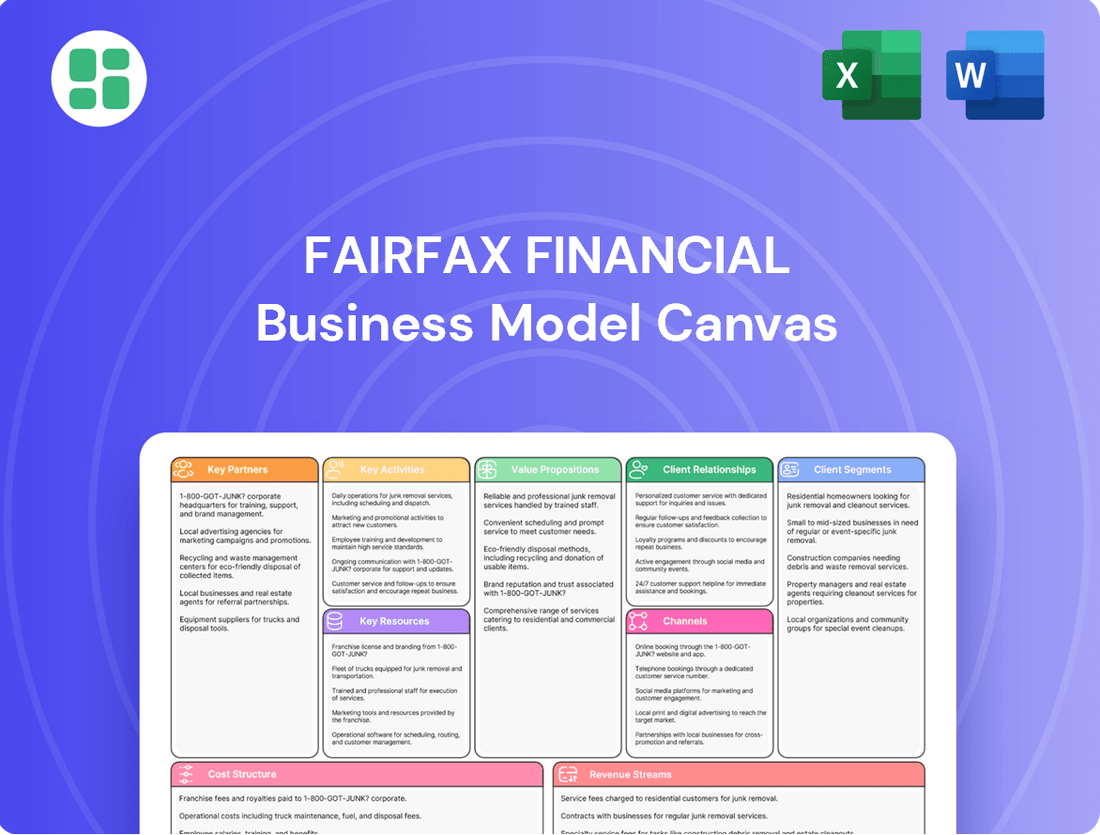

Fairfax Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fairfax Financial Bundle

Unlock the strategic blueprint behind Fairfax Financial's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they leverage their diverse insurance and investment portfolio to create and deliver value. Discover their key partners, revenue streams, and cost structure to gain actionable insights for your own business.

Partnerships

Fairfax Financial leverages a strong network of reinsurance providers to manage its insurance risks, especially for major or catastrophic events. These partnerships are vital for limiting exposure to substantial losses and boosting its capacity to underwrite policies. For instance, in 2023, Fairfax continued to utilize reinsurance to protect against significant natural disaster claims, a strategy that underpins its financial resilience.

Fairfax's insurance subsidiaries rely heavily on a vast network of insurance brokers and agents to distribute their property and casualty and specialty insurance products. These intermediaries are crucial for accessing a broad spectrum of customers and achieving deeper market penetration, offering localized expertise and service. For instance, in 2024, the effective use of these partnerships contributed significantly to Fairfax's premium growth across its diverse insurance lines.

Fairfax Financial's investment management arm thrives through strategic alliances with external investment management firms and its own associates. These partnerships are crucial for managing its extensive portfolio, which spans equities, fixed income, and private equity. By tapping into specialized expertise, Fairfax enhances its ability to generate net gains and income from dividends and interest.

In 2024, Fairfax's commitment to its value-oriented investment philosophy meant these partnerships were instrumental in identifying and capitalizing on strategic stakes in various companies. This approach directly contributes to the company's overall financial performance and its ability to achieve long-term capital appreciation.

Acquired Subsidiaries and Portfolio Companies

Fairfax's decentralized structure relies heavily on its acquired subsidiaries and portfolio companies, functioning as crucial partners. These entities, such as Northbridge Financial, Crum & Forster, Allied World, and Odyssey Group, are vital contributors to the company's gross premiums and establish its specialized market reach.

- Northbridge Financial: A significant contributor to Canadian property and casualty insurance.

- Crum & Forster: Specializes in specialty lines of insurance in the U.S.

- Allied World: Offers a broad range of insurance and reinsurance solutions globally.

- Odyssey Group: Focuses on specialty insurance and surety markets.

The operational success and market performance of these independent units directly influence Fairfax's overall consolidated financial results and strategic positioning.

Regulatory Bodies and Industry Associations

Fairfax Financial maintains crucial ties with regulatory bodies like the U.S. Securities and Exchange Commission (SEC) and Canada's Office of the Superintendent of Financial Institutions (OSFI). These relationships ensure ongoing compliance and operational licensing across its global footprint, which includes significant operations in Bermuda and the UK.

Active engagement with industry associations, such as the Insurance Information Institute, allows Fairfax to monitor evolving market trends and advocate for policies that support business growth. This participation is vital for upholding industry standards and ensuring long-term sustainability in a dynamic financial landscape.

- Regulatory Compliance: Essential for maintaining licenses in key markets like the U.S., Canada, and Bermuda.

- Industry Influence: Participation in associations helps shape favorable policies and uphold standards.

- Market Insight: Staying informed on trends through associations aids strategic decision-making.

Fairfax's strategic alliances with reinsurers are paramount for risk diversification and capital efficiency, enabling the company to underwrite larger risks. In 2023, reinsurance ceded by Fairfax amounted to approximately $16.4 billion, a clear indicator of its reliance on these partnerships to manage exposure to catastrophic events and maintain financial stability.

The extensive network of insurance brokers and agents is fundamental to Fairfax's distribution strategy, driving premium growth and market access. In 2024, these intermediary relationships were critical in expanding Fairfax's customer base across its diverse insurance offerings, contributing to a robust performance in property and casualty and specialty lines.

Fairfax's decentralized model thrives on its acquired subsidiaries, such as Crum & Forster and Allied World, which act as key operational partners. These entities collectively generated substantial gross premiums in 2023, with Fairfax's insurance and reinsurance operations reporting approximately $27.5 billion in net premiums written for the year, highlighting the critical role of these partnerships in the company's overall revenue generation and market presence.

| Partnership Type | Key Role | 2023/2024 Impact |

|---|---|---|

| Reinsurers | Risk management, capacity enhancement | $16.4 billion ceded in 2023 |

| Brokers & Agents | Distribution, market access | Drove premium growth in 2024 |

| Subsidiaries (e.g., Crum & Forster, Allied World) | Operational execution, premium generation | Contributed to $27.5 billion in net premiums written (2023) |

What is included in the product

A detailed, real-world business model canvas for Fairfax Financial, outlining its diversified insurance and investment strategy, customer segments, and value propositions.

This canvas provides insights into Fairfax's operations, competitive advantages, and strategic plans, ideal for understanding its unique approach to the insurance and investment sectors.

Fairfax Financial's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot that simplifies complex insurance operations.

It streamlines strategic understanding and communication, alleviating the pain of deciphering intricate financial structures.

Activities

Fairfax's core activity centers on the disciplined underwriting of property and casualty insurance and reinsurance. This involves rigorous risk assessment, precise pricing, and the efficient issuance of policies, all geared towards ensuring profitability and effectively managing potential claims exposure.

The company's emphasis on conservative underwriting is a key differentiator. This approach allows Fairfax to maintain strong combined ratios, even when faced with substantial catastrophe losses, demonstrating a commitment to long-term financial stability.

In 2023, Fairfax reported a combined ratio of 96.7%, a testament to their effective underwriting and risk management practices. This figure indicates that for every dollar of premiums earned, they paid out 96.7 cents in claims and expenses, leaving a small profit margin before investment income.

Fairfax's core activity is its investment management, where it deploys a long-term, value-driven approach. This involves the strategic deployment of capital across a diverse range of assets, including public equities, fixed income securities, and private equity investments. The primary objective is to achieve consistent, compounded growth in the company's book value per share.

A significant part of this involves identifying and executing opportunistic acquisitions and divestitures. For instance, in 2023, Fairfax completed several significant transactions, including the acquisition of a controlling stake in Poseidon Acquisition Corp. and the divestiture of its stake in Excalibur.

The company's capital allocation strategy is crucial for its success. In 2023, Fairfax reported total investments of $31.1 billion, with a significant portion allocated to equities and fixed income. This disciplined approach to capital allocation aims to maximize long-term shareholder value.

Fairfax Financial's claims management and settlement process is a cornerstone of its operations, focusing on efficiency and fairness to policyholders. This ensures timely processing and resolution of claims, directly bolstering customer satisfaction and reinforcing the company's reputation for reliability.

The company's approach to claims handling is deeply intertwined with sophisticated actuarial management and robust reserve development. Fairfax has consistently demonstrated favorable outcomes in these areas, reflecting a disciplined approach to risk assessment and financial provisioning.

In 2023, Fairfax reported a combined ratio of 93.7%, indicating strong underwriting performance, which is heavily influenced by effective claims management. This metric suggests that for every dollar of premium earned, the company paid out 93.7 cents in claims and expenses, leaving a profit margin.

Strategic Acquisitions and Integration

Fairfax Financial's strategic acquisitions are a cornerstone of its growth, focusing on insurance and related industries. The company actively seeks friendly takeovers of well-managed businesses, aiming to enhance its portfolio and market presence. This approach involves rigorous due diligence and careful negotiation to ensure favorable terms.

Integration is handled with a decentralized philosophy, preserving the autonomy of acquired management teams. This allows new entities to operate independently while benefiting from Fairfax's financial strength and strategic guidance. A prime example of this strategy in action is the recent consolidation of Gulf Insurance Group.

- Acquisition Focus: Primarily targets insurance and related sectors, seeking established, well-run businesses.

- Integration Strategy: Decentralized approach that maintains autonomous management of acquired entities.

- Recent Example: Consolidation of Gulf Insurance Group illustrates the ongoing execution of this strategy.

Financial Reporting and Investor Relations

Fairfax Financial's key activities include comprehensive financial reporting and robust investor relations. This means meticulously preparing quarterly and annual financial results, ensuring accuracy and adherence to all regulatory standards. For example, in their Q1 2024 report, Fairfax highlighted significant growth in operating income, demonstrating their commitment to transparent reporting.

Maintaining open and honest investor relations is paramount. This involves proactive communication through earnings calls, press releases, and direct engagement with shareholders and analysts. Fairfax's consistent communication strategy helps build trust and provides clarity on their financial performance and strategic direction. Their investor relations efforts are designed to keep stakeholders well-informed about the company's progress and outlook.

- Comprehensive Financial Statements: Production of detailed quarterly and annual financial reports.

- Earnings Calls and Webcasts: Regular communication of performance and strategic updates.

- Investor Outreach: Direct engagement with shareholders, analysts, and the financial community.

- Disclosure Compliance: Ensuring adherence to all regulatory and disclosure requirements.

Fairfax's key activities encompass disciplined underwriting, strategic investment management, and efficient claims handling. The company also actively pursues opportunistic acquisitions and maintains robust financial reporting and investor relations.

| Activity | Description | 2023 Data/Example |

|---|---|---|

| Underwriting | Disciplined risk assessment and policy issuance in P&C insurance. | Combined Ratio of 96.7% |

| Investment Management | Long-term, value-driven deployment of capital across diverse assets. | Total Investments of $31.1 billion |

| Claims Management | Efficient and fair processing and settlement of claims. | Contributed to a 93.7% combined ratio. |

| Acquisitions | Targeted acquisitions in insurance and related sectors with decentralized integration. | Acquisition of a controlling stake in Poseidon Acquisition Corp. |

| Financial Reporting & Investor Relations | Transparent reporting and proactive communication with stakeholders. | Q1 2024 report highlighted significant growth in operating income. |

Delivered as Displayed

Business Model Canvas

The Fairfax Financial Business Model Canvas preview you are viewing is an exact representation of the final document you will receive upon purchase. This means you are seeing the actual structure, content, and formatting that will be delivered, ensuring no discrepancies or surprises. Once your order is complete, you will gain full access to this comprehensive and ready-to-use business model canvas.

Resources

Fairfax's substantial financial capital, including significant shareholder equity and the considerable float generated from insurance premiums, forms a cornerstone of its operations. This robust capital base not only fuels underwriting capacity and ensures ample liquidity but is also strategically deployed into investments, thereby generating supplementary returns.

The company's commitment to sound financing is evident in its strong financial standing at the close of 2024. For instance, Fairfax reported total equity attributable to common shareholders of approximately $29.4 billion as of December 31, 2024, underscoring its solid financial foundation.

Fairfax Financial's human capital is anchored by its highly experienced, autonomous subsidiary presidents who are the driving force behind operational excellence. This decentralized management structure allows these leaders to make swift, informed decisions, fostering agility and long-term value creation across the group.

The strategic vision and leadership of Chairman and CEO Prem Watsa are a critical intellectual and strategic asset, guiding the company's disciplined, value-oriented investment philosophy. Fairfax reported total assets of $116.4 billion as of December 31, 2023, a testament to the effective management of its decentralized structure.

Fairfax's diversified portfolio of wholly-owned and associated property and casualty insurance and reinsurance subsidiaries, including major players like Allied World, Odyssey Group, Crum & Forster, and Northbridge Financial, forms a foundational resource. These entities grant access to varied markets and specialized underwriting expertise, directly fueling gross premiums and underwriting profits.

In 2024, this robust network of subsidiaries was instrumental in generating significant financial contributions. For instance, Fairfax reported substantial growth in net premiums written across its insurance operations, a direct reflection of the breadth and depth of its subsidiary network's market penetration and underwriting success.

Proprietary Investment Strategies and Expertise

Fairfax Financial's proprietary investment strategies, deeply rooted in a value-oriented philosophy, are a cornerstone of its business model. This approach is championed by the extensive expertise housed within its investment teams, with Hamblin Watsa Investment Counsel being a prime example. This intellectual capital is vital for pinpointing undervalued assets across various markets and constructing well-diversified portfolios designed to weather economic fluctuations and generate robust returns.

The firm's ability to consistently identify and capitalize on market inefficiencies is directly attributable to this specialized knowledge. For instance, Fairfax's long-term success in identifying undervalued companies, often through deep fundamental analysis, has been a significant contributor to its overall profitability. This expertise allows them to navigate complex financial landscapes and secure substantial investment gains, a critical component of their financial performance.

- Value-Oriented Philosophy: Focus on acquiring assets below their intrinsic value.

- Deep Expertise: Leverages seasoned investment professionals, notably at Hamblin Watsa Investment Counsel.

- Identifying Undervalued Assets: Core competency in finding overlooked investment opportunities.

- Portfolio Management: Skill in constructing and managing diversified portfolios for optimal risk-adjusted returns.

Brand Reputation and Long-Term Focus

Fairfax Financial's brand reputation is a cornerstone, built on a bedrock of financial stability, rigorous underwriting, and a steadfast commitment to long-term value creation. This intangible asset is crucial for attracting and retaining a loyal customer base, as well as for drawing top talent and instilling confidence in investors. In 2023, Fairfax reported total revenues of $23.1 billion, underscoring the market's trust in its established reputation.

This strong reputation acts as a significant differentiator in the highly competitive insurance and financial services landscape. It allows Fairfax to command customer loyalty and attract strategic partnerships. The company's consistent financial performance, with a net earnings per diluted common share of $44.74 in 2023, directly supports and reinforces this positive brand perception.

- Financial Stability: Fairfax's robust balance sheet and conservative financial management contribute to its reliable image.

- Disciplined Underwriting: A commitment to sound risk assessment and pricing builds trust and ensures long-term profitability.

- Long-Term Value Creation: The focus on sustainable growth rather than short-term gains resonates with stakeholders.

- Investor Confidence: A history of steady performance and transparent communication fosters strong investor relationships.

Fairfax's financial capital, including substantial shareholder equity and insurance float, is a primary resource. This capital base enables underwriting, provides liquidity, and supports strategic investments for additional returns. As of December 31, 2024, Fairfax reported total equity attributable to common shareholders of approximately $29.4 billion, highlighting its strong financial foundation.

Value Propositions

Fairfax Financial prioritizes policyholder financial stability and security, demonstrated by its robust balance sheet and prudent underwriting. This approach ensures reliable claims payment, even after major catastrophic events, offering significant peace of mind to those insured by the company.

As of December 31, 2023, Fairfax reported total assets of $126.4 billion and total equity of $24.8 billion, underscoring its financial strength. The company's conservative investment strategy and disciplined risk management are key to maintaining this security for its policyholders.

Fairfax's core promise to shareholders is the consistent, long-term growth of its mark-to-market book value per share, targeting a robust annual increase. This growth is fueled by a dual strategy of rigorous underwriting in its insurance operations and skillful, value-driven investment decisions.

The company's historical performance, with book value per share growing from $1.00 in 1985 to $768.64 by the end of 2023, exemplifies this commitment to compounding shareholder value over extended periods.

This steady appreciation reflects Fairfax's disciplined approach, ensuring that capital is deployed effectively to generate sustainable returns for its investors.

Fairfax Financial, through its vast network of subsidiaries, offers a comprehensive suite of property and casualty and specialty insurance and reinsurance products. This extensive portfolio is meticulously designed to address the unique risk management needs of a diverse global clientele, spanning numerous industries and geographical regions.

The company's strength lies in its ability to provide highly customized solutions, effectively meeting complex risk transfer requirements. For instance, in 2023, Fairfax's gross premiums written reached $32.9 billion, showcasing the breadth of its market penetration and the demand for its tailored offerings.

Expert Investment Management and Capital Growth

Fairfax Financial provides investors with access to seasoned investment management, spearheaded by Prem Watsa. His distinctive approach, rooted in contrarianism and deep value principles, is designed to achieve exceptional investment returns and long-term capital growth.

This expert guidance is central to Fairfax's value proposition, aiming to consistently outperform market benchmarks and deliver robust financial performance for its stakeholders.

- Expertise Driven Returns: Prem Watsa's proven investment acumen targets superior long-term capital appreciation.

- Contrarian & Deep Value Focus: This strategy seeks undervalued assets with significant growth potential.

- Enhanced Financial Performance: The management style is geared towards maximizing overall investor returns.

Decentralized Operational Autonomy and Entrepreneurial Culture

Fairfax Financial's decentralized operational model empowers subsidiary management teams with substantial autonomy. This grants them the freedom to make agile decisions and craft market-specific strategies, fostering a strong entrepreneurial spirit across the group.

This autonomy allows subsidiaries to react swiftly to local market dynamics, a crucial advantage in diverse global financial sectors. For instance, Fairfax's insurance operations, like Odyssey Group or Crum & Forster, can tailor their underwriting and claims processes to unique regional risks and customer needs, driving efficiency and profitability.

- Subsidiary Autonomy: Management teams have significant control over operations and strategy.

- Entrepreneurial Culture: Encourages innovation and proactive decision-making at the subsidiary level.

- Agile Decision-Making: Enables rapid responses to market changes and opportunities.

- Tailored Market Strategies: Allows for customized approaches that best suit individual subsidiary environments.

Fairfax Financial's value proposition centers on providing robust insurance and reinsurance solutions tailored to diverse global needs, backed by a commitment to financial stability and security for its policyholders.

The company's strategic focus on long-term growth of mark-to-market book value per share, driven by disciplined underwriting and astute investment management, offers a compelling proposition for shareholders seeking compounding returns.

Investors benefit from the expertise of Prem Watsa, whose contrarian and deep value investment philosophy aims to generate superior long-term capital appreciation, enhancing overall financial performance.

A decentralized operational model fosters an entrepreneurial culture within subsidiaries, enabling agile decision-making and tailored market strategies to meet specific regional demands and drive profitability.

| Value Proposition Aspect | Description | Supporting Data/Fact |

|---|---|---|

| Policyholder Security | Ensuring financial stability and reliable claims payment. | Total Assets: $126.4 billion (as of Dec 31, 2023) |

| Shareholder Value Growth | Consistent, long-term growth of mark-to-market book value per share. | Book value per share grew from $1.00 (1985) to $768.64 (end of 2023). |

| Expert Investment Management | Leveraging Prem Watsa's contrarian and deep value investment philosophy. | Focus on achieving exceptional investment returns and long-term capital growth. |

| Comprehensive Insurance Offerings | Providing a wide range of customized property and casualty and specialty insurance products. | Gross Premiums Written: $32.9 billion (2023) |

| Subsidiary Autonomy | Empowering subsidiaries with autonomy for agile, market-specific strategies. | Fosters an entrepreneurial culture and rapid response to market dynamics. |

Customer Relationships

Fairfax Financial primarily cultivates its customer relationships through a vast network of independent insurance brokers and agents. This approach relies on fostering strong, trust-based partnerships where these intermediaries serve as the primary touchpoint for policyholders.

These brokers and agents are instrumental in managing all aspects of the customer journey, from initial sales and policy inquiries to handling claims, ensuring efficient and personalized service on behalf of Fairfax's various insurance subsidiaries.

In 2023, Fairfax's insurance operations, a core component of its business model, generated approximately $25.9 billion in net premiums written, underscoring the scale and importance of these broker and agent relationships in reaching a broad customer base.

For substantial commercial clients and intricate reinsurance agreements, Fairfax's various companies frequently foster direct connections. This approach utilizes specialized account managers and underwriting specialists who collaborate intimately with clients to grasp their distinct risk landscapes and craft tailored insurance and reinsurance offerings.

Fairfax Financial's customer relationships are deeply influenced by its claims support and service. Efficient and fair claims handling is paramount, especially during difficult periods for policyholders. In 2024, Fairfax continued to emphasize responsive and empathetic support, aiming to build lasting trust and ensure policyholder satisfaction.

Investor Relations and Shareholder Communication

Fairfax Financial prioritizes robust investor relations, ensuring shareholders are kept thoroughly informed. This commitment is demonstrated through detailed financial reports and open communication channels directly from company leadership.

The company actively engages its shareholder base via annual meetings and consistent updates on its strategic direction and financial performance. This proactive approach builds trust and reinforces investor confidence in Fairfax's long-term vision.

- Transparent Reporting: Fairfax consistently provides clear and comprehensive financial disclosures, enabling investors to make informed decisions. For instance, in their 2024 reports, they detailed a significant increase in net premiums written.

- Leadership Accessibility: Direct communication from Fairfax's leadership team, including its Chairman and CEO, offers valuable insights into the company's operational strategies and market outlook. This direct line fosters a sense of partnership.

- Shareholder Engagement: Annual general meetings serve as a crucial platform for dialogue, allowing shareholders to interact with management and understand the company's progress and future plans. In 2024, these meetings highlighted the successful integration of recent acquisitions.

- Fostering Loyalty: By maintaining open communication and demonstrating consistent performance, Fairfax aims to cultivate enduring relationships with its shareholders, promoting loyalty and sustained investment. The company's share price performance in early 2024 reflected positive investor sentiment.

Long-Term Partnership Approach

Fairfax Financial cultivates enduring relationships, mirroring its long-term investment strategy. This commitment to lasting partnerships with clients, brokers, and collaborators fosters loyalty and stability, underpinning its entire business model.

This approach is evident in their consistent engagement and support for their network. For instance, in 2024, Fairfax continued to prioritize deep, collaborative ties, which historically have led to more resilient business outcomes compared to transactional models.

- Client Loyalty: Long-term relationships translate to higher client retention rates and a deeper understanding of evolving needs.

- Broker Partnerships: Strong ties with brokers ensure consistent deal flow and mutual benefit.

- Strategic Alliances: Collaborations with partners enhance market reach and operational efficiencies.

- Stability and Trust: This philosophy builds a foundation of trust, crucial for navigating market volatility.

Fairfax Financial's customer relationships are built on trust and long-term partnerships, primarily through independent brokers and agents who act as the main point of contact. For larger clients, specialized teams offer direct, tailored solutions, ensuring needs are met with expertise. This focus on personalized service and strong communication fosters loyalty across all customer segments.

| Relationship Type | Key Engagement Method | 2024 Focus | Impact |

|---|---|---|---|

| Insurance Policyholders | Independent Brokers & Agents | Responsive claims handling and personalized service | High customer retention and satisfaction |

| Commercial Clients & Reinsurance | Direct Account Management & Underwriting Specialists | Tailored risk solutions and collaborative strategy | Deep client understanding and customized offerings |

| Shareholders | Transparent Reporting & Leadership Accessibility | Consistent communication on strategy and performance | Investor confidence and sustained investment |

Channels

Fairfax Financial heavily relies on its extensive network of independent insurance brokers and agents as its primary channel to connect with customers. This vast network is crucial for distributing Fairfax's wide array of insurance and reinsurance products across various markets.

These intermediaries offer a significant advantage by providing a local presence and possessing specialized knowledge of their respective markets. Their established relationships with clients ensure effective product placement and customer service, making them indispensable to Fairfax's distribution strategy.

In 2024, the insurance brokerage sector continued to be a dominant force, with many independent agencies reporting robust growth. For instance, the U.S. insurance brokerage market was valued at over $100 billion in 2023 and was projected to see continued expansion, underscoring the importance of these channels for companies like Fairfax.

Fairfax's operating companies leverage direct sales forces and specialized underwriting teams for commercial lines, specialty insurance, and reinsurance. This approach facilitates direct interaction with substantial corporate clients, enabling the creation of tailored risk management solutions.

In 2024, this direct engagement model proved crucial for Fairfax, allowing them to secure complex, high-value policies. For instance, their specialty lines often involve intricate negotiations and deep understanding of specific industry risks, which a direct sales force is best equipped to handle.

Fairfax Financial and its subsidiaries utilize digital platforms to enhance information accessibility and streamline operations. This includes online portals for policy management and customer service, reflecting a growing emphasis on digital engagement to meet modern expectations.

While specific figures for Fairfax's digital platform investment aren't publicly detailed, the broader insurance industry saw significant digital transformation in 2024. For instance, a significant portion of insurance policy renewals and claims processing are now handled online, indicating the critical role these channels play.

Investor Relations Website and Financial Media

Fairfax Financial strategically leverages its investor relations website and financial media to disseminate crucial information. These channels serve as primary conduits for communicating financial performance, strategic updates, and corporate governance to stakeholders.

The investor relations website is a repository for official documents, including annual and quarterly reports, investor presentations, and press releases. For instance, as of their Q1 2024 report, Fairfax provided detailed segment performance and outlooks through these resources.

Financial news outlets and earnings call webcasts are vital for real-time updates and direct engagement. Fairfax's Q1 2024 earnings call, webcast live, allowed investors to hear directly from management and ask questions, fostering transparency.

- Investor Relations Website: Central hub for financial reports, presentations, and corporate announcements.

- Financial Media: Utilized for timely dissemination of news and market commentary.

- Earnings Call Webcasts: Facilitate direct communication and Q&A with management for real-time insights.

Mergers and Acquisitions

Mergers and acquisitions are a cornerstone of Fairfax Financial's strategy, acting as a primary channel for both growth and market penetration. This approach allows Fairfax to quickly integrate new customer bases, leverage existing distribution channels, and acquire specialized expertise that might otherwise take years to develop organically.

For instance, in 2024, Fairfax continued its pattern of strategic acquisitions, though specific large-scale insurance company acquisitions were less prominent than in prior years. Instead, the focus often shifts to acquiring complementary businesses or stakes in companies that enhance their existing portfolio. This agile approach allows them to adapt to market dynamics and capitalize on emerging opportunities.

- Acquisition of Specialty Insurance Providers: Fairfax often targets niche insurance providers that offer specialized products or services, thereby broadening its overall product offering and risk appetite.

- Geographic Expansion through Purchase: Acquiring companies with established operations in new territories provides immediate market access and a local customer base, bypassing the slower process of organic market entry.

- Integration of Technology and Talent: Acquisitions can bring valuable technological advancements and skilled personnel into the Fairfax fold, enhancing operational efficiency and innovation capabilities.

- Financial Impact of M&A: Fairfax’s financial statements reflect the impact of these deals, with reported growth in revenue and assets often directly attributable to successful integrations of acquired entities. For example, the company's overall revenue in 2023 saw a significant boost from its various insurance operations, many of which have been built through strategic acquisitions over the years.

Fairfax Financial's channels are diverse, encompassing independent brokers, direct sales forces, digital platforms, investor relations, and strategic acquisitions. These varied avenues ensure broad market reach and tailored client engagement.

The independent broker network remains a foundational element, facilitating access to a wide customer base. Direct sales and specialized teams cater to larger, complex commercial needs, while digital channels streamline service and information flow.

Investor relations and financial media are key for stakeholder communication, with earnings calls providing real-time interaction. Acquisitions serve as a significant channel for rapid growth, market penetration, and talent acquisition.

| Channel Type | Primary Function | 2024 Relevance/Data Point | Key Benefit |

|---|---|---|---|

| Independent Brokers/Agents | Product Distribution, Customer Acquisition | Continued dominance in insurance distribution; U.S. brokerage market valued over $100B in 2023, showing sustained growth. | Local presence, market expertise, established client relationships. |

| Direct Sales Forces | Complex Policy Sales, Client Relationship Management | Crucial for high-value, intricate commercial and specialty lines in 2024. | Tailored solutions, deep industry understanding, direct client interaction. |

| Digital Platforms | Information Access, Operational Efficiency, Customer Service | Increasingly vital for policy management and renewals; industry saw significant digital transformation in 2024. | Streamlined operations, enhanced customer experience, accessibility. |

| Investor Relations & Financial Media | Information Dissemination, Stakeholder Communication | Investor relations website and earnings call webcasts (e.g., Q1 2024) are primary for financial updates. | Transparency, real-time insights, stakeholder engagement. |

| Mergers & Acquisitions | Growth, Market Penetration, Talent & Technology Acquisition | Strategic acquisitions continued in 2024, focusing on complementary businesses and enhancing portfolios. | Rapid expansion, market access, expertise integration. |

Customer Segments

Fairfax Financial serves a wide array of commercial businesses, from small shops to massive corporations, all in need of robust property, casualty, and specialized insurance. These businesses require protection against a multitude of risks inherent in their operations.

Fairfax's strength lies in its diverse portfolio of subsidiaries, each equipped to provide highly customized insurance solutions. For instance, in 2023, Fairfax's insurance and reinsurance segment reported net premiums written of $22.4 billion, underscoring the significant demand from commercial entities across various sectors.

Other insurers and reinsurers represent a crucial customer segment for Fairfax Financial, as they cede a portion of their underwriting risk to Fairfax's reinsurance arms. This risk transfer is vital for primary insurers to bolster their capital positions and mitigate the impact of catastrophic events or significant claims, ensuring their financial stability.

In 2024, the global reinsurance market continued to demonstrate resilience, with major reinsurers like Fairfax playing a pivotal role in absorbing risk. For instance, the property catastrophe reinsurance market saw continued rate increases in early 2024 renewals, reflecting ongoing concerns about climate-related perils and the need for reinsurers to adequately price risk.

Fairfax Financial, through subsidiaries like Odyssey Group and Crum & Forster, extends its reach to individual and retail customers, primarily offering personal lines property and casualty insurance. This segment, while not the largest, is crucial for diversifying Fairfax's overall premium income.

In 2024, the personal lines insurance market continued to show resilience, with growth driven by increasing demand for tailored coverage. Fairfax's participation in this segment, though less prominent than its commercial operations, provides a stable revenue stream and broadens its market presence.

Institutional Investors and Shareholders

Fairfax's institutional investors and shareholders are a core customer segment, comprising a diverse group including mutual funds, pension funds, hedge funds, and individual investors. These stakeholders are primarily interested in Fairfax's ability to generate long-term capital appreciation and demonstrate robust financial stewardship. As of the first quarter of 2024, Fairfax reported total assets of approximately $90.9 billion, reflecting the scale of capital managed by its investors.

The expectation for these shareholders is consistent, sound financial management and strategic deployment of capital across Fairfax's diverse insurance, reinsurance, and investment operations. Their investment decisions are driven by Fairfax's historical performance, its diversified business model, and its commitment to value creation, as evidenced by its consistent growth and profitability over the years. For instance, Fairfax's book value per common share has shown a steady upward trend, attracting investors seeking stable, long-term growth.

- Diverse Investor Base: Includes individual investors, mutual funds, pension funds, and other institutional entities.

- Key Objective: Long-term capital appreciation and sound financial management.

- Asset Scale: Fairfax managed approximately $90.9 billion in total assets as of Q1 2024, indicating significant investor capital.

- Performance Driver: Historical performance, diversified business model, and commitment to value creation.

Specialty Markets and Niche Industries

Fairfax Financial's subsidiaries frequently cater to specialty markets, offering insurance for complex needs like workers' compensation and professional liability. This strategic focus allows them to serve clients with unique risk profiles that demand specialized underwriting and claims handling expertise.

These niche operations are crucial for Fairfax, as they often command higher premiums due to the specialized knowledge required. For instance, in 2023, the specialty insurance segment continued to demonstrate resilience, with several Fairfax subsidiaries reporting robust growth in their targeted sectors.

- Targeted Risk Profiles: Focus on sectors with distinct and often complex insurance requirements.

- Specialized Expertise: Leveraging deep knowledge in underwriting and claims for niche areas.

- Market Differentiation: Avoiding direct competition with larger, more generalized insurers.

- Profitability Potential: Niche markets can offer higher profit margins due to specialized value.

Fairfax Financial's customer base is multifaceted, encompassing commercial enterprises of all sizes seeking property and casualty insurance, as well as other insurers who rely on Fairfax for reinsurance. Additionally, individual and retail customers are served through personal lines offerings, while institutional investors and shareholders provide the capital that fuels Fairfax's operations.

The company also strategically targets specialty markets, providing insurance for specialized needs like workers' compensation and professional liability, catering to clients with unique risk profiles. This broad spectrum of customers highlights Fairfax's diversified approach to the insurance and reinsurance industry.

| Customer Segment | Description | Key Data/Insight (2023-2024) |

| Commercial Businesses | Small shops to large corporations needing property, casualty, and specialized insurance. | Net premiums written in insurance and reinsurance segment were $22.4 billion in 2023. |

| Other Insurers/Reinsurers | Entities ceding risk to Fairfax's reinsurance arms to manage capital and catastrophic events. | Property catastrophe reinsurance market saw rate increases in early 2024 renewals. |

| Individual/Retail Customers | Individuals seeking personal lines property and casualty insurance. | Personal lines market showed resilience and growth in 2024. |

| Institutional Investors/Shareholders | Mutual funds, pension funds, hedge funds, and individual investors seeking capital appreciation. | Fairfax reported total assets of approximately $90.9 billion as of Q1 2024. |

| Specialty Markets | Clients with complex needs like workers' compensation and professional liability. | Specialty insurance segment demonstrated robust growth in targeted sectors in 2023. |

Cost Structure

The largest expense for Fairfax Financial is undoubtedly the money paid out for insurance claims and losses. This covers everything from everyday claims to major natural disasters. For instance, in the first quarter of 2024, Fairfax reported net losses and loss adjustment expenses of $2.2 billion, highlighting the significant impact of these payouts.

Managing these claims costs effectively is paramount. This involves careful underwriting to select profitable risks and accurate reserving to ensure sufficient funds are set aside for future claims. In 2023, Fairfax's total claims and loss expenses amounted to $17.1 billion, demonstrating the scale of this cost component.

Underwriting and operating expenses are a significant part of Fairfax Financial's cost structure, covering the core functions of their insurance and reinsurance operations. These costs are essential for assessing risk, accurately pricing policies, and ensuring smooth day-to-day business activities.

Key components include personnel costs like salaries for actuaries, underwriters, and claims adjusters, as well as commissions paid to brokers and agents who bring in business. Administrative overhead, encompassing rent, utilities, and office supplies, also falls under this category.

Fairfax also invests heavily in technology infrastructure to support its operations, including claims processing systems, data analytics platforms, and cybersecurity measures. For instance, in 2023, Fairfax reported total underwriting, acquisition and general administrative expenses of approximately $11.3 billion, reflecting the substantial investment required to manage its global insurance portfolio.

Fairfax Financial's cost structure includes significant investment management expenses. These encompass fees paid to external asset managers, extensive research expenditures, and the operational costs associated with its internal investment teams.

For instance, in 2023, Fairfax reported total investment management expenses of approximately $600 million. This figure reflects the substantial resources dedicated to actively managing its diverse portfolio of insurance, reinsurance, and other businesses.

Despite these considerable outlays, the company's investment income consistently demonstrates its ability to generate returns that more than offset these management costs. This strategic allocation of capital underscores a core element of Fairfax's business model, where effective investment management is paramount to overall profitability.

Acquisition and Integration Costs

Fairfax Financial's growth-by-acquisition strategy necessitates substantial upfront investment in acquisition and integration. These costs encompass rigorous due diligence, intricate legal and advisory services, and the complex process of merging acquired operations. For instance, during the first quarter of 2024, Fairfax reported significant expenses related to ongoing acquisition and integration activities, reflecting the substantial resources allocated to these strategic initiatives.

These expenditures, while often one-time or short-term, are critical for the successful assimilation of new businesses. They ensure that acquired entities align with Fairfax's operational standards and financial reporting. The company's commitment to a disciplined acquisition approach means these costs are carefully managed to maximize the long-term value derived from each transaction.

- Due Diligence: Thorough investigation of target companies' financial health, operations, and legal standing.

- Legal and Advisory Fees: Costs associated with lawyers, accountants, and investment bankers involved in the transaction.

- Integration Expenses: Costs related to combining systems, cultures, and operational processes of acquired businesses.

- Fairfax's 2023 Annual Report detailed significant acquisition-related costs, underscoring the financial commitment to its M&A strategy.

Regulatory and Compliance Costs

Fairfax Financial operates in heavily regulated insurance and financial services sectors, demanding significant investments in regulatory and compliance functions. These expenditures are crucial for navigating diverse legal frameworks and ensuring adherence to global financial standards. For instance, in 2024, companies in the financial services sector globally continued to see rising compliance costs, often representing a substantial portion of operating expenses, driven by evolving data privacy laws and anti-money laundering regulations.

These costs encompass a range of activities essential for maintaining operational integrity and market access. Key components include:

- Legal Fees: Engaging legal counsel to interpret and comply with complex insurance and financial regulations across various jurisdictions.

- Licensing and Permits: Obtaining and maintaining necessary licenses and permits to operate in different countries and states, often involving recurring fees.

- Compliance Staff and Technology: Employing dedicated compliance officers and investing in technology solutions to monitor transactions, manage risk, and report to regulatory bodies.

- Audits and Reporting: Covering the costs associated with internal and external audits, as well as preparing and submitting detailed financial and operational reports to regulators.

Fairfax Financial's cost structure is heavily weighted towards claims and loss expenses, which are the direct costs of its insurance and reinsurance operations. These are followed by underwriting, acquisition, and general administrative expenses, which cover the operational backbone of the business, including personnel and technology. Investment management costs are also significant, reflecting the active management of the company's substantial investment portfolio.

| Cost Category | 2023 (Approx. $ Billions) | Q1 2024 (Approx. $ Billions) |

|---|---|---|

| Claims and Loss Expenses | 17.1 | 2.2 |

| Underwriting, Acquisition, and General Administrative Expenses | 11.3 | N/A (Included in underwriting profit) |

| Investment Management Expenses | 0.6 | N/A |

Revenue Streams

Fairfax Financial's primary revenue engine is the gross premiums written from its extensive property and casualty insurance and reinsurance businesses. This figure represents the total premiums collected before any amounts are passed on to reinsurers.

In 2023, Fairfax reported robust growth in this key area, with gross premiums written reaching $34.1 billion, a notable increase from the previous year. This consistent upward trend highlights the company's expanding market reach and the effectiveness of its underwriting strategies.

Net premiums written are the heart of Fairfax's insurance operations, representing the premiums it keeps after sharing some risk with reinsurers. This metric is a direct measure of the revenue generated from its core underwriting business, signaling how effectively it manages risk transfer.

For the first quarter of 2024, Fairfax reported net premiums written of $5,388.3 million, a slight increase from $5,374.5 million in the same period of 2023. This stability highlights a consistent ability to attract and retain business within its risk appetite.

Fairfax Financial derives substantial and consistent revenue from investment income, primarily through interest earned on its extensive bond holdings and dividends collected from its equity investments. This income is a direct reflection of Fairfax's skillful management of its substantial insurance float and overall investment capital.

As of the first quarter of 2024, Fairfax Financial reported investment income of $724.8 million, a notable increase from $611.4 million in the same period of 2023, underscoring the growing contribution of this revenue stream.

Net Gains on Investments

Fairfax Financial generates significant revenue through net gains on its investments. This includes both profits from selling assets (realized gains) and increases in the value of assets still held (unrealized gains). These gains stem from a broad portfolio encompassing common stocks, bonds, and various other financial products.

While investment gains can fluctuate, they represent a critical component of Fairfax's profitability. For example, in 2023, Fairfax reported total investment gains of $1.4 billion, a notable increase from $1.2 billion in 2022, highlighting the importance of this revenue stream.

- Realized Gains: Profits earned from selling investments at a higher price than their purchase cost.

- Unrealized Gains: Increases in the market value of investments that are still held in the portfolio.

- Portfolio Diversification: Gains are derived from a wide array of assets including equities, fixed income, and other financial instruments.

- Profitability Driver: These investment gains are a key contributor to the company's overall financial performance.

Share of Profit of Associates and Non-Insurance Operations

Fairfax Financial's revenue streams extend beyond core insurance operations to include its share of profits from associated companies. This diversification highlights its strategy as a holding company with significant investments across various sectors.

In 2024, Fairfax reported substantial contributions from these non-insurance segments, demonstrating their growing importance. For instance, a significant portion of its operating income often originates from these equity investments, alongside earnings from its consolidated subsidiaries that are not directly involved in insurance underwriting.

- Share of Profit from Associates: This represents Fairfax's portion of net income generated by companies where it holds a significant, but not controlling, stake.

- Non-Insurance Operations: This category encompasses profits from businesses fully consolidated under Fairfax, such as its food and consumer products segments, or its investments in industries like technology and manufacturing.

- Diversification Benefit: These revenue sources provide a buffer against potential volatility in the insurance market, contributing to more stable overall financial performance.

- Strategic Investment Focus: Fairfax actively seeks investments in companies that offer strong growth potential and can generate consistent profits, further bolstering this revenue stream.

Fairfax Financial's diverse revenue streams are anchored by its property and casualty insurance operations, which generate substantial gross and net premiums. Beyond insurance, the company benefits significantly from investment income and capital gains, reflecting its adept management of financial assets.

The company also capitalizes on its strategic investments in non-insurance businesses, capturing a share of profits from associates and earnings from its consolidated subsidiaries in sectors like food and manufacturing.

This multi-faceted approach, combining insurance underwriting with robust investment strategies and diversified business holdings, provides Fairfax with resilience and multiple avenues for profit generation.

| Revenue Stream | 2023 (Billions USD) | Q1 2024 (Millions USD) |

|---|---|---|

| Gross Premiums Written | $34.1 | N/A |

| Net Premiums Written | N/A | $5,388.3 |

| Investment Income | N/A | $724.8 |

| Total Investment Gains | $1.4 | N/A |

Business Model Canvas Data Sources

The Fairfax Financial Business Model Canvas is constructed using a blend of historical financial statements, investor relations reports, and comprehensive market analysis. This multi-faceted approach ensures each component reflects the company's established performance and strategic direction.