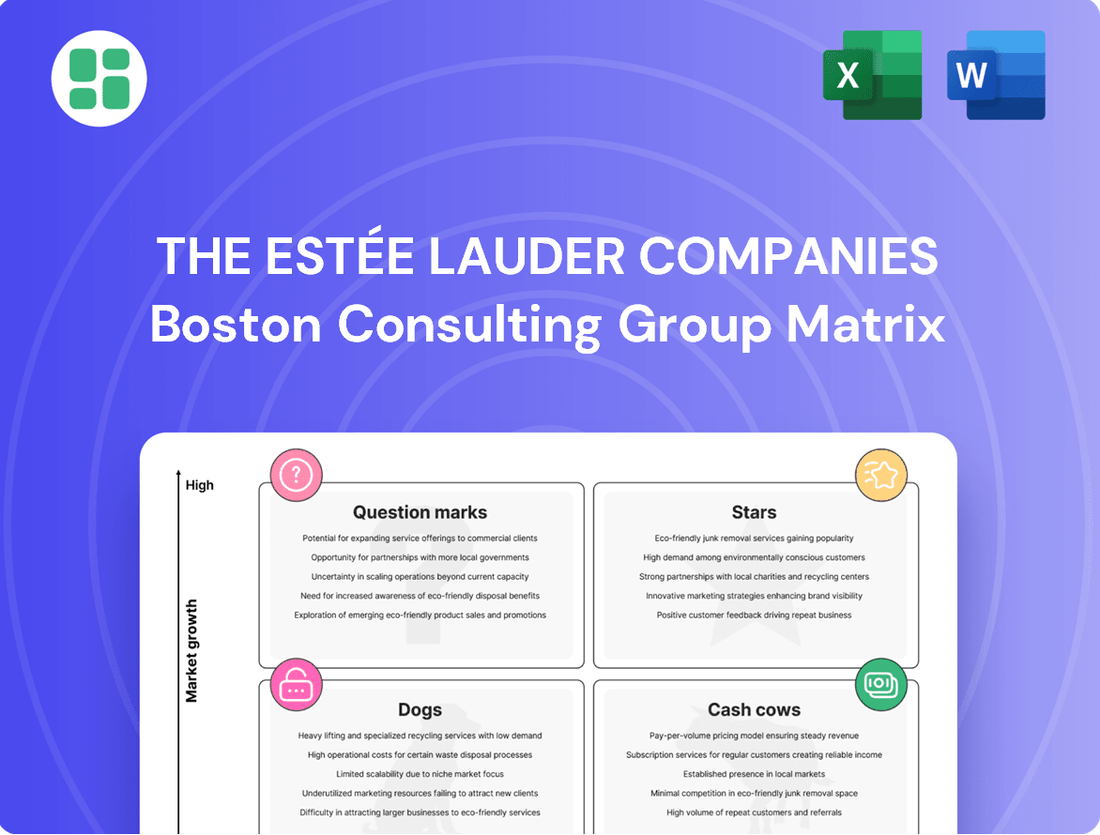

The Estée Lauder Companies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Estée Lauder Companies Bundle

Unlock the strategic secrets of The Estée Lauder Companies' product portfolio with a glimpse into their BCG Matrix. See which brands are driving growth and which might need a closer look, but this preview is just the beginning.

Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for this beauty giant.

Stars

Le Labo is a shining Star for The Estée Lauder Companies (ELC). This luxury fragrance brand is experiencing robust double-digit growth globally, a testament to its appeal in the booming prestige fragrance sector. Its distinctive artisanal scents and focused marketing have made it a significant contributor to ELC's overall performance.

Le Labo's remarkable success is clearly visible in markets like Japan, where it played a crucial role in ELC achieving the number one position in the fragrance category. This strong performance across diverse regions firmly places Le Labo as a key growth driver and a quintessential Star in ELC's BCG Matrix.

Jo Malone London is a shining example of a Star within The Estée Lauder Companies' portfolio. Its prestige fragrance segment is booming, and Jo Malone is leading the charge, especially in Asia.

The brand has seen impressive double-digit growth in China, a testament to its appeal in a key emerging market. Furthermore, its strategic expansion into Japan, marked by the successful launch of a flagship store, has cemented a significant market share there.

This robust performance in a high-growth category, like the global luxury fragrance market which was valued at over $15 billion in 2023 and is projected to grow further, clearly places Jo Malone London in the Star quadrant. Continued investment is crucial to sustain this momentum and its leadership position.

The Ordinary, a key brand within The Estée Lauder Companies' portfolio following the DECIEM acquisition, is a major force in the prestige skincare sector. It's recognized for its commitment to science-backed formulations, transparency in ingredients, and affordability, making it a disruptive player.

In its primary markets, including Canada and the United States, The Ordinary holds a strong position in the prestige skincare category. The brand is actively broadening its market presence by leveraging rapidly expanding sales channels like Amazon's U.S. Premium Beauty store and TikTok Shop, demonstrating its adaptability to evolving consumer behaviors.

The Ordinary's success in capturing significant market share within a growing skincare segment, coupled with its increasing brand recognition and scalability, firmly establishes it as a Star in the BCG Matrix. This classification reflects its high growth and high market share, indicating strong potential for future revenue generation.

Clinique

Clinique is performing exceptionally well, capturing a greater share of the U.S. prestige beauty market, especially in skincare. The brand has seen solid growth everywhere, with notable strength in its lip and mascara product lines.

The brand's smart move to expand into new sales avenues, like launching on Amazon's U.S. Premium Beauty store, shows its skill in reaching new customers and keeping a strong market position in important, growing areas. This ongoing success across different product types and sales channels firmly places Clinique in the Star category.

- U.S. Prestige Skincare Market Share Gain: Clinique has demonstrated significant growth in this competitive segment.

- Geographic Growth: Robust performance observed across all global regions.

- Key Category Strength: Notable expansion in lip and mascara subcategories.

- Strategic Channel Expansion: Successful launch on Amazon's U.S. Premium Beauty store to reach new consumers.

Estée Lauder Advanced Night Repair

Estée Lauder's Advanced Night Repair (ANR) franchise is a shining example of a Star product within the company's portfolio. This iconic serum continues to dominate the highly competitive anti-aging skincare market, consistently delivering robust sales. Its enduring appeal is a testament to its proven efficacy and the deep trust consumers place in the brand.

ANR's performance is particularly noteworthy given the broader market dynamics. In 2023, the global skincare market was valued at over $150 billion, with anti-aging products representing a significant and growing segment. Estée Lauder's ANR has maintained a leading market share within this category, driven by its loyal customer base and ongoing product innovation.

- Global Best-Seller: Advanced Night Repair is consistently one of Estée Lauder's top-selling products worldwide.

- Strong Organic Growth: The franchise continues to experience significant organic sales increases, outpacing many competitors.

- Market Leadership: ANR holds a dominant position in the premium anti-aging serum segment.

- Consumer Trust: Decades of proven results have cultivated immense consumer loyalty and confidence in the product's performance.

The Estée Lauder Companies boasts several brands and product lines that are considered Stars in their BCG Matrix, indicating high growth and high market share.

Le Labo and Jo Malone London are prime examples in the prestige fragrance sector, experiencing robust double-digit growth globally and leading in key markets like Japan and China. The Ordinary, acquired through DECIEM, is a disruptive force in prestige skincare, showing strong market presence and adaptability across new sales channels like Amazon and TikTok Shop.

Clinique is also a Star, gaining share in the U.S. prestige beauty market, particularly in skincare, with notable strength in lip and mascara products and strategic expansion onto platforms like Amazon's U.S. Premium Beauty store.

Furthermore, Estée Lauder's Advanced Night Repair franchise remains a dominant player in the anti-aging skincare segment, consistently delivering strong organic growth and holding a leading market share, underscoring its status as a key Star product.

| Brand/Product | Category | Growth | Market Share | Key Markets |

| Le Labo | Prestige Fragrance | High (Double-Digit) | High | Global, Japan |

| Jo Malone London | Prestige Fragrance | High (Double-Digit) | High | Global, China, Japan |

| The Ordinary | Prestige Skincare | High | High | North America, Expanding Globally |

| Clinique | Prestige Beauty | High | Growing | U.S., Global |

| Advanced Night Repair | Anti-Aging Skincare | High (Organic) | Dominant | Global |

What is included in the product

This BCG Matrix overview details Estée Lauder's product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

The Estée Lauder Companies BCG Matrix provides a clear, one-page overview of each business unit's position, relieving the pain point of complex portfolio analysis.

Cash Cows

The Estée Lauder brand, with its extensive skincare and makeup lines, operates as a cash cow for Estée Lauder Companies. Its strong global footprint and dominant position in the mature prestige beauty sector are key drivers of this status. Despite facing challenges in certain markets, the brand's enduring legacy and popular products consistently deliver robust revenue and healthy profit margins.

In fiscal year 2023, Estée Lauder Companies reported net sales of $15.9 billion. The core Estée Lauder brand, as a cornerstone of the portfolio, contributes significantly to this overall figure, benefiting from its established distribution channels and widespread consumer trust.

La Mer is a prime example of a cash cow within The Estée Lauder Companies' portfolio. It commands a substantial market share in the high-end skincare market, consistently generating significant profits. This strong position is built on its premium branding and the enduring loyalty of its customer base.

While La Mer experienced a dip in sales, particularly in Asia travel retail and China during 2023 and early 2024, due to shifts in consumer spending, its core strengths remain. The brand's ability to maintain high profit margins, even with these headwinds, underscores its cash-generating power. For instance, Estée Lauder's overall net sales for the fiscal year ending June 30, 2023, were $15.91 billion, and La Mer's premium pricing contributes significantly to this revenue stream, even if specific divisional figures aren't always broken out publicly.

M·A·C, a prominent player in the color cosmetics sector, functions as a cash cow for The Estée Lauder Companies. Its significant market share within a mature industry is a testament to its enduring appeal and established presence.

While the broader cosmetics market has seen shifts, M·A·C's broad appeal among professionals and consumers, supported by a wide array of products, consistently yields substantial cash flow. This brand's ability to maintain profitability with comparatively modest investment in promotions, especially when contrasted with emerging brands, underscores its cash cow status.

In 2023, The Estée Lauder Companies reported net sales of $15.91 billion, with its makeup category, which includes M·A·C, contributing significantly. M·A·C's strong retail footprint and loyal customer base enable it to command high profit margins, reinforcing its role as a stable cash generator for the parent company.

Aveda

Aveda, a brand renowned for its natural, high-performance hair and skincare, operates as a solid cash cow for The Estée Lauder Companies (ELC). Its established market position and dedicated customer following ensure consistent revenue generation. Despite some challenges in its salon distribution channels, Aveda continues to hold a substantial share in the professional and prestige hair care segments.

The brand's strong equity translates into reliable cash flows, which are vital for funding ELC's other ventures. For instance, in fiscal year 2023, ELC reported net sales of $16.0 billion, with its Hair Care segment, where Aveda primarily resides, showing resilience. While specific figures for Aveda are not always broken out, its contribution to the segment's overall performance is significant.

- Market Position: Aveda maintains a strong presence in the premium hair care market.

- Revenue Generation: Consistent sales driven by brand loyalty and product efficacy.

- Financial Contribution: Provides stable cash flow to support ELC's broader portfolio.

- Brand Equity: High recognition and trust contribute to its cash cow status.

Bobbi Brown Cosmetics

Bobbi Brown Cosmetics, a well-established name in makeup and skincare, functions as a cash cow within The Estée Lauder Companies' (ELC) portfolio. Its significant market share, particularly in both professional and consumer beauty sectors, underpins its reliable revenue generation. The brand's reputation for natural aesthetics and high-quality products fosters a loyal customer base, ensuring consistent sales.

In 2023, ELC reported net sales of $15.61 billion, and while specific brand breakdowns are not publicly disclosed, established brands like Bobbi Brown are known contributors to overall profitability. As a mature brand in a competitive but stable market, Bobbi Brown requires less capital investment for growth compared to ELC's emerging or high-growth brands, allowing it to generate substantial free cash flow.

- Market Position: Strong, established market share in professional and consumer beauty.

- Revenue Generation: Consistent and reliable revenue streams due to a loyal customer base.

- Profitability: Stable profitability due to its mature market status.

- Investment Needs: Requires minimal aggressive investment, contributing significantly to ELC's cash flow.

Clinique, a dermatologist-developed skincare and makeup brand, is a significant cash cow for The Estée Lauder Companies (ELC). Its strong reputation for efficacy and allergy-tested products cultivates deep customer loyalty. This brand consistently generates substantial revenue with relatively stable marketing expenditures.

In fiscal year 2023, Estée Lauder Companies reported net sales of $15.91 billion. Clinique, with its broad appeal across various age demographics and its focus on sensitive skin solutions, contributes reliably to this overall revenue, particularly within the skincare segment.

The brand's established presence in department stores and online channels ensures consistent access to consumers. While it operates in a mature market, Clinique's product innovation and focus on core skincare benefits allow it to maintain strong profit margins, reinforcing its cash cow status.

Clinique's consistent performance and lower reinvestment needs compared to newer brands make it a vital contributor to ELC's overall financial stability and ability to fund growth initiatives in other parts of its portfolio.

| Brand | BCG Category | Fiscal Year 2023 Net Sales (Est. Contribution) | Key Strengths |

| Estée Lauder | Cash Cow | Significant | Global footprint, prestige positioning, enduring legacy |

| La Mer | Cash Cow | Substantial | High-end skincare, premium branding, customer loyalty |

| M·A·C | Cash Cow | Significant | Dominant in color cosmetics, broad appeal, strong retail presence |

| Aveda | Cash Cow | Substantial | Natural ingredients, professional hair care, brand equity |

| Bobbi Brown Cosmetics | Cash Cow | Reliable | Natural aesthetics, high-quality products, loyal customer base |

| Clinique | Cash Cow | Reliable | Dermatologist-developed, allergy-tested, broad demographic appeal |

Full Transparency, Always

The Estée Lauder Companies BCG Matrix

The Estée Lauder Companies BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This analysis-ready file offers a comprehensive strategic overview, meticulously prepared by industry experts, ensuring you gain immediate access to actionable insights for your business planning.

Dogs

Smashbox, a makeup brand, is positioned as a Dog within The Estée Lauder Companies' (ELC) BCG Matrix. This classification stems from its reportedly low market share within the highly competitive makeup segment, a market that may also be experiencing slower growth compared to other beauty categories. ELC has reportedly considered divesting Smashbox, a move typical for brands that are underperforming and consuming resources without generating substantial returns.

Too Faced, a prominent makeup brand, has been identified as a significant underperformer for The Estée Lauder Companies, directly contributing to substantial impairment charges. This situation highlights the brand's challenges in a highly competitive market that demands continuous innovation and considerable marketing expenditure.

The brand's struggles are indicative of a low market share within a dynamic segment. Its inability to generate adequate returns or achieve meaningful growth, as reflected in its financial impact, firmly places Too Faced in the Dog category of the BCG matrix. For instance, The Estée Lauder Companies reported impairment charges related to goodwill and other intangible assets in fiscal year 2023, with Too Faced being a contributing factor, underscoring its weak financial performance.

Dr. Jart+ in travel retail is a clear example of a Dog within The Estée Lauder Companies' portfolio. Its performance in this channel has been notably weak, prompting ELC to exit the market entirely in November 2024. This strategic move underscores the brand's diminished market share and unfavorable outlook in a segment that was once a significant contributor.

The decision to divest from travel retail, accompanied by goodwill impairment charges, highlights the brand's struggle to gain traction. This channel for Dr. Jart+ represents a drain on resources, yielding insufficient returns and marking it as a Dog that requires careful management or divestment to reallocate capital more effectively.

Aveda's Salon Channel

Aveda's salon distribution channel is currently positioned as a Dog in The Estée Lauder Companies' BCG Matrix. This classification stems from its ongoing struggles with declining sales and market softness, indicating a low-growth or even contracting segment for this specific business model.

Despite Aveda's strong brand equity, the salon channel is finding it difficult to hold onto its market share and maintain profitability. This sustained underperformance suggests a need for strategic recalibration within this part of Aveda's operations.

- Sales Decline: Reports indicate continued softness and declines in sales for Aveda's salon channel, a key indicator of its Dog status.

- Market Segment Performance: This particular distribution model operates within a market segment that is experiencing low growth or contraction.

- Profitability Challenges: The channel is facing difficulties in maintaining profitability despite the overall strength of the Aveda brand.

- Strategic Review: The sustained underperformance necessitates strategic adjustments, solidifying its position as a Dog requiring attention.

Certain Legacy Makeup Lines (within various brands)

Certain legacy makeup lines within The Estée Lauder Companies' vast brand portfolio might be categorized as Dogs in the BCG Matrix. These older, less innovative products, even within strong brands, often face a market with rapidly shifting consumer tastes and intense competition from newer, trend-focused alternatives. This can lead to low growth rates and a declining market share, making them less profitable.

For instance, while Estée Lauder as a whole is a powerhouse, specific foundational or lipstick ranges that haven't been updated in years might fall into this category. In 2024, the beauty industry continues to be driven by social media trends and ingredient innovation, making it harder for established but static product lines to maintain relevance. These lines may require substantial investment to revitalize or could be candidates for divestment if they no longer align with strategic goals.

- Low Market Growth: These legacy lines operate in makeup segments that are not expanding significantly, or are even contracting due to changing consumer demands.

- Low Relative Market Share: Despite being part of a larger brand, these specific products struggle to capture a meaningful share against newer, more appealing competitors.

- Minimal Cash Generation: The sales volume is often insufficient to cover marketing and development costs, resulting in little to no positive cash flow.

- Limited Future Potential: Without a significant overhaul or repositioning, these products are unlikely to see substantial growth or market revitalization.

Brands like Smashbox and Too Faced are categorized as Dogs within The Estée Lauder Companies' portfolio due to their low market share in competitive beauty segments and slower growth. The company has considered divesting Smashbox, and Too Faced has contributed to significant impairment charges, highlighting underperformance and challenges in generating adequate returns.

Dr. Jart+'s travel retail segment and Aveda's salon distribution channel are also classified as Dogs, marked by weak performance and sales declines. ELC's exit from Dr. Jart+ in travel retail in November 2024 and the ongoing struggles in Aveda's salon channel underscore their low market share and unfavorable outlooks, necessitating strategic adjustments.

Certain legacy makeup lines, lacking innovation and facing shifting consumer tastes, also fall into the Dog category. These products struggle to maintain relevance and market share against newer competitors, generating minimal cash flow and possessing limited future potential without significant revitalization efforts.

Question Marks

BALMAIN Beauty, launched in fiscal 2025, is positioned as a Question Mark within Estée Lauder Companies' (ELC) portfolio. It operates in the rapidly expanding luxury fragrance market, a segment that saw global sales reach an estimated $35 billion in 2024, with prestige fragrances accounting for a significant portion.

Despite the high-growth environment, BALMAIN Beauty currently holds a minimal market share as it focuses on establishing its brand identity and distribution channels. ELC's strategic investment in this new venture signals a commitment to bolstering its luxury offerings, recognizing the substantial growth potential inherent in the prestige fragrance sector.

The brand's trajectory is uncertain, requiring substantial, sustained investment in marketing campaigns and retail partnerships to capture a meaningful market share. Success could see BALMAIN Beauty transition into a Star, contributing significantly to ELC's overall performance.

Clinique CX, launched in China in November 2024, represents Clinique's foray into advanced post-procedure skincare. This new franchise targets a specific, high-potential segment within the rapidly expanding Chinese skincare market.

As a recent entrant, Clinique CX currently possesses a modest market share. However, its strategic focus on innovation and a burgeoning market suggests significant growth potential, classifying it as a Question Mark within the BCG matrix.

The success of Clinique CX hinges on substantial investment to build brand awareness and capture a larger portion of its target market. This strategic allocation of resources is crucial for its transition from a Question Mark to a potential Star performer in the Estée Lauder Companies portfolio.

The Ordinary's GF 15% Solution, a new anti-aging serum hitting the market in January 2025, is currently classified as a Question Mark in the BCG matrix. Its recent launch places it in a rapidly evolving and intensely competitive skincare landscape, particularly within the lucrative anti-aging sector which saw global sales exceed $15 billion in 2024.

This product's disruptive pricing strategy, a hallmark of The Ordinary, aims to capture market share rapidly. However, its success hinges on significant investment in marketing and building consumer awareness to climb the market share ladder.

The GF 15% Solution's future trajectory is uncertain; it needs to gain substantial traction to potentially evolve into a Star product, or it risks remaining a low-growth, low-share offering.

Estée Lauder Brand on Amazon U.S. Premium Beauty Store

The Estée Lauder brand's strategic move onto Amazon's U.S. Premium Beauty store in October 2024 positions it as a Question Mark within the BCG Matrix. This initiative is a deliberate investment to tap into the burgeoning e-commerce market, aiming to expand market share in a digital landscape where the brand's direct presence was previously less pronounced. The success of this venture is crucial for future growth, necessitating substantial marketing and operational resources to achieve significant scale.

This expansion is particularly noteworthy given the broader beauty market trends. In 2023, the U.S. online beauty market was valued at approximately $22 billion, with projections indicating continued robust growth. Estée Lauder's decision to enter this premium segment on Amazon reflects a calculated risk to capitalize on this trend, even as the brand's established product lines might be considered cash cows in other channels.

- Strategic Channel Expansion: Estée Lauder's entry into Amazon's U.S. Premium Beauty store is a calculated move to capture a larger share of the rapidly growing online beauty market.

- Investment for Growth: While the core Estée Lauder brand is a strong performer, this specific channel initiative represents an investment in a high-potential, yet developing, segment.

- Market Dynamics: The U.S. online beauty market reached an estimated $22 billion in 2023, highlighting the significant opportunity for brands to scale their digital presence.

- Resource Allocation: Significant marketing and operational investments are required to ensure the success and scalability of this new e-commerce channel.

Tom Ford Beauty

Tom Ford Beauty, acquired by Estée Lauder Companies (ELC) in April 2023 for $2.8 billion, is currently positioned as a Question Mark in the BCG matrix. ELC has ambitious plans for it to become a leading luxury brand, but recent performance suggests it's not yet consistently achieving high growth.

While Tom Ford Beauty holds a significant market share aspiration within the luxury beauty segment, its fragrance sales experienced a decline in the first quarter of fiscal year 2025. This indicates that the brand is facing challenges in translating its premium positioning into sustained high growth, a key characteristic of a Star.

The brand requires substantial and ongoing investment from ELC to fully integrate its operations and capitalize on its luxury appeal. Strategic realignment is crucial to help Tom Ford Beauty overcome its current hurdles and potentially evolve into a Star or a robust Cash Cow within ELC's portfolio.

- Acquisition Cost: $2.8 billion in April 2023.

- Q1 FY25 Performance: Fragrance sales declined, indicating growth challenges.

- Strategic Imperative: Requires significant investment and realignment to achieve high growth potential.

- BCG Classification: Question Mark, with potential to become a Star or Cash Cow.

Question Marks in Estée Lauder Companies' portfolio represent new ventures or products with high growth potential but low current market share. These require significant investment to gain traction and could become Stars if successful, or Dogs if they fail to capture market share. BALMAIN Beauty, Clinique CX, and The Ordinary's GF 15% Solution are examples of such initiatives, each targeting specific, high-potential market segments.

The Estée Lauder brand's expansion onto Amazon and the Tom Ford Beauty acquisition also fall into this category, reflecting strategic investments in new channels and brands. These ventures demand substantial resources for marketing, distribution, and brand building to achieve their growth objectives.

The success of these Question Marks is crucial for ELC's future growth, as they aim to capture emerging market trends and expand the company's overall reach. Their evolution will be closely monitored, with strategic decisions dictating their transition towards becoming market leaders or being divested.

The Estée Lauder Companies' investment in these Question Marks underscores a commitment to innovation and market expansion. For instance, the global luxury fragrance market, where BALMAIN Beauty operates, was valued at approximately $35 billion in 2024. Clinique CX targets the Chinese skincare market, which is experiencing rapid growth. The Ordinary's GF 15% Solution enters the competitive anti-aging sector, a market that exceeded $15 billion globally in 2024.

| Brand/Product | Category | Market Potential | Current Share | Investment Need |

| BALMAIN Beauty | Luxury Fragrance | High | Low | High |

| Clinique CX | Post-Procedure Skincare (China) | High | Low | High |

| The Ordinary GF 15% Solution | Anti-Aging Serum | High | Low | High |

| Estée Lauder (Amazon) | E-commerce Beauty | High | Developing | High |

| Tom Ford Beauty | Luxury Beauty | High | Moderate (with recent challenges) | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.