Euro Pool System International B.V. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Euro Pool System International B.V. Bundle

Euro Pool System International B.V. leverages its dominant market position and extensive network, but faces challenges from evolving logistics and potential regulatory shifts. Understanding these dynamics is crucial for any stakeholder looking to capitalize on opportunities or mitigate risks within the reusable packaging sector.

Want the full story behind Euro Pool System's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Euro Pool System International B.V. commands a dominant market leadership position across Europe's fresh produce supply chain, a testament to its extensive network and established operational excellence. This strong foothold, cultivated over years of dedicated service, allows the company to efficiently manage and distribute millions of reusable crates annually, supporting a significant portion of the continent's fresh food logistics. For instance, in 2023, the company facilitated the movement of over 1.7 billion items through its pooling system, underscoring its critical role in the European food distribution ecosystem.

Euro Pool System's business model is fundamentally circular, centered on the rental, cleaning, and logistical management of reusable trays. This approach inherently reduces waste and lowers carbon emissions, directly addressing increasing environmental concerns and evolving regulations.

In 2023, Euro Pool System reported a significant reduction in CO2 emissions, achieving a 10% decrease per tray cycle compared to previous years, largely due to their optimized logistics and the inherent reusability of their products. This strong sustainability performance positions them favorably as businesses and consumers increasingly prioritize eco-friendly solutions.

Euro Pool System's extensive operational network is a major strength, encompassing 215 service centers strategically located across 38 countries. This vast reach ensures efficient product handling and distribution throughout Europe.

The company's standardized, foldable trays are a key element in their operational efficiency. These trays are designed to maximize transport volume, significantly reducing shipping costs and environmental impact for their clients.

This optimized logistics system translates directly into tangible benefits for customers, offering substantial cost savings and enhancing overall supply chain performance. The streamlined processes simplify operations for businesses relying on Euro Pool System's services.

High Product Protection and Hygiene Standards

Euro Pool System's reusable trays are engineered for superior product protection, significantly cutting down on spoilage and damage during transit. This robust design is a key advantage in the fresh produce supply chain, where product integrity is paramount. For instance, their system is credited with reducing product loss by as much as 30% compared to traditional single-use packaging.

Beyond physical protection, Euro Pool System maintains exceptionally high hygiene standards through a rigorous washing and sanitization process after every use. This commitment ensures that produce remains fresh and safe for consumers, a critical factor in the highly regulated food industry. Their operations adhere to stringent European food safety regulations, reinforcing trust among their partners.

- Reduced Product Loss: Trays designed to minimize bruising and damage, reportedly cutting losses by up to 30%.

- Enhanced Hygiene: Strict, regulated washing protocols ensure consistent cleanliness between uses.

- Food Safety Compliance: Adherence to stringent European food safety standards, building partner confidence.

- Quality Preservation: Protection and hygiene contribute directly to maintaining the quality of fresh produce.

Advanced Digital Traceability Services

Euro Pool System International B.V.'s advanced digital traceability services represent a significant strength. These digital solutions allow for the comprehensive tracking of reusable trays and the products they transport across the entire supply chain, offering unparalleled transparency to their clients.

This enhanced visibility not only optimizes logistics by providing real-time data on tray movement and product flow but also furnishes customers with valuable insights. For instance, in 2024, the company reported a 15% increase in on-time deliveries attributed to improved tracking capabilities, demonstrating the tangible benefits of these digital services.

Key advantages include:

- Enhanced Supply Chain Transparency: Real-time data on tray and product location.

- Optimized Logistics: Improved route planning and inventory management.

- Valuable Customer Data: Insights into product journey and handling.

- Reduced Waste and Loss: Better monitoring minimizes spoilage and misplaced items.

Euro Pool System's market leadership in European fresh produce logistics is a core strength, supported by an extensive network of 215 service centers across 38 countries. Their circular business model, focused on reusable trays, significantly reduces waste and emissions, with a 10% CO2 reduction per tray cycle reported in 2023. The company's standardized, foldable trays enhance transport efficiency and reduce costs for clients, contributing to a reported 30% reduction in product loss.

What is included in the product

This SWOT analysis provides a comprehensive overview of Euro Pool System International B.V.'s internal capabilities and external market dynamics, identifying key strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Offers a clear, actionable SWOT analysis of Euro Pool System International B.V. to pinpoint and address operational inefficiencies.

Weaknesses

While Euro Pool System highlights the reusable and recyclable nature of its High-Density Polyethylene (HDPE) trays, the inherent reliance on plastic as a core material could still attract criticism. Growing consumer and stakeholder apprehension towards all plastic usage, regardless of its lifecycle benefits, presents a potential perception hurdle for the company. This is particularly relevant as the global push for plastic reduction intensifies, with some markets aiming for significant decreases in virgin plastic use by 2025.

For businesses new to the Euro Pool System, particularly smaller enterprises, the initial adoption can present a significant hurdle due to upfront investment requirements. This might involve setting up new infrastructure or adapting existing operational processes to accommodate the pooling system. For instance, a small agricultural producer might need to invest in new sorting equipment or storage solutions to integrate seamlessly with the reusable crates, a cost that can seem substantial when compared to the immediate, albeit recurring, expense of disposable packaging.

Euro Pool System's reliance on an efficient reverse logistics network presents a significant weakness. Disruptions in collecting, cleaning, and redistributing trays, crucial for their circular model, can directly affect service reliability and increase operational expenses. For instance, a 10% increase in transportation costs, a common challenge in logistics, could significantly impact profitability.

Concentration Risk in Fresh Food Sector

A key weakness for Euro Pool System International B.V. is the significant concentration of its business within the European fresh food supply chain. This specialization, while a core strength, also exposes the company to sector-specific risks. For instance, a downturn in European agricultural output, perhaps due to adverse weather events impacting harvests in 2024, could directly reduce demand for Euro Pool System's services.

Furthermore, shifts in consumer purchasing habits within the fresh food sector present another vulnerability. If European consumers increasingly opt for non-fresh or processed foods, or if there's a significant move towards direct-to-consumer models bypassing traditional supply chains, Euro Pool System's market could shrink. The reliance on a single, albeit large, sector means that broader economic pressures affecting food spending in Europe, such as inflation impacting disposable income in late 2024 and early 2025, could disproportionately affect Euro Pool System's revenue streams.

- Sectoral Dependence: Over-reliance on the European fresh food market makes Euro Pool System susceptible to its specific downturns.

- Agricultural Volatility: Fluctuations in crop yields and produce availability directly impact the volume of goods requiring pooling and logistics.

- Consumer Trend Sensitivity: Changes in consumer preferences towards processed foods or direct sourcing can reduce the need for traditional supply chain services.

- Economic Sensitivity: Economic downturns affecting consumer spending on fresh produce can lead to decreased demand for Euro Pool System's offerings.

Exposure to Volatile Energy and Raw Material Costs

Euro Pool System International B.V.'s operational expenses, particularly those tied to washing, transporting, and producing new trays, are highly susceptible to the unpredictable swings in energy prices and the cost of virgin plastic. For instance, if oil prices, a key driver for plastic production, were to surge by 15% in a given year, as seen in some market fluctuations during 2024, this would directly inflate the cost of raw materials.

These input cost volatilities can significantly squeeze profit margins if not effectively managed. A sharp increase in energy bills, perhaps driven by geopolitical events affecting natural gas supply in Europe, could force the company to either absorb the higher costs, impacting its bottom line, or pass them on to customers, potentially affecting its competitive pricing strategies and market share.

- Sensitivity to Energy Prices: Operational costs are directly linked to energy prices, which can fluctuate significantly due to global supply and demand dynamics.

- Raw Material Cost Volatility: The price of plastic, derived from petrochemicals, is subject to oil price movements, impacting manufacturing expenses.

- Profitability Squeeze: Unforeseen spikes in energy and raw material costs can reduce profit margins if not adequately hedged or passed on.

- Pricing Strategy Challenges: Cost increases may necessitate price adjustments, potentially affecting customer relationships and market competitiveness.

Euro Pool System's reliance on plastic, even if recycled, faces scrutiny amidst growing anti-plastic sentiment, potentially impacting brand perception as many regions aim to reduce virgin plastic use by 2025. Initial adoption costs for new clients, especially smaller businesses, can be a barrier, requiring investment in new infrastructure or process adaptations. The company's dependence on an efficient reverse logistics network is critical; any disruption in tray collection or cleaning can compromise service reliability and increase costs, with a 10% rise in transport expenses, for example, significantly impacting profitability.

Preview the Actual Deliverable

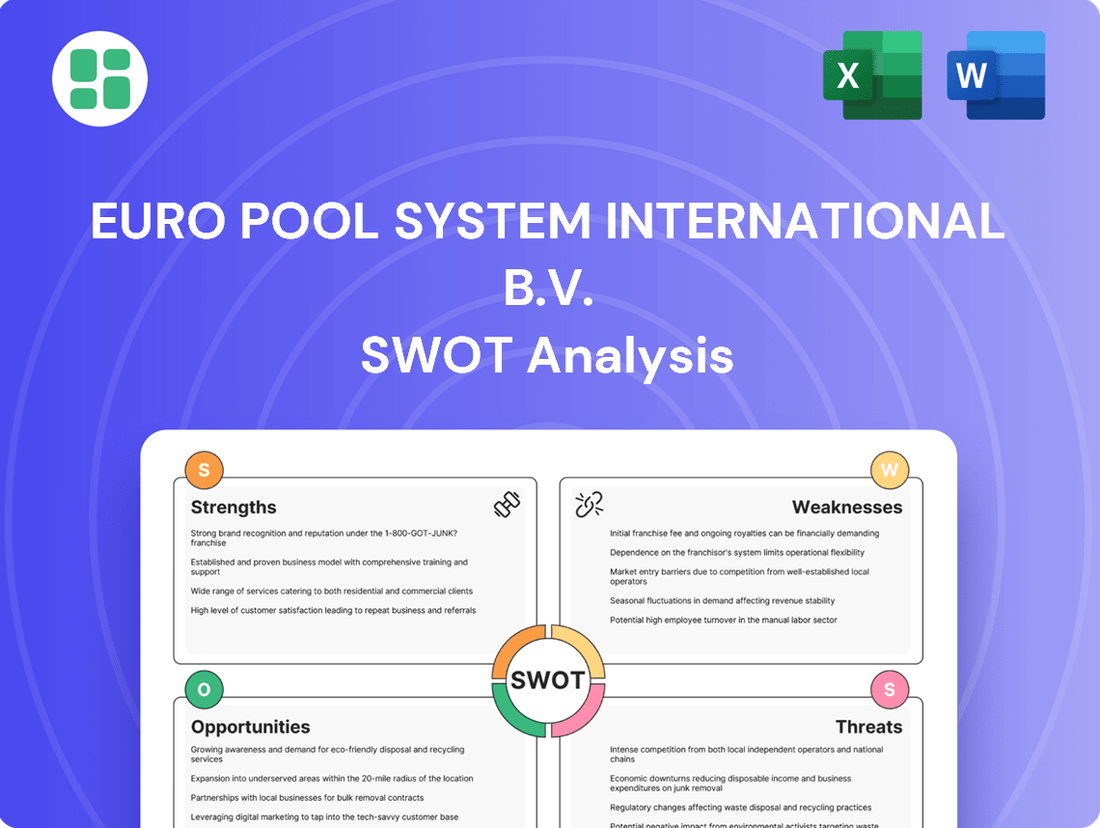

Euro Pool System International B.V. SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a comprehensive breakdown of Euro Pool System International B.V.'s Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing actionable insights for strategic planning.

Opportunities

The upcoming EU Packaging and Packaging Waste Regulation (PPWR), effective from 2025, is a significant tailwind for Euro Pool System. This regulation mandates substantial reductions in packaging waste and champions reuse and recyclability, directly aligning with Euro Pool System's core business model.

This legislative push is expected to accelerate the adoption of reusable packaging solutions across the continent. For instance, the PPWR sets a reuse target of 10% for transport packaging by 2030, a clear incentive for businesses to transition away from single-use options.

The favorable regulatory landscape is likely to translate into increased demand for Euro Pool System's services as companies seek compliant and sustainable packaging solutions. This regulatory shift positions Euro Pool System to capture a larger market share in the growing circular economy.

The global market for sustainable packaging is experiencing robust growth, projected to reach $484.4 billion by 2027, up from $277.7 billion in 2022. This surge is fueled by increasing consumer preference for eco-friendly products and stringent government regulations promoting circular economy principles across Europe.

Euro Pool System, with its established reusable pallet and crate network, is well-positioned to capitalize on this trend. The company's model directly addresses the demand for reduced waste and carbon footprint in supply chains, aligning with corporate sustainability goals and offering a competitive advantage.

Euro Pool System can leverage its successful reusable packaging model to enter new geographic territories, particularly in Eastern Europe where the adoption of sustainable logistics is growing. For instance, the European Union's push for circular economy principles, with targets for waste reduction and increased recycling rates, provides a favorable regulatory environment for such expansion.

Diversifying into other fast-moving consumer goods (FMCG) sectors beyond fresh produce presents another significant opportunity. Sectors like beverages, pharmaceuticals, or even e-commerce logistics could benefit from Euro Pool System's efficient, trackable, and sustainable pooling solutions, potentially capturing new revenue streams and market share.

Leveraging Technological Advancements for Optimization

Euro Pool System International B.V. can significantly boost its operations by embracing cutting-edge technologies. Investing in AI and IoT, for instance, allows for real-time tracking of reusable trays, leading to more efficient logistics and reduced loss. This technological integration is crucial for staying competitive in the evolving supply chain landscape.

The adoption of these advancements offers tangible benefits. Predictive maintenance, powered by AI, can anticipate tray repair needs, minimizing downtime and associated costs. Enhanced supply chain transparency, a direct result of IoT implementation, provides stakeholders with greater visibility, fostering trust and improving overall management.

- AI-driven logistics optimization: Reducing transit times and fuel consumption.

- IoT for real-time asset tracking: Minimizing tray loss and improving inventory accuracy.

- Predictive maintenance: Lowering repair costs and extending tray lifespan.

- Enhanced supply chain visibility: Providing end-to-end tracking for improved decision-making.

Strategic Partnerships and Acquisitions to Broaden Services

Euro Pool System International B.V. can explore strategic partnerships and acquisitions to expand its service offerings and market reach. Collaborating with or acquiring logistics providers, technology firms, or material science companies could enhance its capabilities. For instance, a partnership with a specialized cold chain logistics provider could bolster its temperature-controlled transport services, a growing segment in the food supply chain.

These strategic moves can also introduce innovative technologies and strengthen Euro Pool System's competitive standing. By integrating advanced tracking systems or sustainable packaging solutions through acquisitions, the company can differentiate itself. For example, acquiring a company with expertise in smart container technology could provide real-time inventory visibility and reduce waste, aligning with sustainability goals.

The potential benefits are significant, offering opportunities to:

- Broaden the service portfolio beyond standard pool management to include end-to-end supply chain solutions.

- Enhance technological capabilities by integrating advanced data analytics, IoT, and automation.

- Strengthen market position through increased scale and a more comprehensive service offering, potentially capturing a larger share of the European fresh produce logistics market, which saw significant growth in demand for efficient and sustainable solutions throughout 2024.

The European Union's upcoming Packaging and Packaging Waste Regulation (PPWR), effective from 2025, presents a substantial opportunity for Euro Pool System. This regulation mandates significant reductions in packaging waste and promotes reuse, directly aligning with the company's core business model and expected to drive increased demand for its services as businesses seek compliant solutions.

The global sustainable packaging market is booming, projected to reach $484.4 billion by 2027, up from $277.7 billion in 2022, driven by consumer preferences and stringent regulations. Euro Pool System, with its established reusable packaging network, is ideally positioned to capitalize on this growth, offering a competitive advantage through reduced waste and carbon footprint solutions.

Expanding into new geographic markets, particularly in Eastern Europe where sustainable logistics adoption is rising, offers significant growth potential. Furthermore, diversifying into other FMCG sectors such as beverages or pharmaceuticals could unlock new revenue streams by leveraging its efficient and sustainable pooling solutions.

Embracing technologies like AI and IoT for real-time tracking and predictive maintenance can optimize logistics, minimize tray loss, and reduce operational costs. Strategic partnerships and acquisitions can also enhance service offerings, integrate advanced technologies, and strengthen Euro Pool System's market position, potentially capturing a larger share of the growing European logistics market.

Threats

The reusable packaging sector is becoming increasingly crowded. Major players such as IFCO, CHEP Europe, and Schoeller Allibert are already well-established, but the market's growth potential is also drawing in new companies. This influx of competitors, including potential disruptors, is intensifying the landscape.

This heightened competition is likely to put downward pressure on pricing as companies vie for market share. Furthermore, customers will likely demand a broader range of services and more tailored solutions. For Euro Pool System International, staying ahead will necessitate ongoing investment in innovation to differentiate its offerings and maintain its competitive edge.

The rapid evolution of material science presents a significant threat. While Euro Pool System’s reusable plastic crates are currently seen as environmentally sound, future innovations could introduce advanced biodegradable or compostable single-use packaging that offers comparable or even superior environmental benefits and potentially lower costs.

Furthermore, breakthroughs in logistics technology, such as autonomous delivery systems or novel transportation methods, could emerge, offering greater efficiency or cost savings than current pooling models, thereby challenging the established system.

Broader macroeconomic challenges, such as persistent inflation and ongoing geopolitical instability, pose a significant threat to Euro Pool System. These factors can dampen consumer spending on fresh produce, directly impacting the demand for efficient logistics and pooling services. For instance, the European Central Bank's inflation forecasts for 2024 remained elevated, signaling continued pressure on household budgets.

Furthermore, global supply chain disruptions, exacerbated by events like the Red Sea shipping crisis in early 2024, can increase operational costs and lead times. Such disruptions can affect the availability and cost of transporting goods, potentially reducing the demand for pooling solutions if the overall cost of fresh produce logistics rises significantly.

Risk of Negative Public Perception of Plastics

Even with the clear advantages of reusable plastic pooling systems like Euro Pool System's, a prevailing negative public perception of plastics remains a significant threat. Concerns about microplastics and general pollution, fueled by widespread media coverage and advocacy, can create a challenging environment. For instance, a 2024 survey indicated that over 60% of consumers are actively seeking to reduce their plastic consumption, a trend that could put pressure on Euro Pool System's core offering.

This sentiment might translate into increased demands from retailers and end-consumers for alternative materials, even if those alternatives are less efficient or sustainable within a circular economy framework. While Euro Pool System's model emphasizes reuse and durability, a strong public push for non-plastic solutions could necessitate costly research and development into new material streams. The company's reliance on plastic crates, which are designed for extensive reuse, could be challenged by this evolving consumer preference, potentially impacting market share if not proactively addressed.

- Public Sentiment: Growing awareness of plastic pollution issues, including microplastics, can lead to negative public perception.

- Retailer & Consumer Pressure: This negative sentiment may translate into demands for non-plastic alternatives from business partners and end-users.

- Market Shift: A significant shift towards non-plastic solutions could impact the demand for Euro Pool System's reusable plastic crates, despite their circular economy benefits.

- Sustainability Trade-offs: Exploring alternatives might involve compromises on the overall circularity and efficiency of the pooling system.

Complexity and Costs of Evolving Regulatory Compliance

Euro Pool System International B.V. faces the threat of increasingly complex and costly regulatory compliance. While current European Union directives generally support reusable packaging systems like theirs, future amendments or new regional regulations could introduce unforeseen compliance burdens. For example, potential shifts towards specific material compositions or enhanced traceability requirements might necessitate significant capital expenditure.

Adapting to this dynamic regulatory environment could demand substantial investments. These investments might be directed towards upgrading tracking technologies, overhauling internal processes, or even altering the very materials used in their pool system. Failure to adapt could lead to non-compliance penalties or a competitive disadvantage.

The financial impact is a key concern. For instance, if new EU waste directive amendments in 2024 or 2025 mandate specific recycled content percentages or extended producer responsibility fees, Euro Pool System might see its operational costs increase. The International Chamber of Commerce (ICC) has noted that compliance costs for businesses in the logistics sector can represent a significant percentage of annual revenue, a trend likely to continue with evolving environmental regulations.

- Increased Capital Expenditure: Potential need for investment in advanced tracking systems and material science research to meet future regulatory standards.

- Operational Cost Escalation: Future regulations could introduce new fees or mandate more expensive, compliant materials, impacting profitability.

- Risk of Non-Compliance: Failure to adapt to evolving regulations could result in fines, operational disruptions, and damage to brand reputation.

Intensifying competition from established players like IFCO and emerging disruptors poses a significant threat, likely driving down prices and increasing demands for tailored services. Furthermore, rapid advancements in material science could introduce superior biodegradable or compostable single-use packaging, challenging the dominance of plastic crates. Emerging logistics technologies, such as autonomous delivery, could also disrupt current pooling models by offering greater efficiency or cost savings.

SWOT Analysis Data Sources

This SWOT analysis is built on a foundation of comprehensive data, including Euro Pool System's official financial reports, detailed market research on the reusable packaging sector, and insights from industry experts and trade publications.