Euskaltel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Euskaltel Bundle

Uncover the critical political, economic, and technological forces shaping Euskaltel's trajectory. Our PESTLE analysis provides a comprehensive overview of the external landscape, empowering you to anticipate market shifts and identify strategic opportunities. Don't get left behind; download the full version now for actionable intelligence.

Political factors

The Spanish government's 'Spain Digital 2025' agenda is a significant driver for telecommunication companies like Euskaltel. Its core objective is to achieve universal 100Mbps broadband connectivity for the entire population by 2025. This ambitious national strategy directly influences Euskaltel's investment decisions in expanding and upgrading its digital infrastructure across Spain.

This digital agenda fosters an environment that encourages widespread adoption of high-speed internet services. For Euskaltel, this translates into both opportunities for market growth and the necessity to continually enhance its network capabilities to meet the government's connectivity targets and evolving consumer demand.

The telecom market in Spain is undergoing significant consolidation, notably with the European Commission and Spanish government approving the Orange-MásMóvil merger in early 2024. This pivotal event directly impacts Euskaltel, integrating it into a larger entity.

This consolidation creates a more formidable competitor, poised to invest more heavily in advanced network technologies like 5G and fiber optics. Such scale is crucial for meeting the increasing demand for high-speed connectivity and maintaining competitiveness in the evolving digital landscape.

Regulatory bodies, including the European Commission and Spain's Data Protection Agency (AEPD), remain vigilant in protecting consumer rights and fostering a competitive telecom landscape. These entities actively implement measures to ensure fair market practices, even as industry consolidation occurs.

The recent approval of the Orange-MásMóvil merger serves as a prime example, as it came with significant regulatory conditions designed to mitigate potential competition concerns within the Spanish telecommunications sector. This highlights the ongoing scrutiny of market power shifts.

Regional Government Policies

Euskaltel's operations are significantly shaped by regional government policies, particularly within its historical stronghold of the Basque Country. These policies often focus on fostering socio-economic growth and advancing technological capabilities, directly impacting Euskaltel's strategic direction and investment priorities.

As a key player in the region, Euskaltel, now integrated into the MASORANGE group, has pledged substantial investments aimed at enhancing the digital infrastructure of the Basque Country. This commitment aligns with regional development strategies, potentially unlocking new opportunities and reinforcing Euskaltel's market position. For instance, MASORANGE's 2024-2027 strategic plan includes a focus on expanding fiber optic networks across Spain, with significant allocations expected for regions like the Basque Country, reflecting a direct response to regional development goals.

- Regional Development Funds: Euskaltel benefits from and aligns with regional government initiatives that provide funding or incentives for digital infrastructure upgrades, crucial for maintaining competitive broadband and mobile services.

- Digital Inclusion Programs: Policies promoting digital literacy and access for all citizens can create demand for Euskaltel's services, especially in underserved areas.

- Technological Innovation Hubs: Regional support for innovation centers and startups can foster partnerships and create new business avenues for Euskaltel in emerging technologies.

- Regulatory Frameworks: Regional authorities set specific regulations concerning telecommunications infrastructure deployment and service provision, which Euskaltel must navigate.

Data Protection Regulations

The telecommunications industry in Spain is facing a significant shift with the implementation of a new Code of Conduct for data protection, effective December 2024. This updated framework mandates that operators, including Euskaltel, must adopt more robust mediation systems and broaden the scope for resolving data protection-related disputes. This move underscores the increasing importance of safeguarding customer information within the sector.

Adherence to the General Data Protection Regulation (GDPR) and Spain's national data protection laws, such as the Ley Orgánica de Protección de Datos Personales y garantía de los derechos digitales (LOPDGDD), remains paramount. For Euskaltel, maintaining compliance is not just a legal necessity but a crucial element in fostering customer trust and ensuring operational integrity. Non-compliance can lead to substantial fines; for instance, under GDPR, penalties can reach up to €20 million or 4% of annual global turnover, whichever is higher.

- December 2024: New Code of Conduct for data protection in Spanish telecommunications sector takes effect.

- Key Requirements: Updated mediation systems and expanded dispute resolution for data protection.

- Legal Frameworks: Strict adherence to GDPR and Spain's LOPDGDD is mandatory.

- Customer Trust: Compliance is vital for maintaining customer confidence and legal standing.

The Spanish government's 'Spain Digital 2025' agenda, aiming for 100Mbps broadband for all by 2025, directly impacts Euskaltel's infrastructure investments. This national push for connectivity encourages high-speed internet adoption, creating market growth opportunities and demanding network upgrades from Euskaltel to meet targets and consumer needs.

The telecommunications market is seeing significant consolidation, with the Orange-MásMóvil merger approved in early 2024, integrating Euskaltel into a larger entity. This creates a stronger competitor with increased capacity for advanced network technologies like 5G and fiber optics, essential for meeting demand and staying competitive.

Regulatory bodies like the European Commission and Spain's Data Protection Agency (AEPD) actively ensure fair market practices and protect consumer rights, even amidst industry consolidation. The Orange-MásMóvil merger, for example, was approved with conditions to mitigate competition concerns, demonstrating ongoing scrutiny of market power shifts.

Regional government policies, particularly in the Basque Country, significantly shape Euskaltel's strategy, focusing on socio-economic growth and technological advancement. MASORANGE's 2024-2027 plan includes substantial fiber optic expansion in regions like the Basque Country, aligning with local development goals.

What is included in the product

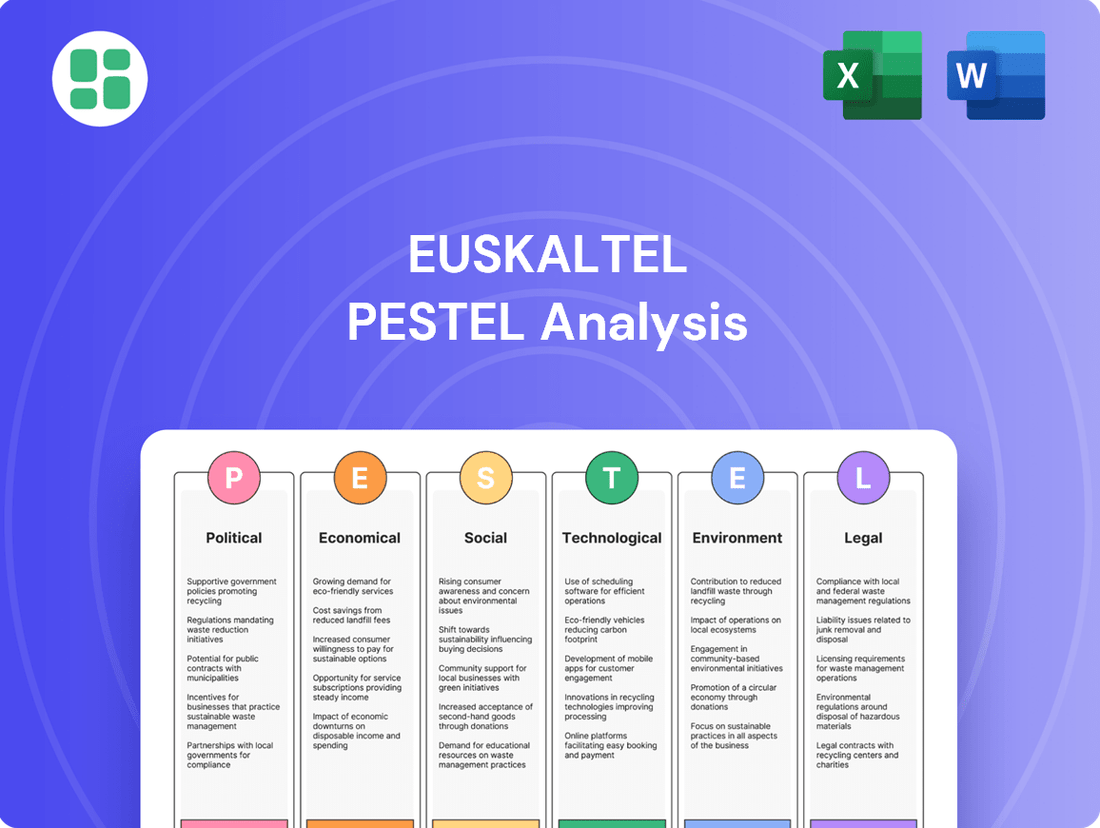

This Euskaltel PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

It provides actionable insights into how these external forces create both challenges and opportunities for Euskaltel within its operating landscape.

The Euskaltel PESTLE analysis provides a structured framework to identify and address external challenges, acting as a pain point reliver by proactively highlighting potential risks and opportunities for strategic adaptation.

Economic factors

The Spanish telecommunications market is showing a steady upward trend. It's expected to expand from an estimated USD 36.08 billion in 2025 to reach USD 41.86 billion by 2030. This growth is a positive sign for companies like Euskaltel.

Several key factors are fueling this market expansion. The demand for faster internet connections continues to rise, and more people are using smartphones. These trends directly benefit telecom operators by increasing their customer base and service usage.

Despite ongoing consolidation, the Spanish telecommunications market continues to be a battleground for market share, with new low-cost providers frequently entering the fray. This dynamic directly translates into significant pricing pressure for established players like Euskaltel.

As a subsidiary of MásMóvil Iberia, Euskaltel must navigate a landscape where aggressive pricing strategies, particularly through bundled services and frequent discounts, are common tactics to attract and retain customers. This makes maintaining both market share and healthy profit margins a constant challenge.

For instance, in early 2024, the Spanish telecom market saw continued price wars, with major operators offering substantial discounts on mobile and broadband packages, sometimes exceeding 50% for initial periods, impacting overall revenue per user (ARPU) across the industry.

Significant investments are pouring into Spain's digital infrastructure, with a strong focus on fiber optic and 5G network expansion. Euskaltel, alongside its parent group, is actively participating in these capital expenditures, aligning with the national 'Spain Digital 2025' agenda. These efforts are vital for enhancing technological capabilities and broadening service reach across the country.

For instance, by the end of 2023, Spain had achieved over 90% fiber optic coverage to households, a testament to ongoing investment. These substantial outlays, while critical for future growth and service innovation, represent significant financial commitments for companies like Euskaltel.

Inflation and Operating Costs

Inflation significantly impacts the telecommunications sector by driving up operating costs for Euskaltel. As inflation moderates in Europe, the industry anticipates some margin improvement, but careful cost management remains crucial. For instance, energy prices, a key component of operating expenses, saw considerable volatility in 2023 and early 2024, directly affecting network infrastructure and service delivery costs.

Operators like Euskaltel face the challenge of absorbing or passing on these increased costs. While a general slowdown in inflation across the Eurozone, with rates falling from peaks seen in 2022, offers some relief, specific input costs can remain elevated. For example, the cost of electronic components and skilled labor, essential for network upgrades and maintenance, can be influenced by broader inflationary pressures.

- Rising Energy Costs: Electricity, a major expense for data centers and network equipment, saw significant price increases in 2023, impacting profitability.

- Component Price Volatility: Global supply chain issues and inflation have led to fluctuating prices for essential network hardware.

- Labor Expenses: Demand for skilled technicians and engineers in the telecom sector contributes to upward pressure on wages.

- Impact on Margins: Even with moderating inflation, the cumulative effect of higher operating costs can squeeze profit margins if not effectively managed.

Revenue Diversification and Value-Added Services

Euskaltel actively diversifies revenue streams to mitigate the impact of declining traditional service revenues and intense market competition. The company's strategy centers on offering integrated communication packages, often bundling mobile, fixed-line, and internet services.

A key driver for future revenue growth is Euskaltel's focus on high-performance data services and premium pay-TV offerings. Beyond core telecommunications, the company is expanding into adjacent markets such as energy provision and home security systems, aiming to capture additional customer spending.

- Bundled Services: Euskaltel's bundled packages are designed to increase customer loyalty and average revenue per user (ARPU).

- Value-Added Services: Investments in high-speed broadband and advanced TV content are crucial for differentiation.

- New Markets: Entry into sectors like energy and alarms represents a strategic move to broaden the customer value proposition.

- Revenue Growth Drivers: The company anticipates that these diversified offerings will contribute significantly to its top-line growth in the coming years.

The Spanish economy is a key factor for Euskaltel, influencing consumer spending and business investment in telecommunications. While economic growth provides a favorable environment, factors like inflation and interest rates directly affect operating costs and the affordability of services for customers.

Spain's GDP growth has shown resilience, with projections indicating a moderate expansion in 2024 and 2025, supporting demand for telecom services. However, persistent inflation, particularly in energy and raw materials, continues to pressure operational expenses for companies like Euskaltel.

Interest rate hikes by the European Central Bank, aimed at curbing inflation, can increase the cost of borrowing for capital-intensive projects like network upgrades, potentially impacting Euskaltel's investment capacity.

| Economic Indicator | Value (2024/2025 Projection) | Impact on Euskaltel |

|---|---|---|

| Spanish GDP Growth | ~2.0% (2024), ~1.8% (2025) | Supports demand for telecom services, increased consumer spending. |

| Eurozone Inflation Rate | ~2.5% (2024), ~2.0% (2025) | Moderating but still impacts operating costs (energy, components). |

| ECB Interest Rates | ~4.5% (main refinancing operations) | Increases cost of capital for network investments and debt servicing. |

Full Version Awaits

Euskaltel PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Euskaltel PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a thorough understanding of the external forces shaping Euskaltel's strategic landscape.

Sociological factors

Bridging the digital divide, especially in rural Spain, presents both a significant challenge and a substantial opportunity for Euskaltel. Many areas still lack robust fiber optic infrastructure, limiting access to high-speed internet.

Euskaltel's initiative, 'Hegan', leverages 5G technology to deliver fiber-like speeds to these underserved rural communities. This strategy directly addresses national digital inclusion objectives, aiming to connect more citizens and businesses.

In 2024, Spain continued its push for digital transformation, with government initiatives targeting improved rural broadband. For instance, the 'UNICO-Banda Ancha' program allocated significant funds to expand fiber networks. Euskaltel's 5G solutions are well-positioned to complement these efforts, potentially reaching an estimated 20% of the Spanish population living in rural areas by 2025.

Consumers increasingly expect lightning-fast internet and dependable mobile coverage, fueled by a surge in data-hungry activities like streaming high-definition video, engaging on social media platforms, and utilizing cloud-based services. This escalating demand for seamless, high-speed connectivity is a significant sociological trend shaping the telecommunications landscape.

Euskaltel's strategic imperative involves not just meeting but anticipating these evolving consumer needs by offering integrated connectivity solutions. For instance, as of early 2024, the average household internet consumption in many European countries, including Spain where Euskaltel operates, has surpassed 300 GB per month, underscoring the need for robust network infrastructure.

Customer satisfaction is paramount in the fiercely competitive telecommunications sector, directly impacting retention. Euskaltel, now integrated into MASORANGE, demonstrated this commitment by reporting its strongest customer satisfaction scores for both residential and business customers in Q1 2024.

This achievement highlights a deliberate emphasis on enhancing the user experience and the overall quality of services provided. Such positive feedback is a critical sociological indicator, reflecting how well the company is meeting societal expectations for reliable and satisfactory communication services.

Changing Work and Lifestyle Patterns

The global shift towards remote work, significantly amplified by events in 2020-2021, has cemented the necessity of robust home connectivity. This trend shows no signs of reversing, with many companies continuing to offer hybrid or fully remote options. For instance, a 2024 survey indicated that over 60% of professionals in Spain prefer a hybrid work model, underscoring the sustained demand for reliable home internet.

Euskaltel's business model is directly influenced by these evolving lifestyle patterns. As more individuals and families spend increased time at home, their reliance on high-speed broadband for work, education, and entertainment escalates. This makes Euskaltel's integrated connectivity solutions, including fiber optic internet and television services, more critical than ever for daily life.

- Increased Demand for Broadband: The sustained adoption of remote work models fuels consistent demand for high-speed internet services.

- Home as a Hub: Homes are increasingly serving as centers for work, education, and social interaction, requiring dependable digital infrastructure.

- Service Integration Value: Bundled offerings from providers like Euskaltel, combining internet, mobile, and TV, become more attractive as consumers seek seamless home connectivity.

Digital Literacy and Adoption

The digital literacy and readiness of Euskaltel's customer base significantly impact the adoption of new telecommunication services. In Spain, as of early 2024, approximately 88% of households had internet access, with a growing emphasis on digital skills across various age groups.

Euskaltel actively works to bridge the digital divide and foster greater adoption. Initiatives like technology conferences and community workshops aim to demystify advanced digital solutions, thereby encouraging uptake among both individual consumers and businesses.

- Digital Inclusion Efforts: Euskaltel's programs focus on enhancing digital skills, particularly for older demographics and underserved communities, to ensure broader access to its services.

- Growing Internet Penetration: With Spain's household internet penetration rate at 88% in early 2024, there's a substantial and expanding market for advanced digital services.

- Impact on Service Adoption: Higher digital literacy directly correlates with increased consumer willingness to adopt and utilize new digital offerings, from smart home devices to advanced connectivity solutions.

Societal expectations for seamless connectivity are rising, driven by increased data consumption from streaming and social media. Euskaltel's focus on customer satisfaction, with strong Q1 2024 scores, reflects its success in meeting these demands.

The ongoing trend of remote and hybrid work necessitates robust home internet, a need Euskaltel addresses with its integrated solutions. Over 60% of Spanish professionals preferring hybrid work in 2024 highlights this sustained demand.

Digital literacy is key to service adoption; Euskaltel's initiatives aim to boost this, especially in rural areas where internet penetration is still growing, with 88% of Spanish households having internet access by early 2024.

| Sociological Factor | Trend/Observation | Euskaltel Relevance |

| Connectivity Expectations | Rising demand for high-speed internet for streaming, social media. | Euskaltel's integrated solutions meet this need. |

| Remote Work | Sustained preference for hybrid work models (60%+ in Spain, 2024). | Drives demand for reliable home broadband. |

| Digital Literacy | Growing importance; 88% Spanish household internet access (early 2024). | Euskaltel's training programs enhance service adoption. |

Technological factors

Euskaltel, now part of the MásMóvil Group, is aggressively rolling out its 5G network. By mid-2024, an impressive 90% of the Basque population could access their 5G mobile technology, a significant leap in connectivity.

This expansion isn't just for consumers. Euskaltel is also providing advanced 5G Standalone services specifically tailored for businesses. This means companies can benefit from the highest levels of quality and security for their operations.

Euskaltel has made significant strides in its technological infrastructure, transitioning its network to fiber optics. This strategic move means that over 80% of its broadband customers are now connected via fiber, a testament to their commitment to advanced connectivity.

The company's Fiber-to-the-Home (FTTH) deployment has reached an impressive nearly 100% of the Basque population, solidifying its position as a leader in broadband access within the region. This extensive fiber coverage is a core component of Euskaltel's ongoing growth strategy.

Continued investment in expanding and enhancing its fiber optic network remains a crucial technological pillar for Euskaltel. This focus is essential for maintaining a competitive edge and meeting the ever-increasing demand for high-speed internet services.

The telecommunications industry is rapidly embracing Artificial Intelligence (AI) and the Internet of Things (IoT). These technologies are not just buzzwords; they are actively reshaping how companies like Euskaltel operate. For instance, AI can automate customer service, predict network issues before they occur, and personalize user experiences. IoT, on the other hand, opens up new revenue streams and service possibilities through connected devices.

Euskaltel is actively investigating how AI and IoT can boost operational efficiency and deliver real-time services. A tangible example of this is their exploration of connected V16 beacons for road safety. This initiative leverages IoT to gather data and AI to analyze it, potentially improving traffic management and emergency response times. Such advancements are crucial for staying competitive in a dynamic market.

Network Sharing and Infrastructure Agreements

Euskaltel actively utilizes network sharing agreements with other significant telecommunications operators. This strategy is crucial for expanding its national coverage and enhancing operational efficiency, particularly in areas where its own infrastructure is less developed. These collaborations are instrumental in broadening the company's service reach and expediting the deployment of broadband services throughout Spain.

In 2023, the Spanish telecommunications market saw continued investment in infrastructure, with operators like Euskaltel benefiting from shared resources. For instance, agreements for passive infrastructure sharing, such as towers and ducts, allow for reduced capital expenditure and faster rollout of 5G and fiber optic networks. This approach is particularly effective in rural or less densely populated regions where building entirely new infrastructure would be cost-prohibitive.

- Network Sharing Benefits Euskaltel's participation in network sharing allows it to access a wider footprint without the full cost of independent deployment, boosting its competitive edge.

- Accelerated Broadband Rollout These agreements directly contribute to faster availability of high-speed internet services across more Spanish territories.

- Efficiency Gains By sharing infrastructure, Euskaltel can optimize its capital and operational expenditures, leading to improved profitability and investment capacity.

Cybersecurity and Data Security

As technological advancements accelerate, so do the associated cybersecurity risks, a critical consideration for Euskaltel. The company actively participates in technology conferences, underscoring cybersecurity as a strategic imperative for safeguarding its networks and sensitive customer data against increasingly sophisticated threats.

Euskaltel's commitment to robust data security is not merely a compliance measure but a foundational element of its operational strategy. This focus is crucial in an era where data breaches can lead to significant financial losses and reputational damage.

- Increased Threat Landscape: The constant evolution of cyber threats requires ongoing investment in advanced security solutions.

- Data Protection Regulations: Euskaltel must adhere to stringent data protection laws, such as GDPR, which impose significant penalties for non-compliance.

- Customer Trust: Maintaining customer confidence hinges on the company's ability to demonstrably protect their personal information.

- Network Resilience: Ensuring the integrity and availability of its network infrastructure is paramount to service delivery.

Euskaltel's technological advancements are centered on its aggressive 5G rollout, with 90% of the Basque population having access by mid-2024, alongside business-focused 5G Standalone services. The company has also significantly upgraded its infrastructure, with over 80% of broadband customers now on fiber optics, and nearly 100% of the Basque population covered by Fiber-to-the-Home (FTTH).

The integration of AI and IoT is a key focus for Euskaltel, aiming to enhance operational efficiency and explore new service opportunities, such as connected V16 beacons for road safety. Furthermore, network sharing agreements are crucial for expanding national coverage and improving efficiency, particularly in less developed areas, allowing for reduced capital expenditure and faster network deployment.

Cybersecurity is a critical technological factor for Euskaltel, necessitating ongoing investment in advanced security solutions to protect networks and customer data against evolving threats, ensuring compliance with regulations like GDPR and maintaining customer trust.

| Technology Area | Status/Initiative | Impact |

|---|---|---|

| 5G Network | 90% Basque population access (mid-2024) | Enhanced mobile connectivity, new business services |

| Fiber Optics | 80%+ broadband customers on fiber; nearly 100% FTTH in Basque Country | Superior broadband speeds, improved customer experience |

| AI & IoT | Exploring for operational efficiency and new services (e.g., connected beacons) | Automation, predictive maintenance, new revenue streams |

| Network Sharing | Agreements with other operators | Expanded national coverage, cost efficiency, faster deployment |

| Cybersecurity | Strategic imperative, ongoing investment | Data protection, network resilience, customer trust |

Legal factors

Euskaltel navigates a complex web of telecommunications regulations in Spain and across the European Union. These rules govern crucial aspects like how companies acquire and use radio frequencies (spectrum allocation), how they set prices for their services, and the terms under which competitors can access their networks. For instance, the EU's Digital Decade targets aim to expand 5G coverage and gigabit connectivity by 2030, influencing investment and operational strategies for companies like Euskaltel.

The regulatory environment is not static; it's constantly evolving. European bodies and national regulators frequently review and update these rules. The primary goals are usually to encourage more competition within the sector, which can lead to better services and prices for consumers, and to ensure that essential telecommunications services are available to everyone, regardless of their location – a concept known as universal service. This dynamic nature means Euskaltel must remain agile in its compliance and strategic planning.

Euskaltel's operations are heavily influenced by data protection regulations like the General Data Protection Regulation (GDPR) and Spain's Organic Law on Data Protection and Guarantee of Digital Rights (LOPDGDD). Compliance is critical due to the vast amounts of customer information the company manages, impacting its marketing, service delivery, and customer relationship management strategies.

The company's commitment to data privacy is underscored by the appointment of a Data Protection Officer and the implementation of robust procedures for handling personal data and respecting shareholder rights. This focus ensures adherence to legal requirements and builds customer trust, a vital asset in the telecommunications sector.

The successful completion of the Orange-MásMóvil merger in March 2024 highlights the critical role of regulatory approvals in the telecommunications sector. This landmark deal, valued at approximately €19 billion, required thorough scrutiny and sign-off from the European Commission and the Spanish government.

These approvals were contingent on significant commitments from the merged entity to maintain market competition. For instance, the combined company, MasOrange, agreed to divest certain assets, including mobile spectrum and retail stores, to address potential antitrust concerns raised by regulators.

Such regulatory oversight directly shapes the operational landscape and strategic direction of major players like Euskaltel. Future M&A activities or significant market changes will undoubtedly face similar rigorous examination, impacting growth strategies and market positioning within the Spanish and broader European telecom markets.

Consumer Protection Laws

Euskaltel operates within a framework of stringent consumer protection laws. These regulations dictate how service contracts are structured, ensure fair billing practices, and mandate effective complaint resolution processes. For example, the recent Code of Conduct for the telecommunications sector in Spain, which came into effect in early 2024, emphasizes a mediation system to efficiently address consumer disputes, aiming to improve customer satisfaction and trust.

Adherence to these consumer protection measures is crucial for Euskaltel's reputation and operational integrity. Non-compliance can lead to significant fines and reputational damage, impacting customer acquisition and retention. The Spanish government, through bodies like the National Commission for Markets and Competition (CNMC), actively enforces these consumer rights, ensuring a level playing field and protecting subscribers from unfair practices.

- Service Contracts: Laws ensure transparency in contract terms, including pricing, service levels, and termination clauses.

- Billing Practices: Regulations prevent deceptive billing and require clear, itemized statements for all charges.

- Complaint Resolution: Companies must provide accessible and timely mechanisms for addressing customer grievances.

- Data Protection: Euskaltel must comply with GDPR and sector-specific data handling rules, as reinforced by the new Code of Conduct.

Infrastructure Deployment Regulations

The rollout of critical telecommunications infrastructure like fiber optic and 5G networks for Euskaltel is heavily influenced by a complex web of legal requirements. These regulations, spanning both local municipalities and national governments, dictate everything from the necessary permits for construction to the environmental impact assessments and the rules governing the use of public land. Navigating these legal hurdles efficiently is paramount for Euskaltel to achieve its expansion goals on schedule and in full compliance with the law.

Key legal considerations for Euskaltel's infrastructure deployment include:

- Permitting Processes: Obtaining permits for trenching, pole attachments, and tower construction can be time-consuming and vary significantly by region. For instance, in Spain, the General Telecommunications Law (Ley General de Telecomunicaciones) outlines many of these requirements.

- Environmental Impact Assessments: Regulations often mandate thorough environmental studies to mitigate potential harm to ecosystems during network construction, impacting project timelines and costs.

- Public Land Access: Agreements for using public rights-of-way and easements are legally binding and require adherence to specific terms and conditions set by local authorities.

- Spectrum Licensing: For 5G deployment, securing and maintaining appropriate spectrum licenses from regulatory bodies like Spain's Ministry of Economic Affairs and Digital Transformation is a fundamental legal prerequisite.

Legal factors significantly shape Euskaltel's operational landscape, particularly concerning spectrum allocation, pricing, and network access, all governed by EU and Spanish telecommunications regulations. The EU's Digital Decade targets, aiming for widespread gigabit connectivity by 2030, directly influence Euskaltel's investment in 5G and fiber infrastructure, requiring adherence to evolving regulatory frameworks designed to foster competition and ensure universal service access.

Data protection laws, including GDPR and Spain's LOPDGDD, are paramount, impacting how Euskaltel manages customer data, affecting marketing and service delivery strategies. The company's compliance, exemplified by appointing a Data Protection Officer, is crucial for maintaining customer trust and avoiding penalties. This focus on privacy is a legal and strategic imperative in the digital age.

Consumer protection laws mandate transparent service contracts, fair billing, and effective complaint resolution, with Spain's early 2024 Code of Conduct emphasizing mediation for disputes. Adherence to these rules, enforced by bodies like the CNMC, is vital for Euskaltel's reputation and customer retention, preventing significant fines and reputational damage.

Infrastructure deployment for Euskaltel, including 5G and fiber, is subject to extensive legal requirements for permits, environmental impact assessments, and public land access, as detailed in Spain's General Telecommunications Law. Securing spectrum licenses from the Ministry of Economic Affairs and Digital Transformation is also a fundamental legal prerequisite for 5G rollout.

Environmental factors

Euskaltel's parent company, MásMóvil, has set ambitious environmental goals, aiming for net zero carbon emissions in scopes 1 and 2 since 2020. This commitment is validated by the Science Based Targets initiative (SBTi).

Further reinforcing this, MásMóvil has established a near-term objective to reduce its Scope 1 and 2 emissions by 42% between 2022 and 2030. These targets reflect a strong focus on sustainability within the group's operations.

Euskaltel is actively increasing its renewable energy capacity, aiming for a cleaner and more self-sufficient energy model. This strategic shift is evident in its efforts to expand renewable energy use across its facilities and reduce overall gas consumption.

In 2024, Euskaltel reported that 60% of its electricity consumption was sourced from renewables, a significant increase from 45% in 2022. The company plans to reach 80% renewable sourcing by 2026, further solidifying its commitment to environmental sustainability.

Euskaltel is actively engaged in responsible waste management, striving to minimize landfill contributions and champion circular economy principles. This commitment involves enhancing resource efficiency throughout its extensive network infrastructure and corporate activities.

Environmental Governance and Reporting

Euskaltel demonstrates a strong commitment to environmental governance through its annual Environmental Declaration, adhering to the EU Eco-Management and Audit Scheme (EMAS) regulations. This declaration meticulously outlines the company's environmental impact, including energy consumption and waste management, and details its ongoing initiatives for continuous improvement. For instance, in its 2023 declaration, Euskaltel reported a 5% reduction in its overall carbon footprint compared to the previous year, primarily driven by increased renewable energy sourcing for its operations.

This transparent reporting approach not only fulfills regulatory requirements but also underscores Euskaltel's dedication to environmental accountability. By openly sharing its performance data and improvement strategies, the company fosters trust and engagement with its diverse stakeholder base, including investors, customers, and regulatory bodies. This proactive stance in environmental reporting is becoming increasingly crucial as sustainability metrics gain prominence in investment decisions and corporate valuations.

Key aspects of Euskaltel's environmental reporting include:

- EMAS Compliance: Adherence to the EU Eco-Management and Audit Scheme for verified environmental performance.

- Carbon Footprint Reduction: Documented efforts to lower greenhouse gas emissions, with a 5% reduction reported for 2023.

- Resource Efficiency: Data on energy consumption and waste generation, highlighting efficiency improvements.

- Stakeholder Transparency: Open communication of environmental impact and improvement plans to all interested parties.

Sustainable Business Practices and ESG Integration

Euskaltel, now a key player within the MásMóvil Group, is actively weaving Environmental, Social, and Governance (ESG) principles into its core business strategy. This commitment extends beyond mere environmental stewardship to encompass a broader vision of positive societal impact and robust governance. For instance, Euskaltel’s 2023 sustainability report highlighted a 15% reduction in its carbon footprint compared to 2022, demonstrating tangible progress in its environmental goals.

The group's focus on ESG integration is evident in its efforts to build more inclusive communities and enhance corporate governance. This approach aims to ensure long-term value creation, not just for shareholders, but for all stakeholders. Euskaltel's investment in digital inclusion programs reached over 50,000 individuals in 2023, showcasing its dedication to social impact initiatives.

Key environmental and social initiatives include:

- Energy Efficiency: Implementing measures to reduce energy consumption across its network infrastructure and offices, aiming for a 20% decrease in energy intensity by 2025.

- Circular Economy: Promoting the repair and recycling of electronic equipment to minimize waste and extend product lifecycles.

- Digital Inclusion: Developing programs to bridge the digital divide and provide access to technology and digital skills training for underserved populations.

- Ethical Governance: Upholding high standards of transparency, accountability, and ethical conduct in all business dealings.

Euskaltel's environmental strategy is deeply integrated with its parent company, MásMóvil, which has committed to net-zero carbon emissions by 2020 (scopes 1 & 2) and a 42% reduction in these emissions by 2030 from a 2022 baseline. The company is significantly increasing its renewable energy usage, reaching 60% of its electricity consumption from renewables in 2024, up from 45% in 2022, with a target of 80% by 2026. Euskaltel also prioritizes waste management and circular economy principles, evidenced by a 5% reduction in its carbon footprint in 2023 compared to the prior year, as detailed in its EMAS-compliant Environmental Declaration.

| Environmental Metric | 2022 Value | 2023 Value | 2024 Target/Actual | 2026 Target |

|---|---|---|---|---|

| Scope 1 & 2 Emissions Reduction (vs 2022) | - | - | - | 42% |

| Renewable Electricity Sourcing | 45% | - | 60% | 80% |

| Carbon Footprint Reduction (vs previous year) | - | 5% | - | - |

PESTLE Analysis Data Sources

Our Euskaltel PESTLE analysis is built on a robust foundation of data from official Spanish and Basque government agencies, leading economic indicators from institutions like Eurostat, and comprehensive industry reports from telecommunications sector analysts. This ensures our insights into political, economic, social, technological, legal, and environmental factors are accurate and relevant to Euskaltel's operating environment.