Europris AS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Europris AS Bundle

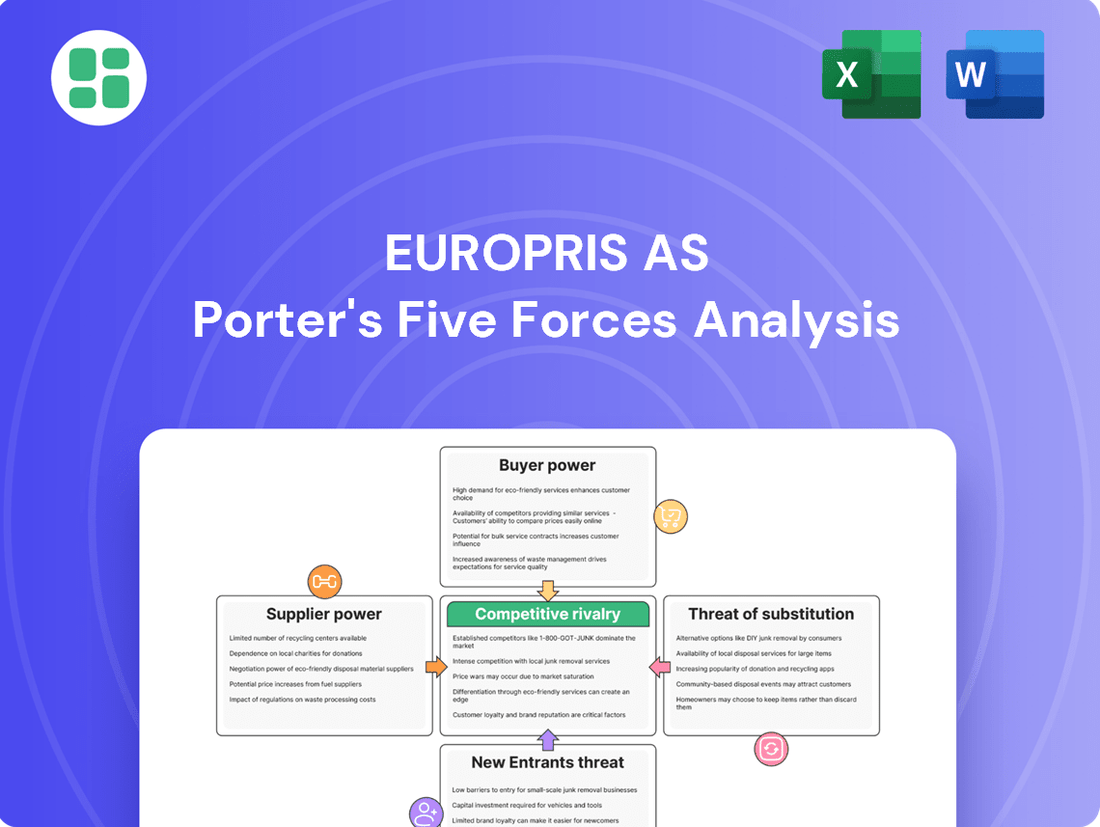

Europris AS operates in a retail landscape where buyer power is a significant factor, influencing pricing and product variety. The threat of new entrants, while present, is somewhat mitigated by established brand loyalty and economies of scale. Understanding these dynamics is crucial for any competitor or investor.

The complete report reveals the real forces shaping Europris AS’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Europris AS sources a wide array of products, from home goods and leisure items to clothing and seasonal decorations. The concentration of its suppliers is a key factor in its bargaining power. If Europris relies on a limited number of large suppliers for critical product categories, these suppliers would possess greater leverage in price negotiations.

Conversely, a fragmented supplier base, where Europris sources from many smaller entities, would typically grant Europris more negotiating strength. Understanding the specific supplier landscape for its diverse product mix is crucial for assessing this aspect of supplier power.

Europris faces moderate bargaining power from its suppliers, largely influenced by switching costs. If Europris were to change suppliers, it would likely incur expenses related to identifying and vetting new partners, renegotiating terms, and potentially adapting its product lines or packaging. These costs, while not prohibitive, add a layer of friction to supplier relationships.

For instance, in 2023, Europris reported that its cost of goods sold was approximately NOK 6.5 billion. A significant disruption in sourcing or a need for extensive product re-qualification due to a supplier change could impact this substantial figure, affecting profitability and operational continuity.

Europris AS primarily sources a wide range of products, many of which are considered commodities or have readily available substitutes. This suggests that the uniqueness of individual supplier offerings is generally low. For instance, many of the everyday household goods and consumables Europris stocks are produced by multiple manufacturers, limiting the power of any single supplier.

While Europris may engage with suppliers for specific private label brands or exclusive promotions, the core of its business relies on efficient procurement of a diverse product assortment. In 2023, Europris reported a significant portion of its sales coming from its own brands, which could indicate some level of supplier collaboration, but the overall market for these types of goods remains competitive, keeping supplier leverage in check.

Importance of Europris to Suppliers

Europris AS's significance as a customer directly impacts its bargaining power with suppliers. If Europris constitutes a substantial portion of a supplier's overall sales, that supplier will likely be more accommodating to Europris's pricing and terms, as losing Europris as a client would be detrimental.

Conversely, if Europris is a relatively small client for its suppliers, the suppliers hold more leverage. They can afford to be less flexible, knowing that Europris's business is not critical to their own financial health. This dynamic is crucial in understanding the supplier's bargaining power.

- Europris's Revenue Contribution: The percentage of a supplier's total revenue that Europris represents is a key indicator of supplier power. A higher percentage for Europris means less supplier power.

- Supplier Diversification: If suppliers have a diverse customer base, they are less reliant on Europris, thus increasing their bargaining power.

- Market Concentration: The number of alternative suppliers available to Europris also influences this dynamic. A more concentrated supplier market grants suppliers greater power.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into retail and becoming direct competitors to Europris AS is generally considered low. This is primarily due to Europris's business model as a discount variety retailer, offering a wide and diverse product assortment. Such a broad mix makes it challenging for any single supplier to effectively replicate the entire retail operation.

However, it's crucial to monitor specific supplier relationships. For instance, if a key supplier for a high-volume, proprietary product line were to possess both the financial capability and a strong incentive to enter the retail space, the threat could increase. This would require them to manage logistics, marketing, and customer service across a broad product range, which is a significant undertaking.

- Low Likelihood: Europris's diverse product categories (home, garden, personal care, food) make it difficult for a single supplier to replicate the entire retail offering.

- Supplier Capabilities: Most suppliers in Europris's network likely focus on manufacturing or sourcing specific product types, lacking the infrastructure and expertise for broad retail operations.

- Incentive Assessment: The primary incentive for forward integration would be capturing retail margins, but the complexity of Europris's business model might outweigh this potential gain for most suppliers.

Europris faces moderate bargaining power from its suppliers, primarily due to the availability of substitute products and relatively low switching costs for many of its inventory items. The company's ability to source from a diverse range of manufacturers for common goods limits the leverage of individual suppliers.

In 2023, Europris's cost of goods sold was approximately NOK 6.5 billion, highlighting the significant volume of procurement. While some private label development might create stronger supplier ties, the broader market for many of Europris's product categories remains competitive, keeping supplier power in check.

The threat of suppliers integrating forward into retail is low, given Europris's broad product assortment and discount model, which is difficult for single-product suppliers to replicate. However, the company's substantial revenue contribution to certain suppliers could increase their willingness to negotiate favorable terms.

| Factor | Assessment | Impact on Europris |

|---|---|---|

| Supplier Concentration | Moderate to Fragmented | Lower supplier power |

| Switching Costs | Moderate | Moderate supplier power |

| Product Differentiation | Low for most items | Lower supplier power |

| Forward Integration Threat | Low | Lower supplier power |

What is included in the product

This analysis meticulously examines the competitive forces impacting Europris AS, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes within the discount retail sector.

Effortlessly assess competitive intensity and identify strategic vulnerabilities within Europris AS's market landscape.

Gain actionable insights into buyer and supplier power, enabling more effective negotiation and partnership strategies.

Customers Bargaining Power

Europris operates as a discount variety retailer, meaning its customers are highly attuned to price. This inherent price sensitivity forces Europris to maintain competitive pricing to attract and retain shoppers who are actively seeking the best value for their money.

This focus on value directly impacts Europris's profit margins, as the company must balance low prices with the need for profitability. In 2023, Europris reported a gross margin of 42.7%, a figure that reflects the constant pressure to offer compelling prices while managing operational costs.

Europris AS operates in a market where customers have numerous options for non-food items and daily consumables. The ease with which shoppers can find comparable products at other discount retailers, supermarkets with expanding non-food aisles, or even specialized stores significantly influences their leverage. For instance, in 2024, the Norwegian retail landscape saw continued growth in online grocery and general merchandise sales, providing consumers with more accessible alternatives.

Customers of Europris AS benefit significantly from increased information and transparency. The ease with which consumers can now compare prices and product features across various retailers, both online and in physical stores, directly amplifies their bargaining power. This heightened transparency, fueled by readily available digital tools and intense market competition, allows customers to make more informed purchasing decisions, often pushing retailers like Europris to offer more competitive pricing and value propositions.

Volume of Purchases by Individual Customers

The typical purchase volume for an individual customer at Europris is relatively small, reflecting its position as a discounter offering everyday consumer goods. This generally means that no single customer holds significant sway over pricing or terms.

However, Europris's success hinges on attracting a large customer base, and while individual transactions are modest, the aggregate impact of customer purchasing patterns, especially during sales events, can be substantial. For instance, in 2023, Europris reported a total revenue of NOK 8.8 billion, indicating a high volume of transactions across its customer base.

- Low Individual Purchase Value: Most customers buy a few items at a time, limiting their individual bargaining power.

- High Transaction Volume: The discounter model relies on a large number of small transactions.

- Collective Influence: While individual customers have little power, coordinated customer actions, like responding en masse to promotions, can influence sales.

- Price Sensitivity: Europris's target market is often price-sensitive, meaning customers are more likely to switch if prices are perceived as too high.

Switching Costs for Customers

For discount variety goods like those offered by Europris AS, switching costs for customers are typically very low. This means shoppers can easily move to a competitor if they find better prices, more convenient locations, or a wider product selection elsewhere.

In 2024, the retail landscape in Norway, Europris's primary market, remained highly competitive. While specific switching cost data for Europris isn't publicly detailed, the general trend in the discount sector indicates minimal barriers to customer movement. For instance, a customer looking for home goods or seasonal decorations can readily compare prices and offerings between Europris, Clas Ohlson, or even larger supermarket chains that carry similar items.

- Low Switching Costs: Customers face minimal financial or logistical hurdles when changing from Europris to another retailer.

- Price Sensitivity: The discount segment thrives on price, making customers highly attuned to even small price differences between competitors.

- Product Availability: If a competitor offers a desired product that Europris lacks, customers can easily switch their purchasing habits.

Customers of Europris AS possess significant bargaining power, primarily driven by their high price sensitivity and the availability of numerous alternatives. The ease with which consumers can compare prices and switch between retailers, especially in the discount sector, forces Europris to maintain competitive pricing strategies. This dynamic is further amplified by the transparency in the market, allowing customers to readily identify better value propositions elsewhere.

| Factor | Impact on Europris | Evidence/Data (2023/2024) |

| Price Sensitivity | High; customers actively seek best value. | Europris's gross margin was 42.7% in 2023, indicating pressure to keep prices low. |

| Availability of Alternatives | Significant; numerous competitors offer similar goods. | Norwegian retail saw increased online sales in 2024, offering more consumer choices. |

| Low Switching Costs | High; minimal barriers to moving to competitors. | Customers can easily switch between Europris, Clas Ohlson, and supermarkets for similar items. |

| Information Transparency | High; easy price and feature comparison. | Digital tools and market competition empower informed consumer choices. |

Full Version Awaits

Europris AS Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Europris AS, detailing the competitive landscape and strategic implications. The document you see here is the exact, fully formatted report you will receive immediately after purchase, offering immediate actionable insights into industry rivalry, buyer and supplier power, threat of new entrants, and substitute products. Rest assured, what you are previewing is the complete, ready-to-use analysis file, providing a thorough understanding of Europris AS's market position without any alterations or missing sections.

Rivalry Among Competitors

Europris operates in a highly competitive Norwegian retail landscape. Key rivals include major supermarket chains like Norgesgruppen, Rema 1000, and Coop, which increasingly offer non-food items. Discount chains such as Normal and Flying Tiger Copenhagen also vie for consumer spending, alongside specialized retailers and a growing number of online stores.

The Norwegian retail market, especially the non-food and discount segments where Europris AS operates, has experienced moderate but steady growth. In 2023, the overall retail trade in Norway saw a growth of 0.7% compared to 2022, according to Statistics Norway. This indicates a relatively stable environment, but one where expansion requires strategic maneuvering.

While the market isn't contracting, a slower growth rate means that companies like Europris must work harder to capture market share. This intensifies rivalry, as each player aims to attract and retain customers in a market where overall demand is not rapidly increasing. Success hinges on differentiation and efficiency.

Europris faces significant competition in differentiating its extensive non-food and daily consumable offerings. While strong private labels and loyalty programs can foster customer allegiance and mitigate intense rivalry, the discount retail sector inherently emphasizes price as a primary competitive lever. In 2024, Europris's focus on value-driven private label brands like "Everyday" and "First Price" aims to build loyalty, but competitors also heavily leverage private labels and aggressive pricing strategies.

Exit Barriers for Competitors

Competitors in the Norwegian retail market, including those directly impacting Europris AS, face considerable exit barriers. These barriers can trap companies in a market even when profitability is low, leading to sustained, aggressive competition. For instance, the significant investment in physical retail locations, including store fit-outs and distribution infrastructure, represents a substantial sunk cost. These assets are often difficult to repurpose or sell quickly without substantial loss.

Furthermore, long-term lease agreements for prime retail space can obligate companies to continue paying rent for years, even if they wish to cease operations. In 2024, the retail property market in Norway, while generally stable, can experience slower absorption rates for vacant commercial spaces, increasing the financial burden for exiting firms. Employee severance costs, particularly for a large workforce, also add a significant financial hurdle to exiting the market.

- High Fixed Asset Investment: Retailers often have substantial capital tied up in stores, warehouses, and logistics networks, making liquidation challenging.

- Long-Term Lease Commitments: Exiting tenants may be liable for remaining lease payments, especially in a market with potentially slow re-leasing of retail space.

- Employee Severance Costs: Redundancy packages for staff can represent a significant financial outflow upon market exit.

- Brand and Reputation: A poorly managed exit can damage a company's reputation, impacting its ability to operate in other markets or divest assets.

Market Concentration and Balance

The Norwegian retail sector, particularly groceries, shows significant concentration, with a few major players dominating. Europris, however, competes in a wider variety segment, which includes discount variety stores and home furnishings. This positioning means it faces competition from a broader range of retailers, not just the top grocery chains.

In 2024, the Norwegian retail landscape continues to be shaped by a few dominant grocery chains, but Europris carves out its niche. While specific market share data for the broader variety segment is less consolidated, Europris's strategy targets consumers seeking value across multiple product categories.

A balanced market, where several strong competitors exist, inherently fuels intense rivalry. Europris navigates this by focusing on its unique value proposition and store experience, aiming to differentiate itself in a dynamic retail environment.

- Market Share Dynamics: While the Norwegian grocery market is highly concentrated, Europris operates in the broader discount variety and home furnishings sector, facing competition from a diverse set of retailers.

- Competitive Landscape: The presence of several strong players across various retail segments intensifies competition, requiring Europris to maintain a clear value proposition.

- Europris's Niche: Europris differentiates itself by offering a wide range of products at competitive prices, appealing to value-conscious consumers across different categories.

Europris faces intense competition from established grocery chains like Norgesgruppen and Rema 1000, which are expanding their non-food offerings, and from specialized discount retailers such as Normal. This broad competitive set, including online players, means Europris must constantly innovate its value proposition to attract and retain customers in a market with moderate growth. In 2024, aggressive private label strategies and price competition are key battlegrounds.

| Competitor Type | Key Players | Competitive Tactics |

| Major Supermarkets | Norgesgruppen, Rema 1000, Coop | Expanding non-food ranges, private labels, loyalty programs |

| Discount Variety | Normal, Flying Tiger Copenhagen | Aggressive pricing, unique product curation, impulse buys |

| Online Retailers | Various | Convenience, price comparison, broad selection |

| Specialty Retailers | Home furnishings, electronics stores | Niche product expertise, brand loyalty |

SSubstitutes Threaten

Consumers often have a wide array of options beyond direct competitors to satisfy their needs, impacting Europris AS. For example, instead of purchasing new home furnishings or decorative items from Europris, customers might turn to DIY projects using readily available materials, significantly reducing the need for new product purchases.

The burgeoning popularity of the second-hand market, including online platforms and physical thrift stores, presents another substantial substitute. In 2023, the global secondhand apparel market alone was valued at over $177 billion, demonstrating a significant consumer shift towards pre-owned goods, which can also extend to home decor and other product categories Europris offers. This trend indicates a growing willingness among consumers to explore alternative, often more budget-friendly and sustainable, ways to acquire goods.

The threat of substitutes for Europris AS is influenced by the price-performance trade-off. While online retailers and discount chains might offer lower prices on certain goods, they often fall short in providing the immediate availability and tangible shopping experience that Europris customers value. For instance, a customer needing household essentials urgently might opt for Europris over waiting for an online delivery, even if the online price is slightly lower.

Customer propensity to substitute for Europris AS is influenced by the availability and attractiveness of alternatives. Factors like price, quality, and convenience play a significant role. For instance, a growing trend towards online shopping could increase the ease of switching to e-commerce retailers offering similar discount variety goods.

In 2024, Europris observed that while price remains a primary driver for its customer base, there's an increasing willingness to explore online channels for household essentials and seasonal items. This shift is partly due to enhanced digital offerings from competitors and a general move towards omnichannel retail experiences, potentially making substitutes more accessible and appealing.

Technological Advancements Enabling Substitutes

Technological advancements are significantly increasing the threat of substitutes for traditional retailers like Europris AS. The rapid growth of e-commerce and digital platforms allows new players to emerge and offer alternative ways for consumers to shop. For instance, online-only retailers and direct-to-consumer (DTC) brands can bypass the need for physical stores, directly reaching customers with potentially lower overheads. This bypass of traditional retail channels creates more purchasing avenues for consumers, directly challenging established brick-and-mortar businesses.

The ease with which digital platforms can be established means that a wider array of substitute products and services can reach consumers. Consider the rise of subscription box services or marketplaces that aggregate niche products, offering convenience and curated selections that might compete with a generalist retailer’s offerings. In 2024, the global e-commerce market continued its upward trajectory, projected to reach trillions of dollars, underscoring the increasing consumer comfort and preference for online shopping, which directly fuels the threat of substitutes.

- E-commerce Growth: Global e-commerce sales were estimated to be over $6.3 trillion in 2024, a substantial increase from previous years, highlighting the growing consumer shift to online channels.

- Digital Platform Accessibility: The decreasing cost and increasing ease of setting up online stores and digital marketplaces allow new entrants to quickly offer substitute products.

- Direct-to-Consumer (DTC) Brands: The DTC model bypasses traditional retail intermediaries, enabling brands to control their customer experience and pricing, often offering competitive alternatives.

- Subscription Services: The popularity of subscription models, from household goods to specialized items, provides a recurring substitute for traditional one-off purchases.

Regulatory or Social Trends Favoring Substitutes

Emerging regulations and evolving societal attitudes pose a significant threat to Europris AS by potentially favoring substitutes. For instance, a growing global and European focus on sustainability and the circular economy could lead consumers to seek out more durable, repairable, or second-hand goods, thereby reducing demand for the typically lower-priced, mass-produced items that form the core of Europris's offering.

Consider the increasing consumer interest in local sourcing and ethical production. This trend, amplified by heightened awareness of environmental impact and labor practices, could steer shoppers towards smaller, independent retailers or specialized online platforms that emphasize these values, presenting an alternative to the broad-reach discount model.

- Circular Economy Push: Growing adoption of circular economy principles across the EU, encouraging product longevity and reuse, directly challenges the disposable nature of some discount retail products.

- Localism Movement: Increased consumer preference for locally sourced goods, driven by environmental and community support, offers an alternative to the centralized supply chains typical of large discount retailers.

- Ethical Consumption: A rise in demand for ethically produced and transparently sourced products may lead consumers to bypass discount chains perceived as lacking in these areas.

The threat of substitutes for Europris AS is amplified by the growing accessibility of online shopping and the increasing popularity of the second-hand market. Consumers are increasingly willing to explore alternatives like DIY projects or pre-owned goods, especially as platforms for these options become more prevalent and user-friendly.

In 2024, the continued expansion of e-commerce, with global sales projected to exceed $6.3 trillion, directly increases the availability and appeal of substitute products. Furthermore, the rise of direct-to-consumer (DTC) brands and subscription services provides consumers with more convenient and often niche alternatives to traditional retail offerings, impacting purchasing decisions.

The price-performance trade-off remains a key factor, but the convenience of online purchasing and the growing emphasis on sustainability are shifting consumer preferences. While Europris offers immediate availability, the ease of online comparison and the appeal of circular economy options present significant challenges.

Emerging trends like localism and ethical consumption also contribute to the threat of substitutes. Consumers are increasingly drawn to products that align with their values, potentially bypassing discount retailers in favor of smaller, specialized, or ethically certified alternatives.

| Substitute Type | Key Drivers | Impact on Europris |

|---|---|---|

| Second-hand Market | Affordability, Sustainability, Uniqueness | Reduced demand for new goods, potential price pressure |

| DIY & Upcycling | Creativity, Cost Savings, Personalization | Lower sales of ready-made home goods and decor |

| E-commerce & DTC Brands | Convenience, Wider Selection, Competitive Pricing | Increased competition, potential loss of market share |

| Subscription Services | Convenience, Curation, Recurring Need | Cannibalization of impulse and regular purchases |

| Local & Ethical Retailers | Values Alignment, Quality Perception, Community Support | Shift in consumer loyalty, potential for premium pricing |

Entrants Threaten

Establishing a retail chain comparable to Europris demands substantial capital. This includes significant upfront investments in securing prime retail leases, building a robust inventory, developing efficient logistics networks, and implementing sophisticated IT infrastructure. For instance, setting up a single large-format store can easily run into hundreds of thousands of Euros.

Newcomers also struggle to achieve the economies of scale that Europris benefits from. These scale advantages translate into lower per-unit costs for purchasing, distribution, and marketing, making it difficult for new entrants to compete on price. In 2023, Europris reported a revenue of NOK 8.7 billion (approximately €770 million), highlighting the scale of operations that new competitors would need to match to gain significant market traction.

Newcomers face considerable hurdles in securing prime retail locations across Norway, a challenge amplified by Europris's established presence. The company's extensive network means that many desirable, high-traffic spots are already occupied, forcing new entrants to either pay premium prices for less ideal sites or invest heavily in building their own infrastructure.

Establishing efficient supply chains is another significant barrier. Europris benefits from economies of scale and long-standing relationships with suppliers, allowing for cost-effective procurement and distribution. New entrants would need substantial upfront investment to replicate this logistical advantage, making it difficult to compete on price and availability.

As of the end of 2023, Europris operated 280 stores in Norway, demonstrating a widespread and entrenched retail footprint. This density of locations acts as a powerful deterrent, limiting the availability of prime real estate and making it exceptionally difficult for new competitors to gain a foothold in key markets.

Newcomers face a significant hurdle in replicating Europris's established brand loyalty, built on its reputation for value and a wide product selection. To even enter the market, they'd need considerable investment in marketing to build recognition and might require truly innovative or niche offerings to draw customers away from a trusted, budget-friendly option.

Regulatory Barriers and Government Policy

Regulatory barriers in Norway’s retail sector, while generally open, can still present challenges for newcomers. Specific licensing requirements for certain product categories, such as alcohol or pharmaceuticals, can add complexity and cost to market entry. For instance, obtaining a license to sell wine and spirits in Norway involves adherence to strict regulations overseen by the Directorate of Health, which can be a deterrent for businesses not already equipped to navigate these processes.

Government policies aimed at fostering fair competition and consumer protection also play a role. Norway’s Competition Act, for example, prevents anti-competitive practices, meaning new entrants must ensure their strategies do not violate these established rules. While not an outright prohibition, the need to comply with these legal frameworks and potentially undergo scrutiny from the Norwegian Competition Authority can slow down or complicate the entry of new retail players, especially those with aggressive market entry strategies.

The retail landscape in Norway is also influenced by policies related to sustainability and ethical sourcing, which are increasingly important for consumers and regulators alike. Companies looking to enter the market may face pressure to demonstrate compliance with environmental standards or fair labor practices, adding another layer of operational and strategic consideration. For example, regulations concerning packaging waste and recycling, such as those managed by Grønt Punkt Norge, require investment and planning from all businesses operating in the retail space.

- Licensing: Specific permits are required for selling certain goods, like alcohol, increasing operational complexity.

- Competition Law: Norway's Competition Act mandates adherence to fair market practices, scrutinizing potentially monopolistic entry strategies.

- Sustainability Policies: Growing emphasis on environmental standards and ethical sourcing can impose additional compliance costs and strategic planning needs.

Incumbent Advantages (e.g., Sourcing, Experience)

Europris benefits from significant incumbent advantages that deter new entrants. Its long operational history in Norway has cultivated deep market knowledge and a loyal customer base, making it challenging for newcomers to gain traction quickly.

Established supplier relationships, particularly through its joint buying operations with Tokmanni, provide Europris with considerable sourcing power and cost efficiencies that new competitors would struggle to match. For instance, in 2023, the combined purchasing volume for the Tokmanni-Europris alliance offered significant leverage in negotiations with suppliers, a benefit that new entrants would need years to build.

- Established Brand Recognition: Years of operation have built strong brand awareness and trust among Norwegian consumers.

- Economies of Scale in Sourcing: Joint purchasing power with Tokmanni secures favorable terms and pricing.

- Market Expertise: In-depth understanding of Norwegian consumer preferences and retail landscape.

The threat of new entrants for Europris is relatively low due to substantial capital requirements for establishing a comparable retail chain, including inventory, logistics, and prime retail locations. Newcomers also face challenges in achieving the economies of scale that Europris leverages, as evidenced by its 2023 revenue of approximately €770 million. Furthermore, Europris's established network of 280 stores across Norway by the end of 2023 limits the availability of desirable retail sites.

New entrants must overcome significant barriers, including replicating Europris's brand loyalty and navigating regulatory landscapes that may involve specific licensing for certain product categories and adherence to competition and sustainability policies. The company's strong supplier relationships, amplified by its alliance with Tokmanni, provide considerable sourcing power and cost efficiencies that are difficult for new players to match.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High costs for retail leases, inventory, logistics, and IT infrastructure. | Significant financial hurdle; single large-format store setup can exceed hundreds of thousands of Euros. |

| Economies of Scale | Lower per-unit costs in purchasing, distribution, and marketing. | Difficult to compete on price; Europris's 2023 revenue of NOK 8.7 billion (€770 million) highlights the scale needed. |

| Location Access | Securing prime, high-traffic retail spots. | Europris's 280 stores (end of 2023) occupy many desirable locations, forcing higher costs or less ideal sites for newcomers. |

| Supplier Relationships | Established networks and joint buying power (with Tokmanni). | New entrants struggle to achieve similar cost efficiencies and sourcing leverage. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Europris AS is built upon a robust foundation of data, including Europris's annual reports, investor presentations, and financial statements. We supplement this with industry-specific market research reports from reputable firms and publicly available competitor data to provide a comprehensive view of the competitive landscape.