The Estée Lauder Companies Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Estée Lauder Companies Bundle

Discover the strategic engine behind The Estée Lauder Companies with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Perfect for anyone looking to understand the dynamics of a global beauty leader.

Partnerships

The Estée Lauder Companies (ELC) leverages key partnerships within the biotechnology sector to drive innovation. For instance, their collaboration with Serpin Pharma focuses on cutting-edge anti-inflammatory research, aiming to develop novel skincare ingredients and accelerate product development. This strategic alliance underscores ELC's commitment to scientific advancement.

Further strengthening their innovation pipeline, ELC also partners with leading academic institutions like the Massachusetts Institute of Technology (MIT). These collaborations are crucial for advancing green chemistry principles and exploring biotech-driven skincare solutions, ensuring ELC remains at the forefront of sustainable and effective beauty products.

The Estée Lauder Companies (ELC) is actively expanding its technology partnerships, notably with Microsoft, to establish an AI Innovation Lab. This collaboration focuses on harnessing generative AI to boost marketing effectiveness and expedite product development cycles.

Further solidifying its digital capabilities, ELC has partnered with Adobe Inc. to integrate Adobe Firefly, a generative AI solution. This integration aims to streamline content creation processes and accelerate the execution of digital marketing campaigns, reflecting a strategic push towards AI-driven operational efficiencies.

Estée Lauder Companies relies heavily on its extensive network of global retailers and distributors, including prestigious department stores, specialty multi-brand retailers, and upscale perfumeries. These partnerships are vital for ensuring their prestige brands reach consumers across diverse geographical markets, facilitating widespread product availability. For instance, in 2023, the company reported net sales of $16.0 billion, underscoring the significant reach and impact of these retail collaborations.

Influencers and Media Platforms

Estée Lauder strategically partners with prominent influencers like Karlie Kloss and Kendall Jenner. These collaborations are crucial for boosting brand awareness and accessing diverse consumer segments. In 2024, influencer marketing continued to be a dominant force in beauty, with Estée Lauder leveraging these relationships to drive engagement and product discovery.

The company also actively collaborates with digital platforms, notably TikTok, through initiatives such as 'The Catalysts' program. This program focuses on identifying and nurturing emerging talent in the beauty industry, thereby expanding Estée Lauder's market footprint and tapping into new trends.

- Influencer Reach: Partnerships with individuals like Karlie Kloss and Kendall Jenner provide access to millions of followers, amplifying Estée Lauder's brand message.

- Platform Expansion: Collaborations with platforms like TikTok are vital for reaching younger demographics and staying ahead of digital marketing trends.

- Innovation Discovery: Programs like 'The Catalysts' on TikTok aim to identify and support new beauty innovators, fostering future growth and market relevance.

- Brand Visibility: These key partnerships are instrumental in maintaining and enhancing Estée Lauder's visibility in the competitive beauty landscape.

Sustainable Sourcing and Packaging Partners

The Estée Lauder Companies (ELC) actively collaborates with key partners to drive sustainability throughout its value chain. This includes working with suppliers to ensure responsible sourcing practices, with a notable focus on achieving targets for sustainably certified palm oil ingredients. ELC’s commitment extends to packaging innovation, as seen in its partnerships with companies like Verescence, aimed at increasing the use of recycled content and promoting eco-friendly designs.

These strategic alliances are crucial for ELC's sustainability goals. For instance, by 2023, ELC reported that 80% of its palm oil derivatives were sourced from RSPO (Roundtable on Sustainable Palm Oil) certified suppliers, with a clear objective to reach 100%.

- Responsible Sourcing: ELC partners with suppliers to ensure that key raw materials, such as palm oil derivatives, meet sustainability certifications, with a significant portion already RSPO certified.

- Packaging Innovation: Collaborations with packaging manufacturers like Verescence focus on integrating higher percentages of post-consumer recycled (PCR) content into glass packaging.

- Eco-friendly Design: These partnerships also drive the development of lighter-weight packaging and explore alternative, more sustainable materials to reduce environmental impact.

Estée Lauder Companies (ELC) cultivates vital partnerships with global retailers and distributors, essential for brand presence and consumer access. These include major department stores and specialty beauty retailers, ensuring their prestige products reach a wide audience. In fiscal year 2023, ELC reported net sales of $16.0 billion, a testament to the extensive reach facilitated by these retail collaborations.

The company also strategically engages with influential figures and digital platforms to amplify brand messaging and connect with diverse demographics. Collaborations with influencers like Kendall Jenner and initiatives on platforms such as TikTok are key to driving engagement and staying relevant in the fast-paced beauty market.

Furthermore, ELC actively seeks partnerships in biotechnology and technology sectors to fuel innovation. Collaborations with entities like MIT for green chemistry research and Microsoft for AI development underscore a commitment to scientific advancement and digital transformation, aiming to enhance product development and marketing effectiveness.

What is included in the product

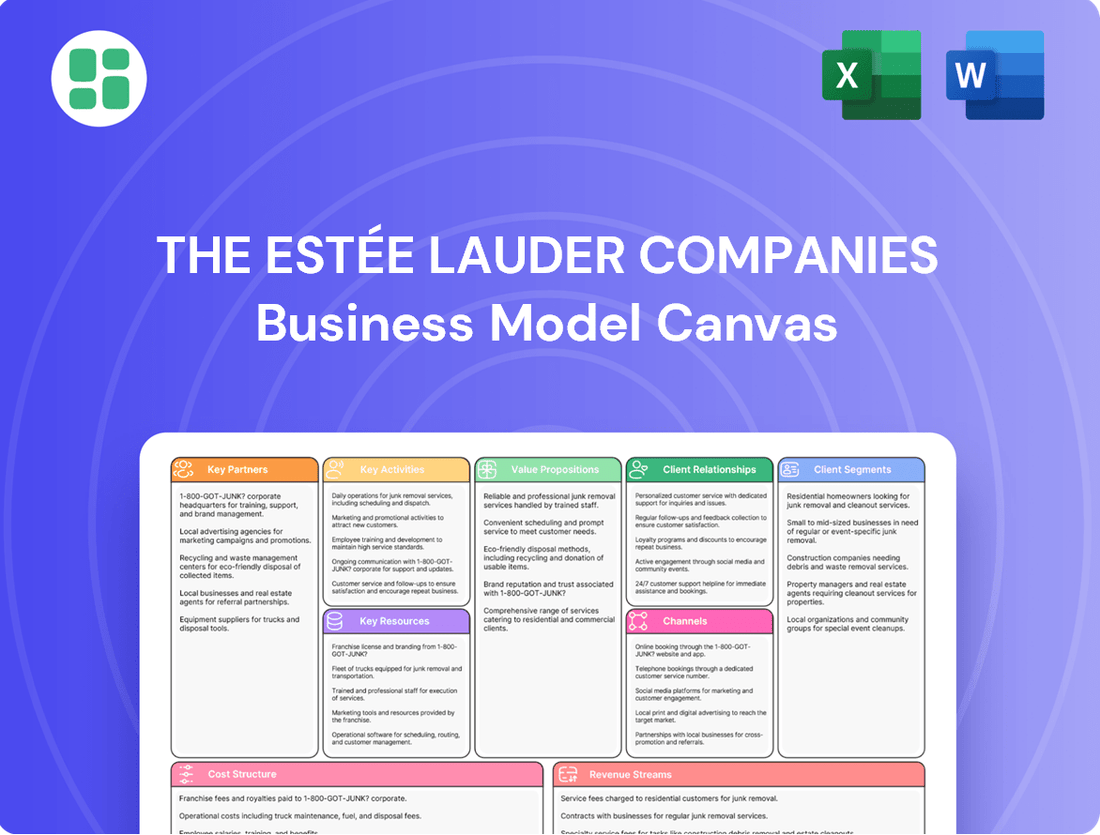

This Estée Lauder Companies Business Model Canvas provides a comprehensive overview of their strategy, detailing customer segments, channels, and value propositions to reflect real-world operations.

It's designed for informed decision-making, covering competitive advantages and SWOT analysis within the classic 9 BMC blocks, ideal for presentations and validation.

The Estée Lauder Companies Business Model Canvas acts as a pain point reliever by providing a clear, visual overview of their complex operations, allowing for rapid identification of strategic alignment and potential inefficiencies.

Activities

The Estée Lauder Companies (ELC) dedicates significant resources to research and development, fueling a pipeline of innovative skincare, makeup, fragrance, and hair care products. In fiscal year 2023, the company's R&D spending supported the launch of numerous new products and the enhancement of existing lines, reflecting a commitment to staying ahead in a dynamic beauty market.

ELC actively integrates cutting-edge technologies like artificial intelligence and biotechnology. These tools are instrumental in identifying emerging consumer trends, accelerating the product development cycle, and ensuring innovations are precisely tailored to meet evolving consumer demands and preferences.

Estée Lauder manages a vast global manufacturing and supply chain network to bring its extensive range of beauty products to consumers worldwide. This involves overseeing numerous production facilities and distribution channels to ensure timely and efficient delivery.

In fiscal year 2023, the company reported net sales of $15.91 billion, underscoring the scale of its operations and the critical role of its supply chain in meeting global demand.

Key activities focus on streamlining operations, from sourcing raw materials to final product distribution, with a constant drive to reduce inventory levels and enhance overall efficiency. This optimization is crucial for adapting to market fluctuations and maintaining competitiveness.

Estée Lauder's key activities heavily feature crafting and implementing global marketing plans to boost brand recognition and connect with customers. This encompasses everything from classic ads to digital campaigns, social media interaction, and partnerships with influencers to showcase their high-end beauty products.

In 2024, the company continued to invest significantly in marketing, with digital channels playing an ever-larger role. For instance, their social media presence across platforms like Instagram and TikTok is crucial for reaching younger demographics and driving engagement with new product launches.

This brand-building effort is vital for maintaining their prestige positioning. The Estée Lauder Companies reported net sales of $16.25 billion for fiscal year 2023, underscoring the substantial resources dedicated to marketing and brand equity development.

Sales and Multi-Channel Distribution

Estée Lauder Companies (ELC) orchestrates its sales and distribution through a dynamic multi-channel strategy. This includes robust wholesale partnerships with department stores and specialty retailers, alongside a growing direct-to-consumer (DTC) presence via its own freestanding stores and increasingly vital e-commerce platforms. ELC's approach is geared towards maximizing consumer access and engagement by prioritizing expansion in high-growth channels and emerging markets.

The company's commitment to channel diversification is evident in its performance. For fiscal year 2023, ELC reported net sales of $15.91 billion, with its DTC channels, particularly online, showing significant growth. This strategic focus aims to capture a wider consumer base and adapt to evolving purchasing behaviors.

- Wholesale: Partnerships with global retailers, department stores, and specialty beauty stores remain a cornerstone of ELC's distribution.

- Direct-to-Consumer (DTC): This includes freestanding brand stores and a significant investment in e-commerce, driving personalized customer experiences.

- Channel Expansion: ELC actively seeks to increase its footprint in high-growth geographic markets and digital channels to broaden consumer reach.

Sustainability and Corporate Citizenship

Estée Lauder Companies actively pursues sustainability and corporate citizenship, setting ambitious goals for climate action, sustainable packaging, and responsible sourcing. These efforts underscore a dedication to environmental stewardship and social responsibility throughout their operations.

In 2023, the company reported progress towards its 2030 climate targets, aiming for a 50% reduction in Scope 1 and 2 greenhouse gas emissions. They also continue to invest in innovations for sustainable packaging, with a goal to make 75% of their packaging recyclable, reusable, or compostable by 2025.

- Climate Action: Targeting a 50% reduction in Scope 1 and 2 GHG emissions by 2030 against a 2018 baseline.

- Sustainable Packaging: Aiming for 75% of packaging to be recyclable, reusable, or compostable by 2025.

- Responsible Sourcing: Continued focus on ethical and sustainable sourcing of key raw materials.

- Social Impact: Programs like the Breast Cancer Campaign and commitments to diversity and inclusion are integral to their citizenship efforts.

Estée Lauder Companies' key activities revolve around robust research and development to create innovative beauty products, leveraging technology like AI for trend identification and product acceleration. They manage a complex global supply chain, ensuring efficient production and timely delivery, as evidenced by their $15.91 billion net sales in fiscal year 2023. Marketing and brand-building are paramount, utilizing digital campaigns and influencer collaborations to maintain prestige and reach diverse demographics, with 2024 seeing continued investment in these areas.

| Key Activity | Description | Fiscal Year 2023 Data/2024 Focus |

| Research & Development | Innovation in skincare, makeup, fragrance, hair care. | Supported numerous new product launches and enhancements. |

| Manufacturing & Supply Chain | Global production and distribution network. | Net sales of $15.91 billion; focus on streamlining operations. |

| Marketing & Brand Building | Global marketing plans, digital campaigns, influencer partnerships. | Continued investment in 2024, emphasis on social media engagement. |

| Sales & Distribution | Multi-channel strategy: wholesale, DTC, e-commerce. | DTC channels showing significant growth; expansion in high-growth markets. |

| Sustainability & Citizenship | Environmental stewardship and social responsibility. | Progress towards 2030 climate targets; packaging goals for 2025. |

Full Document Unlocks After Purchase

Business Model Canvas

The Estée Lauder Companies Business Model Canvas preview you are viewing is the authentic document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and full transparency. You'll gain immediate access to this complete, ready-to-use analysis of their business strategy.

Resources

The Estée Lauder Companies' key resource is its extensive portfolio of over 25 prestige beauty brands. This diverse collection includes iconic names like Estée Lauder, Clinique, M·A·C, La Mer, and Jo Malone London, appealing to a wide range of consumer tastes and market segments.

Estée Lauder Companies safeguards its innovations through a robust portfolio of intellectual property, encompassing thousands of patents worldwide. These patents cover everything from unique product formulations and advanced delivery systems to distinctive packaging designs and efficient manufacturing techniques.

Trademarks for its iconic brands, such as Estée Lauder, Clinique, and MAC Cosmetics, are critical assets, fostering strong brand recognition and consumer loyalty. In 2023, the company continued to invest in R&D, with a focus on sustainable innovation, further solidifying its competitive edge and the perceived efficacy of its offerings.

The Estée Lauder Companies (ELC) leverages its extensive global research and development (R&D) capabilities, housing state-of-the-art facilities and a dedicated team of scientific and technical experts. This robust R&D infrastructure is crucial for driving continuous innovation across their product portfolio.

This expertise enables ELC to explore novel ingredients and formulate advanced beauty solutions, ensuring they remain at the forefront of the beauty industry. In 2023, the company invested $1.2 billion in R&D, a testament to its commitment to innovation and product development.

Extensive Global Distribution Network

The Estée Lauder Companies boasts an extensive global distribution network, a cornerstone of its business model. This sophisticated infrastructure includes numerous manufacturing facilities, strategically located warehouses, and advanced logistics operations.

This robust network is instrumental in ensuring Estée Lauder can effectively deliver its diverse range of beauty products to consumers in roughly 150 countries and territories worldwide. The efficiency of this supply chain is paramount, facilitating seamless product flow through various retail touchpoints, including traditional brick-and-mortar stores and the increasingly important travel retail sector.

- Global Reach: Serves consumers in approximately 150 countries and territories.

- Infrastructure Elements: Comprises manufacturing sites, warehouses, and logistics operations.

- Channel Enablement: Critical for efficient delivery across diverse retail and travel retail channels.

- Operational Efficiency: Supports the timely and effective supply of products to a global customer base.

Data and Artificial Intelligence Infrastructure

The Estée Lauder Companies leverages its growing investment in data analytics and artificial intelligence as a crucial resource. This technological backbone allows for sophisticated trend spotting, highly personalized marketing campaigns, and the optimization of complex supply chain operations. These capabilities are fundamental to the company's agility and precision in strategic decision-making.

In 2024, Estée Lauder continued to emphasize digital transformation, with significant investments in AI and data infrastructure. This focus is designed to enhance customer engagement and operational efficiency across its diverse brand portfolio.

- Data Analytics Capabilities: Enables granular understanding of consumer behavior and market shifts.

- Artificial Intelligence Tools: Powers personalized recommendations, targeted advertising, and predictive inventory management.

- Supply Chain Optimization: Drives efficiency and responsiveness through data-driven logistics and demand forecasting.

- Digital Transformation Investments: Underpins innovation in product development and go-to-market strategies.

The Estée Lauder Companies' key resources extend beyond its brand portfolio and intellectual property to include its highly skilled workforce and strong relationships with suppliers and retail partners. The company's employees, from R&D scientists to marketing professionals and sales associates, are vital for innovation and customer engagement. Furthermore, established partnerships ensure access to quality ingredients and prime retail placement, supporting the company's expansive global operations.

Value Propositions

Estée Lauder Companies (ELC) builds its business on a foundation of superior quality and proven efficacy, especially within the competitive prestige skincare, makeup, and fragrance markets. Consumers consistently turn to ELC brands because they expect tangible results and a luxurious experience, fostering deep brand loyalty. This commitment to excellence is a cornerstone of their value proposition.

In 2023, ELC's net sales reached $15.91 billion, underscoring the market's strong reception of their high-quality offerings. The company's dedication to research and development ensures that their products not only meet but often exceed consumer expectations for performance and sensory appeal, reinforcing their reputation for efficacy.

Estée Lauder Companies drives value through innovation and advanced scientific formulations, offering cutting-edge products developed via extensive research. Their commitment includes leveraging biotech and AI-driven insights to anticipate and meet evolving consumer demands and beauty trends.

Estée Lauder's diverse portfolio, encompassing over 25 brands, allows them to offer highly personalized beauty solutions. This breadth caters to a wide range of consumers, from Gen Z to mature demographics, addressing various skin types, concerns, and aesthetic preferences. For instance, their brands span skincare, makeup, fragrance, and hair care, ensuring a comprehensive offering within the prestige market.

Luxury Brand Experience and Heritage

Estée Lauder’s brands cultivate a luxurious and aspirational consumer journey. This is deeply rooted in their extensive heritage, evoking prestige and sophistication that appeals to a discerning clientele. This intangible value proposition is a cornerstone for consumers desiring exclusive, high-quality beauty products.

The company’s commitment to this premium experience is evident in its brand portfolio, which consistently commands higher price points and fosters strong brand loyalty. For instance, in fiscal year 2023, Estée Lauder reported net sales of $15.91 billion, demonstrating the market's continued demand for their luxury offerings.

- Heritage-driven prestige: Brands like Estée Lauder, Clinique, and La Mer leverage decades of history to build trust and desirability.

- Aspirational marketing: Campaigns often feature high-profile ambassadors and sophisticated imagery, reinforcing the luxury image.

- Premium product development: Investment in research and development ensures cutting-edge formulations that justify premium pricing.

- Exclusive distribution: Selective retail partnerships and direct-to-consumer channels maintain an aura of exclusivity.

Commitment to Sustainability and Transparency

The Estée Lauder Companies (ELC) demonstrates a robust commitment to sustainability and transparency, offering consumers products and practices that align with environmental and social responsibility. This focus resonates strongly with a growing segment of eco-conscious buyers.

ELC's approach includes providing clear, transparent ingredient information, allowing consumers to make informed choices. Furthermore, the company is actively investing in sustainable packaging solutions, reducing its environmental footprint and enhancing brand appeal.

- Sustainable Packaging Initiatives: In 2023, ELC reported that 54% of its packaging was recyclable, made from recycled content, or could be refilled. The company aims for 100% of its packaging to be recyclable, reusable, or compostable by 2030.

- Ingredient Transparency: ELC provides detailed ingredient lists on its product packaging and websites, empowering consumers with knowledge about what they are applying to their skin.

- Reduced Carbon Footprint: The company has set science-based targets to reduce its greenhouse gas emissions, with a goal of a 50% absolute reduction in Scope 1 and 2 emissions by 2030 from a 2018 baseline.

Estée Lauder Companies delivers a range of high-quality, effective prestige skincare, makeup, and fragrance products. Consumers are drawn to the tangible results and luxurious experience these brands provide, fostering significant brand loyalty.

The company's diverse portfolio, featuring over 25 brands, enables personalized beauty solutions for a broad demographic. This extensive offering caters to various skin types, concerns, and preferences across different age groups.

Innovation is central, with ELC investing in advanced scientific formulations and leveraging technologies like biotech and AI. This focus ensures products meet evolving consumer demands and beauty trends.

ELC's value proposition is also built on a heritage of prestige and aspirational marketing. This strategy, combined with exclusive distribution, maintains an aura of luxury and desirability, justifying premium pricing and driving repeat purchases.

| Value Proposition | Description | Supporting Data/Fact |

|---|---|---|

| Superior Quality & Efficacy | High-performance products delivering tangible results in skincare, makeup, and fragrance. | Net sales of $15.91 billion in fiscal year 2023. |

| Personalized Beauty Solutions | A diverse brand portfolio catering to a wide range of consumer needs and preferences. | Over 25 distinct brands within the company's portfolio. |

| Innovation & Science-Driven Formulations | Cutting-edge products developed through extensive research and advanced technologies. | Investment in R&D to anticipate and meet evolving consumer demands and beauty trends. |

| Heritage & Aspirational Luxury | Cultivating a luxurious consumer journey rooted in brand heritage and sophisticated marketing. | Strong brand loyalty and premium pricing strategies supported by a legacy of prestige. |

Customer Relationships

Estée Lauder cultivates robust customer connections through dynamic digital interaction. They actively engage on social media, particularly Instagram and Facebook, sharing valuable beauty advice, step-by-step tutorials, and the latest product announcements. This consistent digital presence creates a lively beauty community, fostering a sense of belonging and brand loyalty among consumers.

Estée Lauder focuses on creating personalized experiences to boost customer satisfaction and loyalty. For example, in fiscal year 2023, the company continued to invest in digital capabilities to better understand and engage with its diverse customer base across its many brands.

Leveraging AI and data analytics is key to this personalization strategy. This allows Estée Lauder to tailor marketing messages and product suggestions, making each customer feel uniquely valued. This approach aims to drive repeat purchases and strengthen brand affinity.

Estée Lauder Companies (ELC) cultivates strong customer relationships through high-touch service in its freestanding stores and via retail partners, offering personalized advice and product demonstrations. This direct engagement fosters trust and elevates the luxury shopping experience for consumers.

Loyalty Programs and Exclusive Offers

Estée Lauder Companies (ELC) cultivates customer loyalty through sophisticated omni-channel programs. These initiatives are designed to reward repeat purchases and foster ongoing engagement across all touchpoints.

These loyalty programs frequently grant members early access to coveted new product launches and exclusive promotional events. Furthermore, they offer personalized benefits tailored to individual customer preferences, enhancing the overall brand experience.

- Omni-channel Integration: ELC’s loyalty programs are accessible and rewarding whether customers shop online, in-store, or via mobile apps, ensuring a seamless experience.

- Exclusive Access: Members often receive priority access to limited-edition collections and new product introductions, creating a sense of exclusivity and desirability.

- Personalized Rewards: Data analytics are leveraged to offer customized promotions, birthday gifts, and product recommendations, strengthening the customer-brand connection.

- Engagement Metrics: In fiscal year 2023, ELC reported continued growth in its loyalty program membership, with a notable increase in repeat purchase rates among active members, indicating the effectiveness of these strategies.

Direct-to-Consumer (DTC) Interaction

The Estée Lauder Companies (ELC) directly connects with its customers through its own e-commerce websites and physical stores. This direct interaction is crucial for gathering immediate consumer feedback and building more robust brand loyalty. For instance, in fiscal year 2023, ELC's direct-to-consumer (DTC) channels played a significant role in its overall sales performance, reflecting a growing trend in the beauty industry.

These owned channels provide ELC with invaluable insights into what consumers want and allow the company to react quickly to evolving market demands. This agility is a key advantage in the fast-paced beauty sector. In 2024, ELC continues to invest in enhancing these digital and physical touchpoints to foster deeper customer relationships and drive sales growth.

- Direct Engagement: ELC's owned e-commerce and freestanding stores enable direct conversations and feedback loops with consumers.

- Brand Loyalty: This direct interaction helps cultivate stronger, more personal relationships between consumers and ELC's brands.

- Market Responsiveness: Direct channels allow for quicker identification of consumer preferences and faster adaptation to market trends.

- Data Insights: ELC leverages data from these interactions to better understand its customer base and inform product development and marketing strategies.

Estée Lauder Companies (ELC) prioritizes personalized customer engagement through a multi-faceted approach, blending digital interaction with in-person experiences. Their loyalty programs, active across various brands, aim to foster deep connections by offering exclusive benefits and early access to new products. In fiscal year 2023, ELC saw continued growth in its loyalty membership, with a notable increase in repeat purchase rates among active members, underscoring the success of these relationship-building strategies.

| Customer Relationship Strategy | Key Tactics | Impact/Data (FY2023/2024 Focus) |

|---|---|---|

| Digital Engagement & Community Building | Social media interaction, beauty advice, tutorials | Fosters brand loyalty and a sense of belonging. Continued investment in digital capabilities for enhanced customer understanding. |

| Personalization & Data Analytics | AI-driven tailored marketing, product suggestions | Enhances customer satisfaction and drives repeat purchases by making customers feel uniquely valued. |

| Omni-channel Loyalty Programs | Exclusive access to launches, personalized rewards | Increases customer retention and engagement across all touchpoints. Reported growth in loyalty program membership. |

| Direct-to-Consumer (DTC) Channels | Owned e-commerce, freestanding stores | Enables direct feedback, builds brand loyalty, and allows for quick market adaptation. DTC channels played a significant role in sales performance in FY2023. |

Channels

Department stores and specialty multi-retailers have historically been a cornerstone for Estée Lauder, providing a premium environment to showcase their prestige beauty products and offer expert advice. These channels remain vital for achieving broad market reach and ensuring widespread consumer accessibility to their brands.

In 2024, Estée Lauder continued to leverage these established relationships, recognizing their importance for brand visibility and customer engagement. While specific sales figures by channel are not always publicly detailed, the company's overall performance in 2024, with net sales reaching $16.1 billion, reflects the ongoing contribution of these traditional retail partners.

Travel retail, a historically high-growth channel for Estée Lauder Companies, includes airports, downtown duty-free shops, airlines, and cruise lines. This channel targets over one billion consumers globally each year, making it crucial for the company's international presence. In fiscal year 2023, Estée Lauder reported that travel retail represented 15% of its net sales.

Estée Lauder operates its own freestanding stores, offering a direct channel for consumers to experience its brands. This strategy allows for a highly curated brand presentation and deeper customer engagement.

For luxury and artisanal fragrance brands such as Le Labo and KILIAN PARIS, these physical locations are crucial for growth and brand building. As of fiscal year 2023, Estée Lauder continued to invest in its retail footprint, with freestanding stores playing a key role in showcasing premium products and fostering brand loyalty.

E-commerce Platforms

The Estée Lauder Companies leverages a robust digital strategy, with its own brand websites and third-party platforms serving as crucial sales channels. This omnichannel approach allows for direct consumer engagement and expanded market penetration. For instance, their presence on Amazon's U.S. Premium Beauty store and Shopee in Southeast Asia highlights a commitment to meeting consumers where they shop online.

E-commerce integration is not just about convenience; it's a significant driver of sales growth and customer acquisition. By streamlining the online shopping experience, Estée Lauder can effectively reach a wider audience and foster brand loyalty. This digital focus is particularly evident in their performance, with online sales contributing a substantial portion to overall revenue, reflecting a broader industry trend toward digital commerce.

- Digital Sales Growth: Estée Lauder's online channels are experiencing significant expansion, mirroring the overall surge in e-commerce.

- Third-Party Platform Expansion: Strategic partnerships with platforms like Amazon and Shopee broaden consumer access to Estée Lauder brands.

- Consumer Reach: E-commerce directly enhances the company's ability to connect with a global customer base, driving both sales and brand awareness.

Upscale Perfumeries and Pharmacies

The Estée Lauder Companies (ELC) strategically leverages upscale perfumeries and pharmacies as key distribution channels, moving beyond traditional department store footprints. This approach provides specialized retail environments designed for beauty product sales, offering consumers a more curated and focused shopping experience.

These specialized channels are crucial for reaching a discerning customer base that values expert advice and personalized service. In 2024, ELC's focus on these premium locations continued to drive brand perception and sales, particularly for its prestige brands.

- Specialized Retail Environments: Upscale perfumeries and pharmacies offer a concentrated setting for beauty discovery.

- Expert Consultation: These locations often feature trained beauty advisors, enhancing the customer's purchasing journey.

- Brand Prestige: Association with high-end retailers reinforces the luxury image of ELC's portfolio.

- Targeted Reach: These channels effectively connect with consumers actively seeking premium beauty solutions.

The Estée Lauder Companies utilizes a multi-channel approach to reach its diverse customer base. This includes traditional department stores, its own freestanding stores, travel retail, and a significant digital presence through brand websites and third-party e-commerce platforms. Upscale perfumeries and pharmacies also serve as important specialized channels for premium brand placement and expert customer engagement.

| Channel Type | Key Characteristics | Relevance to ELC | 2023 Data Point |

|---|---|---|---|

| Department Stores & Specialty Multi-retailers | Premium environment, broad reach, expert advice | Core for visibility and accessibility | Contributed to $16.1B net sales in 2024 |

| Travel Retail | Airports, duty-free, airlines; global consumer access | Crucial for international presence | 15% of net sales in FY23 |

| Freestanding Stores | Direct consumer experience, curated brand presentation | Key for brand building, especially for luxury fragrances | Continued investment in retail footprint in FY23 |

| Digital (Brand Websites & Third-Party Platforms) | Direct engagement, expanded market penetration, convenience | Significant driver of sales growth and customer acquisition | Expanded presence on Amazon, Shopee |

| Upscale Perfumeries & Pharmacies | Specialized environments, expert consultation, brand prestige | Targeted reach for discerning customers | Focus on these premium locations in 2024 |

Customer Segments

Estée Lauder's primary customer segment consists of high-income women aged 25 to 55. This group actively seeks premium beauty products, valuing not just efficacy but also the luxury experience and the brand's established heritage. In 2024, this demographic continues to represent a significant portion of the luxury beauty market, with spending power that supports Estée Lauder's premium pricing strategy.

The Estée Lauder Companies' luxury beauty consumers are discerning individuals who place a high value on prestige, advanced formulations, and exclusive brand experiences. These customers are not deterred by higher price points, instead viewing them as indicative of quality and exclusivity.

This segment is willing to make substantial investments in premium skincare, makeup, and fragrance products. For instance, in fiscal year 2023, Estée Lauder reported net sales of $15.91 billion, a significant portion of which is driven by these high-spending luxury consumers across its portfolio of brands.

Millennials and Gen Z are a significant focus for Estée Lauder, driving a shift towards digital engagement and values-based purchasing. These consumers, who represent a growing portion of the beauty market, are highly influenced by social media trends, the demand for clean and sustainable beauty products, and a strong emphasis on inclusivity and diversity in brand messaging. In 2023, Estée Lauder reported that digital channels accounted for a substantial portion of its sales, reflecting the online-centric behavior of these younger demographics.

Global Prestige Beauty Market

Estée Lauder's customer segments are broad, encompassing a global consumer base that values prestige and quality in beauty products. Their reach extends to over 150 countries, demonstrating a commitment to serving diverse markets worldwide.

A key focus for Estée Lauder is the high-growth Asia-Pacific region, with China being a particularly important market. The company actively works to balance its growth across different geographical areas to mitigate risks and capitalize on emerging opportunities.

- Global Reach: Serves consumers in over 150 countries.

- Geographic Focus: Significant emphasis on Asia-Pacific, especially China.

- Growth Rebalancing: Strategy to diversify and stabilize growth across regions.

- Prestige Segment: Targets consumers seeking premium beauty products.

Emerging Middle Class and Male Grooming Segment

Estée Lauder Companies is strategically targeting the burgeoning middle class across the globe, recognizing its substantial potential for growth. By 2030, this demographic is expected to represent a significant portion of the consumer market, driving demand for premium beauty products.

The company is also actively expanding its reach within the male grooming sector, a market experiencing robust expansion. This includes a growing emphasis on skincare and fragrance offerings tailored specifically for men, broadening Estée Lauder's traditional customer appeal.

- Global Middle Class Growth: Projections indicate the global middle class could reach 5.3 billion people by 2030, with a significant portion residing in emerging markets, presenting a vast opportunity for Estée Lauder.

- Male Grooming Market Expansion: The global male grooming market was valued at approximately $60 billion in 2023 and is forecast to grow at a compound annual growth rate of around 5.5% through 2030, highlighting a key area of focus for ELC.

- Increased Spending Power: As the middle class expands, so does disposable income, enabling a greater number of consumers to invest in higher-quality beauty and personal care items.

Estée Lauder's customer base is diverse, spanning affluent women aged 25-55 who prioritize luxury and heritage, alongside a growing segment of digitally-savvy Millennials and Gen Z consumers focused on values like sustainability and inclusivity. The company also actively targets the expanding global middle class and the robust male grooming market, demonstrating a broad strategic approach to capturing diverse consumer spending power.

| Customer Segment | Key Characteristics | 2023/2024 Relevance |

|---|---|---|

| Affluent Women (25-55) | Seek premium, luxury beauty products, value brand heritage and experience. | Continue to drive significant sales in the luxury beauty market, supporting premium pricing. |

| Millennials & Gen Z | Digitally engaged, influenced by social media, value clean beauty, sustainability, inclusivity. | Represent significant growth potential, driving digital channel adoption and brand messaging evolution. |

| Global Middle Class | Growing disposable income, increasing demand for quality beauty products. | Projected to be a major growth driver, especially in emerging markets. |

| Male Grooming Consumers | Interested in specialized skincare and fragrance. | A rapidly expanding market with significant revenue opportunities. |

Cost Structure

The Estée Lauder Companies dedicates substantial resources to research and development, a critical component for fostering product innovation and sustaining its competitive advantage in the beauty industry. These investments are essential for staying ahead of market trends and consumer preferences.

In fiscal year 2023, Estée Lauder's selling, general and administrative expenses, which encompass R&D, totaled $4.45 billion. This figure reflects ongoing commitment to scientific studies, advanced product formulation, and the crucial development and protection of intellectual property, ensuring a pipeline of novel and effective beauty solutions.

Selling, General, and Administrative (SG&A) expenses form a significant part of Estée Lauder's cost structure. These costs encompass crucial areas like extensive marketing and advertising campaigns, maintaining a dedicated sales force, and the operational overhead required to run a global corporation.

In fiscal year 2023, Estée Lauder reported SG&A expenses of $6.33 billion. The company's strategy involves strategically increasing its investment in consumer-facing activities. This approach is designed to drive faster customer acquisition and build brand loyalty in a competitive market.

The Estée Lauder Companies incurs significant costs in manufacturing and its global supply chain operations. These expenses cover everything from sourcing raw materials like botanical extracts and specialty chemicals to the actual production of cosmetics, skincare, and fragrances. In fiscal year 2023, the company reported Cost of Sales of $9.37 billion, reflecting these substantial manufacturing and supply chain outlays.

Managing a vast network of factories, distribution centers, and transportation routes worldwide adds another layer of operational cost. This includes warehousing, inventory management, and the logistics of moving finished goods to retailers and consumers. These costs are critical for ensuring product availability and timely delivery across Estée Lauder's diverse markets.

Marketing and Advertising Spend

The Estée Lauder Companies dedicates a substantial portion of its budget to marketing and advertising, a key driver for its global brand presence and sales. In fiscal year 2023, the company reported significant investments in promotional activities to maintain its competitive edge in the beauty industry.

These expenditures encompass a wide array of channels, from traditional media to cutting-edge digital strategies. This includes extensive global campaigns, targeted digital marketing efforts, robust social media engagement, and strategic collaborations with influencers who resonate with their diverse customer base.

- Global Reach: Marketing spend fuels brand awareness across numerous international markets.

- Digital Focus: Significant allocation towards digital marketing and social media platforms is essential for reaching younger demographics.

- Influencer Marketing: Partnerships with influencers are a key strategy for authentic brand messaging and product promotion.

- Sales Driver: These marketing investments are directly linked to driving sales growth and market share.

Restructuring and Impairment Charges

Estée Lauder Companies incurs significant costs associated with its Profit Recovery and Growth Plan. These expenses stem from organizational restructuring, workforce adjustments, and potential impairment charges on assets like goodwill or trademarks. For instance, in fiscal year 2023, the company reported approximately $400 million in aggregate charges related to its strategic initiatives, including severance and other costs.

These restructuring and impairment charges are a direct reflection of the company's efforts to optimize its operations and improve long-term profitability. By streamlining its organizational structure and workforce, Estée Lauder aims to create a more agile and efficient business model. Such charges are often a necessary component of adapting to evolving market conditions and consumer preferences.

- Restructuring Costs: Expenses related to workforce reductions and severance packages as part of operational streamlining.

- Impairment Charges: Potential write-downs of intangible assets such as goodwill or trademarks if their carrying value exceeds their recoverable amount.

- Strategic Initiatives: These costs are directly linked to the company's Profit Recovery and Growth Plan, designed to enhance future earnings.

- Fiscal Year 2023 Impact: The company recorded around $400 million in charges related to these strategic and restructuring efforts.

The Estée Lauder Companies' cost structure is heavily influenced by its commitment to research and development, marketing, and its global supply chain. In fiscal year 2023, the company reported $6.33 billion in Selling, General, and Administrative (SG&A) expenses, which includes significant investments in marketing and advertising to drive brand awareness and sales. The Cost of Sales was $9.37 billion in the same period, reflecting the substantial costs associated with manufacturing and global logistics.

Additionally, the company incurred approximately $400 million in charges during fiscal year 2023 related to its Profit Recovery and Growth Plan, encompassing restructuring and workforce adjustments. These costs are strategically managed to optimize operations and ensure long-term profitability in a dynamic beauty market.

| Cost Category | Fiscal Year 2023 (USD Billions) | Key Drivers |

|---|---|---|

| Cost of Sales | 9.37 | Raw material sourcing, manufacturing, global supply chain logistics |

| Selling, General & Administrative (SG&A) | 6.33 | Marketing, advertising, sales force, R&D, operational overhead |

| Restructuring & Other Charges | ~0.40 | Organizational restructuring, workforce adjustments, strategic initiatives |

Revenue Streams

Sales of skincare products are the bedrock of Estée Lauder's business, consistently driving the highest portion of their net sales. This segment is incredibly diverse, encompassing everything from anti-aging serums and moisturizers to cleansers and sunscreens, catering to a vast array of consumer needs and preferences across different demographics and skin types.

In fiscal year 2024, Estée Lauder reported that its skincare category was a primary growth engine, underscoring its importance. For example, the company's strong performance in skincare, particularly with brands like Estée Lauder and Clinique, was a key factor in their overall financial results, demonstrating the category's substantial contribution to their revenue.

Sales of makeup products represent a significant revenue driver for Estée Lauder, featuring a broad range of items like foundations, mascaras, and lipsticks. This diverse portfolio allows the company to capture various consumer segments and preferences in the dynamic beauty market.

In fiscal year 2023, Estée Lauder's makeup segment generated substantial sales, contributing significantly to the company's overall performance. For instance, the company reported net sales of $15.91 billion for the full fiscal year 2023, with makeup being a key component of this figure.

Sales of fragrance products, encompassing both mass-market and premium luxury scents, form a significant pillar of The Estée Lauder Companies' (ELC) revenue generation. This segment includes iconic brands known for their enduring appeal and innovative new offerings.

ELC strategically leverages the burgeoning demand for high-end and artisanal fragrances, a market segment that has shown consistent growth. For instance, in the fiscal year 2023, ELC reported net sales of $16.0 billion, with fragrances playing a crucial role in this overall performance, demonstrating the category's substantial contribution to the company's financial success.

Sales of Hair Care Products

The Estée Lauder Companies' revenue streams include the sale of hair care products, which, while a smaller segment compared to other categories, still play a role in diversifying their offerings. This part of the business provides a range of shampoos, conditioners, and styling products, catering to a specific consumer need and broadening the company's market reach.

For fiscal year 2023, Estée Lauder reported net sales of $15.61 billion. While specific figures for the hair care segment are not broken out separately in their primary financial reporting, it contributes to the overall success of their diversification strategy. This approach helps to mitigate risks associated with over-reliance on any single product category.

- Hair Care Contribution: Adds to the overall revenue mix, though it's a smaller segment.

- Product Range: Includes shampoos, conditioners, and styling products.

- Diversification Benefit: Reduces reliance on other product categories and expands market presence.

Direct-to-Consumer and E-commerce Sales

Direct-to-consumer (DTC) and e-commerce sales represent a key and increasingly important revenue engine for The Estée Lauder Companies. This channel allows the company to connect directly with its customer base, bypassing traditional retail intermediaries.

This direct engagement fosters higher profit margins due to reduced wholesale markups. Furthermore, it provides invaluable first-party data, offering deep insights into consumer preferences, purchasing behavior, and product trends. This information is crucial for personalized marketing efforts and product development.

For fiscal year 2023, The Estée Lauder Companies reported that its online channel accounted for approximately 20% of its total net sales. This highlights the significant and growing contribution of e-commerce to the company's overall revenue.

- Higher Margins: DTC and e-commerce sales typically yield better profitability compared to wholesale channels.

- Direct Customer Insights: This channel provides rich data on consumer behavior for targeted strategies.

- Brand Control: Estée Lauder maintains greater control over the customer experience and brand presentation.

- Growing Sales Contribution: Online sales represented about 20% of total net sales in fiscal year 2023.

The Estée Lauder Companies generates revenue through multiple product categories, with skincare, makeup, and fragrance being the most significant. These core segments cater to a wide range of consumer needs and preferences, driving the majority of the company's sales.

The company also benefits from direct-to-consumer (DTC) and e-commerce sales, which offer higher profit margins and direct customer insights. This channel is increasingly vital, accounting for a substantial portion of their overall revenue.

In fiscal year 2023, The Estée Lauder Companies reported net sales of $15.61 billion. While specific segment breakdowns vary, skincare, makeup, and fragrance are consistently highlighted as key revenue drivers, with online sales representing approximately 20% of total net sales during that period.

Business Model Canvas Data Sources

The Estée Lauder Companies Business Model Canvas is informed by a blend of internal financial disclosures, extensive market research reports, and competitive analysis from leading industry sources. This multi-faceted approach ensures a comprehensive understanding of customer segments, value propositions, and revenue streams.