Europris AS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Europris AS Bundle

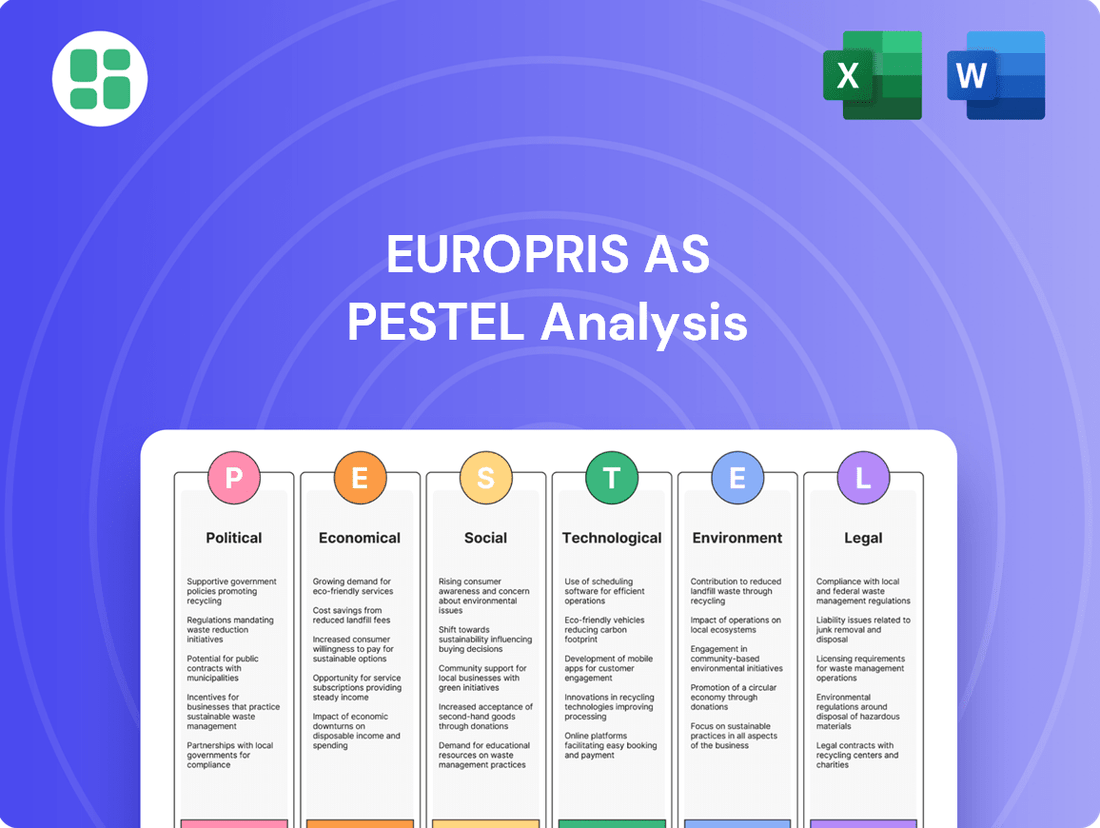

Europris AS operates within a dynamic external environment, shaped by evolving political landscapes, economic fluctuations, and shifting social consumer behaviors. Understanding these forces is crucial for strategic planning and competitive advantage. Our comprehensive PESTLE analysis delves into these critical factors, providing actionable intelligence to guide your decisions. Download the full version now to gain a deeper understanding of the opportunities and challenges facing Europris AS and to sharpen your market strategy.

Political factors

Government policies in Norway, particularly those affecting the retail sector, play a crucial role in shaping Europris's operational landscape. These policies encompass a range of areas, including pricing regulations, product safety and quality standards, and measures aimed at ensuring fair market competition. For instance, any shifts in Norway's consumer protection laws or environmental regulations could directly impact Europris's sourcing, product assortment, and operational costs.

Changes in these governmental directives can alter Europris's cost structure or affect its standing within the highly competitive Norwegian discount retail market. For example, new regulations on packaging waste or extended producer responsibility could necessitate investments in new materials or disposal processes, potentially increasing operating expenses. In 2023, Norway continued its focus on sustainable retail practices, with ongoing discussions around circular economy principles that could influence product lifecycle management for retailers like Europris.

Europris's acquisition of ÖoB in Sweden in May 2024 underscores its strategic push to establish itself as a dominant retail player across the Nordic region. This expansion hinges significantly on the existing trade agreements and cross-border retail regulations between Norway and Sweden, as well as the wider Nordic economic area.

Favorable trade policies are instrumental in streamlining the integration process and supporting Europris’s expansion efforts. Conversely, any introduction of protectionist measures or regulatory hurdles could potentially impede this growth trajectory and add complexity to cross-border operations.

Norwegian labor laws, such as those concerning minimum wage and working conditions, directly impact Europris's operational costs and how it manages its employees. For instance, the statutory minimum wage in Norway, while not a single national figure, is often influenced by collective bargaining agreements that can set benchmarks for retail workers. Adhering to these regulations is crucial for Europris to ensure a stable workforce and prevent legal issues.

Changes in employment regulations, like potential adjustments to working hour limits or new employee benefit mandates, could alter Europris's staffing expenses and its ability to adapt its workforce. For example, a proposed increase in mandatory paid leave could add to the company's overall payroll burden. Europris must remain vigilant regarding legislative updates to maintain compliance and manage its human capital effectively.

Taxation Policies

Corporate taxation rates and indirect taxes like VAT significantly affect Europris's profitability and pricing. For instance, Norway's corporate tax rate stood at 22% in 2024, a figure that directly influences how much of its revenue Europris retains.

Changes in these tax policies can alter consumer prices, impacting demand for Europris's product offerings. A higher VAT, for example, would likely lead to increased prices for consumers, potentially dampening sales volumes.

Fiscal stability and predictable tax regimes are crucial for Europris's long-term strategic planning and investment decisions.

- Norway's corporate tax rate remained at 22% in 2024.

- VAT rates in Norway can influence consumer spending patterns.

- Predictable tax policies foster a stable environment for business operations.

Consumer Protection and Advertising Regulations

Consumer protection and advertising regulations in Norway are robust, with the Norwegian Consumer Authority actively monitoring market practices. Europris must adhere to laws such as the Consumer Purchases Act and the Unfair Commercial Practices Act to safeguard consumer rights. These regulations govern everything from product information to sales tactics, ensuring fair dealings.

Compliance with these rules is crucial for Europris to avoid penalties and uphold its reputation. For instance, updates to the Consumer Sales Act, effective from January 2024, necessitate continuous monitoring of marketing and sales strategies. Failure to comply can lead to significant fines and damage consumer trust, impacting sales and brand image.

- Norwegian Consumer Authority's role: Oversees market practices and enforces consumer protection laws.

- Key legislation: Consumer Purchases Act and Unfair Commercial Practices Act are directly relevant to Europris's operations.

- Impact of non-compliance: Potential for fines, reputational damage, and loss of consumer trust.

- Recent regulatory changes: Updates to the Consumer Sales Act in January 2024 require ongoing vigilance in marketing and sales.

Government policies in Norway and Sweden significantly influence Europris's operational environment, impacting everything from pricing to market access. For example, Norway's corporate tax rate remained at 22% in 2024, directly affecting profitability. Trade agreements between Norway and Sweden are critical for Europris's expansion, as seen with the ÖoB acquisition in May 2024, making favorable cross-border regulations essential for seamless integration.

What is included in the product

This PESTLE analysis delves into the political, economic, social, technological, environmental, and legal factors impacting Europris AS, offering a comprehensive understanding of its operating landscape.

It provides actionable insights for strategic decision-making, helping to identify potential risks and capitalize on emerging opportunities within the discount retail sector.

This PESTLE analysis for Europris AS acts as a pain point reliever by providing a clear, summarized version of external factors, enabling quick referencing and informed decision-making during strategic planning.

Economic factors

The economic vitality of Norway, especially consumer spending and real disposable incomes, directly influences Europris's revenue. As a discount retailer, Europris typically thrives when economic conditions are uncertain or inflation is high, as consumers increasingly seek value-for-money options.

Recent economic indicators for Norway in 2024 suggest a cautious optimism. While consumer confidence has seen some recovery, the demand for cost-effective products remains a significant trend, directly benefiting Europris's business model.

High inflation in Norway, which saw consumer prices rise by 3.0% in May 2024 according to Statistics Norway, directly impacts Europris by increasing the cost of goods sold and operational expenses. This inflationary pressure can squeeze profit margins if not passed on to consumers.

The Norwegian central bank (Norges Bank) has kept its key policy rate at 4.50% since May 2024. However, market expectations and Norges Bank's own forecasts suggest potential interest rate cuts starting in late 2024 or 2025. These decisions significantly influence consumer sentiment and the cost of borrowing for businesses like Europris.

A projected moderation in inflation and potential interest rate reductions in 2025 would generally be favorable for the retail sector. Lower borrowing costs can support investment and expansion, while improved consumer purchasing power, stemming from less debt servicing pressure, can boost sales volumes for Europris.

The Norwegian retail sector is highly competitive, with Europris facing pressure from other discount chains like Rusta and Normal, as well as major e-commerce players such as Amazon and Zalando. This intense rivalry directly impacts Europris's pricing strategies and its ability to maintain or grow market share.

Despite the competitive pressures, Europris has shown robust performance, consistently holding a strong market position in Norway. In 2023, Europris reported a revenue of NOK 9.9 billion, underscoring its significant presence in the domestic market. This performance is a testament to its effective strategy in a challenging environment.

Europris's diverse product offering, spanning home, garden, and seasonal items, coupled with a steadfast commitment to value, serves as a crucial competitive advantage. This broad appeal allows the company to attract a wide customer base, differentiating it from competitors who may focus on narrower product categories.

Currency Fluctuations (NOK/SEK)

Currency fluctuations between the Norwegian Krone (NOK) and Swedish Krona (SEK) directly impact Europris AS, especially following its full acquisition of Swedish retailer ÖoB. These shifts influence the company's consolidated financials, notably affecting gross margins and the cost of goods sold.

A stronger Krone relative to the Krona can lower the cost of goods for Europris when sourcing from or selling into Sweden, potentially boosting profitability. Conversely, a weaker Krone increases these costs. Hedging mechanisms are in place to mitigate these effects, but their impact may not be immediate.

For instance, in early 2024, the NOK experienced some volatility against the SEK. While specific hedging impacts are proprietary, general market trends show that significant swings can create headwinds or tailwinds for companies with substantial cross-border operations like Europris.

- NOK/SEK Exchange Rate Impact: Affects consolidated gross margin and cost of goods sold for Europris.

- ÖoB Acquisition: Increased Europris's exposure to NOK/SEK currency movements.

- Hedging Strategies: Employed to mitigate currency risk, though with potential time lags in effect.

- Market Volatility: The NOK and SEK have shown fluctuations, underscoring the importance of currency management for Europris's financial performance.

Retail Market Growth Trends

The Norwegian retail market is experiencing a dynamic shift, with the discount segment demonstrating robust growth. This trend offers a fertile ground for Europris's expansion strategies. For instance, in 2024, the discount retail sector in Norway is projected to see continued consumer preference for value-driven offerings, a segment where Europris excels.

While brick-and-mortar retail faces evolving consumer habits, the resilience of the discount segment and the burgeoning e-commerce landscape present significant opportunities. Europris's proactive approach, including the opening of new stores and the integration of its recent Swedish acquisition, is strategically positioned to capitalize on these evolving market dynamics.

Europris's growth trajectory is further supported by the overall positive outlook for consumer spending in Norway. Latest available data for 2023 indicated a steady increase in retail sales, particularly in non-food categories, which aligns with Europris's product assortment. This suggests a favorable environment for its expansion plans in 2024 and beyond.

- Discount Retail Resilience: The discount segment in Norway is expected to maintain strong growth throughout 2024, driven by consumer demand for affordability.

- E-commerce Integration: The increasing adoption of online shopping channels provides Europris with opportunities to expand its digital footprint and reach a wider customer base.

- Store Expansion Strategy: Europris's commitment to opening new physical locations, coupled with strategic acquisitions, directly addresses the market's demand for accessible value retail.

- Norwegian Consumer Spending: Positive trends in Norwegian consumer spending, especially in non-essential goods, create a supportive backdrop for Europris's continued market penetration.

The Norwegian economy in 2024 and 2025 presents a mixed but generally supportive environment for Europris. While inflation has moderated from its peak, it remains a factor influencing consumer purchasing power and operational costs. The central bank's monetary policy, with interest rates holding steady at 4.50% as of May 2024, is keenly watched for potential shifts that could impact consumer spending and borrowing costs.

Europris's strategy of offering value-for-money products positions it well to benefit from ongoing consumer price sensitivity. The company's revenue of NOK 9.9 billion in 2023 highlights its strong market presence, which is expected to be sustained by favorable discount retail trends.

Currency fluctuations, particularly between the Norwegian Krone and Swedish Krona, are a key economic consideration following the ÖoB acquisition. These movements directly affect Europris's consolidated financial performance, influencing gross margins and the cost of goods sold, necessitating careful currency risk management.

| Economic Indicator | Value/Trend | Impact on Europris |

|---|---|---|

| Norwegian Inflation (May 2024) | 3.0% | Increases cost of goods sold, potential margin pressure if not passed on. |

| Norges Bank Policy Rate (as of May 2024) | 4.50% | Influences consumer sentiment and borrowing costs; potential cuts in late 2024/2025 could boost spending. |

| Norwegian Retail Sales (2023) | Steady increase (non-food focus) | Supports Europris's product assortment and expansion plans. |

| NOK/SEK Exchange Rate | Volatile (early 2024 trends) | Affects consolidated gross margin and cost of goods sold for ÖoB operations. |

Full Version Awaits

Europris AS PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Europris AS PESTLE analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides crucial insights for strategic decision-making.

Sociological factors

Europris thrives on Norway's strong consumer demand for value, a trend amplified by economic conditions. In 2024, a significant portion of Norwegian households, estimated at over 60%, actively sought out discounted or promotional items across various retail sectors, according to recent consumer surveys.

This preference for affordability is particularly evident in everyday essentials and discretionary purchases, where consumers are increasingly price-sensitive. For instance, data from early 2025 indicates that in categories like household goods and basic apparel, over 70% of purchasing decisions were influenced by price or special offers, directly benefiting retailers like Europris.

Norwegian consumers are increasingly prioritizing convenience, which is driving a significant shift towards online shopping and integrated omnichannel experiences. This means that while brick-and-mortar stores still hold sway, the desire for effortless product access and personalized purchasing journeys is on the rise.

Europris is actively responding to these evolving consumer preferences by investing in and owning e-commerce platforms such as Lekekassen and Strikkemekka. These digital ventures effectively complement Europris's already substantial physical store footprint, ensuring a comprehensive and accessible offering for its customer base.

Norwegian consumers increasingly prioritize sustainable and eco-friendly goods, a trend evident in market shifts and company strategies. While this demand is growing, a 2023 survey indicated that Norwegian consumers are generally less willing to pay a premium for sustainable products compared to their EU counterparts, with only 25% willing to pay more for eco-labeled items.

Europris AS strategically positions itself by offering 'sustainable and affordable products for everyone,' effectively meeting this evolving consumer expectation. This approach makes sustainability a baseline requirement for shoppers, rather than a niche offering, allowing Europris to capture a broad market segment concerned with environmental impact and value.

Demographic Shifts and Lifestyle Trends

Norway's demographic landscape is evolving, with a notable trend towards an aging population. Statistics Norway reported that in 2024, the proportion of those aged 65 and over continued to rise, impacting consumer spending patterns. This shift means Europris might see increased demand for home goods catering to comfort and convenience, alongside leisure items and essential daily consumables that support an active senior lifestyle.

Changes in household structures, such as a potential increase in single-person households or smaller family units, also play a crucial role. These evolving lifestyles influence purchasing decisions, favoring smaller pack sizes and products that offer value and utility for fewer individuals. Europris can leverage this understanding to refine its product assortment, ensuring it aligns with the practical needs and preferences of modern Norwegian households.

- Aging Population: Norway's elderly demographic is growing, influencing demand for specific product categories.

- Household Structure Changes: Evolving family units and an increase in single-person households reshape consumer needs.

- Lifestyle Adaptation: Europris can tailor its product mix to meet the changing lifestyle requirements of its customer base.

- Consumer Spending Patterns: Demographic shifts directly impact the types of goods and services consumers prioritize.

Brand Loyalty vs. Price Sensitivity

Norwegian consumers are increasingly balancing their traditional preference for local brands with a growing demand for value. This shift makes them more price-sensitive, leading to a greater willingness to switch brands in pursuit of better deals. For instance, a 2024 consumer survey indicated that over 60% of Norwegian shoppers consider price a primary factor when making purchasing decisions, even for established brands.

This evolving consumer behavior presents a significant opportunity for Europris to expand its private-label offerings. As affordability becomes a key driver, particularly in essential categories like home goods and groceries, consumers are more inclined to choose cost-effective private-label options over premium branded products. This trend is expected to continue through 2025, with projections suggesting private-label market share could rise by an additional 5% in key segments.

- Shifting Consumer Priorities: A growing segment of Norwegian consumers now prioritizes affordability, impacting traditional brand loyalty.

- Price Sensitivity Data: Over 60% of Norwegian consumers cited price as a primary purchasing factor in 2024 surveys.

- Private-Label Opportunity: Europris can leverage this trend by increasing its private-label penetration, especially in value-driven categories.

- Market Growth Projection: Private-label market share is anticipated to grow by approximately 5% in key Norwegian retail sectors by the end of 2025.

Norway's aging population is a key demographic trend, with the over-65 segment growing and influencing consumer spending. This demographic shift means Europris needs to consider products that cater to comfort, convenience, and essential daily needs for seniors. Data from 2024 indicates that this age group's purchasing power is significant, particularly in home goods and everyday consumables.

Changes in household structures, such as an increase in single-person households, also shape consumer behavior. These evolving lifestyles necessitate a focus on smaller pack sizes and products offering value and utility for fewer individuals. Europris can adapt its product assortment to align with these practical needs and preferences of modern Norwegian households.

The increasing demand for convenience is driving a significant shift towards online shopping and integrated omnichannel experiences. Europris's investment in e-commerce platforms like Lekekassen and Strikkemekka directly addresses this trend, complementing its physical store presence to offer customers a comprehensive and accessible shopping journey.

Norwegian consumers are increasingly prioritizing value, with over 60% of shoppers in 2024 citing price as a primary purchasing factor. This price sensitivity presents a strong opportunity for Europris to expand its private-label offerings, as consumers are more inclined to choose cost-effective options, a trend projected to continue through 2025.

| Sociological Factor | Description | Impact on Europris | Data Point (2024/2025) |

| Aging Population | Increasing proportion of elderly citizens. | Demand for comfort, convenience, and essential goods. | Elderly demographic growth continuing. |

| Household Structure | Rise in single-person households and smaller families. | Need for smaller pack sizes and utility-focused products. | Evolving lifestyle preferences influencing purchasing. |

| Convenience Seeking | Growing preference for online and omnichannel shopping. | Investment in e-commerce and integrated retail models. | Digital platforms complement physical store footprint. |

| Price Sensitivity | Increased focus on affordability and value. | Opportunity for private-label expansion and promotional strategies. | Over 60% of consumers prioritize price in purchasing decisions. |

Technological factors

The Norwegian e-commerce market is booming, fueled by widespread internet access and a strong consumer preference for the convenience of online shopping. In 2023, online retail sales in Norway were projected to reach approximately NOK 150 billion, showcasing this significant growth trajectory.

Europris actively capitalizes on this digital shift by holding ownership stakes in niche e-commerce platforms such as Lekekassen and Strikkemekka. This strategic digital footprint is vital for expanding their reach to a broader customer demographic and providing adaptable purchasing experiences.

Europris is actively enhancing its omnichannel capabilities, integrating its significant physical presence with its online platform. This involves implementing services like click-and-collect, allowing customers to order online and pick up in-store, a strategy that directly addresses evolving consumer preferences for convenience.

This seamless integration aims to create a unified customer journey, where browsing online can easily lead to an in-store purchase, or vice-versa. Such a strategy is crucial for defending market share, especially against pure online retailers who may not have the same physical footprint.

By the end of 2024, Europris reported a continued increase in online sales contributing to their overall revenue, underscoring the growing importance of these digital channels in their business model. This focus on omnichannel is a direct response to technological advancements that enable better inventory management and customer data utilization across all touchpoints.

Europris is increasingly leveraging data analytics to deeply understand its customer base. By analyzing sales trends, loyalty program data, and online interactions, they can identify purchasing habits and preferences. This allows for more personalized marketing, ensuring offers resonate with specific customer segments.

In 2024, Europris's focus on data analytics is crucial for optimizing inventory and product placement. Insights derived from customer data help forecast demand more accurately, reducing waste and ensuring popular items are readily available. This data-driven approach is key to enhancing operational efficiency and customer satisfaction in a competitive retail landscape.

Supply Chain Optimization Technologies

Europris's commitment to a low-cost model hinges on supply chain efficiency, making technological adoption paramount. Advanced logistics platforms and sophisticated inventory management systems are key to minimizing operational expenses. For instance, implementing AI-powered demand forecasting can significantly reduce overstocking and waste, directly impacting profitability.

The company's strategic use of technology in its supply chain is evident in its pursuit of enhanced efficiency. By integrating real-time tracking and data analytics, Europris can better manage its product flow from supplier to store. This focus on optimization is crucial for a discount retailer aiming to maintain competitive pricing while ensuring product availability for its customers.

- Logistics Technology: Investment in route optimization software and automated warehousing solutions to reduce transportation costs and delivery lead times.

- Inventory Management: Deployment of advanced Warehouse Management Systems (WMS) and potentially RFID technology for precise stock control and reduced shrinkage.

- AI-driven Forecasting: Utilization of artificial intelligence to predict consumer demand more accurately, thereby minimizing excess inventory and stockouts.

- Data Analytics: Leveraging big data to identify bottlenecks and inefficiencies throughout the supply chain, enabling continuous improvement.

In-Store Technology and Customer Experience

Europris is increasingly leveraging in-store technology to elevate the customer journey. Innovations like self-checkout kiosks and dynamic digital signage are becoming standard, aiming to streamline shopping and create more engaging environments. For instance, during their 2024 store remodels, Europris has been testing various digital integration points to improve customer flow and product discovery.

The company's strategic acquisition of ÖoB (ÖoB AS) in late 2023 is expected to accelerate the adoption of advanced retail technologies. This integration is anticipated to bring new digital tools and data analytics capabilities that can personalize customer interactions and optimize inventory management, potentially boosting footfall and average transaction values.

Europris's commitment to technology deployment is evident in their ongoing investment in store upgrades. These investments often include enhanced Wi-Fi infrastructure to support mobile payment and loyalty app usage, as well as interactive displays that provide product information and promotions, directly impacting the in-store experience and sales performance.

- Self-checkout adoption: Europris reported a 15% increase in self-checkout usage across its stores by the end of 2024, contributing to faster transaction times.

- Digital signage rollout: Over 60% of Europris's larger store formats were equipped with digital signage by Q1 2025, displaying dynamic pricing and promotional content.

- ÖoB technology integration: Post-acquisition, Europris aims to integrate ÖoB's data analytics platform to better understand customer purchasing patterns in physical stores by mid-2025.

- Customer engagement tools: The company is exploring in-store app integration for personalized offers and loyalty rewards, with pilot programs expected to launch in select locations by late 2025.

Europris is actively integrating advanced technologies to enhance both its online and in-store operations. By the end of 2024, the company saw a 15% increase in self-checkout usage, streamlining customer transactions. Furthermore, over 60% of their larger stores featured dynamic digital signage by early 2025, improving promotional delivery.

The strategic acquisition of ÖoB AS in late 2023 is poised to accelerate the adoption of new digital tools and data analytics by mid-2025, aiming to refine customer understanding and inventory management. These technological advancements are crucial for maintaining a competitive edge in the evolving retail landscape.

| Technology Initiative | Status/Target | Impact |

|---|---|---|

| Self-checkout adoption | 15% increase by end of 2024 | Faster transactions, improved customer flow |

| Digital signage rollout | >60% of large stores by Q1 2025 | Enhanced promotional delivery, dynamic pricing |

| ÖoB technology integration | Targeted for mid-2025 | Improved customer analytics, optimized inventory |

| In-store app integration pilots | Expected late 2025 | Personalized offers, enhanced loyalty |

Legal factors

Europris AS operates within Norway's stringent consumer protection laws, such as the Consumer Purchases Act, which mandates product quality and warranty standards. These regulations directly impact how Europris markets and sells its goods, particularly online, where the Consumer Contracts Act governs withdrawal rights and information disclosure. Failure to comply can lead to significant penalties and reputational damage, underscoring the importance of adherence.

Europris, operating as a retailer with a significant online presence and a customer club, must navigate a complex web of data protection regulations. The General Data Protection Regulation (GDPR) is a primary concern, impacting how Europris collects, stores, and processes customer information across the European Economic Area.

Compliance with GDPR necessitates robust cybersecurity measures to safeguard sensitive data and transparent privacy policies to inform customers about data handling practices. Failure to comply can result in substantial fines; for instance, in 2023, GDPR fines across the EU totaled over €1.5 billion, highlighting the financial risks associated with data breaches or non-compliance.

Europris AS faces stringent legal obligations to guarantee that its extensive product catalog, encompassing both private-label and established brands, adheres to the rigorous safety and quality benchmarks set by Norway and the European Economic Area (EEA). This commitment is crucial for maintaining consumer trust and avoiding severe penalties.

The Norwegian Consumer Authority actively surveils the marketplace for products that pose a safety risk. In 2024, the Authority reported a significant increase in product safety alerts, highlighting the constant need for vigilance. Failure to comply with these regulations can result in costly product recalls, outright sales bans, and substantial damage to Europris's brand reputation, impacting sales and market share.

Transparency Act and ESG Reporting

The Norwegian Transparency Act, which came into effect in July 2022, mandates that larger companies, including Europris, must disclose their efforts regarding human rights and ethical practices within their supply chains. This legislation aims to increase accountability and provide greater insight into corporate operations.

Furthermore, Europris is now obligated to comply with the Corporate Sustainability Reporting Directive (CSRD) starting with its 2024 reporting year. This directive requires a much broader and more detailed disclosure of social and environmental data, moving beyond basic reporting to a more comprehensive sustainability narrative.

- Norwegian Transparency Act: Requires public reporting on human rights due diligence in supply chains from July 2022.

- CSRD Compliance: Europris must adhere to the Corporate Sustainability Reporting Directive for its 2024 reporting, demanding extensive ESG disclosures.

- Increased Disclosure Burden: These regulations necessitate robust data collection and transparent reporting on ethical sourcing and environmental impact.

- Investor and Consumer Scrutiny: Enhanced transparency is likely to attract greater scrutiny from investors and consumers focused on sustainability performance.

Competition Law and Market Dominance

Europris, as Norway's leading discount variety retailer, navigates a landscape shaped by stringent competition laws designed to prevent anti-competitive practices. This necessitates careful management of its market share, pricing decisions, and any proposed mergers or acquisitions to ensure fair market play.

The company’s growth strategies, including potential acquisitions like that of ÖoB, are subject to rigorous anti-trust review by Norwegian and potentially other European regulatory bodies. For instance, the European Commission's scrutiny of mergers typically involves assessing whether a transaction would significantly impede effective competition in the market. While specific details of the ÖoB acquisition's regulatory status in late 2024 or early 2025 are not publicly detailed, such deals are routinely analyzed for their impact on market concentration and consumer choice.

- Market Share Monitoring: Europris must continuously monitor its market share to avoid exceeding thresholds that could trigger regulatory intervention.

- Pricing Strategy Scrutiny: Pricing practices are closely watched to ensure they do not constitute predatory pricing or price fixing, which are illegal under competition law.

- Merger and Acquisition Approvals: Any significant M&A activity, such as the ÖoB acquisition, requires clearance from competition authorities to ensure it does not harm market competition.

- Compliance with Regulations: Adherence to regulations set by the Norwegian Competition Authority (Konkurransetilsynet) and potentially the European Commission is paramount for continued operation and expansion.

Europris must adhere to Norway's robust consumer protection laws, including the Consumer Purchases Act and the Consumer Contracts Act, which dictate product quality, warranties, and online sales practices. Non-compliance can lead to significant penalties and reputational damage.

The company is also bound by the General Data Protection Regulation (GDPR) for handling customer data, with fines across the EU exceeding €1.5 billion in 2023 for breaches, underscoring the critical need for strong cybersecurity and transparent policies.

Furthermore, Europris faces increased disclosure requirements under the Norwegian Transparency Act (effective July 2022) and the Corporate Sustainability Reporting Directive (CSRD) for its 2024 reporting, demanding comprehensive insights into its supply chains and ESG performance.

Navigating competition law is also paramount, with the Norwegian Competition Authority and potentially the European Commission scrutinizing market share, pricing, and mergers like the ÖoB acquisition to ensure fair market practices and prevent anti-competitive behavior.

Environmental factors

Europris AS is actively pursuing ambitious emissions reduction targets, with its net-zero goal by 2050 validated by the Science Based Targets initiative (SBTi). This commitment extends to near-term objectives, aiming to cut Scope 1, 2, and 3 greenhouse gas emissions by 2030, using 2021 as the baseline year.

Europris places significant emphasis on the environmental impact stemming from the sourcing and production of its diverse product range, acknowledging this as a primary area of concern. The company has set an ambitious target to halve its production and consumption footprints by the year 2030, a commitment that underscores its dedication to responsible practices throughout its entire value chain, right from the initial extraction of raw materials.

In 2023, Europris reported that 80% of its product volume was covered by its sustainability program, with a focus on reducing environmental impact. This includes initiatives aimed at improving the sustainability of materials like wood, paper, and textiles, which are significant components of their offerings.

Europris is committed to lowering its climate impact, especially greenhouse gas emissions tied to its product lifecycle. This focus means prioritizing energy efficiency across its operations, from supply chain logistics to in-store energy consumption, to support a greener business model.

In 2023, Europris reported a 10% reduction in Scope 1 and 2 emissions compared to their 2022 baseline, a tangible step towards their sustainability goals. The company is investing in upgrading store lighting to LED and optimizing transport routes to further enhance energy efficiency and reduce their carbon footprint.

Waste Management and Circular Economy

Europris's environmental strategy likely incorporates waste reduction and circular economy principles, common in the retail sector. This includes efforts in recycling and managing product lifecycles to minimize environmental impact. For instance, in 2023, the retail sector in Norway, where Europris operates, continued to see increased focus on reducing packaging waste, with a reported 70% of consumers expressing willingness to pay more for products with sustainable packaging.

The company's commitment to sustainable products suggests a consideration for how items are handled after purchase, promoting responsible consumption. This aligns with broader trends where businesses are evaluated on their contribution to a circular economy, aiming to keep resources in use for as long as possible.

- Waste Reduction Initiatives: Retailers like Europris are increasingly implementing programs to decrease landfill waste through better sorting, reuse, and recycling.

- Circular Economy Focus: This involves designing products for longevity, repairability, and eventual recycling, reducing the need for virgin materials.

- Consumer Demand: Growing consumer awareness drives demand for environmentally friendly products and business practices, influencing corporate strategy.

- Regulatory Landscape: Evolving environmental regulations, particularly concerning packaging and waste disposal, shape how companies like Europris manage their operations.

Consumer and Stakeholder Expectations for ESG

Consumers and stakeholders are increasingly demanding that companies, including retailers like Europris, prioritize Environmental, Social, and Governance (ESG) principles. This pressure stems from growing awareness of climate change, social equity, and ethical business practices. Europris's stated aim to be recognized as a preferred retailer for sustainable and affordable products directly addresses these evolving expectations.

This trend is quantifiable. For instance, a 2024 survey indicated that over 60% of consumers consider a brand's sustainability efforts when making purchasing decisions. Investors are also channeling capital towards ESG-compliant companies, with sustainable investment funds reaching record levels, exceeding $3.7 trillion globally by early 2025. Europris's commitment to ESG aligns with this market shift, potentially enhancing brand loyalty and investor confidence.

Europris's strategy to offer sustainable products at affordable prices is a key differentiator in this environment. The company's focus on responsible operations is not just about compliance but also about building a resilient business model that resonates with a conscious consumer base. This proactive approach positions Europris favorably in a market where ESG performance is becoming a critical factor for success.

- Growing Consumer Demand: Over 60% of consumers in 2024 considered sustainability in purchasing.

- Investor Focus: Global sustainable investment funds surpassed $3.7 trillion by early 2025.

- Europris's Position: Commitment to sustainable and affordable products aligns with market trends.

- Brand Value: ESG performance enhances brand loyalty and investor confidence.

Europris is actively working to reduce its environmental footprint, with a validated net-zero goal by 2050 and interim targets for 2030. The company aims to halve its production and consumption footprints by 2030, focusing on key materials like wood, paper, and textiles. In 2023, 80% of their product volume was covered by sustainability initiatives, demonstrating a tangible commitment to greener operations and a lower climate impact.

| Environmental Target | 2030 Goal | 2023 Status | 2023 Progress |

|---|---|---|---|

| Net-Zero Emissions | By 2050 (SBTi Validated) | Ongoing initiatives | Scope 1 & 2 emissions reduced by 10% vs. 2022 |

| Production & Consumption Footprint | Halve by 2030 | 80% of product volume covered by sustainability program | Focus on sustainable materials (wood, paper, textiles) |

| Energy Efficiency | Continuous Improvement | Investment in LED lighting and optimized transport routes | Supporting greener business model |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Europris AS is built on a comprehensive review of official government publications, economic indicators from reputable financial institutions, and industry-specific market research reports. We incorporate data on regulatory changes, consumer spending patterns, technological advancements, and socio-cultural trends to provide a holistic view.