Fannie Mae Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fannie Mae Bundle

Fannie Mae operates within a complex financial landscape, heavily influenced by government policy and the stability of the housing market. Understanding the intensity of competition, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for navigating its strategic path.

The complete report reveals the real forces shaping Fannie Mae’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fannie Mae's primary suppliers are the mortgage originators, essentially the banks and financial institutions that originate the loans it guarantees. The bargaining power of these lenders is a key factor in Fannie Mae's operational landscape. When a few large lenders dominate the market, their substantial origination volumes can give them leverage to negotiate more favorable terms or pricing with Fannie Mae, as they represent a significant portion of the mortgages securitized. In 2023, for example, the top 10 mortgage originators accounted for a substantial share of the market, underscoring the potential influence of concentrated lender power.

Lenders possess multiple avenues to offload mortgages they originate, including selling them to Freddie Mac, Ginnie Mae, or through private label securitization. This array of choices significantly enhances their leverage, allowing them to select the most advantageous terms and pressuring Fannie Mae to maintain competitive purchasing standards and pricing.

In 2024, the mortgage market saw continued activity, with lenders actively seeking the best outlets for their loan portfolios. While Fannie Mae remains a dominant buyer, the presence of Freddie Mac and Ginnie Mae, along with the growing private label securitization market, ensures lenders have viable alternatives, thereby moderating Fannie Mae's supplier power.

The high degree of standardization in conventional mortgages that Fannie Mae purchases significantly curtails the bargaining power of individual lenders. Because mortgages, once they adhere to Fannie Mae's underwriting criteria, are essentially interchangeable commodities, Fannie Mae can readily shift its business between lenders without incurring substantial costs or operational disruptions. This fungibility inherently limits the leverage any single mortgage originator holds over Fannie Mae.

Regulatory Environment and GSE Mandates

The regulatory environment, primarily shaped by the Federal Housing Finance Agency (FHFA), significantly constrains the bargaining power of suppliers, particularly lenders. FHFA oversight and Fannie Mae's government-sponsored enterprise (GSE) mandates dictate the types of loans Fannie Mae can acquire and the terms involved, effectively setting predefined parameters that limit lenders' negotiation leverage.

These regulations directly influence the volume and nature of business available to lenders. For instance, the FHFA imposes multifamily loan purchase caps on both Fannie Mae and Freddie Mac, directly impacting the market capacity for these financial institutions and, by extension, the suppliers to Fannie Mae.

- FHFA Oversight: Sets the operational boundaries for Fannie Mae, influencing its purchasing decisions and supplier relationships.

- GSE Mandates: Require Fannie Mae to operate within specific public policy goals, further shaping its interactions with the market.

- Loan Purchase Parameters: Regulations define eligible loan types and terms, limiting supplier discretion.

- Multifamily Loan Caps: In 2024, FHFA continued to manage multifamily loan purchase limits, impacting lender business volumes.

Capital Requirements for Lenders

Capital requirements for primary mortgage lenders can significantly impact their ability to originate and retain mortgages, directly influencing their supply to Fannie Mae. For instance, in 2024, regulatory capital ratios, such as the Common Equity Tier 1 (CET1) ratio, remained a key focus for financial institutions. Lenders facing stringent capital adequacy rules might find it more advantageous to sell mortgages to Fannie Mae to free up capital, thereby diminishing their bargaining leverage in these transactions.

Fannie Mae's core mission is to provide liquidity to the mortgage market, a function that inherently benefits lenders by offering an outlet for their mortgage originations. This liquidity provision is crucial, especially during periods of market stress. For example, in the first quarter of 2024, Fannie Mae reported purchasing $100 billion in mortgages, demonstrating its continued role in supporting market liquidity.

- Capital Adequacy: Stricter capital requirements for lenders can incentivize them to sell mortgages to Fannie Mae to improve their balance sheets.

- Liquidity Provision: Fannie Mae's role as a liquidity provider reduces lenders' need to hold mortgages, thereby weakening their bargaining power.

- Market Impact: In 2024, Fannie Mae’s consistent mortgage purchases underscore its importance in maintaining market stability and supporting lender operations.

The bargaining power of Fannie Mae's suppliers, primarily mortgage originators, is generally moderate. While large originators can exert some influence due to volume, Fannie Mae's ability to purchase standardized loans from multiple sources limits individual supplier leverage. Furthermore, FHFA regulations and Fannie Mae's role in providing market liquidity tend to keep supplier power in check. In 2024, the ongoing need for liquidity for originators, coupled with Fannie Mae's consistent purchasing activity, maintained this balance.

| Factor | Impact on Supplier Bargaining Power | 2024 Relevance |

|---|---|---|

| Supplier Concentration | Moderate (Few large originators have some leverage) | Top originators continued to hold significant market share. |

| Availability of Alternatives | Lowers supplier power (Freddie Mac, Ginnie Mae, private label securitization) | These alternatives remained viable outlets for originators. |

| Switching Costs | Lowers supplier power (Standardized loans are interchangeable) | Fannie Mae's underwriting criteria ensure loan fungibility. |

| Regulatory Environment (FHFA) | Lowers supplier power (Sets purchase parameters and caps) | FHFA's multifamily loan caps in 2024 influenced lender capacity. |

| Fannie Mae's Liquidity Provision | Lowers supplier power (Reduces need for lenders to hold mortgages) | Fannie Mae purchased $100 billion in mortgages in Q1 2024, supporting liquidity. |

What is included in the product

Tailored exclusively for Fannie Mae, analyzing its position within its competitive landscape by examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes.

Quickly identify and address competitive threats with a visual overview of all five forces, making strategic adjustments effortless.

Customers Bargaining Power

Fannie Mae's customers are primarily the investors who buy its Mortgage-Backed Securities (MBS). The sheer size and diversity of this investor base, which includes major players like pension funds, insurance companies, mutual funds, and international financial institutions, significantly impacts their collective bargaining power. For instance, as of the first quarter of 2024, Fannie Mae's MBS outstanding reached trillions of dollars, spread across a vast number of entities.

A broad and deep investor pool generally dilutes the power of any single customer. This means Fannie Mae isn't overly reliant on any one entity for the demand of its MBS. The ability of investors to diversify their portfolios across various asset classes and issuers limits the leverage any individual investor or small group of investors can exert on Fannie Mae's pricing or terms.

Investors have a wide array of alternative investment options besides Fannie Mae's Mortgage-Backed Securities (MBS). These include corporate bonds, U.S. Treasury securities, and other forms of securitized products, each offering different risk and return profiles.

The presence and appeal of these substitutes empower investors. If Fannie Mae MBS fail to provide competitive returns or if their perceived risk increases, investors can readily reallocate their capital to these alternative assets, thereby increasing their bargaining power.

For instance, as of early 2024, yields on U.S. Treasury bonds remained attractive, offering a safe-haven alternative. The corporate bond market also presented opportunities, with various sectors showing strong performance, providing investors with viable choices if Fannie Mae MBS terms become less favorable.

The implicit government guarantee for Fannie Mae's mortgage-backed securities (MBS) significantly dampens customer (investor) bargaining power. This backing instills a high level of perceived safety and liquidity, making Fannie Mae MBS a benchmark. For instance, in 2024, Fannie Mae continued to be a dominant force in the secondary mortgage market, with its MBS offerings being a cornerstone for many fixed-income portfolios.

Investors, reassured by this government backing, are generally willing to accept lower yields on Fannie Mae MBS compared to similar but unguaranteed securities. This reduced sensitivity to yield demands limits their ability to negotiate for better terms or higher returns, effectively capping their bargaining power.

Market Liquidity and Transparency (TBA Market)

The To-Be-Announced (TBA) market for agency Mortgage-Backed Securities (MBS) is known for its high liquidity and transparency. This efficiency allows investors to easily enter and exit positions, fostering confidence and participation. For instance, in 2024, the TBA market continued to be a cornerstone of MBS trading, with daily volumes often reaching hundreds of billions of dollars, reflecting its substantial depth.

This robust liquidity means that collective investor sentiment can significantly influence pricing. Any notable shift in demand or supply within the TBA market can lead to rapid price adjustments. This dynamic empowers buyers and sellers by providing clear price discovery and the ability to act on market information swiftly.

- High Liquidity: The TBA market facilitates quick and easy trading of agency MBS, reducing transaction costs and risks for investors.

- Transparency: Standardized contract terms and readily available pricing information allow for efficient market assessment.

- Investor Influence: The ease of trading means that aggregated investor demand or supply can exert considerable pressure on prices, giving customers significant bargaining power.

- Market Dynamics: In 2024, the market's ability to absorb large trades without significant price disruption underscored its deep liquidity.

Interest Rate Environment and Yield Expectations

The prevailing interest rate environment significantly shapes investor demand for Mortgage-Backed Securities (MBS). When interest rates are on the rise, investors often expect higher yields on new MBS to compensate for the increased risk and the opportunity cost of holding lower-yielding older securities. This can strengthen their bargaining power as issuers must offer more attractive terms to attract capital.

In 2024, the Federal Reserve maintained a cautious approach to interest rate policy. While inflation showed signs of moderating, the central bank kept its benchmark interest rate elevated, impacting the yield curve. For instance, the 10-year Treasury yield, a key benchmark for MBS, fluctuated throughout the year, generally trading in a range that reflected ongoing economic uncertainties and inflation concerns.

- Investor Yield Expectations: In a rising rate scenario, investors may demand yields on new MBS issuances that are 50-75 basis points higher than prevailing yields on existing, similar-maturity MBS to account for interest rate risk.

- Demand in Low-Rate Environments: Conversely, during periods of persistently low interest rates, the search for yield can drive significant demand for MBS, potentially diminishing customer bargaining power as investors are more willing to accept lower returns.

- Impact on MBS Pricing: Higher yield expectations translate directly into lower prices for MBS, as the present value of future cash flows is discounted at a higher rate.

Fannie Mae's customers, primarily institutional investors, possess moderate bargaining power. This stems from the vast number of investors, the availability of alternative investments like U.S. Treasuries and corporate bonds, and the high liquidity of the To-Be-Announced (TBA) market for Mortgage-Backed Securities (MBS). However, the implicit government guarantee on Fannie Mae MBS significantly tempers this power by reducing perceived risk.

The sheer scale of Fannie Mae's MBS issuance, with outstanding volumes in the trillions as of early 2024, means no single investor holds significant sway. Investors can easily substitute Fannie Mae MBS with other fixed-income products if terms become less attractive, a dynamic amplified by fluctuating interest rates in 2024, which saw the 10-year Treasury yield moving in a range influenced by inflation concerns.

| Factor | Impact on Customer Bargaining Power | 2024 Data/Context |

|---|---|---|

| Investor Base Size & Diversity | Dilutes individual power | Trillions in MBS outstanding, spread across numerous large institutions. |

| Availability of Substitutes | Increases power | Attractive yields on U.S. Treasuries and corporate bonds offered alternatives. |

| Implicit Government Guarantee | Reduces power | Fannie Mae MBS remain a benchmark due to perceived safety and liquidity. |

| TBA Market Liquidity | Increases power | Daily TBA market volumes in the hundreds of billions facilitated price discovery and swift trading. |

| Interest Rate Environment | Variable impact | Elevated Fed rates in 2024 influenced MBS yields and investor expectations. |

Preview Before You Purchase

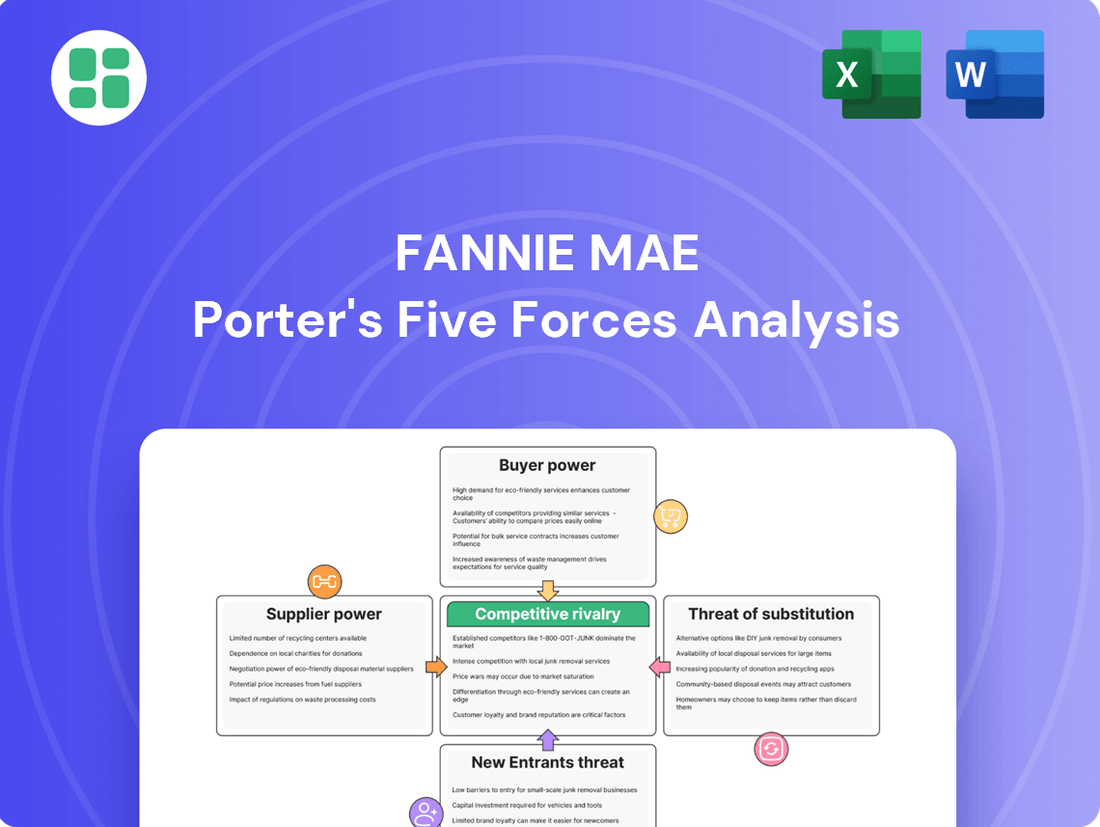

Fannie Mae Porter's Five Forces Analysis

This preview showcases the exact Fannie Mae Porter's Five Forces Analysis you will receive upon purchase, offering a comprehensive examination of the competitive landscape. You are viewing the complete, professionally formatted document, ensuring no surprises or placeholder content. Once your purchase is complete, you will gain instant access to this detailed analysis, ready for immediate use.

Rivalry Among Competitors

Fannie Mae's most significant direct competitor is Freddie Mac, another government-sponsored enterprise (GSE) operating in the secondary mortgage market. Both entities share a similar mission: to provide liquidity and stability to the housing finance system by purchasing mortgages from lenders. This direct rivalry means they often compete for the same lenders and market share, even with oversight from the Federal Housing Finance Agency (FHFA).

While the FHFA manages competition through directives and market share caps, a competitive dynamic persists. For instance, in 2024, both Fannie Mae and Freddie Mac continued to play crucial roles in the mortgage market, with their combined market share of agency mortgage-backed securities remaining substantial, reflecting their ongoing competition for lender business and influence in mortgage securitization.

Fannie Mae and Freddie Mac have operated under government conservatorship since the 2008 financial crisis. This oversight fundamentally reshapes their competitive landscape, limiting independent strategic maneuvering and often necessitating aligned approaches.

The Federal Housing Finance Agency (FHFA) directly influences their competitive intensity by setting critical parameters like capital requirements and multifamily loan purchase caps. For instance, in 2024, the FHFA announced a multifamily loan purchase limit of $75 billion for Fannie Mae and Freddie Mac combined, a figure that can restrict aggressive pricing or innovative product offerings, thereby dampening direct rivalry between the two entities.

Fannie Mae and Freddie Mac dominate the secondary mortgage market, collectively guaranteeing around 40% of all securitized U.S. mortgages in the past year. This duopoly creates intense rivalry, as their core products, conforming mortgages and Mortgage-Backed Securities (MBS), are highly standardized.

The homogeneity of these products means differentiation is minimal, pushing competition towards subtle service improvements or pricing adjustments within the strict confines of regulatory frameworks. This environment fosters a constant drive for operational efficiency to maintain market share.

Potential for Privatization

The ongoing discussions and renewed pushes for the privatization of Fannie Mae and Freddie Mac inject significant uncertainty into the competitive landscape. This potential shift could fundamentally alter how these entities operate and compete within the mortgage market.

Should privatization occur, Fannie Mae might gain greater autonomy. This could allow for more aggressive competition, but it would also necessitate raising substantial private capital. A key concern is the potential loss of their implicit government guarantee, a factor that has historically shaped their competitive approach and risk profile.

- Privatization Uncertainty: Discussions around privatizing Fannie Mae and Freddie Mac are ongoing, creating a dynamic competitive environment.

- Increased Autonomy vs. Capital Needs: Privatization could grant more operational freedom but would require significant private capital infusion.

- Loss of Government Guarantee: A potential removal of the implicit government guarantee could dramatically change Fannie Mae's competitive strategy and risk-taking.

Focus on Mission-Driven Lending

Fannie Mae and Freddie Mac, both Government-Sponsored Enterprises (GSEs), are guided by mandates to bolster affordable housing and serve underserved communities. The Federal Housing Finance Agency (FHFA) establishes specific mission-driven minimum percentages for their multifamily lending activities, creating a shared objective.

This common mission often fosters collaboration rather than direct competition in particular market areas, as both entities strive to meet overarching housing policy goals. For instance, in 2024, the FHFA set multifamily mission requirements that encouraged both GSEs to increase financing for affordable housing preservation and development.

- Shared Mandates: Both Fannie Mae and Freddie Mac are tasked with supporting affordable housing.

- FHFA Oversight: The FHFA sets minimum mission-driven percentages for multifamily lending.

- Collaborative Potential: Common goals can lead to cooperation in specific market segments.

- 2024 Mission Goals: FHFA's 2024 guidelines emphasized affordable housing preservation and development, influencing GSE strategies.

Fannie Mae's competitive rivalry is primarily with Freddie Mac, its direct counterpart in the secondary mortgage market. Both entities are government-sponsored enterprises (GSEs) with similar missions to provide liquidity to the housing finance system by purchasing mortgages from lenders. This creates a duopoly where competition centers on standardized products like conforming mortgages and mortgage-backed securities (MBS), leading to a focus on operational efficiency and service improvements within strict regulatory boundaries.

The Federal Housing Finance Agency (FHFA) actively manages this rivalry. For example, in 2024, the FHFA set a combined multifamily loan purchase cap of $75 billion for Fannie Mae and Freddie Mac, directly influencing their ability to aggressively compete on price or product innovation. This oversight, coupled with their shared conservatorship status since 2008, often necessitates aligned strategies, thereby dampening direct, independent competition.

Despite regulatory constraints, a competitive dynamic persists, particularly as discussions around the potential privatization of both GSEs continue. Privatization could grant Fannie Mae greater autonomy, potentially leading to more aggressive competition, but it would also require substantial private capital and could alter its risk profile by potentially removing its implicit government guarantee.

| Competitor | Market Share (Approx. Agency MBS) | Key Differentiator/Competitive Factor |

|---|---|---|

| Freddie Mac | ~20% (combined with Fannie Mae) | Similar product offerings, operational efficiency, FHFA-regulated market share caps |

| Other Lenders/Issuers | ~60% (non-agency MBS, whole loan sales) | Product innovation, pricing flexibility, direct client relationships, alternative securitization structures |

SSubstitutes Threaten

Private Label Securitization (PLS) directly competes with Fannie Mae's core business by offering an alternative avenue for securitizing mortgages. This means investors can buy mortgage-backed securities issued by private entities instead of those guaranteed by Fannie Mae.

While the volume of PLS dropped dramatically after the 2008 financial crisis, it's showing signs of recovery. For instance, in 2023, PLS issuance reached approximately $100 billion, a notable increase from prior years, indicating a potential resurgence. If private markets become more efficient, offer more attractive pricing, or can securitize loan types that fall outside Fannie Mae's conforming loan limits, this could represent a significant threat by diverting capital and market share.

Primary mortgage lenders can opt to keep originated mortgages on their own books instead of selling them to Fannie Mae, effectively sidestepping the secondary market. This approach, while exposing lenders to substantial capital and interest rate risks, becomes a more attractive alternative when Fannie Mae's guaranty fees are perceived as excessive or when lenders possess abundant liquidity and a strong inclination to retain servicing rights and the associated interest income.

Direct government lending programs, while not a widespread substitute for conventional mortgages currently, pose a potential threat. Ginnie Mae's existing role in guaranteeing securities backed by FHA, VA, and USDA loans demonstrates government participation in the mortgage market.

An expansion of direct government lending or guarantees across a broader spectrum of loan types could diminish the reliance on entities like Fannie Mae. For example, if the government were to offer more competitive rates or terms directly, it would present a viable alternative for borrowers.

Alternative Financing Structures

Alternative financing structures pose a threat by offering mortgages outside Fannie Mae's traditional securitization framework. Fintech companies and private capital sources are developing innovative products that could disintermediate Fannie Mae, providing liquidity directly to borrowers or originators. For example, in 2024, the non-bank mortgage origination market, a key area for alternative players, continued to be a significant force, though the exact market share fluctuates based on interest rate environments and regulatory shifts.

These substitutes, while growing, often face challenges related to scale and navigating complex regulatory landscapes. The sheer volume of mortgages handled by Fannie Mae and Freddie Mac, backed by government guarantees, creates a significant barrier to entry for smaller, less-established alternative models. Despite these hurdles, the pursuit of yield by institutional investors and the demand for flexible lending solutions continue to drive innovation in this space, suggesting a persistent, albeit evolving, threat.

Key considerations regarding these substitutes include:

- Fintech Innovations: Platforms offering direct lending or peer-to-peer mortgage financing.

- Private Capital: Investment funds and private equity firms seeking to originate and hold mortgages, bypassing the securitization market.

- Regulatory Hurdles: The significant compliance and capital requirements that alternative lenders must meet, often mirroring those faced by traditional institutions.

- Market Share: While not yet a dominant force, the collective market share of non-GSE securitization and direct lending is monitored for growth potential, especially during periods of higher interest rates that can strain the GSE model.

Shift in Housing Tenure to Rental

A long-term societal shift towards renting over homeownership could present a significant threat of substitution for Fannie Mae. If more individuals and families choose rental properties, the demand for single-family mortgages, a core component of Fannie Mae's business, would naturally decline. This would directly impact the volume of mortgages available for securitization.

However, this threat is somewhat mitigated by Fannie Mae's established presence in the multifamily housing sector. As rental demand rises, so too does the need for financing for apartment buildings and other rental complexes, an area where Fannie Mae is already a major player.

For instance, in 2024, the rental vacancy rate in the US hovered around 5.5%, indicating sustained demand for rental units. While homeownership rates saw a slight dip in early 2024, reaching approximately 65.7%, the long-term trend of increasing rental demand could still pose a challenge to traditional mortgage origination volumes.

- Societal Shift: Growing preference for renting over owning reduces demand for single-family mortgages.

- Fannie Mae's Role: A decrease in single-family mortgage demand directly impacts securitization volume.

- Multifamily Mitigation: Fannie Mae's significant involvement in the multifamily market helps offset this threat.

- Market Data: US rental vacancy rates remained around 5.5% in 2024, while homeownership was approximately 65.7%.

Private Label Securitization (PLS) and direct lending by financial institutions present significant substitutes by offering alternative ways to finance mortgages outside of Fannie Mae's guaranteed securitization model. While PLS issuance was around $100 billion in 2023, its continued recovery and the potential for private markets to offer more competitive pricing or securitize non-conforming loans could divert capital. Lenders may also choose to hold mortgages rather than sell them to Fannie Mae, especially if guaranty fees are high or if they have ample liquidity and wish to retain servicing income.

The threat of substitutes is amplified by innovative fintech platforms and private capital sources that are creating alternative financing structures. These players aim to disintermediate traditional securitization processes, providing liquidity more directly. In 2024, the non-bank mortgage origination market, a key arena for these alternative entities, continued to demonstrate its influence, though its market share is sensitive to interest rate shifts and regulatory changes.

Furthermore, a societal trend favoring renting over homeownership directly reduces the demand for single-family mortgages, a core business for Fannie Mae. Although Fannie Mae has a strong presence in the multifamily sector, which benefits from increased rental demand, the decline in single-family mortgage origination volumes remains a notable substitute threat. For example, in early 2024, US homeownership stood at approximately 65.7%, with rental vacancy rates around 5.5%, indicating sustained rental demand that could impact traditional mortgage volumes.

Entrants Threaten

Entering the secondary mortgage market at a scale comparable to Fannie Mae demands truly massive capital. For instance, as a government-sponsored enterprise (GSE), Fannie Mae operates with regulatory capital requirements that are in the hundreds of billions of dollars. This immense financial hurdle makes it incredibly challenging for any new entity to gather the necessary funds to even begin competing.

The secondary mortgage market operates under a stringent regulatory framework. Any new entity aiming to replicate Fannie Mae's role would confront substantial legislative and regulatory obstacles, making entry exceptionally difficult.

Establishing a new government-sponsored enterprise (GSE) with similar functions would necessitate an act of Congress. This process is not only lengthy but also involves rigorous scrutiny from bodies like the Federal Housing Finance Agency (FHFA), which oversees Fannie Mae and Freddie Mac.

For instance, the Housing and Economic Recovery Act of 2008 significantly tightened oversight of GSEs. The capital requirements and operational standards mandated by such legislation create a high barrier, demanding substantial compliance resources and expertise that new entrants would struggle to acquire quickly.

Fannie Mae's designation as a government-sponsored enterprise (GSE) is a significant barrier to entry. This status grants it an implicit government guarantee, which substantially lowers its borrowing costs and makes its mortgage-backed securities (MBS) highly attractive to investors due to perceived safety. For instance, in 2024, Fannie Mae's ability to access capital markets efficiently underpins its operational scale and competitive pricing.

Established Relationships and Market Infrastructure

Fannie Mae benefits from deeply entrenched relationships with primary lenders, mortgage servicers, and a vast network of investors, cultivated over decades. These established connections are critical for the smooth functioning of the U.S. housing finance system, making it difficult for newcomers to replicate.

The existing market infrastructure, particularly the To-Be-Announced (TBA) mortgage-backed securities market, is intrinsically designed around government-sponsored enterprises (GSEs) like Fannie Mae. This intricate web of processes and expectations presents a significant barrier to entry for any potential competitor.

- Decades of Relationship Building: Fannie Mae's long-standing ties with key market participants provide a significant competitive advantage.

- Embedded Market Infrastructure: The TBA market's structure is built to accommodate and rely on GSEs, creating a high hurdle for new entrants.

- Cost and Time Investment: A new entity would face substantial costs and time to develop comparable relationships and build out necessary infrastructure.

Mission-Driven Mandates and Social Impact

Fannie Mae's core mission to ensure housing market liquidity and affordability, especially for lower-income households, presents a significant hurdle for potential new entrants. A private competitor would likely find it challenging to align purely profit-driven objectives with these public service mandates, which are often prerequisites for regulatory approval and market acceptance.

This inherent conflict can act as a substantial barrier. For instance, while Fannie Mae is mandated to support affordable housing initiatives, a new entrant focused solely on maximizing shareholder returns might deprioritize such activities, potentially limiting its ability to gain traction or necessary government backing.

- Mandated Social Objectives: Fannie Mae is legally obligated to support affordable housing, a requirement that new private entities may not be able or willing to meet.

- Regulatory Hurdles: Gaining approval for operations often involves demonstrating a commitment to public interest goals, which can be complex for profit-centric newcomers.

- Public Perception: Entrants lacking a clear social mission may face challenges in building trust and acceptance within the broader housing market ecosystem.

The threat of new entrants into the secondary mortgage market, where Fannie Mae operates, is considerably low. This is primarily due to the immense capital requirements, stringent regulatory landscape, and the unique status of Fannie Mae as a government-sponsored enterprise (GSE). For example, in 2024, Fannie Mae's role in providing liquidity and stability to the housing market necessitates operations on a scale that demands hundreds of billions in capital, a figure that is exceptionally difficult for any new private entity to match.

The established infrastructure and deep-seated relationships Fannie Mae has cultivated over decades present another formidable barrier. Replicating the intricate network of primary lenders, mortgage servicers, and investors, along with the established processes within markets like the To-Be-Announced (TBA) mortgage-backed securities market, would require substantial time and investment. Furthermore, Fannie Mae's mandated public service objectives, such as supporting affordable housing, create a complex alignment challenge for purely profit-driven new entrants seeking regulatory approval and market acceptance.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Operating scale comparable to Fannie Mae requires hundreds of billions in capital. | Extremely high financial hurdle, making entry prohibitive. |

| Regulatory Framework | Stringent legislation and oversight from bodies like FHFA. | Significant compliance costs and expertise needed. |

| GSE Status | Implicit government guarantee lowers borrowing costs and enhances MBS attractiveness. | New entrants lack this cost advantage and perceived safety. |

| Established Relationships | Decades of cultivated ties with lenders, servicers, and investors. | Difficult and time-consuming to replicate essential market connections. |

| Market Infrastructure | TBA market is designed around GSEs, creating an embedded advantage. | New entrants must adapt to or overcome existing, GSE-centric systems. |

| Public Service Mandates | Fannie Mae's commitment to affordable housing. | Profit-focused newcomers may struggle to meet these requirements for market acceptance. |

Porter's Five Forces Analysis Data Sources

Our Fannie Mae Porter's Five Forces analysis leverages data from Fannie Mae's own financial reports, SEC filings, and investor presentations to understand internal dynamics. We also incorporate industry-wide data from housing market reports, economic indicators, and competitor analysis to provide a comprehensive view.