Fairfax Financial Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fairfax Financial Bundle

Fairfax Financial's marketing prowess is built on a solid foundation of product, price, place, and promotion. This analysis delves into how their diverse insurance and financial services offerings are strategically positioned, priced competitively, distributed effectively, and promoted to reach their target markets. Discover the intricate details of their success.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Fairfax Financial's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into a market leader.

Product

Fairfax Financial's property and casualty insurance offerings are extensive, managed through subsidiaries like Northbridge Financial, Crum & Forster, Allied World, and Zenith National. These companies provide a broad spectrum of products, from standard commercial policies to specialized coverages and workers' compensation. This diverse portfolio addresses a wide range of client requirements.

The company's decentralized structure is key to its product strategy. It enables each subsidiary to fine-tune its property and casualty insurance products for specific market niches and local needs. For instance, in 2023, Crum & Forster reported gross written premiums of $5.1 billion, showcasing their significant market presence in various P&C segments.

Fairfax's reinsurance solutions, primarily through Odyssey Group and Brit, represent a cornerstone of their product offering. These services enable other insurers to offload significant risks, bolstering their financial stability and capacity to underwrite new business.

This strategic product allows Fairfax to participate in and manage substantial, intricate risks across diverse international insurance markets. For instance, in 2023, the global reinsurance market saw premiums written exceed $300 billion, highlighting the immense scale and importance of this sector.

Fairfax Financial's investment management services are integral to its business model, managing a significant portfolio beyond its insurance and reinsurance core. This strategic allocation across diverse asset classes like stocks, bonds, private equity, and real estate is designed for sustained long-term value growth.

In 2024, Fairfax reported strong investment income. For instance, their investment portfolio generated approximately $1.7 billion in net investment gains in the first quarter of 2024, showcasing the crucial role of their investment strategy in bolstering overall earnings and providing a competitive edge.

Specialty and Niche Insurance Offerings

Fairfax Financial's subsidiaries excel in niche insurance markets, offering highly specialized coverage. Brit and Odyssey Group, for instance, underwrite unique risks in areas like marine and aviation, demonstrating a commitment to tailored solutions. Zenith National focuses on specific workers' compensation needs, showcasing deep expertise in a particular segment.

This strategic specialization allows Fairfax to effectively target and capture market share in less crowded, high-margin segments. By developing profound knowledge in these specialized areas, they can offer superior risk management and underwriting capabilities, differentiating themselves from broader insurance providers.

- Specialty Lines: Brit and Odyssey Group provide coverage for unique risks, enhancing market penetration.

- Focused Expertise: Zenith National's specialization in workers' compensation highlights deep domain knowledge.

- Market Capture: Niche offerings enable Fairfax to secure specific, often profitable, market opportunities.

- Risk Differentiation: Tailored solutions cater to distinct risk profiles, fostering customer loyalty.

Global Diversified Portfolio

Fairfax Financial's Global Diversified Portfolio product offers significant advantages through its extensive geographic reach. Operations in North America, Europe, Asia, and Latin America spread risk effectively. This global footprint, combined with a broad suite of insurance and reinsurance products, is designed to reduce concentration risk and bolster resilience against localized economic downturns or unexpected catastrophic events.

The company's commitment to diversification is evident in its operational structure. For instance, as of Q1 2024, Fairfax reported total assets of approximately $96.8 billion, spread across various geographies and business lines. This broad diversification helps to smooth out earnings volatility and provides a more stable platform for growth.

- Geographic Spread: Operations across North America, Europe, Asia, and Latin America.

- Product Breadth: Offering a wide range of insurance and reinsurance products.

- Risk Mitigation: Reduced concentration risk and enhanced resilience.

- Financial Strength: Supported by substantial asset base, with total assets around $96.8 billion as of Q1 2024.

Fairfax Financial's product strategy centers on a diversified portfolio of property and casualty insurance, alongside robust reinsurance solutions. This includes specialized coverages managed through subsidiaries like Crum & Forster and Zenith National, which together generated substantial gross written premiums, with Crum & Forster alone reporting $5.1 billion in 2023.

The company leverages its decentralized structure to tailor products for niche markets, enhancing its ability to capture specialized segments. Furthermore, its reinsurance operations through Odyssey Group and Brit are crucial, allowing Fairfax to manage significant global risks, a sector that saw over $300 billion in premiums written globally in 2023.

| Subsidiary | Specialty Focus | 2023 Contribution (if available) |

|---|---|---|

| Crum & Forster | Commercial P&C, Specialty Lines | $5.1 billion Gross Written Premiums |

| Zenith National | Workers' Compensation | N/A |

| Brit | Specialty Risks (e.g., Marine, Aviation) | N/A |

| Odyssey Group | Reinsurance, Specialty Risks | N/A |

What is included in the product

This analysis offers a comprehensive breakdown of Fairfax Financial's marketing mix, detailing its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It provides a professionally structured overview of Fairfax Financial's marketing positioning, ideal for benchmarking and informing strategic decisions.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of strategic ambiguity for Fairfax Financial.

Provides a clear, concise overview of Fairfax Financial's 4Ps, easing the burden of understanding their market positioning for busy executives.

Place

Fairfax's decentralized subsidiary network is a cornerstone of its product strategy, allowing each autonomous unit to tailor its offerings and distribution to specific market needs. This approach fosters agility, enabling subsidiaries like Northbridge Financial and Crum & Forster to independently manage their product placement and sales channels, a key factor in their localized success.

Fairfax Financial's 'Place' is truly global, with substantial operations spanning the United States, Canada, Europe, and Asia. This extensive geographical presence means their insurance and reinsurance offerings reach a diverse international clientele, a key component of their distribution strategy.

This wide reach is a significant strategic asset for Fairfax. For instance, in 2023, Fairfax reported that its international operations contributed a substantial portion to its overall revenue, highlighting the importance of its global footprint in diversifying income and mitigating country-specific risks.

Fairfax Financial's property and casualty insurance products largely flow through established networks of independent brokers and agents. These intermediaries are vital for reaching both individual consumers and businesses, acting as the primary link to Fairfax's diverse offerings. This reliance on traditional distribution channels capitalizes on existing relationships and deep local market expertise, a strategy that has proven effective for the company.

Direct Client Relationships for Reinsurance

Fairfax Financial's reinsurance segment thrives on direct client relationships, primarily with other insurance companies and substantial corporate entities. This B2B model necessitates close collaboration, enabling the development of highly customized reinsurance solutions and intricate negotiations that are fundamental to the industry. These engagements are the bedrock of trust and enduring partnerships, crucial for long-term success in this specialized market.

The direct approach allows Fairfax to deeply understand the unique risk profiles and strategic objectives of its clients. This intimate knowledge facilitates the creation of bespoke reinsurance treaties, which are far more complex than standard insurance policies. For instance, in 2024, the global reinsurance market saw continued demand for tailored solutions addressing emerging risks like cyber threats and climate change, areas where direct dialogue is paramount.

- Direct Engagement: Focuses on building relationships with insurers and large corporations, not individual consumers.

- Tailored Solutions: Enables the creation of specific reinsurance contracts to meet unique client needs.

- Complex Negotiations: Facilitates discussions around risk transfer, pricing, and capacity for large, intricate deals.

- Partnership Building: Emphasizes long-term trust and collaboration, essential for the B2B reinsurance model.

Strategic Acquisitions and Partnerships

Fairfax Financial strategically expands its 'place' in the market through calculated acquisitions and partnerships, effectively broadening its reach and distribution channels. A prime example is the integration of Gulf Insurance Group, which significantly bolstered Fairfax's presence in the Middle East and North Africa (MENA) region. This inorganic growth is a cornerstone of their distribution strategy, allowing them to enter new territories and gain access to established customer bases and product portfolios.

These strategic moves are not just about geographical expansion; they are about deepening market penetration and enhancing product offerings. By acquiring companies with complementary strengths, Fairfax strengthens its ability to serve diverse customer needs and compete more effectively. For instance, the acquisition of Allied World in 2017, valued at approximately $4.9 billion, significantly expanded Fairfax's global insurance footprint and specialty lines of business.

- Acquisition of Gulf Insurance Group: Enhanced Fairfax's market access and distribution in the MENA region.

- Allied World Acquisition (2017): A $4.9 billion deal that broadened Fairfax's global insurance operations and specialty lines.

- Strategic Partnerships: Continuously pursued to gain entry into new markets and leverage existing distribution networks.

- Inorganic Growth Focus: A key element in expanding Fairfax's 'place' and market share.

Fairfax's 'Place' is characterized by a dual distribution strategy: independent brokers and agents for property and casualty insurance, and direct relationships for reinsurance. This leverages established networks and deep client understanding.

The company's global footprint, spanning North America, Europe, and Asia, is critical. In 2023, international operations represented a significant portion of Fairfax's revenue, underscoring the importance of its diversified geographical presence.

Strategic acquisitions, like the 2017 purchase of Allied World for $4.9 billion, have been instrumental in expanding Fairfax's market access and product reach, further solidifying its 'place' in key insurance sectors.

| Distribution Channel | Product Focus | Key Characteristic | Example/Data Point |

|---|---|---|---|

| Independent Brokers/Agents | Property & Casualty Insurance | Leverages existing networks and local market expertise | Primary channel for reaching consumers and businesses |

| Direct Client Relationships | Reinsurance | Focuses on insurers and large corporations; tailored solutions | Facilitates complex negotiations for risk transfer |

| Acquisitions/Partnerships | Broad Insurance Lines | Expands geographical reach and market penetration | Gulf Insurance Group integration strengthened MENA presence |

What You See Is What You Get

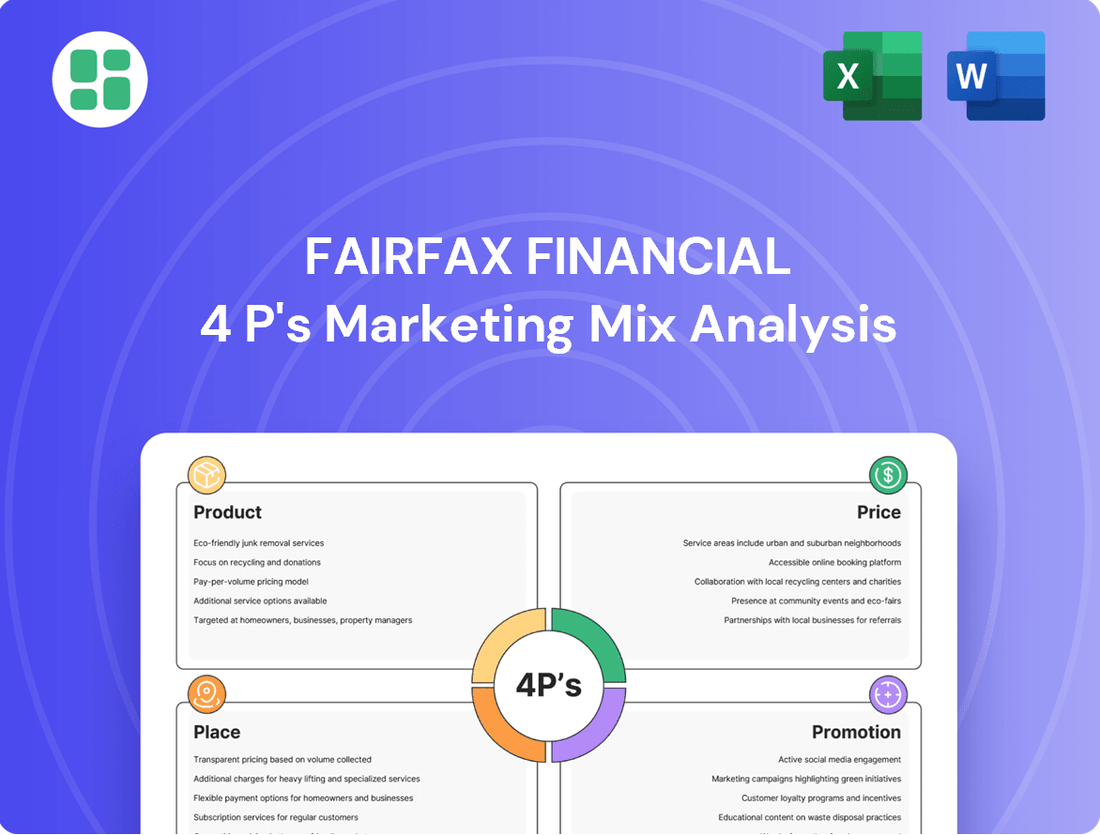

Fairfax Financial 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Fairfax Financial 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll gain immediate access to this ready-to-use document upon completing your order.

Promotion

Fairfax Financial prioritizes its investor relations, emphasizing financial strength and long-term value. This is achieved through detailed annual reports and quarterly earnings calls, fostering trust among financially-literate decision-makers. For instance, their Q1 2025 results, alongside the full 2024 annual report, consistently highlight disciplined underwriting practices.

Fairfax Financial's promotional core emphasizes its unwavering commitment to disciplined underwriting and a conservative, value-oriented investment approach. This philosophy, consistently articulated by CEO Prem Watsa, resonates with investors prioritizing stability and enduring capital growth.

This strategic focus has translated into tangible results, with Fairfax reporting a combined ratio of 94.3% for the nine months ended September 30, 2024, indicating strong underwriting profitability. This figure demonstrates their ability to generate profit from insurance operations even after accounting for claims and expenses.

Fairfax Financial actively cultivates its image through strategic public relations, notably by issuing news releases detailing its financial performance, significant acquisitions, and key leadership transitions. This consistent communication ensures stakeholders remain informed and reinforces the company's stability and forward momentum.

Industry recognition, particularly in the form of enhanced credit ratings for its re/insurance subsidiaries, significantly bolsters Fairfax's brand and credibility within the competitive financial services landscape. For example, S&P's recent upgrades underscore the company's robust capital adequacy and sound financial management, providing a tangible measure of its strength.

Chairman's Letter to Shareholders

Fairfax Financial's Chairman's Letter to Shareholders is a cornerstone of its promotional strategy, offering a candid look at the company's performance and guiding principles. Prem Watsa's annual missives are not just reports; they are a direct line to the investor community, reinforcing Fairfax's distinctive culture and long-term, value-oriented investment philosophy.

The 2024 letter, in particular, highlighted the effectiveness of Fairfax's decentralized operating model, a key differentiator that fosters agility and accountability across its diverse subsidiaries. This approach allows for specialized expertise to thrive while remaining aligned with the overarching corporate vision.

- Reinforces Core Philosophy: The letter articulates Fairfax's commitment to long-term investing and disciplined capital allocation, a strategy that has historically delivered consistent results.

- Highlights Decentralized Structure: It provides specific examples of how subsidiary autonomy contributes to operational efficiency and market responsiveness, a key element of their competitive advantage.

- Outlines Strategic Outlook: Shareholders receive clear insights into management's perspective on current market conditions and future growth opportunities, fostering investor confidence.

- Direct Investor Engagement: The letter serves as a direct communication channel, building trust and transparency with the shareholder base by sharing the company's journey and outlook.

Community Engagement and Charitable Initiatives

Fairfax Financial actively engages its communities and demonstrates corporate social responsibility through various charitable initiatives. This commitment is detailed in their annual Charitable Giving Report, showcasing their dedication to societal well-being beyond core business operations. These efforts not only build a positive public image but also reinforce the company's core values.

In 2024, Fairfax Financial reported significant contributions to a range of causes. For instance, their support for education initiatives saw a notable increase, with specific programs benefiting underprivileged students. The company also continued its long-standing support for healthcare advancements and disaster relief efforts, reflecting a broad spectrum of philanthropic focus.

- Charitable Giving: Fairfax's 2024 Charitable Giving Report highlighted substantial donations to various non-profit organizations.

- Community Investment: The company invested in local community development projects, focusing on areas like youth programs and environmental sustainability.

- Employee Engagement: Fairfax encouraged employee volunteerism, with many staff members participating in local charity events throughout the year.

- Partnerships: Collaborations with key charitable foundations amplified the impact of their giving, reaching a wider audience.

Fairfax Financial's promotional efforts center on transparency and demonstrating financial prudence, particularly through detailed investor communications. Their consistent reporting of strong underwriting results, like the 94.3% combined ratio for the first nine months of 2024, serves as a key promotional tool. This focus on operational excellence and financial discipline is a core message that resonates with their target audience seeking stability and long-term value.

| Metric | Value (9 Months Ended Sep 30, 2024) | Significance |

|---|---|---|

| Combined Ratio | 94.3% | Indicates strong underwriting profitability. |

| Shareholder Equity Growth | Reported year-over-year increase | Demonstrates capital appreciation and financial strength. |

| Net Earnings | Detailed in Q1 2025 and 2024 reports | Highlights overall company performance and profitability. |

Price

Fairfax's pricing, or the risk-adjusted underwriting premiums, is deeply rooted in a rigorous evaluation of potential risks. They aim for underwriting profitability by setting premiums that accurately reflect the likelihood and severity of insured events. This disciplined approach ensures they can cover losses and still generate a profit, even when facing significant catastrophe events.

For instance, in 2023, Fairfax reported a net earnings of $2.5 billion, with their insurance and reinsurance operations demonstrating resilience. Their emphasis on underwriting profitability is a core tenet, meaning they strive to earn more from premiums and investment income than they pay out in claims and expenses, a strategy that has historically served them well.

Fairfax Financial strategically prices its insurance and reinsurance products, always keeping a close eye on what competitors are doing. While profitability is key, they understand the need to stay competitive in a dynamic market. This means they adjust their rates based on industry trends and what other companies are offering. For instance, in 2024, Fairfax reported significant premium growth, partly driven by these carefully considered, incremental rate adjustments that reflect their competitive positioning.

Fairfax Financial's pricing strategy benefits from its robust investment income, a core component of its overall earnings. This substantial investment performance, which has historically seen significant contributions, allows for greater flexibility in its insurance underwriting operations.

The company's ability to generate strong investment returns, for instance, its reported net earnings of $3.7 billion in 2023, enables it to offer more competitive pricing on its insurance products. This approach, focusing on total return rather than solely underwriting profit, sets Fairfax apart from many competitors in the insurance sector.

Long-Term Value Creation Focus

Fairfax Financial's pricing strategy is deeply rooted in its commitment to long-term value creation rather than chasing immediate, high premiums. This means they might opt for a more measured approach, potentially sacrificing short-term gains to cultivate sustainable, profitable relationships.

This philosophy directly influences their pricing decisions, often leading to a more conservative stance. Instead of engaging in aggressive pricing wars that could erode profitability, Fairfax prioritizes securing business that aligns with its long-term growth objectives.

The ultimate goal is to consistently compound book value per share over extended periods. For instance, as of the first quarter of 2024, Fairfax reported a book value per share of $1,050.80, reflecting this steady growth trajectory.

- Focus on Sustainable Profitability: Fairfax avoids pricing strategies that could jeopardize long-term financial health for short-term market share gains.

- Compounding Book Value: The core objective is to increase book value per share, a key metric for long-term shareholder value.

- Conservative Pricing Approach: This often translates to not being the cheapest option, but rather offering value that supports sustained profitability.

- Relationship Building: Prioritizing long-term partnerships over transactional, high-volume, low-margin business.

Regulatory Compliance and Capital Adequacy

Fairfax Financial navigates pricing decisions within a complex web of global regulatory requirements, prioritizing capital adequacy to ensure long-term financial stability and the capacity to fulfill future obligations. This commitment to robust financial health underpins their pricing strategies, making sure they are not only competitive but also sustainable.

The company's strong financial footing is evident in its capital levels, which are consistently maintained above regulatory minimums. As of the first quarter of 2024, Fairfax reported total shareholders equity of $26.5 billion, demonstrating a solid base to support its underwriting and investment activities.

- Regulatory Framework: Fairfax operates under diverse insurance regulations in North America, Europe, and Asia, influencing pricing by mandating solvency margins and risk-based capital requirements.

- Capital Adequacy Ratios: The company consistently reports strong risk-based capital ratios, often exceeding 200% of regulatory requirements in key operating jurisdictions, providing a significant buffer.

- Financial Stability: Fairfax's conservative investment portfolio and disciplined underwriting contribute to its ability to withstand market volatility and maintain pricing integrity.

- Future Claims: Pricing is strategically set to ensure sufficient reserves are built to cover potential future claims, a critical factor in the insurance industry's long-term viability.

Fairfax's pricing strategy is a delicate balance between competitive market positioning and long-term profitability, aiming to secure business that aligns with its growth objectives rather than engaging in price wars. This disciplined approach is supported by strong investment income, which provides flexibility and allows for more competitive offerings.

The company's focus on compounding book value per share, exemplified by a book value per share of $1,050.80 as of Q1 2024, guides its pricing towards sustainable profitability and value creation over short-term gains.

Fairfax maintains robust capital adequacy, with total shareholders equity at $26.5 billion in Q1 2024, ensuring compliance with global regulations and enabling stable pricing that can absorb market volatility.

| Metric | Value (as of Q1 2024) | Significance to Pricing |

| Book Value Per Share | $1,050.80 | Reflects long-term value compounding, influencing pricing to support this growth. |

| Total Shareholders Equity | $26.5 billion | Indicates strong capital base, allowing for regulatory compliance and stable pricing. |

| Net Earnings (2023) | $2.5 billion | Demonstrates underwriting and investment profitability, supporting competitive pricing. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Fairfax Financial leverages a robust blend of primary and secondary data sources. We meticulously review public filings, including annual reports and SEC submissions, alongside investor presentations and official company press releases to capture their strategic initiatives.