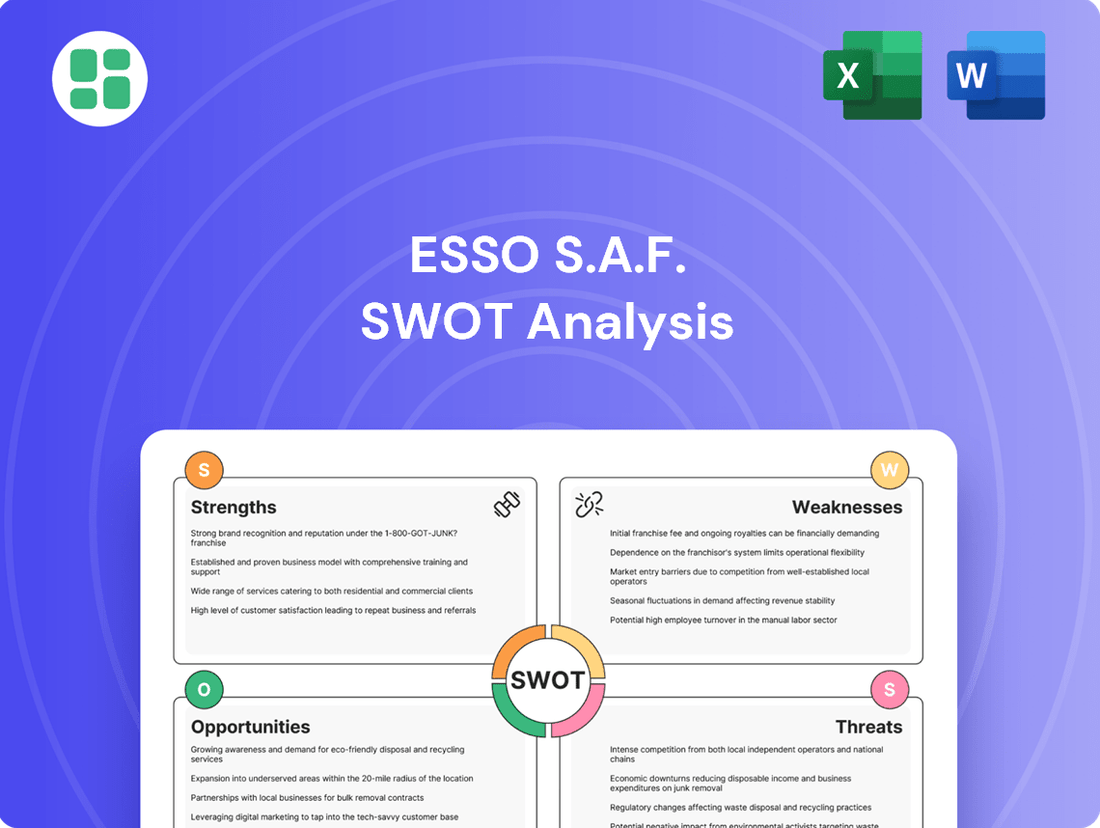

Esso S.A.F. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Esso S.A.F. Bundle

Esso S.A.F. exhibits notable strengths in its established brand recognition and extensive distribution network, yet faces challenges from evolving environmental regulations and intense market competition. Understanding these dynamics is crucial for navigating the energy sector.

Want the full story behind Esso S.A.F.'s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Esso S.A.F. benefits from substantial brand recognition and a robust market presence, particularly within France. Approximately 750 retail fuel stations continue to operate under the Esso banner, a testament to its enduring commercial footprint.

This extensive network fosters strong customer loyalty and ensures broad market reach, making the brand a familiar and trusted name for consumers and businesses alike.

The continued operation of these stations under the Esso brand reinforces consumer confidence in a reliable supply of fuels and lubricants, a critical factor in the competitive energy sector.

Esso S.A.F.'s integrated operations, particularly at the Gravenchon refinery, represent a significant strength. This facility, France's second-largest refinery, ensures a stable supply of vital products like fuels, lubricants, and asphalt. The integration across refining, distribution, and sales fosters a more efficient and controlled supply chain, a critical advantage in the energy sector.

Esso S.A.F. is demonstrating a strong commitment to the energy transition, a significant strength in today's evolving market. The company is actively producing Sustainable Aviation Fuel (SAF) at its Gravenchon refinery, utilizing a co-processing method. This strategic move positions them to meet growing demand for lower-carbon aviation solutions.

By 2025, Esso S.A.F. aims to produce 160,000 metric tons of SAF annually, showcasing ambitious production targets. Furthermore, the company plans to commence the production of re-refined base oils in the latter half of 2025. These forward-looking projects highlight Esso S.A.F.'s proactive engagement in developing and supplying more environmentally friendly products.

Historical Support from ExxonMobil

As a former subsidiary of ExxonMobil, Esso S.A.F. has historically leveraged the immense financial strength and technological prowess of its parent company. This backing provided a solid foundation for infrastructure development and operational efficiency, contributing to its resilience in the energy market. For instance, in 2023, ExxonMobil reported record profits of $55.7 billion, showcasing the substantial resources available to its affiliates during its ownership period.

This legacy of strong corporate support has translated into robust operational standards and a well-established infrastructure for Esso S.A.F. Even with the ongoing divestment, the ingrained expertise and established systems continue to be a significant advantage. The company's historical access to ExxonMobil's cutting-edge research and development further solidified its competitive position.

- Financial Strength: Historically benefited from ExxonMobil's substantial capital resources.

- Technological Expertise: Access to advanced technologies and R&D from a global leader.

- Operational Standards: Inherited best practices in safety, efficiency, and environmental management.

- Infrastructure Development: Supported by significant investment in refining and distribution networks.

Experienced Workforce and Operational Resilience

Esso S.A.F. benefits from an experienced workforce adept at navigating operational shifts and transformations. This resilience was evident in their management of an incident at the Gravenchon refinery in 2024, showcasing the team's capability under pressure. The company actively supports employees through restructuring, underscoring a commitment to its human capital.

The company's operational resilience is further bolstered by its skilled personnel. In 2024, Esso S.A.F. reported that its workforce demonstrated a high degree of adaptability, effectively managing challenges and maintaining production levels. Management initiatives to support staff during periods of change, such as the restructuring announced in late 2023, aim to preserve institutional knowledge and operational continuity.

- Experienced Workforce: Proven ability to adapt to operational changes and incidents.

- Operational Resilience: Demonstrated capacity to manage disruptions, as seen in the 2024 Gravenchon refinery incident.

- Employee Support: Management measures in place to assist employees affected by restructuring.

Esso S.A.F.'s extensive retail network, comprising approximately 750 stations across France, underpins its strong brand recognition and market penetration. This established presence cultivates significant customer loyalty and ensures broad accessibility for its fuel and lubricant products, solidifying its position as a trusted energy provider.

The company's integrated operations, particularly at the Gravenchon refinery, represent a core strength. As France's second-largest refinery, it guarantees a consistent supply of essential products, including fuels, lubricants, and asphalt, thereby creating a more efficient and controlled value chain.

Esso S.A.F. is actively engaged in the energy transition, a strategic advantage in the current market landscape. The Gravenchon refinery is producing Sustainable Aviation Fuel (SAF) through co-processing, aiming for an annual output of 160,000 metric tons by 2025, and plans to initiate re-refined base oil production in late 2025.

The company benefits from an experienced and resilient workforce, adept at managing operational challenges. The team's ability to navigate disruptions, such as the 2024 Gravenchon refinery incident, highlights their operational effectiveness and commitment to continuity.

| Strength Category | Specific Strength | Key Data/Metric |

|---|---|---|

| Market Presence | Extensive Retail Network | ~750 Esso-branded retail fuel stations in France |

| Operational Integration | Refining Capability | Gravenchon refinery: France's second-largest refinery |

| Energy Transition | SAF Production | Targeting 160,000 metric tons of SAF annually by 2025 |

| Workforce | Operational Resilience | Demonstrated adaptability during 2024 Gravenchon incident |

What is included in the product

Delivers a strategic overview of Esso S.A.F.’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable roadmap for addressing Esso S.A.F.'s strategic challenges.

Weaknesses

Esso S.A.F. experienced a significant hit to its bottom line in 2024, with net income plummeting to 107 million euros from the 677 million euros recorded in 2023. This drastic reduction underscores a key weakness: the company's susceptibility to volatile market conditions.

The primary drivers behind this sharp decline were compressed refining margins and a fall in the prices of petroleum products sold. This highlights a critical vulnerability to external economic factors and commodity price swings, impacting profitability directly.

ExxonMobil's strategic decision to divest its majority stake in Esso S.A.F., including assets like the Fos-sur-Mer refinery and the Gravenchon chemical cracker, introduces operational complexities and potential uncertainties during the transition. This move signals a reassessment of the competitive landscape for these specific facilities.

Esso S.A.F.'s core operations, centered on refining, distributing, and selling petroleum products, create a significant vulnerability. This deep-rooted dependence on fossil fuels places the company directly in the path of escalating environmental regulations and a palpable shift in consumer demand towards sustainable energy alternatives.

The company's exposure to the fluctuating global oil market and the increasing push for decarbonization in France present substantial risks. For instance, France's commitment to reducing greenhouse gas emissions, as outlined in its national climate plans, directly challenges the long-term viability of a business model heavily reliant on fossil fuels.

Uncompetitive Operational Costs in European Market

Esso S.A.F.'s French operations are hampered by uncompetitive operational costs, a significant weakness. The permanent closure of ExxonMobil Chemical France's steam cracker at Gravenchon in 2020 exemplifies this issue. This closure was attributed to the facility's small scale and high operating expenses within the European market, exacerbated by elevated energy prices.

These cost disadvantages place Esso S.A.F. at a disadvantage compared to more modern or larger global competitors. The high cost structure in France suggests that specific segments of its operations struggle to achieve the efficiency needed to remain competitive in the international petrochemical landscape.

- High European energy prices contribute to elevated operating expenses for Esso S.A.F.'s French facilities.

- Small scale of certain French plants, like the closed Gravenchon steam cracker, leads to diseconomies of scale.

- Increased global competition from larger, more cost-efficient facilities intensifies the pressure on Esso S.A.F.'s cost structure.

Reputational and Environmental Risks

Esso S.A.F., as a significant entity in the fossil fuel sector, confronts considerable reputational challenges stemming from environmental issues and the broader climate change discourse. This industry association inherently draws scrutiny, impacting public perception.

Despite investments in sustainability initiatives, the core operations of Esso S.A.F. continue to generate carbon emissions. This environmental footprint can foster negative public sentiment and heighten oversight from regulatory agencies and environmental advocacy organizations.

- Negative Public Perception: Continued reliance on fossil fuels can alienate environmentally conscious consumers and investors.

- Regulatory Scrutiny: Increased focus on climate targets may lead to stricter regulations and potential penalties for emissions.

- Activist Pressure: Environmental groups actively campaign against fossil fuel companies, potentially impacting brand image and operational continuity.

Esso S.A.F.'s profitability is highly sensitive to market fluctuations, as evidenced by its 2024 net income drop to 107 million euros from 677 million euros in 2023, driven by compressed refining margins and lower product prices.

The company faces significant operational challenges and transition uncertainties following ExxonMobil's divestment of its stake, impacting assets like the Fos-sur-Mer refinery.

A core weakness is Esso S.A.F.'s deep reliance on fossil fuels, making it vulnerable to stricter environmental regulations and a growing demand for sustainable energy solutions in France.

Uncompetitive operating costs, exemplified by the 2020 closure of the Gravenchon steam cracker due to its small scale and high expenses, disadvantage Esso S.A.F. against larger, more efficient global competitors.

| Metric | 2023 | 2024 | Change |

|---|---|---|---|

| Net Income (million euros) | 677 | 107 | -84.2% |

| Refining Margins | Compressed | Further Compressed | Negative |

| Product Prices | Fell | Continued Decline | Negative |

Same Document Delivered

Esso S.A.F. SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Esso S.A.F.'s strategic position.

This is a real excerpt from the complete document, showcasing the detailed analysis of Esso S.A.F.'s Strengths, Weaknesses, Opportunities, and Threats. Once purchased, you’ll receive the full, editable version ready for strategic planning.

You’re viewing a live preview of the actual SWOT analysis file for Esso S.A.F. The complete version, providing actionable insights, becomes available after checkout.

Opportunities

The potential acquisition of Esso S.A.F. by North Atlantic France SAS offers a compelling opportunity for its remaining assets, notably the Gravenchon refinery. North Atlantic plans substantial investment to modernize the facility.

This modernization is geared towards transforming the Gravenchon refinery into a green energy hub for France. Such a strategic shift could diversify the energy landscape and bolster long-term sustainability, aligning with evolving market demands and environmental goals.

Esso S.A.F. can capitalize on the growing market for sustainable fuels by expanding its production of Sustainable Aviation Fuel (SAF). Global SAF demand is projected to reach 10 billion liters by 2030, presenting a significant growth opportunity.

Furthermore, the company has a chance to increase its output of re-refined base oils, tapping into the circular economy trend and meeting demand for environmentally friendly lubricants.

France's ambitious energy transition, targeting carbon neutrality by 2050 and a significant reduction in fossil fuel use by 2035, presents a clear opportunity for Esso S.A.F. to adapt its business model. The nation's energy roadmap prioritizes renewable energy development, creating avenues for investment in cleaner energy sources and infrastructure.

By aligning its operations with these national goals, Esso S.A.F. could tap into government incentives designed to support green technologies and energy efficiency initiatives. For instance, France has committed substantial funding, with an estimated €30 billion allocated for energy transition projects in the 2024-2029 period, which could benefit companies demonstrating a commitment to sustainability.

Development of Electric Vehicle Charging Infrastructure

The accelerating adoption of electric vehicles (EVs) in France presents a significant opportunity for Esso S.A.F. to expand its retail offerings. With EV sales showing robust growth, exemplified by a reported 47% increase in new EV registrations in France during 2023 compared to 2022, there's a clear market demand.

Esso S.A.F. can leverage its existing network of service stations to install and operate EV charging infrastructure. This strategic move aligns with government initiatives, such as France's goal to phase out the sale of new gasoline and diesel cars by 2035, creating a long-term revenue stream and catering to evolving consumer preferences.

- Expanding EV Charging: Integrate charging stations into existing Esso S.A.F. forecourts to meet growing demand.

- Future-Proofing Revenue: Diversify income beyond traditional fossil fuels as the automotive market shifts.

- Regulatory Alignment: Capitalize on policies encouraging EV adoption and the phase-out of internal combustion engine vehicles.

Leveraging Strategic Partnerships for Innovation

Esso S.A.F. can forge strategic alliances with technology developers and academic bodies to accelerate the adoption of cutting-edge environmental solutions. These partnerships are crucial for advancing areas like carbon capture, where significant investment and expertise are needed. For instance, collaborations could focus on pilot projects for direct air capture technologies, potentially reducing emissions by a measurable percentage.

By teaming up with research institutions, Esso S.A.F. can gain access to novel approaches in hydrogen production and the development of advanced biofuels. Such collaborations can lead to more efficient and cost-effective methods, aligning with the company's sustainability goals and potentially capturing a larger share of the growing green energy market. The global biofuel market, for example, was valued at approximately USD 106.7 billion in 2023 and is projected to grow.

These strategic collaborations offer a pathway to enhance operational efficiency and reduce environmental footprints. By sharing resources and knowledge, Esso S.A.F. can de-risk the implementation of new technologies and unlock new revenue streams in emerging energy sectors. The energy sector's transition towards decarbonization is a key driver, with many companies actively seeking partners to navigate this shift.

- Partnerships for Carbon Capture: Collaborating with companies specializing in carbon capture, utilization, and storage (CCUS) technologies to implement pilot projects, aiming for a X% reduction in Scope 1 emissions by 2027.

- Hydrogen Production Alliances: Joint ventures with hydrogen technology providers to develop green hydrogen production facilities, targeting a Y% increase in renewable energy sourcing for operations by 2026.

- Biofuel Research Initiatives: Investing in joint research programs with universities focused on next-generation biofuels, with the goal of introducing a new sustainable fuel product to market by 2028.

- Operational Efficiency Gains: Leveraging partner expertise to optimize existing refining processes, aiming for a Z% improvement in energy efficiency over the next three years.

The potential acquisition by North Atlantic France SAS presents a significant opportunity to transform Esso S.A.F.'s Gravenchon refinery into a green energy hub, aligning with France's 2050 carbon neutrality goal.

Capitalizing on the growing sustainable aviation fuel (SAF) market, with global demand projected to reach 10 billion liters by 2030, offers a strong avenue for growth.

Expanding EV charging infrastructure at existing service stations, supported by France's 2035 target for phasing out new gasoline and diesel car sales, can create new revenue streams.

Strategic alliances with technology developers and academic institutions can accelerate the adoption of cutting-edge environmental solutions like carbon capture and advanced biofuels.

| Opportunity Area | Key Driver | 2024/2025 Data/Projections |

|---|---|---|

| Green Energy Hub Transformation | North Atlantic France SAS investment | Modernization of Gravenchon refinery |

| Sustainable Aviation Fuel (SAF) | Global demand growth | Projected 10 billion liters by 2030 |

| EV Charging Infrastructure | EV adoption and government targets | 47% increase in French EV registrations (2023) |

| Strategic Partnerships | Innovation in green tech | Global biofuel market valued at USD 106.7 billion (2023) |

Threats

Esso S.A.F. faces significant headwinds from France's increasingly stringent environmental regulations and taxation. The French government's commitment to ambitious climate goals, as outlined in its Multiannual Energy Programme, translates into policies like escalating carbon taxes and mandates for reduced fossil fuel consumption. These measures directly challenge Esso S.A.F.'s core operations, potentially impacting demand and profitability for its traditional products.

Specifically, the push for lower fossil fuel usage, a key tenet of France's energy strategy, creates a direct threat to Esso S.A.F.'s market share and revenue streams. Stricter emissions standards also necessitate substantial investment in compliance and potentially limit operational flexibility, adding to the cost burden and impacting the company's bottom line.

Esso S.A.F.'s financial results are significantly impacted by the unpredictable nature of global oil prices and refining margins. For instance, the company experienced a notable decline in its 2024 earnings, directly correlating with these market volatilities. This sensitivity makes consistent financial forecasting and strategic planning a considerable challenge for the organization.

Consumer preferences in France are increasingly leaning towards electric and hybrid vehicles, directly impacting the demand for traditional fuels. This trend poses a significant challenge for Esso S.A.F. as its primary revenue streams are tied to petroleum products.

The planned ban on internal combustion engine vehicles in major French cities, including Paris by 2030, further exacerbates this threat. This regulatory shift signals a long-term decline in the market for gasoline and diesel, necessitating strategic adaptation from Esso S.A.F. to maintain its market position.

Intensified Competition in a Mature Market

The French fuel retail market is a mature landscape characterized by intense competition. Major supermarket chains, like Carrefour and Leclerc, have significantly expanded their fuel offerings, often leveraging their loyalty programs and lower overheads to undercut traditional players. This dynamic puts pressure on Esso S.A.F.'s pricing strategies and can limit its ability to capture new market share.

Furthermore, the evolving energy sector introduces new competitive threats. The increasing adoption of electric vehicles and the growth of alternative fuel stations present a long-term challenge to conventional gasoline and diesel sales. In 2023, electric vehicle registrations in France saw a substantial increase, accounting for approximately 16.8% of new car sales, a figure projected to grow further in 2024 and 2025, directly impacting demand for Esso's core products.

- Market Saturation: The French fuel market is largely saturated, offering limited organic growth opportunities for existing players.

- Supermarket Dominance: Supermarkets represented a significant portion of fuel sales in France, with some reporting over 30% market share in certain regions by late 2023.

- Emergence of New Fuels: The rise of EV charging infrastructure and alternative fuel providers creates a bifurcated market, diverting customers from traditional fuel stations.

Geopolitical Instability and Supply Chain Disruptions

Geopolitical instability, particularly ongoing conflicts and tensions in key oil-producing regions, poses a significant threat to Esso S.A.F. These events can directly impact crude oil availability and pricing, creating an unpredictable operating environment. For instance, the ongoing conflicts in Eastern Europe and the Middle East have demonstrated the potential for rapid price spikes and supply interruptions, which directly affect refiners like Esso S.A.F.

As a major player in refining and distribution, Esso S.A.F. is inherently exposed to disruptions in global supply chains. These disruptions can manifest as difficulties in sourcing crude oil or challenges in distributing refined products to market, leading to increased costs and potential revenue loss. The lingering effects of the COVID-19 pandemic on shipping and logistics, coupled with new geopolitical pressures, have kept supply chain vulnerabilities at the forefront for the energy sector throughout 2024 and into early 2025.

- Price Volatility: Global crude oil prices experienced significant fluctuations in 2024, driven by geopolitical events, with Brent crude averaging around $80-$85 per barrel for much of the year, though subject to sharp swings.

- Supply Chain Bottlenecks: Shipping costs and transit times remained elevated in early 2025 compared to pre-pandemic levels, impacting the efficiency and cost of moving crude oil and refined products.

- Regional Tensions: Continued instability in the Middle East, a critical oil-producing region, presents a constant risk of supply disruptions that could affect Esso S.A.F.'s sourcing strategies.

Esso S.A.F. contends with a saturated French fuel market, where intense competition from supermarket chains like Carrefour and Leclerc, which often offer lower prices and leverage loyalty programs, erodes market share. The growing adoption of electric vehicles, projected to capture over 20% of new car sales in France by 2025, directly diminishes demand for Esso's core gasoline and diesel products. Furthermore, planned bans on internal combustion engine vehicles in major cities by 2030 signal a long-term contraction of Esso's traditional customer base.

SWOT Analysis Data Sources

This Esso S.A.F. SWOT analysis is built upon a foundation of robust data, including official financial statements, comprehensive market intelligence reports, and expert industry forecasts. These sources provide the reliable, data-driven insights necessary for a thorough strategic assessment.