Euro Pool System International B.V. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Euro Pool System International B.V. Bundle

Euro Pool System International B.V. operates within a competitive landscape shaped by moderate buyer power and significant supplier influence, particularly concerning reusable packaging solutions. The threat of new entrants is somewhat mitigated by capital requirements and established networks, while the threat of substitutes, though present, is challenged by the efficiency and sustainability benefits of their pooling model.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Euro Pool System International B.V.’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Euro Pool System's reliance on High-Density Polyethylene (HDPE) plastic as its primary raw material means suppliers of this material hold a degree of bargaining power. This power is influenced by the specialized nature of the plastic required for their durable, reusable trays and the ongoing collaborative innovation between Euro Pool System and its suppliers to enhance product features. For instance, in 2023, global HDPE prices saw fluctuations, impacting input costs for tray manufacturers.

Euro Pool System's commitment to reducing its carbon footprint through local sourcing and optimized logistics can bolster the bargaining power of suppliers who offer unique, sustainable solutions. For instance, if a local supplier can provide materials with a demonstrably lower environmental impact, they become more crucial to Euro Pool's strategic goals.

This strategic alignment means suppliers who can meet stringent sustainability criteria, such as those aligned with the EU's Green Deal initiatives, are in a stronger position. As of early 2024, the logistics sector is increasingly prioritizing green certifications, giving suppliers with such credentials a distinct advantage in negotiations.

The EU's Corporate Sustainability Due Diligence Directive (CSDDD), coming into effect in 2024, significantly impacts Euro Pool System's (EPS) supply chain. Suppliers who proactively demonstrate robust sustainability and ethical compliance will likely see their bargaining power increase, as they become crucial partners in EPS's efforts to meet these new regulatory demands and uphold its corporate image.

Supplier Power 4

The reusable transport packaging market, a key sector for companies like Euro Pool System that utilize materials such as HDPE, is seeing robust expansion. This growth, driven by increasing demand for sustainable logistics solutions, could bolster the bargaining power of suppliers who can reliably provide high-quality, specialized plastic materials. For instance, the global reusable packaging market was valued at approximately USD 12.5 billion in 2023 and is projected to reach over USD 20 billion by 2030, indicating strong supplier leverage potential.

Suppliers who offer advanced material formulations or possess proprietary production technologies may command higher prices or more favorable terms. Euro Pool System's reliance on a consistent supply of durable and food-safe plastic for its crates means that suppliers with proven track records and certifications hold a stronger negotiating position. The increasing emphasis on circular economy principles further incentivizes suppliers who can offer recycled content or more easily recyclable materials.

- The global reusable packaging market is projected for significant growth, expected to exceed USD 20 billion by 2030.

- Companies like Euro Pool System depend on specialized plastic materials, such as HDPE, for their reusable transport packaging.

- Suppliers who can guarantee quality, sustainability, and innovative material solutions are likely to experience increased bargaining power.

- The demand for recycled content and easily recyclable materials in packaging further strengthens the position of environmentally conscious suppliers.

Supplier Power 5

Euro Pool System International B.V. (EPS) recognizes that its long-term objective of enhancing efficiency and circularity within the fresh supply chain hinges on robust partnerships with its suppliers. This collaborative approach fosters a mutual reliance, underscoring the critical role dependable suppliers play in achieving EPS's operational goals and sustainability commitments. Consequently, these suppliers possess a notable degree of bargaining power.

The reliance on specialized, high-quality reusable packaging solutions means that suppliers of these materials, or those capable of producing them to EPS's stringent standards, can exert significant influence. For instance, in 2024, the global demand for sustainable packaging materials continued to rise, with reports indicating a 5% year-over-year increase in the market for eco-friendly logistics solutions, potentially strengthening the negotiating position of suppliers in this niche.

- Supplier Specialization: Key suppliers often possess unique expertise or proprietary technology in producing the durable, hygienic, and standardized containers essential for EPS's operations.

- Concentration of Suppliers: If the number of qualified suppliers for specific components or materials is limited, their collective bargaining power increases.

- Cost of Switching: The expense and disruption associated with changing suppliers for specialized packaging can be substantial, making it more advantageous for EPS to maintain existing relationships, thereby empowering current suppliers.

- Importance of Raw Materials: The cost and availability of raw materials used in EPS's containers, such as specific grades of plastic, can also influence supplier power, especially if these materials are subject to market volatility.

Suppliers of specialized plastic materials, like High-Density Polyethylene (HDPE), hold considerable bargaining power due to the unique requirements of Euro Pool System's durable, reusable trays. This power is amplified by the increasing global demand for sustainable packaging solutions, with the reusable packaging market projected to exceed USD 20 billion by 2030. Suppliers who can offer high-quality, eco-friendly materials and meet stringent sustainability standards, such as those aligned with EU Green Deal initiatives, are in a stronger negotiating position.

The cost and availability of essential raw materials, coupled with the expense and disruption involved in switching suppliers for specialized packaging, further empower existing suppliers. As of early 2024, the logistics sector's growing emphasis on green certifications provides an advantage to suppliers possessing such credentials, reinforcing their negotiating leverage.

| Factor | Impact on Supplier Bargaining Power | Supporting Data/Trend (as of mid-2024) |

|---|---|---|

| Material Specialization | High | EPS relies on specific HDPE grades for durable, hygienic trays. |

| Market Growth (Reusable Packaging) | Increasing | Projected to exceed USD 20 billion by 2030. |

| Sustainability Demand | High | EU Green Deal initiatives and corporate ESG goals favor eco-friendly suppliers. |

| Switching Costs | Significant | High costs and disruption associated with changing specialized packaging suppliers. |

What is included in the product

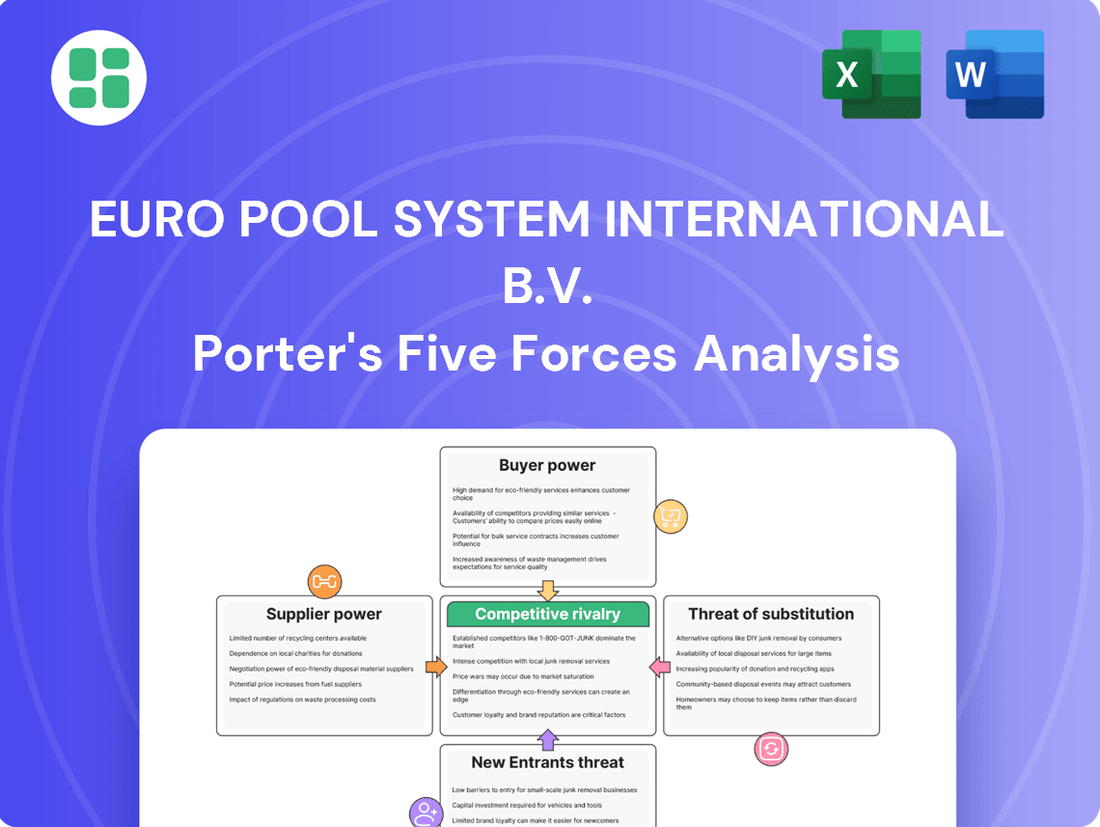

This analysis unpacks the competitive forces impacting Euro Pool System International B.V., focusing on supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the reusable packaging sector.

Understand competitive pressures instantly with a visual representation of each force, streamlining strategic planning and highlighting areas for proactive intervention.

Quickly assess the impact of buyer power and supplier negotiation on Euro Pool System's profitability, enabling data-driven strategies to mitigate these challenges.

Customers Bargaining Power

Euro Pool System's primary customers are major players in the European fresh food sector, such as large supermarket chains and agricultural producers. These significant buyers, due to their substantial purchase volumes, wield considerable influence over Euro Pool System's pricing and service terms.

Customers are increasingly prioritizing sustainability, with a significant portion of consumers and businesses actively seeking eco-friendly options. For instance, a 2024 survey indicated that over 60% of businesses consider sustainability a key factor in their procurement decisions. This trend directly benefits Euro Pool System (EPS) as its reusable packaging solutions are inherently aligned with these environmental mandates.

The strong demand for sustainable practices empowers EPS by reducing the bargaining power of its customers on core services. Because EPS's offerings help clients meet their own environmental targets and reduce their carbon footprint, customers are less likely to negotiate aggressively on pricing or terms for these essential, value-added services. This is particularly true as the cost of single-use packaging, including disposal fees and environmental taxes, continues to rise.

New EU regulations like the Packaging and Packaging Waste Regulation (PPWR) and the Corporate Sustainability Due Diligence Directive (CSDDD) are significantly influencing the food industry. These mandates require companies to embrace sustainable practices, particularly concerning reusable packaging solutions. This regulatory push directly benefits Euro Pool System (EPS) by increasing the demand for their services.

The growing emphasis on reusable packaging, driven by these regulations, strengthens EPS's bargaining power. As food producers and retailers face compliance requirements, they become more reliant on providers like EPS, making them less able to dictate terms and more receptive to EPS's offerings and pricing structures.

Buyer Power 4

Euro Pool System International B.V. generally faces moderate buyer power. While customers benefit from the significant logistical efficiencies, cost reductions, and high reliability offered by EPS's pooling services, the integration of EPS's system into a customer's supply chain creates considerable switching costs. These costs, stemming from operational disruption and potential investment in alternative solutions, tend to lock customers into the EPS system, thereby limiting their ability to easily switch providers and exert downward pressure on pricing.

The substantial upfront investment and operational adjustments required to transition away from EPS's established pooling infrastructure act as a significant deterrent for many customers. This integration creates a sticky customer base, where the perceived benefits of staying with EPS outweigh the costs and complexities of switching. For instance, a major retailer relying on EPS for its entire fresh produce distribution network would face immense disruption and retraining costs if it were to change providers.

- Logistical Efficiencies: EPS's pooled system streamlines supply chains, reducing handling and transportation costs for users.

- Cost Reductions: Customers benefit from lower labor and storage expenses compared to managing their own reusable packaging.

- High Reliability: The consistent availability and quality of EPS’s packaging ensure uninterrupted supply chain operations.

- Switching Costs: Integration into a customer's existing supply chain creates barriers to entry for competitors and reduces buyer power.

Buyer Power 5

Euro Pool System's digital services, like real-time tray tracking, significantly boost supply chain visibility for its customers. This enhanced transparency helps clients manage inventory more effectively and meet increasing regulatory demands for traceability. In 2024, the demand for such integrated digital solutions in the logistics sector continued to grow, with many businesses prioritizing partners that offer advanced data management capabilities.

The value derived from Euro Pool System's technological offerings, which streamline operations and ensure compliance, reduces the inclination for customers to switch to less integrated or technologically advanced alternatives. This creates a degree of customer loyalty and dependence on the system's unique capabilities.

- Enhanced Supply Chain Visibility: Digital services provide real-time tracking of trays, crucial for inventory management and regulatory compliance.

- Reduced Incentive for Switching: The integrated value proposition makes it less attractive for customers to seek less sophisticated alternatives.

- Customer Loyalty and Dependence: The technological advantages foster a reliance on Euro Pool System's solutions.

- Growing Demand for Digital Integration: In 2024, businesses increasingly favored partners offering advanced digital supply chain management.

Euro Pool System's customers, primarily large supermarket chains and agricultural producers, hold moderate bargaining power. While their substantial purchase volumes give them some leverage, the high switching costs associated with integrating EPS's pooling system into their supply chains significantly limit their ability to dictate terms. Furthermore, the increasing demand for sustainability and the regulatory push towards reusable packaging, as highlighted by a 2024 survey showing over 60% of businesses prioritizing eco-friendly procurement, actually strengthens EPS's position by making its core offerings more indispensable.

The integration of EPS's pooling system creates substantial switching costs for customers, effectively locking them in. These costs are not just financial, involving potential new infrastructure or operational adjustments, but also operational, given the disruption to established supply chains. For instance, a major retailer utilizing EPS for its entire fresh produce distribution would face significant hurdles in transitioning to an alternative, making them less inclined to aggressively negotiate pricing.

Euro Pool System's digital solutions, such as real-time tray tracking, further enhance customer reliance. In 2024, the logistics sector saw a continued rise in demand for advanced data management, making EPS's integrated digital services a key value proposition. This technological advantage reduces the incentive for customers to seek less integrated or technologically advanced alternatives, fostering loyalty and dependence.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Reasoning |

|---|---|---|

| Customer Concentration | Moderate | Large supermarket chains and agricultural producers are significant buyers. |

| Switching Costs | Lowers Bargaining Power | High integration into supply chains creates operational and financial barriers to switching. |

| Sustainability Demand | Lowers Bargaining Power | Over 60% of businesses prioritized eco-friendly options in 2024, aligning with EPS's reusable solutions. |

| Regulatory Environment | Lowers Bargaining Power | New EU regulations (e.g., PPWR) mandate reusable packaging, increasing reliance on EPS. |

| Digital Integration | Lowers Bargaining Power | Real-time tracking and data management enhance supply chain visibility, creating customer dependence. |

What You See Is What You Get

Euro Pool System International B.V. Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis of Euro Pool System International B.V., providing a deep dive into the competitive landscape. You'll receive this exact, professionally formatted document immediately after purchase, offering actionable insights into industry rivalry, buyer and supplier power, threat of new entrants, and the threat of substitutes. This detailed analysis is ready for your immediate use, enabling informed strategic decision-making.

Rivalry Among Competitors

Euro Pool System International B.V. operates within a landscape where its parent, Euro Pool Group, holds a dominant position as Europe's premier provider of reusable packaging solutions. This leadership, while a strength, naturally intensifies the efforts of competitors aiming to chip away at its market share. For instance, the reusable packaging market in Europe is projected to grow, with some estimates placing the growth rate at around 5% annually in the coming years, signaling an attractive market that will draw competitive attention.

Euro Pool System International B.V. faces significant competitive rivalry from direct competitors in the reusable packaging sector. A prime example is IFCO, which launched a new reusable plastic pallet across Europe in early 2024. This move by IFCO underscores the dynamic nature of the market, where established players are actively introducing innovative solutions.

The competitive landscape necessitates continuous innovation. Companies like Euro Pool System must constantly adapt and improve their offerings to retain their market share and appeal. The introduction of new products by rivals, such as IFCO's pallet, signals that staying ahead requires a proactive approach to product development and service enhancement.

The European reusable packaging market is set for substantial growth, with projections indicating a significant expansion from 2025 through 2030. This burgeoning market, while attractive, naturally fuels a more intense competitive rivalry as existing and new players strive to capture a greater slice of the increasing demand.

As the reusable packaging sector matures and expands, companies like Euro Pool System International B.V. will likely face heightened competition. This intensified rivalry stems from the shared pursuit of market share within a growing, yet finite, customer base, potentially leading to price pressures and increased innovation efforts.

Competitive Rivalry 4

Competitive rivalry within the reusable packaging sector, including players like Euro Pool System International B.V., is intensifying, with sustainability performance emerging as a key differentiator. Companies are increasingly judged by their capacity to support customer environmental objectives.

Euro Pool System distinguishes itself through its integrated circular economy approach, optimized logistics networks, and dedicated carbon footprint reduction strategies. These efforts compel competitors to allocate significant resources towards developing comparable sustainable initiatives.

For instance, in 2023, the reusable packaging market saw substantial investment in eco-friendly technologies. Euro Pool System reported a 15% reduction in its Scope 1 and 2 emissions compared to 2022, a metric that rivals are now under pressure to match or surpass.

- Sustainability as a Competitive Driver: Customer demand for verifiable environmental impact is reshaping competitive strategies.

- Circular Economy Models: Companies adopting closed-loop systems gain an advantage, pushing others to innovate.

- Logistical Efficiency: Optimized supply chains are crucial for cost-effectiveness and reduced environmental impact.

- Investment in Green Technologies: Rivals are compelled to invest in reducing their carbon footprint to remain competitive.

Competitive Rivalry 5

Competitive rivalry within the reusable packaging sector, like that faced by Euro Pool System International B.V., is intense, driven by a constant push for innovation in optimizing reverse logistics and integrating digital solutions for enhanced traceability. Companies are actively investing in technology to gain an edge.

This focus on technological advancement and operational efficiency is a primary battleground. Firms are competing to deliver more sophisticated and seamlessly integrated services to their clientele. For instance, companies are exploring AI-driven route optimization and IoT sensors for real-time asset tracking.

- Innovation in Reverse Logistics: Companies are heavily investing in optimizing the return journey of packaging, reducing costs and environmental impact.

- Digital Integration: The adoption of digital services for traceability, such as RFID tags and blockchain, is becoming a standard competitive differentiator.

- Operational Efficiency: Firms are striving for greater efficiency in cleaning, repair, and redistribution processes to lower operational expenditures.

- Customer-Centric Solutions: The ability to offer tailored and integrated packaging management solutions is key to winning and retaining customers in this market.

Competitive rivalry for Euro Pool System International B.V. is robust, with players like IFCO actively introducing new products and technologies, such as advanced reusable plastic pallets launched in early 2024. This environment demands continuous innovation and efficiency improvements from all participants to maintain market share and attract customers.

The market's growth, projected at around 5% annually, fuels this rivalry, encouraging investments in sustainability and digital integration. Companies are differentiating themselves through circular economy models, optimized logistics, and reduced carbon footprints. For example, Euro Pool System reported a 15% reduction in Scope 1 and 2 emissions in 2023, a benchmark rivals are pressured to meet.

Key competitive factors include the efficiency of reverse logistics, digital traceability solutions like RFID, and operational excellence in cleaning and redistribution processes. Ultimately, offering customer-centric, integrated packaging management solutions is paramount for success.

| Competitor | Key 2024/2025 Initiatives | Market Focus |

|---|---|---|

| IFCO | New reusable plastic pallet launch across Europe; Continued investment in digital tracking. | Global reusable packaging solutions, strong in fresh produce. |

| CHEP | Expansion of pooling services for various industries; Focus on sustainability reporting. | Pallet and container pooling across supply chains. |

| LogiNext | AI-driven route optimization for logistics; Enhanced last-mile delivery solutions. | Logistics and supply chain optimization software. |

SSubstitutes Threaten

Single-use packaging, primarily cardboard and various plastic types, continues to be the main alternative to Euro Pool System's reusable trays. Despite environmental drawbacks, these disposable options can sometimes present lower initial expenses and more straightforward handling for certain companies, posing an ongoing challenge.

Emerging sustainable packaging materials are a growing, though currently minor, threat to Euro Pool System International B.V. Innovations like compostable films and biodegradable bioplastics, such as PLA and mushroom-based alternatives, are gaining traction. These materials address increasing environmental concerns and could potentially capture market share if they achieve scalability and cost-effectiveness for widespread logistics use.

Regulatory shifts in Europe are a major factor here. For instance, the European Union's Single-Use Plastics Directive, implemented in phases starting in 2021, aims to reduce the environmental impact of plastic products. This legislation, which includes bans on certain single-use plastic items and mandates for reusable alternatives, directly weakens the appeal of disposable packaging solutions that could otherwise substitute for Euro Pool System's reusable crates.

These evolving regulations are not just theoretical; they are actively reshaping the market. By 2024, many European countries have seen significant progress in implementing these directives, leading to increased adoption of reusable packaging systems. This trend makes it harder for single-use alternatives to compete on both environmental and increasingly, economic grounds, as compliance costs for disposable options rise.

4

The threat of substitutes for Euro Pool System's reusable trays is relatively low, primarily due to the significant operational and sustainability advantages they offer. For instance, their trays are designed to reduce product loss by up to 30 times compared to single-use alternatives, a compelling benefit for businesses focused on minimizing waste and maximizing yield. This superior product protection, coupled with enhanced hygiene standards, creates a strong value proposition that many substitutes find difficult to replicate.

Furthermore, the total cost of ownership for reusable trays, when considering the long-term savings from reduced product damage and waste disposal, often outweighs the initial perceived lower cost of single-use options. In 2024, the emphasis on circular economy principles and ESG (Environmental, Social, and Governance) reporting further solidifies the appeal of Euro Pool System's offering, making it a preferred choice over less sustainable alternatives.

- Superior Product Protection: Significantly reduces damage and spoilage compared to single-use packaging.

- Enhanced Hygiene: Designed for easy cleaning and sanitization, crucial for food safety.

- Reduced Product Loss: Studies indicate up to 30 times less product loss with reusable trays.

- Sustainability and Cost-Effectiveness: Aligns with circular economy goals and offers long-term cost savings.

5

While edible packaging is an emerging innovation, its current market penetration remains limited. For instance, in 2024, the global edible packaging market was valued at approximately USD 1.5 billion, a fraction of the larger logistics and packaging sectors. This indicates that while it represents a potential future threat, it is not yet a significant substitute for Euro Pool System's (EPS) core operations. The scale and logistical demands of EPS's business, which involves the high-volume, temperature-controlled transport of fresh produce across Europe, far exceed the current capabilities of edible packaging solutions.

The primary limitation of edible packaging as a substitute for EPS lies in its current application and scalability. Most edible packaging is found in niche consumer goods, such as single-serving food items or specialized confectionery. It is not engineered to withstand the rigors of multi-modal transportation, the diverse weight requirements of various fresh produce, or the extended supply chain durations that EPS manages. For example, a pallet of tomatoes or a crate of apples requires robust, reusable containers that can be stacked, handled by automated systems, and endure varying environmental conditions, a performance standard edible packaging has yet to meet at scale.

The threat of substitutes for Euro Pool System is currently low due to the specialized nature of its reusable pool system.

- Niche Application: Edible packaging, while innovative, is largely confined to niche consumer products, not large-scale logistics.

- Scalability Issues: Current edible packaging cannot match the volume, durability, and handling requirements of EPS's fresh produce transport.

- Performance Gaps: Edible solutions lack the structural integrity needed for multi-modal transport, stacking, and extended supply chain durations compared to EPS's robust containers.

- Market Size: The global edible packaging market, estimated around USD 1.5 billion in 2024, is a small segment compared to the vast logistics and packaging industry EPS operates within.

The threat of substitutes for Euro Pool System's reusable trays remains relatively low, largely due to the strong performance advantages and increasing regulatory support for their model. While single-use packaging like cardboard and plastic persists as an alternative, its environmental drawbacks and rising compliance costs, especially with EU directives like the Single-Use Plastics Directive, diminish its appeal. By 2024, these regulations are actively pushing the market towards reusable solutions.

Emerging materials such as compostable films and bioplastics present a potential, albeit currently minor, threat. However, these innovations must achieve greater scalability and cost-effectiveness to truly compete with the established operational and sustainability benefits of Euro Pool System's trays, which offer up to 30 times less product loss compared to disposables.

Edible packaging, while a novel concept, is not yet a significant substitute. Its current market, valued at approximately USD 1.5 billion in 2024, is small and focused on niche consumer goods. Edible solutions lack the durability, structural integrity, and handling capabilities required for the high-volume, multi-modal transportation of fresh produce that Euro Pool System specializes in.

Entrants Threaten

The reusable packaging industry, especially large-scale pooling systems like Euro Pool System's, demands significant upfront capital. This includes investments in manufacturing trays, setting up washing facilities, and building extensive logistics networks. For instance, establishing a new, competitive pooling system could easily require hundreds of millions of euros in initial investment, making it difficult for smaller companies to enter the market.

The threat of new entrants for Euro Pool System International B.V. is moderate due to the substantial capital investment and complex operational infrastructure required to replicate their extensive reusable packaging network. Building a comparable logistics system, managing reverse flows, and ensuring consistent product availability across diverse markets demands significant expertise and upfront financial commitment.

The threat of new entrants for Euro Pool System International B.V. is moderate, largely due to the increasing regulatory burden in Europe. Directives like the proposed Packaging and Packaging Waste Regulation (PPWR) and the Corporate Sustainability Due Diligence Directive (CSDDD) demand significant investment in compliance, particularly concerning sustainability and traceability. For instance, the PPWR aims to harmonize packaging rules across the EU, potentially increasing operational complexity for any new player entering the pooling system.

4

The threat of new entrants for Euro Pool System International B.V. is relatively low, primarily due to significant barriers to entry. Euro Pool System boasts an expansive network of over 200 service centers strategically located across 38 countries in Europe. This extensive infrastructure represents a substantial capital investment and operational complexity that new players would need to replicate.

Furthermore, Euro Pool System benefits from deeply entrenched, long-standing relationships with major European retailers and producers. These established partnerships translate into significant customer loyalty and network effects, making it difficult for newcomers to gain traction and secure comparable business volumes. For instance, in 2024, the company continued to solidify its position by expanding its service offerings to key agricultural hubs, further embedding itself within the supply chain.

The capital required to build a comparable network and establish the necessary trust with major clients presents a formidable hurdle. New entrants would also face challenges in achieving the economies of scale that Euro Pool System currently enjoys, impacting their cost competitiveness.

- Extensive Network: Over 200 service centers across 38 countries.

- Established Relationships: Long-standing ties with major European retailers and producers.

- Network Effects: Deep market penetration creates loyalty and makes competition difficult.

- Capital Intensity: High investment needed to replicate infrastructure and relationships.

5

The threat of new entrants in the reusable packaging sector, particularly for companies like Euro Pool System International B.V., is somewhat mitigated by the increasing demand for sophisticated digital services. These services, crucial for traceability and supply chain optimization, represent a significant barrier. Euro Pool System has already invested heavily in these areas, making it challenging for newcomers to match their capabilities without substantial upfront investment.

Developing and integrating advanced technological solutions for tracking and data management demands considerable research and development, along with specialized expertise. This technological hurdle, coupled with the capital required for a robust digital infrastructure, effectively raises the entry cost for potential competitors in the reusable pool system market.

- High R&D Investment: New entrants need to invest heavily in R&D to develop comparable digital tracking and optimization technologies.

- Technological Expertise: Acquiring or developing the necessary technical talent for advanced supply chain solutions is a significant challenge.

- Capital Expenditure: The cost of building out a digital platform that rivals existing players like Euro Pool System is substantial.

- Integration Complexity: Seamlessly integrating new digital services with existing logistics and customer systems requires deep industry knowledge and resources.

The threat of new entrants for Euro Pool System International B.V. remains moderate. While the company's extensive network of over 200 service centers across 38 European countries presents a significant physical barrier, new players can emerge by focusing on niche markets or leveraging digital platforms. For example, in 2024, several smaller, regional pooling initiatives gained traction by offering specialized services to specific agricultural sectors, demonstrating that a full replication of EPS's scale isn't always necessary for market entry.

The high capital investment required to establish a comparable logistics and washing infrastructure, estimated to be in the hundreds of millions of euros, is a primary deterrent. However, advancements in modular infrastructure and shared service models could potentially lower this barrier for future entrants. Furthermore, the increasing regulatory focus on packaging sustainability, such as the EU's proposed Packaging and Packaging Waste Regulation, could create opportunities for agile newcomers who can adapt quickly to new compliance requirements.

Euro Pool System's established relationships with major retailers and producers, built over decades, create substantial network effects and customer loyalty, making it difficult for new entrants to secure significant market share. However, the growing demand for advanced digital tracking and supply chain optimization technologies, where EPS has invested heavily, also represents a significant barrier. Newcomers would need to make substantial R&D investments to match these capabilities, potentially increasing their initial capital outlay significantly.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Euro Pool System International B.V. is built upon a foundation of comprehensive data, including the company's annual reports, industry-specific market research from reputable firms, and relevant trade publications. This blend ensures a robust understanding of the competitive landscape.