Fairfax Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fairfax Financial Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Fairfax Financial's trajectory. Our comprehensive PESTLE analysis provides the strategic intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full, actionable report now to gain a decisive competitive advantage.

Political factors

The global insurance and reinsurance sectors are constantly navigating a shifting regulatory environment, directly affecting Fairfax Financial's business. New federal and state rules, particularly those focused on financial health, capital reserves, and safeguarding policyholders, demand ongoing strategic adjustments.

For example, anticipated changes to tax provisions by the end of 2025, potentially influenced by shifts in government administrations, could impact Fairfax's ability to pursue strategic acquisitions and affect its overall profitability.

Geopolitical volatility, exemplified by ongoing conflicts in Ukraine and the Middle East, injects significant uncertainty into global financial markets. This instability directly impacts investment strategies, as seen in the fluctuating commodity prices and currency markets that affect Fairfax's diverse holdings.

These tensions heighten the risk of adverse macro scenarios, such as renewed supply shocks or a global recession. For instance, the ongoing energy market disruptions stemming from the Ukraine conflict have had ripple effects across various industries, potentially impacting insurance claims and investment valuations for Fairfax Financial.

Governments worldwide are stepping up their involvement in managing climate risks, driven by a surge in climate-related disasters. This trend suggests a future with more regulations and potentially government-backed insurance programs, especially for properties in high-risk areas. For instance, in 2023, the US experienced 28 separate billion-dollar weather and climate disasters, totaling over $92.9 billion in damages, underscoring the urgency for such interventions.

These governmental actions aim to bridge the protection gap, ensuring that individuals and businesses in vulnerable locations can still access insurance coverage. This could reshape the property and casualty insurance market, impacting companies like Fairfax Financial by potentially creating new opportunities or increasing compliance burdens. Regulators are also demanding greater clarity on how insurers are accounting for their exposure to climate change risks.

Trade Policies and Tariffs

Trade policies and tariffs significantly impact global markets, and shifts in these areas, especially from major economies like the United States, can create volatility. For instance, ongoing trade disputes and the potential for new tariffs in 2024 and 2025 could disrupt supply chains and alter the cost of goods for companies with international operations, like Fairfax Financial.

These policy changes can also influence global economic growth trajectories. For example, if tariffs lead to increased costs for imported goods, it could contribute to inflationary pressures, affecting investment income and the overall profitability of Fairfax Financial's diverse portfolio. The company's global diversification strategy means it must navigate a complex web of international trade regulations.

- US Trade Policy Uncertainty: Continued trade tensions, particularly with China and the European Union, can lead to unpredictable market conditions, impacting Fairfax Financial's investment and insurance operations.

- Impact on Inflation: Tariffs can increase the cost of goods, potentially exacerbating inflation and affecting the real returns on Fairfax Financial's investments. For example, a 10% tariff on key imported components could add millions in costs for businesses in Fairfax's portfolio.

- Global Economic Growth: Shifts in trade policies can slow global economic expansion, which in turn can reduce investment opportunities and growth prospects for companies like Fairfax Financial that operate worldwide.

Political Stability and Business Confidence

Political stability is a cornerstone for business confidence, especially for a global player like Fairfax Financial. Regions experiencing stable governance tend to attract more foreign investment, which is crucial for Fairfax's expansion and operational efficiency. For instance, in 2024, countries with a strong track record of political stability often saw higher inflows of foreign direct investment in the financial services sector compared to those with ongoing political turmoil.

Uncertainty stemming from upcoming elections or potential shifts in government policy can significantly dampen business sentiment. This often leads to a cautious approach, with companies delaying major investment decisions or pausing mergers and acquisitions. In the insurance industry, such delays can directly impact growth strategies and the ability to integrate new entities, potentially hindering Fairfax's decentralized model which relies on strategic acquisitions.

- Impact on Investment: Political instability can lead to a 5-10% decrease in foreign direct investment in emerging markets during election years, according to industry reports from late 2024.

- M&A Activity: Uncertainty surrounding regulatory frameworks post-election can temporarily freeze M&A deals, affecting companies like Fairfax that rely on strategic acquisitions for market penetration.

- Operational Model: Fairfax's decentralized structure is particularly sensitive to regional political shifts, as each subsidiary operates within a specific national legal and political environment.

Governmental focus on financial sector stability and consumer protection continues to shape regulatory landscapes, demanding adaptive strategies from insurers like Fairfax Financial. Anticipated shifts in tax legislation by late 2025 could influence capital allocation and acquisition strategies, impacting overall profitability.

Geopolitical tensions and trade policy adjustments, particularly those affecting major economies in 2024-2025, introduce market volatility and potential disruptions to supply chains and global economic growth. This necessitates careful navigation of diverse international trade regulations for Fairfax's global operations.

Increased government involvement in climate risk management, evidenced by the over $92.9 billion in US weather/climate disaster damages in 2023, suggests a future with more stringent regulations and potential for new insurance market opportunities or compliance burdens for Fairfax.

| Political Factor | Impact on Fairfax Financial | 2024/2025 Data Point |

| Regulatory Changes | Affects capital requirements, operational compliance, and profitability. | Anticipated tax provision changes by end of 2025. |

| Geopolitical Instability | Creates market volatility, impacting investment strategies and asset valuations. | Ongoing conflicts in Ukraine and Middle East affecting commodity and currency markets. |

| Climate Risk Regulation | Drives new compliance demands and potential market shifts in property & casualty insurance. | 28 billion-dollar weather/climate disasters in US in 2023, totaling $92.9B in damages. |

| Trade Policy Shifts | Impacts global economic growth, supply chains, and international operational costs. | Potential for new tariffs in 2024-2025 affecting imported goods costs. |

What is included in the product

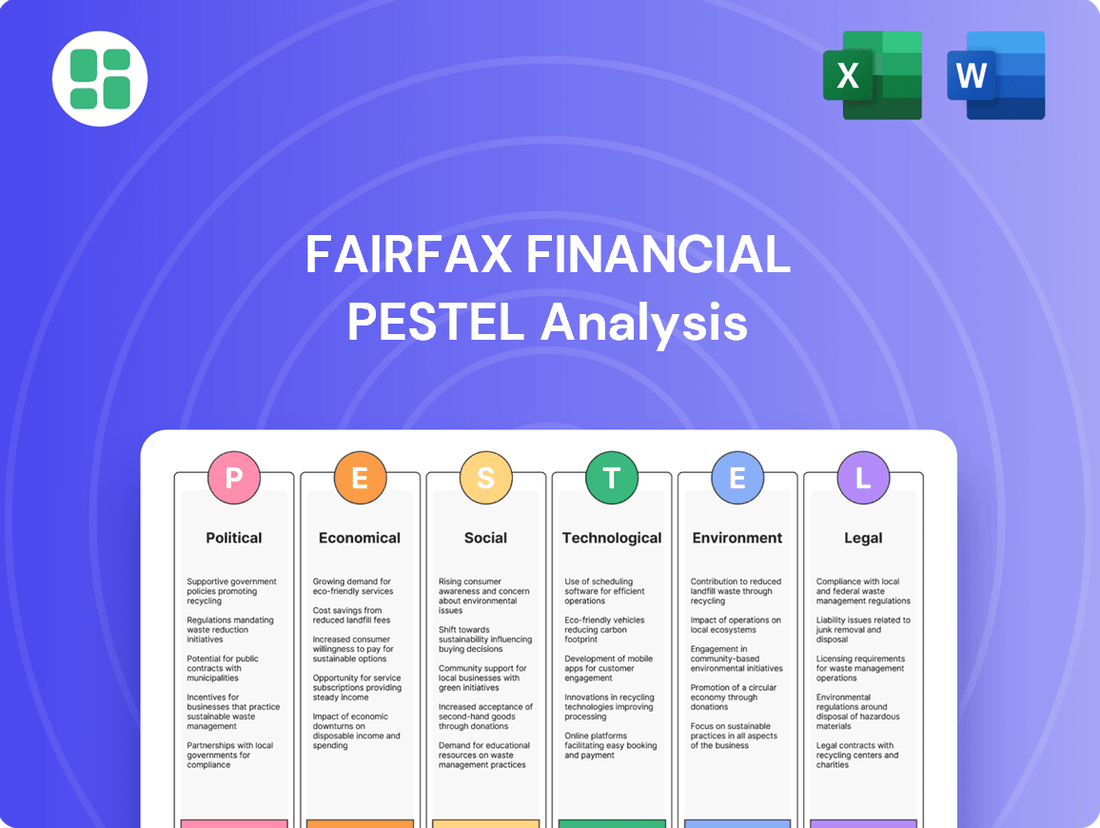

This PESTLE analysis critically examines the external macro-environmental forces impacting Fairfax Financial across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these global and regional factors create both strategic threats and opportunities for Fairfax Financial's diverse insurance and investment operations.

A PESTLE analysis for Fairfax Financial, presented in a concise, easily digestible format, alleviates the pain of sifting through complex data, enabling rapid understanding of external factors impacting their strategy.

Economic factors

Persistently elevated interest rates, while potentially boosting Fairfax Financial's investment income through higher bond yields, also present challenges. These higher rates increase the cost of capital for potential mergers and acquisitions, a key growth strategy for Fairfax. Furthermore, sustained high rates can dampen overall economic activity, impacting premium growth and investment returns.

As of early 2024, many central banks, including the US Federal Reserve, have maintained benchmark interest rates at multi-year highs. For instance, the Federal Funds Rate has remained in a range of 5.25%-5.50% for an extended period. This environment allows Fairfax's significant investment management arm to generate more income from its fixed-income holdings, which represented a substantial portion of its assets under management in its 2023 financial reports. However, the market anticipates potential monetary easing later in 2024 and into 2025, which could lead to lower bond yields and a shift in market sentiment that Fairfax must carefully manage.

Structural inflationary trends, amplified by recent policy shifts, are a significant concern for property and casualty insurers. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase, with annual inflation rates hovering around 3.4% in early 2024, impacting everything from repair costs to replacement values. This surge directly translates to higher claims costs, squeezing underwriting profitability.

Fairfax, like other insurers, faces the challenge of claims inflation, particularly in property lines where material and labor costs are directly affected. To counter this, insurers must continually adjust premium rates and enhance their risk modeling capabilities to accurately reflect these escalating costs. The ongoing need for rate adjustments is evident across the industry, with many carriers seeking approvals for double-digit rate increases in specific segments.

Social inflation, a phenomenon driven by increased litigation and larger jury awards, remains a persistent headwind, especially for casualty reinsurance. This trend, which can lead to claims costs exceeding initial estimates, puts considerable pressure on the profitability of long-tail casualty lines. Reinsurers, including those working with Fairfax, are actively recalibrating their pricing and reserving strategies to account for this evolving legal landscape.

Global economic growth is projected to continue at a moderate pace, with the International Monetary Fund (IMF) forecasting a 3.2% expansion for 2024 and a similar outlook for 2025. However, this growth is not uniform across regions, with some economies experiencing stronger upturns than others, directly influencing the demand for insurance products and the potential for premium increases.

Generally, stable Gross Domestic Product (GDP) growth is a positive indicator for the non-life insurance sector, as it often correlates with increased economic activity, higher disposable incomes, and greater demand for various insurance coverages. For instance, a robust economy typically means more businesses operating, more goods being transported, and more assets being insured, all of which contribute to premium growth.

Conversely, any significant deceleration in key global economic powerhouses or a resurgence of trade disputes could act as a drag on premium expansion. For example, a slowdown in the United States or China, or escalating geopolitical tensions impacting global trade flows, could dampen business confidence and investment, thereby reducing the appetite for comprehensive insurance solutions.

Capitalization and Reinsurance Market Stability

The global reinsurance market is showing strong signs of stability, with reinsurers expected to earn their cost of capital thanks to healthy operating profits and solid capitalization. This robust financial health means there's plenty of capacity available, and risk is being spread more effectively. For Fairfax, this creates a dependable environment for its reinsurance business, although we might see some softening in pricing for specific insurance types.

Key indicators supporting this stability include:

- Strong Capitalization: Reinsurers are well-capitalized, with capital levels generally exceeding regulatory requirements, providing a buffer against unexpected losses. For instance, major reinsurers reported strong solvency ratios in early 2024, often well above the 200% mark.

- Profitability: Operating profits have been consistently strong, allowing reinsurers to reinvest and maintain their financial strength. Many reinsurers achieved combined ratios below 90% in 2023, a significant improvement from prior years.

- Ample Capacity: The market has ample capacity to absorb risks, which can lead to more competitive pricing but also ensures that reinsurers can meet the demand for coverage.

- Improved Risk Layering: Better understanding and pricing of risks, coupled with more sophisticated risk transfer mechanisms, contribute to a more stable market structure.

Mergers and Acquisitions Activity

The insurance sector is poised for a surge in mergers and acquisitions (M&A) throughout 2025. This trend is fueled by a renewed emphasis on core business strengths, strategic portfolio adjustments, and the growing influence of consolidators within the industry.

While 2024 saw a dip in the sheer number of deals, the overall transaction value climbed significantly. This suggests a market favoring larger, more impactful acquisitions, a dynamic that Fairfax Financial, as a diversified holding company, is well-positioned to participate in or be affected by.

- 2025 M&A Outlook: Anticipated increase in deal volume and value within the insurance sector.

- 2024 Deal Trends: Lower deal count but higher aggregate value, signaling a preference for substantial transactions.

- Fairfax's Position: A holding company structure allows for strategic engagement in transformative M&A.

- Industry Drivers: Focus on fundamentals, portfolio rebalancing, and consolidator strategies are key motivators.

Persistently high interest rates, while beneficial for Fairfax's investment income from fixed-income assets, increase the cost of capital for M&A activities. The US Federal Reserve maintained the Federal Funds Rate between 5.25%-5.50% through early 2024, but potential easing in 2024-2025 could lower bond yields. Inflationary pressures, with the US CPI around 3.4% in early 2024, directly increase claims costs for insurers like Fairfax, impacting underwriting profitability.

Social inflation, driven by litigation, continues to pressure casualty reinsurance profitability, requiring reinsurers to adjust pricing and reserves. Global economic growth is projected at 3.2% for 2024 and 2025, but regional variations affect insurance demand. A stable global reinsurance market with strong capitalization and profitability, evidenced by solvency ratios above 200% and combined ratios below 90% in 2023, provides a favorable environment for Fairfax, though some pricing softening may occur.

The insurance sector anticipates a surge in M&A in 2025, building on higher transaction values in 2024 despite fewer deals, positioning Fairfax for strategic engagement.

| Economic Factor | 2024 Data/Outlook | 2025 Outlook | Impact on Fairfax |

|---|---|---|---|

| Interest Rates | High (Fed Funds Rate 5.25%-5.50% in early 2024) | Potential easing | Higher investment income, but increased M&A costs; potential yield reduction |

| Inflation | US CPI ~3.4% (early 2024) | Continued pressure expected | Increased claims costs, reduced underwriting profitability |

| Global GDP Growth | Projected 3.2% (IMF) | Similar to 2024 | Moderate demand for insurance; regional variations impact growth |

Same Document Delivered

Fairfax Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fairfax Financial delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. Understanding these external forces is crucial for stakeholders to assess potential opportunities and threats.

Sociological factors

Consumers increasingly expect tailored insurance experiences, demanding personalized product recommendations and proactive communication. For instance, a 2024 survey indicated that over 60% of insurance customers prefer digital channels for policy management and claims, highlighting the need for robust online portals and mobile apps.

Fairfax's subsidiaries must therefore invest in data analytics to understand individual customer needs and offer customized coverage. The shift towards on-demand and usage-based insurance, like telematics for auto insurance, is also gaining traction, with early adopters reporting potential premium savings, forcing traditional insurers to innovate or risk losing market share.

Demographic shifts, like the increasing proportion of older adults in many developed nations, directly impact insurance demand. For Fairfax Financial, this means a potentially higher need for health, life, and annuity products, but also a need to adapt underwriting for age-related risks. In 2024, for instance, Canada's population aged 65 and over represented over 19% of the total, a figure projected to grow.

These demographic changes also affect the talent pool. An aging workforce can lead to a shortage of experienced professionals, such as seasoned claims adjusters. This necessitates that companies like Fairfax Financial invest more in training and explore automation solutions to maintain operational efficiency and service quality in 2024 and beyond.

Public perception of risk significantly shapes demand for insurance products. For instance, growing awareness of climate change impacts, with events like severe weather costing the US an estimated $150 billion in 2023 alone, drives demand for specialized coverages. Fairfax Financial, like other insurers, must navigate this by clearly communicating how these emerging risks affect premiums and policy terms, fostering trust through transparency.

Social Inflation and Litigation Trends

Social inflation, the trend of rising jury awards and litigation expenses, remains a significant headwind for casualty insurers like Fairfax Financial. This phenomenon directly impacts the profitability of insurance lines by increasing the ultimate cost of claims. For instance, studies from organizations like the Insurance Information Institute (III) have highlighted the persistent upward trend in large commercial liability awards in recent years, exceeding general inflation rates.

Fairfax's reinsurance segment, in particular, must carefully manage its reserves for prior underwriting periods. The increasing frequency and severity of litigation, often fueled by broader societal attitudes towards corporate accountability and a more litigious environment, can lead to unexpected increases in claim payouts. This necessitates robust actuarial analysis and a keen understanding of evolving legal precedents.

- Rising Jury Awards: Average jury awards in large commercial liability cases have shown a marked increase, often outpacing general inflation.

- Increased Litigation Costs: Legal defense expenses, expert witness fees, and settlement costs continue to climb, adding to the overall cost of claims.

- Impact on Reinsurance: Reinsurers like Fairfax must account for these trends when setting reserves for historical underwriting years, as latent claims can emerge with higher costs.

- Societal Attitudes: Shifts in public perception and a greater willingness to sue contribute to the environment driving social inflation.

Workforce Dynamics and Talent Attraction

The insurance sector, including companies like Fairfax Financial, is grappling with a significant talent shortage, especially in critical roles such as claims adjusters and cybersecurity experts. This makes attracting and keeping skilled employees a major hurdle.

Demographic shifts, with an aging workforce and fewer young people entering specialized fields, exacerbate these labor challenges. For instance, the Society of Actuaries reported in 2024 that the average age of actuaries continues to rise, highlighting a need for new talent pipelines.

- Talent Gap: Difficulty in finding qualified individuals for specialized insurance roles.

- Demographic Pressure: An aging workforce in the insurance industry is creating a growing need for new talent.

- Automation Investment: Companies are increasing investments in automation and AI to improve efficiency and manage potential labor shortages.

- Service Impact: Labor shortages can strain service delivery and potentially increase claims leakage if not addressed effectively.

Societal attitudes toward risk and corporate responsibility are evolving, influencing demand for insurance and driving trends like social inflation. Growing awareness of climate change, for example, led to an estimated $150 billion in costs from severe weather events in the US in 2023, increasing demand for specialized coverages.

The insurance industry faces a significant talent shortage, particularly in areas like claims adjusting and cybersecurity, with the average age of actuaries rising according to a 2024 Society of Actuaries report. This necessitates increased investment in training and automation to maintain operational efficiency and service quality.

Consumer expectations are shifting towards personalized, digitally-driven insurance experiences, with over 60% of customers preferring online channels for policy management and claims in 2024, according to a recent survey. This trend pushes companies like Fairfax Financial to enhance their digital offerings and data analytics capabilities.

Demographic shifts, such as an aging population, present both opportunities and challenges for insurers. For instance, Canada's population aged 65 and over represented over 19% in 2024, a growing segment that increases demand for health and life products but also requires adaptation to age-related risks.

Technological factors

Artificial intelligence and machine learning are fundamentally reshaping how insurance companies operate. These technologies are being integrated into core functions like assessing risk, identifying fraudulent claims, and streamlining the claims handling process. Furthermore, AI is enhancing customer interactions, offering more personalized and efficient support.

The commitment to AI is significant, with projections indicating that over 70% of property and casualty insurers intend to boost their AI investments by 2025. This increased spending is expected to lead to more precise underwriting, enabling insurers to better price risk. It also facilitates real-time fraud detection, saving considerable resources, and ultimately improving the overall customer experience.

The insurance industry's move towards cloud-native platforms is a major driver of digital transformation. Projections indicate that by 2025, more than 85% of property and casualty insurers will have embraced cloud-first strategies. This shift is crucial for enhancing security protocols, streamlining operational workflows, and lowering the overhead associated with physical infrastructure.

For Fairfax Financial, adopting these cloud-native approaches supports its decentralized operational structure by boosting agility and scalability. This technological evolution allows for more efficient data management and quicker deployment of new services, directly impacting its ability to adapt to market changes and innovate within the insurance landscape.

The Internet of Things (IoT) is transforming how Fairfax Financial assesses and prevents risk. Real-time data from telematics in vehicles, smart home sensors, and wearable devices offer unprecedented insights into customer behavior and potential hazards.

This influx of data allows Fairfax to refine risk models, enabling the development of usage-based insurance policies and highly personalized services. For instance, telematics data can reward safer driving habits, directly impacting premiums.

Effectively leveraging IoT necessitates significant investment in robust data management systems and advanced analytical capabilities. By mid-2024, the global IoT market was projected to reach over $1.1 trillion, highlighting the scale of data generation and the imperative for insurers to harness it.

Cybersecurity and Data Privacy Technologies

The increasing reliance on digital platforms for insurance operations, from policy issuance to claims processing, amplifies cybersecurity risks. Fairfax Financial, like all insurers, faces constant threats of data breaches and cyberattacks targeting sensitive policyholder information. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, underscoring the critical need for robust defenses.

Navigating the complex web of data privacy regulations, such as GDPR and CCPA, presents a significant technological and operational challenge. Fairfax must ensure compliance across its diverse global operations, which often involves substantial investment in data management and security technologies. Failure to comply can result in hefty fines and reputational damage, impacting customer trust and business continuity.

- Increased Investment: Expect continued significant investment in advanced cybersecurity solutions, including AI-driven threat detection and encrypted data storage, to safeguard policyholder data.

- Regulatory Compliance: Fairfax must adapt its technological infrastructure to meet evolving data privacy mandates, which vary significantly by region, impacting data handling and storage protocols.

- Data Governance: Implementing sophisticated data governance frameworks and technologies is essential to ensure the ethical and secure management of personal and financial information.

Automation and Operational Efficiency

Automation is a critical driver for Fairfax Financial, streamlining everything from policy issuance to claims processing. This not only slashes operational costs but also significantly boosts customer satisfaction by speeding up service delivery. For instance, in 2023, many insurance firms reported a reduction in claims processing times by up to 30% through enhanced automation, a trend Fairfax is actively pursuing across its diverse portfolio.

By embracing advanced automation technologies, Fairfax's subsidiaries can effectively navigate the complexities of outdated legacy systems and mitigate the impact of ongoing labor shortages. This strategic adoption allows them to achieve higher levels of operational excellence, ensuring competitiveness in a rapidly evolving market.

- Streamlined Policy Issuance: Automation reduces manual data entry and approval bottlenecks, leading to faster policy generation.

- Efficient Claims Management: AI-powered tools can automate initial claims assessment and fraud detection, accelerating payouts.

- Cost Reduction: Automating repetitive tasks lowers labor costs and minimizes errors, improving the bottom line.

- Enhanced Customer Experience: Quicker processing times and more accurate service contribute to greater customer loyalty.

Technological advancements are profoundly impacting the insurance sector, with AI and machine learning becoming integral to risk assessment, fraud detection, and claims processing. By 2025, over 70% of property and casualty insurers are expected to increase their AI investments, aiming for more precise underwriting and improved customer experiences. Cloud-native strategies are also paramount, with projections indicating over 85% of P&C insurers will adopt cloud-first approaches by 2025, enhancing security and operational agility.

The Internet of Things (IoT) is revolutionizing risk management by providing real-time data from sources like vehicle telematics, enabling usage-based insurance and personalized services. The global IoT market's growth, projected to exceed $1.1 trillion by mid-2024, underscores the vast data potential for insurers. Automation is another key driver, with many insurers reporting up to a 30% reduction in claims processing times in 2023 through automation, a trend Fairfax is actively pursuing to boost efficiency and customer satisfaction.

| Technology Area | Impact on Fairfax Financial | Key Data/Projections |

|---|---|---|

| Artificial Intelligence & Machine Learning | Enhanced risk assessment, fraud detection, personalized customer service | 70%+ P&C insurers increasing AI investment by 2025 |

| Cloud-Native Platforms | Improved security, operational agility, scalability | 85%+ P&C insurers adopting cloud-first strategies by 2025 |

| Internet of Things (IoT) | Refined risk models, usage-based insurance, personalized offerings | Global IoT market > $1.1 trillion (mid-2024 projection) |

| Automation | Streamlined operations (policy issuance, claims), cost reduction | Up to 30% reduction in claims processing times (reported by insurers in 2023) |

| Cybersecurity | Mitigation of data breaches and cyberattacks | Global cost of cybercrime projected at $10.5 trillion annually by 2025 |

Legal factors

Fairfax Financial navigates a complex web of global insurance and reinsurance regulations, with each jurisdiction imposing unique requirements. Staying compliant with these ever-changing laws, covering everything from policy wording to solvency ratios, is paramount for its worldwide operations.

For instance, in 2024, the International Association of Insurance Supervisors (IAIS) continued its focus on strengthening supervisory convergence and addressing emerging risks, impacting how companies like Fairfax manage capital and consumer protection across borders. Failure to adhere to these diverse legal frameworks can result in significant penalties and operational disruptions.

Fairfax Financial operates within an evolving landscape of data privacy and consumer protection laws. Increasingly stringent regulations, such as GDPR and CCPA, directly affect how insurers collect, use, and store sensitive customer information, particularly concerning third-party data and the algorithms underpinning predictive models. Compliance is paramount for maintaining customer trust and avoiding significant penalties; for instance, GDPR fines can reach up to 4% of global annual revenue.

Fairfax Financial's operations, particularly its frequent engagement in mergers and acquisitions, are heavily influenced by anti-trust and competition laws. Regulators worldwide scrutinize these deals to prevent market monopolization and ensure a level playing field for all players in the insurance industry. For instance, in 2023, the global insurance M&A market saw significant activity, with deal volumes reaching hundreds of billions of dollars, all subject to these stringent reviews.

Navigating these regulations is crucial for Fairfax's strategic growth. Failure to comply can result in hefty fines, divestiture orders, or even the blockage of proposed transactions. In 2024 and 2025, continued consolidation within the insurance sector means Fairfax must remain vigilant, proactively assessing the competitive landscape and ensuring its M&A strategies align with evolving anti-trust frameworks across its diverse operating regions.

Corporate Governance and Reporting Standards

As a publicly traded financial holding company, Fairfax Financial operates under stringent corporate governance mandates and International Financial Reporting Standards (IFRS). This regulatory framework dictates how the company must conduct its business and disclose its financial performance, ensuring a level of accountability to stakeholders.

Adherence to these standards, particularly timely and transparent financial reporting, is paramount for maintaining investor confidence and ensuring ongoing regulatory compliance. For instance, in its 2023 annual report, Fairfax Financial detailed its compliance with IFRS, which is crucial for its global operations and investor base. The company's commitment to these reporting standards underpins its credibility in the financial markets.

Fairfax Financial's corporate governance practices are designed to safeguard shareholder interests and promote ethical conduct. Key aspects include:

- Board Oversight: Independent directors and audit committees provide robust oversight of financial reporting and internal controls.

- Shareholder Rights: Mechanisms are in place to ensure fair treatment and engagement of shareholders.

- Ethical Conduct: Codes of conduct and compliance programs guide employee behavior and business practices.

- Transparency: Regular disclosures of financial results and material information are made available to the public.

Litigation and Legal Trends (Social Inflation)

The escalating trend of social inflation, characterized by increased litigation and larger jury awards, particularly in casualty insurance lines, presents a significant legal risk to Fairfax Financial's underwriting profitability. This phenomenon, driven by factors like a more plaintiff-friendly legal environment and a willingness to sue, can lead to higher claims costs than initially anticipated.

Fairfax must actively monitor evolving legal landscapes and adapt its underwriting and claims management strategies to effectively mitigate these growing liabilities. For instance, the U.S. saw a significant increase in large jury verdicts in recent years, with some studies indicating a substantial rise in the frequency and severity of awards exceeding $1 million in liability cases, directly impacting insurers like Fairfax.

- Social Inflation Impact: Litigation trends, including rising jury awards, directly affect casualty insurance profitability.

- Risk Mitigation: Adapting underwriting and claims practices is essential to manage increased legal liabilities.

- Data Point: Reports from 2023 and early 2024 highlighted a persistent upward trend in large jury verdicts across various U.S. jurisdictions.

Fairfax Financial must navigate a complex and evolving global regulatory environment. Key legal factors include compliance with diverse insurance regulations, data privacy laws like GDPR, and anti-trust legislation impacting M&A activities. The company also faces challenges from social inflation, which increases litigation costs and jury awards, particularly in casualty lines.

| Regulatory Area | Key Considerations | Impact on Fairfax | 2024/2025 Focus |

|---|---|---|---|

| Insurance Regulations | Jurisdictional variations, solvency requirements, consumer protection | Operational complexity, capital management | IAIS convergence efforts, emerging risk management |

| Data Privacy | GDPR, CCPA, customer data handling | Customer trust, potential fines (up to 4% global revenue) | Algorithm transparency, third-party data usage |

| Anti-Trust & M&A | Market competition, merger reviews | Deal approval, market access | Increased M&A scrutiny in a consolidating market |

| Social Inflation | Litigation trends, jury awards | Underwriting profitability, claims costs | Monitoring rising large jury verdicts in U.S. liability cases |

Environmental factors

Climate change presents a significant environmental hurdle, intensifying the frequency and severity of extreme weather events such as wildfires, floods, and hurricanes. This trend directly impacts Fairfax Financial by driving up insurance claims and expanding the geographical areas deemed high-risk, placing considerable strain on their property and casualty insurance and reinsurance underwriting processes.

Fairfax Financial, like many in the insurance and financial services sector, faces increasing pressure from regulators and investors regarding ESG performance. For instance, in 2024, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations are becoming more embedded in corporate reporting frameworks globally, requiring detailed climate risk assessments. This means Fairfax must clearly articulate its approach to underwriting climate-vulnerable assets and its own operational carbon footprint.

Stakeholder expectations are also shifting, with a growing demand for transparency in how companies manage environmental impact and social responsibility. By 2025, it's anticipated that a significant portion of institutional capital will be screened through ESG criteria, meaning Fairfax's ability to attract and retain capital will increasingly depend on its demonstrated commitment to sustainability. This could influence its investment choices, pushing it towards greener assets and away from high-carbon industries.

The increasing frequency and severity of climate-related events, such as hurricanes and wildfires, demand sophisticated natural catastrophe modeling. Fairfax's resilience hinges on its capacity to accurately assess and price these risks, a challenge amplified by evolving weather patterns. In 2024, global insured losses from natural catastrophes are projected to be significant, underscoring the need for advanced analytics.

Leveraging AI-driven predictive modeling allows Fairfax to refine underwriting strategies for catastrophe-prone regions. This technological edge is crucial for maintaining profitability and ensuring operational resilience in the face of escalating climate risks. For instance, advancements in catastrophe modeling in 2025 are expected to provide even more granular insights into regional vulnerabilities.

Environmental Liabilities and Transition Risks

Fairfax Financial's insurance subsidiaries are increasingly exposed to environmental liabilities stemming from gradual climate changes, like rising sea levels. These long-tail risks require sophisticated assessment and management strategies to account for their long-term impact on the company's balance sheet.

Furthermore, the global transition to a low-carbon economy presents significant transition risks. This includes potential shifts in asset values and the need for insurers to adapt their underwriting practices and product offerings to support businesses navigating this economic transformation. For instance, the insurance industry, as a whole, is grappling with how to price and underwrite risks associated with renewable energy projects, a key component of the low-carbon transition.

- Emerging Risks: Insurers like Fairfax face growing liabilities from climate-related events and gradual environmental shifts.

- Transition Challenges: The move to a low-carbon economy creates new underwriting needs and potential asset repricing.

- Market Adaptation: Fairfax must assess its ability to offer coverage for businesses involved in the green energy sector.

Resource Scarcity and Operational Impact

While not a direct operational input for an insurance and financial services company like Fairfax, the growing global trend of resource scarcity, particularly concerning water and energy, can subtly increase the cost of doing business across various sectors. For instance, rising energy prices, driven by supply constraints or geopolitical factors, could indirectly affect Fairfax's subsidiaries by increasing their operational expenses, such as utilities for office spaces or transportation costs for claims adjusters. The International Energy Agency reported that global energy demand grew by 1.3% in 2023, a trend that is expected to continue, potentially leading to higher energy costs impacting businesses Fairfax invests in or insures.

Furthermore, resource scarcity can influence the long-term valuations of Fairfax's extensive investment portfolio. Companies heavily reliant on water-intensive processes or fossil fuels may face increased regulatory pressures, higher operating costs, and diminished market demand as economies shift towards sustainability. This could lead to downward adjustments in their valuations. For example, a drought affecting agricultural output, a sector Fairfax might hold investments in, could reduce the profitability and thus the value of those holdings.

Looking ahead to 2024 and 2025, the pressure of resource scarcity is likely to persist and potentially intensify. Global initiatives aimed at climate change mitigation and sustainable resource management will continue to shape economic policies and corporate strategies. Fairfax will need to monitor how these environmental trends translate into financial risks and opportunities across its diverse business lines and investment holdings.

- Rising Energy Costs: Global energy demand is projected to continue its upward trajectory, potentially increasing operational overheads for Fairfax's subsidiaries and its investee companies.

- Water Stress Impact: Regions experiencing water scarcity may see increased costs for businesses reliant on water, affecting sectors like agriculture and manufacturing where Fairfax may have exposure.

- Investment Valuation Adjustments: Companies with significant environmental footprints or reliance on scarce resources may face valuation challenges as sustainability becomes a more critical factor for investors.

- Regulatory and Policy Shifts: Governments worldwide are implementing policies to address resource scarcity, which could create new compliance costs or market opportunities for Fairfax's portfolio.

The increasing frequency and severity of climate-related events, such as hurricanes and wildfires, demand sophisticated natural catastrophe modeling. Fairfax's resilience hinges on its capacity to accurately assess and price these risks, a challenge amplified by evolving weather patterns. Global insured losses from natural catastrophes were estimated to be around $100 billion in 2023, underscoring the need for advanced analytics.

The transition to a low-carbon economy presents both risks and opportunities. Fairfax must adapt its underwriting practices and investment strategies to support businesses navigating this shift, potentially increasing its exposure to renewable energy projects. By 2025, a significant portion of institutional capital is expected to be screened through ESG criteria, influencing Fairfax's ability to attract and retain capital.

Resource scarcity, particularly concerning water and energy, can subtly increase the cost of doing business. For instance, global energy demand grew by 1.3% in 2023, potentially leading to higher energy costs impacting businesses Fairfax invests in or insures. Companies reliant on scarce resources may face increased regulatory pressures and diminished market demand, affecting their valuations.

| Environmental Factor | Impact on Fairfax Financial | Data Point/Trend |

|---|---|---|

| Climate Change & Extreme Weather | Increased insurance claims, higher risk assessment costs | Global insured losses from natural catastrophes ~$100 billion (2023) |

| Low-Carbon Transition | Need for new underwriting, potential asset repricing, ESG capital screening | Significant institutional capital screened by ESG criteria by 2025 |

| Resource Scarcity (Energy/Water) | Higher operational costs, impact on investment valuations | Global energy demand grew 1.3% (2023) |

PESTLE Analysis Data Sources

Our Fairfax Financial PESTLE Analysis draws data from official financial reports, regulatory filings, and industry-specific market research. We incorporate insights from global economic indicators, geopolitical analyses, and technological advancements to provide a comprehensive view.