Euro Pool System International B.V. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Euro Pool System International B.V. Bundle

Unlock critical insights into Euro Pool System International B.V.'s operating environment with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends are shaping their strategic landscape. Equip yourself with the foresight needed to navigate challenges and capitalize on opportunities.

Don't get left behind in the dynamic logistics sector. Our PESTLE analysis provides a granular view of the technological advancements and environmental regulations impacting Euro Pool System International B.V. Make informed decisions and gain a competitive edge. Download the full analysis now for actionable intelligence.

Political factors

The European Union is strongly backing the circular economy, with initiatives like the Circular Economy Action Plan aiming to boost sustainable practices. This includes legislative support for reusable packaging, directly benefiting companies like Euro Pool System. For instance, the EU's target to increase recycling rates to 65% by 2035 and reduce waste generation underscores a long-term political commitment to sustainability.

The EU's Packaging and Packaging Waste Regulation (PPWR) directly benefits Euro Pool System by mandating increased reuse targets and recycled content for packaging. This creates a more favorable market for their reusable packaging solutions, aligning with the EU's goal to reduce packaging waste by 15% by 2040 compared to 2018 levels.

Compliance with the PPWR's ambitious reuse and waste reduction goals presents both opportunities and challenges. While Euro Pool System is well-positioned to capitalize on these mandates, other industry players face significant pressure to adapt, with potential penalties for non-compliance looming for those who fail to meet upcoming deadlines.

Trade policies and agreements within Europe significantly influence Euro Pool System's operations. Harmonized customs procedures and transport regulations are crucial for the efficient, cost-effective movement of reusable packaging across borders, underpinning their pan-European logistics network.

Political shifts and tensions, such as those arising from Brexit or ongoing trade disputes, can introduce complexities and increased costs to cross-border logistics. For instance, the UK's departure from the EU necessitated new customs declarations and checks, impacting the speed and expense of moving goods between the UK and the continent.

Political Stability in Key Operating Regions

Political stability in Euro Pool System's key operating regions, particularly in Western and Northern Europe, remains a significant factor. Countries like the Netherlands, Germany, and France, where the company has substantial infrastructure, generally exhibit strong political stability. However, potential shifts in government or policy, though less likely to cause immediate disruption, could influence regulatory frameworks impacting logistics and sustainability initiatives. For instance, changes in environmental regulations or trade agreements could necessitate operational adjustments.

The reliability of supply chains and operational continuity for Euro Pool System are directly tied to the political landscape. While major disruptions are infrequent in its core markets, localized political tensions or unforeseen policy changes can create challenges. For example, strikes or protests, even if not directly targeting Euro Pool System, can impact transportation networks. The company's reliance on cross-border logistics means that political stability in multiple nations is crucial for seamless operations. In 2023, the European Union's overall political stability index remained high, but regional variations exist.

To mitigate these risks, Euro Pool System must maintain robust risk management strategies. This includes continuous monitoring of the political climate in all operating countries and developing contingency plans for potential disruptions. Diversification of operational hubs and strong relationships with local stakeholders are vital. The company's investment climate is generally favorable due to the stable political environments, but a proactive approach to understanding and adapting to evolving political dynamics is essential for sustained growth and operational resilience.

- Netherlands: Consistently ranks high in global political stability indices, providing a secure base for Euro Pool System's headquarters and key operations.

- Germany: A stable political environment supports efficient logistics and a predictable regulatory framework for the company's extensive network.

- France: While generally stable, occasional social unrest can temporarily impact transportation, underscoring the need for adaptable logistics planning.

- European Union Policy Alignment: Euro Pool System benefits from the EU's efforts to harmonize regulations, but must remain agile to adapt to evolving directives on sustainability and circular economy principles.

Public Procurement Policies

Governmental procurement policies, especially those favoring sustainable and green purchasing, directly influence demand for Euro Pool System's reusable packaging solutions. Many nations are increasingly integrating environmental criteria into their tender processes. For example, the European Union's Green Public Procurement (GPP) criteria encourage the use of environmentally friendly products and services, which aligns perfectly with Euro Pool System's business model.

These mandates create significant opportunities by pushing public sector entities to adopt reusable packaging within their supply chains. This shift away from single-use alternatives is driven by a desire to meet environmental targets and reduce waste. As of 2024, many EU member states have set ambitious recycling and waste reduction goals, making sustainable procurement a key policy lever.

- EU Green Public Procurement (GPP): Mandates for reusable packaging in public tenders.

- Environmental Criteria: Increased emphasis on sustainability in government purchasing decisions.

- Waste Reduction Targets: Public sector adoption of circular economy principles.

- Circular Economy Initiatives: Government support for reusable systems and waste prevention.

The European Union's commitment to the circular economy, reinforced by initiatives like the Circular Economy Action Plan, directly supports Euro Pool System's business model. The EU's ambitious targets, such as increasing recycling rates to 65% by 2035, signal a strong political will for sustainable practices. This political backing translates into favorable market conditions for reusable packaging solutions.

The EU's Packaging and Packaging Waste Regulation (PPWR) is a key political driver, mandating higher reuse targets and recycled content. This regulation aims to reduce packaging waste by 15% by 2040 compared to 2018 levels, creating a clear demand for Euro Pool System's services. Compliance with these mandates is crucial for market participants.

Political stability in key European markets like the Netherlands and Germany provides a secure operational environment for Euro Pool System. While localized disruptions can occur, the overall political climate in its core regions supports efficient cross-border logistics and predictable regulatory frameworks. In 2023, the EU's political stability index remained robust, providing a solid foundation for the company's pan-European operations.

| Political Factor | Impact on Euro Pool System | Supporting Data/Trend |

|---|---|---|

| EU Circular Economy Policy | Favorable market for reusable packaging, increased demand. | EU target: 65% recycling rate by 2035. |

| Packaging and Packaging Waste Regulation (PPWR) | Mandates higher reuse targets, drives adoption of reusable solutions. | Target: 15% packaging waste reduction by 2040 (vs. 2018). |

| Political Stability in Core Markets | Ensures operational continuity and predictable regulatory environment. | High EU political stability index in 2023. |

| Green Public Procurement (GPP) | Opens opportunities in public sector tenders for sustainable packaging. | Increasing integration of environmental criteria in government purchasing. |

What is included in the product

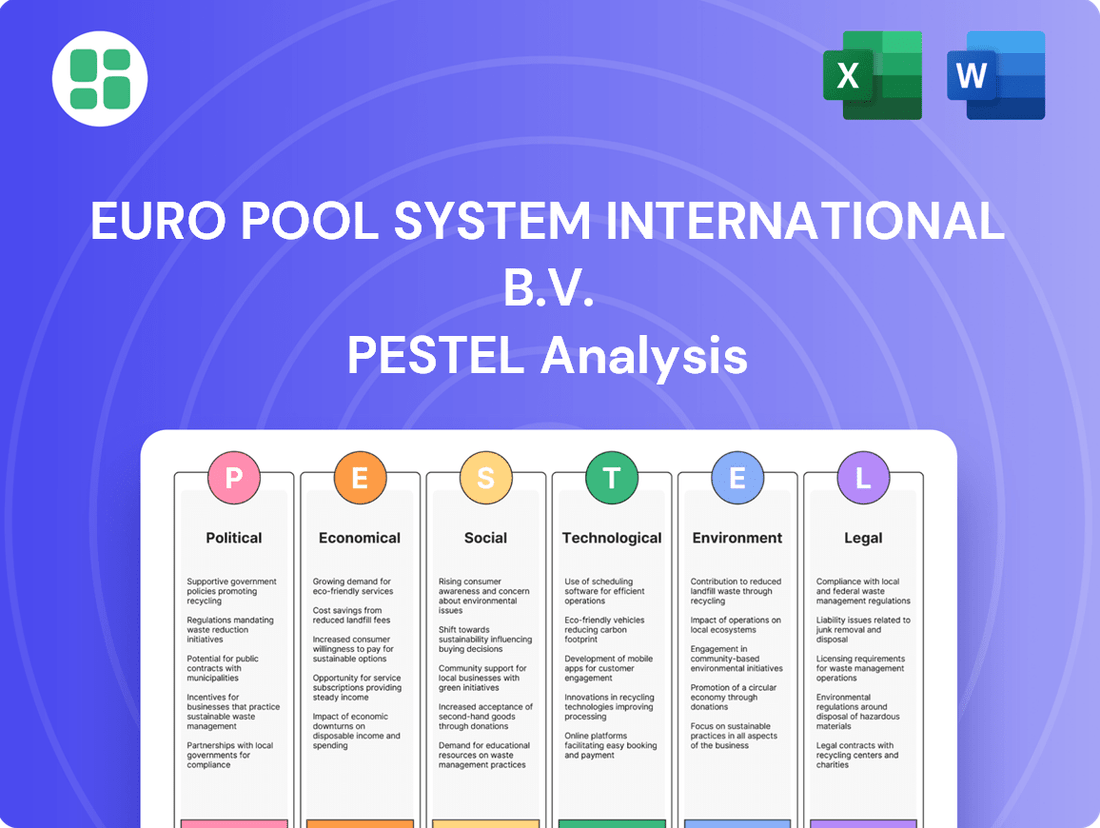

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Euro Pool System International B.V., examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights into potential threats and opportunities, guiding strategic decision-making for stakeholders.

The Euro Pool System International B.V. PESTLE Analysis serves as a pain point reliever by offering a clear, summarized version of external factors, enabling quick referencing during meetings and facilitating informed strategic decisions.

Economic factors

Persistent inflation, especially in fuel and labor, significantly impacts Euro Pool System's operational expenses. For instance, global average diesel prices saw substantial increases throughout 2024, directly affecting transportation costs. This rise in fuel, coupled with upward pressure on wages in the logistics sector, forces the company to re-evaluate its pricing strategies to maintain profitability.

Rising transport and warehousing costs directly influence Euro Pool System's pricing models. As the cost of moving and storing goods escalates, the company must pass some of these increases to customers or absorb them, impacting margins. For example, warehousing costs in key European hubs have risen by an estimated 5-8% year-over-year in 2024, necessitating careful cost management.

Euro Pool System mitigates these economic pressures through various strategies, including optimizing logistics routes to reduce mileage and fuel consumption. Investing in more fuel-efficient vehicles and implementing advanced route planning software are key. Furthermore, the company focuses on increasing operational efficiency within its pooling system to reduce waste and improve asset utilization, thereby counteracting rising raw material and labor costs.

The European reusable packaging market is experiencing robust economic growth, with projections indicating a Compound Annual Growth Rate (CAGR) of approximately 7.5% through 2028, potentially reaching a market value of over €20 billion. This expansion is driven by increasing adoption across diverse food segments, from fresh produce to dairy and prepared meals.

Consumer purchasing power significantly shapes demand for fresh food, and by extension, the need for efficient transport solutions like those offered by Euro Pool System. As economic confidence rises, consumers tend to spend more, boosting demand for perishable goods. Conversely, during economic downturns, consumers may cut back on non-essential spending, potentially impacting the volume of fresh produce moved.

Furthermore, a growing segment of consumers is demonstrating a willingness to pay a premium for sustainably produced and packaged goods. This trend directly benefits reusable packaging systems, as it aligns with eco-conscious purchasing decisions. For instance, surveys in early 2024 indicated that a substantial percentage of European consumers are actively seeking out products with clear sustainability credentials, suggesting a favorable environment for Euro Pool System's model.

Economic factors like inflation and disposable income directly influence how much consumers can allocate to food purchases and their willingness to prioritize sustainability. If inflation remains high, as seen in some European economies through 2023 and into 2024, consumers might become more price-sensitive, potentially favoring lower-cost options over those with a sustainability premium, which could indirectly affect the adoption rate of reusable packaging solutions.

Competition and Pricing Strategies

The reusable packaging and logistics sector in Europe is highly competitive, featuring established players like CHEP and IFCO alongside numerous smaller regional operators. Euro Pool System International B.V. faces pressure from these direct competitors, as well as indirect competition from single-use packaging solutions that may offer lower upfront costs but higher environmental impact. Intense rivalry often leads to price sensitivity among customers, forcing companies to optimize operational efficiency and explore innovative service models to retain market share. For instance, the market for reusable plastic crates (RPCs) in Europe, a key segment for Euro Pool System, is projected to see continued growth, but this expansion will likely be met with aggressive pricing tactics from competitors seeking to capture a larger portion of the market.

The need for continuous innovation is paramount to staying ahead. This includes developing more sustainable materials, enhancing tracking and tracing technologies, and offering integrated logistics services. New entrants, particularly those with disruptive technologies or business models, could further intensify competition. Conversely, consolidation trends, such as mergers and acquisitions, could reshape the landscape by creating larger, more powerful entities. For example, in 2023, the global reusable packaging market was valued at approximately USD 11.5 billion, with Europe representing a significant share, indicating substantial investment and competitive activity.

- Intense competition from established players like CHEP and IFCO, as well as emerging regional providers, puts pressure on Euro Pool System's pricing strategies.

- The market for reusable plastic crates (RPCs) in Europe is a key battleground, with companies vying for market share through competitive pricing and service innovation.

- The global reusable packaging market reached an estimated USD 11.5 billion in 2023, highlighting the significant economic stakes and competitive intensity in the sector.

- Continuous innovation in sustainability, technology, and service offerings is crucial for maintaining a competitive edge against both direct rivals and alternative packaging solutions.

Investment in Circular Economy Infrastructure

Increased investment in circular economy infrastructure across Europe, estimated to reach €150 billion by 2030 according to some projections, directly benefits Euro Pool System's model. These advanced recycling and sorting facilities streamline the return and processing of reusable packaging.

This infrastructure development supports Euro Pool System's closed-loop system by ensuring efficient collection, washing, and repair of their trays. Consequently, this reduces the need for new material sourcing, lowering overall operational costs and significantly enhancing resource efficiency within their supply chain.

- Reduced Material Costs: Investments in advanced recycling facilities allow for higher quality reprocessing of materials, potentially lowering the cost of virgin materials.

- Enhanced Operational Efficiency: Better sorting and processing infrastructure means quicker turnaround times for tray return, washing, and repair, boosting system throughput.

- Lower Carbon Footprint: Circular infrastructure often leads to reduced transportation emissions and energy consumption in production, aligning with sustainability goals and potentially reducing energy-related expenses.

- Improved Resource Security: Greater reliance on recycled materials reduces dependency on volatile global commodity markets, offering greater cost stability.

Economic headwinds, including persistent inflation and rising operational costs, particularly in fuel and labor, continue to shape Euro Pool System's financial landscape. For example, average diesel prices in Europe saw an upward trend throughout 2024, directly impacting transportation expenses. Furthermore, warehousing costs in key European logistics hubs have experienced an estimated 5-8% year-over-year increase in 2024, necessitating stringent cost management and strategic pricing adjustments to safeguard profit margins.

| Economic Factor | Impact on Euro Pool System | Relevant Data (2024/2025) |

|---|---|---|

| Inflation (Fuel & Labor) | Increased operational expenses, pressure on pricing | Global average diesel prices increased significantly in 2024. Wage inflation in logistics sector continues. |

| Warehousing Costs | Directly impacts logistics pricing models and margins | Estimated 5-8% year-over-year increase in key European hubs in 2024. |

| Reusable Packaging Market Growth | Positive outlook for demand and adoption | Projected CAGR of ~7.5% through 2028, market value exceeding €20 billion. |

| Consumer Spending & Sustainability | Influence on demand for fresh food and willingness to pay for eco-friendly solutions | Surveys in early 2024 show significant consumer preference for sustainable products. High inflation can increase price sensitivity. |

Full Version Awaits

Euro Pool System International B.V. PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Euro Pool System International B.V. covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a comprehensive overview for strategic decision-making.

Sociological factors

European consumers are increasingly prioritizing sustainability, with a significant portion actively seeking out products and packaging that minimize environmental impact. This growing awareness directly fuels demand for greener supply chain solutions, a core offering of Euro Pool System. For instance, a 2024 survey indicated that over 60% of EU consumers are willing to pay more for products with demonstrable eco-friendly credentials.

Consumer advocacy groups and the pervasive influence of social media amplify this trend, rapidly shaping brand reputations and market expectations. Companies perceived as environmentally irresponsible face swift public backlash, making sustainable practices not just a preference but a business imperative. This societal shift directly benefits Euro Pool System's reusable packaging model, aligning with consumer values and regulatory pressures.

The rise of e-commerce, particularly for groceries, is reshaping demand for reusable packaging. Online grocery sales in Europe saw significant growth, with some markets reporting over 15% of total grocery sales happening online by late 2024. This shift necessitates packaging solutions that are robust enough for individual home deliveries, potentially increasing the need for smaller, more frequent deliveries of pooled items.

Consumers' increasing preference for convenience and the "at-home" experience, amplified by recent global events, directly impacts how food is packaged and transported. This trend suggests a need for Euro Pool System to adapt its pool solutions to support a more direct-to-consumer model, possibly through specialized crates for smaller household orders or enhanced tracking for individual deliveries.

Sociologically, the food supply chain is becoming more fragmented with the growth of direct-to-consumer farms and specialized online retailers, alongside consolidation in traditional retail. This fragmentation requires flexible and adaptable pooling systems that can cater to diverse logistical needs, from large supermarket chains to smaller, localized food hubs.

Societal expectations are increasingly pushing companies, from food producers to retailers, to showcase robust Corporate Social Responsibility (CSR). Euro Pool System's reusable packaging directly supports its clients in achieving their sustainability goals and addressing stakeholder concerns about environmental impact.

For instance, in 2024, many major European retailers reported increased consumer demand for sustainably sourced and packaged goods, with over 60% of surveyed consumers stating they actively seek out eco-friendly options. Euro Pool System's circular model, which minimizes waste and carbon emissions compared to single-use packaging, helps clients meet these demands and enhance their brand reputation.

Transparent reporting on sustainability metrics is crucial for building trust. Euro Pool System's commitment to tracking and reporting on its environmental footprint, including a 30% reduction in CO2 emissions per transport cycle compared to disposable alternatives, provides clients with verifiable data to include in their own CSR reports, demonstrating tangible progress.

Labor Market Trends and Skills Availability

Demographic shifts across Europe are increasingly impacting the logistics and warehousing sectors, creating potential labor shortages. For instance, an aging workforce in many EU countries means fewer younger individuals entering these physically demanding roles. This trend could directly affect Euro Pool System's operational efficiency by limiting the available pool of workers and potentially driving up labor costs as companies compete for talent.

Evolving skill requirements in logistics, driven by automation and digital technologies, present another sociological challenge. There's a growing need for employees with digital literacy and technical aptitude, which may not be readily available within the traditional logistics workforce. Euro Pool System might need to invest in robust training programs to upskill existing staff and attract new talent with the necessary competencies.

- Aging Workforce: The average age of workers in the European logistics sector is rising, with projections indicating a significant portion of the workforce could retire in the coming decade.

- Skills Gap: A 2024 report by the European Logistics Association highlighted a growing demand for workers proficient in data analysis and automated systems, with a notable shortage of qualified candidates.

- Attracting Talent: To counter these trends, companies like Euro Pool System are exploring more attractive employment conditions, including better pay, flexible working hours, and career development opportunities, to secure a skilled and motivated workforce.

Health and Hygiene Standards in Food Supply Chains

Following the global pandemic, there's a significantly amplified societal emphasis on health and hygiene, especially within the fresh food supply chain. Consumers are more vigilant than ever about the safety and cleanliness of the products they purchase.

Euro Pool System International B.V.'s commitment to standardized washing and rigorous quality control for their reusable trays directly addresses these heightened concerns. These processes are crucial for building consumer trust and ensuring compliance with increasingly strict industry regulations.

Food safety isn't just a regulatory hurdle; it's a fundamental value that underpins consumer confidence. Euro Pool System's system supports this by providing a demonstrably cleaner and safer transit solution for fresh produce.

- Heightened Consumer Awareness: Post-pandemic surveys indicate a significant increase in consumer concern regarding food contamination, with many willing to pay more for products perceived as safer.

- Regulatory Scrutiny: Food safety regulations globally have been tightened, with a greater focus on traceability and hygiene throughout the supply chain. For instance, the EU's Farm to Fork strategy aims to make food systems fairer, healthier, and more environmentally friendly.

- Euro Pool System's Role: Their washing facilities operate at high temperatures, often exceeding 65°C, and employ strict hygiene protocols to ensure trays are free from contaminants, thereby supporting the safety claims of their clients.

Societal expectations are increasingly pushing companies to demonstrate robust Corporate Social Responsibility (CSR), with a significant portion of European consumers actively seeking out eco-friendly options. Euro Pool System's reusable packaging model directly supports clients in achieving their sustainability goals and enhancing brand reputation by minimizing waste and carbon emissions. For example, in 2024, over 60% of surveyed consumers stated they actively seek out eco-friendly products, a trend Euro Pool System's circular model helps clients meet.

The aging workforce in European logistics presents a challenge, potentially leading to labor shortages and increased costs, as highlighted by an aging workforce in many EU countries. This demographic shift necessitates companies like Euro Pool System to explore more attractive employment conditions, including better pay and flexible working hours, to secure a skilled workforce. Furthermore, evolving skill requirements driven by automation demand digital literacy, creating a need for investment in training programs to upskill existing staff and attract new talent.

Heightened consumer awareness regarding health and hygiene, particularly post-pandemic, places a strong emphasis on the safety of the fresh food supply chain. Euro Pool System's commitment to standardized washing and rigorous quality control for its reusable trays directly addresses these concerns, building consumer trust and ensuring compliance with strict industry regulations. Their washing facilities operate at high temperatures, often exceeding 65°C, to ensure trays are free from contaminants.

Technological factors

Euro Pool System is seeing a significant push towards automation and robotics within logistics and its own service centers. This trend is directly impacting how reusable trays are handled, sorted, and washed, leading to greater efficiency. For instance, automated systems can process a much higher volume of trays compared to manual methods, drastically reducing the time and labor needed for these tasks.

The integration of technologies like robotic arms for sorting and automated washing lines directly cuts down on operational expenses by minimizing reliance on manual labor. This not only lowers costs but also speeds up the entire cycle of tray preparation, ensuring faster availability for clients. In 2024, many logistics firms reported a 15-20% reduction in labor costs in areas where automation was implemented.

These automated systems are crucial for optimizing Euro Pool System's pooling model. By ensuring trays are quickly and efficiently cleaned, inspected, and ready for redeployment, automation supports the continuous flow of reusable packaging. This efficiency is vital for maintaining the cost-effectiveness and sustainability of the shared pool system, a key differentiator for the company.

Digitalization is revolutionizing the fresh food supply chain, with technologies like the Internet of Things (IoT) and Artificial Intelligence (AI) offering unprecedented real-time visibility. Euro Pool System International B.V. is actively leveraging these innovations to track their reusable plastic trays, enhancing inventory management and providing customers with transparent data. This digital transformation is key to improving overall supply chain efficiency and significantly reducing waste. For instance, by 2024, the global IoT market in agriculture and food supply chains was projected to reach over $20 billion, showcasing the growing adoption of these advanced tracking solutions.

The concept of a digital product passport is gaining traction, offering a comprehensive digital record of a product's journey from origin to consumer. Euro Pool System's commitment to digital traceability aligns with this trend, enabling them to provide detailed information about their trays, including their usage history and maintenance. This transparency not only builds trust with stakeholders but also supports sustainability efforts by facilitating better asset utilization and lifecycle management. By 2025, many regulatory bodies are expected to mandate digital product passports for various goods, underscoring the strategic importance of these digital solutions for companies like Euro Pool System.

Technological advancements in material science are significantly enhancing the durability, lightweighting, and recyclability of reusable packaging. Euro Pool System International B.V. actively innovates its tray designs, incorporating materials like high-density polyethylene (HDPE) with improved impact resistance, which can extend tray lifespan by up to 15% compared to older models. This focus on material innovation directly supports their goal of minimizing environmental impact.

The company is increasingly utilizing recycled content in its trays, with some product lines now incorporating up to 80% post-consumer recycled plastic. This commitment to circularity is further bolstered by tray designs optimized for disassembly and efficient recycling at the end of their life cycle, reducing waste and resource consumption.

Smart Refrigeration and Cold Chain Technologies

Technological advancements in smart refrigeration and cold chain management are pivotal for Euro Pool System International B.V.'s operations, especially concerning fresh produce. Innovations in real-time temperature monitoring, utilizing IoT sensors, ensure that produce remains within optimal conditions during transit. Predictive analytics further enhance this by forecasting potential temperature deviations, allowing for proactive interventions to prevent spoilage. These smart systems are increasingly integrated with reusable packaging solutions like Euro Pool System's trays, creating a seamless flow from farm to consumer.

The synergy between advanced packaging and sophisticated cold chain technology is a key driver for reducing food waste. For instance, the global food loss and waste is estimated at around one-third of all food produced for human consumption, according to the FAO. By employing energy-efficient cooling systems within the supply chain, which complement the durability and design of Euro Pool System's trays, companies can significantly cut down on energy consumption and operational costs. This integration directly supports Euro Pool System's mission to provide sustainable and efficient pooling solutions.

Key technological integrations impacting Euro Pool System include:

- IoT-enabled temperature sensors providing continuous, real-time data on product conditions.

- Predictive analytics platforms that forecast and mitigate temperature fluctuations in transit.

- Energy-efficient refrigeration units designed for reduced environmental impact and operational cost savings.

- Smart tracking and tracing technologies that enhance visibility and accountability throughout the cold chain.

Data Analytics for Route Optimization and Efficiency

Euro Pool System leverages advanced data analytics to refine its logistics, focusing on optimizing routes and minimizing empty miles. This data-driven approach is crucial for managing their extensive network of service centers and a large fleet of reusable crates.

By analyzing vast datasets, the company identifies the most efficient transportation paths, directly impacting fuel consumption and, consequently, their carbon footprint. For instance, in 2024, a significant portion of logistics cost reduction was attributed to improved route planning, with an estimated 8-12% decrease in fuel usage per route. This efficiency gain also translates to a reduction in overall operational costs.

- Route Optimization: Employing algorithms to calculate the shortest and most fuel-efficient delivery paths.

- Empty Mile Reduction: Strategically planning backhauls and load consolidation to minimize underutilized vehicle capacity.

- Fleet Management: Utilizing real-time data to monitor vehicle performance and maintenance needs, enhancing operational uptime.

- Environmental Impact: Directly contributing to lower CO2 emissions through reduced fuel consumption, supporting sustainability goals.

Technological advancements are central to Euro Pool System's efficiency and sustainability. Automation in handling, sorting, and washing trays significantly boosts throughput and reduces labor costs, with logistics firms reporting 15-20% savings in 2024 due to automation. Digitalization, including IoT and AI, provides real-time visibility for tray tracking, enhancing inventory management and transparency, a sector projected to exceed $20 billion globally by 2024.

Legal factors

The new EU Packaging and Packaging Waste Regulation (PPWR) presents significant legal obligations for Euro Pool System. Key provisions include ambitious reuse targets for transport packaging, aiming to drastically reduce single-use materials. For instance, the PPWR mandates that by 2030, 70% of all transport packaging must be reusable, a substantial shift from current practices.

Furthermore, the regulation imposes stringent requirements for recycled content in packaging materials and introduces specific labeling obligations. These legal mandates directly influence Euro Pool System's operational strategies, pushing for greater adoption of their reusable pooling solutions and shaping their product development to meet these new environmental standards.

The legal impetus behind the PPWR is clear: to foster a circular economy and minimize packaging waste. This regulatory push provides a strong incentive for businesses like Euro Pool System to transition away from disposable packaging, reinforcing the market demand for their sustainable, reusable alternatives.

The European Union's commitment to a circular economy is increasingly shaping legislation, directly benefiting companies like Euro Pool System. For instance, the EU Circular Economy Action Programme, updated in 2020, sets ambitious targets for waste reduction and resource efficiency, creating a legal push towards reusable packaging solutions. This legislative push is further supported by national laws in key markets, such as Germany's Packaging Act (VerpackG), which promotes reusable systems and sets recovery targets, making Euro Pool System's model more legally advantageous.

These legal frameworks actively incentivize circular business models by imposing stricter regulations on single-use items and offering financial incentives for sustainable practices. For example, extended producer responsibility (EPR) schemes are being broadened to cover more product categories, encouraging the adoption of durable and repairable goods. This creates a more favorable legal landscape for Euro Pool System's services, as their reusable pallet and crate systems directly align with these regulatory objectives, reducing waste and promoting resource longevity.

Euro Pool System International B.V. operates within a strict European regulatory framework for food safety and hygiene, crucial for the fresh produce supply chain. These regulations mandate rigorous standards for handling and transporting food products to prevent contamination and ensure consumer protection.

The company's washing processes for its reusable trays are designed to meet or surpass these stringent European Union directives, such as Regulation (EC) No 852/2004 on the hygiene of foodstuffs. This includes careful material selection for trays and meticulous operational protocols to maintain a high level of cleanliness throughout their lifecycle, safeguarding the integrity of the produce they carry.

Maintaining hygiene across the entire supply chain is a legal responsibility shared by all participants, including logistics providers like Euro Pool System. Non-compliance can lead to significant penalties, impacting business operations and reputation, underscoring the importance of adhering to these food safety laws.

Extended Producer Responsibility (EPR) Schemes

Extended Producer Responsibility (EPR) schemes are increasingly shaping packaging regulations across Europe, directly impacting how companies manage their waste. These laws, such as those implemented in France and Germany, place the financial and logistical burden of packaging end-of-life management squarely on the producers. This regulatory shift makes reusable packaging solutions, like those offered by Euro Pool System, a more appealing and legally compliant choice for businesses looking to mitigate these new responsibilities and associated costs.

The financial implications for clients are significant. By utilizing Euro Pool System's durable, reusable crates and pallets, companies can often reduce or even eliminate their direct EPR fees, which are calculated based on the volume and type of single-use packaging they introduce into the market. For instance, in countries with robust EPR systems, the avoidance of disposal fees and the potential for reduced administrative overhead can translate into substantial cost savings. These savings are a direct result of shifting from a linear, disposable model to a circular, reusable one.

Several European countries have already implemented or are strengthening their EPR packaging laws:

- France: The AGEC law (Anti-waste for a Circular Economy) significantly expanded EPR obligations, impacting a wider range of packaging materials and setting ambitious recycling targets.

- Germany: The VerpackG (Packaging Act) requires producers to register and pay fees based on the quantity and recyclability of their packaging placed on the market.

- Spain: Similar EPR regulations are in place, with producers responsible for financing and managing packaging waste collection and treatment.

- Italy: The country is moving towards stricter EPR compliance, with ongoing reforms to its packaging waste management system.

Competition Law and Market Dominance

Euro Pool System International B.V.'s significant market share in the European reusable packaging sector could attract scrutiny from competition authorities. Regulators like the European Commission actively monitor market practices to prevent anti-competitive behavior and potential monopolistic tendencies. For instance, the Commission has previously investigated and fined companies for cartel agreements and abuse of dominant positions in various industries.

Adherence to antitrust regulations is crucial for Euro Pool System to maintain its operational freedom and avoid substantial penalties. Transparent pricing, fair contract terms, and avoiding exclusionary practices are vital. In 2023, the European Union continued its robust enforcement of competition law, with a particular focus on digital markets and supply chain dynamics, underscoring the need for vigilance in established sectors.

- Market Share Scrutiny: Euro Pool System's leading position may invite regulatory review to ensure fair competition.

- Antitrust Compliance: Strict adherence to competition laws is essential to prevent fines and operational disruptions.

- Regulatory Focus: The EU's ongoing enforcement of competition rules highlights the importance of transparent business practices.

The evolving legal landscape in the EU, particularly concerning packaging waste and the circular economy, significantly impacts Euro Pool System. New regulations like the EU Packaging and Packaging Waste Regulation (PPWR) mandate ambitious reuse targets, with a goal of 70% reusable transport packaging by 2030, directly boosting the demand for Euro Pool System's services.

Furthermore, Extended Producer Responsibility (EPR) schemes across Europe, such as France's AGEC law and Germany's VerpackG, place the onus of packaging waste management on producers. This makes Euro Pool System's reusable solutions a more cost-effective and legally compliant option for businesses, potentially saving them substantial EPR fees.

Euro Pool System's dominant market position also necessitates strict adherence to antitrust regulations to avoid scrutiny from bodies like the European Commission, which actively monitors for anti-competitive practices. Maintaining transparent operations and fair competition is paramount, especially given the EU's continued robust enforcement of competition law in 2023.

Environmental factors

Euro Pool System International B.V. is actively pursuing significant carbon footprint reductions, aiming for a 20% decrease by 2025. Their core reusable tray system inherently offers a lower CO2 impact compared to single-use packaging, a key environmental advantage.

Operational enhancements further bolster these efforts. Optimized logistics, including efficient route planning for transport, and the implementation of energy-saving measures in their washing facilities contribute directly to lowering emissions. These initiatives underscore a commitment to broader climate goals.

Euro Pool System International B.V. is a leader in reducing packaging waste within the fresh food supply chain. Their reusable tray system directly tackles the environmental burden of single-use packaging, a significant contributor to landfill. In 2024, the food sector continues to face pressure to adopt more sustainable practices, making Euro Pool System's model highly relevant.

The company's closed-loop system is a prime example of circular economy principles in action. Trays are reused thousands of times, drastically cutting down the need for virgin plastic and minimizing waste sent to landfills. This approach directly combats the estimated 1.3 billion tonnes of food waste generated globally each year, a portion of which is exacerbated by packaging issues.

Euro Pool System International B.V. is deeply invested in resource efficiency, primarily through the robust design and material choices for its reusable trays. The company utilizes high-density polyethylene (HDPE), a durable plastic known for its longevity, incorporating recycled content to further reduce virgin material demand. This commitment to material science aims to maximize the lifespan of their assets, thereby minimizing the need for frequent replacement and the associated raw material consumption.

Water Usage and Treatment in Washing Processes

Euro Pool System International B.V. places significant emphasis on sustainable water management within its washing processes, recognizing water as a critical resource. The company actively implements advanced water recovery schemes and employs efficient washing technologies designed to dramatically reduce overall water consumption. This commitment ensures that wastewater is treated responsibly before discharge, adhering to stringent environmental regulations.

Their operational strategy prioritizes minimizing the environmental footprint associated with cleaning reusable packaging. For instance, by investing in closed-loop water systems, Euro Pool System can reuse a substantial portion of the water used in their washing facilities. This approach not only conserves water but also reduces the energy required for water heating and treatment.

The importance of sustainable water management is underscored by global trends and increasing regulatory pressures. In 2024, many regions are experiencing water scarcity, making efficient water use a key differentiator. Euro Pool System's proactive stance on this issue positions them favorably against competitors and aligns with growing consumer demand for environmentally conscious businesses.

- Water Recovery: Euro Pool System utilizes advanced filtration and purification systems to recycle water within their washing operations, aiming to achieve high rates of water reuse.

- Efficient Technologies: The company invests in washing equipment that optimizes water flow and cleaning effectiveness, thereby minimizing the volume of water needed per cycle.

- Wastewater Treatment: All discharged water undergoes rigorous treatment processes to meet or exceed environmental standards for quality and safety.

- Resource Conservation: By focusing on water efficiency, Euro Pool System contributes to the conservation of local water resources and reduces operational costs.

Biodiversity and Ecosystem Protection

Euro Pool System's commitment to a circular economy indirectly bolsters biodiversity and ecosystem protection. By championing reusable packaging solutions, the company significantly curtails the generation of single-use plastic waste, a major contributor to pollution in terrestrial and aquatic environments. This reduction in plastic waste directly lessens the threat to wildlife and delicate ecosystems.

Their operational model actively decreases the demand for virgin resources, such as timber and raw materials for new packaging. This, in turn, alleviates the pressure on natural habitats and ecosystems that would otherwise be exploited for resource extraction. For instance, in 2023, Euro Pool System's pooled assets prevented the use of an estimated 1.2 billion single-use crates, saving substantial amounts of raw materials.

- Reduced Plastic Pollution: Less single-use plastic means less contamination in oceans, rivers, and land, protecting marine life and terrestrial ecosystems.

- Conservation of Natural Resources: Reusable crates lessen the need for logging and mining, preserving forests and natural landscapes.

- Lower Carbon Footprint: A circular model often translates to lower energy consumption and emissions compared to producing new packaging, benefiting the climate and ecosystems.

- Support for Circular Economy: Promoting reuse and recycling fosters a system that respects planetary boundaries and ecological limits.

Euro Pool System International B.V. is actively reducing its environmental impact, targeting a 20% decrease in its carbon footprint by 2025 through its inherently lower-impact reusable tray system. Their commitment extends to operational efficiencies, like optimized logistics and energy-saving measures in washing facilities, further contributing to emissions reduction and broader climate goals.

The company's circular economy model significantly curtails single-use plastic waste, directly protecting ecosystems from pollution and reducing the demand for virgin resources. In 2023 alone, Euro Pool System's pooled assets prevented the use of an estimated 1.2 billion single-use crates, conserving substantial raw materials and lessening pressure on natural habitats.

Water conservation is a key focus, with advanced water recovery schemes and efficient washing technologies implemented to dramatically reduce consumption. This proactive approach to water management, crucial given increasing global water scarcity in 2024, positions them favorably and aligns with consumer demand for eco-conscious businesses.

| Environmental Focus | 2024/2025 Target/Data | Impact |

|---|---|---|

| Carbon Footprint Reduction | 20% by 2025 | Lower CO2 impact than single-use packaging |

| Plastic Waste Reduction | 1.2 billion single-use crates prevented (2023) | Reduced pollution, resource conservation |

| Water Management | Advanced water recovery schemes | Minimizes water consumption and wastewater discharge |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Euro Pool System International B.V. is informed by a robust combination of official EU and national government publications, reports from leading logistics and packaging industry associations, and economic data from reputable institutions like Eurostat and the World Bank. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the reusable packaging sector.