The Estée Lauder Companies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Estée Lauder Companies Bundle

The Estée Lauder Companies navigates a dynamic beauty landscape, facing intense rivalry, significant buyer power, and the ever-present threat of new entrants. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping The Estée Lauder Companies’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Estée Lauder's reliance on specialized suppliers for unique active ingredients and proprietary formulations is a key factor in its product differentiation. These niche suppliers, often possessing scarce or patented components, wield considerable bargaining power. This can translate into higher ingredient costs or potential supply constraints for Estée Lauder.

For instance, in 2023, the beauty industry saw increased demand for scientifically advanced ingredients, driving up costs for some specialized suppliers. Estée Lauder's significant purchasing volume and established, long-term partnerships with these key suppliers help to temper this power, ensuring more stable access and potentially more favorable pricing than smaller competitors might achieve.

The bargaining power of packaging material providers for prestige beauty brands like Estée Lauder is significant. High-quality, innovative packaging is intrinsically linked to brand perception and consumer desire in this segment. Suppliers offering unique materials or patented manufacturing processes, especially for luxury components like specialized glass or advanced pump mechanisms, can command higher prices or favorable terms.

Estée Lauder's increasing emphasis on sustainability further influences this dynamic. The demand for specific eco-friendly packaging solutions, such as recycled glass or biodegradable plastics, can concentrate purchasing power with a smaller group of specialized suppliers. For instance, the global luxury packaging market was valued at approximately USD 27.2 billion in 2023 and is projected to grow, indicating robust demand for these specialized materials.

Suppliers of cutting-edge manufacturing equipment, biotech breakthroughs, and AI for supply chain and personalization are gaining leverage. Estée Lauder's focus on AI integration and digital transformation means potential reliance on key tech partners.

For instance, in fiscal year 2023, Estée Lauder's investment in technology and innovation was a significant part of their strategy to stay competitive. This ongoing investment in advanced solutions inherently strengthens the bargaining power of the providers of these critical technologies.

The company's 'Beauty Reimagined' initiative includes a strategic review of its supplier base, aiming to optimize procurement and build stronger, more resilient relationships, particularly with those offering advanced manufacturing and digital capabilities.

Fragrance Houses

The bargaining power of fragrance houses supplying Estée Lauder is considerable, as a select few global players are essential for creating unique scents across the company's extensive brand portfolio. These specialized suppliers hold significant intellectual property and creative talent, which are difficult for Estée Lauder to replicate internally. The reliance on these houses is particularly pronounced for brands where fragrance is a core differentiator, such as Tom Ford and Le Labo.

In 2023, the global fragrance market was valued at approximately $52.5 billion, with a projected compound annual growth rate (CAGR) of 4.9% through 2030, indicating the market's robust demand and the importance of key suppliers. Estée Lauder, as a major player, likely engages with these top-tier fragrance houses for a significant portion of its product development. The exclusivity and proprietary nature of the fragrances developed mean that switching suppliers can be costly and time-consuming, further strengthening the suppliers' position.

- Concentration of Suppliers: A small number of global fragrance houses dominate the market, creating a concentrated supply base.

- Intellectual Property & Expertise: Fragrance houses possess unique formulations and creative skills, acting as a barrier to entry for competitors and a key asset in negotiations.

- Brand Dependence: Brands heavily reliant on signature scents, like those within Estée Lauder's luxury segment, are more susceptible to supplier influence.

- Switching Costs: The significant investment in developing and registering unique fragrance formulas makes it difficult and expensive for Estée Lauder to change suppliers frequently.

Marketing and Advertising Agencies

Marketing and advertising agencies hold significant bargaining power within the beauty sector, including for Estée Lauder. In 2024, the global advertising market saw continued growth, with digital advertising accounting for a substantial portion, highlighting the need for specialized agency expertise. Agencies that excel in areas like influencer marketing and social media engagement, crucial for reaching younger demographics, can leverage their skills to negotiate favorable terms.

Estée Lauder's commitment to visible advertising and marketing optimization in 2024 underscores its dependence on these agencies. The increasing complexity of digital platforms and the demand for creative, data-driven campaigns mean that agencies with proven track records and niche capabilities are in high demand. This demand translates into their ability to influence pricing and service agreements.

- Digital Dominance: In 2024, digital advertising spend continued to rise, with social media and influencer marketing becoming increasingly vital for beauty brands like Estée Lauder to connect with consumers.

- Specialized Expertise: Agencies offering advanced analytics, AI-driven campaign management, and unique creative concepts can command higher fees due to their critical role in driving brand awareness and sales.

- Agency Consolidation: As the agency landscape consolidates, larger, more integrated agencies may wield greater power, but specialized boutique firms offering unique value propositions also retain strong leverage.

- Performance-Based Fees: While agencies seek higher fees, there's a growing trend towards performance-based compensation models, allowing brands to tie agency compensation to measurable results, thus mitigating some of the agency's inherent bargaining power.

The bargaining power of suppliers for Estée Lauder is influenced by the concentration of providers for key inputs like specialized ingredients, innovative packaging, and advanced technology. Suppliers with unique intellectual property, proprietary formulations, or cutting-edge capabilities often hold significant leverage, potentially leading to higher costs or supply chain complexities for Estée Lauder.

In 2023, the beauty industry experienced rising costs for scientifically advanced ingredients, a trend that likely continued into 2024, empowering specialized suppliers. Similarly, the luxury packaging market, valued at approximately USD 27.2 billion in 2023, saw strong demand for unique and sustainable materials, giving packaging providers considerable influence.

Estée Lauder mitigates this power through large-scale purchasing, long-term partnerships, and strategic supplier relationship management, aiming for stable access and favorable terms, especially for critical components like unique fragrance formulations and advanced digital solutions.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Estée Lauder | Mitigation Strategies |

|---|---|---|---|

| Specialized Ingredients | Scarcity, Patents, Scientific Advancement | Higher costs, potential supply constraints | Long-term partnerships, large volume purchases |

| Luxury Packaging | Unique Materials, Innovative Design, Sustainability | Increased material costs, reliance on niche providers | Diversified sourcing, strategic alliances |

| Fragrance Houses | Intellectual Property, Creative Expertise, Exclusivity | High development costs, switching costs | Exclusive contracts, collaborative R&D |

| Technology Providers (AI, Digital) | Cutting-edge solutions, proprietary platforms | Dependence on key tech partners, integration costs | Strategic investments, in-house development |

What is included in the product

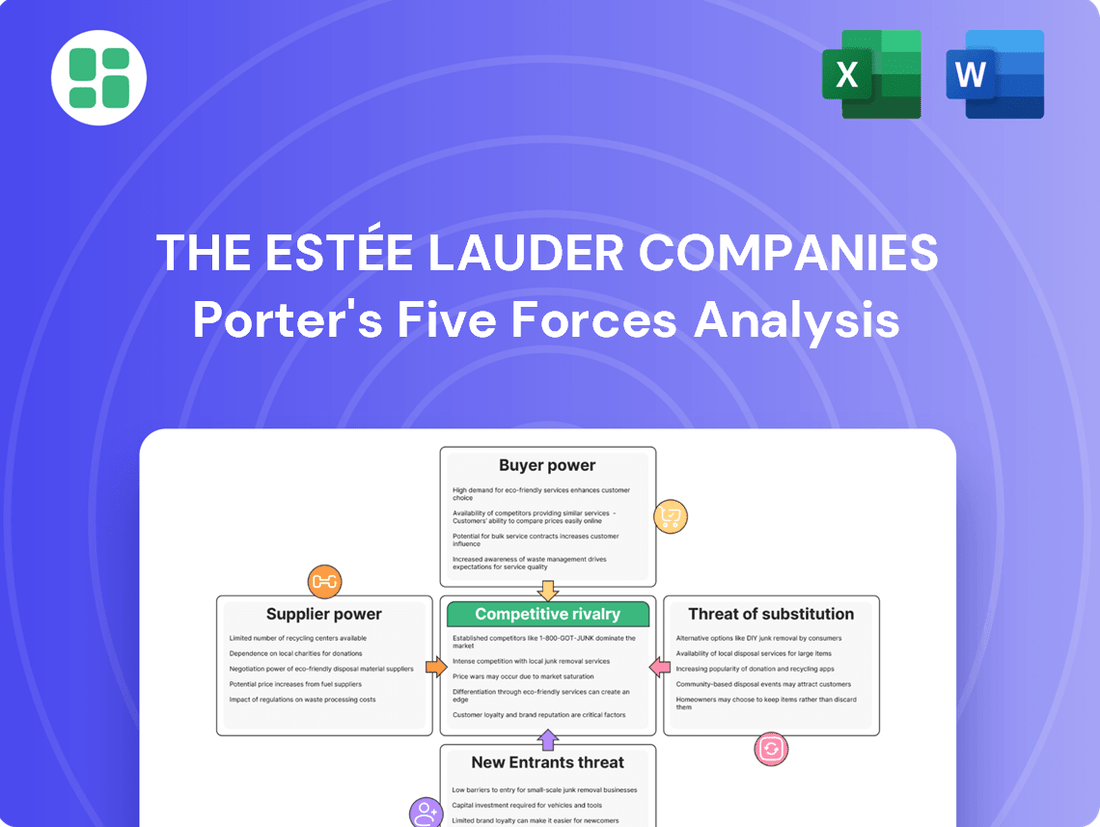

This analysis dissects the competitive landscape for The Estée Lauder Companies, examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly assess competitive pressures from suppliers, buyers, new entrants, substitutes, and rivals with a clear, visual breakdown of The Estée Lauder Companies' Porter's Five Forces.

Customers Bargaining Power

Individual consumers, especially in the premium beauty market, show a mixed response to pricing and brand allegiance. While there aren't direct costs associated with switching brands, Estée Lauder's robust brand reputation and the perceived effectiveness of its products cultivate strong customer loyalty, particularly for its flagship items.

For instance, Estée Lauder's net sales for the fiscal year ended June 30, 2023, reached $15.9 billion, demonstrating the significant market presence and consumer trust in its brands. This loyalty, however, can be tested by the increasing availability of beauty products through discount channels and broader economic pressures, which might push consumers to prioritize value in their buying choices.

Department stores and specialty multi-retailers, as key distribution partners, exert a degree of bargaining power over Estée Lauder. Their control over prime retail locations and direct customer engagement allows them to negotiate favorable terms, including promotional support and inventory management. This leverage is significant, as Estée Lauder relies on these channels to reach a broad consumer base.

In 2024, Estée Lauder continued to navigate this dynamic by strategically expanding its presence in high-growth channels, including direct-to-consumer online platforms, to mitigate reliance on traditional retail. This adaptation is crucial as consumer shopping habits increasingly favor digital experiences, influencing the negotiating leverage of brick-and-mortar partners.

The burgeoning e-commerce landscape, exemplified by giants like Amazon and emerging players such as TikTok Shop, significantly amplifies the bargaining power of online retailers. These platforms provide unparalleled access to a global consumer base and rich data analytics, yet they often leverage this position to negotiate favorable terms, including competitive pricing and extensive promotional commitments from brands.

Estée Lauder has actively embraced this digital transformation, strategically increasing its brand presence across key e-commerce channels. This move is designed to tap into new customer segments and align with the evolving digital-first purchasing habits prevalent in the beauty industry, where online sales are increasingly dominant.

In 2023, Estée Lauder reported that its direct-to-consumer (DTC) channel, which includes its own e-commerce sites and third-party online retailers, continued to be a significant growth driver, highlighting the importance of these digital partnerships in its overall sales strategy.

Travel Retail Consumers

The bargaining power of customers in the travel retail segment, especially in Asia, is a notable force for Estée Lauder. This market has been a crucial source of income, but these consumers are quite responsive to economic downturns, travel limitations, and political events. For instance, recent reports indicate a slowdown in this area, with weak consumer sentiment in China and lower-than-expected sales conversions demonstrating the significant influence this customer base wields over the company's performance.

- Historically significant revenue driver: Travel retail, particularly in Asia, has been a key contributor to Estée Lauder's sales.

- Sensitivity to external factors: This consumer group is highly susceptible to global economic conditions, travel restrictions, and geopolitical shifts.

- Evidence of power: Declines in the segment, attributed to subdued consumer sentiment in China and reduced conversion rates, underscore their collective bargaining power.

Growing Demand for 'Clean' and Sustainable Beauty

The growing consumer demand for clean and sustainable beauty significantly amplifies customer bargaining power. Consumers are actively seeking products with eco-friendly ingredients, sustainable packaging, and ethical production, as evidenced by a 2024 report showing a 15% year-over-year increase in searches for "clean beauty" products. This heightened awareness means Estée Lauder and its competitors must align with these values, or risk alienating a growing segment of their customer base.

This trend directly empowers consumers, forcing companies like Estée Lauder to adapt their product development and supply chain strategies. Brands that proactively embrace sustainability, such as by increasing their use of recycled plastics in packaging, can capture market share. For instance, Estée Lauder's commitment to using 100% recycled or recyclable materials for its primary packaging by 2025 is a direct response to this consumer pressure.

- Consumer Preference Shift: Consumers are increasingly prioritizing products with natural, organic, and ethically sourced ingredients.

- Packaging Innovation: Demand for reduced plastic waste and recyclable or compostable packaging is rising.

- Brand Reputation Impact: Companies failing to meet sustainability expectations face reputational damage and potential sales decline.

- Market Responsiveness: Brands demonstrating transparency and commitment to eco-conscious practices gain a competitive edge.

While individual consumer loyalty to Estée Lauder's premium brands is strong, the increasing availability of beauty products through discount channels and broader economic pressures does give consumers more leverage. For instance, Estée Lauder's net sales reached $15.9 billion in fiscal year 2023, but this can be influenced by price-sensitive consumers seeking value.

The bargaining power of customers is also amplified by the growing demand for clean and sustainable beauty, with searches for "clean beauty" products increasing by 15% year-over-year in 2024. This forces companies like Estée Lauder to adapt their strategies, with a commitment to using 100% recycled or recyclable materials for primary packaging by 2025.

Online retailers, including e-commerce giants and emerging platforms, significantly increase customer bargaining power by offering broad access and data analytics, often negotiating favorable terms and pricing. Estée Lauder's strategic expansion into these direct-to-consumer and third-party online channels, a significant growth driver in 2023, reflects this dynamic.

The travel retail segment, a historically significant revenue driver, particularly in Asia, shows customer sensitivity to economic downturns and travel limitations, as evidenced by subdued consumer sentiment in China and lower sales conversions impacting performance.

Full Version Awaits

The Estée Lauder Companies Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for The Estée Lauder Companies, detailing the competitive landscape and strategic positioning within the beauty industry. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, ensuring complete transparency and immediate usability.

Rivalry Among Competitors

The prestige beauty market is a battlefield, with global titans like L'Oréal, Procter & Gamble, Shiseido, Unilever, and Coty holding significant sway. These giants wage war through relentless product innovation, diverse brand offerings, expansive distribution channels, and colossal marketing investments. For Estée Lauder, this means a constant uphill battle to stand out and retain its market position against these formidable, well-funded competitors.

The beauty industry is seeing a surge in niche and independent brands, often operating on a direct-to-consumer (DTC) model. These agile companies, like Glossier and Drunk Elephant, are carving out significant market share by focusing on specific consumer needs or product categories. Their success, particularly with younger demographics like Gen Z, highlights a shift in consumer preference towards authenticity and specialized offerings.

The beauty industry, including companies like Estée Lauder, is characterized by substantial fixed costs. These include significant investments in research and development to innovate new products, the setup and maintenance of manufacturing facilities, and large-scale marketing and advertising efforts to build brand awareness. For instance, in fiscal year 2023, Estée Lauder reported research and development expenses of $856 million, highlighting the ongoing commitment to product innovation.

These high fixed costs create considerable exit barriers. Discontinuing operations involves substantial costs such as severance packages, lease terminations, and settling outstanding debts. This financial commitment discourages companies from leaving the market, compelling them to continue competing even in challenging conditions, which in turn intensifies the rivalry among existing players.

Product Innovation and Speed-to-Market

Competitive rivalry within the beauty industry is intensely fueled by the relentless pursuit of product innovation and rapid speed-to-market. Estée Lauder, like its peers, must continuously invest in research and development to launch novel, trend-aligned products that capture consumer interest.

The ability to quickly translate emerging consumer preferences, particularly in dynamic segments like skincare and makeup, into successful product offerings is a critical determinant of competitive standing. This necessitates agile product development cycles and a keen understanding of evolving market demands.

- Product Innovation: Estée Lauder's commitment to innovation is evident in its robust R&D pipeline, aiming to introduce cutting-edge formulations and technologies.

- Speed-to-Market: The company strives to shorten product development timelines to capitalize on fleeting trends and maintain a competitive edge.

- Consumer Trends: Success hinges on accurately anticipating and responding to rapid shifts in consumer tastes and preferences, especially in fast-moving categories.

- R&D Investment: Significant resources are allocated to research and development, underscoring the importance of innovation in Estée Lauder's strategy.

Marketing and Digital Engagement

The competition for consumer attention is intensely waged through digital marketing, social selling, and influencer partnerships. Estée Lauder's commitment to boosting consumer-facing investments and refining its digital marketing strategies underscores the vital importance of these channels in the current competitive landscape.

Companies are channeling significant resources into these digital avenues to capture consumer interest and cultivate lasting brand loyalty. For instance, in fiscal year 2023, Estée Lauder reported a substantial increase in its marketing and advertising expenses, reflecting this strategic pivot.

- Digital Dominance: The beauty industry's competitive rivalry is heavily influenced by a company's prowess in digital marketing and social media engagement.

- Influencer Impact: Collaborations with influencers continue to be a critical strategy for reaching and engaging target demographics, driving brand awareness and sales.

- Investment Focus: Estée Lauder's increased investment in consumer-facing initiatives highlights the sector-wide trend of prioritizing digital channels for competitive advantage.

- Brand Loyalty: Effective digital engagement is directly linked to building and maintaining consumer loyalty in a crowded marketplace.

The prestige beauty market is intensely competitive, with established global players like L'Oréal and Shiseido, alongside agile direct-to-consumer brands, constantly vying for market share. Estée Lauder faces significant rivalry driven by continuous product innovation, rapid speed-to-market, and a strong digital presence. In fiscal year 2023, Estée Lauder's R&D expenses reached $856 million, demonstrating the substantial investment required to stay ahead.

| Key Competitors | Key Strategies | Estée Lauder's Response |

| L'Oréal, Shiseido, Unilever, Coty | Product innovation, brand portfolio, global distribution, marketing | Focus on R&D, digital marketing, brand differentiation |

| Niche DTC Brands (e.g., Glossier, Drunk Elephant) | Authenticity, specialized offerings, direct consumer engagement | Adapting to consumer preferences for authenticity, enhancing digital engagement |

| All Competitors | Speed-to-market, influencer marketing, social media presence | Shortening product development cycles, increasing consumer-facing investments |

SSubstitutes Threaten

The threat of substitutes in the beauty industry is significant, particularly from mass-market and affordable alternatives. Consumers increasingly find value in these options, as their quality and efficacy improve, often mirroring the benefits offered by prestige brands. For instance, in 2023, the mass beauty segment continued to show robust growth, with some categories even outpacing the prestige market, indicating a clear consumer shift towards more accessible price points when perceived value is comparable.

Economic pressures or a heightened focus on value for money can accelerate this substitution trend. When consumers feel the pinch, they are more likely to trade down from premium beauty products to more budget-friendly alternatives that still meet their needs. This dynamic is especially relevant as the cost of living continues to be a concern for many households globally, making affordability a key driver in purchasing decisions for a wide range of consumer goods, including beauty products.

Consumers seeking rapid or more significant improvements for certain skin conditions may opt for professional dermatological procedures, such as laser treatments or chemical peels, or even cosmetic surgeries, as alternatives to Estée Lauder's topical skincare products. These interventions can offer more immediate and dramatic results, potentially diminishing the perceived value of consistent use of high-end beauty regimens.

The global medical aesthetics market, which includes many of these procedures, was valued at approximately USD 15.9 billion in 2023 and is projected to grow significantly, indicating a strong and expanding substitute market. This growth suggests that a portion of consumers are willing to invest in more intensive treatments, which could divert spending from traditional skincare brands.

A small segment of consumers might turn to DIY and natural home remedies for skincare and haircare, viewing them as more natural or budget-friendly options. This niche, while not a widespread threat, does present a potential substitute for Estée Lauder's commercially produced beauty products.

Wellness and Lifestyle Choices

A holistic approach to wellness, emphasizing diet, exercise, and overall health, can be seen as a substitute for relying solely on beauty products to enhance appearance. This shift towards 'beauty from within' could potentially lessen the demand for specific cosmetic categories as consumers prioritize internal well-being.

The growing consumer focus on health and lifestyle choices presents a significant threat of substitutes for Estée Lauder. For instance, in 2024, the global wellness market was projected to reach over $5.6 trillion, indicating a substantial consumer investment in health-related activities and products that could divert spending from traditional beauty items.

- Growing Wellness Market: The global wellness market's expansion signifies a shift in consumer priorities towards health and self-care, potentially impacting beauty spending.

- 'Beauty from Within' Trend: Increased consumer interest in achieving beauty through diet, supplements, and exercise offers an alternative to topical cosmetic solutions.

- Dietary Supplements for Skin Health: The market for ingestible beauty products, such as collagen and vitamin supplements, is growing, directly competing with skincare and makeup.

- Personalized Fitness and Nutrition: Advancements in personalized fitness and nutrition plans offer consumers avenues to improve their appearance and well-being without exclusively using beauty products.

Generic or Unbranded Products

The threat of generic or unbranded products is relatively low for Estée Lauder, especially within its prestige segments. Consumers seeking high-performance skincare or luxury fragrances often prioritize brand reputation and perceived quality, making them less likely to switch to unbranded alternatives for these core offerings.

However, in categories like basic cleansers or lotions, there's a more discernible threat. For instance, the global market for private label cosmetics, which often includes unbranded options, was valued at approximately $129 billion in 2023, indicating a significant consumer willingness to opt for lower-cost, less differentiated products in certain areas. This segment is expected to grow, but Estée Lauder's focus on innovation and brand equity in its premium lines mitigates this impact.

The prevalence of this threat is more pronounced in less differentiated product categories where brand loyalty is less critical. Estée Lauder's strategy of investing heavily in research and development, along with robust marketing campaigns that emphasize unique formulations and brand heritage, helps to create a barrier against the substitution by generic alternatives, particularly in its high-margin beauty segments.

- Minor Threat in Prestige Segments: Consumers of luxury beauty products are less likely to substitute with generic or unbranded items due to a focus on brand reputation and perceived quality.

- Increased Threat in Basic Categories: In less differentiated product areas like basic skincare, unbranded alternatives pose a more significant, albeit still manageable, threat.

- Market Data: The private label cosmetics market, encompassing unbranded options, reached an estimated $129 billion globally in 2023, highlighting consumer openness to lower-cost alternatives in certain beauty segments.

- Mitigation Strategies: Estée Lauder's investment in R&D and brand building creates a strong defense against substitution by generic products, particularly in its premium offerings.

The threat of substitutes for Estée Lauder is multifaceted, ranging from professional treatments to broader wellness trends. While prestige beauty consumers may be less inclined towards generic alternatives, the growing global wellness market, projected to exceed $5.6 trillion in 2024, presents a significant diversion of consumer spending towards health and self-care, impacting traditional beauty product demand.

The rise of 'beauty from within' through dietary supplements, like collagen, directly competes with topical skincare. Furthermore, advancements in personalized fitness and nutrition offer consumers alternative paths to enhance appearance and well-being, potentially reducing reliance on cosmetic solutions.

| Substitute Category | 2023 Market Value (USD Billions) | Key Trend |

|---|---|---|

| Medical Aesthetics | 15.9 | Significant growth, offering immediate results |

| Private Label Cosmetics | 129 | Growing consumer acceptance of lower-cost options |

| Global Wellness Market | >5,600 (projected 2024) | Shift towards holistic health and self-care |

Entrants Threaten

The prestige beauty industry thrives on deep-seated brand loyalty, presenting a formidable barrier for newcomers. Consumers often develop strong emotional connections with established brands like Estée Lauder, making it challenging for new entrants to sway purchasing habits. In 2023, Estée Lauder's net sales reached $15.9 billion, underscoring the immense scale and consumer trust commanded by its portfolio of brands.

Entering the prestige beauty market, where The Estée Lauder Companies (ELC) operates, demands a considerable financial commitment. Companies need to invest heavily in cutting-edge research and development to create innovative products. Furthermore, establishing high-quality manufacturing facilities capable of meeting stringent industry standards requires substantial capital outlay.

Beyond product development and production, significant funds are necessary for robust marketing and advertising campaigns. In 2023, ELC reported net sales of $15.91 billion, underscoring the scale of investment required to compete effectively and build brand recognition in this competitive landscape. These extensive upfront costs act as a formidable barrier, deterring many potential new entrants.

New companies entering the beauty market face significant hurdles in accessing established distribution channels, which are often dominated by legacy brands like Estée Lauder. Securing prime placement in high-end department stores, influential specialty retailers, and lucrative travel retail locations requires substantial investment and proven brand appeal. For instance, in 2024, the beauty retail landscape continued to consolidate, with major players like Sephora and Ulta Beauty wielding considerable power over product selection and placement, making it difficult for newcomers to gain visibility.

R&D and Innovation Requirements

The beauty industry, particularly the prestige segment, necessitates substantial and ongoing investment in research and development. Estée Lauder, for instance, consistently allocates significant resources to innovation, focusing on scientific advancements, novel ingredient sourcing, and sophisticated product formulation to maintain its competitive edge. This commitment to R&D acts as a considerable barrier for potential new entrants who may not possess the capital or the established scientific expertise required to develop cutting-edge products.

Newcomers often struggle to replicate the deep scientific knowledge and extensive R&D infrastructure that established players like Estée Lauder have cultivated over decades. This includes access to specialized laboratories, partnerships with research institutions, and a talent pool of scientists and formulators. For example, in fiscal year 2023, Estée Lauder Companies reported R&D expenses of $765 million, highlighting the scale of investment required to stay at the forefront of beauty innovation.

- High R&D Investment: Prestige beauty requires continuous investment in scientific research, ingredient sourcing, and product formulation, creating a significant barrier.

- Expertise Gap: New entrants typically lack the deep scientific expertise and R&D capabilities of established companies like Estée Lauder.

- Capital Requirements: Developing innovative products demands substantial capital for laboratories, talent, and advanced formulation techniques.

- Innovation Pace: The rapid pace of innovation in the beauty sector means that sustained R&D is crucial for survival, a challenge for less-resourced new companies.

Regulatory Hurdles and Compliance

The beauty industry faces stringent regulations regarding product safety, ingredient transparency, and accurate labeling, which vary significantly by region. For instance, the European Union's Cosmetic Regulation (EC) No 1223/2009 mandates comprehensive safety assessments and detailed ingredient lists, creating a substantial compliance burden. New entrants must invest heavily in research, testing, and legal counsel to meet these diverse global standards, acting as a significant barrier to entry. In 2024, Estée Lauder, like its peers, continues to navigate these evolving regulatory landscapes, which impact product development timelines and market access.

Ensuring compliance with these complex rules, from Good Manufacturing Practices (GMP) to chemical substance registration like REACH in Europe, requires substantial upfront investment and ongoing operational costs. This can deter smaller, less capitalized companies from entering the market. For example, the cost of obtaining necessary certifications and conducting safety tests can run into hundreds of thousands of dollars for a single product line.

- Global Regulatory Complexity: Navigating differing product safety, ingredient, and labeling laws across key markets like the EU, US, and Asia presents a significant challenge for new entrants.

- High Compliance Costs: The expense associated with regulatory approvals, safety testing, and maintaining compliance can be prohibitive for startups.

- Ingredient Scrutiny: Increasing focus on ingredient safety and sourcing transparency, such as restrictions on certain chemicals, requires new companies to invest in compliant formulations from the outset.

- Market Access Barriers: Failure to meet regulatory requirements in one major market can prevent a new entrant from accessing a significant portion of the global beauty consumer base.

The threat of new entrants for The Estée Lauder Companies (ELC) is moderate, primarily due to significant capital requirements and strong brand loyalty. New companies must invest heavily in R&D, manufacturing, and marketing to compete with established players. In fiscal year 2023, ELC's net sales were $15.91 billion, illustrating the scale of the market and the resources needed to gain traction.

Access to established distribution channels is another major hurdle. Prime placement in luxury retailers and travel retail locations is difficult for newcomers to secure, especially as major beauty retailers like Sephora and Ulta Beauty continue to consolidate their power in 2024. This limited shelf space and visibility makes it challenging for emerging brands to reach consumers effectively.

Furthermore, the prestige beauty sector demands continuous innovation, with ELC reporting $765 million in R&D expenses in fiscal year 2023. This high level of investment in scientific expertise and product development creates a substantial barrier for new entrants lacking the necessary capital and established research infrastructure.

Regulatory compliance adds another layer of complexity and cost. Navigating diverse global regulations for product safety and ingredient transparency requires significant investment in testing and legal expertise, acting as a deterrent for smaller, less-resourced companies looking to enter the market.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for The Estée Lauder Companies is built upon a foundation of publicly available financial reports, investor relations materials, and reputable industry research from firms like Statista and IBISWorld. We also incorporate insights from market share data and competitor announcements to provide a comprehensive view of the competitive landscape.