload a portion of credit risk to private investors, thereby enhancing its financial resilience.

These CRT deals, such as Credit Insurance Risk Transfer (CIRT) transactions, allow Fannie Mae to reduce its exposure to mortgage defaults. For instance, in 2023, Fannie Mae completed CRT transactions covering approximately $100 billion in unpaid principal balance, effectively transferring risk associated with these mortgages.

- Risk Mitigation: CRT transfers a portion of credit risk to private investors, reducing Fannie Mae's potential losses from mortgage defaults.

- Capital Optimization: By reducing its risk exposure, Fannie Mae can optimize its capital requirements, freeing up resources.

- Transaction Volume: In 2023, Fannie Mae executed CRT transactions on a significant volume of mortgages, demonstrating the scale of this revenue-generating activity.

Fannie Mae's revenue streams are multifaceted, extending beyond its core mortgage guarantee business to include net interest income, investment earnings, and various fees. These diverse income sources are crucial for supporting its mission in the housing finance market.

In 2024, the company continued to leverage its retained portfolio for net interest income, while also generating revenue from technology and data services, and its Designated Underwriting System (DUS) program. Credit Risk Transfer (CRT) transactions also contribute by mitigating risk and optimizing capital.

| Revenue Stream | Description | 2023 Data (Approx.) | 2024 Data (Q1 Example) |

|---|---|---|---|

| Guarantee Fees | Fees from lenders for credit risk on securitized mortgages. | $15.6 billion | Continued strong performance |

| Net Interest Income | Spread from holding mortgage assets. | Significant contributor | $16.4 billion (Q1 2024) |

| Investment Income | Earnings from cash and investment securities. | Contributed to overall financial health | Growth in trading securities portfolio |

| Ancillary Fees | Income from technology, data, DUS, and specialized products. | Significant contribution | Ongoing development of new initiatives |

| Credit Risk Transfer (CRT) | Risk mitigation and capital optimization. | Transactions covering ~$100 billion UPB | Active engagement in risk transfer |

Business Model Canvas Data Sources

The Fannie Mae Business Model Canvas is informed by a blend of internal financial data, extensive market research, and regulatory filings. These diverse sources ensure a comprehensive and accurate representation of the company's strategic framework and operational realities.