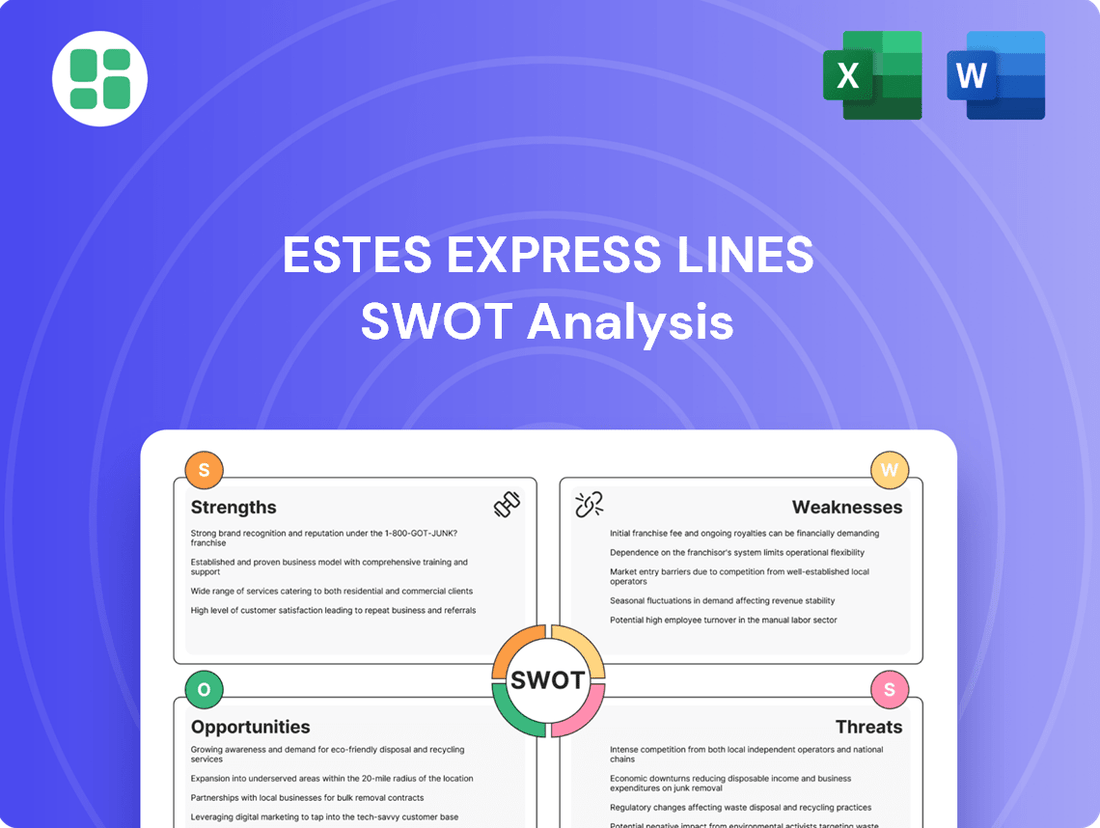

Estes Express Lines SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Estes Express Lines Bundle

Estes Express Lines boasts a strong reputation for reliability and customer service, key strengths in the competitive freight industry. However, potential weaknesses like high operational costs and reliance on specific routes could be further explored.

Want the full story behind Estes Express Lines' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Estes Express Lines boasts an impressive North American footprint, operating over 300 terminals and a substantial fleet of more than 10,500 tractors and 45,000 trailers. This robust infrastructure is a cornerstone of their operational strength, allowing for efficient and dependable freight transportation across a vast geographical area.

The company significantly bolstered its network in 2024 and 2025 through strategic acquisitions, notably integrating numerous former Yellow Corporation terminals. These acquisitions, including 37 owned and 15 leased facilities from Yellow, directly expand Estes' capacity and enhance their ability to manage cross-border freight, especially through critical Canadian entry points.

Estes Express Lines boasts a comprehensive service portfolio, encompassing Less-Than-Truckload (LTL), Volume LTL, Truckload, Time Critical Guaranteed, Custom Shipping and Logistics, and Final Mile solutions. This broad range of offerings allows them to serve a diverse clientele across various industries, from small businesses needing occasional LTL shipments to large corporations requiring integrated logistics management.

The company's ability to handle everything from standard LTL to specialized services like Time Critical Guaranteed and Final Mile demonstrates a significant competitive advantage. For instance, their Time Critical Guaranteed service is crucial for industries like automotive and retail where delays can be exceptionally costly. In 2023, the freight transportation market saw continued demand for reliable and expedited services, a segment where Estes' comprehensive offerings are particularly valuable.

Estes Express Lines, North America's largest privately owned freight carrier, boasts a robust financial standing, notably its commitment to debt-free growth. This financial discipline underpins its ability to execute major strategic moves, ensuring long-term stability.

The company's strategic acquisition of Yellow Corp.'s terminals and equipment throughout 2024 and into 2025 is a prime example of its strength. This expansion significantly bolsters Estes' capacity and market share, adding approximately 2,000 tractors and 6,000 trailers to its fleet, all while maintaining its healthy balance sheet.

This financially sound expansion strategy empowers Estes to channel resources into further investments in operational capacity and cutting-edge technology. Such investments are crucial for reinforcing its leadership position in the highly competitive North American logistics landscape.

Commitment to Sustainability and Technology Adoption

Estes Express Lines is actively pursuing sustainability goals, with a stated aim of achieving net-zero emissions by 2050, as detailed in their 2024 Sustainability Report. This commitment is supported by tangible investments in technology, such as the implementation of AI-powered route optimization tools like Optym RouteMax, which directly contributes to improved fuel efficiency and reduced operational costs. Furthermore, the company is expanding its renewable energy infrastructure through increased solar power capacity.

These strategic moves are not just about environmental stewardship; they directly address increasing market pressures. Customers are increasingly prioritizing partners with strong environmental, social, and governance (ESG) credentials, making Estes's focus on sustainability a competitive advantage. Regulatory bodies are also tightening emissions standards, meaning proactive adoption of green technologies positions Estes favorably for future compliance and operational continuity.

- Net-Zero Target: Estes aims for net-zero emissions by 2050.

- Technology Integration: Utilizes AI for route optimization (e.g., Optym RouteMax).

- Renewable Energy: Expanding solar power capacity.

- Market Alignment: Meets growing customer and regulatory demand for green logistics.

High Customer Satisfaction and Industry Recognition

Estes Express Lines consistently earns high customer satisfaction ratings, a key strength that differentiates them in the competitive LTL market. This dedication to service excellence is validated by numerous industry accolades. For example, they were recognized as the 2024 National Carrier of the Year by American Group and also received the 2024 National LTL Carrier of the Year award from Uber Freight.

Further underscoring their customer-centric approach, Estes saw an improvement in their Net Promoter Score (NPS) for LTL Customer Satisfaction, reaching 59 in 2024. This upward trend reflects a strong commitment to reliability and meeting customer expectations.

- Industry Recognition: Named 2024 National Carrier of the Year by American Group and 2024 National LTL Carrier of the Year by Uber Freight.

- Customer Satisfaction: Achieved an improved LTL Customer Satisfaction NPS of 59 in 2024.

- Service Excellence: Consistent high marks in independent studies and industry awards highlight their commitment to reliable service.

Estes Express Lines' extensive North American network, comprising over 300 terminals and a vast fleet, underpins its operational prowess. The company's strategic acquisitions throughout 2024 and 2025, particularly of former Yellow Corporation assets, significantly expanded its terminal count and fleet capacity, enhancing its ability to serve a broader customer base and manage cross-border logistics more effectively. This growth is supported by a strong financial foundation, characterized by debt-free expansion, enabling continued investment in technology and infrastructure to maintain its competitive edge.

| Metric | Value (2024/2025) | Significance |

|---|---|---|

| Terminals | 300+ | Extensive geographic reach and service capability. |

| Tractors | 10,500+ (plus ~2,000 acquired) | Increased capacity and operational flexibility. |

| Trailers | 45,000+ (plus ~6,000 acquired) | Enhanced ability to handle diverse freight volumes. |

| Financial Stance | Debt-free growth | Financial stability and capacity for strategic investment. |

What is included in the product

Delivers a strategic overview of Estes Express Lines’s internal and external business factors, highlighting its strong market position and operational efficiencies while also identifying potential challenges in labor and industry shifts.

Provides a clear, actionable SWOT analysis for Estes Express Lines to identify and address key operational challenges and leverage competitive advantages.

Weaknesses

As a freight transportation provider, Estes' core business is inherently tied to the health of the broader economy. When economic activity slows, consumer spending often dips, directly impacting the demand for goods that need to be shipped. This can translate into lower freight volumes for companies like Estes.

The trucking industry faced a notable 'freight recession' throughout much of 2024. During this period, reduced freight volumes put pressure on revenues across the sector. While Estes, with its established network and diverse customer base, is generally well-positioned to weather such storms, a prolonged economic downturn could still challenge freight rates and overall profitability.

Estes Express Lines, like all major carriers, faces significant operational risks due to the inherent volatility of fuel prices. These fluctuations directly impact trucking costs, a primary expense for freight movement. While fuel surcharges saw a dip in late 2024, the persistent upward pressure on fuel prices remains a substantial challenge for fleet management and overall profitability.

The trucking industry, including Estes Express Lines, grapples with a persistent global shortage of qualified drivers, a critical component of operations. This scarcity, coupled with high turnover rates in certain sectors, directly impacts freight delivery timelines and escalates labor costs as companies vie for available talent. For instance, the American Trucking Associations reported in late 2023 that the driver shortage could reach 70,000 or more.

Intense Competition in the LTL Market

The Less-Than-Truckload (LTL) sector is a battlefield, with giants like Old Dominion Freight Line, XPO, and Saia aggressively pursuing market share. Estes has been busy expanding its reach, but these competitors are also snapping up former Yellow Corp. assets and launching their own expansion plans. This crowded landscape means constant pressure on pricing and a relentless need to invest in service and technology just to keep pace.

The competitive intensity is evident in market dynamics. For instance, in Q1 2024, Old Dominion reported a 1.7% increase in LTL tons handled year-over-year, demonstrating continued strength despite economic headwinds. Similarly, XPO Logistics has been actively integrating acquired capacity, aiming to bolster its network efficiency. Saia, another key player, has also shown robust growth, with its Q1 2024 revenue reaching $863.5 million, up 14.9% compared to the previous year, highlighting the aggressive expansion strategies across the industry.

- Intense Rivalry: Major carriers like Old Dominion, XPO, and Saia are actively competing for LTL dominance.

- Network Expansion: Competitors are also growing their networks and absorbing capacity from former industry players.

- Pricing Pressure: The crowded market can lead to downward pressure on LTL rates.

- Investment Demands: Maintaining competitiveness requires ongoing investment in operational efficiency and technological advancements.

Operational Complexity and Infrastructure Demands

Estes Express Lines operates an extensive network of over 300 terminals, a significant undertaking that naturally leads to considerable operational complexity. This scale requires sophisticated logistics management and robust systems to ensure smooth operations across its vast footprint.

The company's asset-based model, while a core strength, also presents a substantial weakness due to the inherent infrastructure demands. Maintaining and upgrading a large fleet and numerous facilities necessitates significant and ongoing capital expenditure, demanding meticulous financial planning and efficient resource allocation to remain profitable.

- Infrastructure Investment: In 2023, Estes reported significant investments in its network, including the expansion and modernization of key facilities, highlighting the continuous capital required to support its operational scale.

- Fleet Management Costs: The maintenance and replacement of a large, diverse fleet, estimated to be in the tens of thousands of vehicles, represent a substantial ongoing operational cost that directly impacts profitability.

- Technological Integration: Keeping pace with technological advancements in logistics and fleet management across such a large operation requires continuous investment in IT infrastructure and software, adding to the overall complexity and cost.

The trucking industry, including Estes Express Lines, faces a persistent shortage of qualified drivers, impacting delivery times and increasing labor costs. This scarcity, exacerbated by high turnover, means companies must invest more to attract and retain talent, a challenge evident in the reported shortage of over 70,000 drivers by late 2023.

Estes operates within a highly competitive Less-Than-Truckload (LTL) market, facing aggressive rivals like Old Dominion, XPO, and Saia who are actively expanding their networks and absorbing capacity. This intense rivalry puts pressure on pricing and necessitates continuous investment in service and technology to maintain market share.

The company's extensive network of over 300 terminals and a large asset base, while a strength, also represents a significant weakness due to substantial and ongoing capital expenditure requirements for maintenance, upgrades, and technological integration.

Same Document Delivered

Estes Express Lines SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing an actual excerpt from the complete Estes Express Lines SWOT analysis. Once purchased, you’ll receive the full, editable version, offering comprehensive insights into their Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The logistics sector is embracing advanced technologies like AI, machine learning, and IoT for significant efficiency gains. Estes can build on its existing AI for route optimization by integrating these tools for more accurate demand forecasting and automated warehouse functions.

Further adoption of real-time tracking and digital twins offers opportunities for enhanced supply chain transparency and predictive maintenance, potentially reducing downtime and operational costs.

The persistent growth of e-commerce, projected to reach $7.4 trillion globally by 2025, fuels a strong demand for efficient delivery networks. Estes can leverage this by enhancing its less-than-truckload (LTL) capabilities for the crucial last-mile segment, a market segment that saw significant investment and innovation throughout 2024.

By adapting its LTL services for urban environments and the complexities of final delivery, Estes can tap into the increasing need for agile, smaller-scale freight solutions. This strategic alignment with online retailers and businesses relying on just-in-time inventory management offers a clear path for service expansion and revenue growth.

Estes Express Lines has shown its prowess in expansion, notably with its acquisition of Yellow Corp.'s terminals. This success opens doors for further strategic acquisitions of smaller carriers or logistics technology companies, aiming to broaden service offerings, geographic footprint, and technological capabilities.

Collaborating with technology providers or other logistics services through strategic partnerships can also generate valuable synergies and strengthen Estes' competitive edge in the evolving market.

Growth in Specialized and High-Value Freight

Estes Express Lines can capitalize on the growing demand for specialized and high-value freight services. As ground freight forwarders navigate competitive maritime rates, a strategic pivot towards niches like pharmaceuticals, live animals, or high-security proprietary designs offers a clear path to differentiation.

By leveraging its robust network and proven reliability, Estes can command premium pricing for cargo requiring stringent care and enhanced security. This focus on specialized segments can insulate the company from broader market pressures and reduce direct competition.

- Pharmaceutical Shipments: The global pharmaceutical logistics market was valued at approximately $15.7 billion in 2023 and is projected to grow significantly, driven by the increasing demand for temperature-controlled and secure transport.

- High-Value Electronics: The transportation of sensitive electronics, often requiring specialized handling and security protocols, represents a lucrative segment where Estes's infrastructure can be a key asset.

- Time-Sensitive Deliveries: The e-commerce boom continues to fuel demand for expedited ground shipping, particularly for urgent consumer goods and business-to-business components, an area where Estes's efficiency can be a strong selling point.

Driving Sustainability as a Competitive Advantage

Estes Express Lines can leverage its sustainability initiatives to gain a significant competitive edge. As environmental consciousness grows, a strong commitment to green logistics becomes a powerful differentiator, attracting customers and partners who prioritize eco-friendly operations. This focus on sustainability can translate directly into increased market share and enhanced brand reputation.

Continued investment in electric vehicles and alternative fuels, alongside advancements like carbon-capture systems and transparent emissions reporting, will solidify Estes' leadership. For instance, the increasing adoption of electric trucks in the freight industry, with projections showing a substantial rise in the coming years, highlights the market's shift. Estes' proactive approach in these areas positions it to capture a larger segment of this evolving market.

The company's existing partnerships, such as with the Smart Freight Centre, and its ambitious target of achieving net-zero emissions by 2050, are crucial. These commitments not only demonstrate corporate responsibility but also align with regulatory trends and customer expectations. By 2024, many companies are already setting their own emissions reduction targets, making Estes' forward-thinking strategy particularly appealing.

- Market Demand: Growing customer preference for carriers with demonstrable sustainability practices.

- Operational Efficiency: Potential long-term cost savings through reduced fuel consumption and maintenance with electric fleets.

- Regulatory Compliance: Proactive alignment with evolving environmental regulations, avoiding future penalties or disruptions.

- Brand Enhancement: Strengthening brand image as an environmentally responsible leader in the logistics sector.

Estes can leverage technological advancements like AI and IoT for enhanced demand forecasting and automated warehouse operations, building on its existing AI capabilities.

The continued expansion of e-commerce, expected to reach $7.4 trillion globally by 2025, presents a significant opportunity for Estes to bolster its LTL services, particularly in the last-mile delivery segment which saw substantial investment in 2024.

Strategic acquisitions, similar to the Yellow Corp. terminal purchases, can broaden Estes' service offerings and geographic reach, while partnerships with technology providers can create valuable synergies.

Focusing on specialized freight, such as pharmaceuticals or high-value electronics, allows Estes to command premium pricing and differentiate itself in a competitive market, with the pharmaceutical logistics market valued at approximately $15.7 billion in 2023.

Estes' commitment to sustainability, including investments in electric vehicles and its net-zero emissions target by 2050, appeals to environmentally conscious customers and aligns with growing regulatory trends, mirroring the broader industry shift towards greener logistics.

Threats

The trucking and freight sector faces significant economic headwinds, with ongoing concerns about potential recessions and overcapacity. This environment has led to softened demand and declining freight rates, impacting profitability across the Less Than Truckload (LTL) segment.

While some recovery is projected for late 2024 and into 2025, a prolonged downturn or unforeseen economic shocks could severely curtail freight volumes. For instance, the American Trucking Associations (ATA) reported a 7.1% decrease in truckload freight volume in the first quarter of 2024 compared to the previous year, highlighting the current challenges.

Such a scenario could translate to lower revenues and increased financial pressure for companies like Estes Express Lines, necessitating careful cost management and strategic adjustments to maintain financial stability.

The swift evolution of logistics technology, such as autonomous trucks and advanced digital freight platforms, presents a significant challenge. If Estes Express Lines, a major player in the less-than-truckload (LTL) sector, doesn't integrate these innovations, it risks falling behind competitors who are leveraging these advancements. For instance, the global autonomous truck market is projected to reach $300 billion by 2030, highlighting the scale of potential disruption.

New companies entering the market with cutting-edge tech can swiftly alter industry dynamics. These agile disruptors may bypass legacy infrastructure, offering more efficient or cost-effective solutions. Consider the rise of digital freight brokers; some have seen rapid growth by connecting shippers and carriers more effectively, a model that could pressure traditional asset-based carriers like Estes if they don't adapt their own digital strategies.

To maintain its competitive edge, Estes Express Lines must prioritize ongoing investment in and seamless integration of emerging technologies. This includes exploring how autonomous fleets could eventually supplement or optimize existing operations and enhancing its digital freight management capabilities to match or exceed those of newer market entrants. The company's ability to adapt its operational model to these technological shifts will be crucial for future market share preservation and growth.

The trucking sector faces a constant stream of regulatory shifts, impacting everything from emissions controls to driver hours. For instance, the ongoing implementation and potential updates to electronic logging device (ELD) mandates require continuous investment in technology and training to ensure compliance. These evolving rules necessitate significant capital expenditure and operational adjustments, potentially increasing overhead for carriers like Estes Express Lines.

Adapting to these new regulations often translates into substantial compliance costs. Estes Express Lines, like other major carriers, must allocate resources towards upgrading equipment to meet stricter environmental standards, such as those potentially introduced in 2024 or 2025, and ensuring all vehicles are equipped with the latest compliant logging technology. These investments, while necessary, directly impact profitability and require careful financial planning.

Beyond direct costs, non-compliance carries significant risks. Fines for violations of emissions standards or ELD rules can be substantial, and operational disruptions, such as vehicle impoundment, can severely damage service levels and customer relationships. Maintaining a proactive approach to regulatory changes is therefore critical for Estes Express Lines to avoid these costly penalties and ensure uninterrupted operations.

Cybersecurity Risks and Data Breaches

As logistics operations increasingly rely on digital platforms, cybersecurity risks like phishing and data breaches pose a significant threat to Estes Express Lines. These attacks can cripple operations, resulting in substantial financial losses and downtime. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the escalating danger for all businesses, including transportation firms.

A successful cyberattack could compromise sensitive customer and proprietary operational data, leading to severe reputational damage and loss of trust. The Federal Bureau of Investigation (FBI) reported a 65% increase in reported ransomware incidents between 2022 and 2023, underscoring the growing prevalence of such threats in the business landscape.

- Increased susceptibility due to digitalization of logistics.

- Potential for significant financial losses and operational disruption.

- Risk of reputational damage from data breaches.

- The evolving nature of cyber threats requires continuous adaptation.

Consolidation and Pricing Pressures in the LTL Market

The Less-Than-Truckload (LTL) sector is experiencing significant consolidation, notably with the closure of Yellow Corp. and FedEx's planned divestiture of its LTL segment. While Estes has seen a positive impact from Yellow's market exit, further consolidation among remaining major carriers could escalate competition, potentially leading to more aggressive pricing tactics and squeezed profit margins.

This trend means that while Estes gained market share from Yellow's collapse, the competitive landscape could become more challenging as fewer, larger entities vie for business. For instance, the LTL market saw a substantial shift in capacity and pricing dynamics following Yellow's cessation of operations in August 2023, with industry analysts estimating a significant portion of Yellow's former freight volume being absorbed by competitors like Estes.

The ongoing consolidation presents a dual-edged sword: immediate gains from market disruptions are possible, but the long-term outlook suggests a need for strategic pricing and operational efficiency to counter potential price wars among the remaining industry giants.

- Market Consolidation: Key events like Yellow Corp.'s shutdown and FedEx's LTL spin-off are reshaping the LTL industry.

- Competitive Intensity: Further consolidation could intensify competition among remaining large LTL carriers.

- Pricing Pressures: Increased competition may lead to aggressive pricing strategies, impacting profit margins for companies like Estes.

- Strategic Advantage: Estes' ability to absorb freight from defunct competitors provides an immediate benefit, but sustained success requires adapting to evolving market dynamics.

The trucking industry faces significant economic headwinds, including potential recessions and overcapacity, leading to softened demand and declining freight rates. For example, the American Trucking Associations reported a 7.1% decrease in truckload freight volume in Q1 2024 year-over-year, impacting profitability.

Rapid technological advancements, such as autonomous trucks and digital freight platforms, pose a threat if not integrated, potentially allowing agile disruptors to gain market share. The global autonomous truck market is projected to reach $300 billion by 2030, indicating the scale of this shift.

Evolving regulations, like ELD mandates and stricter emissions controls, necessitate continuous investment in technology and compliance, increasing operational costs. Non-compliance risks substantial fines and operational disruptions, as seen with potential environmental standard updates in 2024-2025.

Cybersecurity risks are escalating, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025, threatening operations and data integrity. The FBI noted a 65% increase in ransomware incidents between 2022 and 2023.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Estes Express Lines' official financial filings, comprehensive industry market research, and expert commentary from transportation sector analysts.