EVERTEC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EVERTEC Bundle

EVERTEC's robust technological infrastructure and expansive payment processing network are significant strengths in the dynamic financial services sector. However, understanding the full scope of their market position, potential threats, and strategic opportunities requires a deeper dive.

Want the full story behind EVERTEC’s competitive advantages, potential vulnerabilities, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

EVERTEC is a dominant force in the financial technology sector, boasting a significant market leadership position as a full-service transaction processor across Latin America and the Caribbean. Its operations span 26 countries, a testament to its extensive regional presence and deep understanding of diverse local markets.

The company's proprietary ATH network is a key differentiator, recognized as one of the leading PIN debit networks in Latin America and the most utilized electronic payment method in Puerto Rico. This robust network infrastructure, coupled with strong brand recognition, solidifies EVERTEC's competitive edge and market penetration.

EVERTEC showcases a consistently strong financial performance, highlighted by an 11% revenue increase to $228.8 million in Q1 2025 and a significant 105% surge in GAAP Net Income. This upward trend continued into Q2 2025 with an 8% revenue growth, reaching $229.6 million.

The company achieved a record $845.5 million in revenue for the full year 2024, marking a substantial 22% increase. Management's confidence in sustained expansion is further evidenced by raising the full-year 2025 outlook for both revenue and adjusted earnings per share.

EVERTEC's advanced technology infrastructure is a significant strength, underscored by substantial investments. In 2024 alone, the company allocated $32.9 million to software development and technology, ensuring a robust and scalable end-to-end platform.

This commitment to innovation fuels the development of cutting-edge digital solutions. Products like ATH Movil, ATH Business, Placetopay, Paystudio, and PIX 2.0 are designed to capture the growing trend towards digital payments, positioning EVERTEC for continued growth in this evolving market.

Furthermore, EVERTEC is actively integrating artificial intelligence into its operations. This strategic focus aims to bolster security measures and drive greater operational efficiency across its technological ecosystem, enhancing its competitive edge.

Diversified Client Base and Stable Revenue Streams

EVERTEC's strength lies in its broad and diverse client base, spanning financial institutions, merchants, corporations, and government entities. This wide reach naturally diversifies its revenue streams, reducing reliance on any single sector. For instance, in 2024, EVERTEC reported that its payment processing segment, serving merchants and financial institutions, continued to be a robust contributor, alongside its growing digital solutions for corporations and governments.

A key aspect of this diversified client base is the stability provided by long-term contracts. Many of EVERTEC's client relationships are formalized through multi-year agreements, often featuring automatic renewal clauses. This contractual structure creates a predictable and recurring revenue model, a significant advantage in the dynamic fintech landscape. This stability was evident in their 2024 financial reports, which highlighted consistent revenue growth driven by these long-term partnerships.

- Diversified Revenue Sources: Serves financial institutions, merchants, corporations, and government agencies.

- Stable Revenue Streams: Benefits from multi-year contracts with automatic renewals.

- Predictable Earnings: Contractual stability mitigates volatility in the fintech market.

- Resilient Business Model: Demonstrated consistent performance in 2024 due to these strengths.

Successful Strategic Acquisitions and Organic Expansion

EVERTEC demonstrates a robust growth strategy, effectively combining organic expansion with strategic acquisitions, especially within the Latin American market. This dual approach has been a significant driver of its success.

The company's commitment to this strategy is evident in its financial performance. In 2024, EVERTEC saw a remarkable 62% year-over-year increase in its Latin American revenue. This surge was fueled by the successful integration of key acquisitions, including Sinqia, Grandata, and Nubity, alongside strong organic growth initiatives.

Looking ahead, EVERTEC remains actively engaged in pursuing further merger and acquisition opportunities. Its focus areas include strategically important markets like Mexico and Colombia, aiming to enhance its regional presence and broaden its product and service portfolio.

- Proven Growth Strategy: EVERTEC excels in expanding its business through both internal development and strategic acquisitions, particularly in Latin America.

- Latin American Revenue Surge: In 2024, Latin American revenue grew by 62% year-over-year, boosted by acquisitions like Sinqia, Grandata, and Nubity, alongside organic gains.

- Continued M&A Focus: The company actively seeks new acquisition targets in key markets such as Mexico and Colombia to bolster its regional footprint and offerings.

EVERTEC's market leadership is a core strength, built on its extensive reach across 26 countries and its proprietary ATH network, a leading PIN debit network in Latin America. This established infrastructure, combined with strong brand recognition, particularly in Puerto Rico where it's the primary electronic payment method, provides a significant competitive advantage and deep market penetration.

The company's financial performance is consistently robust, with 2024 revenue reaching a record $845.5 million, a 22% increase year-over-year. This momentum carried into early 2025, with Q1 revenue up 11% to $228.8 million and Q2 revenue growing 8% to $229.6 million, demonstrating sustained expansion and a raised full-year outlook for 2025.

EVERTEC's commitment to technological advancement is a key differentiator, supported by substantial investments. In 2024, $32.9 million was allocated to software and technology development, fostering innovation in digital payment solutions like ATH Movil and PIX 2.0, while also integrating AI for enhanced security and efficiency.

The company's diversified client base, including financial institutions, merchants, corporations, and governments, coupled with multi-year contracts and automatic renewal clauses, creates stable and predictable revenue streams. This resilient business model ensured consistent performance throughout 2024.

| Metric | 2024 (Full Year) | Q1 2025 | Q2 2025 |

|---|---|---|---|

| Revenue | $845.5 million (+22% YoY) | $228.8 million (+11% YoY) | $229.6 million (+8% YoY) |

| Key Network | ATH Network (Leading PIN Debit in LATAM) | ATH Network | ATH Network |

| Technology Investment (2024) | $32.9 million | N/A | N/A |

What is included in the product

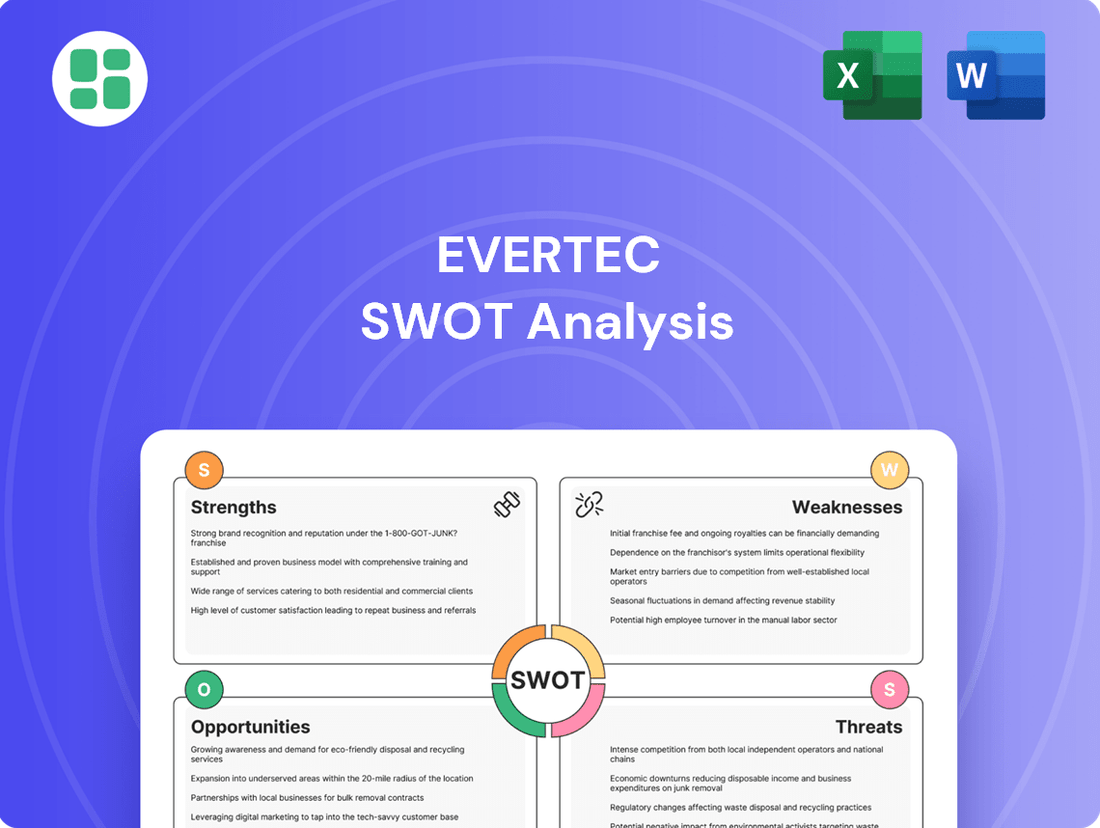

This analysis outlines EVERTEC’s internal strengths and weaknesses alongside external opportunities and threats, providing a comprehensive view of its strategic landscape.

Streamlines EVERTEC's strategic planning by offering a clear, visual representation of their Strengths, Weaknesses, Opportunities, and Threats, facilitating targeted problem-solving.

Weaknesses

EVERTEC faces a notable weakness due to its significant concentration of core operations and revenue in Puerto Rico, despite its expansion efforts in Latin America. This geographic focus creates vulnerability to economic downturns or regulatory changes specific to the island.

Further compounding this is the substantial client concentration, with approximately 31% of EVERTEC's revenue derived from its relationship with Popular, Inc. This reliance on a single major client introduces significant risk should that relationship change.

Adding to this client-specific risk, a 10% discount to Popular, Inc. is slated to begin in 2025. This discount will directly impact EVERTEC's profit margins, making the revenue from this key client less valuable.

Operating across diverse Latin American and Caribbean markets means EVERTEC is inherently exposed to currency fluctuations. For instance, a significant devaluation of the Brazilian Real against the U.S. dollar, which has seen periods of notable weakness in recent years, can directly impact EVERTEC's reported revenue when translated back into dollars. This volatility introduces a layer of unpredictability into financial performance and forecasting.

EVERTEC operates in a fiercely competitive financial technology and payment processing landscape. It contends with established banks, major global payment networks, and a growing number of nimble fintech startups all seeking to capture market share. This intense rivalry demands continuous innovation and strategic agility to stay ahead.

The pressure to innovate is constant, requiring significant and ongoing investment in technology and service development. EVERTEC must adapt quickly to evolving customer needs and emerging technologies to maintain its competitive edge against both established giants and disruptive new players entering the market.

Operational Challenges of Integrating Acquisitions

EVERTEC’s strategic acquisitions, such as Sinqia and Nubity, while bolstering market presence, introduce significant operational integration hurdles. The complexity of merging disparate IT systems, workflows, and employee cultures can strain resources and temporarily hinder efficiency. For instance, integrating Sinqia’s Brazilian operations, a key 2023 acquisition, requires careful navigation of distinct regulatory environments and technological infrastructures.

These integration efforts can lead to:

- System Compatibility Issues: Ensuring seamless data flow and compatibility between acquired and existing platforms is a persistent challenge.

- Cultural Clashes: Merging different corporate cultures can impact employee morale and productivity, requiring dedicated change management initiatives.

- Resource Diversion: The intensive nature of integration can pull key personnel and financial capital away from core business operations, potentially impacting short-term performance.

- Process Harmonization: Standardizing diverse operational processes across acquired entities to maintain consistent service quality and compliance is a complex undertaking.

Vulnerability to Technological Obsolescence

EVERTEC faces a significant weakness in its vulnerability to technological obsolescence. The payments industry is characterized by rapid innovation, meaning that if the company doesn't consistently invest in and adopt new technologies, its existing platforms and services could quickly become outdated. This necessitates substantial and ongoing R&D spending to stay competitive.

For instance, the shift towards real-time payments and the increasing adoption of digital wallets and contactless technologies demand continuous adaptation. Failure to keep pace with these emerging trends could lead to a loss of market share. In 2023, global spending on digital payment technologies was estimated to be in the hundreds of billions of dollars, highlighting the scale of investment required to remain relevant.

- Constant threat of existing technologies becoming outdated.

- Need for continuous, significant investment in R&D to update platforms.

- Risk of losing competitive edge if innovation pace is not maintained.

- Difficulty in accurately predicting and investing in future market trends.

EVERTEC's reliance on Puerto Rico for a substantial portion of its revenue makes it susceptible to the island's economic fluctuations and regulatory shifts. This geographic concentration, even with Latin American expansion, remains a core vulnerability.

The company's significant dependence on Popular, Inc., accounting for roughly 31% of its revenue, presents a considerable risk. This concentration is further exacerbated by a planned 10% discount to Popular, Inc. starting in 2025, which will directly impact profit margins.

EVERTEC operates in a highly competitive fintech landscape, facing pressure from established banks, global payment networks, and agile fintech startups. This necessitates continuous innovation and substantial investment in technology to maintain its market position.

The company's recent acquisitions, like Sinqia, introduce complex operational integration challenges. Merging disparate IT systems, workflows, and corporate cultures can strain resources and potentially hinder short-term operational efficiency.

Same Document Delivered

EVERTEC SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive analysis covers EVERTEC's Strengths, Weaknesses, Opportunities, and Threats, providing actionable insights.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering a thorough examination of EVERTEC's strategic position.

This preview reflects the real document you'll receive—professional, structured, and ready to use. It provides a clear overview of EVERTEC's internal capabilities and external market factors.

Opportunities

The global movement away from cash towards digital, contactless, and mobile payments is a substantial growth avenue for EVERTEC. This trend is particularly pronounced in Latin America, where non-cash transactions surged by 23.2% in 2024.

With digital wallet users in the region anticipated to surpass 300 million by 2025, EVERTEC is well-positioned to capitalize on this expanding market. Its established digital platforms, such as ATH Movil, and ongoing investments in contactless payment technology directly address this escalating consumer preference.

EVERTEC is strategically targeting high-growth Latin American markets like Brazil, Colombia, Mexico, and Chile, alongside smaller Central American economies. This focus leverages their deep regional understanding and established infrastructure.

With a physical presence and firsthand knowledge of local technological demands, EVERTEC is well-positioned for organic growth and potential acquisitions in these vibrant territories. This strategic advantage is crucial for capturing market share.

In 2024, the Latin American fintech market is projected to reach over $100 billion, showcasing the immense potential for EVERTEC’s expansion. Their existing operational footprint gives them a significant head start.

EVERTEC can significantly enhance its payment processing and fraud detection capabilities by further integrating Artificial Intelligence (AI) and advanced data analytics. This allows for more sophisticated anomaly detection, potentially reducing fraud losses for clients. For instance, in 2024, the global AI in fintech market was valued at over $10 billion and is projected to grow substantially, indicating strong demand for these solutions.

By leveraging AI, EVERTEC can offer more personalized customer experiences and streamline its own operational efficiencies. This could translate into faster transaction processing times and more tailored product offerings. The company's commitment to innovation in this area is crucial for maintaining a competitive edge in the rapidly evolving digital payments landscape.

Cross-Selling and Deepening Client Relationships

EVERTEC’s broad portfolio of technology solutions, serving diverse sectors, presents a significant avenue for revenue expansion through cross-selling. By strategically offering complementary services to its existing clientele, the company can unlock new revenue streams and increase the overall value derived from each customer relationship. This approach not only boosts revenue but also strengthens client loyalty by providing a more integrated and comprehensive service experience.

The company's ability to deepen client relationships by leveraging its integrated offerings is a key opportunity. For instance, a client utilizing EVERTEC's payment processing might be receptive to adopting their fraud detection or data analytics services, thereby increasing EVERTEC's wallet share within that account. This strategy is crucial for driving sustainable organic growth and solidifying EVERTEC's position as a vital technology partner.

- Cross-Selling Potential: EVERTEC can leverage its extensive product suite to offer additional services to its existing customer base, potentially increasing average revenue per user.

- Deepening Relationships: By providing a more integrated technology ecosystem, EVERTEC can foster stronger, more loyal client partnerships, reducing churn.

- Wallet Share Growth: Successful cross-selling directly contributes to increasing the proportion of a client's technology spending that is allocated to EVERTEC.

- Organic Growth Driver: This strategy is a powerful engine for organic revenue growth, capitalizing on existing client relationships rather than solely relying on new customer acquisition.

Benefiting from Financial Institution Outsourcing Trends

Financial institutions and government entities are increasingly offloading their technology systems and operations. This shift is driven by the significant expenses and complexities associated with managing outdated infrastructure. EVERTEC, with its established expertise in IT outsourcing, core banking processing, and managed services, is perfectly positioned to benefit from this trend.

By providing modern, efficient, and cost-effective solutions, EVERTEC can attract organizations looking to streamline their operations and reduce their technology burdens. For instance, the global financial outsourcing market was projected to reach over $30 billion by 2024, highlighting the substantial opportunity for providers like EVERTEC.

- Growing demand for IT outsourcing in the financial sector.

- EVERTEC's core competencies align with client needs for modern, cost-effective solutions.

- Opportunity to capture market share from institutions struggling with legacy systems.

EVERTEC's expansion into high-growth Latin American markets like Brazil, Colombia, and Mexico presents a significant opportunity, especially as the region's fintech market is expected to exceed $100 billion in 2024. The company's established digital platforms and investments in contactless technology are well-aligned with the accelerating shift towards digital payments, with digital wallet users in Latin America projected to surpass 300 million by 2025.

Further integration of AI and advanced data analytics can enhance EVERTEC's payment processing and fraud detection capabilities. The global AI in fintech market, valued at over $10 billion in 2024, demonstrates a strong demand for these solutions, allowing EVERTEC to offer more personalized customer experiences and improve operational efficiencies.

The increasing trend of financial institutions and governments outsourcing their technology operations creates a prime opportunity for EVERTEC, given its expertise in IT outsourcing and core banking processing. The global financial outsourcing market, projected to exceed $30 billion by 2024, underscores the substantial potential for EVERTEC to attract organizations seeking to reduce their technology burdens.

| Opportunity | Key Driver | Market Size/Projection (2024/2025) | EVERTEC's Position |

| Digital Payment Growth in LATAM | Shift from cash to digital/contactless payments | Fintech Market: >$100 billion; Digital Wallet Users: >300 million by 2025 | Established digital platforms (ATH Movil), contactless tech investment |

| AI & Data Analytics Integration | Demand for enhanced fraud detection and personalization | AI in Fintech Market: >$10 billion | Can improve processing, fraud detection, and customer experience |

| IT Outsourcing in Financial Sector | Institutions offloading complex/legacy systems | Financial Outsourcing Market: >$30 billion | Expertise in IT outsourcing, core banking, managed services |

Threats

EVERTEC operates in a rapidly evolving payment processing and fintech sector, characterized by intense rivalry and continuous technological advancements. New players, including nimble fintech startups and major technology firms expanding into payments, pose a significant threat.

This escalating competition could result in downward pressure on pricing and potential erosion of EVERTEC's market share if the company cannot maintain its pace of innovation and adaptation. For instance, the global digital payments market was projected to reach $2.4 trillion in 2024, highlighting the vastness and attractiveness of the sector to new entrants.

As a company processing vast amounts of sensitive financial information, EVERTEC faces a significant threat from cyberattacks that are becoming more advanced and frequent. The global cost of cybercrime is expected to reach $10.5 trillion annually by 2025, highlighting the scale of this risk.

A major cybersecurity incident could result in substantial financial damages, severe harm to EVERTEC's reputation, and significant penalties from regulators. Furthermore, such an event would erode customer confidence, a critical asset for any financial services provider.

EVERTEC's operations across diverse Latin American and Caribbean markets expose it to a complex web of financial regulations, data privacy laws, and payment network rules that are continually shifting. For instance, in 2024, several countries in the region saw updates to their data protection frameworks, requiring significant investment in compliance technology and personnel. These evolving mandates can lead to increased operational expenses and potentially limit certain revenue-generating activities.

Stricter enforcement of existing regulations or the introduction of new compliance requirements could necessitate costly operational overhauls for EVERTEC. A hypothetical example could be a new mandate on cross-border data transfer in 2025, forcing the company to re-architect its data handling processes. Such changes directly impact profitability by raising compliance costs and could hinder expansion into new markets or the introduction of innovative services.

Macroeconomic Volatility and Political Instability

EVERTEC operates in regions vulnerable to macroeconomic shifts like inflation and interest rate changes, which can dampen consumer spending and payment volumes. For instance, Puerto Rico, a key market, experienced a 1.1% GDP contraction in 2023, highlighting economic sensitivities.

Political instability also poses a threat. Changes in government policy or regulatory environments in Latin America, where EVERTEC has a significant presence, could impact its operational costs and revenue streams. For example, shifts in fiscal policy in countries like Colombia or Mexico can create uncertainty for businesses reliant on consistent economic activity.

- Economic Downturns: Regions like Puerto Rico and other Latin American markets are susceptible to recessions, directly impacting transaction volumes and EVERTEC's revenue.

- Interest Rate Hikes: Rising interest rates can increase borrowing costs for EVERTEC and its clients, potentially slowing investment and payment activity.

- Political Uncertainty: Elections or policy changes in key operating countries can lead to unpredictable business environments and affect consumer confidence.

- Currency Fluctuations: Volatility in Latin American currencies can impact EVERTEC's reported earnings when translated back to U.S. dollars.

Technological Disruption and Rapid Innovation Cycles

The payments sector is constantly evolving with new technologies, like real-time payments and digital wallets, emerging at a rapid pace. EVERTEC faces a significant threat if it cannot keep up with these innovations. For instance, while EVERTEC reported a 7% increase in total payment volume in Q1 2024 compared to the previous year, a failure to integrate emerging technologies could see this growth stall.

Competitors are actively developing and deploying disruptive solutions. If EVERTEC’s existing infrastructure and services are not continuously upgraded or replaced with more advanced alternatives, they risk becoming outdated. This could lead to a loss of market share and a decline in revenue, as clients seek out more modern and efficient payment processing solutions.

- Rapid Innovation: The payments industry is seeing advancements in areas like embedded finance and tokenization, requiring constant adaptation.

- Obsolescence Risk: Failure to invest in R&D could make EVERTEC's current offerings less competitive.

- Competitive Lag: Being outpaced by fintech startups or established players launching new payment rails poses a direct threat.

EVERTEC faces intense competition from both established financial institutions and agile fintech startups, which can lead to price erosion and market share loss. For example, the global digital payments market is projected to reach $2.4 trillion in 2024, attracting numerous new entrants. The company also confronts significant cybersecurity threats, with the global cost of cybercrime expected to hit $10.5 trillion annually by 2025, posing risks of financial damage and reputational harm.

Navigating diverse and evolving regulatory landscapes across Latin America and the Caribbean presents another challenge, requiring continuous investment in compliance. Macroeconomic volatility, including inflation and interest rate fluctuations in key markets like Puerto Rico, can impact consumer spending and transaction volumes. Furthermore, the rapid pace of technological innovation in payments, such as real-time payments and digital wallets, demands constant adaptation to avoid obsolescence and maintain competitiveness.

| Threat Category | Specific Threat | Impact on EVERTEC | Supporting Data/Trend |

|---|---|---|---|

| Competition | Fintech Startups & Tech Giants | Price pressure, market share erosion | Global digital payments market projected $2.4T in 2024 |

| Cybersecurity | Advanced Cyberattacks | Financial loss, reputational damage, regulatory penalties | Global cybercrime cost to reach $10.5T annually by 2025 |

| Regulatory Environment | Evolving Laws & Data Privacy | Increased compliance costs, operational limitations | Updates to data protection frameworks in Latin America in 2024 |

| Economic Factors | Inflation & Interest Rate Hikes | Reduced consumer spending, lower transaction volumes | Puerto Rico GDP contraction of 1.1% in 2023 |

| Technological Change | Emerging Payment Technologies | Risk of obsolescence, loss of competitive edge | Q1 2024 total payment volume up 7%, but innovation is key |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from EVERTEC's official financial filings, comprehensive market research reports, and insightful expert commentary from industry analysts to ensure a well-rounded and accurate assessment.