Europris AS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Europris AS Bundle

Europris AS leverages its strong brand recognition and extensive store network as key strengths, but faces increasing competition and evolving consumer preferences. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Europris AS's strengths, opportunities, weaknesses, and threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Europris stands as Norway's undisputed largest discount variety retailer, a position solidified by its substantial sales volume. This market leadership translates into significant brand recognition, allowing for greater customer trust and loyalty.

This dominance also grants Europris considerable economies of scale in purchasing, enhancing its bargaining power with suppliers and potentially leading to more favorable terms. By the end of 2023, Europris operated a vast network of 287 stores throughout Norway, a testament to its extensive reach and accessibility.

Europris AS's discount variety retail model is a significant strength, particularly during economic downturns. Its focus on value-for-money products makes it highly resilient when consumers tighten their belts. For instance, in the first quarter of 2024, Europris reported a revenue increase of 5.1% year-on-year, demonstrating its ability to attract customers even in challenging economic conditions.

The company's campaign-driven concept and extensive selection of affordable goods, including a strong private label offering, consistently draw in shoppers. This strategy proves effective as consumers actively seek out cost-effective alternatives. Europris's ability to adapt to shifting consumer spending habits by offering compelling deals reinforces its enduring market relevance and sales stability.

Europris's strategic Nordic expansion is a significant strength, underscored by the full acquisition of the Swedish discount variety retailer ÖoB in May 2024. This move positions Europris to become a leading Nordic player, integrating two established brands.

The acquisition is projected to drive combined annual sales of approximately NOK 14 billion, significantly broadening Europris's customer base and market presence across the Nordic region. This expansion is a key pillar in their ambition for regional dominance.

Ongoing integration efforts and planned category enhancements are expected to unlock substantial value and create significant synergies. These initiatives are crucial for realizing the full potential of this strategic Nordic consolidation.

Diversified Product Assortment

Europris AS boasts a significantly diversified product assortment, encompassing everything from home goods and leisure items to clothing and seasonal products. This broad selection also includes daily consumables, offering a comprehensive shopping experience for value-seeking customers. The company strategically balances private-label merchandise with well-known brand names, appealing to a wide range of preferences and needs.

This extensive product mix is a key strength, reducing the company's dependence on any single product category. For instance, in the first quarter of 2024, Europris reported a 4.3% increase in total sales, highlighting the resilience and broad appeal of its diverse offerings. The ability to cater to various customer demands positions Europris as a go-to destination for everyday essentials and discretionary purchases alike.

- Broad Category Range Home goods, leisure, clothing, seasonal items, and consumables.

- Product Mix Strategy Combines private-label and national brand merchandise.

- Customer Appeal Acts as a one-stop-shop for value-conscious consumers.

- Sales Performance Indicator Q1 2024 sales growth of 4.3% reflects diversified product strength.

Strong Financial Health and Shareholder Returns

Europris AS demonstrates robust financial health, underscored by a strong gross profit margin in its Norwegian operations, which stood at approximately 56.5% for the first half of 2024. The company consistently maintains a healthy current ratio, indicating its ability to meet short-term obligations. This financial stability translates into attractive shareholder returns, with Europris offering a competitive dividend yield, reflecting management's confidence in sustained profitability and cash flow generation.

Key financial strengths include:

- Impressive Gross Profit Margin: Europris's core Norwegian business consistently achieves high gross profit margins, a testament to efficient operations and strong pricing power.

- Sustainable Current Ratio: The company maintains a healthy current ratio, typically above 1.2, ensuring liquidity and operational flexibility.

- Attractive Dividend Yield: Europris's commitment to shareholder returns is evident in its notable dividend yield, which has historically provided a solid income stream for investors.

- Solid Cash Flow Generation: The company's business model supports consistent and reliable cash flow, enabling reinvestment and shareholder distributions.

Europris's market dominance as Norway's largest discount variety retailer is a significant strength, translating into strong brand recognition and customer loyalty. This leadership position allows for considerable economies of scale in purchasing, enhancing its bargaining power with suppliers and leading to favorable terms. By the close of 2023, the company operated 287 stores across Norway, demonstrating extensive reach.

The discount variety model proves highly resilient, especially during economic downturns, as consumers prioritize value. This was evident in Q1 2024, where Europris reported a 5.1% year-on-year revenue increase, showcasing its ability to attract customers even in challenging economic climates. Their campaign-driven approach and extensive affordable product selection, including a robust private label offering, consistently draw shoppers seeking cost-effective alternatives.

Europris's strategic Nordic expansion, highlighted by the full acquisition of ÖoB in May 2024, positions it as a leading player in the region. This move is projected to drive combined annual sales of approximately NOK 14 billion, significantly broadening its customer base and market presence. Ongoing integration and planned category enhancements are key to unlocking substantial value and synergies from this consolidation.

The company boasts a diversified product assortment, ranging from home goods and leisure items to clothing and seasonal products, alongside daily consumables. This broad mix, balancing private-label and national brands, reduces dependence on any single category. Q1 2024 sales growth of 4.3% underscores the broad appeal and resilience of its diverse offerings, making it a go-to destination for value-conscious consumers.

Europris demonstrates robust financial health, with a strong gross profit margin of approximately 56.5% in its Norwegian operations for H1 2024. It consistently maintains a healthy current ratio, ensuring operational flexibility. The company's commitment to shareholder returns is reflected in its notable dividend yield, supported by consistent cash flow generation.

| Metric | Value (as of H1 2024) | Significance |

|---|---|---|

| Norwegian Gross Profit Margin | ~56.5% | Indicates strong operational efficiency and pricing power. |

| Current Ratio | Consistently > 1.2 | Demonstrates strong liquidity and ability to meet short-term obligations. |

| Dividend Yield | Notable | Reflects confidence in sustained profitability and commitment to shareholder returns. |

| Q1 2024 Revenue Growth | +5.1% | Highlights resilience and customer attraction in a challenging economic environment. |

What is included in the product

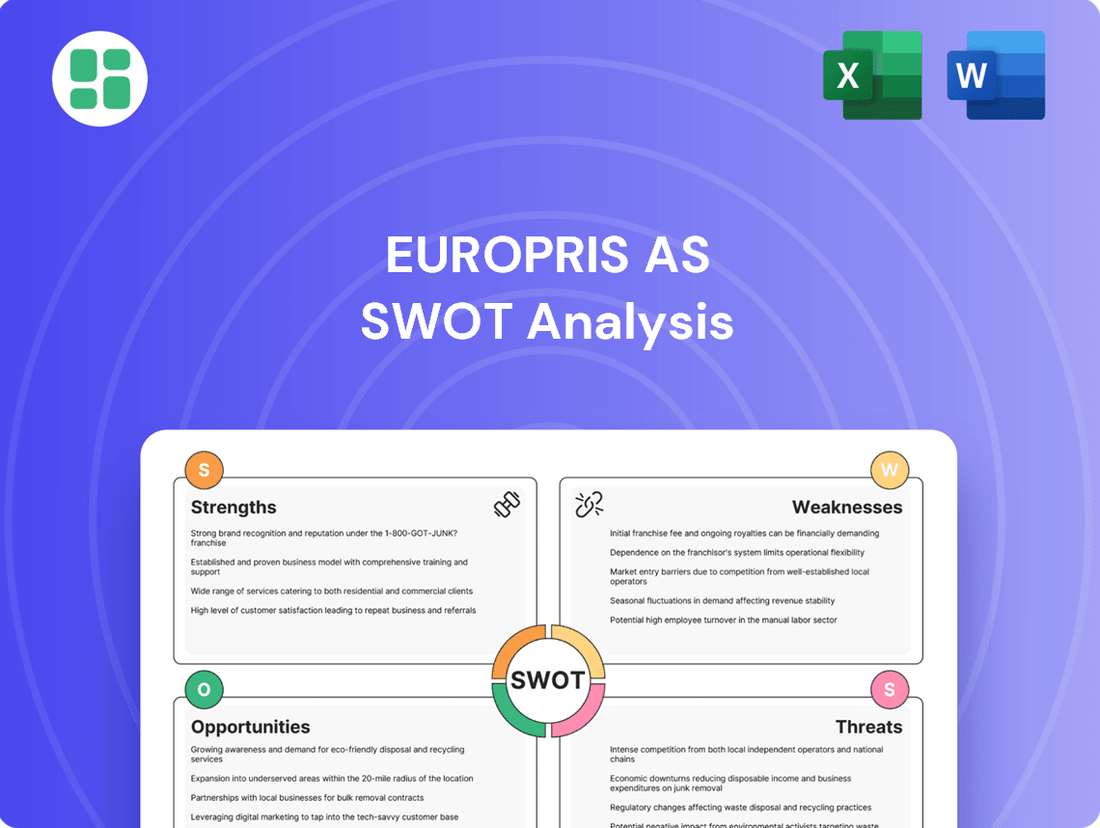

Offers a full breakdown of Europris AS’s strategic business environment, detailing its internal strengths and weaknesses alongside external market opportunities and threats.

Europris AS's SWOT analysis provides a clear, actionable roadmap to address competitive pressures and capitalize on market opportunities.

Weaknesses

Europris encountered significant profitability headwinds in the first quarter of 2025. Despite a notable 12.4% increase in group sales to NOK 2,038 million, the company posted a negative EBIT of NOK -45.1 million and a net loss. This performance highlights the immediate challenges in translating top-line growth into bottom-line results during this period.

The company's overall group gross margin saw a decline, falling to 37.8% from 40.2% in the prior year. This compression was largely attributed to the dilutive effects of the ÖoB acquisition and a less favorable product mix, with a greater proportion of sales coming from consumables and promotional items. These factors directly impacted core profitability, underscoring margin pressure.

Europris's full acquisition of ÖoB in Sweden presents integration hurdles. For instance, clearance sales at ÖoB, intended to clear inventory, unfortunately ate into sales at other Europris locations and put downward pressure on the company's gross margin during the initial phase. This highlights a key challenge in merging operations.

Successfully transforming ÖoB into a cohesive part of the Europris group demands substantial investment in aligning product assortments across both brands and updating store layouts. This process is resource-intensive and unfolds over time, impacting immediate operational efficiency and profitability as these changes are implemented.

Europris AS has seen its net debt climb to NOK 5,260 million as of June 2025. This increase, often a consequence of strategic acquisitions, can limit the company's financial maneuverability. Higher debt levels also mean greater exposure to interest rate fluctuations, potentially increasing financing costs.

Vulnerability to Currency Fluctuations

Europris's reliance on international sourcing exposes it to significant currency fluctuation risks. Unrealized losses on hedging contracts have already impacted financial results, highlighting the volatility of currency markets. For instance, in the first quarter of 2024, the company reported currency losses impacting its financial performance, underscoring this vulnerability.

As Europris expands, particularly into Sweden, the impact of currency volatility on its cost of goods sold and overall gross margin becomes more pronounced. This directly affects reported profitability, making consistent financial forecasting a challenge. The Norwegian Krone's movement against major trading currencies is a key concern for the company's international operations.

- Currency Risk Impact: Volatile currency markets have led to unrealized losses on hedging contracts for Europris, affecting financial results.

- International Sourcing: The company's global procurement strategy inherently exposes it to foreign exchange rate fluctuations.

- Expansion Challenges: Expansion into markets like Sweden amplifies the risk, as costs and revenues are subject to currency conversions.

- Margin Pressure: Fluctuations can directly impact the cost of goods sold, potentially squeezing gross margins and overall profitability.

Exposure to General Economic Caution

Europris's discount model, while generally robust, faces headwinds from a cautious Norwegian retail environment. Core retail sales in Norway have exhibited signs of stagnation, potentially dampening overall market growth. This economic caution, driven by factors such as high exposure to floating interest rates among consumers, could lead to reduced discretionary spending, directly impacting Europris's sales volumes and future growth prospects.

The persistent high operational costs within Norway further exacerbate these challenges. These elevated costs can squeeze profit margins, even for a discount retailer. For instance, Statistics Norway reported that inflation remained elevated throughout 2023 and into early 2024, impacting various cost components for businesses. This environment necessitates careful cost management and strategic pricing to maintain competitiveness while navigating potential dips in consumer demand.

- Stagnating Core Retail Sales: Norwegian retail sales have shown signs of slowing growth, impacting the broader market.

- Consumer Caution: High exposure to floating interest rates is making Norwegian consumers more hesitant to spend.

- Elevated Operational Costs: Persistent high operating expenses in Norway can pressure profitability.

- Impact on Sales Volumes: Reduced consumer spending directly threatens the volume of goods Europris can sell.

The integration of the ÖoB acquisition continues to present challenges, impacting profitability and requiring significant investment to align operations and store formats. This process has led to clearance sales that cannibalized sales at other Europris locations and pressured gross margins. Furthermore, the company's net debt has risen to NOK 5,260 million as of June 2025, limiting financial flexibility and increasing exposure to interest rate risks.

| Financial Metric | Q1 2025 | Prior Year Q1 |

|---|---|---|

| Group Sales (NOK million) | 2,038 | 1,813 |

| EBIT (NOK million) | -45.1 | N/A |

| Group Gross Margin (%) | 37.8 | 40.2 |

| Net Debt (NOK million, June 2025) | 5,260 | N/A |

Preview the Actual Deliverable

Europris AS SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Europris AS. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after purchase.

Opportunities

Europris's full acquisition and integration of ÖoB in Sweden offers a prime opportunity to expand its Nordic footprint. The company aims to grow ÖoB's revenue to SEK 5 billion and achieve a 5% EBIT margin by 2028. This strategic move leverages category harmonization and joint sourcing to unlock significant synergies.

The current economic landscape, with consumers increasingly focused on price and experiencing lower inflation, presents a significant tailwind for discount retailers like Europris. This environment allows Europris to solidify its established 'everyday low prices' image, attracting a wider demographic, including middle-income households actively seeking value for their money.

Europris AS can leverage its existing stakes in e-commerce platforms like Lekekassen and Strikkemekka to broaden its digital footprint. Norway's e-commerce market is experiencing robust growth, with online retail sales projected to increase significantly in 2024 and 2025. Investing further in digital infrastructure and online sales channels will allow Europris to capture a larger share of this expanding market, offering greater convenience to a wider customer base.

Store Concept Optimization and Remodelling

Europris AS has a significant opportunity to boost performance through store concept optimization and remodelling, particularly within its ÖoB (ÖoB is a Swedish retail chain owned by Europris) segment. Initial remodelling efforts in test ÖoB stores have yielded encouraging customer feedback, suggesting these changes resonate well with shoppers.

The strategy focuses on upgrading key product categories and enhancing the overall store environment. This initiative aims to elevate the customer experience, refine the product assortment, and, crucially, attract a broader customer base.

By systematically implementing these store improvements across the entire network, Europris can unlock substantial like-for-like sales growth. This approach is also poised to significantly strengthen the brand's overall appeal and market position.

- Enhanced Customer Experience: Remodelled stores aim to create a more appealing and efficient shopping environment.

- Improved Product Mix: Category upgrades will ensure a more relevant and attractive product offering.

- Attracting New Segments: Store improvements are designed to appeal to a wider demographic.

- Driving Like-for-Like Sales: Successful remodels are expected to translate into increased sales per store.

Improved Consumer Sentiment and Spending

Improved consumer sentiment, driven by anticipated interest rate reductions in Norway and Sweden throughout 2025, is a significant opportunity for Europris. Coupled with projected real wage growth, this economic shift is expected to bolster consumer purchasing power.

This positive economic environment is likely to translate into higher consumer spending across Europris's diverse product offerings, from home goods to groceries. For instance, Norway's Norges Bank has signaled potential rate cuts in 2025, and Sweden’s Riksbank is also expected to follow suit, creating a more favorable spending climate.

- Increased Disposable Income: Lower borrowing costs and rising real wages directly boost consumers' ability to spend.

- Boosted Retail Sales: A confident consumer typically spends more on discretionary and everyday items, benefiting retailers like Europris.

- Favorable Market Conditions: The combination of lower interest rates and wage growth creates a fertile ground for increased sales volumes and potentially higher average transaction values.

Europris can capitalize on the growing Nordic market by fully integrating ÖoB, aiming for SEK 5 billion in revenue and a 5% EBIT margin by 2028 through synergies. The current economic climate, favoring price-conscious consumers and experiencing moderating inflation, strengthens Europris's value proposition. Furthermore, expanding its digital presence via platforms like Lekekassen and Strikkemekka aligns with Norway's robust e-commerce growth, projected to continue through 2024 and 2025.

Store concept optimization, particularly within the ÖoB segment, presents a significant opportunity. Initial remodels have received positive customer feedback, indicating potential for enhanced customer experience, an improved product mix, and the attraction of broader demographics. These improvements are expected to drive like-for-like sales growth and strengthen the brand's market position.

Anticipated interest rate reductions in Norway and Sweden throughout 2025, coupled with projected real wage growth, are set to boost consumer purchasing power. This economic uplift is expected to directly benefit Europris by increasing disposable income and driving higher retail sales across its product categories.

| Opportunity | Key Metric | Target/Projection | Source |

|---|---|---|---|

| ÖoB Integration & Expansion | ÖoB Revenue | SEK 5 billion | Europris AS Strategy |

| ÖoB Integration & Expansion | ÖoB EBIT Margin | 5% | Europris AS Strategy |

| Digital Footprint Expansion | Norway E-commerce Growth | Projected increase in 2024-2025 | Market Analysis Reports |

| Store Concept Optimization | Like-for-like Sales Growth | Expected increase post-remodel | Europris AS Internal Data |

| Improved Consumer Sentiment | Interest Rate Outlook (Norway) | Potential reductions in 2025 | Norges Bank Statements |

| Improved Consumer Sentiment | Interest Rate Outlook (Sweden) | Potential reductions in 2025 | Riksbank Statements |

Threats

The retail sector in Norway and Sweden, where Europris operates, is characterized by fierce competition. This is particularly true for consumables, where grocery chains are aggressively competing on price, directly impacting Europris's market share and profitability.

This intense price pressure can significantly compress profit margins. For instance, in 2023, the average gross margin for discount retailers in Scandinavia hovered around 30-35%, a figure that can be further squeezed by aggressive promotional campaigns and price matching strategies employed by competitors.

Consequently, Europris must continually invest in competitive pricing and promotional activities to maintain its customer base. This ongoing investment, while necessary, can strain financial resources and potentially erode overall profitability if not managed strategically.

Global economic uncertainty, fueled by ongoing geopolitical tensions, continues to pose a significant threat. These tensions can disrupt freight schedules, inflate costs, and introduce unexpected tariffs, directly impacting Europris's supply chain efficiency and overall profitability. For instance, continued instability in key shipping routes could lead to increased freight expenses, a factor that retailers like Europris must absorb or pass on to consumers.

Domestically, Norway's reliance on floating interest rates presents another challenge. As of early 2024, the Norges Bank has maintained its policy rate, but the potential for future adjustments could keep consumer caution high. This caution translates to reduced discretionary spending, directly affecting sales volumes for retailers like Europris, particularly for non-essential goods.

International geopolitical tensions, such as ongoing conflicts and trade disputes, pose a significant threat to Europris's supply chain. These events can lead to increased inbound freight costs, the imposition of new tariffs, and a higher risk of stockouts for key products. For instance, global shipping costs saw substantial volatility in late 2023 and early 2024, directly impacting retailers' cost of goods sold.

Europris's reliance on efficient global sourcing makes it particularly vulnerable to these external factors. Any disruption in the flow of goods or unexpected changes in trade policies could significantly raise operational expenses. This, in turn, would put considerable pressure on the company's gross margins, potentially affecting profitability if not managed effectively.

Fluctuations in Retail Sales Growth

Recent economic indicators suggest a challenging environment for Norwegian retailers. For instance, Statistics Norway reported that retail sales volume in Norway experienced a slight contraction of 0.5% in May 2025 compared to the previous year, following a flat performance in April. This trend points to potential headwinds for companies like Europris, even within the discount sector.

A sustained slowdown in consumer spending directly threatens Europris's sales momentum. If this stagnation continues through the latter half of 2025, it could translate into lower revenue figures for the company. This is particularly concerning given that retail sales growth has been a key driver for many businesses in the region.

- Stagnant Growth: Norway's retail sales volume showed a 0.5% year-on-year decrease in May 2025.

- Impact on Revenue: Prolonged retail sales stagnation poses a direct threat to Europris's revenue streams.

- Discount Resilience Tested: Even Europris's discount model may face pressure if overall consumer demand falters significantly.

- Economic Sensitivity: The company's performance is inherently linked to the broader Norwegian economic health and consumer confidence.

Failure to Adapt to Market Changes

The retail sector is in constant flux, driven by evolving consumer preferences, technological advancements, and increasing demands for sustainability. Europris must remain agile to navigate these shifts effectively. For instance, a failure to adequately integrate sustainable sourcing or update outdated IT infrastructure could significantly weaken its competitive standing and introduce reputational damage.

The rapid pace of change means that companies not keeping up risk falling behind. In 2024, for example, retailers that have not invested in omnichannel strategies or personalized customer experiences are already seeing a decline in market share. Europris's ability to adapt its business model and operations to these emerging trends is crucial for maintaining its relevance and profitability in the coming years.

- Evolving Consumer Expectations: Shifting preferences towards online shopping and personalized experiences require continuous investment in digital platforms and data analytics.

- Technological Advancements: Implementing new technologies, such as AI-driven inventory management or enhanced e-commerce capabilities, is essential to improve efficiency and customer engagement.

- Sustainability Imperatives: Growing consumer and regulatory pressure for eco-friendly practices necessitates a proactive approach to supply chain transparency and sustainable product offerings.

Intense competition, particularly from grocery chains in Norway and Sweden, poses a significant threat by driving down prices and compressing Europris's profit margins. Global economic uncertainty, exacerbated by geopolitical tensions, disrupts supply chains and inflates costs, impacting profitability. Furthermore, evolving consumer preferences and the need for technological and sustainability investments require continuous adaptation, with failure to do so risking competitive decline.

SWOT Analysis Data Sources

This SWOT analysis for Europris AS is built upon a foundation of robust data, drawing from official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.