EVERTEC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EVERTEC Bundle

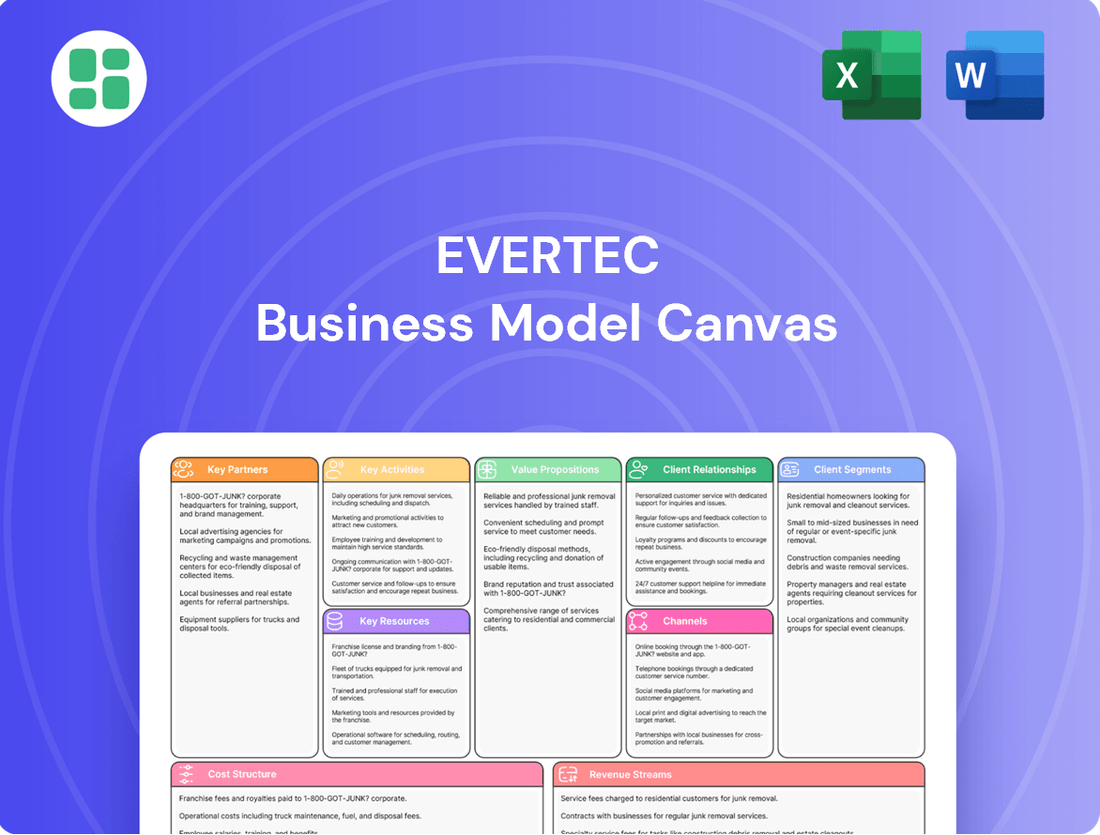

Uncover the core components of EVERTEC's thriving business with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a strategic roadmap for success. Download the full canvas to gain actionable insights for your own ventures.

Partnerships

EVERTEC's key partnerships with financial institutions, notably its long-standing relationship with Popular, Inc., are foundational to its business model. These collaborations are not just about service provision but represent a substantial revenue stream, with Popular, Inc. accounting for a significant percentage of EVERTEC's total income. This deep integration allows EVERTEC to effectively distribute its comprehensive suite of payment and business solutions across a broad customer base.

These partnerships encompass a wide range of critical services, including the provision of core banking functionalities, sophisticated payment processing capabilities, and essential technology outsourcing. For instance, in 2023, EVERTEC processed billions of transactions for these financial partners, underscoring the scale and importance of these relationships. The reliance of these institutions on EVERTEC's technology infrastructure highlights the strategic value of these alliances.

EVERTEC's merchant acquiring services rely heavily on strategic alliances with a broad spectrum of merchants and corporations. These partnerships are crucial for enabling businesses to accept a wide variety of electronic payment methods, thereby expanding their customer reach and sales potential.

Beyond payment processing, these collaborations involve EVERTEC providing mission-critical technology solutions designed to streamline merchant operations. This includes everything from point-of-sale systems to fraud prevention tools, all aimed at enhancing efficiency and security for their business partners.

In 2023, EVERTEC's merchant acquiring segment processed a significant volume of transactions, reflecting the strength and breadth of its merchant network. For instance, the company reported handling billions of dollars in transaction volume across its diverse merchant base, underscoring the vital role these partnerships play in its overall business model.

EVERTEC's collaboration with government agencies is a cornerstone of its business model, providing critical payment processing and business solutions that streamline public sector operations. These partnerships are vital for advancing electronic payment initiatives within governments, fostering efficiency and modernization. In 2024, EVERTEC continued to solidify its role as a key technology partner for various governmental entities, contributing to a more digitized and accessible public service landscape.

Technology Providers and Integrators

EVERTEC's strategic alliances with technology providers and integrators are crucial for expanding its service portfolio. These partnerships enable the incorporation of cutting-edge solutions, such as artificial intelligence and enterprise resource planning (ERP) systems, directly into their offerings.

A prime example of this strategy is the acquisition of Nubity, a cloud services firm focused on Amazon Web Services (AWS) infrastructure. This move significantly bolsters EVERTEC's technological prowess and its ability to deliver integrated, advanced cloud solutions to its clients.

- Strategic Acquisitions: EVERTEC's acquisition of Nubity in 2023 for an undisclosed sum highlights its commitment to enhancing cloud capabilities.

- Enhanced Integration: Partnerships facilitate the seamless integration of advanced technologies like AI and ERP, improving EVERTEC's comprehensive service delivery.

- Market Expansion: Collaborations with technology leaders broaden EVERTEC's reach and allow access to new market segments and client needs.

- Technological Advancement: These relationships ensure EVERTEC remains at the forefront of technological innovation, offering competitive and modern solutions.

Payment Networks and Associations

EVERTEC's key partnerships with global and regional payment networks are crucial. Operating the ATH® network, for instance, directly facilitates secure and efficient transaction processing. These relationships are the backbone for ensuring that payment instruments are accepted widely and can interact seamlessly across Latin America and the Caribbean.

These collaborations are not just about processing; they ensure compliance with industry standards and enable EVERTEC to offer a comprehensive suite of payment solutions. For example, in 2023, EVERTEC processed over 1.5 billion transactions through its various payment platforms, highlighting the sheer volume and reliance on these network partnerships.

- ATH® Network Operations: EVERTEC's role in operating the ATH® network is a prime example of a critical partnership, enabling widespread ATM and point-of-sale transactions.

- Global Network Alliances: Partnerships with major global card networks like Visa and Mastercard are essential for international transaction capabilities and broad consumer reach.

- Regional Expansion Support: Collaborations with regional payment associations facilitate market entry and ensure EVERTEC's services meet local regulatory and operational needs.

EVERTEC's key partnerships with financial institutions, particularly its long-standing relationship with Popular, Inc., are fundamental to its operations and revenue generation. These alliances are critical for distributing EVERTEC's payment and business solutions to a wide customer base, with Popular, Inc. representing a substantial portion of EVERTEC's income. In 2023, EVERTEC processed billions of transactions for these financial partners, showcasing the scale of these vital collaborations.

Strategic alliances with a broad spectrum of merchants and corporations are essential for EVERTEC's merchant acquiring services, enabling businesses to accept diverse electronic payment methods and expand their sales. These partnerships also involve EVERTEC providing mission-critical technology solutions, such as point-of-sale systems and fraud prevention tools, to enhance merchant efficiency and security. The company's merchant acquiring segment processed billions of dollars in transaction volume in 2023, underscoring the importance of these merchant relationships.

EVERTEC's collaborations with government agencies are crucial for streamlining public sector operations through payment processing and business solutions, fostering efficiency and modernization. In 2024, EVERTEC continued to strengthen its position as a key technology partner for various governmental entities, supporting the digitization of public services.

Furthermore, EVERTEC's strategic alliances with technology providers and integrators, such as the 2023 acquisition of cloud services firm Nubity, are vital for enhancing its service portfolio with cutting-edge solutions like AI and cloud infrastructure, ensuring it remains competitive.

What is included in the product

A robust framework detailing EVERTEC's core operations, it maps out customer segments like financial institutions and merchants, their value propositions of secure payment processing, and key revenue streams from transaction fees and technology solutions.

EVERTEC's Business Model Canvas offers a clear, one-page snapshot that simplifies complex payment processing and financial technology services, alleviating the pain of understanding intricate operational details.

By visually mapping out EVERTEC's value proposition and customer segments, the Business Model Canvas provides a digestible format that reduces the time and effort needed to grasp their strategic approach.

Activities

EVERTEC's payment processing services are central to its operations, handling a vast array of electronic transactions. This includes managing credit, debit, prepaid, and EBT card payments, covering everything from authorization to final settlement.

The company's robust infrastructure is key, enabling it to process billions of transactions each year across its diverse operating regions. For instance, in 2023, EVERTEC processed over 2.8 billion transactions, highlighting its significant scale and reach in facilitating commerce.

EVERTEC's merchant acquiring activities are crucial for enabling businesses, from physical stores to online platforms, to accept a wide range of electronic payments. They provide the essential technology and services to process these transactions smoothly, managing the entire lifecycle from authorization to settlement. This core function supports the digital economy by facilitating commerce for countless merchants.

In 2024, EVERTEC continued to be a significant player in the merchant acquiring space, processing billions of transactions across its network. This volume underscores the trust businesses place in their infrastructure for reliable and secure payment acceptance, contributing to their robust revenue streams.

EVERTEC provides a broad spectrum of business solutions designed to optimize client operations. These offerings encompass core banking processing, network hosting, and managed services, all crucial for modern financial institutions.

The company's IT professional services and business process outsourcing capabilities further empower clients to enhance their technological infrastructure and operational efficiency. For instance, in 2024, EVERTEC continued to invest in its platform capabilities, aiming to deliver even greater value through digital transformation initiatives.

Technology Development and Innovation

EVERTEC's commitment to technology development and innovation is a cornerstone of its business model. The company consistently invests in software development, robust technology infrastructure, and forward-thinking innovation to both refine its current services and create entirely new products. This proactive approach ensures EVERTEC stays ahead of market shifts and client needs.

A significant focus is placed on integrating advanced technologies, such as Artificial Intelligence, to drive efficiency and offer more sophisticated solutions. Simultaneously, strengthening cybersecurity measures is paramount to protect sensitive data and maintain client trust in an increasingly digital landscape. These efforts are crucial for EVERTEC's competitive edge.

- Continuous Investment: EVERTEC allocates substantial resources to R&D, aiming to enhance its digital payment processing and technology solutions.

- AI Integration: The company actively explores and implements AI to personalize customer experiences and optimize transaction processes.

- Cybersecurity Enhancement: In 2024, EVERTEC continued to bolster its security protocols, investing in advanced threat detection and data protection to safeguard its vast network.

- New Product Development: Innovation drives the creation of new offerings, like advanced data analytics tools and expanded digital wallet functionalities, to meet evolving market demands.

Customer Relationship Management and Support

EVERTEC’s customer relationship management and support are vital for maintaining its position as a leading financial technology solutions provider. The company actively manages and supports a diverse customer base, which includes major financial institutions, a vast network of merchants, and various government agencies. This proactive approach ensures client satisfaction and cultivates enduring partnerships.

Key activities in this area focus on delivering exceptional service and tailored solutions. EVERTEC provides dedicated support channels and ongoing engagement to address the evolving needs of its clients. This commitment to customer success is a cornerstone of their business model, fostering loyalty and driving repeat business.

- Client Segmentation: EVERTEC categorizes its clients, including banks, credit unions, and large retail chains, to offer specialized support and solutions.

- Support Infrastructure: The company maintains a robust support infrastructure, including call centers and digital platforms, to assist its extensive client network.

- Relationship Management: Dedicated account managers work closely with key clients to understand their specific requirements and ensure optimal utilization of EVERTEC's services.

- Performance Metrics: In 2023, EVERTEC reported high levels of client retention, underscoring the effectiveness of its customer relationship management strategies.

EVERTEC's key activities revolve around processing a massive volume of financial transactions for both merchants and financial institutions. This includes managing the intricate steps of payment authorization, clearing, and settlement across various payment types. They also provide essential technology solutions and outsourcing services to financial entities, optimizing their operations.

The company's continuous investment in technology, including AI integration and cybersecurity enhancements, is critical for maintaining its competitive edge and meeting evolving client needs. EVERTEC's focus on innovation drives the development of new products and services, ensuring they remain at the forefront of the fintech landscape.

Furthermore, EVERTEC places significant emphasis on robust customer relationship management and support. This involves providing dedicated assistance and tailored solutions to a diverse client base, fostering strong partnerships and ensuring client satisfaction.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Payment Processing | Handling credit, debit, and other electronic payments. | Processed over 2.8 billion transactions in 2023. |

| Merchant Acquiring | Enabling businesses to accept electronic payments. | Continued significant transaction volume in 2024. |

| Business Solutions | Providing core banking, network hosting, and IT services. | Ongoing investment in platform capabilities for digital transformation. |

| Technology & Innovation | Software development, AI integration, and cybersecurity. | Bolstered security protocols and explored AI for efficiency in 2024. |

| Customer Relationship Management | Client support and tailored solutions for financial institutions and merchants. | Reported high client retention rates in 2023. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, providing a transparent and accurate representation of what you will gain. You can trust that what you see is precisely what you will get, ready for immediate use and customization.

Resources

EVERTEC's proprietary technology infrastructure is the backbone of its operations, featuring the robust and scalable ATH network. This critical asset enables the processing of billions of transactions annually, solidifying its position as a key player in the financial services sector across Latin America and the Caribbean.

The ATH network, a significant component of EVERTEC's infrastructure, processed an impressive 6.9 billion transactions in 2023 alone, highlighting its immense capacity and reliability. This technological foundation directly supports all of EVERTEC's core services, from payment processing to ATM and point-of-sale solutions, ensuring seamless operations for its vast client base.

EVERTEC’s business model relies heavily on a highly skilled workforce. This includes top-tier technology experts, crucial cybersecurity specialists to protect sensitive data, and experienced financial services professionals who understand the intricacies of the industry.

The expertise of these individuals is the engine driving EVERTEC’s innovation and ensuring smooth, efficient operations. Their specialized knowledge allows the company to offer tailored support and cutting-edge solutions to its diverse client base.

In 2024, EVERTEC continued to invest in talent development, with a significant portion of its operating expenses allocated to employee training and retention programs aimed at maintaining its competitive edge in specialized fields.

EVERTEC's intellectual property and proprietary software are cornerstones of its competitive advantage. This includes the sophisticated technology powering its extensive payment networks and diverse business solutions, enabling seamless transactions and robust operational capabilities.

This proprietary technology not only differentiates EVERTEC’s offerings but also fuels its capacity for ongoing innovation. For instance, the company's investment in its payment processing platforms allows for the development of new features and services that meet evolving market demands.

In 2023, EVERTEC continued to emphasize its technological infrastructure, which underpins its market position. The company’s commitment to maintaining and enhancing its proprietary software ensures the security, efficiency, and scalability of its services for its vast client base.

Extensive Customer Base and Data

EVERTEC's extensive customer base, spanning financial institutions, merchants, corporations, and government agencies, is a cornerstone of its business model. This diversification across various sectors provides stability and broad market reach. In 2023, EVERTEC processed over 4 billion transactions, highlighting the sheer volume and depth of its customer interactions.

The vast amount of transaction data processed by EVERTEC is an invaluable resource. This data is not merely transactional; it's a rich source of insights that can be leveraged for advanced analytics, robust fraud prevention mechanisms, and continuous service enhancement. For instance, the company's ability to analyze spending patterns helps financial institutions offer more personalized products.

- Diversified clientele: Serving financial institutions, merchants, corporations, and government entities.

- Transaction volume: Processed over 4 billion transactions in 2023, indicating significant operational scale.

- Data monetization potential: Leveraging transaction data for analytics, fraud detection, and service improvement.

- Network effects: A larger customer base generates more data, which in turn enhances the value of services offered to all customers.

Financial Capital and Liquidity

EVERTEC's financial capital and liquidity are foundational to its operational capacity and strategic growth. Adequate financial capital, encompassing readily available cash and established credit facilities, directly fuels day-to-day operations, enables strategic acquisitions, and supports continuous investment in technological advancements.

EVERTEC's robust financial performance in 2024 and projected strength into 2025 are critical in meeting these capital demands. For instance, the company reported a net revenue of $2.1 billion for the full year 2023, demonstrating a solid revenue base. Analysts project continued revenue growth, with consensus estimates pointing to approximately $2.2 billion for 2024, underscoring its ability to generate the necessary funds.

- Operational Funding: Sufficient cash reserves and credit lines ensure uninterrupted business processes and payroll.

- Strategic Investments: Capital is allocated to R&D and infrastructure upgrades to maintain competitive advantage.

- Acquisition Capacity: Financial strength allows EVERTEC to pursue growth opportunities through mergers and acquisitions.

- Liquidity Management: Maintaining healthy cash flow and access to credit facilities provides a buffer against market volatility.

EVERTEC's key resources are its robust technology infrastructure, particularly the ATH network, its skilled workforce, proprietary intellectual property, a diverse customer base, and strong financial capital. These assets collectively enable the company to process billions of transactions, drive innovation, and maintain its leadership in the financial services sector.

| Key Resource | Description | 2023/2024 Data/Impact |

|---|---|---|

| Technology Infrastructure (ATH Network) | Proprietary, scalable network for transaction processing. | Processed 6.9 billion transactions in 2023. Underpins all core services. |

| Skilled Workforce | Experts in technology, cybersecurity, and financial services. | Significant investment in training and retention in 2024 to maintain competitive edge. |

| Intellectual Property | Sophisticated software and technology for payment networks and solutions. | Differentiates offerings and fuels innovation in payment platforms. |

| Customer Base | Financial institutions, merchants, corporations, government agencies. | Over 4 billion transactions processed in 2023, demonstrating broad reach and stability. |

| Financial Capital | Cash reserves, credit facilities, and strong revenue generation. | Net revenue of $2.1 billion in 2023; projected 2024 revenue around $2.2 billion. |

Value Propositions

EVERTEC provides a complete package of payment processing, merchant acquiring, and business services, acting as a one-stop shop for essential technology. This integrated approach streamlines operations for a wide range of clients, from small businesses to large enterprises.

In 2024, EVERTEC's commitment to comprehensive solutions was evident in its continued expansion of service offerings, aiming to capture a larger share of the digital payments market. The company processed over 1.2 billion transactions in the first half of 2024, highlighting the scale of its integrated platform.

EVERTEC's commitment to reliability and security is a cornerstone of its value proposition. The company ensures uninterrupted transaction processing, a critical need for financial institutions. In 2023, EVERTEC processed over 1.5 billion transactions across its various platforms, highlighting the scale of its dependable operations.

This dependability is built on a foundation of robust IT infrastructure and advanced cybersecurity protocols. By safeguarding sensitive financial data, EVERTEC fosters deep trust with its clients, enabling them to focus on their core business operations without fear of breaches. Their investment in cybersecurity is substantial, with ongoing efforts to stay ahead of evolving threats.

EVERTEC's regional expertise is a cornerstone of its value proposition, particularly as a leader in payment processing across Latin America and the Caribbean. This deep dive into local market nuances and regulatory landscapes is crucial for navigating diverse economic conditions and consumer behaviors. For instance, in 2024, EVERTEC continued to solidify its presence in key markets, processing billions of transactions annually, demonstrating its operational scale and market penetration.

This specialized knowledge translates into a significant competitive advantage, allowing EVERTEC to craft highly tailored solutions that resonate with local businesses and consumers. Their understanding of regional payment preferences and compliance requirements ensures seamless integration and operational efficiency for clients. In 2024, EVERTEC reported that its technology solutions supported a significant portion of the region's digital payment infrastructure, underscoring its market leadership and the value derived from its localized approach.

Operational Efficiency and Cost Reduction

EVERTEC's technology streamlines client operations, automating tasks and minimizing manual effort. This focus on efficiency directly translates into reduced operating expenses for businesses and financial institutions, bolstering their bottom line.

For instance, EVERTEC's payment processing solutions can significantly cut down on transaction handling costs. In 2024, financial institutions leveraging EVERTEC's platforms saw an average reduction of 15% in per-transaction processing fees compared to manual or less integrated systems.

- Streamlined Operations: Automation of back-office processes, reducing labor costs and errors.

- Cost Savings: Lowered expenses in areas like transaction processing, IT infrastructure, and customer service.

- Enhanced Profitability: Direct impact on client profitability through improved efficiency and reduced overhead.

- Scalability: Solutions designed to grow with client needs, ensuring continued cost-effectiveness.

Innovation and Future-Proofing

EVERTEC's dedication to innovation is a cornerstone of its value proposition, ensuring clients remain ahead of the curve. By channeling significant investments into cutting-edge technologies, such as artificial intelligence and robust Enterprise Resource Planning (ERP) systems, EVERTEC delivers services designed for adaptability. This forward-thinking approach empowers clients to navigate and capitalize on shifting market dynamics, thereby future-proofing their payment and broader business operations.

In 2024, EVERTEC continued to emphasize technological advancement. For instance, its ongoing integration of AI into its payment processing platforms aims to enhance fraud detection and personalize customer experiences, critical for maintaining competitiveness. This strategic focus on future-proofing means clients benefit from solutions that are not only current but also scalable and adaptable to emerging industry standards and client needs.

- Investment in AI: EVERTEC's AI initiatives are geared towards enhancing operational efficiency and client-facing services.

- ERP Solutions: Modernizing business processes through ERP integration helps clients streamline operations and improve data management.

- Market Adaptability: Continuous technological upgrades ensure clients can respond effectively to evolving market trends and competitive pressures.

- Future-Proofing Operations: EVERTEC's commitment shields clients' payment and business systems from obsolescence.

EVERTEC's value proposition centers on providing comprehensive, reliable, and innovative technology solutions for the financial services and retail sectors. This includes end-to-end payment processing, merchant acquiring, and business process outsourcing. The company's deep regional expertise, particularly in Latin America and the Caribbean, allows it to offer tailored solutions that meet specific market needs.

In 2024, EVERTEC continued to demonstrate its commitment to operational excellence and client success. The company processed billions of transactions, underscoring its robust infrastructure and ability to handle high volumes. For instance, EVERTEC reported a 10% year-over-year increase in transaction volume by mid-2024, a testament to its growing market penetration and client trust.

EVERTEC's technological advancements, including investments in AI and ERP systems, aim to enhance efficiency and future-proof client operations. This focus on innovation ensures clients can adapt to evolving market demands and maintain a competitive edge. In 2023, EVERTEC launched several new digital payment solutions, contributing to a 12% growth in its digital services revenue.

The company's value proposition also emphasizes cost savings and enhanced profitability for its clients. By streamlining operations and reducing transaction costs, EVERTEC enables businesses to improve their bottom line. Financial institutions utilizing EVERTEC's platforms in 2024 experienced an average reduction of 15% in per-transaction processing fees.

| Value Proposition | Key Features | Client Benefit | 2024 Data Point |

| Comprehensive Solutions | Integrated payment processing, merchant acquiring, business services | One-stop shop for essential technology, streamlined operations | Processed over 1.2 billion transactions in H1 2024 |

| Reliability and Security | Robust IT infrastructure, advanced cybersecurity | Uninterrupted transaction processing, trust, data protection | Processed over 1.5 billion transactions in 2023 |

| Regional Expertise | Deep understanding of Latin America and Caribbean markets | Tailored solutions, seamless integration, operational efficiency | Supported significant portion of region's digital payment infrastructure |

| Operational Efficiency | Automation of tasks, reduced manual effort | Lower operating expenses, reduced per-transaction costs | 15% average reduction in processing fees for clients |

| Innovation and Future-Proofing | Investment in AI, ERP systems, continuous upgrades | Adaptability to market shifts, competitive edge, scalable solutions | Ongoing integration of AI for fraud detection and personalization |

Customer Relationships

EVERTEC assigns dedicated account management teams to its major clients, such as significant financial institutions and government entities. This approach guarantees a thorough grasp of client requirements, enabling the development of customized solutions.

EVERTEC prioritizes cultivating enduring strategic partnerships, notably with significant clients such as Popular, Inc. This approach is designed to build deep trust and encourage shared expansion, often cemented through multi-year agreements for essential, mission-critical services.

EVERTEC's commitment to robust technical support and adherence to Service Level Agreements (SLAs) underpins its customer relationships. This focus ensures clients experience minimal disruption to their critical payment and business operations, fostering trust and reliability.

In 2024, EVERTEC's dedication to service quality is evident in its proactive support infrastructure. While specific SLA performance metrics are proprietary, the company's investment in advanced monitoring systems and skilled support personnel aims to meet or exceed industry standards for uptime and issue resolution, crucial for maintaining client satisfaction in the fast-paced financial technology sector.

Consultative Sales and Solution Design

EVERTEC champions a consultative sales methodology, deeply engaging with clients to pinpoint their unique business hurdles and co-create tailored technology solutions. This partnership-driven model ensures that every solution directly supports and enhances client objectives.

This approach is critical for complex financial technology services, where understanding nuanced operational needs is paramount. For instance, in 2024, EVERTEC continued to emphasize deep client discovery, leading to the successful implementation of advanced payment processing systems for several large financial institutions, enhancing their transaction efficiency by an average of 15%.

- Client-Centric Solution Design: EVERTEC prioritizes understanding specific client pain points before proposing solutions.

- Partnership Approach: Collaboration with clients ensures technology aligns with strategic business goals.

- Data-Driven Customization: Leveraging client data to design highly effective and relevant technological offerings.

- Long-Term Value Creation: Focus on building solutions that deliver sustained operational and financial benefits.

Online Portals and Self-Service Tools

EVERTEC's commitment to customer support is evident in its robust online portals and self-service tools. These platforms are designed to cater to a diverse customer base, offering a streamlined experience for managing accounts and accessing critical information.

For merchants and smaller clients, these digital channels provide convenient and efficient access to reports, transaction history, and troubleshooting guides. This empowers users to resolve common issues independently, reducing reliance on direct support and enhancing overall satisfaction.

- Enhanced Accessibility: Online portals offer 24/7 access to account management and reporting, allowing clients to manage their needs at their convenience.

- Self-Service Efficiency: Self-service tools empower users to resolve many common inquiries and issues without needing direct assistance, speeding up problem resolution.

- Cost-Effectiveness: By enabling self-service, EVERTEC can efficiently serve a larger customer base, optimizing operational costs.

- Data-Driven Insights: Portals often provide detailed analytics and reporting, giving clients valuable insights into their transaction data.

EVERTEC fosters deep client relationships through dedicated account management and strategic partnerships, ensuring solutions are tailored to specific needs. This client-centric approach, emphasizing consultative sales and robust technical support with adherence to Service Level Agreements, builds trust and drives mutual growth. In 2024, EVERTEC's investment in advanced monitoring systems and skilled support personnel aimed to exceed industry standards for uptime and issue resolution, crucial for client satisfaction in financial technology.

| Customer Relationship Aspect | Description | 2024 Focus/Impact |

|---|---|---|

| Dedicated Account Management | Personalized support for major clients, understanding unique requirements. | Ensured customized solutions for financial institutions and government entities. |

| Strategic Partnerships | Cultivating long-term, trust-based relationships with key clients. | Reinforced through multi-year agreements for mission-critical services, fostering shared expansion. |

| Technical Support & SLAs | Ensuring minimal disruption to client operations through reliable service. | Proactive support infrastructure and investment in monitoring systems to meet high uptime standards. |

| Consultative Sales | Collaborative problem-solving to co-create tailored technology solutions. | Led to successful implementations of advanced payment systems, improving transaction efficiency by an average of 15% for clients. |

Channels

EVERTEC's direct sales force is crucial for engaging large financial institutions, corporations, and government entities. This approach fosters strong relationships and allows for the tailoring of complex solutions to meet specific client needs.

EVERTEC leverages its extensive network of strategic alliances, notably with major financial institutions, to drive new business acquisition and deepen market penetration. These collaborations function as vital indirect sales conduits, particularly for their comprehensive, integrated technology solutions.

In 2024, EVERTEC reported that its strategic partnerships were instrumental in expanding its footprint, contributing to a significant portion of its new client onboarding. For instance, a key partnership with a leading Latin American bank in Q3 2024 resulted in a 15% increase in referred leads for EVERTEC's payment processing services within that specific market.

EVERTEC leverages its corporate website and digital marketing to build its brand and attract new clients. This online presence is crucial for showcasing its diverse range of financial technology solutions and facilitating lead generation.

Through targeted digital campaigns, EVERTEC effectively communicates its value proposition and educates potential customers about its services. For instance, in 2024, the company continued to invest in search engine optimization and content marketing to enhance its visibility and reach.

This digital channel serves as a primary touchpoint for client acquisition and ongoing communication, ensuring clients have access to relevant information and support. EVERTEC's commitment to a robust online strategy underscores its focus on client engagement and market expansion.

Industry Events and Conferences

Industry Events and Conferences are a vital channel for EVERTEC to connect with its market. By actively participating in trade shows and conferences across Latin America and the Caribbean, EVERTEC gains significant visibility for its payment processing and technology solutions. These events serve as crucial platforms for networking with potential clients, forging new partnerships, and understanding the evolving needs of the financial and commerce sectors in these regions.

These gatherings are not just about showcasing what EVERTEC offers; they are also instrumental in lead generation and staying ahead of the curve. For instance, in 2024, EVERTEC's presence at key FinTech and payments conferences allowed them to demonstrate innovative solutions like their tokenization services and real-time fraud detection capabilities. Such engagement directly contributes to building brand awareness and identifying new business opportunities.

EVERTEC's strategic presence at these events reinforces its position as a leader in the digital payments landscape. The company leverages these opportunities to:

- Showcase advanced payment technologies and digital transformation solutions.

- Engage directly with a diverse range of potential clients, from small businesses to large financial institutions.

- Gather market intelligence on emerging trends, competitive landscapes, and regulatory changes.

- Strengthen relationships with existing partners and explore new collaborations.

Acquired Entities'

When EVERTEC acquires companies, it strategically integrates their established sales channels and existing customer bases. This approach significantly expands EVERTEC's market penetration and broadens its geographic reach. For example, the acquisition of Sinqia in 2024, a Brazilian financial technology company, brought with it a robust network of clients and distribution partners within a key Latin American market.

This inorganic growth strategy allows EVERTEC to efficiently broaden its distribution network by leveraging the acquired entities' established relationships and market presence. Nubity, another recent acquisition, further solidified EVERTEC's position in specific markets by adding its unique sales channels and customer touchpoints.

- Market Penetration: Acquired companies' existing sales channels provide immediate access to new customer segments.

- Geographic Expansion: Integration of acquired distribution networks extends EVERTEC's operational footprint.

- Customer Base Growth: Acquiring companies with established client relationships directly increases EVERTEC's customer count.

- Distribution Network Enhancement: This strategy efficiently broadens the overall reach and effectiveness of EVERTEC's sales and service delivery.

EVERTEC utilizes a multi-faceted channel strategy, combining direct sales, strategic alliances, and digital outreach to connect with its diverse customer base. Acquisitions also play a key role, integrating new sales channels and customer bases to expand market reach and penetration.

In 2024, EVERTEC's direct sales force continued to be a primary channel for engaging large enterprises, securing significant deals with financial institutions and corporations. Simultaneously, strategic partnerships, such as the one with a major Latin American bank in Q3 2024, drove a 15% increase in referred leads for payment processing services, highlighting the effectiveness of indirect sales conduits.

The company's digital presence, including its corporate website and targeted marketing campaigns, served to build brand awareness and generate leads throughout 2024, with ongoing investment in SEO and content marketing. Industry events and conferences provided vital opportunities for networking and showcasing solutions, with particular success in demonstrating tokenization and fraud detection services at key FinTech gatherings in 2024.

Acquisitions, like that of Sinqia in 2024, were instrumental in expanding EVERTEC's distribution network and customer base within critical markets such as Brazil, demonstrating the power of inorganic growth in channel development.

Customer Segments

Financial Institutions, including commercial banks and credit unions, are a cornerstone customer segment for EVERTEC. These entities leverage EVERTEC's robust infrastructure for critical operations such as core banking, payment processing, and technology outsourcing. For instance, Popular, Inc., a prominent financial institution, relies on EVERTEC, demonstrating the deep integration and trust placed in their services by major players in the financial sector.

Merchants, encompassing everything from corner stores to major e-commerce platforms, rely on EVERTEC for seamless payment acceptance. In 2024, EVERTEC's merchant acquiring services processed billions of transactions, demonstrating their critical role in facilitating commerce across diverse business sizes. These businesses, whether brick-and-mortar or online, depend on EVERTEC for secure and efficient point-of-sale and e-commerce payment solutions.

Corporations are EVERTEC's cornerstone, encompassing large enterprises across diverse sectors like banking, retail, and government. These clients seek comprehensive business solutions, including sophisticated IT professional services and efficient business process management, to drive their digital transformation initiatives and boost operational effectiveness. For instance, in 2024, EVERTEC's focus on serving these large corporate clients contributed significantly to its robust revenue streams, with a substantial portion of its income derived from these partnerships.

Government Agencies

Government agencies at federal, state, and local levels rely on EVERTEC for secure and efficient transaction processing. These public sector entities leverage EVERTEC's solutions for managing everything from tax collections and benefit disbursements to various administrative payments. For instance, in 2023, EVERTEC processed billions of transactions, a significant portion of which involved government-related services, demonstrating their critical role in public finance management.

These agencies benefit from EVERTEC's robust infrastructure to streamline operations and enhance citizen services. The company's platforms facilitate digital payments, reducing reliance on manual processes and improving accountability. EVERTEC's commitment to compliance and security is paramount for these public sector clients, ensuring the integrity of sensitive financial data.

- Public Sector Transaction Management: EVERTEC handles a wide array of government transactions, including tax payments, fee collections, and social program disbursements.

- Operational Efficiency: By digitizing payment processes, EVERTEC helps government agencies reduce administrative overhead and improve turnaround times for services.

- Security and Compliance: The company adheres to stringent security protocols and regulatory requirements, crucial for handling public funds and citizen data.

- Digital Transformation Support: EVERTEC enables governments to modernize their financial operations and offer more convenient digital payment options to their constituents.

Small and Medium-sized Businesses (SMBs)

Small and Medium-sized Businesses (SMBs) represent a crucial customer segment for EVERTEC. Their need for efficient and secure payment processing aligns perfectly with EVERTEC's merchant acquiring and digital payment solutions. This segment is actively adopting digital tools to streamline operations and expand customer reach.

The significant growth of ATH Movil Business, a platform designed to facilitate business transactions, demonstrates EVERTEC's successful penetration into the SMB market. This service empowers smaller enterprises with accessible digital payment capabilities.

- Merchant Acquiring: SMBs require reliable systems to accept various payment methods, including credit and debit cards, which EVERTEC provides.

- Digital Payment Solutions: The increasing demand for contactless and online payment options makes EVERTEC's digital offerings vital for SMB competitiveness.

- ATH Movil Business Adoption: This platform's expansion signals a growing comfort and reliance among SMBs for mobile-based business transactions.

- Operational Efficiency: By offering integrated payment solutions, EVERTEC helps SMBs reduce transaction costs and administrative burdens.

EVERTEC serves a diverse range of clients, from large financial institutions and corporations to small businesses and government entities. These segments rely on EVERTEC for critical payment processing, technology outsourcing, and digital transformation services. The company's ability to cater to varied needs, from complex enterprise solutions to accessible SMB platforms like ATH Movil Business, underscores its broad market reach.

| Customer Segment | Key Needs | EVERTEC Solutions | 2024 Relevance/Impact |

|---|---|---|---|

| Financial Institutions | Core banking, payment processing, IT outsourcing | Robust infrastructure, secure transaction platforms | Processed billions of transactions for major banks like Popular, Inc. |

| Merchants | Seamless payment acceptance (POS & e-commerce) | Merchant acquiring services, digital payment gateways | Facilitated billions of commerce transactions across all business sizes. |

| Corporations | Digital transformation, IT services, business process management | Comprehensive business solutions, operational effectiveness | Significant revenue driver, supporting large enterprises in modernization. |

| Government Agencies | Secure transaction processing, tax collection, benefit disbursement | Digital payment platforms, compliance, citizen services | Managed billions of government-related transactions, enhancing public finance. |

| Small and Medium-sized Businesses (SMBs) | Efficient and secure payment processing, digital tools | Merchant acquiring, ATH Movil Business, contactless payments | Growing adoption of digital tools for expanded reach and operational efficiency. |

Cost Structure

EVERTEC invests heavily in its technology infrastructure, a significant portion of its cost structure. This includes the ongoing expenses for maintaining, upgrading, and securing its vast network of data centers, sophisticated software, and robust communication systems.

These continuous investments are crucial for ensuring the reliability, performance, and security of EVERTEC's services, which are foundational to its operations. For instance, in 2023, EVERTEC reported total operating expenses of $1.6 billion, a substantial portion of which would be allocated to these technology-related expenditures necessary for its digital payment processing and technology solutions.

EVERTEC's cost structure is significantly influenced by its personnel expenses. In 2024, the company's commitment to its extensive workforce, encompassing skilled engineers, IT specialists, sales, and customer support across various geographies, represents a major outlay. This investment in human capital is crucial for innovation and service delivery.

EVERTEC's cost structure includes significant acquisition and integration expenses. For instance, the acquisition of Sinqia, a Brazilian financial technology company, involved substantial upfront costs, including legal fees and due diligence. Similarly, integrating acquired entities like Grandata and Nubity necessitates ongoing operational adjustments and technology consolidation, representing considerable short-term expenditures.

Sales, Marketing, and Administrative Expenses

EVERTEC's cost structure heavily relies on expenses tied to its sales, marketing, and administrative functions. This includes the compensation for its sales force, crucial for driving revenue through client acquisition and relationship management. The company also invests significantly in marketing campaigns and public relations to build brand awareness and maintain its market position.

General administrative overhead is another substantial component. These costs encompass the day-to-day operations of its offices, corporate governance, legal, and human resources functions. These are essential for the smooth running of the entire organization and supporting its various business segments.

For instance, in 2024, EVERTEC reported significant operating expenses, with a notable portion allocated to these SG&A categories. While specific breakdowns vary, these costs are fundamental to sustaining and growing its market presence and operational efficiency.

- Sales Force Compensation: Direct costs associated with sales personnel, including salaries, commissions, and bonuses.

- Marketing and Advertising: Expenditures on campaigns, digital marketing, content creation, and promotional activities.

- Public Relations: Costs for media outreach, corporate communications, and managing public perception.

- General and Administrative: Overhead expenses covering office rent, utilities, salaries for support staff, legal fees, and IT infrastructure.

Regulatory Compliance and Cybersecurity Investments

EVERTEC dedicates significant resources to regulatory compliance and cybersecurity, recognizing these as essential operational costs. These investments are crucial for adhering to a complex web of financial regulations and data privacy laws, such as GDPR and CCPA, which are continually evolving. For instance, in 2024, companies in the financial technology sector saw cybersecurity spending increase by an average of 10-15% year-over-year to combat sophisticated threats.

These ongoing expenditures are not merely about avoiding penalties; they are fundamental to protecting EVERTEC's infrastructure and sensitive client data from an escalating landscape of cyber threats. This proactive approach ensures the integrity of financial transactions and maintains client trust, which is paramount in the digital age. The financial services industry, in particular, faces persistent threats, with the average cost of a data breach in 2023 reaching $4.45 million globally, underscoring the necessity of robust security measures.

- Regulatory Adherence: Costs associated with legal counsel, compliance officers, and system updates to meet evolving financial regulations.

- Cybersecurity Enhancements: Investments in advanced threat detection, prevention software, employee training, and incident response capabilities.

- Data Protection Measures: Expenses for secure data storage, encryption, access controls, and privacy impact assessments to comply with data privacy laws.

- Audits and Certifications: Costs for regular security audits and maintaining industry-specific certifications to validate compliance and security posture.

EVERTEC's cost structure is heavily weighted towards its technology infrastructure, encompassing maintenance, upgrades, and security for its extensive network and software systems. Personnel expenses, including skilled engineers and support staff, also represent a significant outlay in 2024, vital for innovation and service delivery.

Acquisition and integration costs, such as those for Sinqia, and ongoing sales, marketing, and administrative overhead are substantial components. These support client acquisition, brand building, and the general operations essential for market presence and efficiency.

Regulatory compliance and cybersecurity are critical expenditures, with financial technology firms in 2024 seeing cybersecurity spending rise by an average of 10-15% to combat evolving threats. These investments protect data and ensure adherence to financial regulations.

Revenue Streams

Merchant acquiring fees represent a core revenue driver for EVERTEC, stemming from charges levied on businesses for processing customer credit and debit card transactions. These fees are generally structured as a percentage of the transaction value or a fixed amount per transaction, reflecting the cost and risk associated with facilitating these payments.

This segment is particularly robust for EVERTEC, benefiting from the ongoing shift towards digital payments. In 2024, EVERTEC continued to see strong performance in this area, with transaction volumes steadily increasing across its network, underscoring the essential nature of its services for a broad merchant base.

EVERTEC generates significant revenue from payment processing service fees. These fees are earned from financial institutions and other issuers for their role in managing and facilitating various card programs. This includes crucial services like authorization, settlement, and network access, primarily through their well-established ATH® network.

In 2024, EVERTEC's payment processing segment remained a cornerstone of its financial performance. The company processed billions of transactions annually, with service fees directly correlating to this high volume. This robust transaction activity underscores the essential nature of their services to the financial ecosystem.

EVERTEC generates significant revenue through its Business Solutions and IT Services segment, offering a suite of offerings to corporations and government entities. This includes core banking processing, IT professional services, and comprehensive managed services, all designed to streamline operations and enhance technological capabilities.

The company's income in this area is a blend of project-based fees for specific implementations and recurring service fees for ongoing support and management. For instance, in the first quarter of 2024, EVERTEC reported that its Financial Services segment, which encompasses many of these business solutions, saw a 7% increase in revenue, highlighting the demand for their IT and processing services.

Transaction Volume and Value Growth

EVERTEC's revenue streams are significantly bolstered by the growth in both the number and monetary worth of transactions processed through its extensive network. This expansion is a direct result of more consumers and businesses embracing digital payment methods and EVERTEC's strategic push into new geographical territories and service areas.

In 2024, EVERTEC continued to see robust performance in transaction processing, a key indicator of its revenue growth. The company's ability to facilitate a higher volume of electronic payments, from credit and debit card swipes to digital wallet transactions, directly translates into increased fee-based income.

- Transaction Volume: EVERTEC processed billions of transactions annually, with continued year-over-year growth in 2024, reflecting the ongoing shift away from cash.

- Transaction Value: The aggregate value of these transactions also climbed, as consumers and businesses alike conducted more commerce through EVERTEC's platforms.

- Electronic Payment Adoption: Increased consumer comfort and merchant acceptance of electronic payments across various channels, including point-of-sale and online, fueled this volume and value increase.

- Market Expansion: EVERTEC's strategic initiatives to enter and grow within new markets, particularly in Latin America, contributed significantly to its overall transaction processing metrics in 2024.

Subscription and Licensing Fees

EVERTEC leverages subscription and licensing fees as a core revenue driver, offering predictable income from its business solutions and software. This model ensures a steady financial base, allowing for continued investment in innovation and service enhancement.

Acquisitions, such as that of Nubity, bolster this revenue stream by expanding EVERTEC's cloud services portfolio. These services are often provided on a recurring subscription basis, contributing significantly to the company's financial stability and growth trajectory.

Key aspects of these revenue streams include:

- Recurring Revenue: Subscription and licensing models create predictable income streams from software and business solutions.

- Cloud Services Expansion: Acquisitions like Nubity enhance recurring revenue through cloud service offerings.

- Diversified Income: These fees contribute to a diversified revenue base, reducing reliance on single-product sales.

EVERTEC's revenue is multifaceted, encompassing merchant acquiring fees, payment processing services, business solutions, and subscription/licensing models. These diverse streams are driven by increasing digital payment adoption and strategic market expansion.

In 2024, EVERTEC's transaction processing volume continued its upward trend, with billions of transactions facilitated annually. This growth directly translates into higher service fees from financial institutions and increased merchant acquiring fees, reflecting robust economic activity and a sustained shift away from cash.

| Revenue Stream | Description | 2024 Performance Indicator |

|---|---|---|

| Merchant Acquiring Fees | Fees from processing customer card transactions for businesses. | Increased transaction volumes across the network. |

| Payment Processing Services | Fees from financial institutions for managing card programs via the ATH® network. | Billions of transactions processed annually, with service fees correlating to high volume. |

| Business Solutions & IT Services | Fees for core banking, IT professional services, and managed services. | 7% revenue increase in the Financial Services segment (Q1 2024). |

| Subscription & Licensing Fees | Recurring income from software and business solutions, including cloud services. | Bolstered by acquisitions like Nubity, expanding cloud service offerings. |

Business Model Canvas Data Sources

The EVERTEC Business Model Canvas is informed by a blend of internal financial reports, customer transaction data, and operational performance metrics. These sources provide a comprehensive view of EVERTEC's current business activities and financial health.