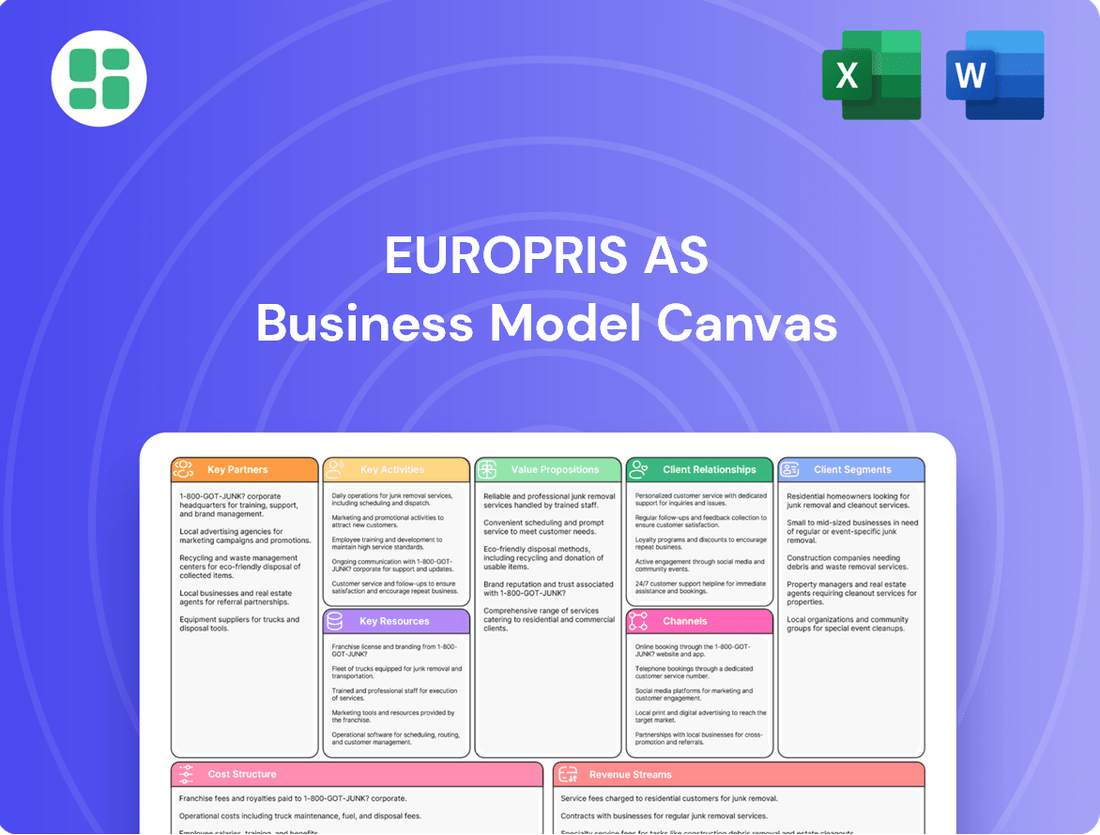

Europris AS Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Europris AS Bundle

Discover the core strategies behind Europris AS's success with our comprehensive Business Model Canvas. This in-depth analysis reveals how they effectively serve their value-conscious customer segments and leverage key partnerships to maintain their competitive edge in the discount retail market.

Unlock the complete strategic blueprint for Europris AS's thriving business model. This detailed canvas breaks down their unique value propositions, revenue streams, and cost structures, offering invaluable insights for anyone looking to understand their operational excellence.

See exactly how Europris AS builds and delivers value with our full Business Model Canvas. This professionally crafted document provides a clear, actionable overview of their customer relationships, key resources, and channels, making it an essential tool for strategic planning.

Partnerships

Europris AS depends on a wide array of global suppliers, mainly from Europe and Asia, to procure its extensive selection of non-food items and everyday consumables. These collaborations are vital for offering a competitive product range and guaranteeing a consistent flow of goods at attractive prices.

The cost of goods sold represents a substantial part of Europris's expenditures, underscoring the critical nature of effective supplier relationships for maintaining profitability and value pricing. For instance, in 2023, Europris reported a cost of sales of NOK 5.7 billion, emphasizing the direct impact of supplier costs on their financial performance.

Efficient supply chain management is crucial for a retailer like Europris, which operates a vast network of stores. They partner with logistics and distribution companies to handle warehousing, transportation, and the timely delivery of goods to their many locations throughout Norway and Sweden.

Collaborations with firms such as Maersk are key to ensuring effective container storage and overall supply chain efficiency. For instance, in 2024, Europris continued to leverage these partnerships to optimize inventory flow and reduce delivery times, a critical factor in maintaining competitive pricing and product availability for their customers.

Europris leverages franchise partners to expand its market reach and efficiently manage resources. This strategy allows for faster growth by tapping into local market knowledge and entrepreneurial spirit.

As of May 2024, Europris operates 21 franchise stores out of its total 287 locations in Norway. This franchise segment contributes to operational efficiency and localized market expertise, supporting the company's overall expansion strategy.

Technology Providers

Europris AS relies on strategic alliances with technology providers to enhance its operational efficiency. These partnerships are vital for critical functions such as point-of-sale (POS) systems, sophisticated inventory management, and robust e-commerce platforms, ensuring a seamless customer experience and streamlined internal processes.

A modern and integrated IT infrastructure is paramount for Europris to function effectively as a unified entity. This is particularly true following the acquisition of businesses like ÖoB, where system integration is key. For instance, in 2023, Europris continued its focus on IT modernization, aiming to consolidate systems and improve data flow across the organization, which is crucial for unified reporting and analysis.

The company is actively investing in upgrading its IT systems to bolster its capabilities in operational reporting and data analysis. This strategic move supports better decision-making by providing clearer insights into performance metrics. For example, the ongoing implementation of new ERP systems aims to provide real-time visibility into sales, stock levels, and supply chain operations, a significant upgrade from previous decentralized systems.

Europris's commitment to technology partnerships is evident in its continuous efforts to modernize its digital backbone. These collaborations enable the company to adapt to evolving market demands and maintain a competitive edge. By leveraging advanced technological solutions, Europris can achieve greater agility and responsiveness in its business operations, ultimately driving growth and profitability.

- POS Systems: Partnerships with providers like IBM for their retail solutions ensure efficient transaction processing and customer data management.

- Inventory Management: Collaborations with supply chain technology firms enhance stock visibility and reduce waste, critical for a high-volume retailer.

- E-commerce Platforms: Strategic alliances with web development and platform providers support Europris's growing online sales channel, ensuring scalability and user experience.

- ERP Integration: Ongoing projects to integrate enterprise resource planning systems with key technology partners simplify financial management, HR, and supply chain operations across the group.

E-commerce Affiliates and Subsidiaries

Europris leverages key partnerships with specialized e-commerce entities to extend its market presence beyond its primary retail operations. These include full or partial ownership stakes in companies like Lekekassen, focusing on toys, Strikkemekka for yarn products, and Designhandel, which caters to the interior design segment.

These strategic alliances are crucial for broadening Europris's product assortment and reaching distinct online consumer groups, thereby creating a more comprehensive offering that complements its established brick-and-mortar footprint. The acquisition of full ownership of Lekekassen in March 2023 exemplifies this strategy, deepening the integration of these digital channels into the broader Europris group.

- E-commerce Expansion: Europris strategically partners with or acquires specialized online retailers to tap into niche markets.

- Portfolio Diversification: Companies like Lekekassen (toys), Strikkemekka (yarn), and Designhandel (interior) represent this diversification, extending Europris's reach.

- Synergistic Growth: These partnerships enhance Europris's overall market penetration by combining physical retail with targeted online sales channels.

- Strategic Acquisitions: The full acquisition of Lekekassen in March 2023 underscores the commitment to integrating and growing these e-commerce subsidiaries.

Europris AS cultivates vital relationships with a broad spectrum of suppliers, primarily from Europe and Asia, to source its diverse product range. These partnerships are fundamental to offering competitive pricing and ensuring consistent product availability for its customers.

In 2023, Europris reported a cost of sales amounting to NOK 5.7 billion, highlighting the significant financial impact of these supplier agreements on the company's profitability and its ability to maintain value pricing strategies.

The company also relies on logistics and distribution partners to manage its extensive supply chain, ensuring timely delivery of goods to its numerous store locations across Norway and Sweden. Collaborations with firms like Maersk are crucial for optimizing container storage and overall supply chain efficiency, as seen in their continued efforts throughout 2024 to reduce delivery times and enhance inventory flow.

Europris further expands its market reach and operational efficiency through strategic franchise partnerships, as evidenced by its 21 franchise stores out of 287 total locations in Norway as of May 2024. These collaborations leverage local market knowledge and entrepreneurial drive for accelerated growth.

What is included in the product

Europris AS operates a discount retail model, focusing on everyday low prices and a broad assortment of household goods, consumables, and seasonal items to attract a wide range of price-sensitive customers.

This model is supported by efficient supply chain management and a strong private label strategy, enabling cost leadership and broad market appeal.

Europris AS's Business Model Canvas offers a clear, one-page snapshot of their strategy, allowing for rapid identification of how they alleviate customer pain points through their value proposition and key activities.

Activities

Europris AS's procurement and sourcing activities are central to its low-price strategy. They focus on identifying, negotiating, and purchasing a broad range of non-food items and select daily consumables from international suppliers. This global sourcing allows them to secure competitive pricing, a key differentiator for their price-sensitive customer base.

A significant aspect of their sourcing strategy is the emphasis on private-label products and promotional campaign sales. These initiatives are designed to attract and retain customers who are actively looking for value. For instance, in 2024, Europris continued to expand its private-label assortment, aiming to offer even greater price advantages to shoppers.

The company actively manages its product categories, constantly refreshing them to appeal to a wider audience and attract new customer segments. This dynamic approach to category management ensures that Europris remains relevant and appealing to evolving consumer preferences, driving foot traffic and sales throughout the year.

Retail Operations Management involves overseeing Europris's extensive network of physical stores throughout Norway and Sweden. This includes ensuring efficient daily activities like stocking shelves, managing inventory, and providing excellent customer service to boost sales and customer satisfaction.

A key focus is on maintaining well-stocked stores and enhancing service quality, directly impacting the customer experience. For instance, in the first quarter of 2024, Europris reported strong performance in its Norwegian segment, with like-for-like sales growth contributing to overall success, underscoring the effectiveness of these operational efforts.

Europris AS's key activities heavily revolve around meticulously overseeing its entire logistics and supply chain. This encompasses everything from the initial sourcing of products to ensuring they are readily available on store shelves.

Managing a network of warehouses, distribution centers, and transportation is crucial for Europris to deliver goods to its widespread store locations efficiently and affordably. For instance, in 2023, the company reported a significant portion of its operational costs being tied to its logistics network, underscoring its importance.

Optimizing these logistical processes directly contributes to Europris's ability to maintain its competitive low-price strategy and ensure consistent product availability for its customers. This focus on efficient movement of goods is a cornerstone of their business model.

Marketing and Campaign Management

Europris's marketing and campaign management is central to its business model, focusing on a campaign-driven approach that resonates with price-sensitive customers. This involves meticulously planning and executing a variety of advertising efforts, from traditional printed leaflets to contemporary digital promotions. The primary goal is to effectively showcase their value-for-money propositions and seasonal product assortments.

The impact of these campaigns is significant, with products featured prominently on the front pages of marketing leaflets demonstrating particularly strong sales performance. In 2023, Europris reported that approximately 70% of its sales were driven by campaign activities, highlighting the effectiveness of this strategy in attracting and engaging its target demographic. This emphasis on promotional activity is a core element of their customer acquisition and retention strategy.

- Campaign-Driven Growth: Europris leverages a campaign-centric strategy to drive sales, particularly appealing to budget-conscious shoppers.

- Integrated Marketing Mix: Campaigns encompass both print (leaflets) and digital channels to maximize reach and impact.

- Promotional Impact: Front-page placement on marketing leaflets shows a direct correlation with increased product sales.

- Sales Contribution: In 2023, roughly 70% of Europris's total sales were attributed to their marketing campaign initiatives.

E-commerce and Digital Platform Management

Europris AS is actively managing and optimizing its e-commerce operations, including its primary online store and specialized platforms like Lekekassen, Strikkemekka, and Designhandel. This focus is crucial for broadening customer access and providing a seamless shopping experience. The company's digital strategy involves diligent management of online stock levels, efficient order processing, and robust digital customer service. For instance, in 2024, Europris continued to invest in its digital infrastructure to support these activities, aiming to capture a larger share of the online retail market.

The integration of ÖoB (ÖoB, a Swedish home furnishing retailer acquired by Europris) into Europris's operational framework is a significant undertaking. This process includes transitioning ÖoB's systems to align with Europris's established campaign methodologies and enhancing its in-store visual presentation to match the Europris brand. This strategic move aims to harmonize the customer experience across all acquired entities and leverage Europris's proven retail strategies. By the end of 2024, substantial progress was reported in aligning ÖoB's operations with Europris's core business practices.

- Online Store Optimization: Continuous improvement of the Europris.no platform and its associated niche e-commerce sites to enhance user experience and sales conversion rates.

- Digital Customer Engagement: Implementing and refining strategies for online customer support, including chat, email, and social media interactions, to foster loyalty and satisfaction.

- ÖoB Integration: Successfully migrating ÖoB's operational systems and visual merchandising to Europris's standards, ensuring a consistent brand experience.

- E-commerce Growth: Expanding the reach and sales volume of all digital platforms, reflecting the growing consumer preference for online shopping in the home and garden sector.

Europris AS's key activities are deeply rooted in its procurement and logistics. The company excels at global sourcing, securing a wide array of non-food items and daily consumables at competitive prices, which is fundamental to its low-price strategy. This is complemented by efficient supply chain management, ensuring products reach their extensive store network reliably and cost-effectively.

Retail operations and marketing are also paramount. Europris focuses on maintaining well-stocked stores and enhancing customer service to drive sales. Their highly effective campaign-driven marketing approach, heavily reliant on promotional leaflets and digital outreach, is a significant sales driver, with a substantial portion of revenue directly linked to these initiatives. In 2023, approximately 70% of sales were campaign-driven.

Furthermore, Europris is actively expanding its e-commerce presence, managing its main online store alongside specialized sites like Lekekassen. The integration of acquired businesses, such as ÖoB, into their operational and branding framework is another critical activity, aiming for a unified customer experience. By the end of 2024, significant progress was made in aligning ÖoB operations with Europris's core practices.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Procurement & Sourcing | Global sourcing of non-food items and consumables to maintain low prices. | Focus on private-label expansion in 2024. |

| Logistics & Supply Chain | Efficient management of warehouses, distribution, and transportation. | Logistics costs represent a significant portion of operational expenses. |

| Retail Operations | Managing store network, inventory, and customer service. | Strong like-for-like sales growth reported in Q1 2024 for Norway. |

| Marketing & Campaigns | Campaign-driven sales strategy using print and digital channels. | ~70% of sales in 2023 attributed to campaign activities. |

| E-commerce & Integration | Operating online stores and integrating acquired businesses. | Continued investment in digital infrastructure in 2024. ÖoB integration progressing well by end of 2024. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing for Europris AS is the actual document you will receive upon purchase. This means the structure, content, and formatting you see here are precisely what you'll get, ensuring no surprises. You'll have full access to this comprehensive analysis, ready for immediate use and adaptation.

Resources

Europris's extensive retail network is a cornerstone of its business model, serving as its primary physical asset. As of May 2024, this network encompassed 287 stores across Norway, with 266 being directly owned and 21 operating under franchise agreements. This broad geographical reach is crucial for ensuring customer convenience and accessibility throughout the nation.

Further strengthening its market presence, Europris completed the acquisition of ÖoB in May 2024. This strategic move brought an additional 92 stores in Sweden into the group's portfolio, effectively expanding the total store count to 381 locations. This expansion significantly broadens Europris's operational footprint and market penetration.

Europris AS relies on a network of warehouses and distribution centers to manage its extensive product inventory. These facilities are crucial for efficiently receiving goods, storing them, and preparing them for shipment to its numerous retail locations.

The company utilizes a combination of owned and partnered transportation fleets to ensure timely and cost-effective delivery of products. This logistics infrastructure is vital for supporting the high volume of sales characteristic of the discount retail sector.

In 2023, Europris AS reported that its logistics and supply chain costs represented a significant portion of its overall operating expenses, highlighting the direct impact of infrastructure efficiency on its bottom line. Effective management of this infrastructure is therefore a key driver of its cost competitiveness.

Europris has cultivated a powerful brand presence in Norway, consistently recognized for offering excellent value. This focus on affordability and quality has cultivated deep customer trust and loyalty. This strong brand equity represents a significant intangible asset for the company.

The company benefits from a substantial and dedicated customer base. With approximately 4 million members in its loyalty program and around 58 million customer transactions occurring each year, Europris demonstrates a remarkable level of engagement and repeat business.

Human Capital (Skilled Workforce)

Europris AS recognizes its human capital as a cornerstone of its business model. A motivated and skilled workforce, encompassing everyone from frontline store staff to logistics teams and corporate management, is absolutely essential for seamless daily operations, delivering excellent customer service, and effectively executing the company's strategic vision. This skilled workforce is key to maintaining Europris's competitive edge in the retail sector.

In 2024, Europris AS reported a total headcount of 5,352 employees. This significant number underscores the importance of their people in driving the company forward. The organization actively invests in its employees, focusing on initiatives designed to enhance both their health and professional development, ensuring a capable and engaged team.

The company's commitment to its human capital is reflected in its ongoing efforts to foster a positive work environment and provide opportunities for growth. This focus on employee well-being and skill enhancement directly translates into improved operational efficiency and customer satisfaction, reinforcing the value of a skilled workforce within the Europris business model.

- Skilled Workforce: Europris AS relies on a motivated and competent team across all levels, from store associates to corporate leadership, to ensure operational excellence and customer satisfaction.

- 2024 Headcount: The company employed 5,352 individuals in 2024, highlighting the scale of its human capital investment.

- Employee Development: Europris prioritizes initiatives focused on employee health and continuous development, recognizing these as critical drivers for sustained performance and strategic execution.

- Operational Impact: A well-trained and engaged workforce is fundamental to Europris's ability to manage daily operations efficiently and deliver on its customer service promises.

Information Technology Systems

Europris AS relies heavily on its proprietary and integrated IT systems to efficiently manage critical business functions. These systems are the backbone for tracking inventory levels, processing sales data, and maintaining customer information, all of which are essential for smooth day-to-day operations.

The company is currently in the midst of a significant Enterprise Resource Planning (ERP) project. This initiative is designed to further streamline operations and enhance data management capabilities across the organization.

In parallel, Europris is upgrading its business intelligence tools. These enhancements are aimed at providing more robust operational reporting and deeper analytical insights, crucial for informed decision-making. The planned go-live for these IT system upgrades is set for the first half of 2025.

- Proprietary and integrated IT systems are fundamental for inventory, sales, and customer data management.

- ERP project underway to enhance overall operational efficiency and data integration.

- Upgraded business intelligence tools will support improved reporting and analysis.

- Planned go-live for IT system upgrades in the first half of 2025.

Europris's key resources are its extensive physical retail network, robust logistics infrastructure, strong brand equity, a loyal customer base, skilled human capital, and advanced IT systems. The company's strategic expansion, including the acquisition of ÖoB, has significantly broadened its market reach. Its commitment to employee development and operational efficiency, supported by ongoing IT upgrades, underpins its competitive advantage.

| Key Resource | Description | 2024 Data/Status |

|---|---|---|

| Retail Network | Physical stores providing customer access. | 287 stores in Norway (266 owned, 21 franchise) + 92 acquired ÖoB stores in Sweden, totaling 381 locations. |

| Logistics Infrastructure | Warehouses, distribution centers, and transportation fleets. | Crucial for efficient inventory management and product delivery; logistics costs were a significant operating expense in 2023. |

| Brand Equity | Strong brand recognition for value and quality in Norway. | Cultivated deep customer trust and loyalty. |

| Customer Base | Large and engaged customer base. | Approximately 4 million loyalty program members; around 58 million annual customer transactions. |

| Human Capital | Motivated and skilled workforce. | 5,352 employees in 2024; focus on employee health and development. |

| IT Systems | Proprietary systems for operations management. | Ongoing ERP project and business intelligence tool upgrades, with a planned IT system upgrade go-live in H1 2025. |

Value Propositions

Europris AS centers its value proposition on offering a wide selection of goods at consistently low prices, making it a go-to destination for shoppers prioritizing affordability. This commitment to value is underscored by their strategic use of campaigns that highlight these competitive price points.

In 2024, Europris continued to emphasize its value-for-money approach, a strategy that resonated strongly with consumers facing economic pressures. The company's ability to maintain attractive pricing across its diverse product categories, from home essentials to seasonal items, solidifies its position as a leader in the discount retail sector.

Europris AS stands out by offering customers a remarkably broad and diverse product assortment, encompassing everything from essential home goods and leisure items to clothing and seasonal decorations. This extensive selection, spanning 15 distinct product categories, ensures shoppers can fulfill a wide array of needs and desires under one roof.

This comprehensive range allows customers to easily source items for daily living as well as for special occasions, fostering convenience and a one-stop-shop experience. For instance, in 2023, Europris reported net sales of NOK 9.1 billion, demonstrating the significant customer engagement driven by its varied product offering.

Europris AS ensures convenience through its widespread retail presence, boasting 277 stores across Norway as of early 2024. This extensive network means customers can easily find a Europris location, often within their local communities, including rural and suburban areas, making everyday shopping a breeze.

Further enhancing accessibility, Europris has strategically expanded into Sweden, operating an additional 26 stores there by the same period. This cross-border presence, coupled with their e-commerce operations, broadens the reach and convenience for a larger customer base.

Seasonal and Trend Relevance

Europris excels by aligning its product selection with the pulse of the seasons and prevailing trends. This means customers find exactly what they need for everything from summer barbecues to festive holiday decorations, ensuring the assortment feels current and appealing year-round. This dynamic approach is a key driver of customer engagement and repeat business.

The company's ability to capitalize on seasonal shifts is a significant contributor to its financial performance. For instance, strong seasonal demand in the fourth quarter of 2024 directly bolstered sales of non-food items, demonstrating the direct impact of this value proposition on revenue. This strategic adaptation ensures Europris remains a relevant and attractive shopping destination throughout the year.

- Seasonal Product Assortment: Europris curates products relevant to holidays, seasons, and current consumer trends.

- Trend Responsiveness: The business actively monitors and incorporates popular trends into its offerings.

- Customer Engagement: This strategy fosters repeat visits by keeping the product selection fresh and timely.

- Q4 2024 Performance: Good seasonal performance was a key factor in the strong sales of non-food items during this period.

One-Stop Shopping Experience

Europris AS provides a one-stop shopping experience by stocking a wide array of products. This includes everything from everyday household necessities to items for leisure activities and seasonal decorations, allowing customers to meet various needs during a single shopping trip. This convenience is a key draw for consumers looking to save time and effort.

This strategy is reflected in their sales performance, with Europris reporting a revenue of NOK 7,056 million for the first quarter of 2024. Their broad product assortment directly contributes to this broad customer appeal.

- Broad Product Mix: Household essentials, leisure items, seasonal goods.

- Customer Convenience: Fulfills multiple needs in one visit, saving time and effort.

- Discount Retailer Appeal: Reinforces its position as a go-to destination for value.

Europris AS offers a compelling value proposition centered on affordability and a broad product selection. This dual focus ensures customers can find a wide range of goods, from everyday essentials to seasonal items, at consistently low prices. Their strategic use of campaigns highlighting these competitive price points further reinforces their commitment to value.

In 2024, Europris continued to resonate with consumers by emphasizing its value-for-money approach. The company's ability to maintain attractive pricing across its diverse product categories, including home essentials and seasonal items, solidifies its position as a leader in the discount retail sector.

Europris AS distinguishes itself by providing an extensive and varied product assortment, covering essential home goods, leisure items, clothing, and seasonal decorations. This comprehensive range, spanning 15 distinct product categories, allows customers to address a multitude of needs and preferences in a single shopping destination.

This extensive product mix facilitates a one-stop shopping experience, enabling customers to easily acquire items for daily living as well as for special occasions. For example, Europris reported net sales of NOK 9.1 billion in 2023, a testament to the significant customer engagement driven by its diverse offering.

| Value Proposition Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Affordability & Value | Consistently low prices across a wide product range. | Strong consumer appeal amidst economic pressures; reinforced by targeted campaigns. |

| Extensive Product Assortment | Broad selection covering household essentials, leisure, clothing, and seasonal items across 15 categories. | Drives customer engagement and fulfills diverse needs, contributing to significant sales figures. |

| Seasonal Relevance | Curated products aligned with holidays, seasons, and current trends. | Boosts customer visits and repeat business; directly impacted Q4 2024 non-food sales positively. |

Customer Relationships

Europris AS primarily engages customers through a transaction-oriented self-service model. This approach is standard for discount variety retailers, allowing shoppers to freely browse and select products at their convenience. The focus is on ensuring clear pricing and readily available stock, facilitating a quick and independent shopping experience.

Europris AS prioritizes in-store customer assistance, even within its largely self-service model. Staff are available to help with product inquiries, locating items, and managing checkout, ensuring a smooth shopping experience.

These in-store interactions are crucial for resolving immediate customer needs and providing a helpful touchpoint. In 2023, Europris reported a significant increase in customer satisfaction scores, partly attributed to enhanced staff training and operational efficiencies that improved service levels.

Europris actively cultivates customer loyalty through its robust customer club, boasting approximately 4 million members. This extensive network allows for targeted engagement and rewards, driving repeat business and strengthening brand affinity.

These loyalty programs are designed to offer tangible value, including exclusive discounts, early access to sales events, and personalized promotions tailored to individual customer preferences. Such benefits are crucial in encouraging sustained patronage and fostering a deeper connection with the Europris brand.

Marketing campaigns, particularly those highlighted in promotional leaflets, serve as a significant catalyst for sales growth. The data indicates that products featured prominently in these campaigns consistently achieve strong performance, underscoring the effectiveness of this customer outreach strategy.

Digital Communication and Engagement

Europris AS actively engages customers through digital channels, leveraging its website, social media platforms, and email newsletters for marketing and communication. This digital presence ensures wide reach for promotional campaigns and offers accessible customer interaction points beyond its physical store network.

The company prioritizes online support, providing customers with avenues to seek assistance and information digitally. This commitment to digital engagement enhances customer experience and fosters loyalty by offering convenient support options.

Europris AS maintains a dedicated investor relations website, a key digital touchpoint for stakeholders. This platform disseminates crucial financial information, including quarterly reports and presentations, ensuring transparency and accessibility for investors.

- Digital Marketing Reach: In 2023, Europris AS reported a significant online presence, with its website and social media channels driving substantial traffic and engagement for promotional offers.

- Customer Interaction: Digital platforms facilitate direct customer feedback and support inquiries, allowing Europris to address customer needs efficiently outside of store hours.

- Investor Communication: The investor relations section of the website provides timely access to financial disclosures, with the Q3 2023 report highlighting key performance indicators for the period.

Campaign-Driven Engagement

Europris AS's customer relationships are significantly shaped by its robust campaign sales strategy. These frequent promotions, often featuring compelling value propositions and new product introductions, are designed to generate excitement and drive repeat store visits. The effectiveness of this approach was particularly evident in 2024, a year characterized by heightened price sensitivity across the market.

The company's campaign-driven model proved resilient, successfully attracting and retaining customers even amidst economic headwinds. This focus on tangible value and timely offers fosters a sense of urgency and reward, strengthening the bond between Europris and its customer base.

- Campaign-Driven Engagement: Customer relationships are heavily influenced by Europris's frequent and impactful campaign sales, emphasizing value and new products.

- Excitement and Regular Visits: These campaigns generate customer excitement, encouraging regular store visits to capitalize on limited-time offers.

- 2024 Resilience: Europris demonstrated resilience in 2024 through its campaign-focused strategy, effectively navigating a price-conscious market.

Europris AS cultivates customer relationships through a blend of in-store assistance, a strong loyalty program, and impactful marketing campaigns. The company's customer club, with approximately 4 million members, facilitates personalized offers and drives repeat business. Digital channels and investor relations websites also play a key role in communication and engagement.

| Customer Relationship Aspect | Key Features | Impact/Data Point |

|---|---|---|

| Loyalty Program | Customer Club | ~4 million members |

| Marketing | Promotional Leaflets, Digital Campaigns | Drives strong product performance, significant online traffic in 2023 |

| Customer Service | In-store assistance, Digital Support | Improved customer satisfaction scores in 2023 |

| Campaign Strategy | Value propositions, New product introductions | Generated excitement and repeat visits, resilient in 2024 market |

Channels

Europris's primary and most significant channel is its extensive network of physical discount variety stores. As of 2024, the company operates 287 locations across Norway, solidifying its position as Norway's largest discount variety retailer by sales. This widespread brick-and-mortar presence ensures high visibility and accessibility for a broad customer base throughout the country.

Europris AS leverages its dedicated e-commerce platform as a key channel, enabling customers to conveniently shop online for home delivery or in-store pickup. This digital storefront significantly broadens Europris's customer base, reaching individuals beyond the immediate vicinity of its physical stores and appealing to the growing segment of consumers who favor online transactions. The e-commerce channel acts as a vital complement to the company's extensive brick-and-mortar retail network, enhancing overall accessibility and customer convenience.

Europris AS leverages specialized e-commerce subsidiaries like Lekekassen (toys), Strikkemekka (yarn), and Designhandel (interior products) to target distinct online market segments. This strategy diversifies its digital presence beyond its core offering, allowing for tailored product assortments and marketing efforts for each niche. For instance, Lekekassen caters to parents seeking a wide variety of children's toys, while Strikkemekka serves the crafting community with a curated selection of yarns and accessories.

Marketing and Advertising Campaigns

Europris AS leverages a multi-channel marketing approach to connect with its customer base. This includes traditional print media, such as their widely distributed marketing leaflets, alongside robust digital advertising and active social media engagement. These efforts are designed to communicate their value proposition and drive both in-store and online traffic.

Marketing campaigns are a significant growth engine for Europris. The company reported that in 2023, their marketing activities, particularly those featured on the front pages of their leaflets, were instrumental in attracting customers. For instance, specific promotional campaigns have historically shown a direct correlation with increased sales volumes, demonstrating the effectiveness of their advertising spend in reaching a broad audience and influencing purchasing decisions.

- Print Media Dominance: Marketing leaflets remain a cornerstone, effectively reaching a wide demographic and driving footfall to physical stores.

- Digital and Social Integration: Online advertising and social media platforms are utilized to complement print efforts, enhancing campaign reach and engagement.

- Campaign-Driven Growth: Promotional campaigns, especially those highlighted prominently, are key drivers of sales and customer acquisition.

- 2023 Performance Insight: The company's 2023 financial reports indicated that strategic marketing initiatives contributed significantly to revenue generation, with specific campaigns showing a notable uplift in customer visits and transaction values.

Local Store Promotions and Community Engagement

Europris AS empowers its local stores to run tailored promotions and engage in community activities, directly addressing the needs of specific demographics. This strategy cultivates a strong neighborhood connection and boosts brand visibility from the ground up. For instance, in 2024, many Europris locations actively participated in local events and offered discounts on seasonal goods relevant to their immediate customer base.

This localized approach is a cornerstone of Europris's customer relationship strategy. By understanding and catering to the unique preferences of each community, the company fosters loyalty and strengthens its market position. The brand's commitment to grassroots engagement was evident in the numerous local sponsorships and partnerships observed throughout 2024.

Furthermore, Europris consistently announces new store openings, signaling ongoing expansion and a commitment to reaching new customer segments. This growth strategy is supported by the success of their localized promotional efforts, which have proven effective in building a strong customer base in established and emerging markets alike.

- Local Promotions: Stores customize offers based on local demographics and seasonal relevance.

- Community Engagement: Active participation in local events and sponsorships strengthens brand ties.

- Brand Presence: Grassroots marketing enhances visibility and connection within neighborhoods.

- Expansion: Regular announcements of new store openings reflect a growing retail footprint.

Europris AS utilizes its physical store network as its primary channel, with 287 locations across Norway in 2024. This extensive retail footprint ensures broad customer accessibility and high visibility throughout the country, reinforcing its position as a leading discount variety retailer.

The company's e-commerce platform serves as a crucial complementary channel, offering home delivery and in-store pickup options. This digital presence extends Europris's reach beyond geographical limitations, catering to the increasing demand for online shopping convenience and broadening its customer base significantly.

Europris also leverages specialized e-commerce subsidiaries, such as Lekekassen for toys and Strikkemekka for yarn, to target niche markets effectively. This multi-pronged digital strategy allows for tailored product assortments and marketing, enhancing engagement with specific customer segments.

| Channel Type | Description | 2024 Presence/Activity |

|---|---|---|

| Physical Stores | Discount variety retail locations | 287 stores across Norway |

| E-commerce Platform | Online sales with home delivery/pickup | Dedicated website, complements physical stores |

| Specialized E-commerce | Niche online retail subsidiaries | Lekekassen (toys), Strikkemekka (yarn), Designhandel (interiors) |

| Marketing Channels | Promotional activities | Print leaflets, digital advertising, social media |

Customer Segments

Price-conscious consumers represent Europris AS's foundational customer base. These individuals and families actively seek the best value for their money, making affordability a primary driver in their purchasing decisions. Europris's strategy directly addresses this by focusing on discount pricing and frequent promotional campaigns, ensuring everyday essentials are accessible.

The economic climate of 2024 amplified the importance of this segment. With many households facing financial pressures, Europris's commitment to low prices resonated strongly, making its value proposition particularly appealing. For instance, in the first half of 2024, Europris reported a 1.9% increase in revenue, reaching NOK 6.8 billion, partly attributed to its ability to attract and retain price-sensitive shoppers.

Families and households represent a core customer segment for Europris, actively seeking a broad spectrum of goods. They are drawn to the convenience of a one-stop shop for both everyday necessities and discretionary purchases, valuing the accessibility of items ranging from home essentials and cleaning supplies to apparel and leisure products. In 2024, Europris's extensive product offering across 15 categories directly addresses these diverse needs, making it a go-to destination for budget-conscious consumers managing household budgets.

This segment represents a significant portion of the population who prioritize the ease of finding a wide array of goods under one roof. They are looking for a shopping destination that simplifies their lives by offering everything from home essentials to seasonal decorations.

Europris caters to this need by providing a broad assortment of products, making it a go-to for everyday purchases and occasional needs. For instance, in 2023, Europris reported a revenue of NOK 8.9 billion, reflecting the substantial purchasing power of this broad customer base that values convenience.

While not solely focused on the lowest price, these customers certainly appreciate value. They are drawn to Europris's promise of smart and affordable shopping, where they can find quality items without overspending, contributing to the company's consistent growth and market presence.

Seasonal Shoppers and Event Planners

Seasonal shoppers, driven by holidays, gardening, and leisure, represent a key customer segment for Europris. Their purchasing habits are directly influenced by the retailer's ever-changing product selection and targeted seasonal promotions. For instance, in 2024, Europris observed robust sales in non-food categories, a trend often bolstered by these seasonal buying patterns.

Event planners also fall into this crucial demographic, seeking a wide array of party supplies and decorations. Europris's ability to offer a diverse and relevant assortment ensures it meets the demands of these customers who are preparing for specific occasions. This focus on seasonal and event-driven needs is a cornerstone of Europris's strategy.

- Seasonal Demand: Customers purchase items for holidays, gardening, and leisure, aligning with Europris's dynamic product offerings.

- Event Planning Needs: Event planners rely on Europris for party supplies and decorations, a segment supported by seasonal campaigns.

- Non-Food Sales Impact: Strong seasonal performance in 2024 positively influenced sales of non-food items, indicating the importance of these customer segments.

Rural and Suburban Communities

Europris’s extensive store network, with over 270 locations across Norway, is a cornerstone of its strategy, particularly in serving rural and suburban communities. This widespread presence ensures that residents in smaller towns and outlying areas have convenient access to a broad range of household goods, seasonal items, and everyday essentials, often filling a gap left by larger, more centralized retailers. For instance, as of early 2024, Europris continues to be a significant retail presence in numerous municipalities, providing vital shopping options for local populations.

The company’s commitment to these areas means that customers in places like Finnmark or Nordland, far from major urban centers, can still find affordable and practical products. This accessibility is crucial for households managing budgets and seeking value. Europris’s store footprint is deliberately designed to reach these demographics, reinforcing its role as a community-focused retailer.

Key aspects of Europris’s customer segment in rural and suburban areas include:

- Widespread Accessibility: Stores are strategically located to serve communities with limited retail alternatives.

- Everyday Needs: Catering to the demand for a variety of household and personal items.

- Value Proposition: Offering affordable products that appeal to budget-conscious consumers.

- Community Presence: Acting as a key retail destination in smaller towns and suburban neighborhoods.

Europris AS primarily serves price-conscious consumers and families who prioritize value and convenience. These segments are attracted to the retailer's broad product assortment, encompassing everyday essentials, home goods, and seasonal items, all offered at competitive prices. The company's extensive store network, with over 270 locations, ensures accessibility, particularly for those in rural and suburban communities.

In 2024, Europris's strategy resonated strongly with these groups, evidenced by a 1.9% revenue increase to NOK 6.8 billion in the first half of the year. This growth reflects the appeal of its value proposition to households managing budgets, especially during periods of economic pressure.

Seasonal shoppers and event planners also form a significant customer base, relying on Europris for holiday, gardening, and party supplies. The retailer's dynamic product selection and targeted promotions cater effectively to these needs, contributing to robust sales, particularly in non-food categories during 2024.

| Customer Segment | Key Characteristics | 2024 Relevance |

| Price-Conscious Consumers | Seek best value, affordability is primary driver | Amplified importance due to economic climate; drove revenue growth |

| Families and Households | Need broad spectrum of goods, value one-stop shopping | Catered to by extensive product offering across 15 categories |

| Seasonal Shoppers & Event Planners | Purchase for holidays, gardening, leisure, and parties | Bolstered non-food sales; key to seasonal promotions |

Cost Structure

The Cost of Goods Sold (COGS) represents the most substantial expense category for Europris AS, directly reflecting the costs associated with acquiring and preparing the merchandise for sale. As a discount retailer, the company's ability to maintain competitive pricing hinges on its effectiveness in managing these costs through strategic sourcing and leveraging economies of scale via bulk purchasing.

In 2024, COGS remained a pivotal component of Europris's overall expenditure. While specific figures for 2024 are still being finalized, historical trends indicate that COGS typically constitutes a significant majority of a discount retailer's operating expenses, directly impacting gross profit margins.

Europris AS incurs significant store operating expenses, encompassing rent, utilities, and maintenance for its widespread network in Norway and Sweden. These costs are a substantial component of their overhead, directly tied to the sheer volume of physical retail locations.

The company's operational efficiency is reflected in its opex-to-sales ratio, which stood at 22.5% in the second quarter of 2025. This figure demonstrates positive impacts from achieving scale economies and maintaining diligent cost management across its store operations.

Personnel costs, encompassing salaries and wages for store associates, warehouse teams, and the corporate office, represent a substantial portion of Europris's operational expenses. In 2024, the company maintained a workforce of 5,352 employees, highlighting the scale of its labor investment.

Effectively managing these labor costs is crucial for profitability. This involves optimizing staffing levels to meet operational demands while simultaneously enhancing employee productivity to ensure cost efficiency across all levels of the organization.

Logistics and Distribution Costs

Logistics and distribution are significant cost drivers for Europris AS, encompassing expenses from supplier to store. This includes freight, warehousing, and fuel, all critical for maintaining their low-price strategy. For instance, in Q3 2024, Europris noted that higher freight costs impacted their results, highlighting the sensitivity of this cost category.

- Freight Costs: Expenses related to moving goods from suppliers to Europris' distribution centers and then to individual retail locations.

- Warehousing Expenses: Costs associated with storing inventory, including rent, utilities, and labor at distribution facilities.

- Fuel Prices: Fluctuations in fuel costs directly impact transportation expenses, a key component of their distribution network.

- Efficiency Impact: Optimizing these logistics is paramount to controlling overhead and supporting Europris' commitment to offering competitive prices.

Marketing and Advertising Expenses

Europris AS invests significantly in marketing and advertising to promote its products and brand, recognizing its role as a campaign-driven retailer. These costs are essential for driving customer traffic and boosting sales, as campaigns have historically been a crucial engine for the company's growth.

In 2024, Europris AS continued to allocate substantial resources to its marketing efforts. For instance, during the first quarter of 2024, marketing expenses amounted to NOK 106 million. This figure represents a notable increase from NOK 92 million in the same period of 2023, highlighting the company's commitment to leveraging marketing as a key growth driver.

- Campaign-Driven Growth: Marketing expenses are a core component of Europris's strategy, directly supporting its campaign-driven retail model.

- Increased Investment in 2024: The company's marketing spend saw a rise in early 2024, with Q1 expenses reaching NOK 106 million, up from NOK 92 million in Q1 2023.

- Promotional Activities: These costs cover the planning and execution of diverse campaigns across multiple channels to attract customers and stimulate purchases.

The cost structure of Europris AS is dominated by the Cost of Goods Sold (COGS), which is directly managed through bulk purchasing and efficient sourcing to maintain competitive pricing. Significant operational expenses include store upkeep, personnel, and a robust logistics network, all critical for their discount retail model.

Marketing and advertising are also substantial investments, fueling their campaign-driven sales strategy. In the first quarter of 2024, marketing expenses reached NOK 106 million, an increase from NOK 92 million in Q1 2023, underscoring the importance of promotional activities.

Europris AS's commitment to cost management is evident in its operational efficiency, with an opex-to-sales ratio of 22.5% in Q2 2025. The company employed 5,352 individuals in 2024, reflecting the labor investment required to support its extensive retail operations.

Logistics, including freight and warehousing, represent key cost drivers, with Q3 2024 results showing an impact from higher freight costs.

| Cost Category | 2024 Data/Notes | Impact on Strategy |

| Cost of Goods Sold (COGS) | Dominant expense; managed via bulk purchasing. | Enables competitive low pricing. |

| Store Operating Expenses | Rent, utilities, maintenance for extensive store network. | Directly tied to physical retail presence. |

| Personnel Costs | Salaries/wages for 5,352 employees in 2024. | Crucial for operational efficiency and profitability. |

| Logistics & Distribution | Freight, warehousing, fuel costs; impacted by higher freight in Q3 2024. | Essential for low-price strategy and inventory flow. |

| Marketing & Advertising | NOK 106 million in Q1 2024 (up from NOK 92 million in Q1 2023). | Drives customer traffic and sales for campaign-driven model. |

Revenue Streams

Europris AS's principal revenue generation stems from the sale of a wide variety of non-food items. This diverse assortment encompasses home furnishings, leisure goods, apparel, seasonal decorations, and personal care products, forming the bedrock of their discount variety retail strategy.

In the fourth quarter of 2024, the non-food product segments demonstrated robust sales performance, underscoring their significance to the company's overall financial results.

Europris AS generates a substantial portion of its revenue through the sale of daily consumables. This category is crucial for driving customer traffic and increasing the average transaction value, as shoppers often pick up everyday necessities during their visits.

While this segment provides a consistent revenue stream, it faces significant price pressure from traditional grocery retailers. This competitive landscape can sometimes impact profitability, as seen in Q2 2025 where the increased share of consumable sales negatively affected the company's gross margin.

Europris AS generates significant revenue through its online sales channel, leveraging its primary e-commerce platform and specialized subsidiaries. This digital strategy allows them to reach a broader customer base beyond their physical store locations.

The company actively utilizes specialized e-commerce platforms such as Lekekassen for toys, Strikkemekka for knitting supplies, and Designhandel for home decor. These niche sites cater to specific customer interests, driving targeted sales and enhancing overall online revenue.

In 2023, Europris reported a notable increase in online sales, contributing to their overall revenue growth. While specific figures for the e-commerce segment are often integrated into broader reporting, the company’s continued investment in and expansion of these digital channels underscores their growing importance to the business model.

Franchise Fees and Royalties

Europris AS generates income from its franchised stores by collecting initial franchise fees and ongoing royalty payments from its franchise partners. This model enables Europris to grow its retail presence more rapidly without the significant capital investment typically required for company-owned stores, while still capturing a share of the sales generated by these locations.

In 2024, franchise fees and royalties contributed approximately 10% to Europris's overall revenue. This demonstrates the effectiveness of their franchise strategy in expanding market reach and generating consistent income streams.

- Franchise Fees: One-time payments from new franchisees to secure the rights to operate a Europris store.

- Royalties: Ongoing percentage-based payments from franchisees on their gross sales, ensuring continued revenue for Europris.

- Network Expansion: Allows Europris to scale its business with reduced capital outlay.

- 2024 Contribution: Franchise revenue represented about 10% of Europris's total revenue for the year.

Seasonal and Campaign-Driven Sales

Europris AS sees substantial revenue uplifts during key seasonal periods like Easter and Christmas. These times, along with well-executed marketing campaigns, draw more customers into stores and encourage them to spend more per visit. For instance, a later Easter in 2025 positively impacted these seasonal sales figures.

Targeted sales initiatives are vital for Europris to capture maximum short-term revenue. These efforts are designed to capitalize on specific consumer behaviors and demand spikes throughout the year.

- Seasonal Peaks: Easter and Christmas are identified as major revenue drivers.

- Campaign Impact: Marketing campaigns directly correlate with increased footfall and basket size.

- 2025 Easter Effect: A later Easter in 2025 provided a beneficial boost to seasonal sales performance.

Europris AS’s revenue streams are primarily driven by the sale of non-food items, which include home furnishings, leisure goods, and seasonal decorations. The company also generates significant income from daily consumables, which, while crucial for traffic, can face margin pressures.

Online sales, facilitated through their main e-commerce platform and specialized sites like Lekekassen, represent a growing and important revenue channel. Furthermore, their franchise model contributes approximately 10% of total revenue through fees and royalties, enabling wider market penetration.

Seasonal peaks, such as Easter and Christmas, are actively leveraged through targeted campaigns, providing substantial revenue uplifts.

| Revenue Stream | Description | 2024 Data/Notes |

|---|---|---|

| Non-Food Item Sales | Core business of discount variety retail | Robust performance in Q4 2024 |

| Daily Consumables | Drives traffic and transaction value | Q2 2025: Increased share negatively impacted gross margin |

| Online Sales | E-commerce platform and specialized sites | Continued investment and expansion; notable increase in 2023 |

| Franchise Revenue | Fees and royalties from franchised stores | Contributed ~10% to overall revenue in 2024 |

| Seasonal Sales | Revenue uplift during key holidays | Later Easter in 2025 positively impacted sales |

Business Model Canvas Data Sources

The Europris AS Business Model Canvas is informed by a blend of internal financial reports, extensive market research on the discount retail sector, and analyses of competitor strategies. These sources provide a robust foundation for understanding customer behavior, operational efficiency, and market positioning.