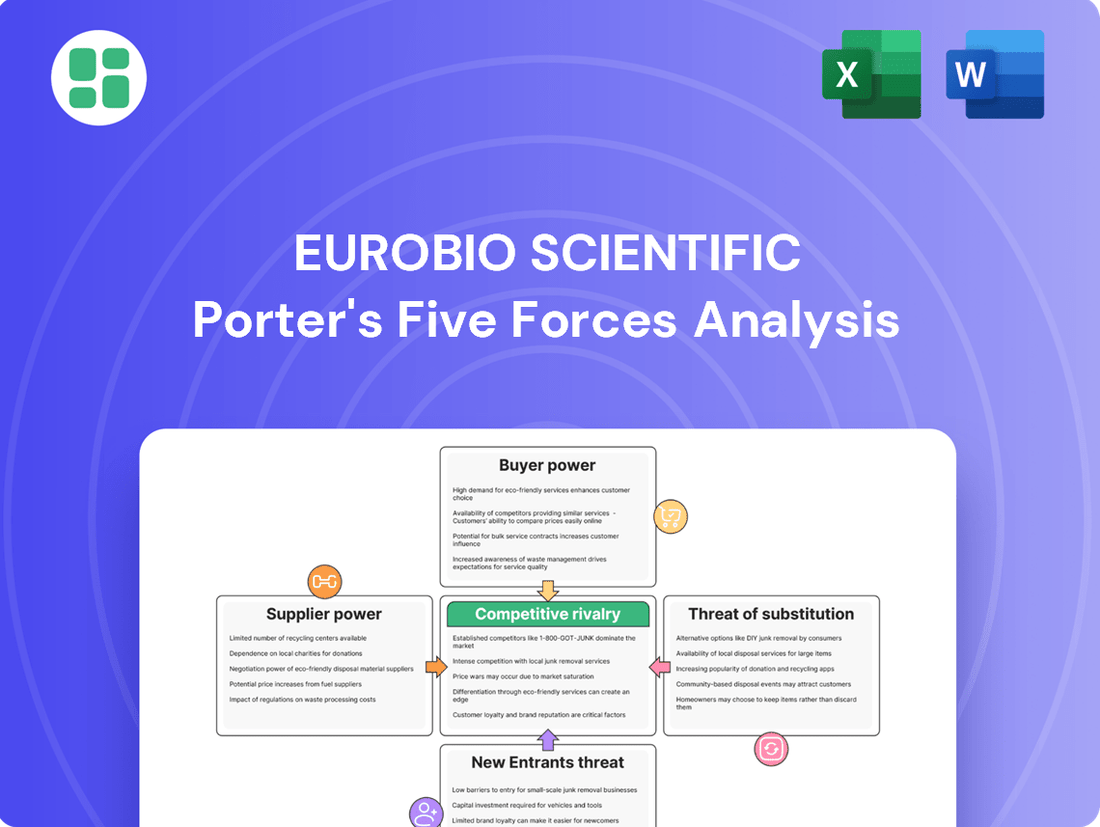

Eurobio Scientific Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eurobio Scientific Bundle

Eurobio Scientific faces moderate threats from new entrants and substitutes, while buyer and supplier power appears manageable. Understanding the intensity of these forces is crucial for navigating its competitive landscape.

The complete report reveals the real forces shaping Eurobio Scientific’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Eurobio Scientific's reliance on specialized reagents and unique components for its in vitro diagnostics (IVD) and life science products significantly influences supplier bargaining power. For niche areas such as transplantation and oncology, where inputs are highly specific, suppliers can command higher prices and dictate terms. This dependency means Eurobio Scientific may face challenges in price negotiations and supplier diversification.

In the In Vitro Diagnostics (IVD) and life science sectors, a limited number of suppliers often provide high-quality, certified materials and sophisticated instruments. This concentration means Eurobio Scientific has fewer choices for crucial components or patented technologies, directly increasing supplier leverage.

This limited supplier base grants them significant bargaining power, allowing them to influence pricing, delivery schedules, and product specifications. For instance, in 2024, the global IVD market, valued at approximately $90 billion, saw continued consolidation among key raw material providers, further concentrating power.

This situation can directly impact Eurobio Scientific's cost of goods sold and reduce its operational agility. When suppliers control essential inputs, they can command higher prices or impose less favorable terms, squeezing profit margins for companies like Eurobio Scientific.

Suppliers who possess proprietary technologies and intellectual property for crucial diagnostic tools or reagents can leverage this advantage to demand higher prices, especially when direct alternatives are scarce. Eurobio Scientific, relying on distribution agreements with global partners, is notably exposed to this supplier leverage. The necessity of securing licensing or integrating specific product functionalities can solidify these supplier relationships, consequently diminishing Eurobio Scientific's bargaining strength.

Switching Costs for Eurobio Scientific

Switching suppliers for critical components or distributed instruments presents substantial switching costs for Eurobio Scientific. These expenses encompass the rigorous validation of new materials, potential re-tooling of manufacturing processes, comprehensive staff retraining, and the complex task of re-establishing robust supply chain logistics. For instance, in the diagnostics sector, the integration of a new reagent supplier often requires extensive performance testing and regulatory re-approval, which can take months and incur significant direct costs.

These considerable switching costs directly diminish Eurobio Scientific's operational flexibility. The company finds itself incentivized to maintain existing supplier relationships, even when facing less favorable terms or price increases. This dynamic inherently strengthens the bargaining power of Eurobio Scientific's suppliers, as the cost and effort of changing providers act as a significant barrier.

- High Validation Costs: The need to validate new diagnostic reagents or equipment components can involve extensive laboratory testing and regulatory compliance, potentially costing tens of thousands of euros per supplier change.

- Process Re-engineering: Adapting manufacturing or quality control processes to new materials or components can require significant capital investment in new machinery or software, impacting operational efficiency during the transition.

- Supply Chain Disruption Risk: Establishing new logistics and distribution channels with unfamiliar suppliers introduces risks of delays and quality inconsistencies, which can directly affect Eurobio Scientific's ability to meet market demand.

- Impact on Product Performance: In the life sciences, even minor variations in raw materials can affect the performance and reliability of diagnostic kits, making suppliers with proven track records highly valuable and difficult to replace.

Supplier Forward Integration Potential

While less common, large, diversified suppliers could theoretically integrate forward into IVD manufacturing or distribution. This would mean they could directly compete with Eurobio Scientific, leveraging their existing resources and market presence. This potential threat grants suppliers additional leverage during price and contract negotiations.

Eurobio Scientific's strategic focus on developing its own proprietary products helps to mitigate this risk. By reducing its sole reliance on distributing third-party products, the company strengthens its competitive position and lessens its vulnerability to supplier forward integration.

- Supplier Forward Integration: Large, diversified suppliers might integrate into IVD manufacturing or distribution, directly competing with Eurobio Scientific.

- Leverage in Negotiations: This potential threat enhances suppliers' bargaining power, influencing terms and pricing.

- Mitigation Strategy: Eurobio Scientific's development of proprietary products reduces dependence on third-party distribution, thereby lowering this risk.

The bargaining power of suppliers for Eurobio Scientific is significantly influenced by the specialized nature of its inputs and the limited availability of qualified providers. In 2024, the global IVD market's continued consolidation among raw material suppliers, valued at around $90 billion, has concentrated power, allowing these suppliers to dictate terms and pricing more effectively.

High switching costs, including validation, process re-engineering, and supply chain risks, further entrench suppliers' leverage, making it costly for Eurobio Scientific to change providers. This dependency can directly impact Eurobio Scientific's cost of goods sold and operational agility.

Suppliers with proprietary technologies or intellectual property for critical diagnostic components hold considerable sway, as alternatives are often scarce. This is compounded by the potential threat of supplier forward integration into manufacturing or distribution, which Eurobio Scientific mitigates by developing its own proprietary products.

| Factor | Impact on Eurobio Scientific | Example Data (2024) |

|---|---|---|

| Supplier Concentration | Limited choices increase supplier leverage. | Global IVD market consolidation among key raw material providers. |

| Switching Costs | High costs discourage supplier changes. | Validation, re-tooling, retraining, and regulatory re-approval for new reagents can cost tens of thousands of euros. |

| Proprietary Technology | Scarcity of alternatives grants suppliers pricing power. | Essential patented technologies for diagnostic tools or reagents. |

| Potential Forward Integration | Threat of direct competition enhances supplier leverage. | Diversified suppliers potentially entering IVD manufacturing or distribution. |

What is included in the product

Eurobio Scientific's Porter's Five Forces analysis reveals the intensity of competition, buyer and supplier power, threat of new entrants and substitutes within the diagnostic sector.

Effortlessly identify and mitigate competitive threats with a streamlined, visual representation of each force, allowing for rapid strategic adjustments.

Customers Bargaining Power

Eurobio Scientific caters to a wide array of clients, from individual research labs to large hospital networks and national health organizations. While a single small lab holds minimal sway, consolidated purchasing power from major institutions significantly amplifies customer leverage.

These large-scale buyers can effectively negotiate for better pricing, more flexible contract terms, and robust post-sale service, directly impacting Eurobio Scientific's profit margins and operational efficiency. For instance, in 2024, major European hospital groups often secured discounts of 5-10% on diagnostic kits through bulk purchasing agreements.

Healthcare budgets across Europe faced significant constraints in 2024, leading to heightened price sensitivity among buyers of diagnostic solutions. This environment directly impacts Eurobio Scientific, compelling them to maintain competitive pricing for their in-vitro diagnostic (IVD) tests and related equipment to secure market share.

The competitive landscape for standard IVD products is robust, with numerous suppliers vying for contracts. This abundance of choice grants customers considerable leverage, enabling them to readily compare offerings and prioritize the most economical options, thereby intensifying price-based competition for Eurobio Scientific.

Customers in the diagnostics market, including hospitals and laboratories, have a significant number of alternative diagnostic solutions available to them. They can source tests and equipment from a wide array of global players and niche specialists, directly impacting Eurobio Scientific's pricing power.

The sheer volume of choices, from established multinational corporations to agile, specialized companies, empowers customers. This competitive landscape means Eurobio Scientific faces pressure to offer compelling value, as customers can readily switch providers if they find better pricing, quality, or service elsewhere.

In 2024, the in-vitro diagnostics market continued to see robust competition, with companies like Roche Diagnostics and Abbott Laboratories holding substantial market share, offering a broad spectrum of products that directly compete with Eurobio Scientific's portfolio. This intense rivalry amplifies customer leverage.

Customer Knowledge and Regulatory Requirements

Customers in the In Vitro Diagnostics (IVD) market, like clinical laboratories, are incredibly well-informed. They thoroughly understand product specifications, performance metrics, and crucial regulatory requirements, such as the EU's In Vitro Diagnostic Regulation (IVDR). This deep knowledge empowers them to critically assess available options and insist on products that adhere to the highest quality and regulatory standards.

Eurobio Scientific's ability to navigate and comply with these evolving regulations is a significant factor influencing customer purchasing decisions. For instance, the IVDR, which came into full effect in May 2022, has significantly raised the bar for product safety and performance, making compliance a key differentiator. Companies that demonstrate robust adherence to such frameworks gain a competitive edge.

- Informed Customer Base: Clinical laboratories possess detailed knowledge of IVD product performance and regulatory compliance.

- Demand for Stringent Standards: Customers actively seek products meeting rigorous quality and regulatory specifications, including those mandated by the EU IVDR.

- Regulatory Compliance as a Differentiator: Eurobio Scientific's adherence to evolving regulations directly impacts customer selection and market position.

- Impact of IVDR: The full implementation of the EU IVDR in May 2022 has intensified the need for robust product safety and performance, influencing customer expectations and supplier choices.

Impact of Reimbursement Policies

Reimbursement policies from national health systems and private insurers play a crucial role in shaping customer choices for in-vitro diagnostic (IVD) products. Eurobio Scientific's sales are directly impacted by whether its products are covered by these policies.

Products that lack adequate reimbursement may experience a decline in demand, even if they offer significant clinical benefits. This pressure forces Eurobio Scientific to align its product development and pricing strategies with existing reimbursement landscapes.

- Reimbursement Influence: National health systems and private insurers significantly steer customer purchasing decisions for IVD products.

- Demand Impact: Products without sufficient reimbursement may face reduced demand, irrespective of their clinical efficacy.

- Strategic Alignment: Eurobio Scientific must ensure its offerings meet prevailing reimbursement frameworks to maintain customer preference and market share.

Eurobio Scientific faces considerable customer bargaining power due to the fragmented nature of its client base, where smaller entities have limited influence, but large hospital networks and national health organizations wield significant leverage through consolidated purchasing. This power is amplified by the availability of numerous alternative diagnostic solutions from a competitive global market, forcing Eurobio Scientific to maintain competitive pricing and demonstrate clear value.

In 2024, European healthcare budgets were notably constrained, increasing customer price sensitivity and driving demand for cost-effective IVD solutions. Customers, particularly well-informed clinical laboratories, are increasingly focused on regulatory compliance, such as the EU IVDR, making adherence a key purchasing criterion. Furthermore, reimbursement policies from national health systems and insurers significantly shape demand, compelling Eurobio Scientific to align its product offerings and pricing with these frameworks.

| Factor | Impact on Eurobio Scientific | 2024 Context/Data |

|---|---|---|

| Consolidated Purchasing Power | Enables large clients to negotiate better pricing and terms. | Major European hospital groups secured 5-10% discounts on diagnostic kits via bulk agreements in 2024. |

| Availability of Alternatives | Intensifies price competition and reduces Eurobio Scientific's pricing power. | Robust competition from players like Roche Diagnostics and Abbott Laboratories in the IVD market. |

| Price Sensitivity | Requires competitive pricing strategies due to budget constraints. | Heightened price sensitivity among buyers due to constrained European healthcare budgets in 2024. |

| Informed Customer Base & Regulatory Demands | Customers demand high quality and strict compliance (e.g., IVDR). | EU IVDR, fully effective May 2022, mandates stringent product safety and performance standards. |

| Reimbursement Policies | Influences product demand and necessitates strategic alignment. | Products lacking adequate reimbursement face reduced demand, impacting sales strategies. |

Same Document Delivered

Eurobio Scientific Porter's Five Forces Analysis

This preview showcases the complete Eurobio Scientific Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within its industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. This professionally formatted analysis is ready for your immediate use, providing valuable strategic insights without any further preparation.

Rivalry Among Competitors

The In Vitro Diagnostics (IVD) and life science sectors in France and across Europe are fiercely competitive. Eurobio Scientific faces rivals ranging from global giants like Roche, Siemens Healthineers, and Abbott, which boast extensive R&D budgets and established distribution networks, to a multitude of agile, specialized local companies. This diverse competitive field means Eurobio Scientific must constantly innovate and adapt to varying market strengths.

The in-vitro diagnostics (IVD) sector, including companies like Eurobio Scientific, is characterized by significant capital outlays. These investments span cutting-edge research and development, advanced manufacturing infrastructure, and rigorous adherence to global regulatory standards. For instance, in 2024, the global IVD market was projected to reach over $100 billion, underscoring the scale of investment required.

These substantial fixed costs create a strong imperative for IVD firms to generate high sales volumes to achieve profitability and recoup their investments. This economic reality intensifies competitive rivalry as companies must aggressively pursue market share to cover their operational expenses and R&D commitments.

The relentless pace of innovation in diagnostics necessitates continuous investment in R&D. Companies that fail to innovate risk obsolescence, further fueling the competitive drive. In 2024, R&D spending as a percentage of revenue for leading IVD players often hovered in the double digits, reflecting this crucial aspect of market competition.

The in-vitro diagnostics (IVD) market is certainly expanding, with the French IVD market alone anticipated to see a 7.5% compound annual growth rate until 2030. This overall growth, however, masks significant variations between different market segments.

Areas such as molecular diagnostics and oncology are outperforming, experiencing even more rapid expansion. Eurobio Scientific's strategic positioning within specialty IVD and life sciences allows it to capitalize on these high-growth niches.

This focus on lucrative segments naturally intensifies competitive rivalry. As other companies recognize these growth opportunities, they too are drawn to these specialized areas, leading to a more crowded and competitive landscape for Eurobio Scientific.

Product Differentiation and Innovation Pace

Eurobio Scientific's competitive rivalry is significantly shaped by product differentiation and the speed of innovation. The company focuses on developing its own proprietary products, aiming for unique diagnostic applications and superior technology to stand out. This strategy is vital in a market where distinct offerings command greater value.

The diagnostic sector, however, is characterized by a relentless pace of technological advancement. Emerging fields like AI-driven diagnostics and liquid biopsies constantly redefine industry standards. Consequently, Eurobio Scientific, like its competitors, must maintain a high level of continuous innovation to avoid falling behind and to preserve its competitive advantage. For instance, in 2023, the global in-vitro diagnostics market was valued at approximately $110 billion, with a significant portion driven by technological upgrades and new product introductions.

- Proprietary Products: Eurobio Scientific's emphasis on developing its own diagnostic solutions is a key differentiator.

- Technological Advancements: The rapid evolution of technologies such as AI and liquid biopsies necessitates constant R&D investment.

- Innovation Pace: Competitors are also investing heavily in innovation, creating an environment where staying ahead technologically is paramount.

- Market Value: The diagnostic market’s growth, exceeding $110 billion in 2023, underscores the importance of innovative and differentiated products.

Acquisition and Consolidation Trends

The in-vitro diagnostics (IVD) market is seeing significant consolidation, with major companies actively acquiring smaller firms that possess specialized technologies. This strategic move allows larger players to broaden their product lines and strengthen their market position. For instance, Eurobio Scientific has been a participant in this trend, having completed several acquisitions such as DID, Alpha Biotech, and EndoPredict/Prolaris to expand its geographical reach and diversify its product portfolio.

This ongoing consolidation underscores a competitive landscape where companies must pursue growth, whether through internal development or mergers and acquisitions, to maintain their standing. The ability to integrate new technologies and expand market access through strategic acquisitions is becoming increasingly crucial for sustained competitiveness in the IVD sector.

- Market Consolidation: The IVD market is characterized by ongoing mergers and acquisitions, with larger entities absorbing niche technology developers.

- Portfolio Enhancement: Acquisitions are a key strategy for companies to expand their product offerings and technological capabilities.

- Eurobio Scientific's Strategy: Eurobio Scientific has actively pursued acquisitions, including DID, Alpha Biotech, and EndoPredict/Prolaris, to bolster its market presence and product range.

- Competitive Imperative: Companies must engage in strategic growth, either organically or via M&A, to remain competitive in this consolidating market.

Eurobio Scientific operates within a highly competitive landscape, facing global giants and specialized local players. The significant capital required for R&D and manufacturing in the IVD sector, projected to exceed $100 billion globally in 2024, intensifies rivalry as firms strive for market share to cover costs. Continuous innovation is paramount, with leading IVD companies investing heavily in R&D, often in the double digits of revenue, to avoid obsolescence.

The strategic focus on high-growth segments like molecular diagnostics and oncology, which are expanding at an even faster rate than the overall French IVD market's projected 7.5% CAGR until 2030, further heightens competition. Eurobio Scientific's emphasis on proprietary products and rapid technological advancement, including AI and liquid biopsies, is crucial for differentiation in a market valued at approximately $110 billion in 2023.

Market consolidation through mergers and acquisitions is a defining trend, as seen with Eurobio Scientific's acquisitions of DID, Alpha Biotech, and EndoPredict/Prolaris. This strategy aims to expand product portfolios and market reach, creating a competitive imperative for all players to grow either organically or through M&A to maintain their standing.

| Key Competitor Characteristics | Impact on Eurobio Scientific | 2023/2024 Data Point |

| Global Giants (e.g., Roche, Siemens Healthineers) | Extensive R&D budgets and distribution networks challenge market entry and growth. | Global IVD market projected >$100 billion in 2024. |

| Specialized Local Companies | Agile competitors can quickly adapt to niche market demands. | French IVD market projected 7.5% CAGR until 2030. |

| High Capital Requirements | Need for substantial investment in R&D, manufacturing, and regulatory compliance. | Leading IVD players' R&D spending often in double digits of revenue. |

| Pace of Innovation | Constant need to develop new technologies (AI, liquid biopsies) to remain competitive. | Global IVD market valued at ~$110 billion in 2023, driven by tech upgrades. |

| Market Consolidation | Acquisitions by larger players to gain market share and technology. | Eurobio Scientific acquisitions: DID, Alpha Biotech, EndoPredict/Prolaris. |

SSubstitutes Threaten

While In Vitro Diagnostics (IVD) remains crucial, emerging non-IVD diagnostic methods present a growing threat. Advanced imaging, like AI-enhanced MRI or CT scans, and wearable health trackers are increasingly capable of providing diagnostic insights, sometimes even predicting conditions before traditional IVD tests can. For instance, the global AI in healthcare market, which includes diagnostic applications, was projected to reach over $100 billion by 2028, indicating significant investment and rapid development in these alternative areas.

These non-IVD approaches offer distinct advantages, such as being non-invasive or enabling continuous health monitoring, which could lessen the demand for conventional laboratory-based IVD tests. The market for wearable devices alone saw substantial growth, with global revenues expected to exceed $100 billion in 2024, showcasing consumer adoption of these alternative health monitoring tools.

The increasing sophistication and accessibility of liquid biopsies and other non-invasive diagnostic methods present a significant threat of substitution for Eurobio Scientific. These technologies, capable of detecting diseases through simple blood or urine samples, offer a less burdensome alternative to traditional, more invasive procedures.

For instance, advancements in liquid biopsy technology are revolutionizing early cancer detection, potentially reducing reliance on tissue biopsies. Similarly, non-invasive prenatal testing is rapidly gaining traction, offering a safer alternative to amniocentesis for genetic screening. As these methods become more accurate and cost-effective, they directly challenge Eurobio Scientific's existing diagnostic portfolio, particularly in areas where less invasive options are viable.

The growing emphasis on preventive healthcare and lifestyle changes presents a potential substitute threat to diagnostic services. As individuals and healthcare systems prioritize proactive health management and chronic disease prevention, the demand for certain diagnostic tests might decrease over time. For instance, successful lifestyle interventions could reduce the incidence of conditions requiring extensive monitoring, thereby impacting the volume of diagnostic procedures.

While diagnostics are indispensable for initial disease detection and ongoing management, a successful shift towards prevention could indirectly curb the overall need for some diagnostic testing. This trend, however, also underscores the continued importance of early detection and personalized medicine, which often rely heavily on advanced diagnostic capabilities.

Development of Direct-to-Consumer (DTC) Testing

The burgeoning field of direct-to-consumer (DTC) genetic testing and at-home health monitoring presents a growing threat of substitution for traditional in-vitro diagnostics (IVD). These services, like those offered by 23andMe and AncestryDNA, provide individuals with health-related information and insights, bypassing conventional clinical pathways. While not always a direct replacement for complex diagnostic tests, they can influence consumer behavior and demand for certain types of health assessments.

For instance, by 2023, over 20 million people had used DTC genetic testing services, according to various market reports. This trend empowers individuals to proactively manage their health, potentially reducing the need for some laboratory-ordered tests. The accessibility and growing affordability of these DTC solutions mean that consumers might opt for these alternatives, particularly for predisposition screening or wellness-focused insights, thereby creating a substitution effect for specific segments of the IVD market.

- Direct-to-consumer genetic testing services are increasingly offering health insights, acting as a substitute for some traditional clinical diagnostics.

- By 2023, over 20 million individuals had utilized DTC genetic testing, demonstrating significant market penetration.

- These accessible and affordable DTC solutions empower individuals to manage their health proactively, potentially impacting demand for certain IVD categories.

Technological Advancements in Therapeutics

Technological advancements in therapeutics present a significant threat of substitutes for diagnostic companies like Eurobio Scientific. Breakthroughs in personalized medicine and targeted therapies, often requiring specific companion diagnostics, are reshaping the healthcare landscape. For instance, the rise of gene therapies, which saw significant investment and progress in 2023 and early 2024, could reduce the long-term need for certain broad-spectrum diagnostic tests if they effectively prevent or cure diseases.

If these new therapies prove highly effective in curtailing disease incidence or slowing progression, the demand for some existing diagnostic tests could indeed decline. Consider the potential impact on tests for chronic conditions where novel treatments might offer a cure rather than just management. However, these same advancements also spur the creation of new markets for highly specialized diagnostic tools, such as liquid biopsies or advanced genetic sequencing tests, which Eurobio Scientific could potentially capitalize on.

The market for companion diagnostics, in particular, is expected to grow substantially. Reports from 2024 indicate the companion diagnostics market reaching tens of billions of dollars globally, driven by the increasing development of targeted cancer therapies. This growth highlights the dual nature of the threat: while some diagnostic demands may wane, new, technologically advanced diagnostic needs emerge.

- Personalized Medicine Impact: New targeted therapies can reduce the need for broad diagnostic screening.

- Therapy Efficacy: Successful disease prevention or cure by new treatments lowers demand for related diagnostics.

- Companion Diagnostics Growth: Advancements create new markets for specialized diagnostic tests, with the global companion diagnostics market projected to exceed $30 billion by 2025.

- Shifting Diagnostic Landscape: The threat lies in the potential obsolescence of older tests and the need to adapt to new, high-tech diagnostic requirements.

The threat of substitutes for Eurobio Scientific stems from non-IVD diagnostic methods and direct-to-consumer (DTC) health monitoring. Advanced imaging and wearable devices are increasingly offering diagnostic insights, with the wearable device market alone expected to exceed $100 billion in 2024. Furthermore, DTC genetic testing, utilized by over 20 million people by 2023, empowers individuals to manage their health proactively, potentially reducing reliance on traditional clinical diagnostics for certain health assessments.

| Substitute Type | Key Characteristics | Market Indicator (2024/2023 Data) | Impact on Eurobio Scientific |

| Non-IVD Diagnostics (e.g., Imaging, Wearables) | Non-invasive, continuous monitoring, AI-enhanced insights | Wearable device market > $100 billion (2024 est.) | Potential reduction in demand for certain IVD tests |

| Direct-to-Consumer (DTC) Genetic Testing | Accessible, affordable, proactive health management | > 20 million users by 2023 | Substitution for specific wellness and predisposition screening tests |

Entrants Threaten

The in-vitro diagnostics (IVD) and life sciences sectors demand significant upfront capital for research and development, state-of-the-art manufacturing facilities, and specialized equipment. For instance, establishing a new IVD manufacturing plant can easily run into tens of millions of euros, with ongoing investment in cutting-edge technology. Developing novel diagnostic assays, particularly proprietary ones, necessitates substantial research expenditure and rigorous clinical validation, often costing millions of euros and taking years to complete. These considerable financial hurdles create a substantial barrier to entry, effectively limiting the number of new players that can realistically challenge established companies like Eurobio Scientific.

The European In Vitro Diagnostic Regulation (IVDR), especially with recent amendments like EU 2024/1860, creates substantial barriers for new companies entering the market. These regulations demand rigorous product development, manufacturing processes, and extensive documentation for market approval.

Obtaining certification from Notified Bodies for a significant portion of in vitro diagnostic devices (IVDs) is a complex and costly undertaking. This process, which can take years and substantial investment, effectively deters many potential new entrants who lack the resources or expertise to navigate these stringent requirements.

Success in the in-vitro diagnostics (IVD) and broader life sciences sector hinges on a deep well of specialized expertise. This isn't just about having smart people; it's about having individuals with very specific knowledge in areas like molecular biology, immunology, bioinformatics, and the intricacies of clinical diagnostics. For instance, developing a novel diagnostic assay requires not only scientific acumen but also a keen understanding of regulatory pathways, which can take years to navigate.

Attracting and keeping these highly skilled professionals is a significant hurdle for any new player. The market for top talent in these niche fields is intensely competitive. Companies like Eurobio Scientific, with established reputations and ongoing research projects, are often better positioned to offer attractive career paths and compensation, making it difficult for emerging companies to assemble a comparable team. This scarcity of specialized human capital acts as a natural barrier to entry.

Building a competitive team capable of innovation and execution in this environment is a formidable challenge. New entrants must invest heavily in recruitment and training, often competing with larger, more established organizations for the same limited pool of talent. The need to secure this specialized workforce can significantly slow down market entry and dilute the resources available for product development and commercialization.

Established Distribution Channels and Customer Relationships

Established players like Eurobio Scientific benefit from deeply entrenched distribution channels and robust relationships with key stakeholders in the healthcare sector. These networks, built over years, provide access to hospitals, research institutions, and influential medical professionals, making it challenging for newcomers to penetrate the market effectively. For instance, in 2024, the European in-vitro diagnostics market, a key area for Eurobio Scientific, continued to see consolidation, with larger players leveraging their established distribution agreements to maintain market share.

The significant investment in time and capital required to replicate these extensive networks and cultivate trust within the complex healthcare ecosystem presents a formidable barrier. New entrants face the daunting task of not only developing innovative products but also securing the necessary distribution partnerships and regulatory approvals, a process that can take years and considerable financial resources. This inherent advantage held by incumbents like Eurobio Scientific significantly deters potential new competitors.

- Established Distribution Networks: Eurobio Scientific leverages existing agreements with distributors and healthcare providers, streamlining product delivery and market access.

- Strong Customer Relationships: Long-standing ties with hospitals, labs, and key opinion leaders foster loyalty and preferential treatment for incumbent products.

- High Entry Costs: The significant financial and temporal investment needed to build comparable distribution and relationship networks acts as a major deterrent for new entrants.

- Market Trust and Credibility: Years of reliable service and product performance have built trust, which new companies must earn from scratch.

Intellectual Property and Patent Protection

The In Vitro Diagnostics (IVD) market, where Eurobio Scientific operates, is significantly shielded by a robust framework of intellectual property and patent protection. These patents cover essential aspects like diagnostic methodologies, specialized reagents, and sophisticated analytical instruments. For any new company looking to enter this space, a major hurdle is the necessity to innovate with technologies that sidestep existing patent claims or to negotiate costly licensing agreements.

Eurobio Scientific's strategic emphasis on developing and commercializing its own proprietary products is a key factor in this competitive landscape. This focus not only bolsters the company's own intellectual property portfolio but also acts as a substantial deterrent against potential new entrants seeking to establish a foothold in the market without infringing on established rights.

- Patent Landscape: The IVD sector is characterized by extensive patent filings, protecting novel diagnostic tests and associated technologies.

- Barriers to Entry: New players must navigate complex patent landscapes, requiring significant R&D investment to develop non-infringing solutions or secure expensive licenses.

- Proprietary Advantage: Eurobio Scientific's investment in its own IP strengthens its market position and creates a competitive moat against emerging rivals.

The threat of new entrants for Eurobio Scientific is considerably low due to high capital requirements for R&D, manufacturing, and regulatory compliance in the IVD sector. For instance, developing a new diagnostic assay can cost millions and take years. The stringent European IVDR regulations, updated in 2024, further complicate market entry, demanding extensive validation and documentation.

The need for specialized expertise in areas like molecular biology and bioinformatics, coupled with intense competition for top talent, presents another significant barrier. New companies struggle to attract and retain the skilled workforce necessary to innovate and compete effectively against established players like Eurobio Scientific.

Established distribution networks and strong relationships with healthcare providers are difficult and costly for newcomers to replicate. These entrenched channels, vital for market access, were highlighted in 2024 as larger IVD companies continued to leverage their existing agreements to maintain market share, making it challenging for emerging competitors.

Intellectual property and patent protection in the IVD market are substantial deterrents. Companies like Eurobio Scientific, which invest in proprietary products, create a strong competitive moat, forcing new entrants to develop non-infringing technologies or secure expensive licenses.

| Factor | Impact on New Entrants | Eurobio Scientific's Position |

| Capital Requirements | Very High (R&D, Manufacturing, Regulation) | Established infrastructure and funding capacity |

| Regulatory Hurdles | Significant (IVDR, Certification) | Expertise in navigating complex compliance |

| Specialized Expertise | High Demand, Scarce Talent | Strong employer brand and research focus |

| Distribution & Relationships | Difficult to Replicate | Long-standing partnerships and market presence |

| Intellectual Property | Complex Patent Landscape | Portfolio of proprietary technologies |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Eurobio Scientific is built upon a foundation of robust data, drawing from company annual reports, investor presentations, and industry-specific market research reports. We also incorporate insights from financial news outlets and regulatory filings to ensure a comprehensive understanding of the competitive landscape.