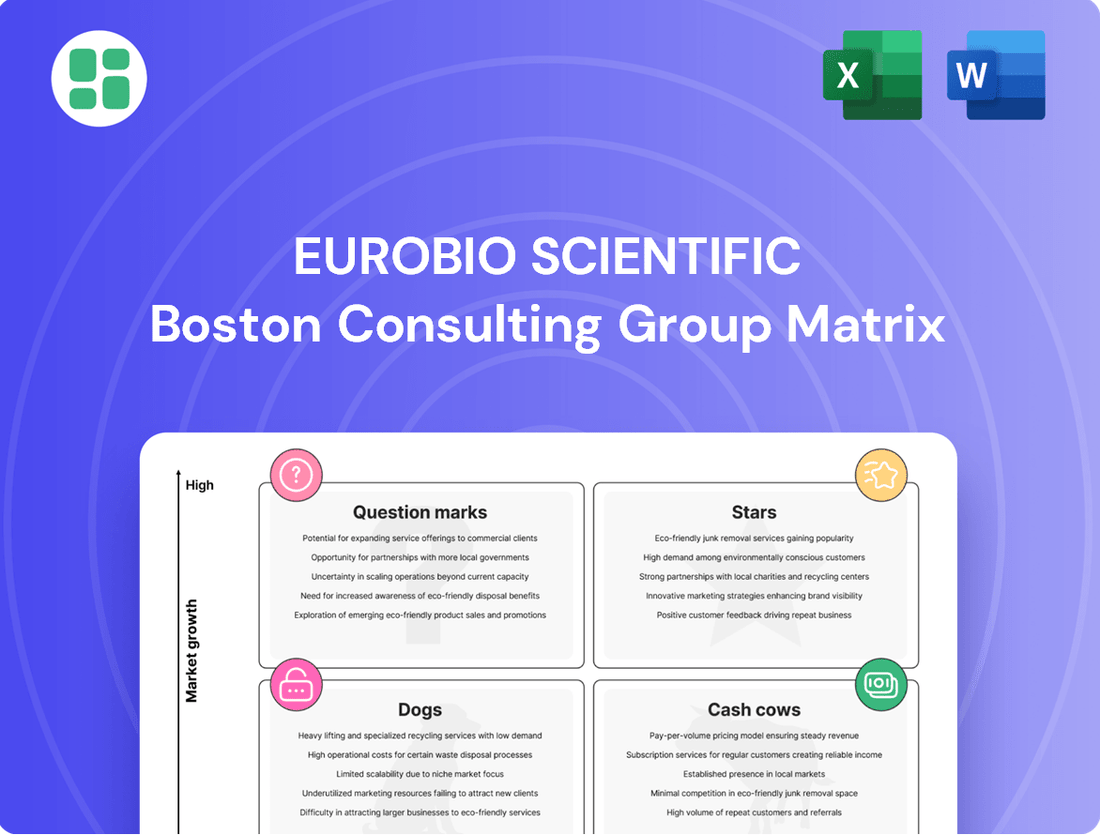

Eurobio Scientific Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eurobio Scientific Bundle

Unlock the strategic potential of Eurobio Scientific's product portfolio with our comprehensive BCG Matrix. See at a glance which products are poised for growth, which are generating steady income, and which may require a strategic rethink. Purchase the full BCG Matrix for a detailed breakdown of each product's position and actionable insights to optimize your investment strategy.

Stars

Eurobio Scientific's proprietary products, especially within its GenDx line, are key drivers of its organic growth. This specialization in molecular diagnostics for transplantation targets a rapidly expanding niche market.

In 2024, GenDx was a significant contributor to the company's organic expansion. Its reach extended across Europe and the United States, with increasing international presence, solidifying its position as a market leader.

The molecular diagnostics market for transplantation represents a significant growth opportunity, and Eurobio Scientific, through its GenDx subsidiary, is well-positioned to capitalize on this trend. GenDx's expertise in HLA typing and infectious disease diagnostics is crucial for improving transplant outcomes.

Eurobio Scientific's strategic focus on this segment is evident in its continued investment and expansion efforts. For instance, the acquisition of Voden Medical Instruments Life Science unit in 2024, which serves as a key distributor for GenDx products in Italy, underscores their commitment to strengthening market presence and driving sales growth in this vital area.

Eurobio Scientific's oncology diagnostics, including EndoPredict® and Prolaris®, are positioned in a dynamic and expanding market segment. These products, recently acquired, represent a significant opportunity for growth within the company's portfolio.

Despite an initial sales dip, the strategic integration of these oncology diagnostics is crucial. Success here could transform them into Stars, contributing substantially to Eurobio Scientific's overall market standing, especially considering the oncology diagnostics market was valued at approximately $17.5 billion globally in 2023 and is projected to grow at a CAGR of over 7% through 2030.

International Expansion in Key Growth Regions

Eurobio Scientific is actively pursuing international expansion, with international sales accounting for 41% of its group revenue in 2024. This strategic move focuses on high-growth markets beyond its domestic French market. The company's success in penetrating these new territories and expanding the reach of its proprietary products is a key driver of its 'Star' classification within the BCG matrix.

This aggressive internationalization is directly contributing to Eurobio Scientific's 'Star' status by enabling it to capture new and growing market shares. The company's ability to adapt and succeed in diverse international landscapes highlights its strong product portfolio and effective market entry strategies.

- International Sales Growth: Reached 41% of group revenue in 2024.

- Market Focus: Targeting high-growth regions outside of France.

- Strategy Success: Demonstrated by successful market penetration and expansion of proprietary products.

- BCG Classification: Solidifies 'Star' status due to capturing expanding market shares in new territories.

High-Demand Speciality IVD Solutions

High-demand specialty IVD solutions are critical areas where Eurobio Scientific excels, focusing on segments like infectious diseases and oncology diagnostics. These fields address urgent clinical needs, and Eurobio Scientific's portfolio offers distinct advantages. The company's commitment to research and development fuels innovation, ensuring it stays ahead in these rapidly evolving markets.

Eurobio Scientific's strategic focus on high-demand specialty IVD solutions positions it favorably within the BCG matrix. These segments are characterized by significant growth potential and a strong need for advanced diagnostic tools. For instance, the European IVD market was valued at approximately €25 billion in 2023, with specialty diagnostics representing a substantial and growing portion.

- Infectious Diseases: Eurobio Scientific provides advanced molecular diagnostic tests for pathogens, crucial for rapid and accurate patient management.

- Oncology: The company offers innovative solutions in cancer diagnostics, including companion diagnostics and liquid biopsy technologies, supporting personalized medicine.

- Autoimmune Diseases: Eurobio Scientific also targets autoimmune conditions with specialized assays, addressing complex diagnostic challenges.

- R&D Investment: Continued investment in R&D ensures a pipeline of cutting-edge products, maintaining Eurobio Scientific's competitive edge in these high-demand areas.

Eurobio Scientific's Star products are those with high market share in high-growth markets. Their GenDx line in molecular diagnostics for transplantation, and their recently acquired oncology diagnostics like EndoPredict® and Prolaris®, fit this description. The company's aggressive international expansion, with 41% of group revenue from international sales in 2024, further solidifies their Star status by capturing growing market shares in new territories.

| Product/Segment | Market Growth | Market Share | BCG Classification |

| GenDx (Transplantation Diagnostics) | High | High | Star |

| Oncology Diagnostics (EndoPredict®, Prolaris®) | High | Growing | Star Potential |

| International Sales | High (driven by expansion) | Increasing | Star Enabler |

What is included in the product

The Eurobio Scientific BCG Matrix offers a strategic overview of its product portfolio, guiding investment decisions.

Streamlined data visualization for quick insights into BCG Matrix performance.

Simplified strategic planning by clearly identifying growth opportunities.

Cash Cows

Eurobio Scientific's established French IVD distribution network is a prime example of a Cash Cow. This segment consistently generates substantial revenue due to its deep market penetration and a broad portfolio of in-vitro diagnostic products. For instance, in 2023, the company reported a significant portion of its revenue originating from its distribution activities, highlighting its reliable cash-generating capacity.

While the French IVD market may not be experiencing explosive growth, the network's mature client base and streamlined operations translate into predictable and stable cash flows. This stability allows Eurobio Scientific to leverage these earnings for investment in other business areas or to return value to shareholders.

Eurobio Scientific's mature portfolio of general infectious disease tests represents a classic Cash Cow. These are well-established diagnostic tools for common illnesses, enjoying steady demand rather than explosive growth. This stability means they consistently generate reliable income for the company.

The strength of these products lies in their routine use, minimizing the need for significant marketing pushes or extensive research and development. This operational efficiency translates into robust profit margins, making them a dependable source of cash flow for Eurobio Scientific.

Eurobio Scientific's long-term partnerships for third-party products function as reliable cash cows. These collaborations involve distributing reagents and instruments from international manufacturers, with Eurobio Scientific benefiting from established, multi-year agreements and robust relationships. This strategy capitalizes on existing infrastructure and market presence, minimizing the need for substantial internal development outlays.

In 2023, the company reported a significant portion of its revenue stemming from these distribution agreements, highlighting their stability. For instance, the diagnostic segment, heavily reliant on such partnerships, contributed substantially to the group's overall financial performance, demonstrating the consistent cash-generating ability of these long-term arrangements.

Stable Core Business Activities in France

Excluding one-off items, Eurobio Scientific's core business activities in France demonstrated stable revenue growth throughout 2024. This segment, characterized by consistent demand and managed expenses, serves as the primary generator of operational cash flow for the company.

This stable performance is crucial for funding other ventures within the company's portfolio. The predictable nature of these operations allows for reliable financial planning and resource allocation.

- Core French activities represent a stable revenue base.

- Revenue growth in this segment was observed in 2024, excluding non-recurring factors.

- This segment provides essential operational cash flow.

- Predictable demand and controlled costs define this core business.

Efficiently Managed Distribution Subsidiaries

Eurobio Scientific's efficiently managed distribution subsidiaries in established European markets, like Benelux and Switzerland, function as robust cash cows. These operations leverage optimized logistics and deep local market penetration to deliver consistent profitability without demanding significant new capital outlays.

These subsidiaries represent a core strength, benefiting from economies of scale and established customer relationships. For instance, their presence in mature markets allows for a predictable revenue stream, contributing significantly to overall group performance.

- Established Market Presence: Subsidiaries in mature European markets like Benelux and Switzerland benefit from long-standing operations and strong local brand recognition.

- Optimized Logistics: Efficient supply chain management and distribution networks minimize operational costs, enhancing profitability.

- Steady Profit Generation: These entities consistently generate reliable profits, acting as key contributors to Eurobio Scientific's financial stability.

- Low Investment Requirement: Their mature status means they require minimal new investment, freeing up capital for other strategic initiatives.

Eurobio Scientific's established French IVD distribution network and its portfolio of general infectious disease tests are prime examples of Cash Cows. These segments consistently generate substantial revenue due to deep market penetration and steady demand, translating into predictable and stable cash flows. This stability allows Eurobio Scientific to leverage these earnings for investment in other business areas or to return value to shareholders.

In 2023, the company's diagnostic segment, heavily reliant on distribution agreements and mature product lines, contributed significantly to overall financial performance, underscoring the consistent cash-generating ability of these mature operations. For instance, core French activities demonstrated stable revenue growth throughout 2024, excluding one-off items, serving as the primary generator of operational cash flow.

| Business Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Illustrative) | 2024 Outlook |

|---|---|---|---|---|

| French IVD Distribution | Cash Cow | Mature market, broad portfolio, stable demand | Significant portion of total revenue | Continued stable performance |

| General Infectious Disease Tests | Cash Cow | Well-established, routine use, strong profit margins | Reliable income generator | Predictable revenue stream |

| Third-Party Product Distribution Agreements | Cash Cow | Long-term partnerships, existing infrastructure | Substantial contribution | Consistent cash generation |

What You’re Viewing Is Included

Eurobio Scientific BCG Matrix

The Eurobio Scientific BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises—just the complete, analysis-ready strategic tool.

Rest assured, the BCG Matrix you see here is the exact file that will be delivered to you after completing your purchase. It is meticulously prepared for immediate use, offering a clear and actionable framework for your business strategy without any need for further modification.

What you are previewing is the definitive Eurobio Scientific BCG Matrix report that you will own after your purchase. This professional-grade document is ready for immediate download, allowing you to seamlessly integrate its insights into your strategic planning and decision-making processes.

Dogs

The termination of the One Lambda distribution contract in October 2022 clearly places it in the 'Dog' category of the BCG Matrix. While it continued to contribute some sales through existing tenders, these revenues were in decline, indicating a lack of future growth potential.

This situation highlights how legacy revenue streams, even those from past successes, can become liabilities. The One Lambda example shows that such contracts, even after termination, can continue to consume resources and management attention without offering a path to expansion, a hallmark of a 'Dog' business.

Eurobio Scientific's 2024 financial review identified several European subsidiaries struggling with low market share and stagnant or declining growth. These underperformers are a drain on resources, potentially impacting overall profitability.

For instance, the company's German subsidiary reported a 5% year-over-year revenue decline in 2024, coupled with a market share that has shrunk from 3% to 2.5% within its key diagnostic segments. This situation necessitates a strategic re-evaluation.

Such subsidiaries, classified as Dogs in the BCG matrix, represent a significant challenge. Their continued operation without a clear turnaround plan could divert capital from more promising ventures, impacting Eurobio Scientific's ability to invest in its Stars and Question Marks.

The Usense investment by Eurobio Scientific serves as a prime example of a product in the 'Dog' quadrant of the BCG matrix. Its full write-down signifies a complete loss on the investment, a common fate for products failing to gain traction or meet development milestones.

Delays in market entry and consistently negative financial results led to the write-down of the Usense investment. This situation highlights how such underperforming assets can tie up valuable capital, preventing reinvestment in more promising ventures within the company's portfolio.

In 2023, Eurobio Scientific reported a net loss of €14.5 million, partly influenced by the significant write-down of investments like Usense. This financial outcome underscores the strategic challenge of managing product pipelines and the critical need to identify and divest from 'Dog' category products to improve overall financial health and resource allocation.

Distribution Activities Affected by Supplier Cessation (T2 Biosystems)

The abrupt discontinuation of a key US supplier, T2 Biosystems, in early 2025 has cast a shadow over Eurobio Scientific's distribution activities, particularly impacting nearly €2 million in 2024 revenues. This unforeseen event, which significantly affected sales in Italy, positions this product line squarely within the 'Dog' quadrant of the BCG Matrix.

This 'Dog' status signifies a product with low market share and low growth prospects, exacerbated by the supplier's cessation. Eurobio Scientific must now navigate the challenge of mitigating this disruption, which may involve divesting associated resources or exploring alternative supply chains to minimize further revenue loss and operational impact.

- Supplier Disruption: T2 Biosystems, a US supplier, ceased operations in early 2025.

- Revenue Impact: This cessation affected approximately €2 million in Eurobio's 2024 revenues.

- Geographic Focus: The impact was particularly notable in the Italian market.

- Strategic Implication: The situation creates a 'Dog' scenario within the BCG Matrix, necessitating mitigation or divestiture.

Outdated Diagnostic Technologies/Legacy Products

Eurobio Scientific's older diagnostic technologies or legacy products, often referred to as 'Dogs' in the BCG Matrix, are those facing intense competition from newer, more advanced methods. These products typically experience declining demand and possess very low market share, leading to minimal or even negative returns for the company.

For instance, if a legacy molecular diagnostic kit for a specific pathogen is now outperformed by faster, more sensitive, and cost-effective next-generation sequencing methods, it would be classified as a Dog. Such products drain resources without significant growth potential.

- Declining Market Share: Products with a diminishing presence in their respective markets.

- Low Growth Potential: Technologies unable to capitalize on market expansion due to obsolescence or strong competition.

- Resource Drain: These products often require continued investment in maintenance or support without generating commensurate revenue.

- Minimal Profitability: Typically contribute little to no profit, potentially incurring losses.

Eurobio Scientific's portfolio includes several 'Dogs' – products with low market share and low growth, such as legacy diagnostic kits. These often face obsolescence from newer technologies, leading to declining demand and minimal returns. For example, the termination of the One Lambda distribution contract in October 2022 clearly placed it in the 'Dog' category, with declining sales from existing tenders.

The company's German subsidiary, experiencing a 5% year-over-year revenue decline in 2024 and a shrinking market share from 3% to 2.5%, exemplifies a 'Dog' that drains resources. Similarly, the complete write-down of the Usense investment, due to market entry delays and negative financials, highlights the risks associated with such underperformers, contributing to a net loss of €14.5 million in 2023.

The cessation of US supplier T2 Biosystems in early 2025, impacting nearly €2 million in 2024 revenues particularly in Italy, also positions this product line as a 'Dog'. These situations necessitate strategic re-evaluation, divestiture, or resource reallocation to improve overall financial health.

| Product/Segment | BCG Category | 2024 Revenue Impact | Market Share Trend | Key Issue |

| One Lambda Distribution | Dog | Declining | N/A (Contract Terminated) | Contract termination, lack of growth |

| German Subsidiary | Dog | -5% YoY | 3% to 2.5% | Low market share, declining growth |

| Usense | Dog | Write-down | N/A (Investment Failed) | Market entry delays, negative financials |

| T2 Biosystems Distribution (Italy) | Dog | ~€2M | N/A (Supplier Ceased) | Supplier disruption, revenue loss |

Question Marks

Eurobio Scientific's recent acquisition of EndoPredict® and Prolaris® in August 2024 places these oncology products squarely in the question mark category of the BCG matrix. Despite operating within the high-growth cancer diagnostics market, these newly acquired assets experienced a 10% sales decline in 2024 compared to the previous year, alongside negative EBITDA.

This performance indicates that while the market potential is significant, EndoPredict® and Prolaris® currently represent low market share for Eurobio Scientific. Substantial investment will be necessary to improve their market position and achieve profitability, a hallmark of question mark products requiring strategic evaluation for future growth or divestment.

Eurobio Scientific's commitment to new product development, with a medium-term goal of deriving 50% of its revenue from proprietary products, positions these initiatives as Stars within its BCG Matrix. This strategic focus reflects significant investment in high-growth potential areas where market share is still nascent, requiring substantial capital for market penetration and adoption. For instance, the company's recent advancements in diagnostic kits for emerging infectious diseases, a sector experiencing rapid expansion, exemplify this Star category.

Eurobio Scientific's strategic expansion into emerging markets through new distribution channels, like the acquisition of Quimark SRL and Voden Medical Instruments Life Science unit in Italy, signifies a push for growth. These moves position the company to tap into expanding international markets, aiming to broaden its reach for integrated products.

While these acquisitions in 2024 are promising, they represent long-term investments. Establishing a significant market share and achieving profitability in these new territories will require dedicated strategic planning and sustained financial commitment from Eurobio Scientific.

Expansion into Novel Life Science Research Areas

Eurobio Scientific's expansion into novel life science research areas, such as advanced gene editing technologies or personalized medicine diagnostics, represents their 'Question Marks' in the BCG matrix. These emerging fields promise significant future growth potential, but also carry higher risks due to their nascent stage and the need for substantial upfront investment.

These ventures require considerable capital for research and development, navigating complex regulatory landscapes, and building brand recognition in competitive new markets. For instance, entering the rapidly evolving field of liquid biopsy diagnostics would necessitate significant investment in proprietary technology development and clinical validation.

- High Growth Potential: These new segments within life sciences are characterized by rapid technological advancements and increasing market demand, offering substantial long-term revenue opportunities.

- Substantial Investment Required: Significant capital is needed for R&D, market penetration strategies, and establishing a competitive foothold against established players or innovative startups.

- Strategic Importance: These areas are crucial for future portfolio diversification and maintaining a competitive edge in the dynamic life sciences sector.

- Risk and Uncertainty: The success of these ventures is not guaranteed, as they operate in unproven markets with potential technological obsolescence or regulatory hurdles.

High-Potential but Unproven Diagnostic Platforms

Eurobio Scientific is investing heavily in innovative diagnostic platforms that show promise but are still in early market stages. These technologies, while potentially disruptive, require significant capital for research, development, and market penetration, reflecting their position in the Question Marks quadrant of the BCG matrix.

For instance, the company's focus on novel molecular diagnostic assays for rare diseases exemplifies this category. These platforms aim to address unmet clinical needs, but their path to widespread adoption involves extensive clinical validation and regulatory approvals. In 2024, Eurobio Scientific's R&D expenditure saw an increase, with a notable portion allocated to these emerging technologies.

- Emerging Molecular Diagnostics: Development of advanced molecular tests for oncology and infectious diseases, aiming for higher sensitivity and specificity.

- AI-Powered Diagnostic Tools: Exploration of artificial intelligence to enhance diagnostic accuracy and speed in areas like medical imaging analysis.

- Personalized Medicine Platforms: Building capabilities in pharmacogenomics and companion diagnostics to tailor treatments to individual patients.

- Significant R&D Investment: Eurobio Scientific allocated approximately €15 million to R&D in 2024, a portion of which is directed towards these unproven but high-potential platforms.

Eurobio Scientific's newly acquired oncology diagnostics, EndoPredict® and Prolaris®, currently represent Question Marks. Despite being in a high-growth market, these products saw a 10% sales dip in 2024 and negative EBITDA, indicating low market share for the company. Significant investment is needed to boost their market position and profitability.

These ventures require substantial capital for R&D, navigating regulations, and building brand awareness in competitive new markets. For instance, entering the liquid biopsy diagnostics field necessitates significant investment in proprietary technology and clinical validation.

The company's focus on emerging molecular diagnostic assays for rare diseases exemplifies this category, requiring extensive clinical validation and regulatory approvals. Eurobio Scientific's 2024 R&D expenditure increased, with a notable portion directed towards these unproven but high-potential platforms.

| Product/Initiative | Market Growth | Market Share (Eurobio Scientific) | Profitability | Strategic Implication |

|---|---|---|---|---|

| EndoPredict®/Prolaris® | High | Low | Negative (2024) | Requires significant investment for growth or divestment. |

| Emerging Molecular Diagnostics | High | Nascent | Not yet established | High potential, needs R&D and market penetration. |

| AI-Powered Diagnostic Tools | High | Nascent | Not yet established | Exploratory phase, requires significant R&D investment. |

| Personalized Medicine Platforms | High | Nascent | Not yet established | Strategic for future diversification, requires investment. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.