Estes Express Lines PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Estes Express Lines Bundle

Navigate the complex external landscape impacting Estes Express Lines with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are reshaping the logistics industry and influencing the company's strategic direction. Gain a critical advantage by uncovering these vital insights. Download the full PESTLE analysis now to fortify your market strategy and make informed decisions.

Political factors

The freight transportation sector, including Estes Express Lines, operates under a robust framework of federal and state regulations. These rules, overseen by bodies like the Department of Transportation (DOT) and the Federal Motor Carrier Safety Administration (FMCSA), dictate crucial aspects of operations, from driver safety and hours-of-service to emissions standards and vehicle maintenance. For instance, ongoing discussions around potential updates to hours-of-service rules in 2024 and 2025 could significantly affect driver scheduling and delivery times.

Compliance with these mandates directly impacts Estes' operational costs and efficiency. Stricter emissions standards, for example, may necessitate investments in newer, more fuel-efficient fleets, a trend already evident with many carriers prioritizing EPA SmartWay certified vehicles. Estes' ability to adapt its fleet and operational practices to these evolving regulatory landscapes is paramount to maintaining competitiveness and avoiding penalties.

Fluctuations in international trade policies and tariffs directly impact freight volumes. For Estes, which provides global services, changes in trade relationships with key partners like Canada and Mexico are significant. For instance, the USMCA agreement, which replaced NAFTA, aimed to streamline cross-border trade, potentially benefiting LTL services. However, ongoing adjustments and potential new tariffs can introduce uncertainty, affecting demand for Estes' cross-border freight capabilities.

Government investment in transportation infrastructure, such as roads, bridges, and intermodal facilities, directly influences freight movement efficiency. For 2024, the U.S. Department of Transportation projected significant outlays under the Infrastructure Investment and Jobs Act, aiming to modernize the nation's freight network.

Improved infrastructure, like upgraded highways and expanded port facilities, can shorten transit times and reduce fuel costs for carriers like Estes Express Lines. This translates to more reliable service and potentially lower operational expenses, crucial in the competitive logistics landscape.

Conversely, a lack of investment can lead to increased congestion on key freight routes, impacting delivery schedules and raising operational costs. For instance, delays on aging road networks can add substantial time and fuel consumption to long-haul routes.

Political Stability and Geopolitical Events

Political stability and geopolitical events significantly influence the logistics sector. Instability, whether domestic or international, can lead to supply chain disruptions and affect freight volumes, directly impacting companies like Estes Express Lines. For instance, the ongoing geopolitical tensions in Eastern Europe and the Middle East continue to pose challenges, requiring adaptable strategies for routing and cost management.

Global events can force significant operational adjustments. The disruptions experienced in the Red Sea in late 2023 and early 2024 serve as a prime example. Shipping companies rerouted vessels around the Cape of Good Hope, adding considerable transit time and increasing costs, which ripple through the entire supply chain. Estes must factor these extended lead times and potential surcharges into their planning and client communications to maintain service reliability.

- Geopolitical Risk Impact: Global conflicts and trade disputes can disrupt international shipping lanes, increasing transit times and operational costs for freight carriers.

- Red Sea Diversions: Attacks on commercial vessels in the Red Sea led to widespread rerouting in late 2023 and early 2024, adding an estimated 7-10 days to journeys between Asia and Europe and increasing shipping costs by up to 30%.

- Supply Chain Resilience: Estes, like other logistics providers, must build resilience into their networks to mitigate the impact of unforeseen political events and ensure consistent service delivery.

- Client Expectations: Managing client expectations regarding delivery schedules and costs becomes crucial when geopolitical events necessitate route changes or surcharges.

Labor Laws and Unionization Trends

Changes in labor laws, such as potential federal minimum wage hikes or new benefit mandates, could significantly increase Estes Express Lines' operational costs. For instance, a national minimum wage increase to $17 per hour, as proposed by some lawmakers in 2024, would directly impact entry-level positions within the company.

Unionization trends are also a key consideration. While union membership in the private sector has seen a general decline, there's renewed interest in unionization within transportation sectors, potentially affecting Estes' labor relations and wage negotiations. For example, Teamsters' successful contract negotiations with other major carriers in late 2023 and early 2024 set new benchmarks for driver compensation and benefits.

Government policies directly impacting driver recruitment and retention are critical. The trucking industry continued to grapple with a driver shortage in 2024, with the American Trucking Associations estimating a deficit of over 78,000 drivers. Regulations concerning driver hours of service, training standards, and the introduction of autonomous trucking technologies will shape Estes' ability to maintain a robust workforce.

- Minimum Wage Impact: A hypothetical increase in the federal minimum wage could raise labor expenses for Estes, particularly for support staff and entry-level roles.

- Union Activity: Increased union organizing efforts in the logistics sector could lead to higher wage demands and improved benefits for drivers and warehouse employees at Estes.

- Driver Shortage Mitigation: Government initiatives aimed at easing the driver shortage, such as expanded CDL training programs or changes to working condition regulations, will be crucial for Estes' operational capacity.

- Regulatory Landscape: Evolving regulations on driver fatigue, safety standards, and the integration of new technologies will necessitate ongoing adaptation and investment by Estes.

Government policies and political stability significantly shape the operational landscape for Estes Express Lines. Regulatory frameworks, encompassing everything from driver safety to emissions, directly influence costs and efficiency. For instance, potential updates to hours-of-service rules in 2024-2025 could alter scheduling and delivery times.

Trade agreements and geopolitical events also play a crucial role. Changes in international trade policies can impact freight volumes, while global instability, such as the Red Sea disruptions in late 2023 and early 2024, necessitates adaptable routing and cost management strategies.

Labor laws and unionization trends are critical considerations for Estes. Potential minimum wage hikes or new benefit mandates could increase operational expenses, and renewed interest in unionization within the transportation sector may affect wage negotiations, with benchmarks set by recent Teamsters' contracts.

Government initiatives aimed at addressing the trucking driver shortage, estimated at over 78,000 drivers by the ATA in 2024, will be vital for Estes' workforce capacity. Evolving regulations on driver fatigue, training, and autonomous trucking will also shape future operations.

What is included in the product

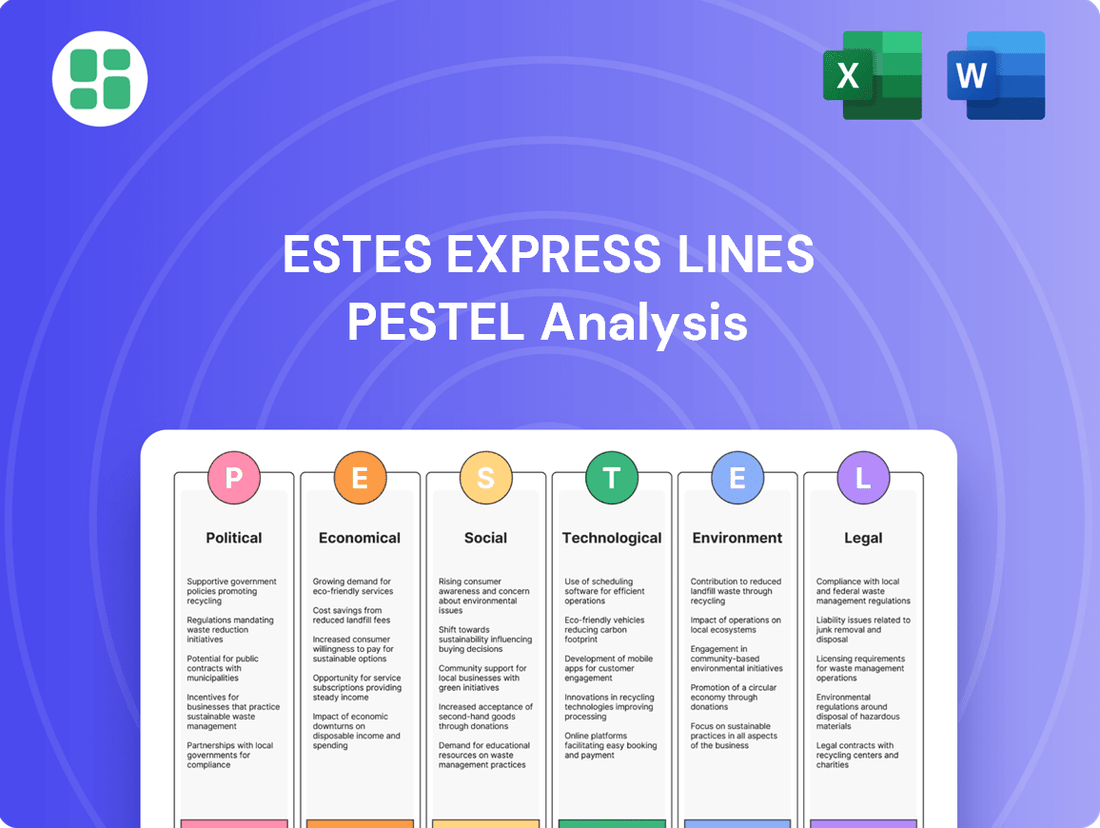

This PESTLE analysis examines the external macro-environmental factors impacting Estes Express Lines across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering a comprehensive view of the industry landscape.

A concise PESTLE analysis for Estes Express Lines offers a pain point reliever by providing easily digestible insights into external factors, enabling proactive strategy adjustments and mitigating potential disruptions.

Economic factors

The demand for Less-Than-Truckload (LTL) services, like those offered by Estes Express Lines, is intrinsically tied to the nation's economic pulse. Robust economic expansion fuels manufacturing output and consumer spending, directly translating into increased freight volumes and potentially favorable pricing for carriers. For instance, the U.S. GDP growth rate, projected to be around 2.5% for 2024, supports higher freight demand.

Conversely, economic slowdowns, often termed 'freight recessions,' can significantly impact the industry. During these periods, reduced industrial activity and consumer purchasing power lead to lower freight volumes. This often results in industry overcapacity and intense downward pressure on freight rates, a situation that became evident in late 2024 as economic indicators showed a cooling trend.

Fuel is a significant cost for freight companies like Estes Express Lines, so changes in diesel prices directly impact their bottom line. For instance, in early 2024, diesel prices saw fluctuations, with averages hovering around $3.80-$4.00 per gallon nationally, a considerable expense for a large fleet.

If fuel costs rise sharply, it can squeeze Estes' profits unless they can pass those costs on through fuel surcharges or become more efficient. For example, a sustained 10% increase in fuel prices could add millions in operating costs annually for a carrier of Estes' size.

Estes actively works to lessen the impact of fuel price swings. They achieve this by fine-tuning their delivery routes to be shorter and more direct, and by investing in newer, more fuel-efficient trucks. These efforts are crucial for maintaining profitability in a volatile market.

Interest rate fluctuations directly impact Estes Express Lines' cost of capital for significant investments like fleet upgrades or new terminal construction. While the company's debt-free approach mitigates direct borrowing costs, the broader economic environment shaped by interest rates influences customer demand for shipping services. For instance, a rising interest rate environment, as seen with the Federal Reserve's aggressive rate hikes in 2022 and 2023 to combat inflation, can slow consumer spending, thereby reducing freight volumes for logistics providers.

Inflationary Pressures

Inflationary pressures significantly impact Estes Express Lines' operational expenses. Rising costs for labor, fuel, equipment, maintenance, and insurance directly affect the company's bottom line. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase, with transportation costs contributing to this rise.

Managing these escalating costs is paramount for Estes to sustain profitability and maintain competitive pricing in the freight industry. The company's ability to effectively pass on these increased expenses to customers through timely rate adjustments is a critical factor in navigating an inflationary economic landscape.

- Rising operational costs: Labor, fuel, equipment, and insurance expenses are all susceptible to inflationary increases.

- Profitability challenge: Estes must absorb or pass on these rising costs to maintain healthy profit margins.

- Pricing strategy: The capacity to implement rate increases is vital for offsetting inflation's impact on revenue.

- Economic indicator: Inflation rates, such as the Producer Price Index (PPI) for transportation services, provide insight into industry cost pressures.

E-commerce Growth and Consumer Spending

The persistent expansion of e-commerce directly fuels the need for robust and often urgent Less-Than-Truckload (LTL) and final-mile delivery services. Estes Express Lines, with its extensive array of shipping solutions, is well-positioned to leverage evolving consumer buying habits and the increasing demand for swift, dependable delivery. For instance, e-commerce sales in the US were projected to reach $1.14 trillion in 2024, representing a significant opportunity for logistics providers.

Estes' ability to adapt to these shifts is crucial. The company's network and service offerings are designed to meet the challenges presented by the growing volume of online orders, which frequently require specialized handling and expedited transit times. This aligns with consumer expectations for rapid fulfillment, a trend that shows no signs of abating.

- E-commerce Dominance: Online retail continues to capture a larger share of consumer spending, driving demand for specialized logistics.

- Delivery Speed Expectations: Consumers increasingly expect faster delivery times, putting pressure on LTL and final-mile services.

- Estes' Strategic Fit: The company's comprehensive service portfolio is designed to address these evolving consumer demands effectively.

- Market Growth: The continued expansion of the e-commerce sector presents a substantial growth avenue for logistics companies like Estes.

The economic landscape directly influences freight demand, with GDP growth acting as a key indicator. For 2024, U.S. GDP growth was anticipated to be around 2.5%, supporting increased freight volumes. However, economic slowdowns, as observed in late 2024, can lead to reduced industrial activity and lower freight rates due to overcapacity.

Fuel prices are a critical operating expense. In early 2024, national average diesel prices ranged from $3.80 to $4.00 per gallon, representing a significant cost for large fleets. Estes' profitability is sensitive to these fluctuations, with a 10% fuel price increase potentially adding millions in annual operating costs.

Inflation impacts all operational costs, from labor and fuel to equipment and insurance. The rising U.S. Consumer Price Index (CPI), with transportation costs being a contributing factor, necessitates strategic pricing adjustments by Estes to maintain margins and competitiveness.

The burgeoning e-commerce sector, projected to reach $1.14 trillion in U.S. sales for 2024, is a major driver for LTL and final-mile delivery services. Estes is positioned to capitalize on this trend, as consumer demand for rapid and reliable delivery continues to grow.

What You See Is What You Get

Estes Express Lines PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Estes Express Lines delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain immediate access to this detailed report upon completing your purchase.

Sociological factors

The trucking industry, including Estes Express Lines, continues to grapple with a persistent shortage of qualified drivers. This scarcity is driven by an aging workforce, with the average age of a truck driver in the US hovering around 46 years old, and demanding schedules that lead to significant time away from home, impacting retention rates.

Estes Express Lines actively addresses these labor dynamics through robust employee training and comprehensive safety programs. These initiatives are crucial for not only attracting new talent but also for retaining experienced drivers, thereby mitigating the ongoing driver shortage and ensuring operational continuity.

Customers now demand speed and transparency, a trend amplified by e-commerce growth. Real-time tracking is no longer a luxury but an expectation, pushing logistics providers to offer constant updates.

Estes Express Lines needs to invest in technology that supports this, like advanced tracking systems and predictive analytics. In 2024, the global last-mile delivery market was valued at over $100 billion, highlighting the immense pressure to innovate in customer service.

Meeting these evolving expectations is crucial for maintaining customer loyalty and a competitive advantage. A focus on seamless communication and a superior customer experience will be key differentiators for Estes.

The trucking industry, including companies like Estes Express Lines, faces a significant challenge in its workforce demographics. The average age of a truck driver in the United States has been a concern for years, with many drivers nearing retirement age. For instance, in 2023, the average age of a commercial truck driver was reported to be around 46 years old, highlighting a need to attract younger individuals to the profession.

To ensure long-term sustainability, carriers must actively work on attracting a more diverse talent pool. This means going beyond traditional recruitment methods and adapting workplace culture to be more inclusive and appealing to a wider range of individuals, including women and minority groups who are currently underrepresented in the industry. Estes, like its peers, will likely need to focus on improving job satisfaction and career progression to retain talent.

Safety and Public Perception

Public perception of the trucking industry, particularly concerning road safety, directly impacts regulatory scrutiny and a company's standing within communities. Negative perceptions can lead to stricter operating rules and strained local relationships.

Estes Express Lines actively cultivates a positive public image through its commitment to safety. Initiatives like their Million Mile Driver Program, which recognizes drivers for achieving one million accident-free miles, not only reinforce this commitment but also serve as a powerful tool for attracting and retaining experienced, safety-conscious professionals. In 2023, Estes reported a significant portion of its driver fleet achieving this milestone, underscoring their dedication to safe operations.

- Safety Culture: Estes' focus on safety is a cornerstone of its brand, influencing public trust and regulatory interactions.

- Driver Retention: Programs recognizing safe driving contribute to attracting and keeping skilled drivers, a critical factor in the industry.

- Industry Perception: A strong safety record helps to counter broader negative stereotypes about trucking safety.

Employee Well-being and Engagement

Prioritizing employee well-being and engagement is paramount for Estes Express Lines in the demanding logistics sector, directly impacting operational efficiency and staff retention. The company’s commitment is evident through initiatives like the 'Open Heart, Open Road' campaign, designed to support drivers' mental and physical health.

Estes invests significantly in its workforce, with employees receiving an average of 120 hours of training annually, a figure that underscores their dedication to skill development and operational readiness. This focus on comprehensive training and fostering a supportive culture directly contributes to higher employee engagement and a more stable workforce, crucial for maintaining service quality.

- Employee Retention: Estes’ focus on well-being and training aims to reduce turnover, a significant cost in the trucking industry.

- Operational Efficiency: Engaged and well-trained employees are more productive and less prone to errors, enhancing overall service delivery.

- Industry Benchmarking: The 120 hours of annual training per employee positions Estes favorably compared to industry averages, signaling a strong investment in human capital.

- Safety Culture: Initiatives promoting well-being often correlate with improved safety records, a critical metric for transportation companies.

Sociological factors significantly shape the trucking industry, influencing everything from workforce availability to customer expectations. An aging driver demographic, with the average age around 46 in 2023, presents a persistent challenge for companies like Estes Express Lines, necessitating strategies to attract and retain younger talent.

Public perception, particularly regarding safety, directly impacts regulatory environments and community relations. Estes actively cultivates a positive image through its strong safety culture, exemplified by its Million Mile Driver Program, which recognized a substantial number of drivers for accident-free milestones in 2023.

Employee well-being and engagement are critical for operational success. Estes invests heavily in its workforce, providing an average of 120 hours of training annually, which enhances skill development and fosters a stable, productive team, contributing to higher service quality.

| Factor | Impact on Estes Express Lines | Supporting Data/Initiatives |

|---|---|---|

| Driver Demographics | Workforce shortage due to aging drivers | Average driver age ~46 (2023); Need to attract younger talent |

| Public Perception | Influences regulatory scrutiny and community trust | Million Mile Driver Program; Strong safety record |

| Employee Well-being & Engagement | Impacts retention, productivity, and service quality | 120 hours average annual training per employee; 'Open Heart, Open Road' campaign |

Technological factors

Estes Express Lines is actively integrating advanced AI tools, such as Optym RouteMax, to sharpen its route optimization strategies. This focus on AI is directly aimed at boosting linehaul efficiency and curbing fuel consumption, a critical factor in the logistics industry.

The company's embrace of AI and machine learning is a significant driver in its pursuit of enhanced operational performance and strategic foresight. These technologies are being deployed across various functions, from more accurate demand forecasting to streamlining warehouse operations and enabling real-time dock management, ultimately improving overall efficiency.

Real-time data and advanced analytics are transforming logistics. Estes Express Lines is leveraging this by enhancing its Pickup Visibility Application, offering customers seamless, real-time updates on their shipments. This focus on immediate information empowers better decision-making and elevates the customer experience.

Furthering this commitment to transparency, Estes is developing shipment-level emissions reporting capabilities. This initiative, expected to be a significant advancement by 2024-2025, will provide customers with crucial environmental impact data, fostering trust and accountability within the supply chain.

Shippers increasingly expect a smooth, digital experience, making digital freight platforms that provide connectivity and real-time data crucial. Estes Express Lines is investing in advanced technology, including CRM tools like Salesforce, to integrate its systems, streamline shipping processes, and improve how different parts of the business talk to each other, all to meet these customer demands.

Fleet Modernization and Advanced Vehicle Technologies

Estes Express Lines is actively investing in modern fleet technology to boost efficiency and sustainability. This includes aerodynamic upgrades and exploring alternative fuel options like electric tractor-trailers, aiming to cut fuel consumption and lessen their environmental footprint. For instance, by 2024, the trucking industry saw significant interest in electric trucks, with manufacturers like Volvo and Freightliner delivering models designed for long-haul, aiming for ranges that can compete with diesel.

The company's ongoing fleet modernization efforts are crucial for enhancing operational performance. By consistently upgrading their vehicles and investigating new technologies, Estes is positioning itself to meet evolving industry standards and customer expectations for greener logistics solutions. This strategic approach is vital in a sector where fuel costs and emissions regulations are increasingly impactful.

- Fleet Upgrades: Estes continues to invest in newer, more fuel-efficient trucks, a trend that accelerated through 2024 as manufacturers rolled out advanced models.

- Aerodynamic Enhancements: These technologies, such as trailer skirts and gap reducers, are standard on many new trucks and can improve fuel economy by up to 5-10%.

- Alternative Fuels: While still developing, the exploration of electric and alternative fuel vehicles is a key technological factor for future fleet operations, with significant industry investment in charging infrastructure and vehicle development throughout 2024-2025.

Cybersecurity and Data Protection

The increasing digitization of logistics operations for companies like Estes Express Lines makes robust cybersecurity essential. Protecting sensitive customer data, operational information, and critical infrastructure from escalating threats such as ransomware is paramount. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, highlighting the significant financial risks involved.

As Estes integrates more advanced technologies, including AI and interconnected systems, the focus on data reliability, security, and transparency intensifies. A data breach could severely damage customer trust and incur substantial recovery costs. For instance, the average cost of a data breach in the transportation sector reached $4.15 million in 2023, according to IBM's Cost of a Data Breach Report.

- Escalating Cyber Threats: The logistics sector is a prime target for cyberattacks, with ransomware incidents on the rise.

- Data Integrity and Trust: Maintaining reliable and secure data is crucial for operational efficiency and customer confidence.

- AI and Interconnectivity Risks: The expansion of AI and interconnected systems introduces new vulnerabilities that require advanced security protocols.

- Financial Ramifications: Cyber incidents can lead to significant financial losses through recovery costs, operational downtime, and reputational damage.

Estes Express Lines is leveraging advanced technologies like AI for route optimization and demand forecasting, aiming to boost efficiency. By 2024, the trucking industry saw significant investment in electric and alternative fuel vehicles, with companies like Volvo and Freightliner introducing long-haul models.

The company's commitment to real-time data enhances customer experience through applications like the Pickup Visibility Application. Furthermore, Estes is developing shipment-level emissions reporting, expected to be a key feature by 2024-2025, increasing supply chain transparency.

Cybersecurity is a critical focus, given that the global cost of cybercrime was projected to reach $10.5 trillion annually in 2024. The transportation sector faced an average data breach cost of $4.15 million in 2023, underscoring the need for robust data protection as Estes expands its digital operations.

| Technology Area | Estes Express Lines Focus | Industry Trend/Data (2023-2025) |

| AI & Machine Learning | Route optimization, demand forecasting, warehouse efficiency | Increased adoption for operational gains |

| Fleet Technology | Aerodynamic upgrades, alternative fuels (electric) | Significant investment in electric truck development and charging infrastructure |

| Digitalization & Data | Real-time visibility apps, CRM integration | Shipper demand for digital experience, rising cybersecurity costs |

| Cybersecurity | Protecting customer data and operational infrastructure | Global cybercrime costs projected at $10.5T (2024); Transportation data breach cost $4.15M (2023) |

Legal factors

Estes Express Lines navigates a complex web of federal and state transportation safety regulations, overseen by agencies like the Department of Transportation (DOT) and the Federal Motor Carrier Safety Administration (FMCSA). These rules dictate everything from vehicle maintenance standards and driver licensing to strict hours-of-service limitations, ensuring the safe operation of their fleet.

Adherence to these mandates is critical for Estes. Non-compliance can lead to significant penalties, including substantial fines and potential suspension or revocation of operating authority, directly impacting their ability to conduct business. For instance, in 2023, the FMCSA reported over $200 million in fines levied against motor carriers for safety violations, highlighting the financial risks involved.

Increasingly stringent environmental regulations, particularly concerning vehicle emissions and waste disposal, are a significant legal factor for Estes Express Lines. These rules demand ongoing investment in advanced, cleaner technologies and the adoption of more sustainable operational methods to ensure compliance. For instance, the push for reduced greenhouse gas emissions directly impacts fleet modernization and fuel efficiency strategies.

Estes' proactive stance is evident in its ambitious goal of achieving net-zero emissions by 2050. This commitment requires substantial capital allocation towards electric or alternative fuel vehicles and the development of more environmentally sound logistics. Their work on allocated emissions reporting further underscores a dedication to transparency and adherence to evolving environmental legal frameworks.

Estes Express Lines operates under a stringent framework of labor and employment laws. These regulations cover critical areas such as minimum wage, overtime pay, workplace safety standards, and the right to unionize. For instance, the Fair Labor Standards Act (FLSA) dictates many of these requirements, impacting how Estes compensates its drivers and dockworkers.

In 2024, the trucking industry continues to grapple with evolving labor regulations. Potential increases in the federal minimum wage or stricter enforcement of hours-of-service rules could directly affect Estes' operational expenses and driver availability. The National Labor Relations Board (NLRB) also plays a significant role, overseeing collective bargaining processes, which can influence labor relations and contract negotiations.

Data Privacy and Security Laws

The logistics industry's increasing reliance on digital platforms and customer data makes adherence to data privacy laws like the GDPR and CCPA paramount for Estes Express Lines. Failure to comply can lead to significant fines and reputational damage.

Estes must prioritize robust data security measures for storing and processing customer information. For instance, in 2024, data breaches in the transportation sector resulted in an average cost of $3.9 million, highlighting the financial risk of non-compliance.

- GDPR Fines: Up to 4% of annual global turnover or €20 million, whichever is higher.

- CCPA Fines: $2,500 per unintentional violation and $7,500 per intentional violation.

- Data Breach Costs: The average cost of a data breach in the transportation industry reached $3.9 million in 2024.

- Customer Trust: Strong data protection builds customer loyalty and trust, a critical asset in the competitive logistics market.

LTL Freight Classification Changes

The National Motor Freight Traffic Association (NMFTA) is set to introduce substantial LTL freight classification revisions in 2025, transitioning to a density-based framework. This significant shift will impact how freight is categorized and billed, moving away from older, less precise methods.

As a prominent LTL carrier, Estes Express Lines must proactively adjust its pricing structures, operational systems, and customer outreach strategies to comply with these forthcoming regulations. Failure to adapt could lead to billing inaccuracies and compliance issues, potentially affecting revenue and customer relationships.

These changes are critical for maintaining competitive pricing and operational efficiency in the LTL sector. For instance, the new density-based system means that the actual space a shipment occupies relative to its weight will become a primary determinant of its classification, a departure from many existing criteria.

- NMFTA's 2025 LTL Classification Overhaul: A move to a density-based system.

- Estes's Adaptation Imperative: Necessary adjustments to pricing, systems, and customer communication.

- Impact on Billing: Ensuring accuracy and compliance with new density metrics.

- Industry-Wide Shift: Affecting all LTL carriers and shippers.

Estes Express Lines must navigate evolving labor laws, including potential minimum wage increases and stricter hours-of-service enforcement in 2024, which could impact operational costs and driver availability. The National Labor Relations Board (NLRB) also plays a role in collective bargaining, influencing labor relations and contract negotiations.

The upcoming 2025 overhaul of LTL freight classifications by the NMFTA, shifting to a density-based framework, necessitates significant adjustments in Estes' pricing, systems, and customer communication to ensure compliance and maintain competitive billing.

Compliance with data privacy regulations like GDPR and CCPA is crucial, with the average cost of a data breach in the transportation sector reaching $3.9 million in 2024, underscoring the financial and reputational risks of non-compliance.

| Legal Factor | 2024/2025 Impact | Data Point |

| Labor Laws | Potential wage increases, stricter HOS enforcement | NLRB oversees collective bargaining |

| Freight Classification | NMFTA's 2025 density-based shift | Requires system and pricing adjustments |

| Data Privacy | GDPR, CCPA compliance | Average 2024 data breach cost: $3.9 million |

Environmental factors

Estes Express Lines is committed to reducing its environmental impact, aiming for net-zero emissions by 2050. This ambitious goal drives initiatives focused on lowering their carbon footprint across operations.

Key strategies include investing in a more fuel-efficient fleet, incorporating aerodynamic features on trucks, and leveraging advanced AI for route optimization to minimize mileage and fuel consumption. For example, by 2024, Estes aims to have 100% of its fleet meeting stringent emissions standards, a significant improvement from 2020 levels.

The transportation sector is actively shifting towards cleaner energy sources, with natural gas, electric vehicles (EVs), and emerging hydrogen technology gaining traction. This trend presents both opportunities and challenges for logistics companies like Estes Express Lines.

Estes is proactively engaging in this transition, evidenced by their pilot programs for carbon-capture systems and the expansion of their electric forklift fleet. Furthermore, they are increasing their use of natural gas trucks, demonstrating a commitment to reducing their environmental footprint despite the ongoing hurdles in developing widespread alternative fuel infrastructure.

There's a growing demand for businesses to openly share their environmental footprint and prove their supply chains are sustainable. This means companies like Estes Express Lines are under more scrutiny than ever to be transparent about their operations and their impact on the planet.

Estes has responded by releasing its 2024 Sustainability Report, which offers a detailed look at their environmental efforts. This report highlights advancements in areas such as expanding their solar power initiatives and providing clear data on their allocated emissions, thereby boosting stakeholder confidence through enhanced transparency.

Waste Management and Resource Efficiency

Beyond direct emissions, Estes Express Lines, like all logistics companies, faces scrutiny regarding waste management and resource efficiency. This involves minimizing waste generated at terminals and optimizing packaging materials for shipments. For instance, in 2023, the transportation sector globally generated millions of tons of waste, highlighting the industry's impact.

Estes' strategic investments in operational efficiency, particularly through technology adoption, directly address these environmental factors. By optimizing routes and load consolidation, the company reduces fuel consumption, which in turn lessens the need for resource-intensive manufacturing and disposal of related materials. This focus on efficiency inherently contributes to a circular economy approach by minimizing the input of new resources and the output of waste.

- Waste Reduction: Focus on minimizing non-recyclable materials in packaging and operational waste streams.

- Resource Efficiency: Implementing technologies that optimize fuel usage and reduce the consumption of operational supplies.

- Circular Economy Principles: Exploring opportunities for reusing or recycling materials within the supply chain.

- Industry Benchmarking: Tracking waste and resource metrics against industry averages to identify areas for improvement.

Climate Change Impact and Resilience

Climate change presents significant challenges for Estes Express Lines, with an increasing frequency of extreme weather events like hurricanes and floods directly impacting transportation infrastructure and supply chain dependability. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, a sharp increase from previous years, highlighting the growing risk to logistics networks.

To address this, Estes must proactively build resilience into its operational framework and distribution network. This involves strategic investments in infrastructure hardening, diversifying routes, and implementing advanced weather monitoring systems to anticipate and adapt to climate-related disruptions, thereby ensuring consistent service delivery to its customers.

- Increased Weather Volatility: Estes faces heightened risks from severe weather events affecting road conditions and delivery schedules.

- Supply Chain Disruptions: Climate change can cause widespread impacts on raw material availability and manufacturing, indirectly affecting freight volumes.

- Infrastructure Vulnerability: Extreme weather can damage roads, bridges, and terminals, leading to costly repairs and service interruptions.

- Operational Adaptation: Estes needs to develop robust contingency plans and invest in resilient infrastructure to maintain service reliability.

Estes Express Lines is actively addressing its environmental impact, aiming for net-zero emissions by 2050 through fleet modernization and route optimization, with a 2024 goal for 100% of its fleet to meet stringent emissions standards.

The company is investing in cleaner energy sources like natural gas and electric vehicles, piloting carbon capture systems, and expanding its electric forklift fleet to reduce its carbon footprint.

Transparency is key, with Estes' 2024 Sustainability Report detailing progress in solar power initiatives and emissions data, enhancing stakeholder trust.

Estes also focuses on waste reduction and resource efficiency, aiming to minimize operational waste and optimize packaging, contributing to a more circular economy.

| Environmental Factor | Estes' Response/Initiative | 2024/2025 Data/Goals |

|---|---|---|

| Emissions Reduction | Fleet efficiency, alternative fuels, route optimization | Net-zero by 2050; 100% fleet meeting emissions standards by 2024 |

| Cleaner Energy Adoption | Natural gas trucks, electric forklifts, carbon capture pilots | Increased use of natural gas trucks; expansion of electric forklift fleet |

| Transparency & Reporting | Sustainability reports | 2024 Sustainability Report released |

| Waste & Resource Management | Minimizing operational waste, optimizing packaging | Focus on non-recyclable material reduction |

| Climate Change Resilience | Infrastructure hardening, route diversification, weather monitoring | Adapting to increased extreme weather events impacting logistics |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Estes Express Lines is built on a comprehensive review of data from government transportation agencies, economic forecasting firms, and industry-specific publications. We analyze regulatory changes, market trends, and technological advancements to provide a well-rounded view.