Estes Express Lines Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Estes Express Lines Bundle

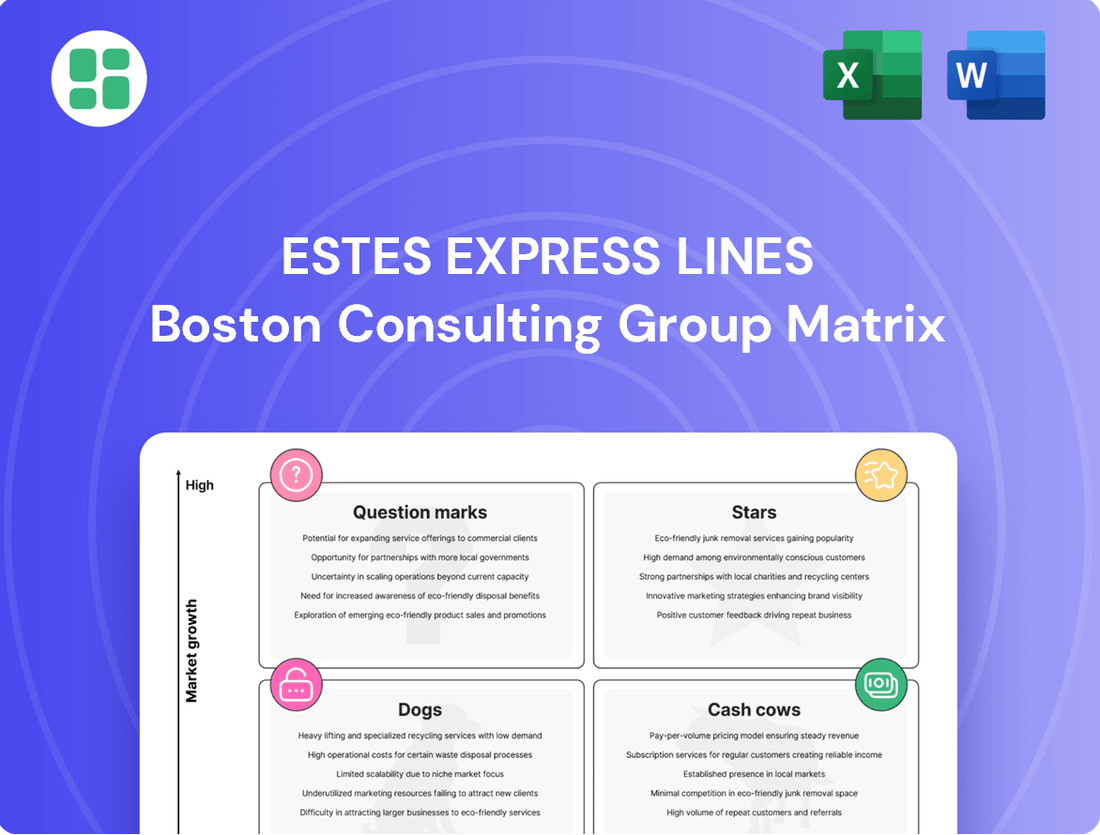

Estes Express Lines' BCG Matrix offers a strategic snapshot of their diverse service offerings, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth potential. Understanding these placements is crucial for optimizing resource allocation and future investments within the logistics sector.

This preview hints at the powerful insights contained within the full Estes Express Lines BCG Matrix. Purchase the complete report to unlock detailed quadrant analysis, actionable strategies for each service category, and a clear roadmap for sustained growth and competitive advantage in the dynamic transportation industry.

Stars

Estes Express Lines is aggressively growing its Final Mile delivery services, which encompass both residential and commercial deliveries that don't require a loading dock. This strategic push is directly driven by the booming e-commerce sector. In 2024, e-commerce sales in the US were projected to reach over $1.7 trillion, underscoring the immense market opportunity for efficient last-mile solutions.

The demand for flexible and expedited shipping in the final mile is soaring, as consumers and businesses increasingly expect direct-to-door service. Estes's investment in this area, offering everything from standard deliveries to premium White Glove services that include assembly, positions them to capitalize on this trend and secure a larger share of this high-growth market.

The demand for expedited and guaranteed freight delivery is a constant in today's fast-paced supply chains. Estes Express Lines' Time Critical Guaranteed service directly meets this need, operating around the clock, every day of the year. This specialized offering is crucial for businesses that cannot afford delays, positioning Estes strongly in a high-value market segment.

Estes is heavily investing in advanced digital logistics, notably integrating AI tools like Optym RouteMax. This strategic move aims to refine route designs and boost linehaul efficiency, a commitment that yielded a 2% improvement in 2024. The expansion of their Pickup Visibility Application also enhances customer experience, showcasing their dedication to transparency in operations.

Strategic Terminal Network Expansion

Estes Express Lines' aggressive terminal network expansion, particularly through the acquisition of 37 former Yellow terminals and 15 leases in 2024-2025, positions it as a strong contender in the Less-Than-Truckload (LTL) sector. This strategic move significantly bolsters its operational footprint.

This expansion has resulted in a substantial increase in Estes' terminal door count, growing by over 12% to surpass 12,750 doors. The addition of nearly 7,000 trailers further enhances its capacity to serve a growing market.

- Terminal Network Growth: Acquired 37 former Yellow terminals and 15 leases in 2024-2025.

- Door Count Increase: Grew terminal door count by over 12% to more than 12,750.

- Fleet Enhancement: Added nearly 7,000 trailers to bolster capacity.

- Market Position: Aims to capture a larger share of the rebounding LTL market and solidify leadership.

Sustainable Logistics Solutions

Sustainable Logistics Solutions represents a significant opportunity for Estes Express Lines, aligning with their ambitious net-zero emissions target by 2050. This strategic focus includes substantial investments in solar power expansion, enhanced fuel efficiency, and pioneering efforts in allocated emissions reporting and electric vehicle adoption.

The global shift towards environmental consciousness fuels a robust and expanding market for green logistics services. Estes' proactive stance, further validated by their recognition with the inaugural Sustainability Pathfinder Award, firmly establishes them as a frontrunner in this burgeoning sector.

- Investment in Sustainability: Estes is channeling significant capital into solar power, fuel efficiency, and EV pilots.

- Market Demand: Growing global emphasis on environmental responsibility is increasing demand for sustainable logistics.

- Industry Leadership: The Sustainability Pathfinder Award highlights Estes' pioneering role in green logistics.

- Future Growth: This segment represents a high-growth, forward-looking market for the company.

Estes' Final Mile delivery service is a clear Star in the BCG Matrix, experiencing rapid growth and high market share. The booming e-commerce sector, projected to exceed $1.7 trillion in US sales in 2024, fuels this demand. Estes' investment in flexible, expedited, and premium services positions them to capture a significant portion of this lucrative market.

| Business Unit | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| Final Mile Delivery | High | High | Star |

| Time Critical Guaranteed | High | High | Star |

| Sustainable Logistics | High | Medium | Question Mark/Star |

| LTL Core Business | Medium | High | Cash Cow |

What is included in the product

This BCG Matrix analysis provides clear descriptions and strategic insights for Estes Express Lines' Stars, Cash Cows, Question Marks, and Dogs.

A clear BCG Matrix visualizes Estes Express Lines' business units, reducing the pain of strategic uncertainty.

Cash Cows

Estes Express Lines' core Less-Than-Truckload (LTL) shipping services are firmly positioned as their Cash Cows within the BCG Matrix. As North America's largest privately-owned LTL carrier, this segment is Estes' bedrock, operating in a mature but consistently vital market.

Despite the inherent cyclicality of freight markets, LTL shipping continues to be a high-volume, dependable revenue generator for Estes. This stability is a testament to their established infrastructure and operational efficiency.

In 2024, the LTL market continued to show resilience, with Estes leveraging its extensive network and reputation for reliability. This allows them to maintain a significant market share, generating substantial and consistent cash flow to support other ventures.

Estes Express Lines boasts an impressive North American terminal network, with over 300 locations spanning the U.S. and Canada. This extensive infrastructure, developed over many years, is a cornerstone of their efficient freight operations. It's a significant asset that consistently generates strong cash flow.

The maturity and broad reach of this network are key drivers of Estes' substantial market share in the North American freight sector. Its operational stability is directly linked to this well-established physical presence, allowing for reliable and widespread service delivery.

Volume LTL Services at Estes Express Lines functions as a classic Cash Cow within their BCG Matrix. This segment handles larger less-than-truckload shipments, a stable and mature part of their core LTL operations.

Leveraging Estes' extensive infrastructure and deep customer relationships, Volume LTL benefits from a high market share in a well-established sector. In 2024, the LTL market continued to show resilience, with Estes consistently ranking among the top carriers, demonstrating their strong position.

The mature nature of this market means it requires minimal new investment for growth or market penetration. Consequently, Volume LTL Services are a significant contributor to Estes' overall cash flow, generating substantial earnings that can be reinvested into other areas of the business.

Standard Truckload Services

Standard Truckload Services, while not Estes Express Lines' primary specialization, represents a significant Cash Cow within their portfolio. Despite Estes being known for Less Than Truckload (LTL) freight, their truckload offerings, encompassing both owned assets and brokered capacity, are robust. This segment operates in a well-established and highly competitive market, yet it consistently generates dependable revenue.

Estes leverages its extensive existing network and broad customer relationships to efficiently manage its truckload operations. This synergy allows them to secure a strong market position on key routes, ensuring a steady and predictable cash flow. The mature nature of this service means operational processes are highly refined, contributing to its status as a reliable profit generator.

- Diversified Revenue: Truckload services, though secondary to LTL, add breadth to Estes' income streams.

- Network Leverage: Estes utilizes its existing infrastructure and client base to optimize truckload efficiency.

- Mature Market Presence: Operating in a competitive but stable market, truckload services provide consistent cash flow.

- Operational Efficiency: Established processes in truckload management contribute to its cash cow status.

Cross-Border Shipping to Canada & Mexico

Estes Express Lines' cross-border shipping to Canada and Mexico represents a significant Cash Cow within their business portfolio. This segment leverages a mature market with consistent demand, where Estes has cultivated a strong and established presence.

Their expertise in navigating the complexities of cross-border logistics allows them to maintain a high market share, ensuring a steady stream of revenue. In 2024, the North American freight market saw continued strength, with cross-border volumes between the US, Canada, and Mexico remaining robust, contributing significantly to carriers like Estes.

- Established Market Dominance: Estes' long-standing operations in Canada and Mexico have solidified their position, allowing them to capture a substantial portion of the existing demand.

- Consistent Revenue Generation: The mature nature of these routes means predictable freight volumes, translating into reliable and stable cash flow for the company.

- Low Investment Needs: Unlike growth-oriented segments, cross-border shipping requires minimal new investment in market development or aggressive promotion, maximizing profitability.

- Strategic Importance: These services are crucial for North American supply chains, providing a bedrock of stability and profitability for Estes Express Lines.

Estes Express Lines’ core Less-Than-Truckload (LTL) shipping services are firmly positioned as their Cash Cows within the BCG Matrix. As North America's largest privately-owned LTL carrier, this segment is Estes' bedrock, operating in a mature but consistently vital market.

Despite the inherent cyclicality of freight markets, LTL shipping continues to be a high-volume, dependable revenue generator for Estes. In 2024, the LTL market continued to show resilience, with Estes leveraging its extensive network and reputation for reliability, allowing them to maintain a significant market share and generate substantial cash flow.

The company boasts over 300 terminals across North America, a key asset for efficient freight operations and a cornerstone of their strong market share. This extensive infrastructure, coupled with refined operational processes, ensures consistent profitability from their LTL offerings.

Volume LTL Services, handling larger less-than-truckload shipments, also functions as a classic Cash Cow. Benefiting from Estes' infrastructure and customer relationships, this segment maintains a high market share in a stable sector, requiring minimal new investment and contributing significantly to overall cash flow.

| Segment | BCG Category | 2024 Market Share (Est.) | Cash Flow Generation | Investment Needs |

|---|---|---|---|---|

| Core LTL Services | Cash Cow | High (Top Tier) | Substantial & Consistent | Low |

| Volume LTL Services | Cash Cow | High | Strong | Minimal |

| Standard Truckload | Cash Cow | Significant | Dependable | Low |

| Cross-Border Shipping | Cash Cow | Dominant | Stable & Predictable | Minimal |

Delivered as Shown

Estes Express Lines BCG Matrix

The Estes Express Lines BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just the complete, analysis-ready report for your strategic planning needs.

Rest assured, the BCG Matrix for Estes Express Lines shown here is precisely the file you'll download upon completing your purchase. It's been meticulously prepared with professional formatting and insightful analysis, ready for your immediate use without any further revisions required.

What you see is the actual, final BCG Matrix document that will be yours once purchased. This professionally designed file is instantly downloadable, allowing you to seamlessly integrate it into your business strategy, presentations, or competitive analysis without delay.

Dogs

Outdated internal processes, particularly those still reliant on manual or paper-based systems, represent a significant drag on efficiency for Estes Express Lines. These legacy operations, not yet fully digitized, are likely situated in a low-growth segment of the business. They demand substantial time and labor, diverting resources that could otherwise fuel innovation or market expansion. For example, if a significant portion of their freight documentation or customer onboarding still involves paper, this directly hinders faster processing times compared to digitally native competitors.

Within Estes Express Lines' extensive network, certain older regional terminals might be classified as 'dogs' in the BCG matrix. These are facilities that, despite strategic expansion elsewhere, consistently underperform. They may struggle with low freight volumes in their specific micro-markets, leading to a low market share in those immediate areas.

These underperforming terminals often exhibit persistent issues like high operational or maintenance costs that outweigh their revenue generation. For instance, if a terminal's operating expenses consistently exceed 85% of its revenue, it could be a strong indicator of 'dog' status. Such locations contribute minimally to Estes' overall growth and profitability, requiring careful evaluation for potential restructuring or divestment.

Non-strategic, highly commoditized niche services within Estes Express Lines' portfolio would likely fall into the Dogs quadrant of the BCG Matrix. These are services where Estes has a low market share and operates in a low-growth market. Think of basic, undifferentiated warehousing or simple freight brokerage in extremely crowded markets.

In these areas, Estes' significant asset base might not provide a strong competitive edge, leading to limited differentiation. For example, a small, standalone warehousing operation in a region saturated with similar offerings would fit this description.

The logistics sector saw significant growth in 2024, with the overall market expanding, but these specific niche services may not have kept pace. Data from industry reports in late 2024 indicated that while specialized logistics solutions saw robust demand, basic, commoditized services experienced slower growth and intense price competition, making it difficult for any single provider to gain substantial market share.

Legacy IT Systems (prior to modernization)

Before Estes Express Lines' recent significant investments in advanced AI and digital tools, their legacy IT systems would have been categorized as 'dogs' in a BCG matrix. These older platforms often had limited functionality and were costly to maintain, struggling to keep pace with growing operational demands.

These legacy systems typically offered minimal scalability and integration capabilities, acting as a bottleneck for efficiency and hindering the company's ability to adapt to market changes. The high maintenance costs associated with these outdated technologies further solidified their 'dog' status.

Estes' commitment to modernization, including substantial investments in new technologies, indicates a strategic effort to phase out these underperforming assets. For instance, by the end of 2023, Estes reported a significant increase in their capital expenditures allocated towards technology upgrades, aiming to replace these legacy systems.

- High Maintenance Costs: Legacy systems often incur disproportionately high costs for upkeep and repair.

- Limited Functionality: These systems typically lack the advanced features and capabilities required for modern logistics.

- Scalability Issues: Older IT infrastructure struggles to adapt to increased data volumes and operational complexity.

- Hindered Efficiency: Outdated technology can slow down processes and reduce overall productivity.

Inefficient Fuel Consumption Practices (pre-optimization)

Before Estes Express Lines heavily invested in sustainability, including fuel-efficient tractors and AI-powered route optimization, inefficient fuel consumption practices would have been classified as a 'dog' in their BCG Matrix analysis. These practices led to increased operational expenses and reduced profit margins without bolstering market presence or driving growth. For instance, in 2023, the trucking industry faced elevated fuel costs, with diesel prices averaging around $4.00 per gallon nationally, directly impacting companies with less optimized fleets.

Such inefficiencies represented a significant drain on profitability. Without modern technology or strategic route planning, many miles were driven with suboptimal fuel usage. This directly translated to higher per-mile operating costs, which in 2024, with ongoing supply chain pressures, would have been even more pronounced for less efficient carriers.

- Higher Operational Costs: Unoptimized routes and older, less fuel-efficient vehicles directly increased fuel expenditures.

- Reduced Profit Margins: Increased fuel costs, without corresponding revenue growth, squeezed profitability.

- Lack of Competitive Advantage: These practices did not contribute to market share or growth, hindering competitive positioning.

- Resource Drain: Inefficient operations consumed resources that could have been allocated to growth-oriented investments.

Estes Express Lines' 'dogs' represent areas of the business with low market share in low-growth markets. These could include certain older, underperforming regional terminals or highly commoditized, non-strategic niche services where differentiation is difficult. Before recent technological investments, legacy IT systems also fit this category, demanding high maintenance and offering limited functionality.

These 'dog' segments, such as basic freight brokerage in saturated markets, often face intense price competition and struggle to generate significant returns. For example, in 2024, while specialized logistics saw strong demand, commoditized services experienced slower growth, making it hard for any provider to gain substantial market share.

The key characteristic of these 'dogs' is their inability to contribute meaningfully to overall growth or profitability, often due to high operational costs relative to revenue. Identifying and addressing these underperforming assets, perhaps through restructuring or divestment, is crucial for optimizing Estes Express Lines' resource allocation and strategic focus.

| BCG Category | Market Growth | Market Share | Estes Example | Key Characteristics |

|---|---|---|---|---|

| Dogs | Low | Low | Legacy IT Systems (pre-investment) | High maintenance, limited functionality, scalability issues |

| Dogs | Low | Low | Underperforming Regional Terminals | Low freight volumes, high operational costs, low revenue generation |

| Dogs | Low | Low | Commoditized Niche Services | Intense price competition, lack of differentiation, slow growth |

Question Marks

Estes Forwarding Worldwide (EFW) is actively pursuing global expansion, with ambitious revenue growth targets set for 2025. However, within the expansive global logistics and freight forwarding sector, EFW's market share remains relatively modest when contrasted with its commanding position in North American Less-Than-Truckload (LTL) services. This global segment presents considerable growth opportunities, but achieving substantial international market penetration necessitates significant capital investment.

Estes Express Lines is actively exploring and piloting cutting-edge, high-growth technologies. These include the implementation of carbon capture systems on their freight vehicles and the deployment of battery-electric Class 8 tractors. These forward-thinking initiatives represent a significant investment in the future of sustainable logistics.

Currently, these innovative technologies occupy a very small fraction of their respective emerging technology markets. For instance, the market for carbon capture on heavy-duty trucks is still in its infancy, with only a handful of pilot projects globally. Similarly, battery-electric Class 8 tractors, while gaining traction, still represent a minuscule percentage of the total Class 8 truck market, which is dominated by diesel engines.

The scaling of these solutions demands substantial capital investment. Estes is committed to assessing the long-term viability and operational efficiency of these technologies before considering wider adoption. This cautious approach is crucial given the high upfront costs and the need to develop robust charging infrastructure and ensure comparable performance to traditional diesel vehicles.

Specialized cold chain logistics, especially for pharmaceuticals and perishables, is a booming market. The global cold chain market was valued at approximately $200 billion in 2023 and is projected to reach over $400 billion by 2030, showcasing significant expansion. Estes Express Lines, while a major player in general freight, might find this highly specialized segment represents a newer or less developed area of their business.

This segment demands significant investment in specialized equipment, technology, and trained personnel to maintain precise temperature controls. While Estes has a broad logistics network, carving out a substantial, competitive share in the specialized cold chain requires focused strategic development and capital allocation to meet stringent industry standards and customer expectations for high-value, sensitive goods.

Strategic Expansion into New International Markets (e.g., Asia via acquisition)

The acquisition of Superior Brokerage Services by Estes Forwarding Worldwide (EFW) strategically positions Estes Express Lines for expansion into Asia, a region characterized by high growth potential. This move into a new international market, particularly through an acquisition, suggests Estes is entering with a relatively low market share, classifying it as a potential 'question mark' within the BCG matrix.

This expansion necessitates significant future investment to build brand recognition, establish robust logistics networks, and navigate diverse regulatory landscapes. For instance, the global logistics market is projected to reach approximately $20.2 trillion by 2027, with Asia-Pacific being a major contributor, underscoring the opportunity and the required capital commitment for Estes to capture meaningful market share.

- High Growth Market: Asia's logistics sector is experiencing rapid expansion, driven by increasing trade volumes and e-commerce growth.

- Low Initial Market Share: Estes is entering these new Asian markets, likely with a nascent presence, requiring substantial effort to gain traction.

- Investment Requirement: Significant capital will be needed for infrastructure development, talent acquisition, and market penetration strategies to compete effectively.

- Strategic Importance: Establishing a strong foothold in Asia is crucial for long-term global competitiveness and revenue diversification.

Advanced Automation in Warehousing & Distribution

Advanced automation in warehousing and distribution represents a potential star segment for Estes Express Lines within a BCG matrix framework. While Estes is primarily known for its transportation services, investing in robotics for sorting and automated storage and retrieval systems (AS/RS) could unlock significant growth in its logistics operations. This strategic move would tap into a high-growth market where operational efficiency and speed are paramount.

Currently, Estes' market share in highly automated warehousing solutions might be relatively low compared to specialized logistics providers. However, substantial investment in these technologies could dramatically improve their distribution network's throughput and accuracy. For instance, the global warehouse automation market was valued at approximately $20 billion in 2023 and is projected to reach over $50 billion by 2030, indicating a strong growth trajectory.

- High Growth Potential: The increasing demand for faster and more accurate order fulfillment fuels the growth of warehouse automation.

- Efficiency Gains: Implementing robotics and AS/RS can reduce labor costs, minimize errors, and increase processing speed.

- Competitive Advantage: Early adoption and strategic investment in advanced automation can differentiate Estes in a competitive market.

- Scalability: Automated systems offer scalability to handle fluctuating volumes, a key factor in the logistics industry.

Estes' expansion into Asia via the Superior Brokerage Services acquisition positions them in a high-growth market but with an initially low market share. This necessitates significant investment to build brand awareness and operational infrastructure in a competitive landscape. The Asian logistics market's projected growth underscores both the opportunity and the capital commitment required for Estes to establish a meaningful presence and achieve long-term global competitiveness.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.