Euskaltel SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Euskaltel Bundle

Euskaltel's strengths lie in its established regional presence and loyal customer base, but it faces intense competition and evolving technological demands. Understanding these dynamics is crucial for navigating the telecommunications landscape.

Want the full story behind Euskaltel's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Euskaltel holds a commanding position as the premier telecommunications provider within its key territories: the Basque Country, Galicia, and Asturias. This robust regional presence is cultivated through significant local involvement and strong brand awareness, translating into customer loyalty and a distinct edge over nationwide competitors.

The company's deep-rooted regional engagement allows it to effectively tailor its service offerings, ensuring they meet the specific demands of both local consumers and businesses. This localized approach is a critical factor in its sustained market leadership.

Euskaltel's comprehensive integrated service offering is a significant strength, encompassing fixed and mobile telephony, high-speed broadband, and digital television. This allows them to create attractive bundled packages for both individuals and businesses. For instance, in 2023, Euskaltel's bundled services contributed to a solid customer retention rate, with approximately 85% of their broadband customers also subscribing to at least one additional service, demonstrating the power of this integrated approach in fostering customer loyalty and a stable revenue stream.

Euskaltel's advanced fiber optic network infrastructure is a core strength, allowing them to offer symmetrical internet speeds up to 10 Gbps. This state-of-the-art network, continuously upgraded with technologies like WiFi 6, provides a significant competitive edge in delivering superior broadband services. Their ongoing investment ensures this infrastructure remains future-proof and ready for escalating data demands.

Synergies within MásOrange Group

Euskaltel's position as a key regional brand within the MásOrange Group, a joint venture between MásMóvil and Orange Spain, is a significant strength. This integration grants Euskaltel access to a larger national entity's combined assets and scale. The group's extensive network infrastructure, bolstered by Orange's reach and MásMóvil's capacity, provides a substantial competitive advantage.

The synergies realized from this merger are substantial, with projections indicating annual savings exceeding €450 million. These efficiencies are expected to translate into improved operational performance and a broader market reach for Euskaltel.

- Leveraging extensive network infrastructure

- Access to combined assets of a larger national entity

- Projected annual synergies exceeding €450 million

- Enhanced operational efficiency and market reach

Diversified Business Segments

Euskaltel's strength lies in its broad customer base, spanning residential users to large corporations and public entities. This wide reach includes SOHO and SME segments, alongside wholesale services like infrastructure leasing and IT outsourcing. This diversified approach creates multiple revenue streams and mitigates risks associated with over-reliance on any single market.

This business model's resilience was evident in its 2023 performance, where its diverse operations contributed to a stable revenue base. For instance, the company reported a consolidated revenue of €1,578.6 million for the fiscal year 2023, demonstrating the collective strength of its various customer and service segments.

- Residential Customers: Serving millions of households across its operating regions.

- Business Clients: Catering to SOHO, SMEs, and large corporations with tailored communication and IT solutions.

- Wholesale Services: Providing essential infrastructure and IT outsourcing to other telecommunication providers and businesses.

Euskaltel's primary strength is its dominant regional market position in the Basque Country, Galicia, and Asturias, fostered by strong local brand recognition and customer loyalty. This deep regional penetration allows for highly tailored service offerings that resonate with local needs, giving it a distinct advantage over national competitors.

The company benefits from a comprehensive, integrated service portfolio that includes fixed and mobile telephony, high-speed broadband, and digital TV. This bundled approach enhances customer retention, with roughly 85% of its broadband customers in 2023 also subscribing to at least one other service, underscoring its effectiveness in creating stable revenue streams.

Euskaltel's advanced fiber optic network, capable of delivering up to 10 Gbps symmetrical speeds and incorporating technologies like WiFi 6, provides a significant technological edge. Continuous investment in this infrastructure ensures it remains competitive and prepared for future data demands.

As part of the MásOrange Group, Euskaltel gains access to a larger national entity's combined assets and scale, projected to yield annual synergies exceeding €450 million. This integration enhances operational efficiency and broadens its market reach, leveraging the extensive network infrastructure of both Orange and MásMóvil.

| Strength Area | Description | Supporting Data/Fact |

|---|---|---|

| Regional Dominance | Leading telecommunications provider in Basque Country, Galicia, and Asturias. | Strong brand awareness and customer loyalty cultivated through deep local engagement. |

| Integrated Services | Offers bundled fixed, mobile, broadband, and TV services. | 85% of broadband customers in 2023 also subscribed to additional services, indicating high retention. |

| Network Infrastructure | Advanced fiber optic network with up to 10 Gbps speeds. | Continuous upgrades with technologies like WiFi 6 ensure future-proofing and competitive advantage. |

| MásOrange Synergies | Leverages combined assets and scale of MásMóvil and Orange Spain. | Projected annual synergies exceeding €450 million from the merger, enhancing operational efficiency. |

What is included in the product

Delivers a strategic overview of Euskaltel’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Identifies key Euskaltel weaknesses and threats, enabling proactive mitigation strategies and reducing the risk of market share erosion.

Weaknesses

Euskaltel's significant geographic concentration, particularly in the Basque Country, Galicia, and Asturias, presents a notable weakness. While this focus has historically allowed for strong local market penetration, it also means the company is more susceptible to regional economic downturns or regulatory changes. For instance, if economic conditions in these specific regions falter, Euskaltel's revenue streams could be disproportionately impacted.

Euskaltel's mobile operations are heavily reliant on Mobile Virtual Network Operator (MVNO) agreements, meaning the company does not own its mobile network infrastructure. This dependence, historically on Vodafone and more recently on Orange España following the latter's acquisition of MásMóvil, creates a vulnerability. The terms of these wholesale agreements directly impact Euskaltel's cost of service and its ability to innovate in the mobile space.

Euskaltel's integration into the MásOrange entity presents significant operational hurdles. Merging distinct IT systems, customer databases, and network infrastructures requires substantial investment and expertise, potentially diverting resources from core business activities. For instance, the initial phases of such large-scale integrations often see increased IT expenditure, which can impact short-term profitability.

The cultural assimilation of Euskaltel's workforce with that of MásOrange is another critical weakness. Differences in corporate culture and employee expectations can lead to friction, reduced morale, and challenges in retaining key talent. This cultural clash can slow down decision-making processes and hinder the realization of expected synergies from the merger.

Maintaining Euskaltel's strong regional identity and customer loyalty during this integration is a delicate balancing act. Over-standardization or a perceived loss of local focus could alienate its established customer base. For example, in 2023, Euskaltel reported maintaining a strong presence in its core Basque Country market, a position that could be diluted if the integration strategy doesn't carefully consider regional nuances.

Intense Competition and Pricing Pressures

Euskaltel operates in a fiercely competitive Spanish telecommunications landscape. Major rivals such as Movistar, Vodafone, and the newly formed MásOrange are known for aggressive pricing, directly impacting Euskaltel's ability to maintain healthy profit margins. Emerging players like DIGI are also intensifying this pressure.

This intense competition forces Euskaltel into a continuous cycle of investment in customer acquisition and retention strategies. Such expenditures can significantly strain the company's financial resources and potentially hinder overall profitability.

- Aggressive Pricing: Competitors frequently engage in price wars, forcing Euskaltel to match or risk losing market share.

- Market Consolidation: The recent MásOrange merger creates an even larger, more formidable competitor.

- Emerging Challengers: DIGI's rapid growth and competitive offerings present an ongoing threat.

Debt and Financial Leverage

Euskaltel's financial health is closely tied to the MásMóvil Group's overall debt burden, a significant factor stemming from the acquisition. While the divestment of EKT Cable in late 2023, valued at €300 million, provided some debt relief, the group's financial leverage remains a key consideration.

High financial leverage can constrain Euskaltel's capacity for new investments and strategic expansion initiatives. This necessitates careful financial oversight and management within the broader MásMóvil structure to maintain operational flexibility and pursue growth opportunities effectively.

- Debt Influence: Euskaltel's financial strategy is inherently linked to the MásMóvil Group's consolidated debt.

- Debt Reduction Efforts: The sale of EKT Cable for €300 million in late 2023 aimed to reduce this debt load.

- Leverage Impact: Despite asset sales, high financial leverage may limit future investment and expansion capital.

Euskaltel's reliance on MVNO agreements, particularly its recent dependence on Orange España following MásMóvil's acquisition, represents a significant weakness. This lack of owned mobile infrastructure limits its control over service quality and innovation, directly impacting its cost structure and competitive agility in the dynamic mobile market.

The company's geographic concentration in specific regions of Spain, while fostering local strength, also exposes it to heightened risk from localized economic downturns or regulatory shifts. This regional focus can make its revenue streams more vulnerable to specific regional challenges.

Integrating Euskaltel into the larger MásOrange entity presents substantial operational challenges. Merging disparate IT systems, customer bases, and network infrastructures demands significant investment and expertise, potentially diverting resources from core business growth and innovation initiatives.

Furthermore, the cultural assimilation of Euskaltel's workforce with that of MásOrange poses a risk of employee friction and talent attrition. Differences in corporate culture could impede decision-making and the realization of expected merger synergies, impacting overall operational efficiency.

Preview the Actual Deliverable

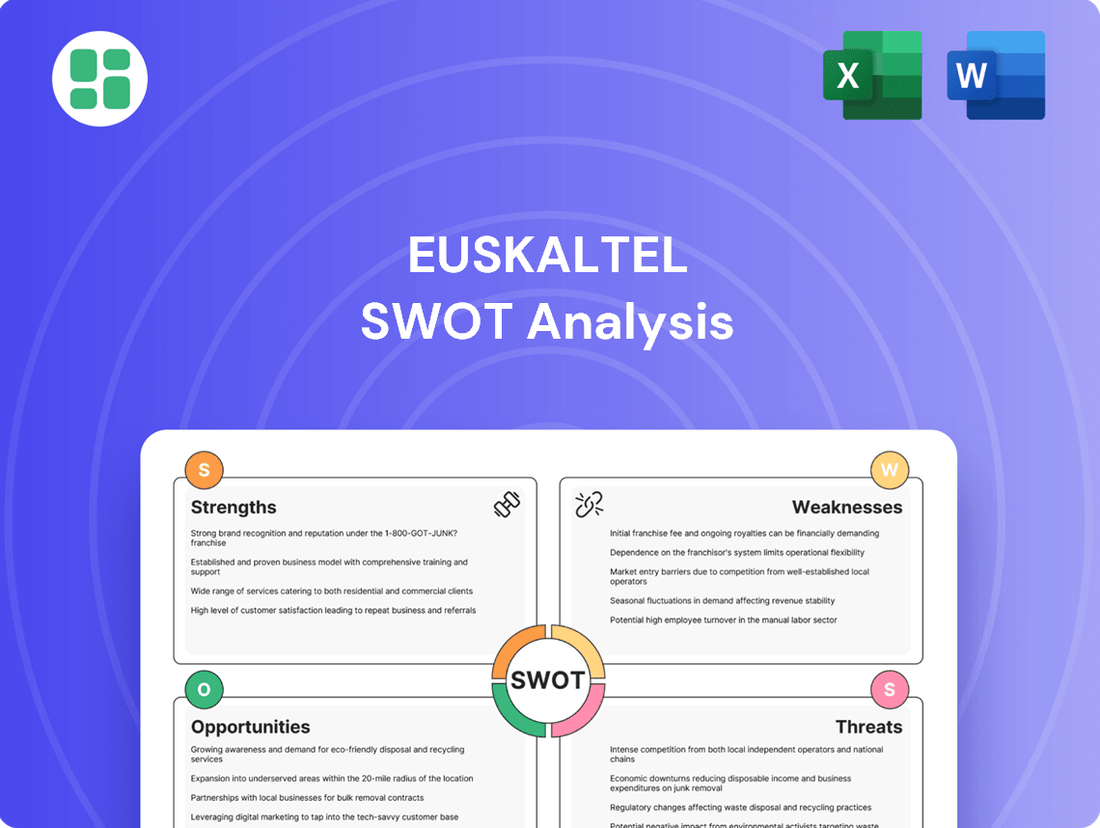

Euskaltel SWOT Analysis

You’re viewing a live preview of the actual Euskaltel SWOT analysis. The complete version becomes available after checkout, giving you the full, in-depth strategic insights.

This is the same Euskaltel SWOT analysis document included in your download. The full content, detailing strengths, weaknesses, opportunities, and threats, is unlocked after payment.

Opportunities

The integration into MásOrange presents a prime opportunity for Euskaltel to significantly expand its market reach beyond its established regional strongholds. This strategic move allows Euskaltel to tap into Orange's robust national infrastructure and MásMóvil's substantial market presence, enabling it to attract a wider customer base across Spain.

By leveraging the combined strength of these entities, Euskaltel can effectively broaden its addressable market, potentially under its existing brands or through newer ventures like Virgin Telco. This expansion is crucial for accelerating national growth ambitions and solidifying its competitive position in the broader Spanish telecommunications landscape.

Spain's commitment to digital infrastructure is a significant tailwind, with the country consistently leading Europe in fiber optic network deployment. This robust foundation fuels a growing consumer and business appetite for ultra-fast broadband and the transformative capabilities of 5G technology.

Euskaltel is strategically positioned to leverage this demand, actively investing in network enhancements to deliver 10 Gbps fiber speeds and expanding its 5G service offerings. This proactive approach ensures the company can meet the escalating requirements for enhanced data transmission and reduced latency, critical for next-generation applications and services.

The increasing adoption of bandwidth-intensive services, from high-definition streaming to advanced cloud computing and the Internet of Things (IoT), creates a substantial growth opportunity for Euskaltel. By aligning its infrastructure investments with these evolving market needs, the company can solidify its competitive advantage and capture new revenue streams in the rapidly expanding digital economy.

The growing prevalence of Internet of Things (IoT) devices and smart city projects across Spain offers a prime opportunity for telecom companies like Euskaltel to provide essential connectivity and specialized managed services. This trend is particularly strong in urban development and industrial applications.

Euskaltel's prior investment in establishing a LoRaWAN network in the Basque Country positions it well to capitalize on this expansion. This infrastructure is crucial for supporting the low-power, wide-area communication needs of many IoT deployments.

By actively developing and offering integrated IoT solutions and services, Euskaltel can unlock substantial new revenue streams. This strategic move not only diversifies its business model but also solidifies its role as a key player in Spain's evolving digital landscape, potentially capturing a significant share of the projected growth in the Spanish IoT market, which is anticipated to reach billions of euros in the coming years.

Further Market Consolidation and Strategic Acquisitions

The Spanish telecommunications sector is ripe for continued consolidation. Analysts anticipate further mergers and acquisitions throughout 2024 and 2025 as companies strive for greater scale and operational efficiencies. Euskaltel, now part of the larger MásOrange entity, is strategically positioned to participate in or benefit from these market shifts.

This consolidation trend presents significant opportunities for Euskaltel. Potential strategic acquisitions or partnerships could bolster its market share, diminish competitive pressures, and unlock access to innovative technologies and new customer demographics. For instance, the Spanish telecom market saw significant M&A activity in the preceding years, with the creation of MásOrange itself being a prime example of this consolidation drive.

- Increased Market Share: Acquisitions can directly translate into a larger customer base and revenue streams.

- Synergies and Cost Efficiencies: Merging operations often leads to reduced overhead and improved profitability.

- Access to New Technologies: Acquiring companies with advanced network capabilities or digital services can accelerate innovation.

- Reduced Competitive Landscape: Consolidation can lead to fewer, stronger players, potentially stabilizing pricing and improving service quality.

Enhanced Digital Services and Value-Added Offerings

Euskaltel can capitalize on the ongoing digital transformation by expanding its service portfolio beyond basic connectivity. This presents a significant opportunity to offer enhanced digital television content, robust cloud services, and essential cybersecurity solutions tailored for businesses. By doing so, Euskaltel can create a more comprehensive digital ecosystem for its customers.

This strategic move allows Euskaltel to differentiate itself in a competitive market by delivering a richer, more integrated digital experience. The company can leverage its existing customer base to introduce these value-added offerings, potentially increasing customer loyalty and average revenue per user (ARPU).

- Expand digital TV: Offer premium content, on-demand services, and interactive features to capture a larger share of the entertainment market.

- Cloud services for SMEs: Develop and market scalable cloud solutions, including storage, computing, and software-as-a-service (SaaS), to support small and medium-sized enterprises.

- Cybersecurity solutions: Provide advanced security packages, threat detection, and managed security services to protect businesses from evolving cyber threats.

- IoT and smart home integration: Explore opportunities in the Internet of Things (IoT) and smart home technologies, offering integrated solutions that enhance convenience and connectivity for consumers.

The integration into MásOrange offers Euskaltel a significant opportunity to expand its national footprint by leveraging Orange's extensive infrastructure and MásMóvil's substantial customer base. This strategic alignment allows Euskaltel to broaden its addressable market, potentially through its existing brands or new ventures like Virgin Telco, accelerating its national growth and competitive positioning.

Spain's strong commitment to digital infrastructure, particularly its leadership in fiber optic network deployment, creates a fertile ground for Euskaltel. The increasing demand for high-speed broadband and 5G services, fueled by bandwidth-intensive applications, allows Euskaltel to capitalize on its network investments, including 10 Gbps fiber and expanded 5G offerings.

The growing adoption of IoT devices and smart city initiatives presents a prime avenue for Euskaltel to offer crucial connectivity and managed services, building on its existing LoRaWAN network in the Basque Country. This positions Euskaltel to capture significant revenue streams within the expanding Spanish IoT market.

The telecommunications sector's ongoing consolidation trend, expected to continue through 2024 and 2025, offers Euskaltel strategic advantages. Potential acquisitions or partnerships can enhance market share, reduce competitive pressures, and provide access to new technologies and customer segments.

Threats

The Spanish telecom sector remains a battleground for aggressive pricing. Euskaltel faces the persistent threat of intensified price wars, where competitors, including new entrants and established players, may resort to steep tariff reductions to gain market share. This competitive pressure directly impacts Euskaltel's ability to maintain healthy profit margins.

For instance, in 2023, the Spanish telecommunications market saw continued promotional activities, with major operators offering bundled services at highly competitive price points, leading to an average revenue per user (ARPU) that remained under pressure for the industry. This environment forces Euskaltel to consider matching these aggressive offers, risking further margin erosion.

The telecommunications sector is characterized by swift technological progress, evident in the ongoing upgrades of fiber optics, moving from GPON to XGS-PON, and the expanding deployment of 5G networks. This necessitates substantial and continuous investment from Euskaltel to maintain its competitive edge.

Failure to adapt to these rapid technological changes or inadequate capital expenditure could result in a decline in service quality, potentially leading to customer attrition. For instance, the global 5G infrastructure market alone was projected to reach $307.3 billion by 2026, highlighting the scale of investment required.

Adverse regulatory shifts pose a significant threat to Euskaltel. The telecommunications industry is inherently sensitive to government policy, and changes in areas like spectrum allocation or wholesale access could directly impact Euskaltel's operational costs and revenue streams. For instance, stricter consumer protection rules or new antitrust measures, especially in light of potential market consolidation, could limit strategic flexibility and impose unforeseen expenses.

Economic Downturn and Decreased Consumer Spending

An economic downturn in Spain, particularly impacting regions where Euskaltel has a strong presence like the Basque Country, could significantly curb consumer and business spending on telecommunication services. During such periods, customers often become more price-sensitive, leading them to switch to more budget-friendly plans, downgrade their existing services, or postpone upgrades. This trend directly threatens Euskaltel's revenue streams and its ability to attract new customers, creating a hurdle for its financial performance.

For instance, if Spain experiences a recession, similar to the economic contractions seen in past downturns, consumer disposable income typically falls. This would translate into fewer households willing or able to pay for premium telecommunication packages, forcing them to seek out basic or discounted offerings. Businesses, facing their own revenue challenges, might also cut back on their telecommunication expenditures, impacting Euskaltel's enterprise segment.

- Reduced Discretionary Spending: Consumers may cut back on non-essential services like higher-tier internet packages or bundled entertainment options.

- Increased Price Sensitivity: A weaker economy often drives customers to seek out the lowest-priced providers or plans, intensifying competition.

- Delayed Upgrades and New Subscriptions: Both individuals and businesses are likely to postpone investments in new technologies or service upgrades.

- Impact on ARPU: Average Revenue Per User (ARPU) could decline as customers opt for cheaper services or reduce their overall spending.

Cybersecurity Risks and Data Breaches

As a telecommunications provider, Euskaltel faces significant cybersecurity risks due to its handling of extensive customer data and operation of critical infrastructure. The potential for data breaches or cyberattacks leading to network disruptions poses a substantial threat, potentially resulting in considerable financial penalties and a severe blow to customer confidence. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the financial stakes involved for companies like Euskaltel.

These security incidents can directly impact Euskaltel's bottom line through:

- Financial losses: Resulting from regulatory fines, legal settlements, and recovery costs.

- Reputational damage: Leading to customer attrition and difficulty in attracting new subscribers.

- Operational disruption: Caused by network outages or compromised systems, affecting service delivery.

Maintaining robust cybersecurity defenses is not only crucial for mitigating these threats but also represents an ongoing and substantial operational expense for Euskaltel, impacting its profitability.

Intensified competition and aggressive pricing strategies from rivals pose a significant threat to Euskaltel's profitability, as seen in the Spanish market's ongoing promotional activities. The rapid pace of technological advancement, such as the rollout of 5G and upgrades to fiber optics, necessitates substantial and continuous investment to remain competitive, with the global 5G infrastructure market alone projected to reach $307.3 billion by 2026. Adverse regulatory changes, including potential new antitrust measures or stricter consumer protection rules, could also negatively impact Euskaltel's operational flexibility and financial performance.

| Threat Category | Description | Potential Impact | Example Data/Context |

|---|---|---|---|

| Intensified Competition & Pricing Pressure | Aggressive pricing by competitors, including new entrants and established players, leading to price wars. | Erosion of profit margins, reduced ARPU. | Continued promotional activities in Spain in 2023 led to pressure on ARPU across the industry. |

| Rapid Technological Obsolescence | Need for continuous investment in upgrading networks (e.g., 5G, fiber optics) to maintain service quality and competitive edge. | Risk of declining service quality, customer attrition, loss of market share if investment lags. | Global 5G infrastructure market projected to reach $307.3 billion by 2026. |

| Adverse Regulatory Changes | Potential shifts in government policy regarding spectrum allocation, wholesale access, consumer protection, or antitrust measures. | Increased operational costs, reduced revenue streams, limited strategic flexibility, unforeseen expenses. | Stricter consumer protection rules or new antitrust measures could impact market dynamics. |

SWOT Analysis Data Sources

This Euskaltel SWOT analysis is built upon a robust foundation of data, including their official financial statements, comprehensive market research reports, and insights from industry experts. This ensures a well-rounded and accurate assessment of the company's strategic position.