Eurobio Scientific PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eurobio Scientific Bundle

Navigate the complex external forces impacting Eurobio Scientific with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its market. Gain a strategic advantage by leveraging these crucial insights. Download the full report now for actionable intelligence to inform your decisions.

Political factors

Government healthcare policies are a major driver for companies like Eurobio Scientific, impacting how their in-vitro diagnostic (IVD) products are used and paid for. In France, a key market for Eurobio Scientific, the government's commitment to healthcare is evident. Healthcare expenditure specifically for medical and diagnostic laboratories is projected to grow from an estimated 4.65% of total current health expenditure in 2024 to 6.95% by 2028.

This upward trend in diagnostic service funding, even with potential budget adjustments elsewhere, signals a favorable environment for Eurobio Scientific. It suggests increased opportunities for their diagnostic solutions within France's healthcare system, directly benefiting their market position.

The European In Vitro Diagnostic Regulation (IVDR) is a major political consideration, with significant updates effective January 2025. These changes impact information duties, the EUDAMED database, and transition timelines for existing products.

Eurobio Scientific, a French company focused on in vitro diagnostics, needs to carefully manage these evolving regulations for both its own and distributed products to ensure continued market access across Europe.

Eurobio Scientific's reliance on international partners for reagents and instruments makes it susceptible to disruptions from geopolitical tensions and trade barriers. For example, the ongoing trade disputes between major global economies in 2024 could lead to increased tariffs or import restrictions, directly impacting the cost and availability of essential diagnostic supplies.

Shifts in international trade agreements, such as potential renegotiations of existing pacts or the emergence of new trade blocs, can significantly alter market access and operational costs for Eurobio Scientific. In 2025, continued focus on regional supply chain resilience might see countries favoring domestic production, potentially creating challenges for companies like Eurobio Scientific that depend on global sourcing.

Public Health Priorities and Preparedness

Government priorities in public health, like bolstering infectious disease surveillance or expanding cancer screening, directly influence the market for diagnostic tests. For instance, the European Centre for Disease Prevention and Control (ECDC) reported a significant increase in reported cases of certain infectious diseases in 2023 compared to previous years, highlighting the ongoing need for robust diagnostic solutions.

The persistent rise in both infectious diseases and chronic conditions across Europe continues to fuel demand for in-vitro diagnostic (IVD) products. This trend is evident in market growth figures, with the European IVD market projected to reach over €25 billion by 2025, indicating strong underlying demand for Eurobio Scientific's offerings.

Political initiatives focused on early detection and prevention present substantial opportunities for Eurobio Scientific. For example, national health strategies emphasizing timely diagnosis for conditions like diabetes or specific cancers can directly translate into increased adoption of the company's advanced diagnostic tests, potentially boosting revenue streams.

- Government focus on public health challenges directly impacts demand for diagnostic tests.

- The increasing prevalence of infectious and chronic diseases drives the IVD market in Europe.

- Political support for early detection creates opportunities for diagnostic companies like Eurobio Scientific.

Investment in Life Sciences and R&D

European governments and the EU are significantly increasing their focus on life sciences, recognizing its importance for economic growth and public health. This commitment is underscored by the EU's inaugural Life Sciences Strategy, unveiled in July 2025. This ambitious plan earmarks a substantial 10 billion Euro for investment through 2029, specifically targeting the acceleration of clinical research and fostering innovation across the sector.

This strategic emphasis on research and development creates a favorable ecosystem for companies like Eurobio Scientific. The influx of funding and supportive policies can directly benefit their product development pipelines and facilitate broader market expansion. For instance, increased public funding for early-stage research can de-risk some of the initial investment hurdles for novel diagnostic technologies.

- EU Life Sciences Strategy: Launched July 2025, aiming to bolster European biotech and healthcare competitiveness.

- Investment Allocation: 10 billion Euro planned through 2029 to support clinical research and innovation.

- Impact on Eurobio Scientific: Potential for enhanced product development and strategic expansion due to increased R&D focus.

Government healthcare spending in France, a key market for Eurobio Scientific, is projected to see diagnostic services grow from an estimated 4.65% of total health expenditure in 2024 to 6.95% by 2028, indicating increased funding opportunities.

The European IVD Regulation (IVDR) is a significant political factor, with crucial updates effective January 2025 impacting product compliance and market access across the EU, requiring careful navigation by Eurobio Scientific.

Geopolitical tensions and trade policy shifts in 2024-2025 could affect Eurobio Scientific's supply chain for reagents and instruments, potentially increasing costs or limiting availability due to tariffs or import restrictions.

The EU's Life Sciences Strategy, launched in July 2025 with a 10 billion Euro investment through 2029, aims to boost clinical research and innovation, presenting a supportive environment for Eurobio Scientific's R&D efforts.

| Political Factor | Description | Impact on Eurobio Scientific | Relevant Data/Event |

|---|---|---|---|

| Healthcare Policy & Funding | Government spending on diagnostics | Increased market opportunities and demand for IVD products | French diagnostic service expenditure projected to rise from 4.65% (2024) to 6.95% (2028) |

| Regulatory Environment | IVDR updates | Compliance challenges and market access considerations | IVDR effective January 2025 |

| Trade & Geopolitics | International trade relations | Supply chain risks and cost fluctuations for imported components | Ongoing global trade disputes (2024) and focus on supply chain resilience (2025) |

| Life Sciences Strategy | EU investment in R&D | Enhanced innovation and product development support | EU Life Sciences Strategy (July 2025) with 10 billion Euro investment through 2029 |

What is included in the product

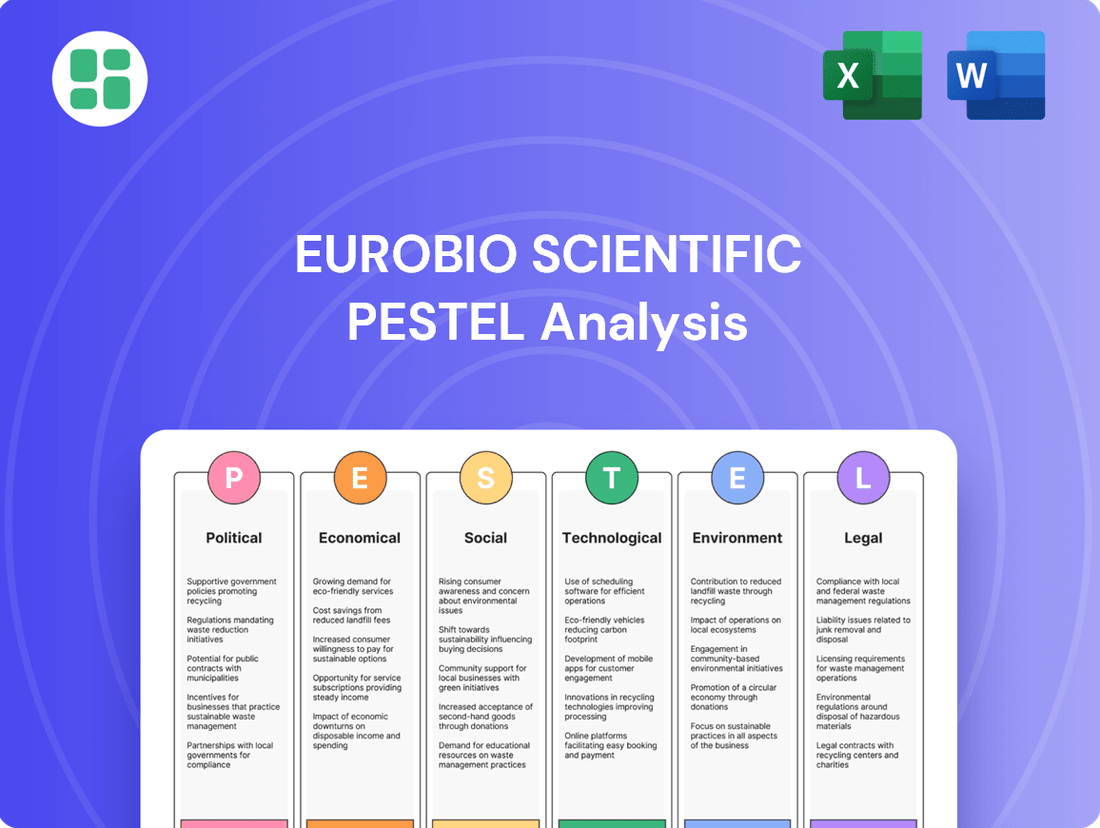

This PESTLE analysis for Eurobio Scientific delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting its operations and strategic positioning.

It provides a comprehensive overview of external factors, highlighting potential challenges and avenues for growth within the diagnostics and biotechnology sectors.

The Eurobio Scientific PESTLE Analysis offers a clean, summarized version of the full analysis for easy referencing during meetings or presentations, streamlining strategic discussions.

Economic factors

France's healthcare system is navigating a complex fiscal landscape. While the demand for diagnostic services, a key area for Eurobio Scientific, is expected to grow, the national healthcare budget for 2025 is projected to face a substantial deficit. This situation is prompting a strong emphasis on cost containment and operational efficiencies across the sector.

This dual dynamic—rising demand for diagnostics coupled with budget pressures—creates a challenging environment for In Vitro Diagnostics (IVD) product providers. Companies like Eurobio Scientific will likely see increased scrutiny on pricing and reimbursement models as the government seeks cost-effective solutions to manage its healthcare spending. This necessitates a focus on demonstrating the value and efficiency of their diagnostic offerings.

Overall economic growth across Europe significantly impacts healthcare budgets, research and development funding, and consumer willingness to spend on health-related products and services. A robust economy generally translates to increased investment in the healthcare sector.

The European In Vitro Diagnostics (IVD) market is a key indicator of this economic influence. It was valued at an estimated USD 23.35 billion in 2024 and is projected to expand to USD 34.47 billion by 2033, showcasing a consistent growth trend. This expansion suggests a healthy underlying demand and economic confidence in the healthcare sector.

However, the current economic landscape in 2025 presents a complex picture. Market volatility and ongoing geopolitical instability are creating significant headwinds, particularly affecting the availability and cost of financing for European biotechnology companies. This can temper the pace of innovation and market penetration despite underlying growth potential.

Investment in life sciences R&D is a cornerstone for Eurobio Scientific's future innovation, particularly in developing new diagnostic products. The landscape for European biotech financing presented a stark picture in the first quarter of 2025, with a substantial 64% drop in total funding compared to the same period in 2024. This downturn disproportionately impacted early-stage companies, creating a more challenging environment for nascent innovation.

However, there are strategic efforts underway to counteract these funding headwinds. Public capital injections and targeted initiatives are designed to mitigate the risks associated with early-stage investments, aiming to stimulate greater private sector participation. These measures could provide a more stable foundation for Eurobio Scientific's ongoing diagnostic product development pipeline.

Inflation and Cost of Goods

Inflationary pressures and the rising cost of raw materials, particularly for reagents and diagnostic instruments, directly affect Eurobio Scientific's manufacturing expenses and, consequently, its profit margins. These cost increases can squeeze profitability, especially if they cannot be fully passed on to customers.

Eurobio Scientific's 2024 annual results clearly indicated these mounting pressures, noting increasing strain on margins and underperformance observed in several of its European subsidiaries. This suggests that the company is already grappling with the financial repercussions of these economic trends.

Effectively managing supply chain costs and enhancing operational efficiency are therefore critical strategies for Eurobio Scientific to maintain and improve its profitability in the current economic climate. Success in these areas will be paramount for navigating the inflationary landscape.

- Rising Input Costs: Increased prices for essential reagents and diagnostic equipment directly impact production expenses.

- Margin Pressure: Higher costs can lead to reduced profit margins if price increases are not fully implemented.

- Subsidiary Performance: Underperformance in some European markets in 2024 highlights the localized impact of economic challenges.

- Supply Chain Management: Efficient control over supply chain expenditures is vital for financial resilience.

Currency Exchange Rates

Currency exchange rates present a significant economic factor for Eurobio Scientific, especially given its substantial international sales. In 2024, a notable 41% of the company's revenue was generated from international markets, highlighting its global reach and reliance on cross-border transactions.

Fluctuations in exchange rates directly impact Eurobio Scientific's financial health. For instance, a stronger Euro could make its products more expensive for international buyers, potentially dampening sales volume. Conversely, a weaker Euro could inflate the cost of imported components and raw materials needed for production, squeezing profit margins.

- International Revenue Exposure: 41% of Eurobio Scientific's 2024 revenue originated from international sales, making it susceptible to currency volatility.

- Cost of Goods Sold: Exchange rate shifts can alter the cost of imported components, affecting the company's gross profit.

- Competitive Pricing: Favorable exchange rates can enhance price competitiveness in foreign markets, while unfavorable ones can diminish it.

- Profit Repatriation: The value of profits earned in foreign currencies and repatriated back to the Euro can be significantly influenced by prevailing exchange rates.

The French government's commitment to healthcare spending, while robust, faces budgetary constraints in 2025. This necessitates a focus on cost-effectiveness, directly impacting companies like Eurobio Scientific that supply diagnostic solutions.

The broader European economic outlook for 2025 indicates a mixed picture. While the IVD market is projected for significant growth, reaching an estimated USD 34.47 billion by 2033 from USD 23.35 billion in 2024, current market volatility and geopolitical instability are hindering financing for biotech firms.

Inflationary pressures are a significant concern, with rising costs for reagents and equipment impacting Eurobio Scientific's margins, as evidenced by underperformance in some European subsidiaries in 2024. Managing supply chain costs is therefore crucial for profitability.

Currency exchange rates significantly affect Eurobio Scientific, given that 41% of its 2024 revenue came from international markets. Fluctuations can impact sales competitiveness and the cost of imported materials.

| Economic Factor | Impact on Eurobio Scientific | 2024/2025 Data Points |

|---|---|---|

| French Healthcare Budget | Pressure for cost-effective solutions | Budget deficit projected for 2025 |

| European IVD Market Growth | Opportunity for increased sales | Projected to reach USD 34.47 billion by 2033 (from USD 23.35 billion in 2024) |

| Biotech Financing Environment | Challenges for R&D investment | 64% drop in Q1 2025 funding vs. Q1 2024 |

| Inflation & Input Costs | Reduced profit margins | Underperformance in several European subsidiaries noted in 2024 results |

| Currency Exchange Rates | Impact on international sales and costs | 41% of 2024 revenue from international markets |

Same Document Delivered

Eurobio Scientific PESTLE Analysis

The preview shown here is the exact Eurobio Scientific PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Eurobio Scientific. You can trust that the insights and structure you see are precisely what you’ll be working with.

Sociological factors

Europe's demographic shift towards an older population is a major catalyst for the in-vitro diagnostics (IVD) market. As people age, they become more vulnerable to chronic illnesses and infections, directly boosting the need for early and accurate disease identification tools. For instance, in 2023, the average age in the EU was 44.4 years, up from 43.7 in 2022, highlighting this trend.

The increasing incidence of conditions such as diabetes and various cancers further underscores the demand for sophisticated diagnostic solutions. In 2024, it's projected that cancer will affect millions across Europe, with specific types like cardiovascular diseases also seeing a rise, necessitating advanced IVD technologies for timely intervention and management.

Public health awareness has significantly intensified, particularly following the COVID-19 pandemic. This heightened consciousness around personal well-being and the benefits of early detection is directly translating into greater demand for diagnostic solutions. For instance, the global market for in-vitro diagnostics, a key area for Eurobio Scientific, was projected to reach over $100 billion in 2024, with strong growth driven by preventive health measures.

This growing emphasis on preventive care fuels the adoption of advanced diagnostic tools, including point-of-care testing and at-home self-testing kits. Consumers are increasingly proactive in managing their health, seeking convenient and accessible ways to monitor their conditions. This shift plays directly into Eurobio Scientific's strategy to provide innovative diagnostic tests across a range of medical applications, from infectious diseases to oncology.

Shifting lifestyle habits are significantly altering disease landscapes, with trends like increased sedentary behavior and dietary changes contributing to a rise in chronic conditions. This evolution directly impacts the demand for diagnostic solutions, creating new market opportunities. For instance, the growing prevalence of certain cancers and infectious diseases necessitates advanced testing, a core area for Eurobio Scientific.

Eurobio Scientific's strategic positioning in oncology and infectious disease diagnostics is well-aligned with these evolving health patterns. As lifestyle-related diseases become more prominent, the need for early detection and monitoring through sophisticated diagnostic tests is paramount. The company's commitment to these fields allows it to capitalize on the increasing demand for its specialized offerings.

Ethical Considerations and Public Acceptance

Public perception of diagnostic technologies, especially concerning genetic testing and healthcare data privacy, significantly impacts market acceptance and regulatory oversight for companies like Eurobio Scientific. Concerns about data security and the ethical implications of genomic information can lead to increased scrutiny and slower adoption rates. For instance, a 2024 survey indicated that over 60% of consumers express reservations about sharing their genetic data, even for medical research, highlighting the need for robust privacy frameworks.

Ensuring transparency in how diagnostic results are handled and actively addressing public ethical debates are crucial for Eurobio Scientific's sustained growth and market penetration. Companies that proactively engage with these concerns, demonstrating a commitment to responsible data management and ethical practices, are better positioned to build trust. This can translate into smoother regulatory pathways and stronger consumer confidence, essential for navigating the evolving landscape of healthcare diagnostics.

- Growing public awareness regarding data privacy in healthcare is influencing consumer willingness to adopt new diagnostic technologies.

- Ethical debates surrounding genetic testing, particularly concerning incidental findings and potential misuse of information, create a complex environment for market acceptance.

- Regulatory bodies are increasingly incorporating public sentiment and ethical considerations into their approval processes for novel diagnostic tools.

- Companies like Eurobio Scientific must prioritize clear communication and ethical data stewardship to foster public trust and ensure long-term market viability.

Healthcare Access and Decentralization of Testing

The growing trend of decentralizing healthcare, making testing more accessible outside of traditional labs, directly benefits Eurobio Scientific. This movement, evidenced by the rise of rapid tests and point-of-care diagnostics, prioritizes consumer convenience and faster results.

This shift presents a significant opportunity for Eurobio Scientific to broaden its product portfolio. The company can target a wider range of end-users, including those in home care settings and smaller physician offices, by offering solutions tailored to these decentralized models.

For instance, the global point-of-care diagnostics market was valued at approximately $34.7 billion in 2023 and is projected to reach $64.7 billion by 2030, growing at a CAGR of 9.3%. This expansion highlights the increasing demand for accessible testing solutions that Eurobio Scientific is well-positioned to meet.

- Increased Demand for Rapid Diagnostics: The market for rapid diagnostic tests is experiencing robust growth, driven by their convenience and speed.

- Focus on Point-of-Care (POC) Solutions: Healthcare providers and consumers are increasingly opting for POC testing, reducing reliance on centralized laboratories.

- Home Healthcare Expansion: The aging population and a preference for home-based care are fueling the demand for self-testing and at-home diagnostic kits.

- Technological Advancements: Innovations in biosensors and microfluidics are enabling more sophisticated and user-friendly decentralized testing devices.

Sociological factors significantly shape the demand for Eurobio Scientific's diagnostic solutions. An aging European population, with the EU average age reaching 44.4 in 2023, drives demand for diagnostics due to increased chronic disease prevalence.

Heightened public awareness of health, particularly post-COVID-19, fuels the need for early detection, contributing to the global in-vitro diagnostics market's projected value exceeding $100 billion in 2024.

Consumer attitudes towards data privacy and genetic testing are critical; over 60% of consumers in a 2024 survey expressed reservations about sharing genetic data, necessitating robust ethical frameworks and transparency from companies like Eurobio Scientific.

The decentralization of healthcare, favoring point-of-care and home testing, is a key trend. The point-of-care diagnostics market, valued at approximately $34.7 billion in 2023, exemplifies this shift, offering growth opportunities for accessible diagnostic solutions.

Technological factors

The in-vitro diagnostics (IVD) sector is experiencing a technological surge, with Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), and Artificial Intelligence (AI) at the forefront. These innovations are fundamentally changing how diseases are identified and managed. For instance, AI is proving invaluable in oncology, boosting diagnostic precision, forecasting patient responses, and tailoring treatment strategies.

Eurobio Scientific's strategic moves, such as its acquisition of oncology genomic tests and its commitment to developing its own unique products, demonstrate a clear alignment with these transformative technological currents. This positions the company to capitalize on the growing demand for advanced diagnostic solutions.

Laboratories are rapidly embracing automation and digital systems, a trend that significantly boosts efficiency and accuracy in diagnostic testing. This shift means a greater need for sophisticated instruments and connected solutions, areas where Eurobio Scientific is well-positioned to supply or distribute. For instance, the global laboratory automation market was valued at approximately USD 5.8 billion in 2023 and is projected to reach USD 9.1 billion by 2028, growing at a CAGR of 9.5% during this period, indicating substantial growth opportunities.

The discovery of new biomarkers and the advancement of precision oncology are revolutionizing cancer treatment, enabling highly personalized plans tailored to a patient's unique genetic profile. This approach not only minimizes adverse effects but also significantly enhances treatment efficacy.

Eurobio Scientific is strategically positioned to capitalize on this trend, evidenced by its significant investments in oncology diagnostics. The company's acquisition of EndoPredict® and Prolaris® genomic tests directly addresses the escalating demand for sophisticated, targeted diagnostic solutions in the oncology market.

Point-of-Care (POC) Testing Innovations

Point-of-care (POC) testing is a rapidly expanding area within Europe's molecular diagnostics market. This growth is fueled by the increasing need for swift diagnostic answers and the development of more portable testing equipment. For Eurobio Scientific, this presents a significant opportunity to expand its reach by providing solutions that allow for faster clinical decisions and support healthcare delivery outside traditional laboratory settings.

The European POC diagnostics market is projected to see robust growth, with estimates suggesting it could reach approximately €10 billion by 2025, up from around €6 billion in 2020. This expansion is largely driven by advancements in technology and a growing preference for decentralized testing models, which are particularly beneficial in managing infectious diseases and chronic conditions.

- Market Growth: The European POC diagnostics market is expected to grow at a CAGR of over 10% between 2023 and 2028.

- Key Drivers: Demand for rapid results, increasing prevalence of chronic diseases, and government initiatives to improve healthcare accessibility are key factors.

- Technological Advancements: Innovations in microfluidics, biosensors, and digital integration are making POC devices more accurate, user-friendly, and cost-effective.

- Eurobio Scientific's Position: The company's existing portfolio in molecular diagnostics positions it well to capitalize on the increasing demand for POC solutions.

Data Analytics and Bioinformatics in Diagnostics

The sheer volume of diagnostic data generated today demands sophisticated data analytics and bioinformatics tools. These are crucial for extracting meaningful insights and driving informed decisions in healthcare. For instance, the global big data in healthcare market was valued at approximately USD 36.5 billion in 2023 and is projected to grow significantly, underscoring the importance of these capabilities.

Artificial intelligence is poised to revolutionize how we process this data. By 2025, AI is expected to be instrumental in analyzing extensive datasets to pinpoint novel drug targets and refine early disease detection techniques. This advancement could lead to more personalized and effective treatments.

Eurobio Scientific can harness these technological trends to its advantage. By integrating advanced data analytics and bioinformatics into its diagnostic platforms, the company can enhance its research and development efforts. This strategic move could lead to more accurate diagnostics and the discovery of new biomarkers.

- Growing Diagnostic Data: The increasing complexity and volume of patient data require advanced analytical tools for interpretation.

- AI in Drug Discovery: AI's role in identifying new drug targets and improving early detection methods is expanding rapidly.

- Eurobio Scientific's Opportunity: Leveraging data analytics and AI can enhance diagnostic accuracy and research efficiency for the company.

Technological advancements like PCR, NGS, and AI are reshaping diagnostics, with AI showing particular promise in oncology for improved accuracy and personalized treatment. Eurobio Scientific's strategic acquisitions in oncology genomics align with this trend, positioning them to meet the demand for advanced solutions.

The increasing adoption of laboratory automation and digital systems is boosting efficiency and accuracy in diagnostics. This trend fuels demand for sophisticated instruments and connected solutions, areas where Eurobio Scientific is well-placed to operate, as the global laboratory automation market is projected to grow substantially.

The rise of point-of-care (POC) testing in Europe, driven by the need for rapid results and portable equipment, presents a significant growth avenue. Eurobio Scientific's existing molecular diagnostics portfolio provides a strong foundation to capitalize on this expanding market, which is expected to reach approximately €10 billion by 2025.

The explosion of diagnostic data necessitates advanced analytics and bioinformatics tools, with AI expected to play a crucial role in early disease detection and drug target identification by 2025. Eurobio Scientific can leverage these capabilities to enhance its R&D and diagnostic accuracy.

| Technology Trend | Impact on Diagnostics | Eurobio Scientific's Alignment |

| AI in Diagnostics | Enhanced accuracy, personalized treatment, early disease detection | Acquisition of oncology genomic tests, R&D focus |

| Laboratory Automation | Increased efficiency, accuracy, demand for sophisticated instruments | Positioned to supply and distribute advanced solutions |

| Point-of-Care (POC) Testing | Rapid results, decentralized testing, market growth | Existing molecular diagnostics portfolio |

| Big Data & Bioinformatics | Meaningful insights from data, improved R&D | Opportunity to integrate advanced analytics |

Legal factors

Eurobio Scientific faces significant legal hurdles with the EU's In Vitro Diagnostic Regulation (IVDR) and Medical Device Regulation (MDR). Key deadlines in 2024 and 2025, particularly the May 26, 2025, QMS requirement for legacy IVDs, demand immediate attention and robust compliance strategies.

Failure to meet these evolving regulatory demands, including enhanced obligations for supply chain transparency and reporting, could lead to market access restrictions or penalties. The comprehensive nature of these regulations, with ongoing updates throughout 2024 and into 2025, necessitates continuous adaptation and investment in quality management systems.

Protecting intellectual property (IP) is paramount for Eurobio Scientific, especially concerning its proprietary diagnostic tests and cutting-edge technologies. This safeguards their innovations from being copied, ensuring a distinct market advantage. For instance, in 2024, the life sciences sector saw continued focus on IP enforcement, with companies investing heavily in patent portfolios to secure their research and development investments.

Robust patent protection is not merely a defensive measure; it is fundamental to Eurobio Scientific's ability to maintain its competitive edge in the dynamic diagnostics market. Without it, competitors could freely replicate their innovations, eroding market share and profitability. The global legal framework for IP in life sciences is also in constant flux, necessitating continuous monitoring and adaptation of strategies to ensure ongoing protection.

Eurobio Scientific operates under stringent data privacy and security regulations, notably the General Data Protection Regulation (GDPR) across Europe. This mandates rigorous handling of sensitive patient data, crucial for their diagnostic services. Failure to comply can result in significant penalties; for instance, GDPR fines can reach up to €20 million or 4% of global annual turnover, whichever is higher.

Ensuring robust data security measures is paramount for Eurobio Scientific to maintain patient trust and avoid legal repercussions. Adherence to legal frameworks governing the collection, storage, and processing of patient information is not just a compliance issue but a core element of their operational integrity. A data breach could severely damage their reputation and lead to substantial financial losses, impacting their market position.

Product Liability and Safety Standards

Eurobio Scientific bears legal responsibility for the safety and efficacy of its diagnostic tools. Adherence to rigorous safety regulations and product liability statutes is critical to prevent costly legal battles, product withdrawals, and damage to its brand image. For instance, in 2024, the European Union continued to emphasize conformity assessment procedures for in-vitro diagnostic devices (IVDs) under the IVDR, with potential penalties for non-compliance impacting market access and financial performance.

The company must navigate a complex web of product liability laws, ensuring its products meet all specified performance criteria and do not pose undue risks to patients or healthcare professionals. Failure to do so can result in significant financial penalties and legal repercussions.

- Product Safety Compliance: Eurobio Scientific must ensure all diagnostic products meet evolving safety standards, such as those outlined in the EU's In Vitro Diagnostic Regulation (IVDR).

- Liability Mitigation: Robust quality control and post-market surveillance are essential to minimize the risk of product liability claims, which can lead to substantial financial damages and reputational harm.

- Regulatory Scrutiny: Ongoing monitoring of regulatory changes and proactive adaptation are necessary to maintain compliance and avoid sanctions, particularly in the highly regulated diagnostics sector.

Anti-Trust and Competition Laws

Eurobio Scientific's expansion strategy, which includes acquisitions and strategic partnerships, necessitates strict adherence to anti-trust and competition regulations. These laws are in place to prevent market monopolization and ensure a level playing field for all businesses. For instance, the company's 2023 acquisition of Alpha Biotech and the EndoPredict®/Prolaris® oncology business from Myriad Genetics were subject to review by relevant competition authorities to ensure no undue market concentration occurred.

Navigating these legal frameworks is crucial for maintaining business integrity and avoiding penalties. Failure to comply can result in significant fines and operational disruptions. For example, the European Commission has the power to impose fines up to 10% of a company's total worldwide annual turnover for breaches of competition law.

Eurobio Scientific must continuously monitor its market position and the competitive landscape to proactively manage compliance. This involves assessing the potential impact of new deals on market share and consumer choice. The company’s ongoing commitment to fair competition is vital for its long-term growth and reputation.

Eurobio Scientific's legal landscape is heavily shaped by the EU's In Vitro Diagnostic Regulation (IVDR) and Medical Device Regulation (MDR), with critical compliance deadlines in 2024 and extending into 2025. These regulations impose stringent requirements on product safety, quality management systems, and post-market surveillance, impacting market access and potentially incurring significant penalties for non-compliance.

Protecting its intellectual property (IP) is vital, as demonstrated by the life sciences sector's continued focus on patent enforcement in 2024, where significant investments were made to secure R&D. Eurobio Scientific's ability to safeguard its proprietary diagnostic tests and technologies is fundamental to maintaining its competitive edge and preventing market erosion from imitation.

Data privacy, particularly under GDPR, necessitates rigorous handling of sensitive patient information, with fines potentially reaching 4% of global annual turnover. Eurobio Scientific must maintain robust data security to preserve patient trust and avoid severe financial and reputational damage from breaches.

The company's strategic growth, including acquisitions, is subject to anti-trust and competition laws, with the European Commission able to impose fines up to 10% of worldwide annual turnover for violations. Proactive management of market position and compliance with fair competition principles are crucial for sustained growth.

| Regulatory Area | Key Regulations/Laws | Compliance Impact | Potential Penalties (Examples) | Timeline Focus (2024-2025) |

|---|---|---|---|---|

| Product Safety & Efficacy | IVDR, MDR | Market access, quality management, post-market surveillance | Market withdrawal, significant fines | IVDR deadlines, QMS requirements |

| Intellectual Property | Patent Law, IP Enforcement | Competitive advantage, R&D protection | Loss of market exclusivity, litigation costs | Ongoing IP portfolio management |

| Data Privacy | GDPR | Patient data handling, security protocols | Fines up to 4% global turnover, reputational damage | Data breach prevention, compliance audits |

| Competition Law | Anti-trust regulations | Mergers, acquisitions, market practices | Fines up to 10% global turnover, operational disruption | Merger reviews, market share assessment |

Environmental factors

The production and use of in-vitro diagnostic (IVD) products by companies like Eurobio Scientific inherently create diverse waste streams, encompassing chemical reagents, disposable plastic components, and materials that could be biohazardous. Effective management of this waste is crucial for environmental stewardship and regulatory adherence.

Eurobio Scientific must implement rigorous waste management protocols, including robust recycling programs, to meet increasingly stringent environmental regulations. For instance, the European Union's Waste Framework Directive sets targets for recycling and waste reduction, impacting how such companies operate.

Eurobio Scientific faces growing scrutiny regarding the environmental footprint of its supply chain, encompassing everything from sourcing raw materials for diagnostic kits to the logistics of distributing finished products. This focus is driven by increasing regulatory pressure and stakeholder demand for greater sustainability across the entire value chain.

Companies like Eurobio Scientific are now expected to actively manage and mitigate greenhouse gas emissions and resource depletion throughout their operations. For instance, in 2024, the European Union's Corporate Sustainability Reporting Directive (CSRD) expanded reporting requirements, pushing companies to disclose Scope 3 emissions, which include supply chain impacts.

In 2023, the life sciences sector, including diagnostics, saw a rise in initiatives aimed at greener logistics and sustainable packaging solutions. Eurobio Scientific's commitment to reducing its environmental impact in these areas will be crucial for maintaining its social license to operate and attracting environmentally conscious investors.

Manufacturing diagnostic tests and operating laboratories are inherently energy-intensive. Eurobio Scientific's operations, particularly in its production facilities and research labs, likely consume significant amounts of electricity and other energy sources to power equipment, maintain controlled environments, and run complex analytical processes.

To enhance environmental sustainability, Eurobio Scientific can focus on adopting energy-efficient technologies and optimizing operational workflows. This could include upgrading to more efficient machinery, improving insulation in facilities, and implementing smart energy management systems. For instance, by reducing energy consumption by just 10% across its operational footprint, the company could see a notable decrease in its carbon emissions and operating costs.

Exploring and integrating renewable energy sources, such as solar power for its facilities or purchasing green energy credits, presents another avenue for improving environmental performance. Many companies in the life sciences sector are increasingly committing to renewable energy targets; for example, by 2024, several major pharmaceutical companies have pledged to source a significant portion of their energy from renewables, setting a precedent that Eurobio Scientific could follow to align with broader industry trends towards greener practices.

Sustainable Product Design and Materials

The medical technology sector is experiencing a significant shift towards environmentally conscious practices. Consumers and regulatory bodies are increasingly prioritizing products that utilize sustainable materials and are designed with their entire lifecycle in mind. This trend is directly impacting companies like Eurobio Scientific, pushing for innovation in how their products are made and packaged.

Eurobio Scientific has an opportunity to enhance its brand reputation and market appeal by actively incorporating sustainability into its product development. This could involve a strategic review of current packaging solutions, aiming for biodegradable or recyclable options. Furthermore, a focus on reducing or eliminating hazardous substances within their diagnostic kits and equipment aligns with global environmental health standards and consumer expectations.

The company can also gain a competitive edge by designing products with end-of-life considerations. This means exploring modular designs that allow for easier repair and component replacement, or developing products that are simpler to disassemble and recycle. For instance, in 2024, the global market for sustainable packaging in the healthcare industry was valued at approximately $25 billion, showing a clear and growing demand for such initiatives.

- Demand for Eco-Friendly Materials: The push for biodegradable plastics and recycled content in medical device packaging is accelerating.

- Hazardous Substance Reduction: Regulations like REACH continue to tighten restrictions on chemicals, prompting manufacturers to seek safer alternatives.

- Circular Economy Principles: Designing for recyclability and reduced material usage is becoming a key differentiator in the medtech market.

- Corporate Social Responsibility (CSR): Companies demonstrating strong environmental stewardship often see improved investor relations and consumer loyalty.

Regulatory Pressure for Environmental Compliance

The European Green Deal is significantly intensifying regulatory pressure on medical device and in-vitro diagnostic (IVD) manufacturers like Eurobio Scientific. New environmental requirements, such as those under the Ecodesign Regulation (EU) 2024/1781, are making compliance an economic imperative. This means companies must integrate robust sustainability management systems to meet these evolving standards, impacting product design and lifecycle management.

Meeting these stricter environmental mandates is no longer optional; it’s a fundamental business requirement. For Eurobio Scientific, this translates into a need for proactive investment in eco-friendly materials, energy-efficient manufacturing processes, and responsible waste management throughout their product lines. Failure to adapt could lead to market access restrictions and reputational damage.

- Increased Compliance Costs: Companies face higher operational expenses to meet new environmental standards.

- Product Innovation Driver: Regulations encourage the development of greener, more sustainable medical technologies.

- Market Access Dependence: Adherence to environmental regulations is crucial for continued access to the EU market.

- Sustainability Reporting: Growing demand for transparent reporting on environmental performance is expected.

Eurobio Scientific operates within an increasingly environmentally conscious landscape, where waste management and resource efficiency are paramount. The company's commitment to sustainability is tested by the energy demands of its manufacturing and laboratory operations, with a growing expectation to adopt renewable energy sources and energy-efficient technologies. For instance, by 2024, many life sciences firms were targeting significant renewable energy adoption, a trend Eurobio Scientific can leverage.

The drive towards greener logistics and sustainable packaging solutions, evident in 2023 initiatives within the life sciences sector, presents both challenges and opportunities. Eurobio Scientific's approach to these trends, including the adoption of biodegradable materials and a focus on product end-of-life considerations, will be crucial for its market positioning and investor appeal.

Stricter environmental regulations, such as those stemming from the European Green Deal and directives like the Ecodesign Regulation (EU) 2024/1781, are making sustainability a non-negotiable aspect of business. Compliance requires proactive investment in eco-friendly practices, impacting product design and lifecycle management to ensure continued market access.

The global market for sustainable packaging in healthcare, valued at approximately $25 billion in 2024, highlights a significant demand for environmentally responsible solutions. Eurobio Scientific can capitalize on this by innovating in packaging, reducing hazardous substances, and embracing circular economy principles to enhance its competitive edge.

PESTLE Analysis Data Sources

Our PESTLE analysis for Eurobio Scientific is meticulously crafted using data from official European Union regulatory bodies, leading financial news outlets, and established market research firms. We ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the life sciences sector.