EVERTEC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EVERTEC Bundle

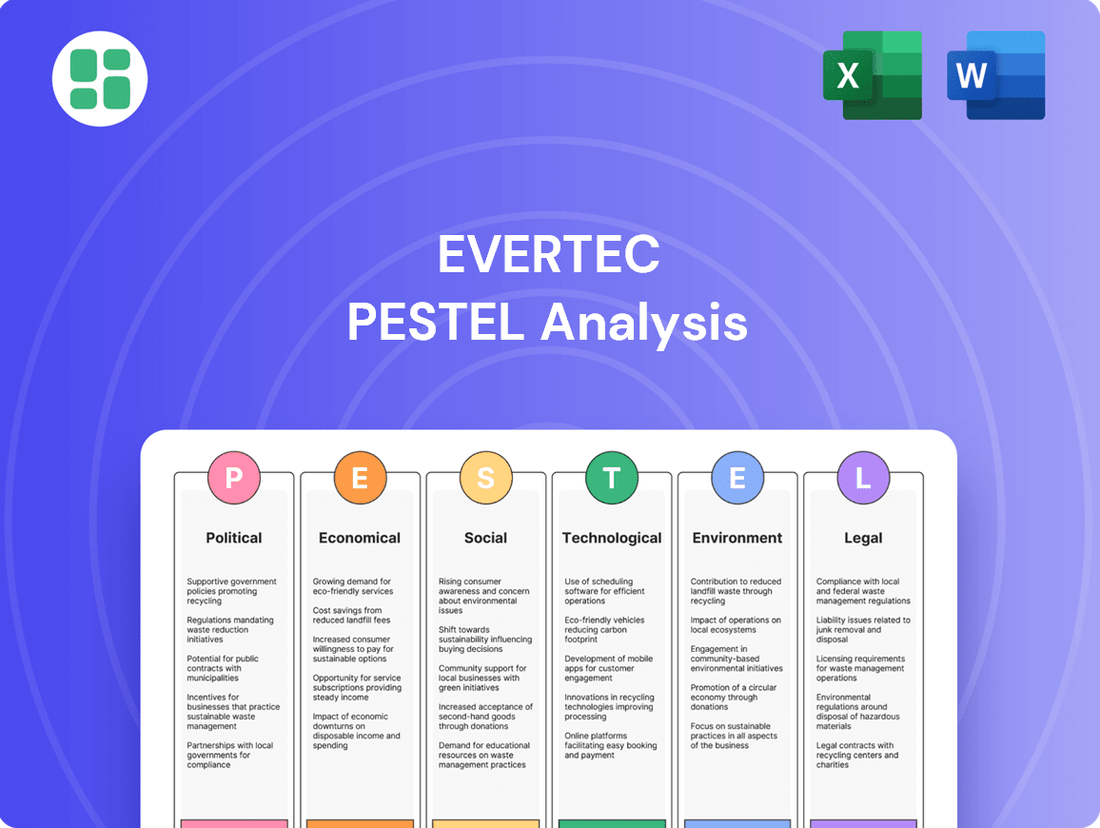

Navigate the complex external forces shaping EVERTEC's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for the company. Equip yourself with the strategic foresight needed to make informed decisions and gain a competitive advantage. Download the full analysis now and unlock actionable intelligence.

Political factors

Governments throughout Latin America and the Caribbean are increasingly prioritizing financial inclusion and the expansion of digital payment systems. For instance, initiatives like Brazil's Pix instant payment system, launched in 2020, have seen massive adoption, with over 1.7 billion transactions recorded in Q1 2024 alone, demonstrating a clear governmental push towards digital finance. This supportive regulatory landscape directly benefits companies like EVERTEC by fostering an environment where electronic transactions are encouraged and formalized, thereby driving demand for their services.

EVERTEC operates across diverse Latin American markets, each with its own political climate and regulatory framework. For instance, in Puerto Rico, a key market, the island's political status and economic policies directly influence the financial services sector. Any shifts in governance or fiscal policies could alter the operating environment for companies like EVERTEC.

Changes in regulations concerning data privacy, cybersecurity, and financial transaction processing are ongoing concerns. For example, the implementation of stricter data protection laws in countries like Colombia or Chile could necessitate significant investment in compliance measures. EVERTEC's ability to navigate these evolving legal landscapes is paramount for continued success and market access.

The political stability within these nations is a critical factor. Unforeseen political events or changes in leadership can lead to abrupt policy reversals, impacting EVERTEC's long-term strategic planning. Maintaining strong relationships with regulatory bodies and staying informed about potential legislative changes are essential for risk mitigation.

Governments globally are stepping up their game against money laundering and terrorist financing, meaning EVERTEC, like other payment processors, faces increasingly rigorous Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. This translates to more demanding customer due diligence processes and a greater emphasis on reporting suspicious transactions.

Compliance with these evolving AML/CTF mandates is not just a matter of good practice; it's essential for EVERTEC to retain its operational licenses and, crucially, the trust of its financial institution partners. For example, the Financial Action Task Force (FATF) continues to update its recommendations, influencing national legislation and enforcement actions worldwide, impacting companies like EVERTEC that operate in cross-border financial transactions.

Government Agency Partnerships

EVERTEC's engagement with government agencies highlights significant political factors influencing its operations. These partnerships are crucial, as demonstrated by EVERTEC's role in processing payments for various government programs. For instance, in 2024, the company continued to be a key player in facilitating digital government services, which are increasingly prioritized by administrations globally to improve efficiency and citizen access.

Political decisions directly impact EVERTEC's government segment. Initiatives focused on expanding digital welfare distribution or modernizing tax collection systems create direct opportunities for EVERTEC's technology solutions. The company's ability to secure and maintain these contracts often hinges on its alignment with government policy objectives and its capacity to adapt to evolving regulatory landscapes, particularly concerning data security and privacy in public sector transactions.

The stability and growth potential within EVERTEC's government business are intrinsically linked to political stability and government spending priorities. In 2024, many governments continued to invest in digital transformation projects, providing a favorable environment for companies like EVERTEC. Strong, established relationships with government entities can translate into predictable revenue streams and open doors for new service offerings, such as digital identity management or enhanced cybersecurity for public infrastructure.

Key aspects of EVERTEC's government partnerships include:

- Facilitation of Public Sector Digitalization: EVERTEC's platforms support government efforts to digitize services, enhancing citizen engagement and operational efficiency.

- Impact of Welfare and Tax Policies: Changes in government policies related to social welfare distribution and tax collection directly influence the demand for EVERTEC's transaction processing capabilities.

- Revenue Stability: Government contracts often provide long-term, stable revenue streams, contributing significantly to EVERTEC's overall financial performance.

- Expansion Opportunities: Successful collaborations with government agencies can lead to expanded service offerings and deeper integration into public sector IT infrastructure.

Geopolitical Risks and Regional Integration

Geopolitical shifts in Latin America and the Caribbean significantly influence EVERTEC's operational landscape. Trade agreements and regional integration initiatives, such as the Pacific Alliance, aim to streamline cross-border transactions, potentially boosting EVERTEC's market reach. However, political instability in key markets, like recent protests in Peru during late 2022 and early 2023, can disrupt payment flows and necessitate agile risk management strategies. For instance, fluctuating political climates can impact foreign direct investment in technology and financial services, areas critical for EVERTEC's growth.

Political unrest and economic sanctions in specific countries pose direct threats to EVERTEC’s operational continuity and require strategic flexibility. For example, the ongoing political and economic challenges in Venezuela have historically presented significant hurdles for companies operating in the region. Conversely, efforts towards greater regional cooperation, such as the expansion of the Mercado Común del Sur (Mercosur), can create a more unified and accessible payment ecosystem, reducing friction for digital transactions and supporting EVERTEC's expansion plans.

- Regional Trade Growth: The value of intra-regional exports in Latin America and the Caribbean reached approximately $160 billion in 2023, highlighting the potential for increased cross-border payment volumes.

- Political Stability Index: Countries with higher political stability scores generally attract more investment in fintech and payment infrastructure.

- Impact of Sanctions: Economic sanctions can lead to disruptions in correspondent banking relationships, affecting international transaction processing for companies like EVERTEC.

- Integration Benefits: Deeper regional integration can reduce transaction costs and processing times, making digital payments more attractive to consumers and businesses.

Governmental focus on financial inclusion and digital payment expansion across Latin America and the Caribbean directly benefits EVERTEC. Initiatives like Brazil's Pix, which processed over 1.7 billion transactions in Q1 2024, underscore this trend, creating a favorable regulatory environment for electronic transactions and driving demand for EVERTEC's services.

EVERTEC's operations are sensitive to political stability and policy changes within its diverse markets. For instance, shifts in governance or fiscal policies in key markets like Puerto Rico can significantly alter the operating environment, impacting strategic planning and necessitating agile risk management.

Evolving regulations around data privacy and cybersecurity require continuous investment in compliance, as seen with stricter data protection laws in countries like Colombia. Navigating these dynamic legal landscapes is crucial for EVERTEC's sustained market access and operational integrity.

The company's engagement with government agencies, facilitating digital welfare distribution and tax collection in 2024, highlights the direct impact of political decisions on its government segment revenue and growth opportunities.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting EVERTEC, offering actionable insights for strategic decision-making.

It delves into the Political, Economic, Social, Technological, Environmental, and Legal landscapes, highlighting potential threats and opportunities for EVERTEC's growth and stability.

A clear, actionable summary of EVERTEC's PESTLE factors, enabling swift identification of external opportunities and threats to inform strategic decision-making.

Economic factors

EVERTEC's performance is intrinsically linked to the economic vitality of Latin America and the Caribbean. For instance, the International Monetary Fund (IMF) projected a 2.1% GDP growth for Latin America and the Caribbean in 2024, a slight deceleration from 2.3% in 2023, but still indicating an expanding economic landscape. This growth fuels consumer spending and a burgeoning middle class, directly translating into higher transaction volumes for EVERTEC.

Increased consumer spending, a key indicator of economic health, directly benefits EVERTEC by boosting transaction volumes. In 2023, many economies in the region saw a rebound in private consumption. For example, Mexico's retail sales experienced a notable year-over-year increase throughout much of 2023, reflecting improved consumer confidence and purchasing power, which in turn supports EVERTEC's transaction processing services.

Conversely, economic instability poses a significant risk. A projected slowdown in global growth for 2024, coupled with persistent inflation in some Latin American countries, could dampen consumer spending and business activity. Should a recession occur, EVERTEC's revenue streams, heavily reliant on transaction volumes and service demand, would likely contract, impacting overall financial performance.

High inflation rates and fluctuating interest rates in Latin America present significant challenges for EVERTEC. For instance, Puerto Rico, a key market, experienced a Consumer Price Index (CPI) increase of 3.4% in April 2024 compared to the previous year, impacting operational costs and potentially the real value of transaction fees if not recalibrated.

Fluctuating interest rates directly influence the lending and investment activities of EVERTEC's financial institution clients. In 2024, the US Federal Reserve maintained interest rates at elevated levels, a trend mirrored by many central banks in Latin America, which can dampen consumer spending and business investment, thereby affecting transaction volumes on EVERTEC's platforms.

The ongoing shift from cash to digital and cashless transactions is a powerful economic engine for EVERTEC. This trend directly fuels higher transaction volumes, creating substantial revenue opportunities for the company as consumers increasingly embrace digital payment methods.

The growing preference for digital wallets, mobile payments, and real-time payment systems is a key economic factor. For instance, Brazil's Pix system saw over 1.7 billion transactions in March 2024 alone, highlighting the rapid adoption and its positive impact on payment processors like EVERTEC.

Mexico's CoDi, a real-time payment platform, is also gaining traction, mirroring the broader economic trend of digitalization in financial services across Latin America. This increasing adoption of digital payment infrastructure is a significant tailwind for EVERTEC's business model.

Currency Exchange Rate Volatility

EVERTEC's operations span multiple Latin American and Caribbean countries, making it susceptible to currency exchange rate volatility. These fluctuations directly impact the company's reported revenues and profits when converting earnings from local currencies into its reporting currency. For example, a strengthening US dollar against currencies like the Colombian Peso or the Puerto Rican Dollar could reduce the reported value of EVERTEC's earnings from those regions.

Beyond reported financials, currency volatility affects the purchasing power of consumers and the financial stability of merchants within EVERTEC's network. A depreciating local currency can erode consumer spending power, potentially leading to lower transaction volumes, while also making it harder for merchants to manage their costs if they have dollar-denominated expenses.

Consider the impact on EVERTEC's 2024 performance. If the average exchange rate for the Mexican Peso against the US Dollar weakens by, say, 5% compared to 2023, this could translate to a noticeable reduction in the dollar-denominated value of EVERTEC's Mexican revenue.

- Impact on Reported Earnings: Fluctuations can significantly alter the reported value of revenue and profit when translated into EVERTEC's primary reporting currency.

- Consumer Purchasing Power: A weaker local currency diminishes consumers' ability to spend, potentially reducing transaction volumes for EVERTEC's services.

- Merchant Financial Health: Merchants may face challenges managing costs or repatriating funds if their local currency weakens against the US Dollar.

- Hedging Strategies: EVERTEC may employ hedging strategies to mitigate some of these currency risks, though these can also incur costs.

Financial Inclusion Initiatives

Financial inclusion initiatives across Latin America are a significant economic driver for EVERTEC. As more individuals and small businesses in the region gain access to digital payment systems and formal banking, EVERTEC's addressable market grows. For instance, by the end of 2024, it's projected that over 70% of the Latin American population will have access to some form of digital financial service, a substantial increase from previous years.

Organizations like the Inter-American Development Bank (IDB) are actively promoting these trends. Their programs aim to reduce barriers to financial services, which directly benefits companies like EVERTEC that provide the underlying technology. The IDB's commitment to digital finance in Latin America, with investments totaling over $1 billion in 2023 alone, underscores the growing importance of this sector.

- Expanding Customer Base: Increased financial inclusion directly translates to a larger pool of potential users for EVERTEC's payment processing and technology solutions.

- Digital Payment Growth: Initiatives encouraging digital transactions boost the volume of transactions processed by EVERTEC, enhancing revenue.

- Regulatory Support: Government and institutional support for financial inclusion often includes favorable regulations that simplify the adoption of new financial technologies.

The economic landscape of Latin America and the Caribbean is crucial for EVERTEC. The IMF projected 2.1% GDP growth for the region in 2024, indicating continued expansion that supports consumer spending and EVERTEC's transaction volumes. This growth is further bolstered by the ongoing shift from cash to digital payments, with platforms like Brazil's Pix processing over 1.7 billion transactions in March 2024 alone, demonstrating a strong trend towards digital financial services.

However, economic headwinds such as inflation and fluctuating interest rates present challenges. Puerto Rico, a key market, saw a 3.4% CPI increase in April 2024, impacting operational costs. Additionally, currency volatility, like a potential 5% weakening of the Mexican Peso against the US Dollar in 2024, can reduce the reported value of EVERTEC's earnings from these regions.

| Economic Factor | 2023/2024 Data/Projection | Impact on EVERTEC |

|---|---|---|

| Regional GDP Growth (LatAm & Caribbean) | 2.3% (2023), 2.1% (2024 proj.) | Supports transaction volumes and consumer spending. |

| Digital Payment Adoption (e.g., Pix Brazil) | 1.7 billion+ transactions (March 2024) | Drives higher transaction processing revenue. |

| Inflation (e.g., Puerto Rico CPI) | 3.4% increase (April 2024) | Increases operational costs; potential impact on real fee value. |

| Currency Volatility (e.g., MXN/USD) | Potential 5% weakening (2024 est.) | Reduces reported dollar-denominated revenue and profits. |

Same Document Delivered

EVERTEC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of EVERTEC provides actionable insights into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. You can trust that the detailed breakdown of EVERTEC's operational landscape, including market trends and competitive pressures, will be delivered precisely as you see it.

The content and structure shown in the preview is the same document you’ll download after payment. This ensures you receive a complete and accurate PESTLE analysis, equipping you with the strategic information needed to understand EVERTEC's business environment.

Sociological factors

EVERTEC's growth hinges on how readily people in its operating regions embrace digital payment methods. As of early 2024, smartphone penetration in Latin America is projected to reach over 75%, a significant increase from previous years, directly supporting the adoption of mobile payment solutions.

Rising digital literacy across the Caribbean and Latin America, with many countries seeing double-digit annual growth in internet usage, creates a fertile ground for EVERTEC's services. This societal shift towards digital engagement is a primary driver for expanding the use of electronic transactions.

Consumer behavior is rapidly shifting away from traditional cash transactions towards more convenient and secure digital payment methods. This trend, driven by urbanization and technological exposure, fuels the demand for EVERTEC's merchant acquiring and payment processing solutions.

The preference for mobile wallets and instant payments is a significant sociological tailwind, with global mobile payment users projected to reach over 1.5 billion by 2024. In Latin America, where EVERTEC has a strong presence, digital payment adoption saw a significant surge, with transaction volumes increasing by over 30% in 2023 alone.

Latin America and the Caribbean boast a youthful population, with a significant portion under 30. For instance, in 2024, countries like Honduras and Nicaragua had median ages well below 25. This demographic trend is a powerful driver for EVERTEC, as these digitally savvy individuals readily embrace new payment solutions like digital wallets and mobile payment apps, fueling future transaction growth.

Financial Inclusion and Social Mobility

The increasing global emphasis on financial inclusion, driven by governments and international organizations, directly supports EVERTEC's mission. This societal trend aims to bring unbanked and underbanked populations into the formal financial system, a core area of EVERTEC's service provision through its payment processing and technology solutions.

For instance, in Latin America, where EVERTEC has a significant presence, efforts to boost financial inclusion are accelerating. According to the World Bank's Global Findex Database 2021, released in 2022, 71% of adults in developing economies had an account, up from 64% in 2017, highlighting a growing market for accessible financial services. EVERTEC's role in facilitating digital payments and expanding access to these services can foster greater economic participation and upward social mobility for individuals and communities.

- Financial Inclusion Growth: Global efforts are expanding access to financial services, with developing economies seeing account ownership rise to 71% in 2021.

- EVERTEC's Alignment: The company's payment solutions directly cater to this societal push, enabling greater participation in the digital economy.

- Social Mobility Impact: By providing accessible financial tools, EVERTEC can contribute to economic empowerment and improved social mobility in the regions it serves.

- Brand Enhancement: Supporting financial inclusion can bolster EVERTEC's reputation and market acceptance as a socially responsible and enabling technology provider.

Urbanization and Infrastructure Development

Increasing urbanization across Latin America, a key market for EVERTEC, concentrates consumers and businesses, creating fertile ground for digital payment adoption. For instance, as of 2023, over 80% of the population in countries like Chile and Uruguay reside in urban centers, driving demand for sophisticated payment solutions.

This urban concentration directly aids EVERTEC by facilitating the expansion of its payment infrastructure and digital services to a denser customer base. However, a significant hurdle remains in extending these digital payment benefits to rural and remote areas, which often lag in technological adoption and infrastructure, potentially limiting universal digital payment penetration.

- Urban concentration: Over 80% of populations in Chile and Uruguay live in urban areas, boosting digital payment opportunities.

- Infrastructure challenge: Extending digital payment services to rural and remote communities remains a barrier to widespread adoption.

- Consumer density: Higher population density in cities increases the efficiency of deploying and managing payment networks.

Societal shifts towards digital engagement are a primary driver for EVERTEC's expansion. With smartphone penetration in Latin America projected to exceed 75% by early 2024, the groundwork is laid for mobile payment solutions. This digital literacy growth, coupled with a youthful demographic embracing new technologies, fuels demand for EVERTEC's services.

The increasing preference for digital transactions over cash is a significant trend, with global mobile payment users expected to surpass 1.5 billion in 2024. EVERTEC's payment processing solutions directly benefit from this behavioral shift, as seen in Latin America's over 30% transaction volume increase in 2023.

Financial inclusion efforts are also a key sociological factor, aiming to bring unbanked populations into the formal financial system. EVERTEC's role in facilitating accessible digital payments aligns with this global push, potentially empowering communities and enhancing social mobility.

| Sociological Factor | Description | Impact on EVERTEC | Supporting Data (2023-2024 Projections) |

|---|---|---|---|

| Digital Adoption | Increasing use of smartphones and internet services | Drives demand for digital payment solutions | Latin America smartphone penetration >75% (early 2024); Global mobile payment users >1.5 billion (2024) |

| Consumer Behavior | Shift from cash to digital payments | Increases transaction volumes processed by EVERTEC | Latin America digital payment transaction volume +30% (2023) |

| Financial Inclusion | Expanding access to financial services for unbanked populations | Opens new market segments for EVERTEC's services | 71% of adults in developing economies had an account (2021, World Bank) |

| Demographics | Young, tech-savvy populations in key markets | Accelerates adoption of new payment technologies | Median age <25 in several Latin American countries (2024) |

Technological factors

Technological advancements in payment systems are rapidly reshaping the financial landscape, directly influencing companies like EVERTEC. Real-time payment networks, such as Brazil's Pix, have seen remarkable adoption, with over 1.5 billion transactions recorded in the first half of 2024 alone. This trend, alongside the increasing prevalence of contactless payments and mobile wallets, necessitates continuous investment in research and development for EVERTEC to maintain its competitive edge and deliver innovative solutions that align with evolving consumer preferences.

Cybersecurity is a critical technological factor for EVERTEC, a payment processor. The company must maintain robust security infrastructure to combat increasingly sophisticated cyber threats. In 2024, the global average cost of a data breach reached $4.45 million, underscoring the financial imperative for strong defenses.

Continuous investment in fraud prevention technologies is essential for EVERTEC to protect its operations and customers. As of early 2025, advancements in AI-powered threat detection are becoming standard, with many organizations allocating significant portions of their IT budgets to these solutions.

Ensuring the security and privacy of sensitive financial data is paramount for maintaining customer trust and regulatory compliance. EVERTEC operates under stringent data protection regulations like GDPR and CCPA, with non-compliance potentially leading to substantial fines, impacting its reputation and bottom line.

EVERTEC's strategic integration of Artificial Intelligence (AI) and Machine Learning (ML) is poised to revolutionize its operations. These technologies are key to boosting efficiency, strengthening fraud detection, and delivering highly personalized customer experiences. For instance, in 2024, financial institutions globally are investing heavily in AI for fraud prevention, with some reporting reductions in fraudulent transactions by up to 20% through AI-powered anomaly detection.

AI-driven analytics offer EVERTEC a powerful lens to understand consumer behavior more deeply. This allows for the optimization of payment routing, leading to faster transaction times and potentially lower costs. Furthermore, enhanced risk management through AI can provide a significant competitive edge, especially in a dynamic financial landscape where accurate risk assessment is paramount. The global AI market in financial services was projected to reach over $25 billion in 2024, underscoring the widespread adoption and perceived value of these technologies.

Cloud Computing and Infrastructure Scalability

EVERTEC's strategic embrace of cloud computing, particularly in 2024 and 2025, is a cornerstone of its infrastructure scalability. This allows the company to efficiently manage fluctuating transaction volumes, a critical factor in the dynamic payments industry. The ability to scale resources up or down on demand ensures resilience and cost-effectiveness, supporting EVERTEC's growth initiatives.

The acquisition of Nubity in late 2023, which closed in early 2024, directly bolsters EVERTEC's cloud services expertise. This move positions EVERTEC to offer more robust and adaptable payment processing solutions, essential for penetrating new geographic markets and catering to a growing client base. This integration enhances their capacity to deliver high-performance cloud infrastructure.

- Cloud Adoption Growth: Global public cloud spending was projected to reach $679 billion in 2024, a 20.4% increase from 2023, indicating a strong market trend EVERTEC can leverage.

- Scalability Benefits: Cloud infrastructure allows EVERTEC to scale its payment processing capacity by an estimated 30-40% during peak demand periods without significant upfront capital expenditure.

- Market Expansion: Enhanced cloud capabilities are vital for expanding into regions with varying regulatory requirements and technological infrastructure, supporting EVERTEC's international growth strategy.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) represent a significant technological factor that could reshape payment landscapes. These systems offer enhanced security, transparency, and efficiency, potentially disrupting established payment processing methods. EVERTEC must actively monitor the evolution and adoption of these technologies, particularly in light of increasing cryptocurrency usage in regions where it operates, such as Latin America.

The potential for blockchain to streamline cross-border payments, reduce transaction fees, and offer real-time settlement is substantial. For instance, by 2024, it's projected that blockchain technology could significantly reduce the costs associated with international money transfers, a key area for companies like EVERTEC.

EVERTEC should consider the following regarding blockchain and DLT:

- Competitive Threat: Emerging blockchain-based payment solutions could offer a more cost-effective and faster alternative to traditional methods, potentially siphoning off market share.

- Integration Opportunities: EVERTEC could explore integrating DLT into its existing infrastructure to improve efficiency, reduce fraud, and offer new services to its clients, such as tokenized payments or digital asset handling.

- Regulatory Landscape: The evolving regulatory environment surrounding cryptocurrencies and DLT will be crucial. EVERTEC needs to stay abreast of these changes to ensure compliance and identify strategic opportunities or risks. For example, by early 2025, several Latin American countries are expected to finalize regulatory frameworks for digital assets.

Technological advancements continue to drive innovation in payment processing, necessitating constant adaptation for companies like EVERTEC. The surge in real-time payment systems globally, with billions of transactions processed in 2024, highlights the need for EVERTEC to invest in cutting-edge solutions. Furthermore, the increasing adoption of contactless payments and mobile wallets demands continuous R&D to remain competitive and meet evolving consumer expectations.

Legal factors

Latin America is increasingly adopting strict data privacy laws, mirroring GDPR. This means EVERTEC must meticulously manage how it collects, stores, and uses customer information. For instance, Brazil's LGPD, enacted in 2020, imposes significant penalties for non-compliance, with fines potentially reaching 2% of annual revenue, capped at $50 million USD per infraction. Adhering to these regulations is not just about avoiding fines; it's crucial for maintaining the trust of EVERTEC's clientele.

EVERTEC navigates a complex web of Anti-Money Laundering (AML) and Know Your Customer (KYC) laws, especially within its core Puerto Rican operations. These regulations, mirroring U.S. federal statutes like the Bank Secrecy Act and the USA PATRIOT Act, are critical for preventing financial crime.

The company's compliance framework necessitates thorough customer due diligence, including identity verification and ongoing monitoring. This proactive approach is essential for identifying and reporting any suspicious financial activities, thereby safeguarding the integrity of the financial system.

In 2023, financial institutions globally reported billions of dollars in suspicious activity to authorities, highlighting the pervasive threat of money laundering. EVERTEC’s adherence to these stringent legal requirements is therefore not just a matter of compliance but a fundamental aspect of its operational risk management.

EVERTEC operates within a heavily regulated payment ecosystem, necessitating the acquisition and ongoing maintenance of numerous licenses across its Latin American and Caribbean markets. These regulations dictate operational standards and compliance rules, directly influencing how EVERTEC conducts its business.

Key regulatory bodies in these regions, such as central banks and financial authorities, actively monitor payment networks, transaction fee structures, and critical interoperability standards. For instance, in 2024, regulatory frameworks in countries like Brazil and Mexico continued to emphasize consumer protection and data security, impacting how EVERTEC processes and manages sensitive financial information.

Consumer Protection Laws

Consumer protection laws are a significant legal factor for EVERTEC. These regulations, covering aspects like fraud liability, dispute resolution processes, and the clear disclosure of fees in financial transactions, directly shape EVERTEC's operational framework and its obligations to customers. For instance, the Consumer Financial Protection Bureau (CFPB) in the United States actively enforces rules designed to prevent unfair, deceptive, or abusive practices in the financial sector, impacting how EVERTEC processes payments and manages customer accounts.

Adherence to these consumer protection statutes is not merely a matter of compliance; it is fundamental to maintaining EVERTEC's reputation and mitigating the risk of costly legal disputes and regulatory penalties. Failure to comply could lead to significant fines and damage customer trust, which is particularly critical in the financial services industry. In 2023, regulatory fines for financial institutions globally exceeded billions of dollars, underscoring the financial repercussions of non-compliance.

- Consumer Protection Regulations: Laws such as the Electronic Fund Transfer Act (EFTA) and the Truth in Lending Act (TILA) in the US mandate specific disclosures and protections for consumers engaging in electronic transactions and credit.

- Dispute Resolution Mandates: Regulations often require clear and accessible procedures for consumers to dispute unauthorized transactions or billing errors, impacting EVERTEC's customer service and back-office operations.

- Transparency in Fees: Laws necessitate the upfront and clear communication of all fees associated with financial services, preventing hidden charges and ensuring consumer understanding.

- Fraud Liability Limits: Consumer protection laws typically define the extent of a consumer's liability for unauthorized transactions, placing certain responsibilities on financial service providers like EVERTEC to detect and prevent fraud.

Competition Law and Antitrust Regulations

EVERTEC, as a significant entity in the financial technology sector, must meticulously adhere to competition laws and antitrust regulations designed to prevent monopolistic practices and foster a level playing field. For instance, in 2024, regulatory bodies globally continued to scrutinize large tech companies for potential anti-competitive behavior, a trend that directly impacts how EVERTEC can expand its market share or engage in strategic partnerships.

Any proposed acquisitions or instances of substantial market dominance by EVERTEC could attract significant attention from antitrust authorities, necessitating thorough legal review and strategic planning to ensure full compliance. Failure to comply can result in substantial fines, divestitures, or restrictions on business operations, as seen in various high-profile antitrust cases in the payments industry throughout 2024 and projected into 2025.

- Antitrust Scrutiny: EVERTEC faces potential review of its market share and business practices by regulatory bodies like the FTC in the US or similar agencies in Latin America.

- Merger Control: Acquisitions or mergers involving EVERTEC will be subject to pre-merger notification and approval processes in relevant jurisdictions, ensuring they do not harm competition.

- Regulatory Fines: Non-compliance with competition laws can lead to significant financial penalties, impacting profitability and investor confidence.

- Market Practices: EVERTEC must ensure its pricing, distribution, and data handling practices do not unfairly disadvantage competitors or consumers.

EVERTEC must navigate evolving data privacy legislation, such as Brazil's LGPD, which can impose fines up to 2% of annual revenue for non-compliance, impacting how customer data is managed. Stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, mirroring U.S. standards, are critical for preventing financial crime and require robust due diligence to maintain operational integrity.

The company requires numerous licenses to operate across Latin America and the Caribbean, with regulators like central banks monitoring transaction fees and interoperability standards. Consumer protection laws, including those related to fraud liability and fee transparency, directly influence EVERTEC's operational procedures and customer interactions.

EVERTEC faces scrutiny under competition laws, with potential for significant fines or operational restrictions if its market practices or acquisitions are deemed anti-competitive, a trend observed in the payments industry throughout 2024 and into 2025.

Environmental factors

Climate change intensifies the risk of natural disasters like hurricanes and floods across the Caribbean and Latin America, regions where EVERTEC has substantial operations. For instance, the 2024 Atlantic hurricane season is predicted to be highly active, with forecasters calling for an above-normal number of storms, posing a direct threat to EVERTEC's physical infrastructure and data centers.

EVERTEC's resilience strategy must therefore focus on robust disaster recovery and business continuity. This includes ensuring redundant systems and secure off-site data storage to maintain service availability and protect sensitive financial data during and after disruptive events, safeguarding against potential revenue loss and reputational damage.

EVERTEC, as a technology company heavily reliant on data centers and digital infrastructure, faces significant energy consumption, directly impacting its carbon footprint. This is a key environmental consideration for the business.

The company's operations, including processing transactions and managing vast amounts of data, necessitate substantial electricity usage. For context, the global IT sector's carbon emissions were estimated to be around 1.4 billion tonnes in 2023, a figure that underscores the environmental challenge for tech-heavy firms like EVERTEC.

There's a growing demand from investors, customers, and governments for businesses to transition towards renewable energy sources and actively reduce their environmental impact. This pressure is likely to intensify, potentially leading to stricter regulations regarding carbon emissions and energy efficiency in the coming years, affecting EVERTEC's operational strategies and costs.

The relentless pace of technological advancement, particularly in areas like fintech and payment processing, inevitably generates significant electronic waste. EVERTEC must implement robust strategies for managing outdated hardware and components, ensuring compliance with evolving environmental regulations.

By adopting a circular economy model, EVERTEC can minimize its ecological footprint. For instance, the global e-waste generated in 2023 reached an estimated 13.8 million tonnes, highlighting the scale of the challenge and the importance of responsible disposal practices.

Water Resource Management

While not a primary concern for a technology services company like EVERTEC, water resource management can still impact operations. Regions where EVERTEC has data centers or significant office facilities might face challenges due to water scarcity or inefficient management, potentially affecting cooling systems or general facility operations. For example, in 2024, several regions in Latin America, where EVERTEC has a presence, experienced drought conditions impacting water availability for industrial and commercial use.

The increasing emphasis on corporate environmental responsibility means that sustainable water usage is becoming a key consideration. Companies are expected to demonstrate efficient water management practices, which can influence investor perception and regulatory compliance. EVERTEC’s commitment to sustainability, including water conservation efforts, is a factor in its overall environmental, social, and governance (ESG) performance.

- Operational Impact: Water scarcity or poor management in operational regions could affect data center cooling, leading to increased costs or potential disruptions.

- Corporate Responsibility: Demonstrating efficient water usage aligns with growing ESG expectations from investors and stakeholders.

- Regulatory Scrutiny: Regions with water stress may introduce stricter regulations on water consumption for businesses.

Corporate Environmental Responsibility and ESG Reporting

EVERTEC faces increasing pressure from investors and the public to showcase its environmental stewardship. This heightened scrutiny on Environmental, Social, and Governance (ESG) factors means the company must actively demonstrate its commitment to sustainability. For instance, in 2023, the financial services industry saw a 15% increase in ESG-focused investment funds, highlighting this trend.

Transparently communicating its environmental initiatives and performance is crucial for EVERTEC. This not only bolsters its corporate image but also serves to attract investors who prioritize socially responsible businesses. A strong ESG report can differentiate EVERTEC in a competitive market, potentially leading to better access to capital and a more favorable valuation.

- Investor Demand: A significant majority of institutional investors now incorporate ESG factors into their decision-making processes.

- Regulatory Landscape: Evolving environmental regulations globally may impose stricter reporting requirements on companies like EVERTEC.

- Public Perception: Consumer and public opinion increasingly favors companies with demonstrable environmental responsibility.

- Competitive Advantage: Proactive environmental management can lead to operational efficiencies and reduced long-term risks.

EVERTEC's operational regions in the Caribbean and Latin America are increasingly vulnerable to climate change impacts, with an active 2024 hurricane season predicted to test infrastructure resilience. The company's reliance on energy-intensive data centers also contributes to its carbon footprint, a growing concern amid global calls for sustainability. Furthermore, the rapid technological evolution necessitates diligent e-waste management to comply with environmental regulations and minimize ecological impact.

PESTLE Analysis Data Sources

Our PESTLE Analysis for EVERTEC is built on a robust foundation of data from official government publications, reputable financial institutions, and leading market research firms. We incorporate economic indicators, regulatory updates, technological advancements, and socio-cultural trends to provide a comprehensive view.