Euskaltel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Euskaltel Bundle

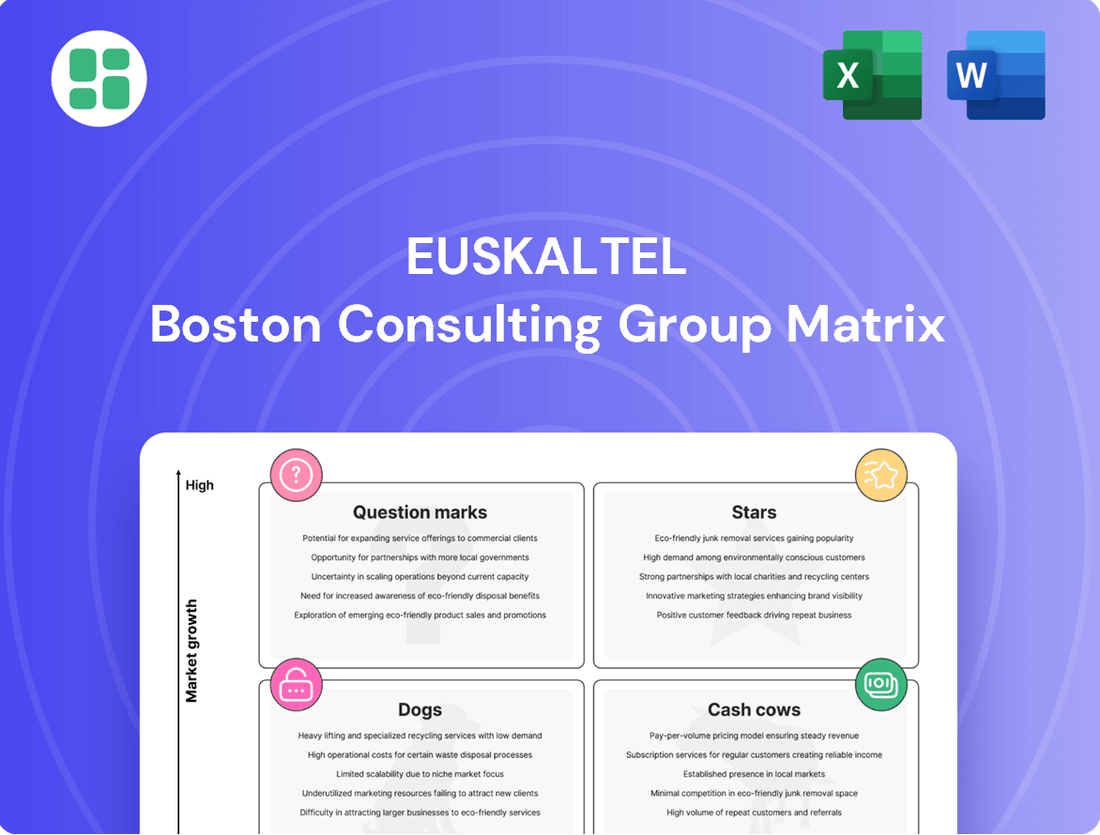

Curious about Euskaltel's strategic positioning? This glimpse into their BCG Matrix highlights key product categories, but the full report unlocks the complete picture. Understand which of their offerings are Stars, Cash Cows, Dogs, or Question Marks, and gain the insights needed to make informed investment decisions. Purchase the full BCG Matrix for a comprehensive breakdown and actionable strategies.

Stars

Euskaltel's high-speed fiber broadband, offering speeds from 500 Mb to 1 Gb and future-proofing for 10 Gb, clearly positions it as a Star in the BCG matrix. This advanced offering, enhanced by WiFi 6, directly addresses Spain's robust fiber infrastructure and the escalating consumer need for ultra-fast internet.

The market's embrace of these speeds is evident; in 2024, a significant and growing percentage of broadband users in Spain are experiencing speeds exceeding 300 Mbps. This trend underscores Euskaltel's strong market standing and the substantial growth potential within this high-demand segment.

Euskaltel's commitment to integrating 5G across its entire mobile service portfolio firmly places it as a Star within the BCG Matrix. This strategic move capitalizes on the burgeoning demand for faster, more reliable mobile connectivity, a trend projected to see significant growth in the coming years.

As a key component of MásOrange, Euskaltel benefits from a substantial spectrum advantage, particularly in the mid and high-band frequencies crucial for robust 5G deployment. This spectrum leadership enables Euskaltel to deliver cutting-edge mobile experiences, reinforcing its position in a high-growth market segment.

The high adoption rate of 5G technology, coupled with Euskaltel's strong market presence within the integrated MásOrange entity, solidifies its Star status. This synergy allows Euskaltel to effectively capture market share and drive revenue in the rapidly expanding 5G ecosystem.

Premium Converged Bundles represent Euskaltel's Stars. These are high-end, integrated communication packages combining high-speed fiber, 5G mobile, and digital television, often featuring 4K quality and content partnerships like SkyShowtime. These comprehensive offerings are designed to attract customers seeking a complete and advanced digital experience, which in turn drives higher Average Revenue Per User (ARPU) and market penetration, even within a competitive market.

Regional Market Leadership

Euskaltel's traditional operating regions, especially the Basque Country, showcase its strong brand and leadership. This localized strength is crucial for MásOrange's multi-brand approach, allowing Euskaltel to secure a significant market share in these expanding regional markets.

As a result, Euskaltel's core regional operations are considered a Star. The company's dedication to addressing local needs within the larger group's strategic framework underpins this dominant position.

- Dominant Regional Market Share: Euskaltel holds a leading position in its established territories, contributing significantly to MásOrange's overall market presence.

- Brand Loyalty and Recognition: A strong, localized brand identity fosters high customer loyalty in key regions, driving consistent revenue.

- Strategic Importance within MásOrange: Euskaltel's regional strength is a cornerstone of MásOrange's multi-brand strategy, leveraging specific market advantages.

Advanced B2B Connectivity Solutions

Leveraging the broader MásOrange strategy, Euskaltel's advanced B2B connectivity solutions, including cybersecurity and cloud infrastructure, are positioned as Stars within the BCG Matrix. This segment is experiencing robust growth, with the B2B telecommunications market projected to reach $200 billion globally by 2025, fueled by enterprise digitalization and the need for integrated communication systems.

Euskaltel, as part of a major operator, is well-equipped to capitalize on this high-growth B2B segment. Their robust network infrastructure and expanding portfolio of digital services are key differentiators. For instance, in 2024, Euskaltel reported a significant increase in B2B service uptake, particularly in cloud and cybersecurity solutions, indicating strong market demand.

- Star: Advanced B2B Connectivity Solutions

- Market Growth Driver: Enterprise Digitalization & Unified Communications

- Euskaltel's Advantage: Robust Network & Comprehensive Digital Services Portfolio

- 2024 Data Point: Significant B2B Service Uptake in Cloud and Cybersecurity

Euskaltel's premium converged bundles, featuring high-speed fiber, 5G mobile, and enhanced TV services, are solidifying its Star status. These offerings cater to a growing demand for integrated, high-quality digital experiences, driving increased Average Revenue Per User (ARPU).

The company's strong regional market share, particularly in the Basque Country, further cements its Star position. This localized dominance is a critical asset within MásOrange's multi-brand strategy, ensuring sustained revenue and market penetration in key areas.

Euskaltel's advanced B2B connectivity solutions, including cybersecurity and cloud services, are also Stars. The B2B telecommunications market is experiencing robust growth, with enterprises increasingly seeking integrated digital solutions, a trend Euskaltel is well-positioned to capitalize on.

In 2024, Euskaltel reported a notable increase in B2B service uptake, especially in cloud and cybersecurity, highlighting strong market demand for these advanced offerings.

| Euskaltel's Star Offerings | Market Position | Key Drivers | 2024 Insight |

|---|---|---|---|

| Premium Converged Bundles | High-End Communication Packages | Demand for integrated digital experiences, higher ARPU | Strong uptake of bundled services |

| Dominant Regional Operations | Leading in established territories (e.g., Basque Country) | Brand loyalty, multi-brand strategy synergy | Consistent revenue generation |

| Advanced B2B Connectivity | Cybersecurity, Cloud, Unified Communications | Enterprise digitalization, need for integrated solutions | Significant increase in B2B service uptake |

What is included in the product

The Euskaltel BCG Matrix analyzes its business units, identifying Stars for growth, Cash Cows for funding, Question Marks for potential, and Dogs for divestment.

The Euskaltel BCG Matrix offers a clear visual of business unit performance, easing the pain of strategic uncertainty.

It provides a simplified framework for resource allocation, alleviating the burden of complex decision-making.

Cash Cows

Euskaltel's traditional fixed broadband and telephony services in the Basque Country are a prime example of a Cash Cow. These mature offerings boast high market penetration, ensuring a stable and predictable revenue stream with minimal need for aggressive marketing spend.

In 2024, the demand for these essential services in Euskaltel's core market remains robust, contributing significantly to the company's overall financial stability. This consistent cash generation allows for reinvestment in other strategic growth areas.

Established residential bundled packages, combining fixed-line, broadband, and mobile services, function as cash cows for Euskaltel within the MásOrange group. These offerings have secured a significant market share and fostered strong customer loyalty over the years.

Despite operating in a mature market, Euskaltel's bundled packages maintain a robust competitive edge. This advantage, coupled with efficient operational management, translates into high profit margins and a consistent, reliable stream of cash flow for the company.

Euskaltel's strong brand loyalty in its core regions, especially the Basque Country, acts as a significant cash cow. This deep-rooted connection with customers minimizes churn and reduces the necessity for costly marketing campaigns. In 2023, Euskaltel reported a stable customer base in its historical territories, demonstrating the enduring appeal of its services.

Mature Fixed-Mobile Convergence (FMC)

Euskaltel's mature Fixed-Mobile Convergence (FMC) offerings represent a significant Cash Cow. These services, which bundle home broadband, mobile, and often television, have been a cornerstone of their business for years. The market for FMC is well-established, meaning growth is slower, but the revenue streams are exceptionally stable and predictable. Euskaltel's high market share in this segment means they benefit from economies of scale and strong brand loyalty.

The mature FMC segment requires minimal incremental investment, as the infrastructure is already in place and operational efficiencies are high. This allows Euskaltel to generate substantial free cash flow from these operations. For instance, in 2024, the telecommunications sector saw continued demand for bundled services, with operators focusing on optimizing existing networks rather than massive new build-outs. Euskaltel's FMC products are perfectly positioned to capitalize on this trend, leveraging their extensive customer base and network investments.

- High Market Share: Euskaltel holds a strong position in the mature FMC market.

- Stable Recurring Revenue: These services provide consistent and predictable income.

- Low Investment Needs: Capital expenditure is minimal, maximizing cash generation.

- Leverages Existing Assets: Efficient use of current infrastructure and customer relationships.

Infrastructure Efficiency and Network Utilization

Euskaltel's position as a cash cow is significantly bolstered by its highly efficient infrastructure and the effective utilization of its extensive fiber optic network. This robust network, a result of substantial prior investment, now requires minimal additional capital expenditure to serve its existing, large customer base.

The integration of Euskaltel into the MásOrange infrastructure further amplifies these efficiency gains. This synergy allows for optimized network operations and shared resources, directly translating into higher profit margins and consistent, strong cash flow generation for Euskaltel.

- Network Utilization: Euskaltel's fiber network operates at high capacity, maximizing the return on its initial investment.

- Integration Benefits: Synergies within MásOrange reduce operational costs and enhance service delivery.

- Profitability: Low incremental investment on a mature network leads to substantial profit margins.

- Cash Flow: Consistent demand from a large customer base ensures predictable and strong cash flow.

Euskaltel's established residential bundled packages, combining fixed-line, broadband, and mobile services, function as cash cows within the MásOrange group. These offerings have secured a significant market share and fostered strong customer loyalty over the years, ensuring a stable revenue stream with minimal need for aggressive marketing spend. In 2024, the demand for these essential services in Euskaltel's core market remains robust, contributing significantly to the company's overall financial stability.

The mature Fixed-Mobile Convergence (FMC) segment requires minimal incremental investment, as the infrastructure is already in place and operational efficiencies are high. This allows Euskaltel to generate substantial free cash flow from these operations. For instance, in 2024, the telecommunications sector saw continued demand for bundled services, with operators focusing on optimizing existing networks rather than massive new build-outs.

Euskaltel's strong brand loyalty in its core regions, especially the Basque Country, acts as a significant cash cow, minimizing churn and reducing the necessity for costly marketing campaigns. In 2023, Euskaltel reported a stable customer base in its historical territories, demonstrating the enduring appeal of its services.

Euskaltel's mature FMC offerings boast high market share and stable recurring revenue, requiring low investment needs and leveraging existing assets for profitability and cash flow.

| Service Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

| Residential Bundled Services (FMC) | Cash Cow | High market share, stable revenue, low investment | Continued robust demand for bundled services in 2024. |

| Fixed Broadband & Telephony (Basque Country) | Cash Cow | Mature market, high penetration, predictable revenue | Stable customer base in historical territories in 2023. |

Delivered as Shown

Euskaltel BCG Matrix

The Euskaltel BCG Matrix preview you see is the identical, fully formatted report you will receive upon purchase, offering a clear strategic overview of their business units. This document is designed for immediate use, allowing you to leverage its insights without any further preparation or watermarks. You can confidently use this preview as a representation of the comprehensive analysis that will be delivered directly to you. It's a ready-to-deploy tool for understanding Euskaltel's market position and strategic imperatives.

Dogs

Any remaining legacy ADSL connections for Euskaltel would undoubtedly fall into the Dog quadrant of the BCG Matrix. The Spanish telecommunications landscape has overwhelmingly embraced fiber optics, rendering ADSL a relic with minimal market share and virtually no growth potential.

By late 2023, over 80% of Spanish households had access to fiber optic broadband, a stark contrast to the declining ADSL subscriber base. This technological shift means ADSL connections for Euskaltel are likely generating very little revenue while still incurring maintenance costs, making them a drain on resources.

Outdated value-added services, such as legacy TV packages or landline bundles that have seen declining subscriber interest, represent a significant challenge for Euskaltel. These offerings often require ongoing maintenance and support, diverting resources from more innovative and profitable ventures. For instance, a 2023 report indicated a 15% year-over-year decline in demand for traditional fixed-line telephony services across the Spanish market, a trend likely impacting Euskaltel's older service portfolios.

Basic standalone mobile plans, particularly those with limited data or lacking 5G, are likely candidates for Euskaltel's question marks. These plans are becoming less appealing as the market shifts towards bundled services and faster, data-rich 5G options.

In 2024, the trend towards convergence is undeniable. For instance, many European telecom operators are seeing a significant portion of their new subscriber growth coming from bundled broadband and mobile packages, often including 5G. Standalone basic mobile plans, especially those not part of a larger bundle, struggle to compete with the perceived value and enhanced capabilities offered by these converged solutions.

The decline in the appeal of these basic plans is also reflected in average revenue per user (ARPU) for standalone mobile services. While specific figures for Euskaltel's basic plans aren't publicly detailed, the broader European market has shown a stagnation or even a slight decrease in ARPU for non-converged, low-data mobile offerings, as customers migrate to higher-tier, bundled packages.

Declining Traditional TV Packages

Traditional digital television packages that lack premium content, flexible streaming options, or 4K quality are facing a significant decline. These outdated offerings, failing to adapt to modern viewing habits, are likely to experience diminishing subscriptions. For instance, in 2024, many legacy pay-TV providers saw continued subscriber losses as consumers shifted to more adaptable streaming services.

The rise of Over-The-Top (OTT) platforms and integrated entertainment solutions further exacerbates this trend. Basic TV offerings, unable to compete with the vast libraries and on-demand features of services like Netflix or Disney+, are experiencing a shrinking market share. Data from 2024 indicated that the overall pay-TV market continued its downward trajectory, with a notable portion of this decline attributed to customers cutting the cord in favor of streaming alternatives.

- Declining Subscriptions: Legacy TV packages are losing subscribers as consumers opt for flexible streaming.

- Market Share Erosion: Basic TV offerings struggle to retain market share against advanced OTT platforms.

- Outdated Features: Lack of premium content, 4K, and on-demand options makes these packages less attractive in 2024.

- Consumer Shift: The trend shows a clear move towards integrated entertainment solutions and away from traditional bundles.

Niche or Underperforming Regional Services

Niche or underperforming regional services within Euskaltel's portfolio are those that, despite the company's strong presence in specific geographic areas, have not managed to capture substantial market share or are struggling against local rivals. These offerings typically represent a low growth and low market share segment.

For instance, if Euskaltel launched a specialized business internet service exclusively for a small industrial park in a particular region, and it only secured a handful of clients with minimal revenue growth, this would fall into the Dogs category. In 2024, a hypothetical example could be a highly localized, low-bandwidth TV package in a rural area of the Basque Country where demand is minimal and competition from national providers offering more comprehensive bundles is fierce.

- Low Market Share: These services struggle to gain a significant foothold, often due to intense local competition or a lack of broad appeal.

- Low Growth: The market for these niche offerings is not expanding, or Euskaltel's penetration within it is stagnant.

- Poor ROI: The investment required to maintain or grow these services often outweighs the returns generated, making them candidates for divestment or significant restructuring.

- Example Scenario: A specialized B2B connectivity solution for a single, small industry in a specific town that has minimal uptake and faces competition from larger, more established regional players.

Legacy ADSL connections represent Euskaltel's Dogs. With Spain's fiber optic penetration exceeding 80% of households by late 2023, ADSL's market share is negligible and its growth prospects are virtually nonexistent. These services likely generate minimal revenue while still incurring maintenance costs, acting as a drain on resources.

Outdated, standalone mobile plans lacking 5G or bundled with other services are also considered Dogs. In 2024, the telecom market strongly favors converged offerings, leaving basic, low-data mobile plans with diminishing appeal. This trend is reflected in stagnant or declining average revenue per user (ARPU) for such standalone services across Europe.

Traditional digital TV packages that don't offer premium content, 4K, or on-demand features are also in the Dog quadrant. The continued shift towards Over-The-Top (OTT) platforms in 2024 means these legacy offerings face shrinking subscriber bases and market share erosion.

Niche or underperforming regional services with low market share and minimal growth also fall into the Dog category. These services often struggle against local competitors and have a poor return on investment, making them candidates for divestment.

| BCG Quadrant | Euskaltel Service Example | Market Trend (2024) | Growth Potential | Market Share |

|---|---|---|---|---|

| Dogs | Legacy ADSL Connections | Declining, replaced by fiber | Very Low | Negligible |

| Dogs | Standalone Basic Mobile Plans (No 5G/Bundles) | Declining, convergence favored | Low | Low |

| Dogs | Outdated Digital TV Packages | Declining, OTT platforms dominate | Very Low | Low |

| Dogs | Niche Regional Services (Low Uptake) | Stagnant or declining | Low | Low |

Question Marks

Euskaltel's expansion into new Spanish regions using the MásOrange network is a classic Question Mark. This strategy aims to capture new customer bases, but initial market penetration is naturally low, demanding substantial capital for marketing and infrastructure development.

For example, if Euskaltel targets a region where its brand presence is minimal, the initial investment in building brand awareness and customer acquisition could be significant. This is crucial for transforming these new ventures from low-share, high-potential areas into future Stars or Cash Cows.

Euskaltel's advanced B2B digital transformation services, encompassing areas like IoT and specialized cloud solutions, represent potential stars in the BCG matrix. These sophisticated ICT offerings cater to a growing demand for tailored business solutions, reflecting a dynamic B2B telecom market.

While these segments offer high growth prospects, Euskaltel's current market penetration is likely nascent. This necessitates significant investment to establish a strong foothold and achieve scalability, a characteristic of businesses in the star quadrant needing continued funding to maintain their growth trajectory.

Euskaltel's strategic move into the energy sector, exemplified by ventures like Euskaltel LUZ y GAS, positions it as a Question Mark within the BCG framework. This sector offers substantial growth potential, a key characteristic for Question Marks, as the demand for energy services, particularly those incorporating digital and connectivity solutions, continues to rise.

However, Euskaltel faces the challenge of establishing a foothold in a market where its brand recognition and market share are nascent. For instance, in 2024, the competitive landscape for energy providers in Spain, especially those offering bundled services, remains robust, with established players and new entrants vying for customer acquisition.

To transform these energy ventures from Question Marks into Stars, Euskaltel must commit substantial capital. This investment is crucial for building out necessary infrastructure, enhancing marketing efforts to build brand awareness, and developing specialized operational expertise in the energy domain. Success hinges on effectively navigating these initial hurdles to capture market share in this high-potential, yet competitive, new arena.

Premium or Niche Digital Content Partnerships

Euskaltel could explore premium or niche digital content partnerships to enhance its TV platform. This strategy aims to attract new subscribers and differentiate its service in a competitive market. For instance, in 2024, the global digital content market continued its robust growth, with subscription video-on-demand (SVOD) services alone projected to reach over $150 billion in revenue by the end of the year.

- Attracting High-Value Subscribers: Investing in exclusive sports rights or high-quality documentary series could draw in subscribers willing to pay a premium, potentially increasing average revenue per user (ARPU).

- Differentiation in a Crowded Market: Offering unique content not readily available on major platforms can create a distinct value proposition for Euskaltel, helping it stand out from competitors.

- Uncertainty and Investment Risk: The significant upfront investment required for premium content, coupled with the unpredictable nature of market adoption in the saturated streaming landscape, presents a considerable risk.

- Potential for Subscriber Growth: Successful niche content partnerships can lead to measurable subscriber acquisition, as demonstrated by smaller streaming services that have carved out successful audiences through specialized content libraries.

Smart Home and Home Automation Services

The smart home and home automation services sector represents a significant growth opportunity for Euskaltel, positioning it as a potential Star or Question Mark within the BCG Matrix. This market is experiencing rapid expansion, with global smart home market revenue projected to reach $200 billion by 2025, according to Statista. Euskaltel's current penetration in this niche is likely modest, demanding substantial investment in innovation and strategic alliances to capture market share.

- Market Potential: The global smart home market is expanding rapidly, with significant growth expected in the coming years.

- Euskaltel's Position: Euskaltel's current market share in smart home services is likely low, indicating a Question Mark status.

- Investment Needs: Achieving substantial adoption requires considerable investment in product development, marketing, and building partnerships within the smart home ecosystem.

- Strategic Focus: Developing integrated smart home services leveraging existing connectivity platforms is crucial for future growth.

Question Marks represent business units with low market share in high-growth industries. Euskaltel's ventures into new regional markets via the MásOrange network and its foray into the energy sector are prime examples. These initiatives require significant investment to build brand awareness and customer acquisition, aiming to convert low share into future market leaders.

The success of these Question Marks hinges on strategic capital allocation for marketing, infrastructure, and operational expertise. For instance, in the energy sector, Euskaltel faces established competitors in 2024, necessitating robust investment to gain traction. Similarly, expanding digital content partnerships for its TV platform, while offering high growth potential, carries inherent investment risk due to market saturation.

The smart home market, another area for Euskaltel, also fits the Question Mark profile with its high growth but likely low initial market penetration. These ventures demand substantial investment to achieve scalability and establish a competitive advantage in rapidly evolving sectors.

Ultimately, the transformation of these Question Marks into Stars or Cash Cows depends on Euskaltel's ability to effectively manage investment, navigate competitive landscapes, and capitalize on market growth opportunities.

BCG Matrix Data Sources

Our Euskaltel BCG Matrix is built upon a foundation of comprehensive market data, integrating financial reports, subscriber growth statistics, and competitive landscape analysis.

This strategic tool leverages official Euskaltel filings, industry growth forecasts, and market share data to accurately position each business unit.