EVERTEC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EVERTEC Bundle

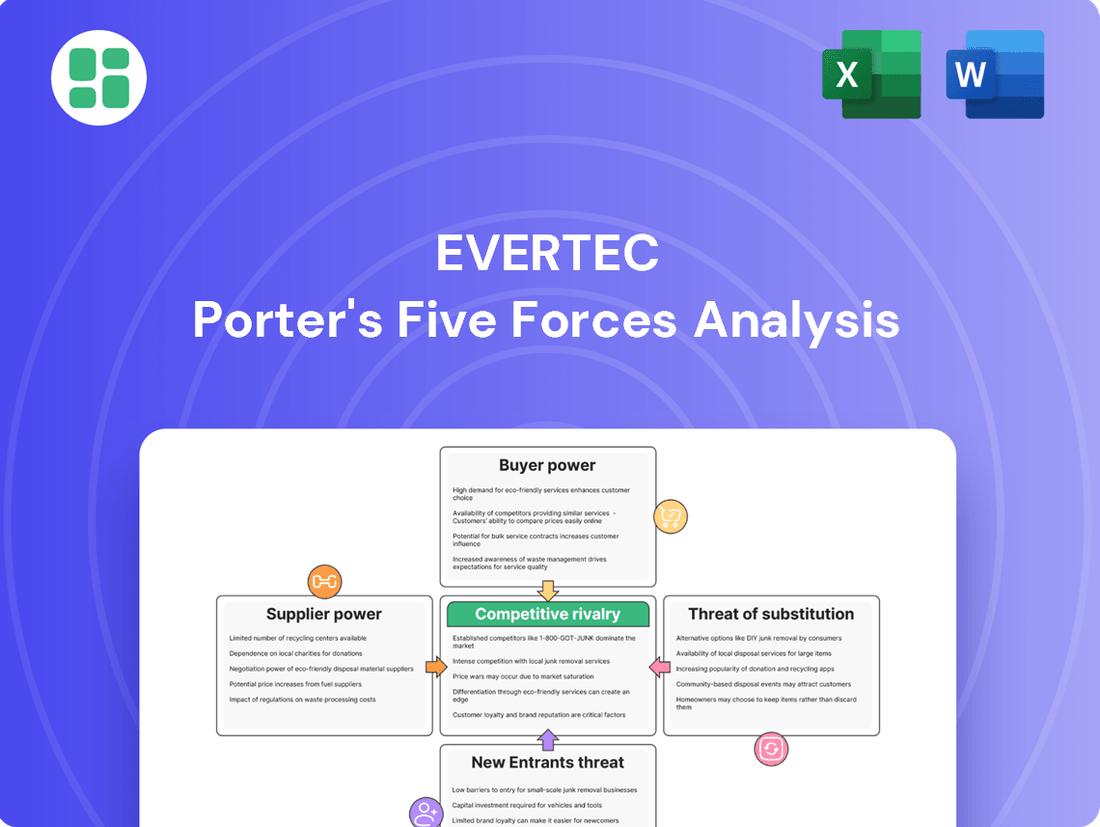

EVERTEC navigates a dynamic payments landscape, facing moderate threats from new entrants and intense rivalry among existing players. Understanding the bargaining power of buyers and the influence of suppliers is crucial for their strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore EVERTEC’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration and specialization of EVERTEC's suppliers significantly impact their bargaining power. For critical payment processing and secure network infrastructure, where few providers offer highly specialized solutions, EVERTEC faces a higher degree of supplier leverage. This is particularly true for unique core processing technologies that are difficult to replicate.

EVERTEC's strategic acquisitions, like that of Nubity, a cloud services provider, highlight an ongoing effort to build internal expertise and potentially mitigate reliance on external, specialized vendors. This move could strengthen EVERTEC's position by developing in-house capabilities for services that were previously outsourced, thereby reducing the bargaining power of those specialized suppliers over time.

In the payment processing sector, while specialized technology is key, many essential components like hardware, software, and network infrastructure can be sourced from numerous vendors. This abundance of alternative suppliers for common needs naturally dilutes the leverage of any single provider. For instance, in 2024, the global IT hardware market saw significant competition, with companies like Dell, HP, and Lenovo offering a wide range of solutions, making it harder for any one to dictate terms to a large payment processor.

However, the bargaining power shifts when dealing with highly specialized or critical systems. If a payment processor relies on unique, proprietary software or a niche network service that only a few companies can provide, those suppliers gain considerable leverage. This was evident in the continued consolidation within certain cybersecurity software segments in 2024, where a limited number of providers offered advanced threat detection, giving them a stronger hand in negotiations with financial institutions.

Switching core technology suppliers in the payment processing industry is a costly endeavor. These costs often include substantial integration expenses, the complex process of data migration, and the inherent risk of service disruptions during the transition. These high switching costs naturally bolster the bargaining power of suppliers who are already established within the ecosystem.

EVERTEC's extensive operational history and deeply embedded infrastructure suggest that changing its key technology partners would present considerable challenges and financial outlays. For example, in 2023, EVERTEC reported significant investments in technology and infrastructure upgrades, underscoring the complexity and cost associated with maintaining and evolving its systems, which directly impacts the difficulty of switching suppliers.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant concern for companies like EVERTEC. If key technology providers, such as those offering core processing software or hardware, were to move into offering payment processing services themselves, they would directly compete with EVERTEC. This would undoubtedly bolster their bargaining power, as they would control both the technology and the service layer.

The fintech sector is particularly susceptible to this dynamic, with technology vendors frequently broadening their service portfolios. For instance, a provider of advanced fraud detection algorithms might expand to offer end-to-end transaction monitoring. While this is a plausible scenario, the substantial capital requirements and stringent regulatory hurdles inherent in payment processing serve as a considerable barrier for many technology-focused firms looking to make such a leap.

- Supplier Integration Risk: Technology suppliers moving into payment processing directly challenges EVERTEC's core business.

- Fintech Expansion Trends: The industry sees technology providers continuously broadening their service offerings.

- Capital & Regulatory Hurdles: High capital intensity and complex regulations in payment processing deter many technology-only vendors from forward integration.

Importance of Supplier's Input to EVERTEC's Business

The inputs from technology and network suppliers are absolutely critical for EVERTEC to handle the immense volume of transactions it processes each year, estimated to be in the billions. Maintaining the integrity and functionality of its ATH® network relies heavily on these essential services.

This dependence grants suppliers significant leverage. Any interruption or decline in their service quality could have a profound negative effect on EVERTEC's day-to-day operations and its hard-earned reputation, especially given the high demands for security and reliability in financial processing environments.

- Criticality of Technology and Network Inputs: EVERTEC's core business of processing billions of transactions annually and operating its ATH® network depends fundamentally on the services provided by its technology and network suppliers.

- Supplier Leverage: The indispensable nature of these inputs provides suppliers with considerable bargaining power, as disruptions can severely impact EVERTEC's operations and reputation.

- Impact of Service Degradation: Any degradation in the quality or availability of these critical services poses a significant risk to EVERTEC, particularly in the context of maintaining secure and reliable financial transaction processing.

The bargaining power of EVERTEC's suppliers is influenced by the concentration of specialized providers for critical payment processing technologies. While many standard IT components are readily available from multiple vendors, unique core processing software or niche network services can grant significant leverage to a few key suppliers. This was highlighted in 2024 with continued consolidation in cybersecurity software, where limited providers of advanced threat detection gained stronger negotiation positions.

High switching costs, including integration, data migration, and potential service disruptions, further strengthen supplier leverage. EVERTEC's substantial investments in its infrastructure, such as those in 2023, underscore the expense and complexity involved in changing core technology partners. The threat of forward integration by technology vendors into payment processing also looms, though high capital and regulatory barriers in this sector limit widespread adoption.

| Factor | Impact on Supplier Bargaining Power | Example/Data Point (2024 unless specified) |

| Supplier Concentration (Specialized Tech) | High | Consolidation in cybersecurity software segments limits alternative providers for advanced threat detection. |

| Availability of Alternatives (Standard IT) | Low | Competitive global IT hardware market (e.g., Dell, HP, Lenovo) offers abundant choices. |

| Switching Costs | High | Significant integration, data migration, and risk of disruption deter changes in core technology. EVERTEC's 2023 infrastructure investments illustrate this complexity. |

| Threat of Forward Integration | Moderate | Fintech vendors expanding service portfolios, but high capital and regulatory hurdles in payment processing act as a deterrent. |

What is included in the product

This analysis dissects EVERTEC's competitive environment by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Instantly identify and mitigate competitive threats with a visual breakdown of EVERTEC's market position.

Customers Bargaining Power

While EVERTEC boasts a broad customer portfolio spanning financial institutions, merchants, corporations, and government entities, its revenue stream exhibits a notable concentration. In the second quarter of 2025, a substantial 31% of EVERTEC's revenue was generated from a single key client, Popular Inc. This level of reliance on one customer significantly amplifies their bargaining power.

Customer switching costs for payment processors like EVERTEC, while present, are often manageable for financial institutions and large merchants. These costs typically involve operational adjustments and technical integrations, which, although requiring investment, are not prohibitive in a dynamic market. For instance, a bank might face fees for migrating data and retraining staff, but these are usually factored into strategic vendor reviews.

The competitive landscape in Latin America and the Caribbean, where EVERTEC operates, significantly influences customer bargaining power. With numerous alternative payment processing solutions available, clients can readily explore other providers if they are dissatisfied with current terms or service levels. This accessibility allows them to negotiate more favorable contracts or switch entirely, thereby amplifying their influence over pricing and service agreements.

Customer price sensitivity significantly impacts EVERTEC's bargaining power of customers. Large financial institutions and high-volume merchants are particularly attuned to processing fees and service costs, especially as some payment services become more commoditized. This sensitivity means they can exert considerable pressure on EVERTEC to maintain competitive pricing.

The intensifying competition within the Latin American payment sector further amplifies this customer power. The emergence of new fintech companies and the growing adoption of alternative payment methods are forcing EVERTEC to be more aggressive with its pricing strategies. For instance, in 2023, the digital payments market in Latin America saw substantial growth, with transaction volumes increasing, indicating a strong demand but also a fertile ground for competitive pricing pressures.

Customer Information and Transparency

As the digital payments landscape matures, customers are increasingly informed about pricing, service quality, and available alternatives. This heightened transparency, fueled by readily accessible market data, significantly bolsters their ability to negotiate favorable terms with providers like EVERTEC. For instance, in 2024, the global digital payments market was valued at over $2.5 trillion, with numerous players competing for market share, intensifying customer leverage.

This enhanced customer awareness translates directly into greater bargaining power. Customers can more easily compare offerings, identify cost-saving opportunities, and switch providers if their demands aren't met. This dynamic is particularly evident in markets where EVERTEC operates, as evidenced by the growing adoption of open banking initiatives which further democratize financial data and empower consumers.

- Informed Decision-Making: Customers can now easily access and compare pricing models, service level agreements, and customer reviews across various digital payment platforms.

- Increased Provider Options: The digital payments sector is highly competitive, offering customers a wide array of choices, which naturally increases their bargaining power.

- Leveraging Transparency: Greater transparency in transaction fees and service charges allows customers to identify discrepancies and negotiate for better rates.

- Switching Costs: While historically high, switching costs are decreasing in many digital payment segments, making it easier for customers to shift their business if dissatisfied.

Potential for Customer Backward Integration

Large financial institutions, EVERTEC's primary customers, have the financial muscle and technical expertise to build or enhance their own payment processing systems. This capability for backward integration gives them considerable leverage, especially if they perceive current service providers as too expensive or inadequate.

For instance, in 2024, major banks continue to invest heavily in digital transformation, which often includes upgrading their core processing infrastructure. This ongoing investment signals their commitment to controlling more of their value chain.

- Customer Backward Integration Potential: Large financial institutions can develop in-house payment processing.

- Resource Availability: These clients possess the necessary financial and technical resources.

- Bargaining Power Driver: The ability to integrate backward strengthens customer negotiation positions.

- Cost and Performance Influence: Customers can leverage this potential to seek better terms or performance from processors like EVERTEC.

EVERTEC faces significant customer bargaining power due to its concentrated revenue stream, with a key client accounting for 31% of revenue in Q2 2025. While switching costs exist for payment processors, they are often manageable for large financial institutions and merchants, who can leverage competitive market options and their own technical capabilities. This environment allows customers to negotiate more favorable terms and pricing, especially as transparency in the digital payments market increases, with the global market valued at over $2.5 trillion in 2024.

| Factor | Impact on EVERTEC | Customer Leverage |

|---|---|---|

| Revenue Concentration | High reliance on key clients | Client can demand better terms |

| Switching Costs | Manageable for large clients | Facilitates provider comparison and switching |

| Competitive Landscape | Numerous alternatives available | Customers can negotiate or move to competitors |

| Price Sensitivity | High for large volume clients | Customers push for competitive pricing |

| Customer Awareness | Increased transparency and data access | Customers are better informed negotiators |

| Backward Integration Potential | Large clients can develop in-house solutions | Clients can threaten to insource, increasing leverage |

Preview the Actual Deliverable

EVERTEC Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details EVERTEC's competitive landscape through a rigorous Porter's Five Forces analysis, covering the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the payment processing industry.

Rivalry Among Competitors

EVERTEC operates in a crowded payment processing landscape across Latin America and the Caribbean. This market is characterized by a significant number of players, ranging from large global corporations to agile regional fintech startups.

Key global competitors such as ACI Worldwide, FIS, Worldpay, and PayPal actively vie for market share. These established entities bring considerable resources and brand recognition, intensifying the competitive pressure on EVERTEC.

In addition to these international giants, EVERTEC also contends with a multitude of local and regional fintech companies. The sheer volume and diversity of these competitors, many offering comparable services, create a highly fragmented and fiercely contested market environment.

The Latin American digital payments market is booming, with projections indicating it will hit USD 0.3 trillion by 2027. This robust growth, estimated at a 10.13% compound annual growth rate from 2024 to 2033, initially seems like it could soften competitive pressures. However, such attractive market expansion inevitably draws in new entrants and intensifies the battle for customers among existing players.

While EVERTEC provides a broad range of services and manages the ATH network, many of its fundamental payment processing functions can be seen as interchangeable, potentially intensifying price-driven competition. For instance, in 2023, the payment processing industry saw continued pressure on transaction fees as providers sought to capture market share.

However, EVERTEC benefits from its integrated service offerings and established client partnerships in key regions, which can create a stickier customer base. The significant technical investment and operational adjustments required for clients to switch payment processors represent substantial switching costs, offering EVERTEC a degree of competitive advantage.

Strategic Acquisitions and Market Consolidation

EVERTEC's competitive rivalry is intensified by its strategic acquisitions, such as the integration of Sinqia, Grandata, and Nubity. These moves are designed to broaden its geographic presence and service portfolio across Latin America. This consolidation trend among key industry participants signals a fierce competition for market leadership.

This ongoing consolidation directly fuels rivalry as companies compete more aggressively for market share in a rapidly expanding sector. The pursuit of scale through acquisitions allows EVERTEC and its rivals to offer more comprehensive solutions, thereby raising the bar for competitors.

- Acquisition Impact: EVERTEC's acquisitions of Sinqia, Grandata, and Nubity significantly expand its operational footprint and service capabilities in the Latin American market.

- Market Consolidation: The trend of major players acquiring smaller ones or merging indicates a concentrated effort to gain market dominance, increasing competitive pressure.

- Heightened Rivalry: This consolidation strategy directly contributes to a more intense competitive environment as companies battle for larger shares of a growing market.

- Competitive Landscape: The strategic moves by EVERTEC and its peers reshape the competitive landscape, often leading to increased price competition and innovation efforts.

Regulatory Environment and Innovation Pace

The regulatory environment in Latin America is a significant driver of competitive rivalry, especially with initiatives focused on real-time payments and financial inclusion. For instance, Brazil's Pix instant payment system, launched in late 2020, rapidly gained traction, with over 130 million users by early 2024, demonstrating how regulatory-backed innovation can reshape market dynamics. This evolving landscape compels companies like EVERTEC to continuously adapt their services to meet new compliance standards and harness emerging technologies, fostering an environment where agility and technological prowess are paramount for staying ahead.

This regulatory push for innovation directly impacts competitive intensity. As governments in regions like Mexico and Colombia also explore similar open banking frameworks and digital payment mandates, companies are pressured to invest heavily in technology and product development. The need to comply with these evolving rules, coupled with the opportunity to leverage new digital channels for financial inclusion, creates a fertile ground for both established players and new entrants to challenge existing market positions. For example, the push for digital onboarding and KYC (Know Your Customer) processes mandated by regulators in several Latin American countries in 2023-2024 has spurred competition among fintechs and traditional banks alike to offer seamless and compliant digital experiences.

- Regulatory Push: Initiatives promoting real-time payments and financial inclusion across Latin America are intensifying competition.

- Innovation Catalyst: New regulations compel companies to innovate their offerings and leverage emerging technologies.

- Agility is Key: Companies must adapt quickly to comply with evolving rules and capitalize on technological advancements.

- Market Reshaping: Examples like Brazil's Pix show how regulatory-driven innovation can rapidly alter competitive landscapes.

EVERTEC faces intense rivalry in the dynamic Latin American payments sector, battling both global financial giants and agile local fintechs. This competition is fueled by a rapidly growing market, projected to reach USD 0.3 trillion by 2027, with an estimated 10.13% CAGR from 2024 to 2033. Strategic acquisitions by EVERTEC and its peers, like the integration of Sinqia, Grandata, and Nubity, further consolidate the market and heighten the competitive drive for dominance.

The regulatory landscape, with a strong push for real-time payments and financial inclusion, acts as a significant catalyst for rivalry. Brazil's Pix instant payment system, adopted by over 130 million users by early 2024, exemplifies how regulatory-backed innovation reshapes market dynamics. This pressure forces companies to invest heavily in technology and product development to remain competitive and compliant.

| Competitor Type | Key Players | Impact on EVERTEC |

|---|---|---|

| Global Financial Services | ACI Worldwide, FIS, Worldpay, PayPal | Significant resource and brand recognition challenge |

| Regional/Local Fintechs | Numerous agile startups | Fragmented market, potential for disruptive innovation |

| Acquired Entities (by EVERTEC) | Sinqia, Grandata, Nubity | Expansion of service portfolio and geographic reach, increasing scale |

SSubstitutes Threaten

The increasing prevalence of real-time payment systems presents a substantial threat of substitution. For instance, Pix in Brazil is expected to overtake credit card payments in the nation's e-commerce sector by 2025, demonstrating a clear shift in consumer preference.

The increasing adoption of digital wallets and mobile payment solutions in Latin America presents a significant threat of substitutes for traditional payment processing. These platforms, like Mercado Pago and Pix in Brazil, are rapidly capturing market share. For instance, Pix, launched in late 2020, facilitated over 42 billion transactions by the end of 2023, demonstrating its swift integration into the financial ecosystem and its potential to displace card-based payments.

The increasing adoption of account-to-account (A2A) payments presents a significant threat of substitution for traditional payment processing services. A2A transactions, which directly move funds from a consumer's bank account to a merchant's, are gaining traction due to their inherent cost-effectiveness and enhanced security features, often bypassing traditional card networks. This shift is particularly pronounced in regions like Latin America, where businesses prioritize lower transaction fees and robust fraud prevention, making A2A a compelling alternative. For instance, in 2024, the global A2A payment market was projected to reach substantial growth, indicating a direct challenge to the revenue streams of companies like EVERTEC that facilitate card-based transactions.

Rise of Buy Now, Pay Later (BNPL) Solutions

The burgeoning popularity of Buy Now, Pay Later (BNPL) services presents a significant threat of substitution for traditional payment processors like EVERTEC in Latin America. These solutions, offering consumers installment payment options directly at checkout, are experiencing rapid growth. For instance, projections suggest the BNPL market in Latin America could reach billions of dollars in transaction value by the mid-2020s, indicating a substantial shift in consumer behavior.

This shift means consumers may increasingly opt for BNPL over credit or debit card transactions, directly impacting the transaction volumes processed by established players. While BNPL currently holds a smaller market share, its swift adoption signals a potential long-term erosion of traditional payment methods. This trend necessitates a keen understanding of evolving consumer preferences and the competitive landscape.

- BNPL Market Growth: Latin America's BNPL market is projected for significant expansion, potentially reaching over $10 billion in transaction value by 2025, according to various industry reports.

- Consumer Preference Shift: Increased adoption of BNPL indicates a growing consumer appetite for flexible, interest-free (or low-interest) payment options at the point of sale.

- Impact on Traditional Processors: A rise in BNPL usage could lead to a decrease in transaction fees for traditional card networks and processors as consumers divert spending.

Cryptocurrency and Blockchain-Based Payments

The increasing adoption of cryptocurrencies and blockchain technology in Latin America presents a growing threat of substitutes for traditional payment processors like EVERTEC. This trend is fueled by economic instability and a demand for greater financial autonomy within the region.

While not yet mainstream for everyday purchases, blockchain-based payment systems offer compelling advantages such as reduced transaction fees and expedited settlement periods. These benefits position them as a viable long-term alternative, particularly for cross-border transactions and potentially for domestic payment processing.

- Cryptocurrency Adoption in Latin America: Reports from 2024 indicate a significant surge in crypto ownership and usage across several Latin American countries, with El Salvador being a notable example of national adoption.

- Cost and Speed Advantages: Blockchain platforms often boast lower transaction costs compared to traditional remittance services, and settlement can occur in minutes rather than days.

- Potential Market Disruption: As regulatory frameworks evolve and user accessibility improves, these digital currencies could capture a notable share of the payment processing market, especially for remittances and international trade.

The rise of real-time payment systems, digital wallets, and account-to-account (A2A) transfers directly challenges traditional card processing. These alternatives often offer lower fees and faster settlement, appealing to both consumers and merchants. For instance, Brazil's Pix system processed over 42 billion transactions by the end of 2023, showcasing a significant shift away from conventional payment methods.

| Payment Method | 2023 Transaction Volume (Est.) | Projected Growth Driver | Key Benefit |

|---|---|---|---|

| Pix (Brazil) | 42 billion+ transactions | Government initiative, widespread adoption | Instantaneous, low-cost |

| Digital Wallets (LATAM) | Significant growth | Mobile penetration, convenience | Seamless online/offline payments |

| Account-to-Account (A2A) | Growing market share | Cost savings, security | Direct fund transfer, bypasses networks |

Entrants Threaten

Entering the payment processing sector demands significant upfront capital. This includes building secure, robust technology infrastructure, maintaining compliant data centers, and meeting stringent regulatory standards. For instance, establishing a payment gateway often requires millions in initial investment for hardware, software development, and cybersecurity measures.

These substantial fixed costs act as a formidable barrier, deterring many potential new competitors. The sheer scale of investment needed to even begin operations makes it challenging for smaller firms or startups to enter the market and compete effectively against established players.

EVERTEC's existing infrastructure, including its proprietary ATH network, represents a massive, long-term investment. Any new entrant would need to invest comparably to replicate the reach, reliability, and security that EVERTEC currently offers its clients, further amplifying the capital hurdle.

The payment processing industry faces significant regulatory hurdles, making entry challenging. For instance, compliance with varying anti-money laundering (AML) and data security standards across Latin America and the Caribbean demands substantial investment and expertise. These complex legal frameworks act as a strong deterrent for potential new competitors seeking to establish a foothold.

EVERTEC's dominance is amplified by powerful network effects, especially within its ATH debit network. This creates a significant barrier for newcomers who must replicate this widespread adoption and ingrained trust among financial institutions, merchants, and government entities.

Building comparable relationships and achieving the same scale of integration is a substantial hurdle. For instance, in 2024, the ATH network processed billions of transactions, a testament to its established reach that new entrants would struggle to match quickly.

Technological Expertise and Talent Acquisition

Developing and maintaining cutting-edge payment processing technology demands deep technical expertise in cybersecurity, data analytics, and cloud infrastructure. New entrants face a steep climb to acquire this specialized knowledge, often needing significant upfront investment in R&D and talent. For instance, in 2023, the global cybersecurity market was valued at over $200 billion, highlighting the cost of building robust security systems.

Attracting and retaining top-tier tech talent is a major hurdle for newcomers. Established players like EVERTEC benefit from existing, experienced teams and proven recruitment pipelines. The competition for skilled professionals in fintech is fierce; in 2024, the average salary for a senior software engineer in the payments sector often exceeds $150,000 annually, making it a costly endeavor for new companies to compete.

- High Demand for Specialized Skills: Fintech requires experts in AI, blockchain, and advanced data science.

- Talent Acquisition Costs: Recruiting and retaining top tech talent in 2024 can cost companies upwards of $200,000 per employee annually.

- Established Player Advantage: Companies like EVERTEC have pre-existing, experienced technical teams.

- R&D Investment Burden: New entrants must invest heavily in technology development and talent, potentially millions of dollars, to match industry standards.

Brand Recognition and Trust

In financial services, brand recognition and trust are paramount, acting as significant barriers to entry. EVERTEC, with its established presence and history, has cultivated deep trust and loyalty across its customer segments. For instance, in 2023, EVERTEC reported a strong customer retention rate, underscoring the stickiness of its established relationships.

Newcomers face the considerable challenge of replicating this level of confidence. They must allocate substantial resources towards marketing campaigns and robust security measures to even begin to erode EVERTEC's ingrained customer trust and achieve market acceptance. This investment is critical to overcome the incumbent's established reputation.

- Brand Loyalty: EVERTEC's long-standing operations foster deep customer loyalty.

- Trust as a Barrier: New entrants must invest heavily to build comparable trust.

- Marketing & Security Costs: Significant expenditure is required to gain market acceptance against established players.

- Customer Retention: EVERTEC's strong retention rates highlight the difficulty new entrants face in acquiring customers.

The threat of new entrants in the payment processing sector, particularly for a company like EVERTEC, is generally low due to substantial barriers. These include immense capital requirements for technology and compliance, as well as the need for deep technical expertise and significant R&D investment. Furthermore, established brand trust and strong network effects, like EVERTEC's ATH network, create formidable hurdles for any newcomer attempting to gain market share.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | Building secure infrastructure and meeting regulatory standards demands millions in upfront investment. | High deterrent due to initial cost. | Establishing a payment gateway can cost $5M-$10M+ for infrastructure and compliance. |

| Technical Expertise & R&D | Requires specialized skills in cybersecurity, data analytics, and AI. | Steep learning curve and high talent acquisition costs. | Senior fintech engineer salaries can exceed $150,000 annually; R&D budgets in the billions for established players. |

| Network Effects | Widespread adoption and ingrained trust in existing networks like EVERTEC's ATH. | Difficult to replicate reach and customer loyalty quickly. | ATH network processed billions of transactions in 2024, demonstrating scale. |

| Brand Trust & Relationships | Long-standing presence fosters customer loyalty and deep relationships. | New entrants must invest heavily in marketing and security to build comparable confidence. | EVERTEC's high customer retention rates in 2023 indicate strong loyalty. |

Porter's Five Forces Analysis Data Sources

Our EVERTEC Porter's Five Forces analysis is built upon a foundation of robust data, drawing from company annual reports, investor presentations, and SEC filings. We also incorporate insights from reputable financial news outlets and industry-specific market research reports.