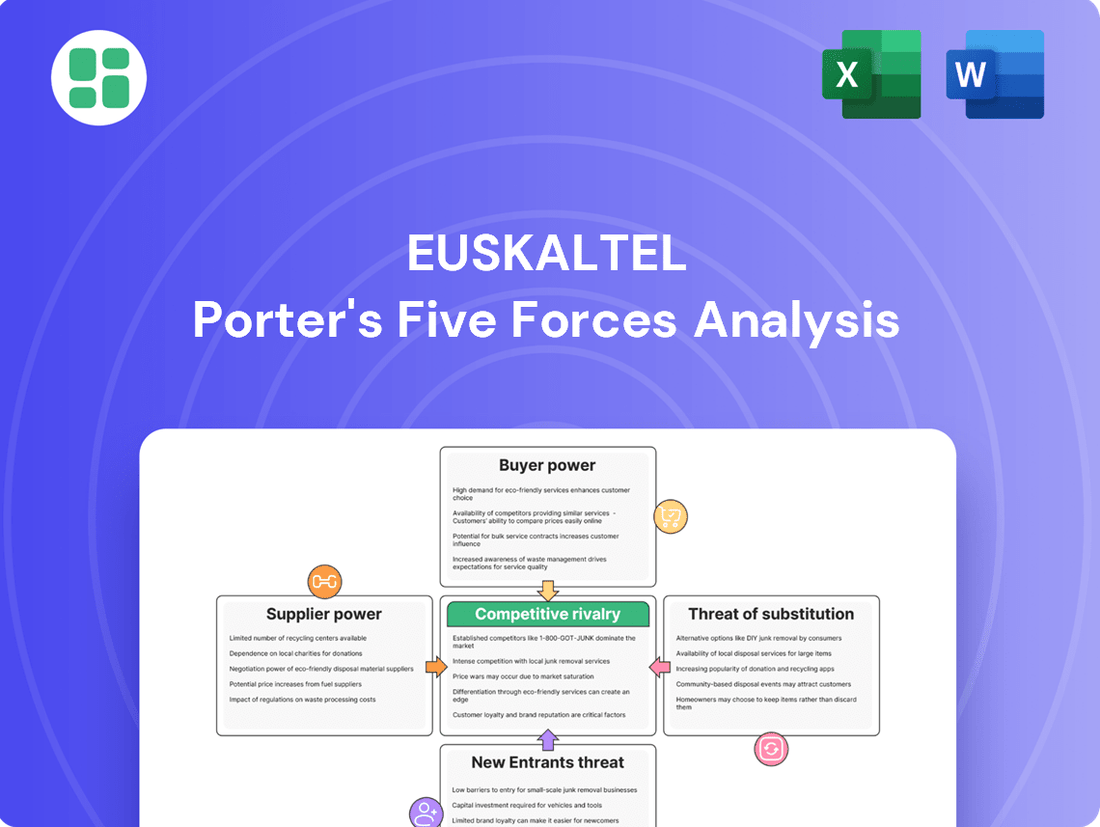

Euskaltel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Euskaltel Bundle

Euskaltel operates within a dynamic telecommunications landscape, where intense rivalry among existing players significantly shapes its competitive environment. The bargaining power of buyers, particularly large corporate clients, also presents a considerable challenge, demanding competitive pricing and tailored service offerings.

The threat of substitutes looms large, as alternative communication and entertainment solutions constantly emerge, forcing Euskaltel to innovate and adapt its service portfolio. Understanding these critical forces is paramount for any strategic decision-making concerning Euskaltel's market position.

Ready to move beyond the basics? Get a full strategic breakdown of Euskaltel’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The telecommunications industry, including companies like Euskaltel, depends on a small number of specialized providers for crucial infrastructure such as fiber optic networks and mobile towers. This limited supplier base grants these providers considerable bargaining power, particularly when it comes to essential network components.

For instance, major equipment manufacturers like Nokia and Ericsson are key players, and their pricing and supply terms can significantly impact operators. While Euskaltel's integration into MasOrange and initiatives like FibreCo aim to bolster its infrastructure control, the reliance on these core network equipment and software vendors persists, maintaining their influence.

Changing core network technology suppliers, such as 5G equipment vendors like Ericsson or Nokia, involves substantial investment and operational disruption for telecommunications companies like Euskaltel. This significant undertaking can cost billions, with estimates for a full network overhaul running into the tens of billions of euros for major operators, thereby creating formidable switching costs.

These high switching costs inherently strengthen the bargaining power of Euskaltel's existing technology suppliers. The complexity of integrating new systems and the need for specialized expertise mean operators are often locked into long-term contracts, giving vendors considerable leverage in negotiations.

Suppliers possessing unique or patented technologies, such as those for advanced fiber optics or specialized network software, significantly influence pricing and terms. Euskaltel, now part of MasOrange, relies on innovations like 5G Stand Alone for business clients, which inherently elevates the bargaining power of providers of these critical components. This dependence can restrict Euskaltel's sourcing options and potentially increase the cost of delivering advanced services.

Labor and Specialized Expertise

The availability of highly skilled labor and specialized technical expertise is a key factor influencing supplier power for Euskaltel. Companies requiring niche skills for network deployment, maintenance, and the development of new services can face increased costs if such talent is scarce. This is especially pertinent with the ongoing expansion of 5G and fiber optic networks across Spain.

Shortages in specialized IT and telecommunications professionals can drive up labor costs, as companies compete for limited talent pools. For instance, the demand for network engineers with expertise in 5G deployment and cybersecurity remains high.

- High demand for 5G and fiber specialists: This creates leverage for skilled technicians and engineers.

- Reliance on external contractors: When internal expertise is insufficient, Euskaltel may need to engage specialized firms, increasing supplier power.

- Wage inflation in tech sectors: Competition for talent can lead to rising salary expectations for critical roles.

Content Providers for Digital Television

For Euskaltel's digital television services, content providers like sports broadcasters and movie studios hold significant sway. This is because the exclusive and highly sought-after nature of their programming directly impacts Euskaltel's ability to attract and keep subscribers.

As more viewers migrate to streaming services, the ability to offer compelling content packages becomes paramount for customer loyalty. The competition for these rights is intense, often leading to substantial costs for Euskaltel.

- Content Exclusivity: Rights holders for major sporting events and popular film franchises can command higher fees due to the limited availability of their content elsewhere.

- Subscriber Retention: A strong content offering is a key differentiator in the competitive pay-TV market, directly influencing churn rates.

- Negotiation Leverage: The growing popularity of direct-to-consumer streaming services by content creators can reduce their reliance on traditional distributors like Euskaltel, thereby increasing their bargaining power.

- Cost of Content: In 2024, the cost of acquiring premium content rights continued to be a major expenditure for telecom operators, with major sports leagues alone representing billions in annual rights fees globally.

The bargaining power of suppliers is a significant factor for Euskaltel, especially given the industry's reliance on specialized infrastructure and content. Key suppliers of network equipment, such as Ericsson and Nokia, hold considerable leverage due to the high costs and complexity associated with switching providers, often running into billions of euros for network overhauls. Similarly, content providers for digital television services, including major sports broadcasters, wield substantial influence due to the exclusivity of their programming, which is critical for subscriber retention in a competitive market. The cost of acquiring premium content rights remained a major expenditure for telecom operators in 2024.

| Supplier Type | Key Players | Impact on Euskaltel | Reason for Power | 2024 Context |

|---|---|---|---|---|

| Network Equipment | Ericsson, Nokia | High dependency on pricing and supply terms | High switching costs, specialized technology | Continued high demand for 5G infrastructure upgrades |

| Content Providers | Sports Broadcasters, Movie Studios | Influence on subscriber acquisition and retention | Content exclusivity, direct-to-consumer competition | Significant expenditure on premium content rights globally |

| Specialized Labor | Network Engineers, IT Specialists | Potential for increased operational costs | Scarcity of niche skills, wage inflation | High demand for 5G and fiber optic deployment expertise |

What is included in the product

Tailored exclusively for Euskaltel, this analysis dissects the competitive forces impacting its operations, from supplier power to the threat of new entrants.

Quickly assess competitive threats and opportunities with a dynamic Euskaltel Porter's Five Forces analysis, highlighting key pressure points to inform strategic adjustments.

Customers Bargaining Power

The Spanish telecommunications landscape is a battleground, with Euskaltel, now part of MasOrange, facing formidable rivals like Telefónica and Vodafone. This intense competition, further amplified by a surge in Mobile Virtual Network Operators (MVNOs), means customers have a plethora of options at their fingertips.

With so many providers vying for attention, customers hold significant sway. They can readily switch to a competitor offering superior deals, more attractive service packages, or a better overall experience. This ease of switching directly translates to increased bargaining power for the consumer.

Switching costs for Euskaltel's customers in Spain are notably low, especially in the mobile sector. This ease of transition is amplified by prevalent promotions, the availability of contract-free plans, and straightforward number portability, allowing customers to switch providers with minimal friction.

This low switching cost environment directly impacts Euskaltel by necessitating continuous efforts to maintain customer loyalty through competitive pricing and appealing service bundles. For instance, in the Spanish telecommunications market, the churn rate can be a significant metric, and providers often engage in aggressive marketing campaigns to attract and retain subscribers, directly reflecting the power customers wield.

Residential customers in Spain, especially in a market where most households already have broadband, are very focused on price. They look for deals that bundle internet, phone, and TV services together, wanting the best value for their money. This means Euskaltel and MasOrange often have to use competitive pricing and special offers to get and keep customers, which can affect how much profit they make.

Availability of Bundled Packages

Euskaltel's business model is built around offering integrated communication packages, combining services like broadband, mobile, and television. This strategy aims to enhance customer loyalty by providing a convenient, all-in-one solution. However, it also means customers are acutely aware of the overall value proposition and expect competitive pricing across the entire bundle.

The availability of bundled packages directly impacts the bargaining power of Euskaltel's customers. If rival telecommunications providers present more appealing or adaptable bundles, customers possess a significant leverage point to consider switching. For instance, in 2024, the Spanish broadband market saw intense competition, with providers frequently adjusting bundle offers to attract new subscribers. Euskaltel's bundled approach, while beneficial for retention, necessitates continuous evaluation against competitor offerings to mitigate customer churn driven by superior value elsewhere.

- Bundled Offerings: Euskaltel's core strategy involves packaging multiple services.

- Customer Expectation: Bundles create an expectation of comprehensive value and competitive pricing.

- Competitive Threat: Competitors offering more attractive or flexible bundles empower customers to switch.

- Market Dynamics: In 2024, the Spanish telecom market experienced aggressive bundle competition, influencing customer switching behavior.

Information Transparency and Digital Comparison

Customers today wield significant influence due to readily available information about service providers. Online comparison platforms and digital channels allow consumers to easily scrutinize offerings, pricing, and peer reviews across the telecommunications landscape.

This heightened transparency directly empowers customers, enabling them to make well-informed choices and effectively negotiate for more favorable terms and pricing. For instance, in 2024, comparison sites saw a significant uptick in user engagement as consumers actively sought the best value.

- Increased Access to Information: Consumers can easily compare Euskaltel's services with competitors on platforms like Kelisto or HelpMyCash.

- Price Sensitivity: A significant percentage of telecom customers, often exceeding 60% in European markets, cite price as a primary factor in their switching decisions.

- Influence of Reviews: Online customer reviews and ratings heavily influence purchasing decisions, with a majority of consumers trusting them as much as personal recommendations.

- Demand for Value: This transparency fuels a demand for competitive pricing and superior service quality, forcing providers like Euskaltel to continuously innovate and offer compelling value propositions.

The bargaining power of customers in the Spanish telecommunications sector is substantial, driven by intense competition and low switching costs. Consumers can easily compare offers from Euskaltel and its rivals, leveraging readily available information and online platforms to secure better deals.

This environment forces providers to focus on competitive pricing and attractive bundled packages to retain subscribers. In 2024, the Spanish market continued to see aggressive promotions, with customer price sensitivity remaining a key factor influencing purchasing decisions and provider strategies.

| Factor | Impact on Euskaltel | Customer Action |

|---|---|---|

| Low Switching Costs | Increased churn risk | Customers switch providers easily for better deals. |

| Price Sensitivity | Pressure on margins | Customers actively seek discounted bundles and promotions. |

| Information Availability | Need for transparency | Customers compare services and pricing on comparison sites. |

| Bundled Offerings | Customer expectation of value | Customers switch if competitor bundles offer superior value or flexibility. |

Same Document Delivered

Euskaltel Porter's Five Forces Analysis

This preview showcases the complete Euskaltel Porter's Five Forces Analysis, providing a detailed examination of the competitive landscape for the company. You are viewing the exact document you will receive immediately after purchase, ensuring full transparency and no hidden surprises. This professionally formatted analysis is ready for your immediate use, offering valuable insights into Euskaltel's strategic positioning.

Rivalry Among Competitors

The Spanish telecom sector is characterized by high market concentration, with Telefónica (Movistar), Vodafone Spain, and the recently merged MasOrange (combining Euskaltel, Orange, and MásMóvil) holding substantial market share. This oligopolistic structure fuels intense competition among these major integrated operators.

The formation of MasOrange in 2024 significantly altered the competitive dynamics, establishing a new leader in terms of customer base and intensifying the rivalry for subscribers and revenue. This consolidation means fewer, larger entities are vying for dominance.

Competitive rivalry in the telecommunications sector is intense, with companies frequently engaging in aggressive pricing and bundling strategies. This means customers often see a stream of promotional offers and packages that combine fixed-line, mobile, and television services. For instance, in 2024, many European telecom operators continued to offer significant discounts on bundled services to win market share, impacting average revenue per user (ARPU) across the board.

These price wars and complex bundles can significantly reduce profit margins for all players in the industry. Euskaltel, now operating as part of the larger MasOrange entity, faces the challenge of differentiating itself beyond just price. This necessitates a constant focus on innovating its product and service offerings to provide unique value that attracts and retains customers, even amidst fierce competition.

Major telecommunications players are engaged in a significant capital expenditure race, aggressively rolling out and enhancing their fiber optic and 5G infrastructure. This push for superior network coverage and speed intensifies competition within the sector. For Euskaltel, now part of the MasOrange group, this means substantial ongoing investment is crucial to keep pace and ensure high-quality service delivery.

In 2024, the Spanish market continued to see substantial investment in these areas. For instance, MasOrange itself has committed billions to network modernization. This relentless infrastructure expansion creates a highly competitive environment where maintaining a leading position requires continuous and significant financial commitment to technological advancement and network reach.

Strong Presence of MVNOs and Regional Operators

The Spanish telecommunications landscape is characterized by more than just major players. A significant number of Mobile Virtual Network Operators (MVNOs) and robust regional operators actively compete. These entities, including Euskaltel itself which operates as a regional brand within the larger MasOrange group, often cater to specific customer groups or provide attractively priced services. This dynamic adds another layer of intense competition to the market.

These smaller, agile competitors frequently focus on underserved niches or deliver aggressively priced plans, directly challenging the established operators. For instance, companies like Digi Spain, a prominent MVNO, have seen substantial subscriber growth, reporting over 4 million customers by the end of 2023, highlighting the impact of competitive pricing strategies on market share.

- MVNO Growth: Digi Spain surpassed 4 million customers in 2023, demonstrating the increasing market penetration of virtual operators.

- Regional Strength: Euskaltel's continued presence, even within a larger conglomerate, signifies the enduring appeal of regional brand loyalty and tailored offerings.

- Price Sensitivity: The success of low-cost providers indicates a significant segment of the Spanish market is highly responsive to competitive pricing.

- Market Fragmentation: The presence of numerous MVNOs and regional players contributes to a more fragmented and competitive market structure.

Focus on Customer Experience and Value-Added Services

As basic telecommunications services become more uniform, competition is intensifying around customer experience and the delivery of extra benefits. Euskaltel, now part of MasOrange, is actively enhancing customer satisfaction and exploring new revenue sources beyond just providing internet and mobile connections.

This strategic shift is evident in MasOrange's significant investments in network upgrades and digital customer service platforms. For instance, in 2023, MasOrange reported a substantial increase in customer satisfaction scores, partly attributed to their focus on personalized support and streamlined digital interactions, aiming to differentiate themselves in a crowded market.

- Focus on Customer Experience: Companies are prioritizing customer satisfaction through improved service quality and personalized interactions.

- Value-Added Services: Expansion into areas like cybersecurity, IoT, and cloud solutions offers new revenue streams and competitive advantages.

- Investment in Digital Platforms: Enhancing digital tools and customer service channels is crucial for meeting evolving customer expectations.

- Revenue Diversification: Moving beyond traditional connectivity allows operators to reduce reliance on commoditized core services.

The competitive rivalry within the Spanish telecommunications sector, where Euskaltel now operates as part of MasOrange, is exceptionally fierce. This intensity is driven by a highly concentrated market dominated by a few large integrated players, including the newly formed MasOrange, Telefónica, and Vodafone Spain. Aggressive pricing, continuous bundling of services, and substantial investments in 5G and fiber optic infrastructure are standard tactics employed by these entities to capture and retain market share.

The consolidation that led to the creation of MasOrange in 2024 has amplified this rivalry, as the combined entity now leads in customer numbers, intensifying the battle for subscribers. Furthermore, the presence of numerous Mobile Virtual Network Operators (MVNOs) and strong regional players, like Euskaltel itself, adds another layer of competition by offering attractively priced alternatives and catering to specific market niches. This dynamic forces all operators to constantly innovate and focus on customer experience to differentiate themselves beyond mere price competition.

| Competitor | Key Strategy | 2024 Focus Areas |

|---|---|---|

| MasOrange (incl. Euskaltel) | Market Leadership, Bundling, Network Investment | 5G/Fiber Expansion, Customer Experience, Digital Services |

| Telefónica (Movistar) | Integrated Services, Network Quality, Digitalization | Fiber Rollout, 5G Standalone, Value-Added Services |

| Vodafone Spain | Network Modernization, Customer Retention, Bundled Offers | 5G Deployment, IoT Solutions, Flexible Plans |

| Digi Spain (MVNO) | Aggressive Pricing, Value-Focused Plans | Subscriber Growth, Network Access, Customer Acquisition |

SSubstitutes Threaten

Over-the-top (OTT) services present a substantial threat to Euskaltel's core business. Platforms like WhatsApp have significantly eroded traditional voice revenues, with global mobile messaging traffic reaching an estimated 100 trillion messages in 2024. Similarly, the proliferation of streaming services such as Netflix, Amazon Prime Video, and Disney+ directly competes with Euskaltel's digital television offerings, capturing a larger share of consumer entertainment spending.

The unbundling of internet and mobile services presents a significant threat to Euskaltel. Customers can now easily source these essential services independently, bypassing the need for bundled packages. This fragmentation allows consumers to cherry-pick providers based on specific needs and price points, directly challenging the appeal of Euskaltel's integrated offerings.

This trend is amplified by the growing presence of Mobile Virtual Network Operators (MVNOs). These companies often specialize in either mobile-only or internet-only plans, providing highly competitive and flexible options. For instance, in 2024, the European market saw a continued surge in MVNO market share, with some regions reporting MVNOs capturing over 20% of the mobile subscriber base, directly siphoning off customers who might otherwise opt for a full-service provider like Euskaltel.

While fiber optic networks are the backbone of broadband in Spain, alternative technologies present a competitive threat to Euskaltel. Satellite internet, notably services like Starlink, and 5G fixed wireless access (FWA) can act as substitutes, especially in regions where fiber deployment is less mature. These alternatives cater to specific user segments, offering broadband where traditional infrastructure is lacking.

Self-Provisioned Wi-Fi and Public Hotspots

The increasing prevalence of self-provisioned Wi-Fi, often via mobile hotspots, and readily available public Wi-Fi networks presents a growing threat to traditional fixed broadband providers like Euskaltel. These alternatives allow users to bypass dedicated internet services for certain tasks, particularly for mobile or intermittent data needs. For instance, in 2024, a significant portion of mobile users regularly utilize tethering, especially in urban areas where public Wi-Fi is abundant.

While not a direct replacement for high-speed, reliable home internet, these substitutes can erode the perceived necessity and value of fixed broadband subscriptions, especially for less data-intensive users. This can impact Euskaltel's ability to attract and retain customers who find these free or low-cost alternatives sufficient for their needs. The trend is further amplified by the expanding reach and speed of 5G mobile networks, making tethering a more viable option for a wider range of activities.

- Mobile Tethering: A growing number of smartphone users leverage their mobile data plans to create personal Wi-Fi hotspots, offering an alternative to fixed broadband for laptops and other devices.

- Public Wi-Fi Availability: Cafes, libraries, airports, and public transport hubs increasingly offer free Wi-Fi, reducing the need for mobile data or fixed connections when out and about.

- Impact on Data Consumption: These substitutes can shift data consumption away from fixed lines, influencing how customers perceive the value and necessity of their broadband packages.

- 5G Network Expansion: The continued rollout and improvement of 5G mobile technology enhance the speed and reliability of mobile data, making tethering a more compelling substitute for some users.

Shift in Media Consumption Habits

The shift in media consumption habits presents a significant threat of substitutes for Euskaltel's traditional digital television services. Consumers are increasingly opting for on-demand content, personalized viewing experiences, and engaging with content through social media platforms. This evolving behavior directly challenges the appeal of linear television packages.

For instance, by late 2023, global streaming services like Netflix and Disney+ reported substantial subscriber growth, indicating a strong consumer preference for flexible, internet-delivered entertainment. This trend forces traditional providers like Euskaltel to adapt by offering competitive streaming bundles or integrating with popular Over-The-Top (OTT) platforms to retain market share and relevance.

- Consumer shift to on-demand: A growing preference for watching content at a time convenient to the viewer.

- Personalized viewing: Demand for curated content recommendations and ad-free experiences.

- Social media integration: Content discovery and discussion increasingly happening on platforms like TikTok and Instagram.

- OTT platform dominance: Services like Netflix, Amazon Prime Video, and Disney+ offer vast libraries accessible via the internet, directly competing with traditional TV.

The threat of substitutes for Euskaltel is multifaceted, stemming from evolving consumer habits and technological advancements. Over-the-top (OTT) services and the unbundling of services are key disruptors, allowing consumers to access communication and entertainment through alternative, often more flexible, channels. Mobile tethering and public Wi-Fi also offer viable alternatives to fixed broadband for certain usage patterns.

The rise of MVNOs and alternative broadband technologies like satellite and fixed wireless access further fragments the market, presenting direct competitive challenges. These substitutes cater to specific customer needs and price sensitivities, eroding Euskaltel's bundled offering's appeal.

The shift towards on-demand streaming and personalized content consumption directly impacts Euskaltel's traditional digital television business. Global streaming services continue to gain subscribers, highlighting a strong consumer preference for internet-delivered entertainment over linear TV packages.

| Substitute Category | Key Examples | Impact on Euskaltel | Relevant Data (2024/Late 2023) |

| Over-the-Top (OTT) Communication | WhatsApp, Telegram | Erodes traditional voice revenues | Global mobile messaging traffic estimated at 100 trillion messages in 2024 |

| OTT Entertainment | Netflix, Amazon Prime Video, Disney+ | Competes with digital TV offerings | Substantial subscriber growth reported by major streaming platforms by late 2023 |

| Unbundled Services | Independent mobile, internet providers | Challenges bundled packages | MVNOs capturing over 20% of mobile subscriber base in some European regions in 2024 |

| Alternative Broadband | Starlink (Satellite), 5G Fixed Wireless Access | Provides broadband where fiber is less mature | Continued expansion of 5G FWA capabilities |

| Wi-Fi Alternatives | Mobile Tethering, Public Wi-Fi | Reduces need for fixed broadband for some tasks | Significant portion of mobile users regularly utilize tethering in urban areas |

Entrants Threaten

The Spanish telecommunications market presents a formidable barrier to new entrants due to the staggering capital investment needed for network infrastructure. Building out comprehensive fiber optic and 5G mobile networks requires billions of euros, a cost that deters many potential competitors from even entering the fray.

For instance, the rollout of 5G alone is a multi-billion euro undertaking, with significant ongoing investment required for spectrum licenses and network upgrades. This high upfront cost creates a substantial competitive advantage for established players like MasOrange, who have already made these extensive investments.

New entrants in the telecommunications sector, particularly for mobile services, confront substantial regulatory obstacles. A primary barrier is the necessity of acquiring licenses for spectrum, a finite and inherently expensive resource. For instance, in 2024, the European Union continued to refine spectrum allocation policies, with countries like Spain seeing new entrants like DIGI gain access through spectrum divestments mandated as part of larger mergers, such as the MasOrange transaction. However, these licensing processes are typically intricate and protracted, often taking years to complete, thereby significantly deterring potential new competitors.

Established brand loyalty and a strong customer base present a significant barrier to new entrants in the telecommunications sector. Incumbent operators like Euskaltel, a prominent regional player, and the consolidated MasOrange group, leverage decades of brand recognition and trust. For instance, MasOrange's combined customer base in Spain reached approximately 37 million mobile customers and 10 million fixed broadband customers by the end of 2023, illustrating the scale of loyalty new players must overcome.

Economies of Scale and Scope

Existing operators like MasOrange leverage significant economies of scale, especially in network infrastructure and customer service. This allows them to spread fixed costs over a larger subscriber base, leading to lower per-unit costs. For instance, MasOrange's 2024 reported revenue of €15.1 billion underscores the financial muscle derived from its scale.

These cost efficiencies enable established players to offer bundled services, such as mobile, broadband, and television, at highly competitive price points. New entrants find it challenging to replicate these bundled offerings profitably without achieving a substantial subscriber volume, which is a considerable barrier to entry.

- Economies of Scale: MasOrange's large operational footprint and subscriber base (over 30 million mobile customers in Spain as of early 2024) create significant cost advantages.

- Bundling Benefits: The ability to offer integrated services at attractive prices through economies of scope is a key deterrent for new, smaller competitors.

- Capital Investment: Matching the network quality and service breadth of incumbents requires immense upfront capital, which new entrants often lack.

- Customer Acquisition Costs: New entrants face high marketing and sales expenses to attract customers away from established, trusted brands.

Wholesale Access and MVNO Model as Entry Point

The threat of new entrants in the telecommunications sector, particularly for mobile services, is significantly influenced by the wholesale access and Mobile Virtual Network Operator (MVNO) model. Building a proprietary mobile network requires immense capital investment, creating a substantial barrier. However, MVNOs bypass this by securing wholesale access to an established operator's network infrastructure. This drastically reduces the initial capital outlay, making it feasible for new, smaller players to enter the market.

This model has been a key enabler for companies like Silbö in Spain, allowing them to offer mobile services without the burden of network construction. In 2023, the MVNO market continued to grow, with projections indicating further expansion as more niche providers identify underserved segments. For instance, the European MVNO market was valued at over €25 billion in 2022 and is expected to see a compound annual growth rate of around 5% through 2028. While this model lowers entry barriers, MVNOs often operate on thinner profit margins compared to network operators and remain reliant on their wholesale partners for network quality and service availability.

- Lowered Capital Requirements: The MVNO model eliminates the need for substantial investment in network infrastructure, significantly reducing the barrier to entry.

- Market Entry Facilitation: Companies like Silbö demonstrate how MVNOs can enter and compete in established markets by leveraging existing networks.

- Margin and Dependency Considerations: MVNOs typically face tighter profit margins and are dependent on the wholesale agreements with host network operators.

- Market Growth: The MVNO sector shows robust growth, with the European market valued at over €25 billion in 2022, indicating its increasing importance.

The threat of new entrants in the Spanish telecommunications sector is considerably low due to immense capital requirements for network infrastructure and spectrum licenses, estimated in the billions for technologies like 5G. Established players like MasOrange, with their extensive networks and over 37 million mobile customers by the end of 2023, benefit from significant economies of scale and brand loyalty, making it difficult for newcomers to compete on price and service breadth.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point |

|---|---|---|---|

| Capital Investment | Building 5G and fiber networks requires billions of euros. | High deterrent due to massive upfront costs. | 5G rollout is a multi-billion euro undertaking. |

| Regulatory Hurdles | Acquiring expensive and limited spectrum licenses. | Complex and lengthy licensing processes deter new competitors. | DIGI's entry in Spain was facilitated by spectrum divestments from mergers. |

| Brand Loyalty & Scale | Established customer bases and decades of brand recognition. | New entrants must overcome significant customer acquisition costs. | MasOrange had ~37 million mobile customers in Spain by end of 2023. |

| Economies of Scale | Lower per-unit costs for established operators. | Difficult for new entrants to match competitive pricing and bundled offers. | MasOrange's 2024 revenue was €15.1 billion. |

Porter's Five Forces Analysis Data Sources

Our Euskaltel Porter's Five Forces analysis is built upon a foundation of robust data, including Euskaltel's annual reports, investor presentations, and regulatory filings. We also incorporate industry-specific market research reports and data from telecommunications sector analysts to provide a comprehensive view of the competitive landscape.