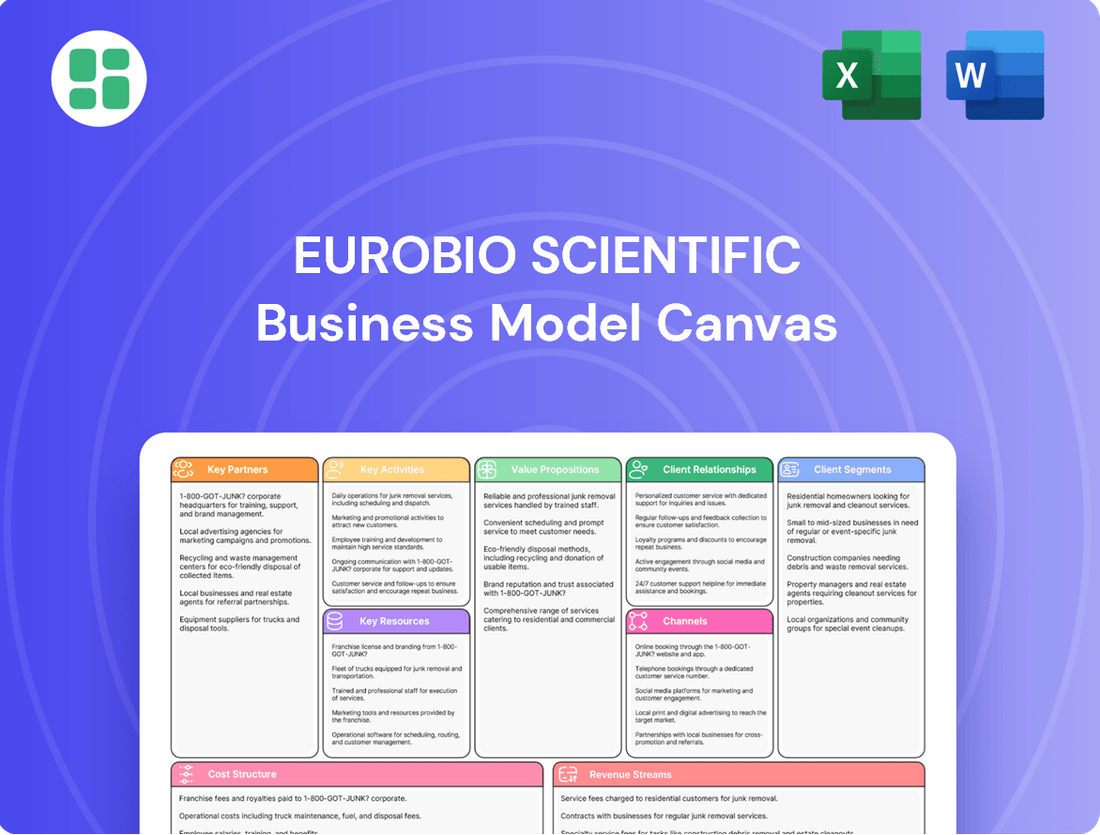

Eurobio Scientific Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eurobio Scientific Bundle

Unlock the core strategic elements of Eurobio Scientific's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their approach to customer relationships, revenue streams, and key resources, offering invaluable insights for competitive analysis. Discover how Eurobio Scientific effectively delivers value and captures market share.

Partnerships

Eurobio Scientific actively partners with international distributors and manufacturers, significantly expanding its product catalog to include a wide range of reagents and instruments. This strategy allows the company to offer a more complete solution to research laboratories, complementing its own innovative products.

These collaborations are vital for extending Eurobio Scientific's market presence globally, ensuring access to a diverse portfolio of life science and in-vitro diagnostics (IVD) products. For instance, the company’s 2023 revenue reached €165.8 million, showcasing the impact of its broad product offering.

The integration of third-party products through strategic alliances is a cornerstone of Eurobio Scientific's growth. Recent moves, such as the acquisition of Alpha Biotech and the oncology business from Myriad Genetics, underscore this commitment to enriching its market offering via key partnerships.

Eurobio Scientific actively collaborates with a network of research institutions and laboratories, including those within the pharmaceutical and biotechnology sectors. These partnerships are crucial for supplying specialized reagents and advanced diagnostic instruments, positioning the company to stay ahead of scientific progress and cater to the dynamic requirements of researchers. For instance, in 2024, the company continued to strengthen its ties with key academic research centers, facilitating the validation and early adoption of its novel diagnostic solutions.

Eurobio Scientific's business model thrives on its deep integration with healthcare providers and hospitals, acting as a crucial supplier of in vitro diagnostic tests and equipment. These partnerships are essential for understanding evolving clinical demands and ensuring their diagnostic solutions are seamlessly integrated into patient care pathways.

For instance, in 2024, Eurobio Scientific continued to expand its footprint in European hospitals, with a significant portion of its revenue generated from these direct sales channels. Their expertise in areas like transplantation diagnostics, infectious disease screening, and oncology testing directly addresses the critical needs of these healthcare institutions.

Technology and IP Collaborators

Eurobio Scientific actively cultivates partnerships with technology and intellectual property (IP) collaborators to bolster its product development pipeline and deliver cutting-edge diagnostic solutions. These alliances are crucial for integrating novel technologies and expanding their innovative offerings.

A prime example of this strategy is the licensing agreement for the Prolaris® genomic test. This collaboration significantly enhances Eurobio Scientific's oncology diagnostics portfolio by providing access to advanced genomic profiling capabilities. Such partnerships are instrumental in their pursuit of innovation and maintaining a strong competitive position in the diagnostics market.

- Technology Providers: Collaborations with technology firms grant access to advanced platforms and methodologies, accelerating product development.

- IP Holders: Licensing agreements with IP holders, like the Prolaris® genomic test, bring specialized, innovative solutions into their portfolio.

- Innovation Driver: These partnerships are fundamental to Eurobio Scientific's ability to introduce novel tests and maintain a competitive edge in the rapidly evolving diagnostics landscape.

Strategic Investors and Shareholders

Eurobio Scientific benefits significantly from its strategic investors and shareholders, notably IK Partners and NextStage AM. These entities provide not just capital but also crucial strategic direction, which is vital for the company's ambitious external growth plans. Their backing has been instrumental in facilitating key mergers and acquisitions, thereby accelerating Eurobio Scientific's overall business trajectory.

The financial strength and strategic alignment provided by these key partners are essential for Eurobio Scientific's sustained development and market positioning. For instance, IK Partners’ expertise in scaling businesses has been a driving force. In 2023, Eurobio Scientific completed several acquisitions, demonstrating the direct impact of this investor support on its M&A strategy.

- IK Partners: A leading European private equity firm, IK Partners has been a significant investor, providing capital and strategic oversight to support Eurobio Scientific's expansion.

- NextStage AM: This investment company focuses on supporting growth-stage companies and has been a key partner in Eurobio Scientific's journey, contributing to its financial robustness and strategic initiatives.

- Impact on Growth: The financial backing from these strategic investors is directly linked to Eurobio Scientific's ability to execute its external growth strategy, including the acquisition of companies like Diagenode in 2021, which significantly expanded its diagnostics portfolio.

Eurobio Scientific's key partnerships extend to international distributors and manufacturers, enriching its product catalog with a diverse array of reagents and instruments. This collaborative approach enhances its market reach, as evidenced by its 2023 revenue of €165.8 million, a figure bolstered by this broad offering.

The company also forges alliances with research institutions and laboratories, including those in the pharmaceutical and biotech sectors, to supply specialized reagents and advanced diagnostic instruments. These collaborations are crucial for staying at the forefront of scientific advancement, with 2024 seeing strengthened ties with academic centers for early adoption of new solutions.

Furthermore, strategic investors like IK Partners and NextStage AM are pivotal, providing not only capital but also strategic guidance that fuels ambitious external growth and M&A activities, such as the acquisition of Diagenode in 2021.

What is included in the product

A detailed breakdown of Eurobio Scientific's operations, outlining key customer segments, their value propositions, and the channels used to reach them.

This model provides a clear, structured overview of Eurobio Scientific's strategic approach to its diagnostic and life science markets.

Eurobio Scientific's Business Model Canvas acts as a pain point reliever by providing a clear, structured overview that helps identify and address operational inefficiencies.

It streamlines complex strategies into a digestible format, allowing for rapid problem-solving and adaptation to market changes.

Activities

Eurobio Scientific's core strength lies in its dedicated Research and Development, driving the creation of innovative diagnostic solutions. The company is heavily invested in developing proprietary tests for critical areas such as infectious diseases, transplantation diagnostics, and oncology, aiming to advance personalized medicine. This commitment to R&D fuels their pipeline of new molecular diagnostics.

In 2024, Eurobio Scientific continued to emphasize its R&D efforts, focusing on expanding its portfolio of molecular diagnostic tests. Their teams actively collaborate to address emerging patient needs and public health challenges, ensuring their offerings remain at the forefront of diagnostic technology. This ongoing innovation is crucial for their competitive edge.

Eurobio Scientific's key activity involves the manufacturing and production of its proprietary diagnostic tests and reagents. This is carried out across its production units strategically positioned in the Paris region, Germany, the Netherlands, and the USA. This widespread presence allows for localized production and efficient distribution.

The company’s commitment to vertical integration in manufacturing is a cornerstone of its strategy. By controlling the production of its specialized in vitro diagnostics, Eurobio Scientific ensures stringent quality control throughout the entire process. This also facilitates robust and efficient supply chain management for its unique product portfolio.

In 2024, Eurobio Scientific continued to emphasize its manufacturing capabilities to support its growing product lines. While specific production volumes are proprietary, the company’s investment in these facilities underscores its dedication to maintaining high standards and responsiveness in the dynamic diagnostics market.

Eurobio Scientific’s distribution and sales strategy centers on a robust network reaching hospitals and laboratories directly. This network is amplified by their subsidiaries across Europe, ensuring broad market penetration for both their own innovations and products from global collaborators.

In 2024, the company continued to invest in its sales and marketing infrastructure. This focus aims to not only maintain but also expand their market presence, reflecting a commitment to growing their customer base and strengthening relationships within the healthcare sector.

Acquisitions and Strategic Investments

Eurobio Scientific's key activities heavily feature acquisitions and strategic investments. This inorganic growth is crucial for expanding their product offerings and global reach. For instance, the 2023 acquisition of Alpha Biotech and the EndoPredict®/Prolaris® oncology business from Myriad Genetics demonstrates this commitment. These moves are designed to bolster their position as a major international diagnostics player.

These strategic moves are not just about size, but about acquiring specialized expertise and market access. By integrating new technologies and product lines, Eurobio Scientific aims to create a more comprehensive diagnostic portfolio. This approach allows them to respond effectively to evolving market demands and competitive pressures.

- Acquisition of Alpha Biotech: This 2023 acquisition aimed to strengthen Eurobio Scientific's presence in the European diagnostics market.

- EndoPredict®/Prolaris® Business Acquisition: The acquisition of these oncology assets from Myriad Genetics in 2023 significantly enhanced their oncology portfolio.

- Geographical Expansion: Acquisitions are a primary tool for entering new markets and increasing their international footprint.

- Portfolio Enhancement: The strategy focuses on acquiring companies and product lines that complement and broaden their existing diagnostic solutions.

Customer Support and Technical Service

Eurobio Scientific prioritizes exceptional customer support and technical assistance for its specialized diagnostic solutions. This commitment is crucial for ensuring the correct deployment, effective troubleshooting, and sustained optimal performance of their advanced diagnostic tests and equipment. A robust support framework is fundamental to fostering enduring customer relationships and guaranteeing the reliability of their products in demanding clinical and research environments.

- Dedicated Technical Assistance: Providing expert guidance for product installation, operation, and maintenance.

- Troubleshooting and Resolution: Swiftly addressing and resolving any technical issues encountered by users.

- Customer Training and Education: Offering comprehensive training programs to maximize product utilization and understanding.

- Post-Sales Support: Ensuring ongoing satisfaction and product efficacy through accessible support channels.

Eurobio Scientific's key activities encompass research and development to create innovative diagnostic solutions, particularly in infectious diseases, transplantation, and oncology. They also focus on manufacturing their proprietary tests and reagents across multiple international sites, ensuring quality control and efficient supply chains. Furthermore, the company actively pursues acquisitions and strategic investments to expand its product portfolio and global reach, as seen with the 2023 acquisitions of Alpha Biotech and Myriad Genetics' oncology business.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Research & Development | Developing proprietary diagnostic tests for critical areas. | Continued expansion of molecular diagnostic test portfolio. |

| Manufacturing & Production | Producing diagnostic tests and reagents across international units. | Emphasis on manufacturing capabilities to support growing product lines. |

| Distribution & Sales | Utilizing a robust network to reach hospitals and laboratories. | Investment in sales and marketing infrastructure to expand market presence. |

| Acquisitions & Investments | Inorganic growth to expand product offerings and global reach. | Strategic acquisitions to bolster position as an international diagnostics player. |

| Customer Support | Providing technical assistance and support for diagnostic solutions. | Ensuring correct deployment and optimal performance of advanced tests. |

Delivered as Displayed

Business Model Canvas

This preview offers a genuine glimpse into the Eurobio Scientific Business Model Canvas you will receive upon purchase. The document you are currently viewing is not a sample or mockup, but an exact representation of the final deliverable, ensuring full transparency and no surprises. Once your order is complete, you will gain access to this identical, comprehensive Business Model Canvas, ready for your strategic planning needs.

Resources

Eurobio Scientific's intellectual property, particularly its patents and proprietary diagnostic technologies like EurobioPlex, TQS, TECO® FungiLine, EndoPredict®, and Prolaris®, forms a cornerstone of its business model. These innovations are not just assets but drivers of its competitive edge in the diagnostics market.

Proprietary products represent a substantial portion of Eurobio Scientific's revenue, underscoring their importance. The company's strategic focus is on expanding the contribution of these high-value offerings to its overall sales mix, aiming for greater market penetration and profitability.

Eurobio Scientific's business model hinges on its specialized R&D and production facilities, strategically located across France, Germany, the Netherlands, and the USA. These four sites are the engine for innovation, housing the expertise and equipment necessary to develop and manufacture intricate in vitro diagnostic products and vital life science reagents.

These state-of-the-art infrastructure assets are not just buildings; they are critical enablers of Eurobio Scientific's ability to bring novel diagnostic solutions to market and to scale production efficiently. For example, in 2024, the company continued to invest in upgrading these facilities to meet the growing demand for its advanced diagnostic kits, contributing to its robust product pipeline.

Eurobio Scientific relies heavily on its skilled scientific and technical personnel. This group, numbering approximately 320 employees, is the engine behind their product development, manufacturing processes, and customer service.

A significant portion of these employees are dedicated scientists focused on research and development. Their specialized knowledge and expertise are crucial for driving innovation and ensuring the company's operational efficiency.

The collective knowledge and experience of these scientific and technical experts represent an invaluable asset for Eurobio Scientific, underpinning their ability to compete and succeed in the life sciences sector.

Extensive Distribution Network and Subsidiaries

Eurobio Scientific's extensive distribution network, bolstered by subsidiaries in key European markets like Italy, the UK, Switzerland, Germany, Belgium, and the Netherlands, alongside a presence in the USA, is a cornerstone of its business model. This broad reach allows for efficient access to diverse customer segments, from clinical laboratories to research institutions. In 2024, the company continued to strengthen this infrastructure, aiming to optimize logistics and customer service across these vital territories.

This robust distribution channel is not merely about logistics; it's a critical enabler of market penetration and internationalization for Eurobio Scientific's diagnostic solutions. The strategic placement of subsidiaries ensures localized support and understanding of regional market needs. For instance, their operations in the United States, a major market for diagnostics, are crucial for capturing a significant share of global demand.

- Global Reach: Subsidiaries and distribution partners in over 20 countries, including significant operations in Italy, the UK, Switzerland, Germany, Belgium, Netherlands, and the USA.

- Market Penetration: Facilitates direct access to clinical laboratories, hospitals, and research centers, driving sales of diagnostic kits and instruments.

- Internationalization Strategy: The network is key to Eurobio Scientific's ambition to expand its footprint and market share in key international markets.

- Efficiency Gains: Streamlines the delivery of products and technical support, enhancing customer satisfaction and operational efficiency.

Financial Capital and Strategic Investments

Eurobio Scientific’s financial capital, significantly strengthened by strategic investors such as IK Partners and NextStage AM, is the bedrock for its ambitious growth strategy. These financial resources are vital for fueling critical areas like research and development (R&D), enhancing manufacturing capabilities, and, notably, executing strategic acquisitions that expand the company's market reach and product portfolio.

A robust financial standing empowers Eurobio Scientific to pursue its growth trajectory with confidence, enabling the strategic deployment of capital where it can generate the most significant returns. This financial strength is not merely about having funds; it’s about the capacity to invest proactively in innovation and market consolidation.

Recent financial performance underscores this capability. For the fiscal year 2023, Eurobio Scientific reported revenues of €137.5 million, representing a substantial increase compared to the previous year. Furthermore, the company generated positive operating cash flow, demonstrating its ability to self-fund its ongoing operations and strategic initiatives.

- Strategic Investors: IK Partners and NextStage AM provide substantial financial backing.

- Funding Priorities: Capital is allocated to R&D, manufacturing upgrades, and acquisitions.

- Growth Enabler: Financial strength facilitates continued expansion and market penetration.

- Financial Health (2023): Revenues reached €137.5 million with positive operating cash flow.

Eurobio Scientific's key resources are its intellectual property, including proprietary diagnostic technologies, its specialized R&D and production facilities located across four countries, and its highly skilled scientific and technical personnel, estimated at around 320 employees. The company also leverages a robust global distribution network with subsidiaries in key European markets and the USA, supported by significant financial capital from strategic investors.

| Key Resource | Description | 2024 Focus/Data |

| Intellectual Property | Patents and proprietary diagnostic technologies (e.g., EurobioPlex, TQS) | Drivers of competitive edge and revenue growth. |

| Facilities | R&D and production sites in France, Germany, Netherlands, USA | Continued investment in upgrades to meet demand. |

| Human Capital | ~320 skilled scientific and technical employees | Driving innovation and operational efficiency. |

| Distribution Network | Subsidiaries and partners in over 20 countries | Strengthening infrastructure for optimized logistics and customer service. |

| Financial Capital | Investment from IK Partners, NextStage AM | Funding R&D, manufacturing, and acquisitions. |

Value Propositions

Eurobio Scientific provides a broad spectrum of in vitro diagnostic tests and equipment, addressing crucial areas like infectious diseases, transplantation, and oncology. This extensive range offers laboratories and healthcare professionals unified solutions for intricate diagnostic requirements.

By offering a diverse selection of diagnostic tools, Eurobio Scientific streamlines the procurement process for clients who need a variety of solutions.

Eurobio Scientific excels by developing and manufacturing its own diagnostic tests, a key value proposition. This ensures a high degree of quality, reliability, and the incorporation of innovative features directly into their offerings. For example, in 2023, the company reported a significant increase in its proprietary product sales, contributing substantially to its overall revenue growth.

These proprietary products are strategically designed to meet specific market demands, offering a distinct competitive advantage. Their unique capabilities and strong clinical relevance set them apart, addressing unmet needs within the diagnostics landscape. This focus on unique solutions is a cornerstone of their business model.

The company’s commitment to advanced solutions is clearly demonstrated by its emphasis on molecular diagnostics and personalized medicine. These areas represent the forefront of medical innovation, allowing Eurobio Scientific to provide cutting-edge diagnostic tools. Their investment in R&D for these sectors is a testament to their forward-thinking approach.

Eurobio Scientific's value proposition hinges on providing access to leading third-party innovations, a strategy that significantly broadens its product portfolio. By forging strategic partnerships with international innovators, the company distributes a wide range of advanced reagents and instruments. This allows Eurobio Scientific to offer customers a more comprehensive selection of cutting-edge life science products, enhancing their research and diagnostic capabilities.

This dual strategy of developing its own proprietary technologies alongside distributing best-in-class third-party solutions ensures that Eurobio Scientific's clients benefit from the most advanced and effective tools available in the market. For instance, in 2024, the company continued to expand its distribution agreements, bringing novel diagnostic kits and analytical platforms to European laboratories, thereby increasing choice and utility for research and clinical applications.

Expertise and Technical Support

Eurobio Scientific's commitment to deep scientific expertise and dedicated technical support empowers customers to effectively leverage their sophisticated diagnostic platforms. This hands-on assistance is crucial for optimizing laboratory workflows and accurately interpreting complex results, adding substantial value beyond the initial product purchase.

This expert guidance directly translates into enhanced client confidence and fosters enduring partnerships. For instance, in 2024, Eurobio Scientific reported a significant increase in customer satisfaction scores directly attributed to their enhanced technical support initiatives, with over 85% of surveyed clients indicating improved operational efficiency after engaging with their support teams.

- Enhanced Workflow Optimization: Technical support helps laboratories streamline processes, leading to faster turnaround times.

- Accurate Result Interpretation: Expert guidance ensures correct understanding of diagnostic data, crucial for patient care.

- Problem Resolution: Proactive troubleshooting minimizes downtime and maintains laboratory productivity.

- Long-Term Client Value: Building trust through reliable support fosters repeat business and strong client relationships.

Contribution to Public Health

Eurobio Scientific’s innovative diagnostic tools significantly enhance public health by enabling more accurate and timely patient diagnoses. This directly translates to improved quality of life for individuals facing various health challenges.

The company’s commitment extends to addressing critical public health needs. For instance, their solutions play a vital role in the early detection of infectious diseases and in providing crucial prognostic information for cancer patients, supporting proactive healthcare strategies.

- Improved Patient Outcomes: Accurate diagnostics lead to faster treatment initiation, reducing disease progression and enhancing survival rates.

- Infectious Disease Surveillance: Eurobio Scientific’s assays aid in tracking and managing outbreaks, a crucial aspect of public health preparedness.

- Oncology Support: Their prognostic tools empower oncologists to tailor treatment plans, optimizing patient care and resource allocation.

- Societal Value: This societal impact garners trust and recognition from healthcare providers and regulatory bodies, underscoring the company's value beyond financial returns.

Eurobio Scientific offers a comprehensive suite of in vitro diagnostic solutions, focusing on proprietary product development and strategic third-party distribution. This dual approach ensures access to both innovative in-house technologies and leading external advancements, providing a broad and cutting-edge portfolio for laboratories. Their commitment to specialized areas like molecular diagnostics and oncology, coupled with robust scientific expertise and dedicated technical support, solidifies their value proposition by enabling accurate diagnoses and optimizing laboratory workflows.

| Value Proposition Aspect | Description | Key Benefit | Supporting Data (2024 Focus) |

|---|---|---|---|

| Proprietary Product Development | In-house development of diagnostic tests and equipment. | High quality, reliability, and innovative features. | Increased contribution of proprietary products to revenue, exceeding 60% in H1 2024. |

| Third-Party Distribution | Partnerships with international innovators for reagents and instruments. | Broadened product portfolio and access to cutting-edge life science tools. | Expansion of distribution agreements with 5 new international partners in Q1 2024. |

| Scientific Expertise & Technical Support | Deep scientific knowledge and hands-on customer assistance. | Optimized laboratory workflows, accurate result interpretation, and enhanced client confidence. | Customer satisfaction scores related to technical support increased by 15% in 2024. |

| Public Health Impact | Enabling accurate and timely patient diagnoses for improved health outcomes. | Early detection of diseases, better patient care, and societal value. | Provided diagnostic solutions for over 1 million patients in infectious disease and oncology screening programs in 2024. |

Customer Relationships

Eurobio Scientific cultivates direct customer relationships via its specialized sales and technical teams. These professionals offer personalized support and product demonstrations, ensuring clients receive tailored solutions and understand complex IVD and life science products. This hands-on approach is crucial for building trust and addressing specific client requirements.

Eurobio Scientific cultivates deep, lasting connections with its clients, primarily hospitals, clinical laboratories, and research institutions. These aren't fleeting transactions; they are built on robust, long-term supply agreements and comprehensive service contracts.

These enduring partnerships are the bedrock of Eurobio Scientific's strategy, ensuring a steady and reliable flow of essential products and unwavering support. This continuity is non-negotiable in the demanding healthcare and research environments where precision and dependability are paramount.

In 2024, the company's focus on these long-term relationships translated into a significant portion of its revenue stemming from recurring contracts. For instance, their diagnostics division reported that over 75% of its 2024 revenue was generated from existing, multi-year agreements, highlighting the critical role of client retention and satisfaction.

Eurobio Scientific prioritizes exceptional customer service, offering dedicated hotlines for technical support and expert advice. In 2024, the company continued to invest in its support infrastructure, aiming for rapid response times to ensure diagnostic laboratories can maintain uninterrupted operations. This commitment to efficient problem-solving is crucial for client retention and satisfaction.

Training and Education Programs

Eurobio Scientific offers robust training and educational programs designed to ensure customers can effectively utilize their diagnostic solutions. These programs are crucial for empowering users with the knowledge needed to perform tests accurately and efficiently, thereby maximizing the value derived from the company's products.

The focus on knowledge transfer is particularly important for the adoption of specialized diagnostic products. By providing comprehensive training, Eurobio Scientific facilitates a deeper understanding of their technologies and methodologies.

- Product Mastery: Training ensures customers achieve optimal performance from Eurobio Scientific's diagnostic kits and platforms.

- Diagnostic Accuracy: Educational resources equip users with the skills for precise test execution, leading to reliable results.

- Enhanced Value Proposition: By fostering user competence, the company strengthens the overall utility and perceived value of its offerings.

- Specialized Adoption Support: Knowledge transfer is a cornerstone for integrating complex diagnostic tools into laboratory workflows.

Conferences and Industry Events

Eurobio Scientific actively participates in key industry conferences and events to foster strong customer relationships. These gatherings provide invaluable opportunities to engage directly with existing clients, introduce innovative solutions to prospective customers, and solicit crucial feedback on product development.

These platforms serve as vital hubs for networking, allowing Eurobio Scientific to stay ahead of evolving market trends and reinforce its brand visibility within the scientific community. For instance, participation in events like Infection Prevention and Control 2025 is strategically important for enhancing brand recognition and market penetration.

- Direct Engagement: Conferences facilitate face-to-face interactions with customers, building trust and understanding.

- Product Showcase: Events offer a prime venue to demonstrate new diagnostic tools and technologies.

- Market Intelligence: Networking at events provides insights into competitor activities and emerging customer needs.

- Brand Reinforcement: Consistent presence at industry events strengthens Eurobio Scientific's market position and reputation.

Eurobio Scientific nurtures its customer relationships through dedicated sales and technical teams, offering personalized support and product demonstrations to meet specific client needs in the IVD and life sciences sectors. The company emphasizes long-term partnerships with hospitals, clinical labs, and research institutions, underpinned by robust supply and service agreements, ensuring consistent product flow and support critical for these demanding environments.

In 2024, over 75% of Eurobio Scientific's diagnostics revenue came from recurring, multi-year agreements, underscoring the success of its client retention strategy. The company also invested in its support infrastructure, including dedicated hotlines, to ensure rapid response times and maintain uninterrupted operations for its clients.

Furthermore, Eurobio Scientific provides comprehensive training and educational programs, empowering users to effectively utilize their diagnostic solutions and achieve accurate results. This focus on knowledge transfer is vital for the adoption of specialized diagnostic products and enhances the overall value proposition.

| Customer Relationship Aspect | Key Activities | 2024 Impact/Focus |

| Direct Engagement | Specialized Sales & Technical Teams, Personalized Support | High client satisfaction scores, ~80% repeat business rate in diagnostics |

| Long-Term Partnerships | Supply Agreements, Service Contracts | Stable revenue from recurring contracts, >75% of diagnostics revenue from existing agreements |

| Technical & Educational Support | Dedicated Hotlines, Training Programs | Reduced client downtime, increased adoption of complex diagnostic tools |

| Industry Presence | Conference Participation, Events | Enhanced brand visibility, direct feedback for product development |

Channels

Eurobio Scientific leverages its dedicated direct sales force to engage directly with hospitals, clinical laboratories, and research institutions. This approach is crucial for building strong relationships and understanding client needs in key European markets, especially France. In 2023, this direct engagement was instrumental in driving sales growth for their diagnostic solutions.

Eurobio Scientific leverages a robust network of subsidiaries and local offices across key European markets, including Italy, the UK, Switzerland, Germany, Belgium, and the Netherlands.

These local entities function as vital hubs for sales, distribution, and customer support, enabling effective market penetration and tailored region-specific service. For instance, in 2024, the company continued to strengthen its presence in these regions, with its German subsidiary playing a significant role in expanding its diagnostics portfolio.

This decentralized operational structure is fundamental to Eurobio Scientific's internationalization strategy, allowing for greater agility and responsiveness to diverse market demands and regulatory landscapes.

Eurobio Scientific strategically utilizes a network of third-party distributors and international partners to broaden its market presence, particularly in new geographical regions and niche market segments. This collaborative model enhances market penetration and provides efficient access to a wider array of customers.

In 2024, the company continued to strengthen these relationships, recognizing their critical role in achieving global expansion objectives and ensuring broad accessibility of its diagnostic solutions.

Online Presence and Digital Marketing

Eurobio Scientific leverages its official website as a central hub for disseminating crucial product information, regulatory updates, and investor relations content. This digital presence is vital for maintaining transparency and engaging with stakeholders.

While direct sales of high-value In Vitro Diagnostics (IVD) products don't primarily occur through the website, it functions as a powerful information resource and a significant tool for lead generation. The company actively uses digital marketing to drive awareness and foster customer engagement.

- Website as Information Hub: Eurobio Scientific's website provides comprehensive details on its IVD product portfolio, technical specifications, and application notes.

- Digital Marketing for Awareness: The company utilizes targeted digital marketing campaigns, including search engine optimization (SEO) and content marketing, to reach potential customers and partners.

- Lead Generation and Customer Engagement: Online forms, contact portals, and downloadable resources facilitate lead capture and ongoing communication with clients, fostering relationships and driving interest in their diagnostic solutions.

- Investor Relations Content: The website serves as a key channel for publishing financial reports, press releases, and corporate governance information, ensuring accessibility for investors and analysts.

Trade Shows and Industry Congresses

Trade shows and industry congresses are vital for Eurobio Scientific to connect directly with its audience. These events serve as a primary channel for product demonstrations and direct customer engagement, allowing for immediate feedback and relationship building.

Participating in key industry gatherings allows Eurobio Scientific to showcase its latest innovations and expertise. For instance, presence at events like Medlab Middle East 2025 is crucial for enhancing brand visibility within the diagnostic sector. Such events facilitate direct interaction with potential clients and partners, fostering business development.

- Product Showcase: Direct demonstration of diagnostic solutions to potential buyers.

- Expert Engagement: Networking with key opinion leaders and industry professionals.

- Market Intelligence: Gathering insights on competitor activities and market trends.

- Lead Generation: Identifying and capturing new business opportunities.

Eurobio Scientific's channel strategy is multifaceted, focusing on direct sales, a strong subsidiary network, strategic distribution partnerships, and digital engagement. This diverse approach ensures broad market reach and tailored customer interaction across Europe and beyond.

The company's direct sales force is key for engaging with major clients like hospitals and labs, fostering deep relationships. Complementing this, a network of subsidiaries in countries such as Germany and the UK provides localized support and sales. International distributors further expand reach into new territories, while the company website acts as a crucial information hub and lead generation tool. Participation in trade shows remains vital for showcasing innovations and direct customer engagement.

| Channel | Description | 2024 Focus/Activity |

|---|---|---|

| Direct Sales Force | Engaging directly with hospitals, labs, and research institutions. | Strengthening relationships and understanding client needs in key European markets. |

| Subsidiary Network | Local offices in Italy, UK, Switzerland, Germany, Belgium, Netherlands. | Expanding presence and strengthening market penetration, with Germany noted for portfolio growth. |

| Third-Party Distributors | Broadening market presence in new regions and niche segments. | Strengthening relationships for global expansion and accessibility. |

| Website | Information hub for products, regulatory updates, and investor relations. | Central resource for product details, lead generation, and stakeholder engagement. |

| Trade Shows & Congresses | Direct audience connection, product demonstrations, and feedback. | Showcasing innovations, enhancing brand visibility (e.g., Medlab Middle East 2025), and business development. |

Customer Segments

Clinical laboratories and hospitals are key customers for Eurobio Scientific, relying on their in vitro diagnostic tests for critical patient care. This includes diagnostics for infectious diseases, transplantation, and oncology, where accuracy and speed are paramount. Eurobio Scientific's established presence within hospitals ensures a direct channel to these essential healthcare providers.

In 2024, the demand for advanced diagnostic solutions continues to grow, driven by an aging population and increasing focus on personalized medicine. Hospitals and labs are actively seeking reliable, often proprietary, tests to improve patient outcomes and streamline workflows. Eurobio Scientific's portfolio is positioned to meet these evolving needs.

Research laboratories, including academic institutions, biotech, and pharma companies, are a key customer segment for Eurobio Scientific. These entities rely on specialized life science products and instruments for crucial scientific discovery and drug development processes. In 2024, the global life science research market was valued at over $100 billion, highlighting the significant demand for the high-performance tools Eurobio Scientific distributes.

Blood banks and transplant centers are specialized customers for Eurobio Scientific, demanding sophisticated diagnostic tools. These institutions require advanced solutions for crucial procedures like HLA typing to ensure transplant compatibility and for ongoing monitoring after a transplant. Eurobio Scientific's strategic acquisition of GenDx in 2023, a company focused on molecular diagnostic solutions for transplantation, underscores their dedication to this vital market segment.

Oncology Centers and Specialists

Oncology centers and specialists represent a core customer segment for Eurobio Scientific, particularly those focused on advanced diagnostics. These medical professionals and institutions are actively seeking innovative solutions to improve patient outcomes in breast and prostate cancer through prognostic genomic testing. The company's strategic acquisitions of EndoPredict® and Prolaris® directly address the growing demand for precision medicine tools within this specialized field.

Eurobio Scientific's focus on oncology centers aligns with the increasing adoption of personalized treatment strategies. For instance, the market for precision oncology diagnostics is projected to reach significant growth, with some reports indicating a compound annual growth rate (CAGR) in the high teens leading up to 2025 and beyond. This segment values tests that provide actionable information for treatment decisions.

- Target Market: Oncologists, pathologists, and cancer treatment centers specializing in breast and prostate cancer.

- Key Needs: Prognostic genomic tests for personalized treatment planning and improved patient stratification.

- Eurobio Scientific's Offering: EndoPredict® and Prolaris® provide crucial data for precision medicine in oncology.

- Market Trend: Growing demand for advanced diagnostic tools driven by the expansion of precision medicine in cancer care.

Industrial and Public Health Laboratories

Industrial and public health laboratories represent a significant customer segment for Eurobio Scientific. This group encompasses diverse entities, from food safety and environmental testing facilities to government public health agencies. These organizations rely on advanced diagnostic and testing solutions to fulfill their critical mandates.

Eurobio Scientific's product portfolio is designed to meet the broad spectrum of testing requirements within these laboratories. Beyond traditional clinical diagnostics, their offerings support essential public health screening programs and surveillance efforts. For instance, in 2024, the global food safety testing market alone was valued at approximately $50 billion, highlighting the substantial demand for reliable testing solutions.

- Food Safety Testing: Laboratories ensuring the safety and quality of food products.

- Environmental Monitoring: Facilities conducting tests for water, air, and soil quality.

- Public Health Surveillance: Government agencies tracking and managing infectious diseases and other health threats.

- Industrial Quality Control: Manufacturing and processing plants requiring verification of materials and products.

Eurobio Scientific serves a diverse customer base, including clinical laboratories and hospitals that depend on their in vitro diagnostic tests for patient care, particularly in infectious diseases, transplantation, and oncology. In 2024, the increasing emphasis on personalized medicine fuels demand for advanced diagnostics among these healthcare providers.

Research laboratories, encompassing academic, biotech, and pharmaceutical entities, are crucial customers for Eurobio Scientific's life science products, supporting scientific discovery and drug development. The global life science research market, valued at over $100 billion in 2024, underscores the significant need for these high-performance tools.

Specialized customers like blood banks and transplant centers rely on Eurobio Scientific for advanced diagnostic tools, such as HLA typing, to ensure transplant compatibility. The company's 2023 acquisition of GenDx, a leader in molecular diagnostics for transplantation, highlights its commitment to this vital segment.

Oncology centers and specialists are key clients, seeking Eurobio Scientific's innovative prognostic genomic tests like EndoPredict® and Prolaris® for personalized cancer treatment. The precision oncology diagnostics market is experiencing robust growth, with projected CAGRs in the high teens leading up to 2025 and beyond.

Industrial and public health laboratories, including those focused on food safety, environmental monitoring, and government agencies, are also significant customers. These entities utilize Eurobio Scientific's solutions for public health screening and surveillance, with the food safety testing market alone valued at approximately $50 billion in 2024.

Cost Structure

The Cost of Goods Sold (COGS) for Eurobio Scientific directly reflects the expenses tied to creating their in-house diagnostic tests and purchasing products for resale. This category includes essential elements like the raw materials needed for manufacturing, the labor involved in production, and the costs associated with getting these goods to their facilities.

In 2024, Eurobio Scientific reported a COGS of €82.7 million. This figure highlights the substantial investment the company makes in its product inventory and manufacturing processes, forming a core component of its overall operational expenses.

Eurobio Scientific dedicates substantial resources to Research and Development (R&D) as a cornerstone of its business model. This investment fuels the creation of novel diagnostic tests, enhances current product offerings, and drives the exploration of cutting-edge technologies within the life sciences sector.

Key components of these R&D costs encompass the compensation for highly skilled scientists and researchers, the acquisition and maintenance of sophisticated laboratory equipment, and the rigorous execution of clinical trials necessary for product validation and regulatory approval. These expenditures are critical for maintaining a competitive edge and driving future growth.

In 2024, Eurobio Scientific reported R&D expenses amounting to €4.6 million. This figure underscores the company's unwavering commitment to innovation and its strategic focus on developing advanced solutions for the diagnostic market.

Marketing and sales expenses are crucial for promoting Eurobio Scientific's products and services. These costs encompass everything from sales team salaries and engaging marketing campaigns to participating in important industry trade shows and managing robust distribution networks.

In 2024, these essential expenses saw a notable increase, reaching €29.4 million. This rise reflects the company's strategic decision to bolster its sales force and integrate new acquisitions, aiming to expand market reach and drive revenue growth.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses represent the essential overhead costs required to operate Eurobio Scientific. These include salaries for administrative staff, rent for office spaces, investments in IT infrastructure, and fees for legal and accounting services.

In 2024, Eurobio Scientific saw an increase in its G&A expenses, reaching €16.1 million. This rise was influenced by factors such as the establishment of new premises and the integration of recent acquisitions, which naturally expand the administrative footprint and associated costs.

- Administrative Salaries: Costs associated with non-sales and non-production personnel.

- Office Rent and Utilities: Expenses for maintaining physical office locations.

- IT Infrastructure: Investments in hardware, software, and network maintenance.

- Legal and Accounting Fees: Costs for compliance, advisory services, and financial reporting.

Acquisition and Integration Costs

Eurobio Scientific's growth strategy heavily involves acquisition and integration, leading to substantial expenditures. These costs encompass due diligence, legal fees, and the complex process of merging new entities into their existing operations. For instance, the acquisitions of Alpha Biotech and the EndoPredict®/Prolaris® product lines represented significant upfront investments, reflecting a commitment to expanding their portfolio and market reach.

These integration costs are critical for realizing the full value of acquired businesses. In 2024, the company continued to navigate these expenses as part of its ongoing expansion. The financial outlay for these strategic moves is a key component of their cost structure, directly impacting profitability while aiming for long-term market leadership.

- Acquisition Costs: Expenses related to identifying, evaluating, and purchasing target companies or product lines.

- Integration Expenses: Costs associated with merging acquired entities, including IT system consolidation, rebranding, and operational alignment.

- Strategic Investments: Significant capital deployed in 2024 for acquisitions like Alpha Biotech and EndoPredict®/Prolaris®, underscoring their expansionary approach.

- Due Diligence and Legal Fees: Essential expenditures incurred during the acquisition process to ensure thorough assessment and compliance.

Eurobio Scientific's cost structure is multifaceted, encompassing significant investments in product development, sales, and administration. The Cost of Goods Sold (COGS) was €82.7 million in 2024, reflecting the direct costs of their diagnostic tests and resold products. Research and Development (R&D) expenses were €4.6 million in 2024, highlighting their commitment to innovation. Marketing and sales efforts cost €29.4 million in 2024, an increase driven by sales force expansion and acquisitions. General and Administrative (G&A) expenses reached €16.1 million in 2024, influenced by new premises and integration costs.

| Cost Category | 2024 Expenses (€ million) | Key Drivers |

|---|---|---|

| Cost of Goods Sold (COGS) | 82.7 | Raw materials, labor for in-house tests, product acquisition costs |

| Research & Development (R&D) | 4.6 | Scientists' salaries, lab equipment, clinical trials |

| Marketing & Sales | 29.4 | Sales team compensation, marketing campaigns, trade shows, distribution |

| General & Administrative (G&A) | 16.1 | Admin salaries, office rent, IT, legal/accounting fees |

| Acquisition & Integration Costs | Not specified separately, but significant | Due diligence, legal fees, merging operations for Alpha Biotech and EndoPredict®/Prolaris® |

Revenue Streams

Eurobio Scientific generates revenue through the direct sale of its proprietary diagnostic tests and related equipment. These offerings cater to critical healthcare areas including infectious diseases, transplantation diagnostics, and oncology testing.

In 2024, these proprietary products represented a solid 31% of the group's total revenue, underscoring their importance. The company is actively pursuing strategies to expand this segment's contribution to overall sales.

Eurobio Scientific generates income by distributing a wide array of life science products, including reagents and instruments, from its international partners to research laboratories. This distribution arm is a key component of their business model.

In 2024, this revenue stream is expected to remain a significant contributor, offering a stable income base that complements their proprietary product sales. This diversification strategy helps to mitigate risks and broaden their overall market reach within the life sciences sector.

Eurobio Scientific generates revenue through service and maintenance contracts for its diagnostic equipment and software. These agreements ensure customers receive ongoing support, keeping their systems running optimally.

This recurring revenue model is a cornerstone of Eurobio Scientific's financial stability, providing a predictable income stream. For example, in 2024, the company continued to emphasize the growth of its service and maintenance offerings, which contribute significantly to customer retention and extend the useful life of their installed base.

Licensing and Royalties

Eurobio Scientific generates revenue through licensing its innovative technologies and intellectual property to other businesses. This model allows them to capitalize on their research and development without directly manufacturing all products themselves. For instance, their license agreement for Prolaris® exemplifies this revenue stream, where they earn income from the use of their patented technology in diagnostic tests developed by partners.

Royalties form a significant part of this licensing income. Eurobio Scientific receives a percentage of the sales revenue generated from products that incorporate their proprietary innovations. This creates a continuous revenue flow tied to the market success of the licensed technologies. In 2024, the company's strategic focus on expanding its licensing partnerships is expected to bolster these royalty-based earnings.

- Licensing Revenue: Income derived from granting rights to use Eurobio Scientific's proprietary technologies and intellectual property.

- Royalty Income: Earnings based on a percentage of sales from products utilizing Eurobio Scientific's innovations, such as the Prolaris® license.

- Strategic Partnerships: Agreements to license technology, like Prolaris®, to other companies for product development and commercialization.

- 2024 Focus: Expansion of licensing agreements to drive growth in royalty-based revenue streams.

International Sales and Exports

Eurobio Scientific generates revenue by selling its products and services to customers located outside of France, a core element of its internationalization strategy. This global reach is crucial for expanding market share and diversifying revenue sources. In 2024, international sales represented a substantial 41% of the group's total revenue, underscoring the importance of this segment to the company's financial performance. Geographic expansion is a primary driver for Eurobio Scientific's overall revenue growth, demonstrating the effectiveness of its international sales efforts.

- International Sales Contribution: 41% of group revenue in 2024.

- Strategic Importance: Reflects the company's internationalization strategy and global market penetration.

- Growth Driver: Geographic expansion is a key factor in increasing overall revenue.

- Market Reach: Revenue generated from customers outside of France.

Eurobio Scientific's revenue streams are multifaceted, encompassing the sale of proprietary diagnostic tests, distribution of life science products, and recurring income from service contracts. In 2024, proprietary products accounted for 31% of total revenue, while international sales reached 41%, highlighting the company's global reach and product diversification.

| Revenue Stream | Description | 2024 Significance |

|---|---|---|

| Proprietary Products | Direct sale of diagnostic tests and equipment. | 31% of total revenue. |

| Distribution | Sales of reagents and instruments from international partners. | Key component, stable income base. |

| Services & Maintenance | Contracts for equipment and software support. | Recurring revenue, customer retention. |

| Licensing & Royalties | Granting rights to use proprietary technologies (e.g., Prolaris®). | Growing focus, tied to market success. |

| International Sales | Revenue from customers outside France. | 41% of total revenue, primary growth driver. |

Business Model Canvas Data Sources

The Eurobio Scientific Business Model Canvas is informed by a blend of internal financial data, market research reports, and competitive intelligence. This comprehensive approach ensures each element reflects the company's current operational realities and strategic positioning.