Estes Express Lines Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Estes Express Lines Bundle

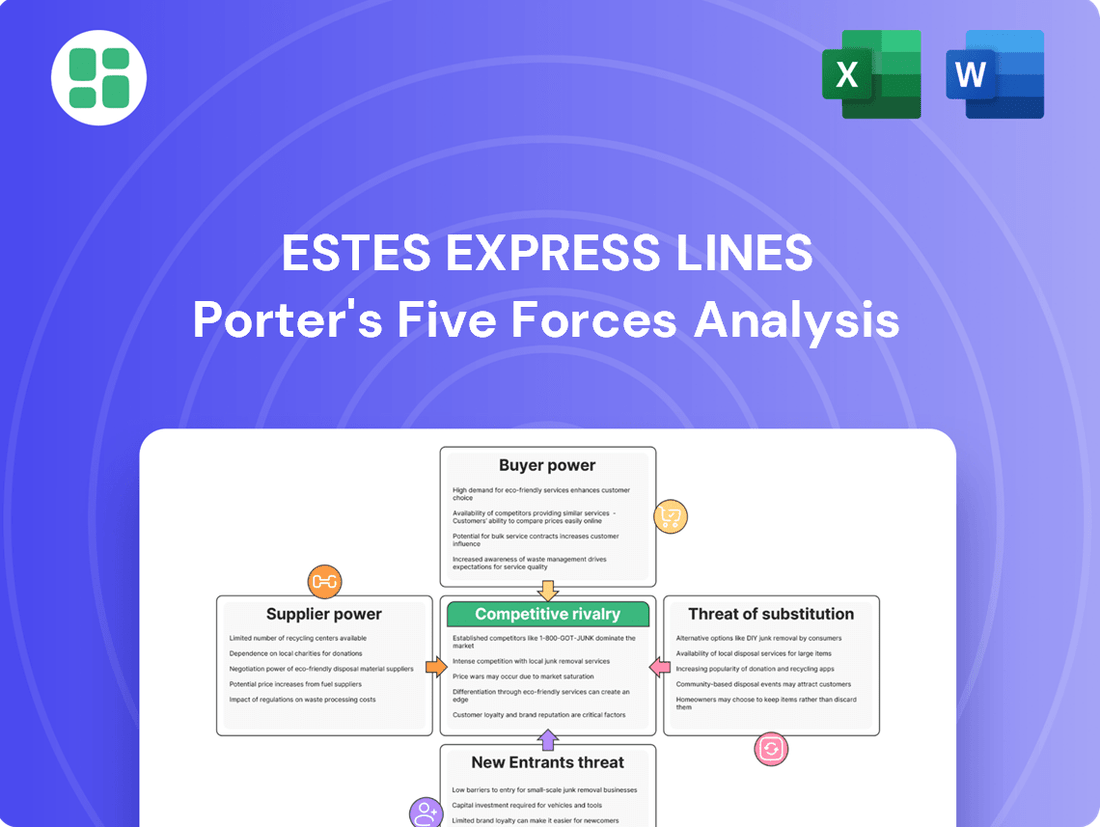

Estes Express Lines navigates a competitive landscape shaped by powerful buyer relationships and the constant threat of new entrants. Understanding the intensity of rivalry and the influence of substitute services is crucial for any player in this market. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Estes Express Lines’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The price of diesel fuel is a major variable expense for freight companies like Estes Express Lines. In 2024, diesel prices saw significant fluctuations, impacting profitability directly. For instance, average on-highway diesel prices in the US hovered around $3.90 per gallon in early 2024, a figure that can drastically change based on global supply and demand.

Oil and gas companies, as suppliers of this critical input, wield substantial bargaining power. While fuel surcharges are a common mechanism to pass on increased costs to customers, they don't entirely eliminate the risk. Suppliers can influence Estes' operational costs by setting prices for this essential commodity, directly affecting the bottom line of less-than-truckload (LTL) carriers.

The bargaining power of suppliers in the truck and trailer manufacturing market for a company like Estes Express Lines is moderate. While demand for new equipment is softening in 2025, the ongoing need for fleet replacements provides a baseline of business for manufacturers, granting them some leverage.

Estes' strategic fleet expansion in 2024, which involved acquiring thousands of new trailers, coupled with a cautious approach to new purchases in 2025 due to these prior investments and prevailing market conditions, likely reduces their immediate reliance on new supplier orders. This strategic inventory management can diminish the suppliers' ability to dictate terms.

The persistent truck driver shortage continues to grant labor significant bargaining power within the LTL sector. In 2024, many trucking companies, including Estes, faced ongoing challenges in attracting and retaining qualified drivers, leading to upward pressure on wages and benefits. This directly impacts Estes' operational costs as they must offer competitive compensation packages to secure the necessary workforce.

Technology and Software Providers

As less-than-truckload (LTL) carriers like Estes Express Lines heavily invest in cutting-edge technologies, the bargaining power of specialized software and technology providers increases. This is particularly true for AI-driven solutions aimed at enhancing route optimization, predictive maintenance, and overall transportation management systems (TMS). Estes' strategic adoption of AI tools, such as Optym RouteMax, underscores a growing dependence on these suppliers for achieving significant efficiency improvements and maintaining a competitive edge in the market.

The increasing integration of advanced software means that LTL carriers are often reliant on a smaller pool of highly specialized vendors. This reliance can grant these providers leverage, especially when their solutions offer unique capabilities or are critical for operational success. For instance, the development and implementation of sophisticated AI algorithms for dynamic route planning can be a complex and costly undertaking, making it difficult for carriers to switch providers easily.

- Increased Dependence: LTL carriers are becoming more reliant on technology for operational efficiency, giving software providers more influence.

- Specialized AI Solutions: Companies like Optym, providing AI for route optimization, gain power due to the critical nature of their specialized services.

- Switching Costs: The significant investment and integration required for advanced TMS and AI systems create high switching costs for carriers, further empowering suppliers.

- Competitive Advantage: Access to and effective use of these technologies are vital for competitive advantage, making carriers hesitant to disrupt their relationships with key technology partners.

Real Estate for Terminal Networks

The bargaining power of suppliers in the context of real estate for terminal networks is significant for Less-Than-Truckload (LTL) carriers like Estes Express Lines. The specialized nature of LTL operations necessitates a robust and strategically located network of terminals. This demand, particularly in the wake of significant industry shifts such as the collapse of Yellow Corporation in 2023, can give property owners considerable leverage.

The availability of suitable industrial real estate, especially in key transportation corridors, is often limited. This scarcity, coupled with the specialized requirements for LTL terminals, means that property owners can command higher prices or more favorable lease terms. Estes' proactive acquisition of former Yellow Corporation terminals underscores the critical importance of securing these facilities and the potential bargaining power held by those who own them.

The market for industrial real estate, particularly for logistics and transportation hubs, saw continued strength in 2024. For instance, industrial vacancy rates across the US remained historically low, hovering around 3.5% for much of the year, according to various real estate market reports. This tight market environment directly translates to increased bargaining power for real estate suppliers.

- Limited Supply: The scarcity of industrial land suitable for large terminal operations in prime locations enhances supplier leverage.

- Specialized Needs: LTL terminals require specific features like extensive dock doors, yard space, and proximity to major highways, narrowing the pool of available properties and empowering owners.

- Industry Consolidation: Events like Yellow's bankruptcy in 2023 increased demand for terminal capacity from surviving carriers, potentially strengthening the hand of real estate owners.

- Rising Costs: Increased demand and persistent low vacancy rates in industrial real estate, which remained under 4% nationally in early 2024, have driven up rental rates and purchase prices, benefiting suppliers.

The bargaining power of suppliers for Estes Express Lines is a significant factor, particularly concerning fuel and specialized technology. In 2024, fluctuating diesel prices around $3.90 per gallon in early 2024 meant oil companies held considerable sway over operational costs, despite fuel surcharges. Similarly, reliance on AI-driven route optimization software from providers like Optym grants these specialized vendors leverage due to high switching costs and the critical nature of their services for competitive advantage.

Real estate suppliers also possess substantial bargaining power, especially for terminal locations. Limited availability of suitable industrial properties, combined with the specific needs of LTL operations and increased demand following industry consolidation in 2023, allowed property owners to command higher prices. National industrial vacancy rates remaining under 4% in early 2024 further amplified this leverage.

| Supplier Category | Bargaining Power | Key Factors | 2024/2025 Data Points |

|---|---|---|---|

| Fuel (Diesel) | High | Volatility of oil prices, essential commodity | Average on-highway diesel prices ~$3.90/gallon (early 2024) |

| Specialized Technology (AI/TMS) | Moderate to High | High switching costs, critical for efficiency, limited vendors | Strategic adoption of AI tools like Optym RouteMax |

| Truck & Trailer Manufacturing | Moderate | Need for fleet replacement vs. softening demand | Softening demand for new equipment in 2025 |

| Industrial Real Estate (Terminals) | High | Limited supply, specialized needs, industry consolidation | Industrial vacancy rates < 4% (early 2024), increased demand post-Yellow collapse |

| Labor (Drivers) | High | Driver shortage, competition for talent | Ongoing challenges in driver recruitment and retention in 2024 |

What is included in the product

This analysis of Estes Express Lines examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential for substitute services within the freight transportation industry.

Quickly assess competitive intensity across the trucking industry, identifying threats and opportunities for Estes Express Lines.

Customers Bargaining Power

The bargaining power of customers for Estes Express Lines is significant, particularly among large Less-Than-Truckload (LTL) shippers. These major clients often demonstrate high price sensitivity, especially when the freight market experiences a downturn. For instance, during periods of soft demand in 2024, many large shippers were actively seeking and successfully negotiating lower rates with carriers.

While the LTL sector has a history of maintaining pricing discipline, the market's recovery trajectory in 2025 could present a mixed bag. An uneven recovery might still allow substantial customers to leverage their volume and push for more advantageous contract terms. This means carriers like Estes need to be prepared for continued negotiation pressure from their most valuable clients.

Customers benefit from a wide array of Less Than Truckload (LTL) carriers, with prominent options like Old Dominion, XPO Logistics, and Saia readily available. This extensive selection empowers customers by offering ample choice in selecting a logistics partner.

The sheer volume of LTL providers creates a competitive environment where customers can readily compare and switch between carriers based on factors such as pricing, transit times, and service reliability. In 2024, the LTL market remained robust, with Estes Express Lines, Old Dominion, and XPO Logistics consistently ranking among the top carriers by revenue, underscoring the competitive pressure customers can exert.

The bargaining power of customers is a significant factor for Estes Express Lines, especially concerning shipper-owned private fleets. Larger shippers can choose to operate or expand their own trucking operations, which directly reduces their dependence on third-party Less-Than-Truckload (LTL) carriers. This capability serves as a potent threat, granting these shippers considerable leverage during price and service negotiations with Estes, particularly for routes with consistent, high-volume freight.

Demand for Enhanced Customer Experience and Technology

Customers are increasingly expecting more from their logistics partners, particularly in terms of technology. This means real-time shipment tracking, seamless communication channels, and easy-to-use digital platforms for booking and managing freight. Estes Express Lines has been investing in these areas to keep up.

For example, Estes' focus on customer experience is reflected in their Net Promoter Score (NPS). While specific 2024 NPS figures for Estes are not publicly available, the industry average for freight and logistics companies often hovers in the 30s to 40s. Companies with higher NPS scores, like those achieving 50+, demonstrate a strong ability to meet and exceed customer expectations, which can shift bargaining power towards those customers who prioritize these advanced features.

- Customer Demand for Technology: Growing expectation for real-time tracking, digital booking, and enhanced communication tools.

- Estes' Investment: The company is investing in customer-facing technology to meet these evolving demands.

- Impact on Bargaining Power: Meeting these tech-savvy customer needs is crucial for retention and attraction, giving customers more leverage.

- Industry Benchmarks: While Estes' specific 2024 NPS isn't public, the logistics industry average NPS is a key indicator of customer satisfaction and influences bargaining power dynamics.

Impact of Freight Classification Changes

The upcoming NMFTA classification overhaul in 2025, moving to density-based pricing, significantly impacts how shippers are charged. This transition requires businesses to meticulously understand and adapt to new cost structures, potentially altering their freight spend.

Customers who proactively adapt and accurately classify their freight stand to gain leverage. By understanding the new density metrics, shippers can better predict costs and negotiate more effectively with carriers like Estes Express Lines, reducing their vulnerability to unexpected reclassification fees.

- NMFTA Overhaul: The National Motor Freight Traffic Association (NMFTA) is implementing a significant overhaul of freight classification, set to take effect in 2025.

- Density-Based Pricing: The core of this change is a shift from commodity-based classification to a system heavily reliant on freight density (weight per cubic foot).

- Shipper Adaptation: Shippers must now understand how their product's density will influence shipping costs, requiring a re-evaluation of packaging and load optimization strategies.

- Negotiation Leverage: Accurate freight classification empowers customers, enabling them to negotiate more favorable rates and avoid costly reclassification penalties, thereby increasing their bargaining power.

The bargaining power of customers for Estes Express Lines remains substantial, particularly for large volume shippers in the Less-Than-Truckload (LTL) sector. These major clients often exhibit high price sensitivity, especially during periods of softer freight demand, as seen in 2024 where many successfully negotiated lower rates.

The competitive LTL landscape, featuring numerous carriers like Old Dominion and XPO Logistics, provides customers with ample choice, allowing them to readily switch for better pricing or service. This competition intensifies customer leverage, as demonstrated by the consistent ranking of top carriers by revenue in 2024, highlighting the pressure customers can exert.

Furthermore, the potential for large shippers to utilize or expand their own private fleets acts as a significant threat, directly diminishing their reliance on third-party LTL providers and bolstering their negotiation power with carriers like Estes.

The upcoming 2025 NMFTA classification overhaul, shifting to density-based pricing, will empower customers who proactively adapt. By accurately understanding and classifying their freight density, shippers can negotiate more effectively and mitigate the risk of unexpected reclassification fees, thereby enhancing their bargaining position.

| Factor | Impact on Customer Bargaining Power | Relevance for Estes Express Lines |

|---|---|---|

| Market Competition | High due to numerous LTL carriers | Requires competitive pricing and service offerings |

| Shipper Volume & Price Sensitivity | Significant for large shippers, especially in soft markets | Pressures rates and contract terms |

| Shipper-Owned Fleets | Provides an alternative, increasing leverage | Reduces reliance on LTL carriers for some clients |

| NMFTA Classification Overhaul (2025) | Empowers informed shippers with better cost prediction | Necessitates clear communication and support for classification changes |

Full Version Awaits

Estes Express Lines Porter's Five Forces Analysis

This preview shows the exact Estes Express Lines Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of the competitive landscape within the freight transportation industry. You'll gain detailed insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This document is fully formatted and ready for your immediate use, providing actionable intelligence for strategic decision-making.

Rivalry Among Competitors

The Less-Than-Truckload (LTL) sector is a battleground dominated by formidable national carriers. Giants like Old Dominion Freight Line, XPO, Saia, FedEx Freight, and ABF Freight command significant market presence, ensuring a highly competitive environment.

Estes Express Lines, a major force in this arena, has been strategically expanding its network. This aggressive growth directly intensifies the competition for market share and the crucial freight volume that fuels the industry.

The abrupt departure of Yellow Corporation in 2023 profoundly reshaped the Less-Than-Truckload (LTL) sector. This event triggered a significant capacity rebalancing, with established players like Estes Express Lines actively acquiring former Yellow terminals and absorbing substantial freight volumes. This strategic move by Estes and its peers has intensified competitive rivalry as carriers aggressively pursue market share and network expansion in the wake of Yellow's exit.

In the face of economic headwinds and unpredictable freight demand throughout 2024 and into 2025, Less Than Truckload (LTL) carriers are intensely focused on boosting profitability and streamlining operations. This strategic imperative fuels fierce competition as companies vie for an edge in network design, workforce management, and the implementation of cutting-edge technologies to enhance their operating ratios and safeguard profit margins.

For Estes Express Lines, this translates into a constant drive to optimize every facet of its business. For instance, achieving a lower operating ratio, a key metric for efficiency, becomes paramount. While specific 2024 figures for Estes are still emerging, the industry benchmark for a strong operating ratio in LTL typically hovers in the high 80s or low 90s. Companies like Estes are investing heavily in advanced routing software and automation to reduce miles driven and labor costs, directly impacting their ability to compete on price and service while maintaining healthy profitability.

Pricing Discipline and General Rate Increases (GRIs)

Despite periods of softer demand, Less-Than-Truckload (LTL) carriers, including Estes Express Lines, have demonstrated strong pricing discipline. In 2024, many LTL carriers implemented General Rate Increases (GRIs) in the mid-single digit percentages, typically ranging from 4.9% to 6.9%.

This sustained ability to enact rate increases, even with fluctuating freight volumes, underscores the industry's relatively oligopolistic structure and the carriers' strategic emphasis on yield management. For example, many major LTL players reported stable or increased revenue per mile in their 2024 reports, directly attributable to these GRIs.

- Pricing Discipline: LTL carriers have largely maintained pricing discipline, with GRIs in the mid-single digits implemented across the industry in 2024.

- Oligopolistic Nature: The industry's structure, characterized by a few dominant players, facilitates the maintenance of these rate increases.

- Yield Management Focus: Carriers are strategically prioritizing yield management, ensuring profitability even during periods of softer demand.

Network Density and Service Coverage

In the Less Than Truckload (LTL) sector, a robust and widespread terminal network is paramount. This density allows for efficient consolidation of shipments and ensures prompt delivery times, directly impacting customer satisfaction and operational efficiency. Estes Express Lines recognizes this, consistently investing in expanding its physical footprint.

Estes' strategic focus on terminal acquisition and expansion is a clear indicator of its commitment to strengthening its competitive advantage. The company's objective to surpass 14,000 doors by 2026 underscores its aggressive growth strategy. This expansion directly translates into an enhanced ability to serve a broader customer base and manage a higher volume of freight more effectively.

- Terminal Network Strength: A dense terminal network is a key differentiator in LTL, facilitating efficient freight movement.

- Estes' Investment: Estes is actively acquiring and expanding terminals, aiming for over 14,000 doors by 2026.

- Competitive Edge: This expansion enhances Estes' ability to consolidate freight, improve delivery times, and serve a wider market.

The competitive rivalry within the Less-Than-Truckload (LTL) sector remains intense, driven by established national carriers like Estes Express Lines, Old Dominion, XPO, Saia, FedEx Freight, and ABF Freight. The 2023 exit of Yellow Corporation intensified this rivalry, leading to a scramble for market share and capacity, with Estes actively absorbing former Yellow terminals and freight volumes. This dynamic environment forces carriers to focus on operational efficiency and network optimization to maintain profitability, especially amidst fluctuating freight demand observed throughout 2024 and projected into 2025.

Estes Express Lines, like its peers, is committed to enhancing its competitive standing through strategic network expansion and operational improvements. The company aims to surpass 14,000 doors by 2026, a move designed to bolster its ability to consolidate freight and ensure timely deliveries, thereby strengthening its market position against rivals. This focus on physical infrastructure is complemented by a dedication to maintaining pricing discipline, as evidenced by industry-wide General Rate Increases (GRIs) in the mid-single digit percentages during 2024, typically between 4.9% and 6.9%, underscoring a collective effort to manage yields effectively.

| Key LTL Competitors | 2024 Focus Areas | Competitive Actions |

|---|---|---|

| Estes Express Lines | Network expansion, operational efficiency, yield management | Terminal acquisitions, aiming for 14,000+ doors by 2026, implementing GRIs |

| Old Dominion Freight Line | Service quality, network density, technology adoption | Continued investment in technology and infrastructure to maintain premium service |

| XPO Logistics | Network optimization, cost management, customer service | Strategic network adjustments and focus on improving operating ratios |

| Saia LTL Freight | Regional strength, service expansion, capacity growth | Aggressive expansion into new territories and service offerings |

| FedEx Freight | Integration, efficiency, customer solutions | Leveraging its integrated network for LTL services, optimizing operations |

| ABF Freight (ArcBest) | Service reliability, technology, customer relationships | Focus on core LTL strengths and enhancing customer experience |

SSubstitutes Threaten

For shippers needing to move significant freight volumes, Full Truckload (TL) services can act as a direct alternative to Less Than Truckload (LTL) options, particularly when TL rates become more competitive. This substitution becomes more pronounced when the TL market experiences a downturn, making it economically viable for larger LTL shipments to transition to TL. For instance, in early 2024, a softening TL market saw spot rates decrease, potentially encouraging some shippers to consolidate their freight into full truckloads, thereby impacting the demand for Estes' core LTL services.

For very small, lightweight shipments, parcel carriers present a strong alternative to Less Than Truckload (LTL) services, often proving more economical. This is particularly true as e-commerce continues its rapid expansion.

The growth of online retail, while beneficial for the freight industry overall, also fuels a significant increase in parcel volumes. This trend can pull the smallest LTL shipments towards parcel services, as companies seek the most cost-efficient option for these lighter packages.

For non-time-critical, long-haul freight, especially bulk commodities, rail and intermodal services present a more economical option compared to Less Than Truckload (LTL) shipping. While LTL offers superior flexibility and faster transit for a wider variety of goods, these alternative transportation methods can indeed replace LTL for specific freight categories.

In 2024, the U.S. freight rail industry moved approximately 1.3 billion tons of goods, showcasing its significant capacity for bulk transport. Intermodal freight, which combines rail and truck, saw continued growth, with volumes often fluctuating based on fuel prices and economic demand, demonstrating its competitive positioning against trucking for longer distances.

Shipper-Owned Private Fleets

Large enterprises with substantial and consistent shipping volumes might opt to develop and enlarge their own private fleets. This strategic move directly substitutes for relying on commercial Less Than Truckload (LTL) carriers like Estes Express Lines. By managing their own logistics, these businesses gain enhanced control over their supply chains and can achieve cost efficiencies, particularly when their shipping needs are predictable and high-volume.

The decision to invest in private fleets is influenced by several factors, including the desire for greater operational autonomy and the potential for long-term cost savings. For instance, a company shipping millions of pounds of goods annually might find that the capital investment in trucks and trailers, along with operational expenses, is offset by reduced per-unit shipping costs compared to commercial LTL rates. This trend can exert pressure on LTL providers by reducing the available market share for their services.

- Increased Control: Private fleets offer businesses direct oversight of their transportation operations, from scheduling to delivery.

- Potential Cost Savings: For high-volume shippers, owning a fleet can sometimes be more economical than paying commercial LTL rates over the long term.

- Supply Chain Integration: Operating a private fleet allows for tighter integration with a company's overall supply chain and inventory management.

Air Cargo for Time-Critical Freight

For shipments where speed is paramount, air cargo presents a significant substitute threat to LTL (Less Than Truckload) services. While air freight generally carries a higher cost, its ability to deliver goods much faster makes it an attractive option for time-critical and high-value shipments. This alternative directly impacts LTL's ability to capture the most urgent segments of the freight market.

The cost differential is a key factor, but the time savings can outweigh the expense for certain industries. For example, in 2024, the average cost per kilogram for air cargo can range from $1.50 to $5.00 or more, depending on the route and urgency, compared to LTL which might be in the range of $0.20 to $0.80 per kilogram. This substantial price gap highlights the trade-off customers make for expedited delivery.

- Air cargo offers significantly faster transit times, crucial for time-sensitive shipments.

- The higher cost of air cargo is offset by the value of expedited delivery for certain goods.

- This substitute limits LTL's market share in the urgent and high-value freight niche.

For shippers needing to move significant freight volumes, Full Truckload (TL) services can act as a direct alternative to Less Than Truckload (LTL) options, particularly when TL rates become more competitive. This substitution becomes more pronounced when the TL market experiences a downturn, making it economically viable for larger LTL shipments to transition to TL. For instance, in early 2024, a softening TL market saw spot rates decrease, potentially encouraging some shippers to consolidate their freight into full truckloads, thereby impacting the demand for Estes' core LTL services.

For very small, lightweight shipments, parcel carriers present a strong alternative to Less Than Truckload (LTL) services, often proving more economical. This is particularly true as e-commerce continues its rapid expansion.

The growth of online retail, while beneficial for the freight industry overall, also fuels a significant increase in parcel volumes. This trend can pull the smallest LTL shipments towards parcel services, as companies seek the most cost-efficient option for these lighter packages.

For non-time-critical, long-haul freight, especially bulk commodities, rail and intermodal services present a more economical option compared to Less Than Truckload (LTL) shipping. While LTL offers superior flexibility and faster transit for a wider variety of goods, these alternative transportation methods can indeed replace LTL for specific freight categories.

In 2024, the U.S. freight rail industry moved approximately 1.3 billion tons of goods, showcasing its significant capacity for bulk transport. Intermodal freight, which combines rail and truck, saw continued growth, with volumes often fluctuating based on fuel prices and economic demand, demonstrating its competitive positioning against trucking for longer distances.

Large enterprises with substantial and consistent shipping volumes might opt to develop and enlarge their own private fleets. This strategic move directly substitutes for relying on commercial Less Than Truckload (LTL) carriers like Estes Express Lines. By managing their own logistics, these businesses gain enhanced control over their supply chains and can achieve cost efficiencies, particularly when their shipping needs are predictable and high-volume.

The decision to invest in private fleets is influenced by several factors, including the desire for greater operational autonomy and the potential for long-term cost savings. For instance, a company shipping millions of pounds of goods annually might find that the capital investment in trucks and trailers, along with operational expenses, is offset by reduced per-unit shipping costs compared to commercial LTL rates. This trend can exert pressure on LTL providers by reducing the available market share for their services.

- Increased Control: Private fleets offer businesses direct oversight of their transportation operations, from scheduling to delivery.

- Potential Cost Savings: For high-volume shippers, owning a fleet can sometimes be more economical than paying commercial LTL rates over the long term.

- Supply Chain Integration: Operating a private fleet allows for tighter integration with a company's overall supply chain and inventory management.

For shipments where speed is paramount, air cargo presents a significant substitute threat to LTL (Less Than Truckload) services. While air freight generally carries a higher cost, its ability to deliver goods much faster makes it an attractive option for time-critical and high-value shipments. This alternative directly impacts LTL's ability to capture the most urgent segments of the freight market.

The cost differential is a key factor, but the time savings can outweigh the expense for certain industries. For example, in 2024, the average cost per kilogram for air cargo can range from $1.50 to $5.00 or more, depending on the route and urgency, compared to LTL which might be in the range of $0.20 to $0.80 per kilogram. This substantial price gap highlights the trade-off customers make for expedited delivery.

- Air cargo offers significantly faster transit times, crucial for time-sensitive shipments.

- The higher cost of air cargo is offset by the value of expedited delivery for certain goods.

- This substitute limits LTL's market share in the urgent and high-value freight niche.

The threat of substitutes for LTL services is multifaceted, encompassing full truckload (TL) for larger shipments, parcel carriers for smaller ones, rail and intermodal for bulk and long-haul, private fleets for high-volume shippers seeking control, and air cargo for time-sensitive deliveries. Each of these alternatives offers distinct advantages, impacting LTL providers by potentially diverting volumes and influencing pricing strategies.

| Substitute Option | Key Advantages | Impact on LTL | 2024 Data/Context |

|---|---|---|---|

| Full Truckload (TL) | Cost-effective for larger volumes, especially during TL market downturns. | Can divert larger LTL shipments when TL rates are competitive. | Softening TL spot rates in early 2024 made TL more attractive for consolidated shipments. |

| Parcel Carriers | Economical for very small, lightweight shipments. | Captures the smallest LTL shipments, particularly with e-commerce growth. | E-commerce expansion fuels parcel volume, pulling lighter LTL freight. |

| Rail & Intermodal | More economical for non-time-critical, long-haul, bulk commodities. | Replaces LTL for specific freight categories focused on cost and bulk. | U.S. rail moved ~1.3 billion tons in 2024; intermodal growth continues. |

| Private Fleets | Increased control, potential long-term cost savings for high-volume shippers. | Reduces market share for commercial LTL by offering in-house logistics. | High-volume shippers may find private fleet investment offset by reduced per-unit costs. |

| Air Cargo | Significantly faster transit times for time-critical, high-value shipments. | Limits LTL's share in the urgent and high-value freight niche. | 2024 air cargo costs $1.50-$5.00+/kg vs. LTL's $0.20-$0.80/kg, highlighting speed-cost trade-off. |

Entrants Threaten

Entering the Less-Than-Truckload (LTL) sector, where Estes Express Lines operates, demands immense capital. Newcomers need to invest heavily in a substantial fleet of tractors and trailers, a significant undertaking. For instance, a single Class 8 truck can cost upwards of $150,000, and a trailer an additional $50,000 to $100,000, quickly escalating costs for a competitive fleet.

Beyond the vehicles, establishing a robust network of terminals and distribution centers is crucial for efficient LTL operations. Acquiring or building these facilities represents another substantial financial hurdle, often running into millions of dollars. This high upfront investment creates a formidable barrier, deterring many potential new entrants from challenging established players like Estes.

The Less-Than-Truckload (LTL) shipping industry, where Estes Express Lines operates, demands a significant upfront investment in infrastructure. A key barrier for new entrants is the necessity of establishing a dense terminal network. This network, comprising numerous strategically placed facilities for sorting, consolidation, and distribution, is crucial for efficient operations and cost-effectiveness in LTL. For instance, in 2024, major LTL carriers maintain hundreds of terminals across the country to serve their customer base effectively.

Beyond physical infrastructure, advanced software solutions are indispensable for modern LTL carriers. These systems are vital for sophisticated load path planning, route optimization, and real-time shipment tracking, all of which directly impact profitability. Developing or acquiring such complex technological capabilities represents a substantial financial and logistical hurdle, deterring potential new competitors from entering the market and challenging existing players like Estes.

Established brand reputation and deep customer relationships present a significant barrier to new entrants in the Less-Than-Truckload (LTL) sector. Companies like Estes Express Lines have cultivated loyalty over decades, making it challenging for newcomers to gain traction. In 2024, the LTL market continues to value reliability and consistent service, areas where incumbents have a distinct advantage.

Building trust and acquiring a substantial customer base is an uphill battle for new LTL carriers. Shippers often prioritize proven track records and existing partnerships, especially for critical supply chain components. This ingrained preference for established providers means new entrants face a steep climb to achieve significant market share.

Regulatory Hurdles and Compliance Costs

The trucking sector faces significant regulatory burdens that act as a barrier to new entrants. These include stringent safety standards, environmental regulations, and complex labor laws. Navigating these requirements demands substantial investment in compliance and operational adjustments.

Specifically, the introduction of enhanced English proficiency and anti-fraud measures for Commercial Driver's License (CDL) holders, set to be fully implemented in 2025, adds another layer of complexity and cost for any new company looking to enter the market. This means new players must not only meet existing operational demands but also invest in training and verification processes to ensure compliance with these evolving regulations.

- Safety Regulations: Federal Motor Carrier Safety Administration (FMCSA) mandates cover vehicle maintenance, driver hours of service, and drug/alcohol testing.

- Environmental Compliance: Emissions standards and fuel efficiency requirements necessitate investment in newer, compliant fleets.

- Labor Laws: Wage and hour laws, along with driver classification, impact operational costs and human resource management.

- CDL Modernization (2025): New requirements for CDL holders, including English proficiency and anti-fraud measures, increase initial onboarding costs and administrative overhead for new entrants.

Difficulty in Achieving Lane Density for Profitability

New entrants into the Less-Than-Truckload (LTL) sector, like those considering challenging established players such as Estes Express Lines, face a significant hurdle in building sufficient lane density. This means that initially, their trucks would likely operate with a substantial amount of empty space, a condition that directly translates into considerable financial losses. For instance, in 2024, the LTL industry's operating ratios, a measure of profitability, remained tight, with many carriers hovering around the 90% mark, indicating little room for inefficiency.

The path to profitability in LTL is heavily reliant on achieving a robust network density and consistent freight volume. This process is not quick; it requires years of sustained investment in infrastructure, technology, and customer acquisition. Without this critical mass, new entrants are unlikely to compete effectively on price or service against incumbents who benefit from established, efficient routes.

- Lane Density Challenge: New LTL carriers start with sparse routes, leading to underutilized capacity and immediate financial strain.

- Profitability Threshold: Achieving the scale needed for profitable operations demands extensive time and substantial, ongoing capital infusion.

- Investment Barrier: The high cost and long payback period for network development act as a significant deterrent to potential new entrants in 2024.

- Competitive Disadvantage: Incumbents like Estes Express Lines leverage their existing density to offer more competitive pricing and reliable service.

The threat of new entrants in the Less-Than-Truckload (LTL) sector, where Estes Express Lines operates, is significantly mitigated by the immense capital required to establish a competitive presence. New companies must invest heavily in a substantial fleet of tractors and trailers, with a single Class 8 truck costing upwards of $150,000 in 2024, and trailers adding another $50,000 to $100,000 each.

Furthermore, building a robust terminal network, essential for efficient LTL operations, represents another substantial financial hurdle, often running into millions of dollars. This high upfront investment, coupled with the need for advanced technological solutions for route optimization and shipment tracking, creates formidable barriers that deter many potential new entrants from challenging established players like Estes.

The LTL industry's reliance on established brand reputation and deep customer relationships also presents a significant barrier. Companies like Estes have cultivated decades of loyalty, making it difficult for newcomers to gain traction in a market that, as of 2024, continues to value reliability and consistent service above all else.

Regulatory burdens, including stringent safety standards, environmental compliance, and evolving labor laws, add another layer of complexity and cost. The upcoming CDL modernization in 2025, with new requirements for English proficiency and anti-fraud measures, further increases initial onboarding costs and administrative overhead for any new company entering the market.

| Barrier Category | Key Components | Estimated Cost/Impact (Illustrative) | Relevance to New Entrants |

| Capital Investment | Tractor & Trailer Fleet | $200,000+ per truck/trailer unit | Requires massive upfront capital for competitive fleet size. |

| Infrastructure | Terminal Network Development | Millions of dollars per facility | Essential for efficient LTL operations; high acquisition/construction costs. |

| Technology | Logistics Software & Systems | Significant investment in development/acquisition | Crucial for route optimization, tracking, and profitability. |

| Brand & Relationships | Customer Acquisition & Trust | Years of consistent service & investment | Incumbents benefit from established loyalty and proven track records. |

| Regulatory Compliance | Safety, Environmental, Labor Laws | Ongoing compliance costs, training, and potential fines | Navigating complex regulations adds significant operational overhead. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Estes Express Lines is built upon a foundation of industry-specific market research reports, financial filings from publicly traded competitors, and data from trucking industry associations to accurately assess competitive pressures.