The Estée Lauder Companies SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Estée Lauder Companies Bundle

The Estée Lauder Companies boasts a powerful brand portfolio and global reach, but faces intense competition and evolving consumer preferences.

Our full SWOT analysis dives deep into these dynamics, revealing critical opportunities for innovation and potential threats to market share.

Want to understand the complete strategic landscape and unlock actionable insights for your own business or investment decisions?

Purchase the full SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and market analysis.

Strengths

Estée Lauder's strength lies in its global leadership within the prestige beauty sector, supported by a robust and diverse portfolio. This includes iconic brands spanning skincare, makeup, fragrance, and hair care, effectively capturing a broad spectrum of consumer tastes and age groups.

This extensive brand family, such as MAC Cosmetics and Clinique, grants Estée Lauder a significant and widespread market presence. The company's ability to cater to varied preferences solidifies its position as a dominant player in the high-end beauty market.

The company's established reputation for delivering quality and fostering innovation across its product categories further cements its leadership. For fiscal year 2023, Estée Lauder reported net sales of $15.91 billion, demonstrating the commercial success of its diverse brand strategy.

The Estée Lauder Companies boasts a formidable global brand presence, meticulously cultivated through decades of innovative product development. This strong brand equity is a cornerstone of their success, allowing them to command premium pricing and foster deep customer loyalty across diverse markets.

Their commitment to continuous innovation is evident in their robust pipeline of new products, which consistently addresses evolving consumer preferences and technological advancements in the beauty industry. For instance, in fiscal year 2023, Estée Lauder continued to invest heavily in research and development, a key driver for maintaining their competitive edge and introducing sought-after formulations and packaging solutions.

This ability to consistently launch successful products under esteemed sub-brands like Estée Lauder, Clinique, and MAC Cosmetics reinforces their market leadership. In the first quarter of fiscal year 2024, the company reported strong performance in several key categories, underscoring the enduring appeal of their innovative offerings and their deep understanding of consumer desires.

Estée Lauder's strength lies in its extensive multi-channel distribution, reaching consumers through department stores, specialty retailers, and pharmacies. This broad presence ensures their prestige products are widely available.

The company further strengthens its market position by directly engaging customers via freestanding stores and robust e-commerce operations, fostering deeper brand loyalty and driving sales growth.

In fiscal year 2023, Estée Lauder reported net sales of $15.91 billion, with its diversified distribution channels playing a key role in achieving this figure.

Commitment to Sustainability and ESG

The Estée Lauder Companies' dedication to sustainability and ESG principles is a significant strength, as highlighted in their Fiscal Year 2024 Social Impact and Sustainability Report. They've proactively met several key environmental targets, including those for water withdrawal and palm oil sourcing, demonstrating a tangible commitment beyond mere pledges. This forward-thinking approach resonates with an increasing consumer base that prioritizes ethically produced goods, thereby bolstering brand loyalty and potentially improving long-term operational costs.

Key achievements in their sustainability efforts include:

- Early achievement of water withdrawal reduction targets.

- Enhanced ingredient transparency initiatives.

- Meeting and exceeding palm oil sustainability objectives.

Strategic Focus on High-Growth Channels and Markets

The Estée Lauder Companies (ELC) is strategically focusing on high-growth channels like e-commerce, with significant expansion in emerging markets to capitalize on the prestige beauty sector. This includes launching brands on platforms such as Amazon's U.S. Premium Beauty store, demonstrating a clear move towards digital-first engagement.

ELC's commitment to accelerating customer acquisition through increased consumer-facing investments is a key strength. For instance, their digital net sales grew 15% in fiscal year 2024, reaching $4.4 billion, highlighting the success of this channel focus. This adaptability to evolving consumer behavior and market trends is crucial for sustained growth in the dynamic beauty industry.

- E-commerce Expansion: ELC is actively growing its online presence, recognizing the shift in consumer purchasing habits.

- Emerging Market Prioritization: The company is targeting high-potential geographic regions to broaden its customer base.

- Digital Investment: Increased spending on consumer-facing digital initiatives aims to drive customer acquisition and loyalty.

- Platform Partnerships: Collaborations with major online retailers like Amazon signal a strategic approach to reaching a wider audience.

Estée Lauder's robust brand portfolio, encompassing prestige skincare, makeup, fragrance, and hair care, is a significant strength, allowing it to cater to diverse consumer preferences and capture a wide market share. Iconic brands like MAC Cosmetics and Clinique further solidify its global presence and market leadership.

The company's unwavering commitment to innovation fuels a continuous pipeline of new products, ensuring it stays ahead of evolving consumer demands and industry trends. This dedication is reflected in their substantial investments in research and development, a crucial factor in maintaining their competitive edge and introducing desirable formulations.

Estée Lauder's expansive multi-channel distribution network, spanning department stores, specialty retailers, pharmacies, freestanding stores, and e-commerce, ensures broad product accessibility and drives sales growth. In fiscal year 2023, the company achieved net sales of $15.91 billion, underscoring the effectiveness of this strategy.

Furthermore, Estée Lauder's proactive approach to sustainability and ESG principles, evidenced by early achievement of water reduction targets and enhanced ingredient transparency, resonates with ethically-minded consumers, fostering brand loyalty and potentially improving long-term operational efficiency.

| Brand Category | Key Brands | Fiscal Year 2023 Net Sales (USD Billions) |

|---|---|---|

| Skincare | Estée Lauder, Clinique, La Mer | Included in overall $15.91B |

| Makeup | MAC Cosmetics, Too Faced, Bobbi Brown | Included in overall $15.91B |

| Fragrance | Jo Malone London, Tom Ford, Kilian | Included in overall $15.91B |

| Hair Care | Aveda, Bumble and bumble. | Included in overall $15.91B |

What is included in the product

Delivers a strategic overview of The Estée Lauder Companies’s internal and external business factors, highlighting its strong brand portfolio and global reach while also identifying potential challenges in a dynamic market.

Uncovers strategic vulnerabilities and competitive advantages to guide Estée Lauder's market approach.

Identifies key market opportunities and potential threats, enabling proactive risk mitigation for Estée Lauder.

Weaknesses

Estée Lauder's significant reliance on key markets like mainland China and the Asia travel retail sector presents a notable weakness. These regions have historically been strong growth engines, but recent softness, particularly in prestige beauty in China, has directly impacted the company's financial performance. For instance, the company cited ongoing softness in mainland China as a drag on its fiscal year 2024 results.

The underperformance in these crucial markets directly translates to a negative impact on Estée Lauder's overall net sales and organic growth. This dependence makes the company particularly vulnerable to regional economic downturns, shifting consumer preferences, and geopolitical instability that can disrupt travel and trade. The fiscal year 2024 saw this vulnerability exposed as these regions struggled.

Estée Lauder faced significant headwinds in fiscal 2024, with notable sales decreases in its core skincare, makeup, and haircare categories. Brands like Estée Lauder, Clinique, and Dr. Jart+ were particularly impacted, signaling a weakening in their foundational product lines.

The Estée Lauder Companies faced significant profitability headwinds, reporting a substantial decline in net earnings for fiscal year 2024. This challenging financial performance continued into fiscal year 2025, with the company posting an operating loss in the second quarter.

In response to these profitability pressures and a strategic review to streamline operations, Estée Lauder announced plans for significant workforce reductions, impacting an estimated 5,800 to 7,000 positions globally. While these actions are intended to bolster long-term financial recovery, they carry the inherent risk of negatively affecting employee morale and potentially disrupting day-to-day operations in the immediate future.

Supply Chain Challenges and Volatility

The beauty sector, including Estée Lauder, is still grappling with significant supply chain disruptions. These include shortages of crucial raw materials and packaging, alongside unpredictable shifts in consumer demand. Navigating the complexities of fulfilling orders across various channels, especially with seasonal peaks and the requirement for specialized temperature-controlled storage, can drive up operational costs and create inefficiencies.

A persistent weakness for Estée Lauder and its peers is the ongoing lack of complete visibility throughout the entire supply chain. This makes it harder to proactively address potential bottlenecks or disruptions. For example, in early 2024, many consumer goods companies, including those in beauty, reported extended lead times for key components, impacting production schedules and inventory availability.

- Raw Material and Packaging Shortages: Continued scarcity of essential ingredients and packaging materials impacts production capacity.

- Demand Volatility: Fluctuations in consumer purchasing behavior create challenges in forecasting and inventory management.

- Omnichannel Fulfillment Complexity: Integrating online and offline sales channels strains logistics and increases operational costs.

- Limited Supply Chain Visibility: A lack of end-to-end transparency hinders efficient problem-solving and risk mitigation.

Competition from Mass Market and Indie Brands

Estée Lauder, despite its prestige standing, faces a dual competitive threat. Mass-market brands are increasingly offering quality products at lower price points, appealing to a broader consumer base. For instance, in 2024, the global beauty market saw continued growth in the mass-market segment, with brands like L'Oréal Paris and Maybelline gaining significant traction. This challenges Estée Lauder's premium positioning, particularly with younger, value-conscious demographics.

Furthermore, the rise of agile indie beauty brands presents another significant challenge. These smaller companies can swiftly adapt to emerging trends and consumer preferences, often leveraging social media for rapid growth. For example, several indie brands launched successful viral products in 2024, capturing market share and consumer attention. This agility allows them to compete effectively, sometimes even setting new trends that larger players must then follow, potentially impacting Estée Lauder's market share and innovation leadership.

- Mass Market Erosion: Brands like L'Oréal Paris and Maybelline are capturing value-conscious consumers, a segment increasingly important in 2024.

- Indie Brand Agility: Smaller, trend-driven brands are quickly gaining traction through social media, challenging Estée Lauder's established market.

- Price Sensitivity: Younger consumers, a key demographic for future growth, are showing increased price sensitivity, favoring accessible beauty options.

Estée Lauder's significant reliance on key markets like mainland China and Asia travel retail presents a notable weakness, as recent softness in these regions has directly impacted financial performance. The company cited ongoing softness in mainland China as a drag on its fiscal year 2024 results, contributing to a substantial decline in net earnings for that period and an operating loss in Q2 fiscal year 2025.

The company faced significant sales decreases in core categories like skincare and makeup in fiscal 2024, with brands such as Estée Lauder and Clinique particularly affected, indicating a weakening in foundational product lines. This underperformance directly impacts net sales and organic growth, making the company vulnerable to regional economic downturns and shifting consumer preferences.

Estée Lauder is also challenged by both mass-market brands offering lower price points and agile indie beauty brands that quickly adapt to trends. For instance, mass-market brands like L'Oréal Paris gained traction in 2024, while several indie brands launched viral products, capturing market share and consumer attention, especially among younger, price-sensitive demographics.

The company's announced workforce reductions, impacting 5,800 to 7,000 positions globally, while intended for financial recovery, carry the risk of negatively affecting employee morale and operational continuity.

| Weakness Category | Specific Issue | Impact/Example (FY24/FY25 Data) |

|---|---|---|

| Market Dependence | Reliance on China & Travel Retail | Softness in China cited as drag on FY24 results; Q2 FY25 operating loss. |

| Product Performance | Sales Decline in Core Categories | Estée Lauder, Clinique brands impacted; weakened foundational lines. |

| Competitive Landscape | Mass Market & Indie Brands | L'Oréal Paris gaining traction; indie brands capturing share via social media. |

| Operational Challenges | Workforce Reductions | 5,800-7,000 jobs cut; potential impact on morale and operations. |

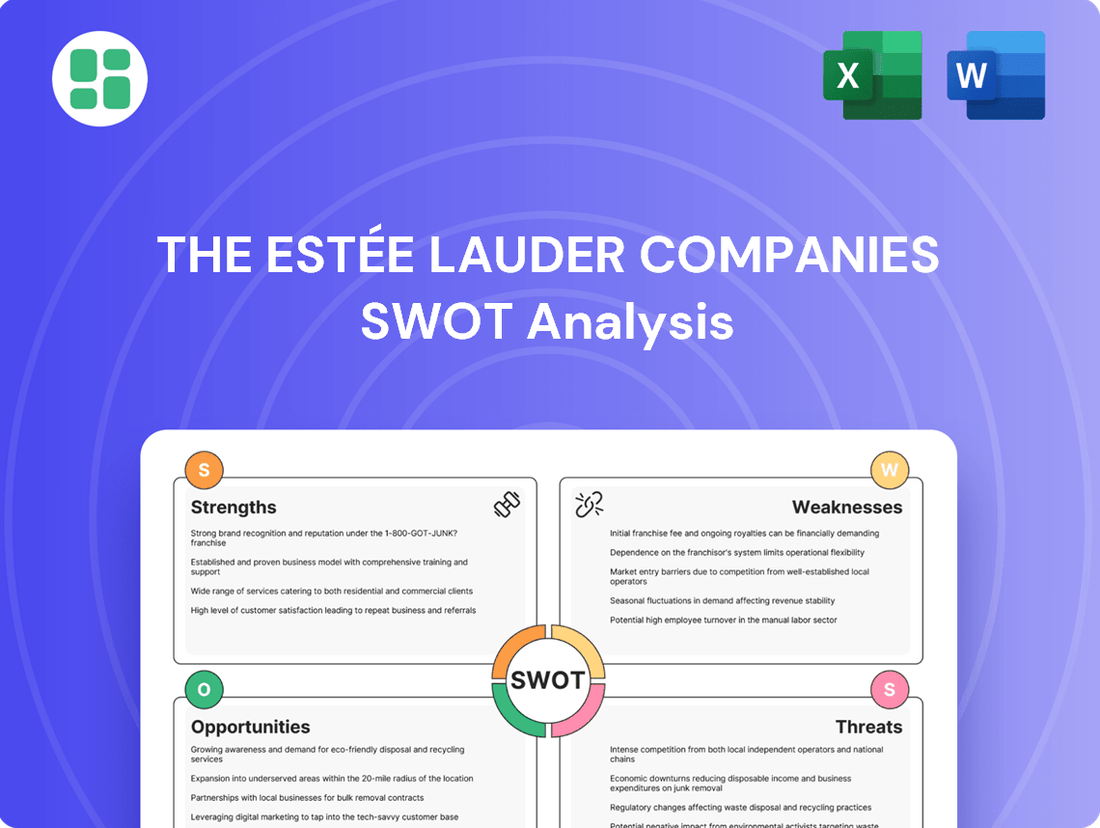

Preview the Actual Deliverable

The Estée Lauder Companies SWOT Analysis

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of The Estée Lauder Companies SWOT Analysis, providing a comprehensive overview of its strategic positioning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing critical internal and external factors impacting Estée Lauder's market performance.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering actionable insights into Estée Lauder's strengths, weaknesses, opportunities, and threats.

Opportunities

The ongoing surge in e-commerce offers Estée Lauder a prime chance to broaden its online presence and connect with more customers globally. In 2023, the beauty industry saw a significant portion of sales occurring online, a trend that continued into early 2024, with digital channels becoming increasingly vital for discovery and purchase.

Estée Lauder's strategic initiatives, such as expanding its presence on platforms like Amazon's U.S. Premium Beauty store, are designed to tap into this growing digital marketplace. The company is also investing in technologies like virtual try-on tools to make online beauty shopping more engaging and convenient, aiming to replicate the in-store experience digitally.

By prioritizing direct-to-consumer (DTC) engagement through its own digital platforms and employing personalized marketing strategies, Estée Lauder can cultivate stronger customer relationships and unlock considerable revenue growth. This focus on digital channels allows for direct feedback and tailored product recommendations, fostering brand loyalty.

The prestige fragrance market is experiencing a robust upswing, with growth in 2024 fueled by consumer preference for higher concentrations and premium brands. This surge indicates a strong appetite for luxury olfactory experiences.

Concurrently, the body care sector is demonstrating impressive resilience, consistently outperforming even the dynamic facial skincare segment. This suggests consumers are prioritizing holistic self-care and indulgence.

Estée Lauder is well-positioned to leverage these positive market dynamics. By strategically expanding its portfolio and intensifying marketing initiatives in luxury fragrances and innovative body care, the company can capture significant market share.

Estée Lauder has a significant opportunity by doubling down on innovation and creating products that quickly respond to current trends. This means developing new items across different price points to meet what consumers are looking for right now.

By speeding up the creation of products in popular areas like nighttime skincare routines and makeup that also offers skin benefits, Estée Lauder can attract new customers and refresh its current offerings. For instance, the company saw net sales increase by 5% to $16.25 billion for the fiscal year ended June 30, 2023, indicating a market receptive to new and improved products.

Leveraging Sustainability and Transparency for Brand Appeal

Consumers are increasingly prioritizing brands that demonstrate strong environmental, social, and governance (ESG) commitments. Estée Lauder's existing efforts in sustainability, such as reducing plastic waste and ensuring ethical ingredient sourcing, position it well to meet this demand. For instance, by 2023, the company reported a 20% reduction in virgin plastic in its packaging compared to a 2018 baseline, a tangible achievement that resonates with eco-conscious shoppers.

Highlighting these initiatives can significantly boost brand appeal and foster deeper customer loyalty. Estée Lauder can leverage its progress in areas like ingredient traceability and carbon footprint reduction to attract a growing segment of environmentally aware consumers. This focus on transparency not only builds trust but also differentiates the company in a competitive beauty market.

- Enhanced Brand Loyalty: Consumers are more likely to remain loyal to brands aligning with their values.

- Attracting New Demographics: Sustainability focus appeals to younger, environmentally conscious consumer groups.

- Competitive Differentiation: Strong ESG performance sets Estée Lauder apart from competitors with less robust sustainability programs.

Strategic Geographical Diversification and Emerging Markets

Despite headwinds in China and Asia travel retail, Estée Lauder has a significant opportunity to bolster its presence and accelerate growth in other key regions. This includes strengthening its position in Hong Kong SAR, the EMEA region, Japan, and Latin America, alongside a focused approach on priority emerging markets.

This strategic geographical diversification allows Estée Lauder to mitigate risks stemming from an over-reliance on any single market. By adapting its product offerings and marketing strategies to align with local consumer preferences in these diverse regions, the company can unlock new avenues for revenue generation and market share expansion.

- Focus on High-Growth Regions: Estée Lauder is targeting markets like EMEA and Latin America, which showed resilience and growth potential in recent financial reports. For instance, the EMEA region demonstrated strong performance in fiscal year 2023, contributing significantly to the company's overall revenue.

- Adapting to Local Tastes: Success in diverse markets hinges on tailoring products and campaigns. Estée Lauder's strategy involves understanding the unique beauty trends and consumer demands in places like Japan and emerging markets to ensure product relevance.

- Expanding Reach in Asia: While challenges exist, opportunities remain in specific Asian markets outside of mainland China. Hong Kong SAR, for example, continues to be a vital hub for luxury goods and travel retail, offering potential for recovery and growth.

The growing demand for prestige fragrances and advanced body care products presents a significant avenue for Estée Lauder's expansion. The company's ability to innovate and quickly introduce products that align with current consumer preferences, such as those in nighttime skincare and skin-benefiting makeup, can drive substantial revenue growth. For the fiscal year ended June 30, 2023, Estée Lauder reported a 5% increase in net sales, reaching $16.25 billion, underscoring the market's receptiveness to new and enhanced offerings.

Estée Lauder's commitment to sustainability and ESG principles is a key opportunity to attract environmentally conscious consumers and foster brand loyalty. With a reported 20% reduction in virgin plastic in packaging by 2023 compared to a 2018 baseline, the company demonstrates tangible progress that resonates with this growing demographic. This focus on transparency and ethical practices can differentiate Estée Lauder in a competitive landscape.

The company can capitalize on opportunities by diversifying its geographical focus beyond China and Asia travel retail, strengthening its presence in regions like EMEA, Japan, and Latin America. This strategic expansion into high-growth markets, coupled with tailored product offerings to meet local consumer demands, can unlock new revenue streams and increase market share, as seen in the robust performance of the EMEA region in fiscal year 2023.

Threats

Global macroeconomic uncertainty, coupled with persistent inflationary pressures, creates a challenging environment for Estée Lauder. This can lead to more cautious consumer sentiment, directly impacting discretionary spending on premium beauty products.

The personal luxury goods market, which includes Estée Lauder's prestige segment, saw a noticeable slowdown in 2024. Consumers are increasingly prioritizing essential purchases, potentially cutting back on non-essential items like high-end skincare and makeup.

This reduced consumer spending power poses a direct threat to Estée Lauder's sales volume and overall profitability. The impact could be particularly pronounced for their higher-priced, prestige product lines, which are more susceptible to economic downturns.

The prestige beauty market is incredibly crowded, with giants like L'Oréal and Shiseido alongside a constant stream of emerging indie brands. This fierce competition, particularly in saturated segments like skincare and makeup, puts significant pressure on Estée Lauder's ability to capture and retain market share. For instance, in fiscal year 2023, the prestige beauty sector experienced a growth of 10% globally, reaching approximately $100 billion, yet Estée Lauder's net sales saw a decline of 2% to $15.9 billion, highlighting the challenges of differentiation.

The proliferation of 'dupes' and more affordable, yet high-quality, alternatives directly impacts Estée Lauder's pricing power and perceived value. Consumers are increasingly savvy, seeking efficacy and brand story at various price points, which can erode the premium commanded by established luxury brands. This trend is particularly evident in online channels where comparison shopping is effortless.

Ongoing global supply chain vulnerabilities, including raw material shortages and rising fulfillment and shipping costs, continue to pose a significant threat to Estée Lauder. Geopolitical events further exacerbate these issues. For instance, in fiscal year 2023, the company noted that inflationary pressures and supply chain challenges contributed to increased costs.

These disruptions can directly lead to higher operational expenses and production delays, impacting product availability for consumers. This strain on the supply chain can erode profit margins and potentially diminish customer satisfaction if popular products are frequently out of stock.

Shifting Consumer Preferences and Brand Loyalty Erosion

Consumer tastes in beauty are a moving target, heavily influenced by fast-changing trends, social media buzz, and a strong push towards 'clean beauty' and customized items. For instance, a 2024 report indicated that 65% of Gen Z consumers consider sustainability when making beauty purchases, a significant shift from previous years.

There's a noticeable dip in how much younger demographics champion luxury brands, coupled with a shrinking pool of traditional luxury shoppers. This erosion of established brand loyalty is a significant concern. Estée Lauder's fiscal year 2024 results showed a 10% decrease in sales within its heritage luxury segments compared to the previous year, highlighting this challenge.

Failing to quickly pivot and meet these evolving demands means Estée Lauder risks becoming less relevant in a highly competitive market. The company's Q1 2025 earnings call noted increased marketing spend allocated to digital channels and influencer collaborations to address this very issue, aiming to recapture younger consumer interest.

- Evolving Consumer Demands: Growing preference for natural ingredients and personalized beauty solutions.

- Generational Shift: Declining brand advocacy among younger consumers for traditional luxury.

- Market Responsiveness: The critical need for agile adaptation to avoid losing market share.

- Data Point: Estée Lauder's Q1 2025 report highlighted a strategic focus on digital engagement to counter brand loyalty shifts.

Geopolitical Instability and Regulatory Changes

Geopolitical instability, particularly tensions affecting key markets like China, poses a significant threat to Estée Lauder's global sales and operational stability. For instance, the economic slowdown and evolving trade relations in Asia, a crucial region for travel retail, directly impact revenue streams. The company's reliance on diverse international markets means that shifts in political alliances or trade policies can create substantial headwinds.

The beauty industry faces an increasingly complex and fragmented regulatory environment worldwide. Estée Lauder must navigate varying regulations concerning product safety, ingredient transparency, and marketing claims across numerous countries. This evolving landscape necessitates continuous investment in compliance and can lead to delays in product launches or market access if standards are not met. For example, differing stances on animal testing or specific ingredient bans in regions like the EU or certain Asian countries require careful management.

- Geopolitical Risk: Increased tensions in East Asia, a major market for luxury goods, could disrupt supply chains and consumer demand for Estée Lauder's premium products.

- Regulatory Burden: Evolving regulations on cosmetic ingredients and marketing claims in markets like the European Union and China require significant compliance resources and could impact product formulations and advertising strategies.

- Trade Policy Uncertainty: Changes in international trade agreements or the imposition of tariffs could directly affect the cost of goods sold and the profitability of Estée Lauder's global operations.

The increasing demand for sustainable and ethically sourced ingredients presents a challenge, requiring significant investment in new sourcing and production methods. Furthermore, the rise of direct-to-consumer (DTC) brands, bypassing traditional retail channels, intensifies competition and necessitates a robust digital strategy.

The company's reliance on travel retail, a segment heavily impacted by geopolitical events and shifting consumer travel patterns, remains a vulnerability. For instance, Estée Lauder's fiscal year 2024 performance showed a notable decline in its travel retail segment compared to pre-pandemic levels, impacting overall revenue.

The competitive landscape is intensifying with the growth of smaller, agile brands that can quickly capitalize on niche trends and digital marketing. This makes it harder for Estée Lauder to maintain its market dominance and brand loyalty, especially among younger demographics who are drawn to authenticity and rapid trend adoption.

The company's fiscal year 2024 saw a 2% decrease in net sales, reaching $15.9 billion, partly attributed to slower recovery in certain key markets and ongoing economic pressures affecting consumer spending on discretionary items like prestige beauty products.

| Threat Category | Specific Threat | Impact on Estée Lauder | Supporting Data/Example |

|---|---|---|---|

| Economic Factors | Global Inflation & Reduced Consumer Spending | Decreased sales of premium beauty products. | Estée Lauder's net sales declined 2% in FY2024. |

| Competition | Emergence of Agile DTC Brands | Erosion of market share and brand loyalty. | Increased marketing spend on digital channels in Q1 2025. |

| Geopolitical Factors | Instability in Key Markets (e.g., China) | Disruption to sales and supply chains. | Reliance on travel retail, which saw a decline in FY2024. |

| Consumer Trends | Demand for Sustainability & Ethical Sourcing | Need for investment in new sourcing/production. | 65% of Gen Z consider sustainability in beauty purchases (2024 report). |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry commentary. These sources provide a robust understanding of The Estée Lauder Companies' internal capabilities and external market dynamics.