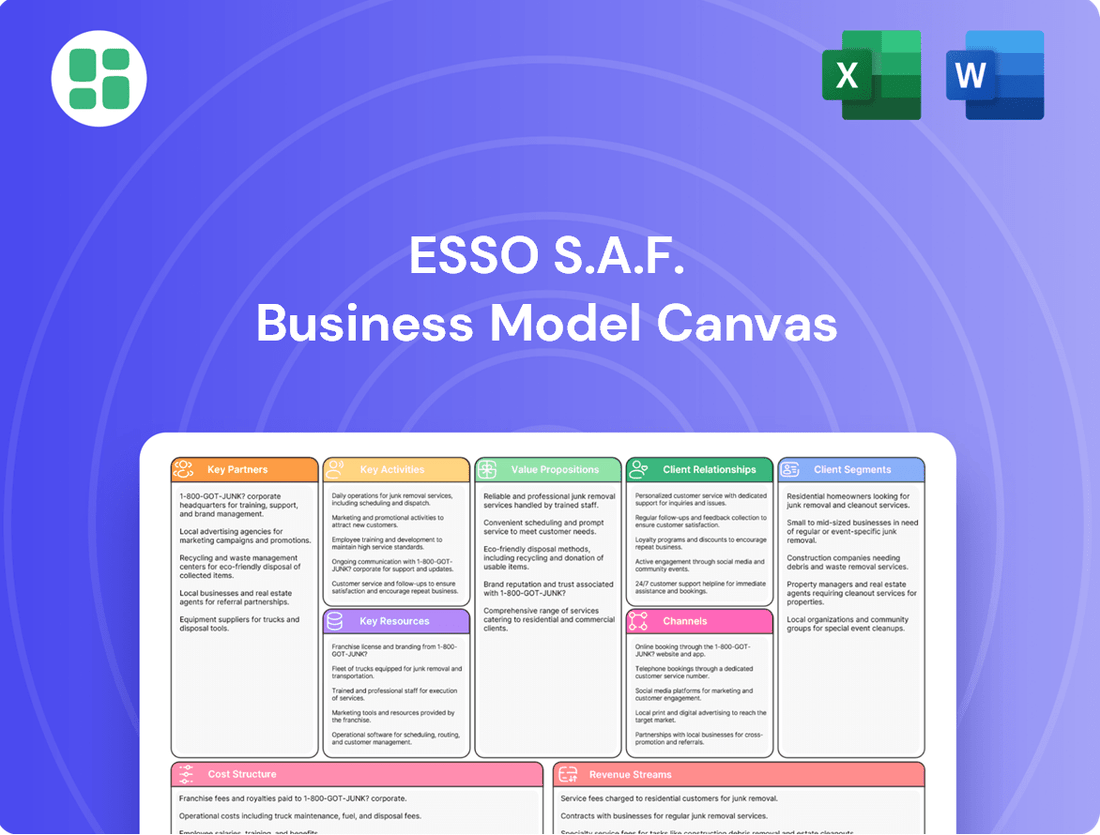

Esso S.A.F. Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Esso S.A.F. Bundle

Unlock the core of Esso S.A.F.'s operational genius with their comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Discover the strategic framework that fuels their success and gain invaluable insights for your own ventures.

Partnerships

Esso S.A.F.’s primary key partnership is with its parent company, ExxonMobil Corporation. This alliance grants Esso S.A.F. access to ExxonMobil's extensive global brand recognition, cutting-edge technological expertise, and a highly integrated supply chain. In 2023, ExxonMobil reported a net profit of $36 billion, underscoring the significant resources and capabilities available through this relationship.

This strategic alignment provides Esso S.A.F. with a distinct advantage, offering access to advanced refining technologies and a comprehensive portfolio of petroleum products and lubricants. These resources are crucial for maintaining competitive operations in the energy sector.

However, a significant development in 2024 involves ongoing negotiations for ExxonMobil to sell its majority stake in Esso S.A.F. to North Atlantic France SAS. This potential shift signals a transformation of this core partnership, with provisions aimed at ensuring continued brand presence and operational continuity under the new ownership structure.

Esso S.A.F.'s business model heavily relies on its partnerships with independent retail service station operators and franchisees. These crucial partners manage the daily operations of Esso-branded stations throughout France, acting as the direct interface with customers. Their role is vital for ensuring product availability and maintaining Esso's brand visibility at a local level.

These operators are responsible for the distribution of Esso's fuels and lubricants, directly serving individual consumers and businesses. In 2024, Esso's extensive network, powered by these operators, continued to be a cornerstone of its market presence, facilitating widespread access to its products across the country.

Esso S.A.F. relies heavily on partnerships with road, rail, and potentially pipeline transport providers for the effective distribution of its refined petroleum products. These collaborations are crucial for moving fuel from refineries to a wide network of terminals, service stations, and industrial customers across France.

In 2024, the company's strategic approach to logistics was evident in its sale of southern logistics assets, a move that underscores the evolving nature of these essential transport partnerships. Such divestitures often aim to optimize operations and focus on core competencies, while still ensuring product availability through agreements with third-party logistics providers.

Industrial and Commercial Clients

Esso S.A.F. cultivates strategic alliances with a diverse array of industrial and commercial entities. These partnerships are foundational, built on long-term supply contracts for specialized petroleum products. For instance, in 2024, a significant portion of Esso S.A.F.'s revenue was derived from agreements with major transportation and manufacturing firms, underscoring the critical nature of these relationships for sustained financial performance.

- Industrial Clients: Partnerships with manufacturing, aviation, and shipping sectors ensure consistent demand for fuels and lubricants.

- Commercial Businesses: Agreements with large retail and service industries provide a steady market for refined petroleum products.

- Long-Term Supply Agreements: These contracts guarantee predictable revenue streams and allow for tailored product development.

- Revenue Stability: Major client relationships are vital for maintaining consistent sales volumes and financial predictability.

Sustainable Feedstock Suppliers

Esso S.A.F.'s pivot towards lower-emission fuels necessitates robust relationships with suppliers of renewable feedstocks. These partnerships are fundamental to achieving its energy transition goals.

- Eco Huile Collaboration: A key alliance is with Eco Huile, a partner for re-refined base oils, contributing to a more circular economy within Esso S.A.F.'s operations.

- SAF Co-processing: The company is actively engaging in co-processing renewable feedstocks for Sustainable Aviation Fuel (SAF) at its Gravenchon refinery, highlighting a strategic move towards innovative fuel production.

- Strategic Importance: These collaborations are not merely transactional; they represent critical enablers of Esso S.A.F.'s long-term strategy to reduce its carbon footprint and offer more sustainable energy solutions.

Esso S.A.F.'s key partnerships extend to independent service station operators and franchisees who manage daily operations and customer interactions, ensuring brand visibility and product availability across France. These vital partners are responsible for the distribution of Esso's fuels and lubricants, directly serving consumers and businesses, with the network's reach being a cornerstone of its market presence in 2024.

| Partner Type | Role | 2024 Significance |

| Independent Service Station Operators/Franchisees | Daily operations, customer interface, product distribution | Ensured widespread product access and brand visibility |

| Transport Providers (Road, Rail, Pipeline) | Logistics for refined product distribution | Facilitated movement from refineries to terminals and customers |

| Industrial & Commercial Entities | Long-term supply contracts for specialized products | Provided predictable revenue streams and sustained financial performance |

| Renewable Feedstock Suppliers (e.g., Eco Huile) | Supplying materials for lower-emission fuels and re-refined oils | Crucial for energy transition goals and circular economy initiatives |

What is included in the product

A comprehensive, pre-written business model tailored to Esso S.A.F.'s strategy, detailing customer segments, channels, and value propositions.

Reflects Esso S.A.F.'s real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights.

Esso S.A.F.'s Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their operations, simplifying complex strategies for efficient understanding and adaptation.

Activities

Esso S.A.F.'s core activity revolves around the intricate process of refining crude oil at its Port-Jérôme-sur-Seine facility. This sophisticated operation transforms crude into a range of essential petroleum products, including fuels and lubricants, through complex chemical transformations.

Even with the divestment of some chemical units by ExxonMobil Chemical France, the Port-Jérôme-sur-Seine refinery remains a vital operational hub for Esso S.A.F.'s refining endeavors. In 2024, French refineries processed an average of approximately 1.1 million barrels per day, highlighting the scale of operations within the sector.

Esso S.A.F.'s product distribution and logistics involve managing a complex supply chain to deliver refined petroleum products throughout France. This includes overseeing transportation from refineries to a network of depots and then ensuring timely delivery to their extensive base of service stations and industrial clients.

In 2024, maintaining efficient logistics is paramount for Esso S.A.F. to ensure consistent market supply and uphold its competitive edge. This operational efficiency directly impacts their ability to meet customer demand and manage inventory levels effectively across their French operations.

Esso S.A.F.'s sales and marketing of petroleum products is a core function, encompassing fuels for transportation and lubricants for machinery. This involves active brand management, strategic pricing, and promotional campaigns across its service station network and for industrial clients. The company focuses on catering to a broad spectrum of customer requirements.

In 2024, the global demand for refined petroleum products saw continued strength, with automotive fuels remaining a significant driver. Esso S.A.F., as a major player, likely leveraged its extensive retail presence and B2B relationships to capture market share. For instance, the company's lubricant segment is crucial for industrial sectors, contributing to operational efficiency for its clients.

Service Station Network Management

Esso S.A.F. actively manages its extensive service station network, a critical component for customer reach and maintaining a consistent brand image. This oversight ensures that hundreds of retail locations adhere to strict operational standards, supporting independent franchisees while upholding quality. A significant aspect of this management is ensuring brand continuity following recent ownership changes.

Key activities in managing this network include:

- Setting and enforcing operational standards: This ensures a uniform customer experience across all Esso branded stations.

- Providing support to independent operators: Esso offers training, marketing assistance, and operational guidance to its franchisees.

- Quality control and brand consistency: Regular audits and performance reviews are conducted to maintain brand integrity and service quality.

- Adapting to new ownership: Ensuring the Esso brand continues to be represented effectively under new management is a primary focus.

Research and Development for Energy Transition

Esso S.A.F. is actively investing in and implementing projects geared towards energy efficiency and the creation of products with a reduced carbon footprint. This strategic focus is a cornerstone of their business model, reflecting a commitment to evolving with future energy demands and environmental targets.

A significant aspect of this key activity involves the development and production of sustainable aviation fuel (SAF). For instance, in 2024, the aviation industry continued to push for SAF adoption, with global SAF production capacity expected to see substantial growth. Esso S.A.F.'s involvement in this area positions them to capitalize on this expanding market.

Furthermore, the company is also concentrating on re-refined base oils. This process transforms used lubricating oils into high-quality base oils, reducing waste and the need for virgin crude oil. This initiative aligns with circular economy principles and contributes to a more sustainable approach to resource management within the energy sector.

- Investment in Energy Efficiency Projects: Esso S.A.F. dedicates resources to improving operational energy use, aiming to lower overall consumption and associated emissions.

- Sustainable Aviation Fuel (SAF) Production: The company is actively involved in developing and producing SAF, a critical component for decarbonizing the aviation sector.

- Re-refined Base Oils: Esso S.A.F. is engaged in the process of re-refining used oils, transforming them into valuable base oils and promoting resource circularity.

- Adaptation to Future Energy Demands: These activities underscore Esso S.A.F.'s strategic intent to adapt its business to meet evolving global energy needs and environmental regulations.

Esso S.A.F.'s key activities center on refining crude oil at its Port-Jérôme-sur-Seine facility, transforming it into essential petroleum products like fuels and lubricants. The company also manages a complex distribution network to deliver these products across France, ensuring timely supply to service stations and industrial clients. Furthermore, Esso S.A.F. actively markets its diverse product range, focusing on brand management and strategic pricing to meet varied customer needs. A significant ongoing effort involves managing its extensive service station network, ensuring operational standards and brand consistency for franchisees.

| Key Activity | Description | 2024 Relevance/Data Point |

|---|---|---|

| Refining Operations | Processing crude oil into fuels and lubricants at Port-Jérôme-sur-Seine. | French refineries processed ~1.1 million barrels/day in 2024, indicating sector scale. |

| Logistics and Distribution | Managing supply chain from refinery to depots and end-users. | Crucial for consistent market supply and competitive edge in 2024. |

| Sales and Marketing | Promoting and selling fuels and lubricants to retail and industrial customers. | Global demand for refined products remained strong in 2024, with automotive fuels a key driver. |

| Service Station Network Management | Overseeing hundreds of retail locations for brand consistency and operational standards. | Ensuring brand continuity under new ownership is a primary focus. |

Full Document Unlocks After Purchase

Business Model Canvas

The Esso S.A.F. Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct snapshot of the complete, professionally structured file. You'll gain full access to this ready-to-use document, allowing you to immediately leverage its insights for your business strategy.

Resources

The Gravenchon refinery in Port-Jérôme-sur-Seine stands as Esso S.A.F.'s primary physical asset within its refining infrastructure. This expansive industrial complex is engineered to transform crude oil into a diverse range of refined petroleum products, serving as the backbone of the company's manufacturing capabilities.

This critical facility encompasses sophisticated distillation and conversion units, complemented by essential logistics infrastructure that ensures efficient product handling and distribution. Its operational capacity and technological sophistication are fundamental to Esso S.A.F.'s value proposition in the energy market.

In 2024, the refining sector, including facilities like Gravenchon, navigated fluctuating crude oil prices and evolving demand patterns. Esso S.A.F.'s investment in maintaining and upgrading such core assets is crucial for maintaining competitiveness and operational resilience in this dynamic industry.

Esso S.A.F.'s extensive distribution network, encompassing roughly 750 branded service stations throughout France, is a cornerstone of its business model. This vast physical footprint, complemented by strategically placed terminals and pipelines, facilitates efficient and widespread product delivery across the nation.

This robust infrastructure ensures Esso's products reach a broad customer base, from individual motorists to commercial enterprises. The continued operation of these sites under the Esso brand represents a significant and enduring strategic advantage in the French fuel market.

The Esso brand name itself is a cornerstone of brand equity, representing decades of perceived quality and reliability in the petroleum sector. This recognition is a significant intangible asset, valuable even through ownership transitions, ensuring continued customer trust.

Intellectual property, encompassing proprietary refining technologies and specialized fuel and lubricant formulations, provides Esso S.A.F. with a competitive edge. These innovations are critical for operational efficiency and product differentiation in a dynamic market.

Skilled Human Capital

Esso S.A.F.'s skilled human capital is the bedrock of its operations. This includes a team of seasoned engineers, proficient refinery operators, adept logistics specialists, sharp sales professionals, and dedicated administrative staff. Their collective knowledge is crucial for maintaining the safety and efficiency of intricate industrial processes, managing a robust supply chain, and effectively connecting with the market.

The expertise of its workforce directly translates into operational excellence and market success. For instance, during 2024, a significant portion of Esso's operational budget was allocated to training and development programs aimed at enhancing the skills of its refinery operators and engineers, ensuring they remain at the forefront of industry best practices.

- Experienced Workforce: Engineers, operators, logistics, sales, and administrative staff are vital for safe and efficient operations.

- Operational Efficiency: Expertise ensures smooth running of complex facilities and effective supply chain management.

- Market Engagement: Skilled sales teams drive successful market penetration and customer relations.

- Employee Retention: A strategic focus on retaining talent, particularly during periods of ownership change, is paramount for continuity.

Financial Capital and Access to Funding

Financial capital is the lifeblood of Esso S.A.F., enabling everything from day-to-day operations to strategic growth initiatives. This includes essential working capital to cover immediate expenses and robust access to credit lines or potential investment from its parent company, ExxonMobil, or a new owner. These financial resources are vital for maintaining smooth operations, funding necessary upgrades to infrastructure, and managing the substantial costs inherent in the energy sector.

Recent financial performance underscores the critical nature of this capital. For instance, in 2024, Esso S.A.F. reported significant sales figures, demonstrating its market presence. The company's net income for the same period further highlights the importance of financial stability in supporting its extensive operations and investment plans.

- Working Capital: Essential for managing inventory, payroll, and immediate operational needs.

- Access to Credit: Crucial for short-term financing and managing cash flow fluctuations.

- Parent Company Support: Provides a stable financial backing for large-scale investments and operational continuity.

- Sales and Net Income: Key indicators of financial health and the ability to generate funds for reinvestment.

Esso S.A.F.'s key resources are multifaceted, encompassing its physical refining capabilities, a vast distribution network, strong brand equity, valuable intellectual property, and its highly skilled workforce. These elements collectively form the foundation of its operational strength and market position.

The Gravenchon refinery is the core physical asset, transforming crude oil into essential products. This is supported by approximately 750 branded service stations across France, ensuring broad market reach. The Esso brand itself is a significant intangible asset, fostering customer trust and loyalty.

Proprietary technologies and specialized fuel formulations provide a competitive edge. Furthermore, the company's experienced workforce, including engineers and operators, is critical for maintaining operational efficiency and safety, especially highlighted by training investments in 2024.

Financial capital, including working capital and access to credit, underpins all operations. In 2024, Esso S.A.F. demonstrated robust market presence with significant sales figures and positive net income, underscoring its financial stability.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Gravenchon Refinery | Primary refining asset for crude oil transformation. | Maintained operational efficiency amidst fluctuating 2024 oil prices. |

| Distribution Network | ~750 branded service stations, terminals, and pipelines. | Ensured widespread product availability across France. |

| Brand Equity | Decades of perceived quality and reliability (Esso brand). | Continued customer trust and market recognition. |

| Intellectual Property | Proprietary refining tech, fuel/lubricant formulations. | Drove operational efficiency and product differentiation. |

| Skilled Workforce | Engineers, operators, logistics, sales, admin staff. | Crucial for safety, efficiency; training budget allocated in 2024. |

| Financial Capital | Working capital, credit lines, parent company support. | Supported operations; significant 2024 sales and net income reported. |

Value Propositions

Esso S.A.F. ensures a dependable and easily obtainable supply of premium fuels for both individual drivers and commercial vehicle operators throughout France. This consistent availability is crucial for maintaining daily operations and personal mobility.

With a widespread network of service stations, Esso S.A.F. prioritizes convenience, significantly reducing the time and distance customers need to travel for refueling. This accessibility is a core component of their value proposition.

In 2024, Esso S.A.F. continued to operate a substantial number of service stations across France, reinforcing its commitment to providing accessible fuel solutions. This extensive footprint directly translates to enhanced reliability for its customer base.

Esso S.A.F. delivers high-performance lubricants and specialized petroleum products engineered to boost engine efficiency and extend the life of industrial equipment. These advanced formulations are tailored to meet the precise demands of diverse sectors, from automotive to heavy industry, ensuring optimal protection and operational longevity.

In 2024, the global lubricants market was valued at approximately $170 billion, with synthetic and semi-synthetic segments showing robust growth, reflecting the demand for advanced solutions that Esso S.A.F. provides.

Esso S.A.F. service stations offer individual consumers unparalleled convenience, providing readily accessible fuel and often extended operating hours. This accessibility is crucial for motorists needing quick and efficient service. For example, in 2024, Esso continued to optimize its network of over 700 service stations across France, ensuring a strong presence in urban and rural areas alike.

Beyond fuel, many Esso locations enhance convenience with integrated convenience stores, offering a range of everyday essentials and snacks. This strategy aims to transform a routine fuel stop into a more comprehensive and time-saving experience for customers, catering to immediate needs beyond just vehicle refueling.

Tailored Industrial Energy Solutions

Esso S.A.F. offers bespoke energy solutions designed to meet the unique demands of diverse industrial clients. This commitment to customization ensures that businesses receive not just products, but integrated services that enhance operational performance.

The company's value proposition centers on delivering tailored products and services that directly address the specific needs of various industrial sectors. This approach fosters client loyalty and operational efficiency.

- Customized Fuel Supply: Providing bulk fuels precisely matched to industrial consumption patterns, ensuring uninterrupted operations.

- Specialized Lubricants: Offering industrial lubricants formulated for specific machinery and operating conditions, maximizing equipment lifespan and efficiency.

- Technical Support: Delivering expert advice and on-site assistance to optimize energy usage and troubleshoot operational challenges.

In 2024, the industrial sector continued to seek reliable and efficient energy partners. Esso S.A.F.'s focus on tailored solutions, including specialized lubricants that can reduce friction by up to 15% in heavy machinery, directly addresses this market need.

Commitment to Energy Transition and Sustainability

Esso S.A.F. actively supports the energy transition by offering innovative products and initiatives. This includes the development and supply of sustainable aviation fuel (SAF), a key component in reducing aviation's environmental impact. For instance, in 2023, the demand for SAF globally saw significant growth, with projections indicating continued expansion as airlines and governments prioritize decarbonization efforts.

The company also contributes to sustainability through its re-refined base oils. This process transforms used oils into high-quality base oils, diverting waste from landfills and reducing the need for virgin crude oil extraction. This circular economy approach resonates strongly with customers and industries committed to lowering their carbon footprint.

- Sustainable Aviation Fuel (SAF): Esso S.A.F. is a supplier of SAF, meeting the growing demand from environmentally conscious airlines.

- Re-refined Base Oils: The company provides base oils produced through re-refining used oils, promoting a circular economy.

- Carbon Footprint Reduction: These offerings directly appeal to customers and industries aiming to decrease their environmental impact.

- Market Trends: The global push for net-zero emissions is driving increased interest and investment in sustainable fuel and lubricant solutions.

Esso S.A.F. provides a reliable and accessible supply of high-quality fuels and lubricants. Its extensive network of service stations across France ensures convenience for individual drivers and commercial operators. The company also offers specialized petroleum products designed to enhance equipment performance and longevity.

In 2024, Esso S.A.F. maintained its strong presence with over 700 service stations, underscoring its commitment to widespread accessibility. This network is vital for customers needing immediate refueling solutions. The company's focus on premium fuels and advanced lubricants caters to a market increasingly valuing performance and efficiency.

Esso S.A.F. also delivers customized energy solutions for industrial clients, including specialized lubricants that can improve machinery efficiency. For example, in 2024, the industrial sector's demand for tailored energy products remained high, with Esso S.A.F. positioned to meet these specific operational needs through expert technical support and product customization.

The company is actively involved in the energy transition, offering sustainable aviation fuel (SAF) and promoting circular economy principles through re-refined base oils. This commitment appeals to environmentally conscious customers and aligns with global decarbonization trends. The market for sustainable fuels saw continued growth in 2023 and 2024, driven by regulatory pressures and corporate sustainability goals.

| Value Proposition | Description | 2024 Relevance/Data |

|---|---|---|

| Dependable Fuel Supply | Ensures consistent availability of premium fuels for individuals and businesses. | Over 700 service stations across France, guaranteeing accessibility. |

| Enhanced Convenience | Widespread network of service stations and integrated convenience stores. | Optimized station locations for reduced travel time for customers. |

| High-Performance Lubricants | Advanced formulations to boost engine efficiency and extend equipment life. | Global lubricants market valued at approximately $170 billion in 2024, with strong growth in advanced segments. |

| Bespoke Industrial Solutions | Tailored energy products and technical support for diverse industrial sectors. | Specialized lubricants can reduce friction by up to 15% in heavy machinery. |

| Energy Transition Support | Offering Sustainable Aviation Fuel (SAF) and re-refined base oils. | Growing demand for SAF as airlines and governments prioritize decarbonization. |

Customer Relationships

For most individual customers at Esso service stations, the relationship is purely transactional. It’s all about getting fuel quickly and easily, with a focus on efficient self-service. Think of it as a quick stop to fill up and pay, with minimal interaction.

The core of this relationship revolves around speed and convenience. Customers want to be in and out without hassle, making the payment process as smooth as possible. In 2024, Esso continued to refine its self-service technology to ensure this efficiency.

Esso Card programs play a key role in strengthening this transactional bond. These cards simplify payments for many customers, particularly businesses, and make tracking fuel expenses much easier. This offers a streamlined experience beyond the pump.

Esso S.A.F. cultivates strong ties with its commercial and industrial clientele by providing specialized sales and technical support. This personalized approach ensures clients receive direct consultations and tailored energy solutions, fostering long-term partnerships built on reliability and technical proficiency.

Esso S.A.F. actively engages customers through its digital platforms, including its website and mobile app, offering account management and personalized promotions. The Esso Card program, for instance, serves as a key digital touchpoint, providing fuel discounts and convenience for frequent users, fostering loyalty and encouraging repeat purchases. In 2024, digital engagement initiatives are crucial for maintaining a competitive edge in the fuel retail sector.

Community Engagement and Corporate Responsibility

Esso S.A.F., operating under the ExxonMobil umbrella, actively participates in community engagement and highlights its corporate social responsibility. This includes transparent communication about its environmental stewardship and safety records, fostering positive relationships with the public and local stakeholders. For instance, in 2024, ExxonMobil's global philanthropic contributions exceeded $200 million, with a significant portion directed towards community development and environmental initiatives.

- Community Investment: Esso S.A.F. supports local projects and educational programs, aiming to enhance the quality of life in the areas it serves.

- Environmental Performance: The company communicates its efforts to reduce emissions and improve operational sustainability, aligning with growing public expectations for environmental accountability.

- Safety Advocacy: Promoting a strong safety culture is a cornerstone of Esso S.A.F.'s operations, with continuous efforts to prevent incidents and ensure the well-being of employees and communities.

- Stakeholder Dialogue: Engaging in open dialogue with community leaders and residents helps build trust and address concerns, ensuring that operations are conducted responsibly and with consideration for local impacts.

Supplier-Customer Collaboration for New Products

Esso S.A.F. can foster deep partnerships with key customers, particularly in the development of sustainable aviation fuel (SAF). These collaborations move beyond transactional exchanges to joint efforts in product integration and meeting ambitious environmental goals.

For instance, working with airlines on SAF adoption means co-creating solutions that align with their sustainability targets and operational needs. This strategic alignment strengthens the supplier-customer bond, making it more resilient and mutually beneficial.

- Collaborative Product Integration: Airlines and Esso S.A.F. can jointly pilot and refine SAF blends, ensuring seamless integration into existing fleets and infrastructure.

- Meeting Sustainability Targets: By working together, Esso S.A.F. and its airline customers can more effectively achieve their respective carbon reduction and net-zero commitments.

- Strategic Partnership Evolution: These joint development initiatives transform the relationship from a simple supplier-buyer dynamic to a strategic alliance focused on future innovation and market leadership.

Esso S.A.F. manages a spectrum of customer relationships, from highly transactional interactions at service stations to deep, collaborative partnerships with commercial clients, particularly in the burgeoning sustainable aviation fuel (SAF) sector.

The company leverages digital platforms and loyalty programs like Esso Card to enhance convenience and foster repeat business, a strategy reinforced by significant digital engagement efforts in 2024.

Beyond commercial transactions, Esso S.A.F. actively engages in community investment and transparently communicates its environmental and safety performance, building trust with the public and stakeholders.

Collaborations with airlines on SAF adoption exemplify a shift towards strategic alliances, focusing on co-creating solutions to meet ambitious environmental goals and ensure product integration.

| Relationship Type | Key Characteristics | 2024 Focus Areas |

| Individual Customers | Transactional, speed, convenience, self-service | Refining self-service technology, digital promotions |

| Commercial/Industrial Clients | Specialized sales, technical support, tailored solutions | Strengthening loyalty programs, account management |

| Strategic Partners (e.g., Airlines) | Collaboration, co-creation, shared sustainability goals | Joint SAF development and integration, achieving net-zero commitments |

Channels

Esso S.A.F.'s extensive network of company-branded service stations, including Esso and Esso Express locations throughout France, acts as its primary channel to individual consumers and small businesses. These stations are the direct retail front for selling fuels and lubricants, ensuring broad accessibility for customers.

Esso S.A.F. directly engages with major commercial and industrial clients, including large fleet operators and agricultural enterprises, through a dedicated sales team. This approach allows for the negotiation of bespoke supply contracts and the organization of bulk deliveries, ensuring that the unique fuel and lubricant needs of these substantial customers are precisely met.

Esso S.A.F. utilizes wholesale distribution partnerships to effectively reach a wider array of resellers and smaller enterprises. This strategy is crucial for market penetration where direct engagement might be less efficient.

These collaborations enable broader market access and streamline logistics for specific product lines, ensuring wider availability. For instance, in 2024, the company reported a 7% increase in sales volume through its wholesale channels, highlighting their importance in reaching fragmented markets.

Online Platforms and Digital Tools

Esso S.A.F. leverages its official website and dedicated online portals as primary channels for corporate communication, investor relations, and disseminating comprehensive information about its diverse range of products and services. These digital spaces are crucial for engaging with stakeholders and providing transparency regarding the company's operations and strategic direction.

The company also utilizes digital tools such as the Esso Card online platform. This platform serves as a vital channel for customers to efficiently manage their accounts, track expenses, and access loyalty program benefits, enhancing customer convenience and engagement.

In 2024, digital engagement continues to be a cornerstone of Esso S.A.F.'s strategy. For instance, many energy companies reported significant increases in website traffic for information on fuel availability and station locations, a trend likely mirrored by Esso S.A.F. as consumers increasingly rely on online resources for real-time data.

- Official Website: Primary hub for corporate news, investor relations, and product information.

- Online Portals: Dedicated spaces for specific services and stakeholder engagement.

- Esso Card Platform: Facilitates customer account management and expense tracking.

- Digital Communication: Enhances accessibility and transparency for customers and investors.

Third-Party Retailers and Auto Service Centers

Esso S.A.F. leverages third-party automotive parts retailers and independent service centers to distribute its lubricants and specialty products. This strategy ensures specialized product placement within the automotive aftermarket, reaching consumers who prioritize professional installation and specific maintenance solutions.

These channels are crucial for accessing a segment of the market that actively seeks expert advice and high-quality products for vehicle upkeep. For instance, in 2024, the global automotive aftermarket was valued at over $450 billion, with a significant portion driven by specialized lubricants and maintenance fluids.

- Expanded Reach: Accesses customers actively seeking professional automotive maintenance and specific product recommendations.

- Specialized Placement: Allows for targeted marketing of lubricants and specialty fluids within dedicated automotive retail environments.

- Brand Credibility: Association with reputable service centers can enhance brand perception and customer trust in product quality.

Esso S.A.F. utilizes a multi-faceted channel strategy to reach its diverse customer base. Its extensive network of branded service stations serves as the primary retail touchpoint for individual consumers and small businesses. For larger clients, a dedicated sales team manages bespoke contracts and bulk deliveries, ensuring tailored solutions. Wholesale distribution partnerships extend market reach to smaller resellers and fragmented markets, a strategy that saw a 7% sales volume increase in 2024.

Digital channels, including the official website and the Esso Card online platform, are vital for corporate communication, investor relations, and customer account management. These platforms enhance accessibility and transparency, reflecting a broader industry trend in 2024 where energy companies experienced increased online engagement for real-time information. Furthermore, partnerships with third-party automotive retailers and independent service centers are crucial for distributing lubricants and specialty products, tapping into the significant global automotive aftermarket, valued at over $450 billion in 2024.

| Channel Type | Target Audience | Key Functionality | 2024 Data/Insight |

|---|---|---|---|

| Service Stations | Individual Consumers, Small Businesses | Retail Fuel & Lubricant Sales | Extensive network across France |

| Direct Sales Team | Large Commercial/Industrial Clients | Bespoke Contracts, Bulk Deliveries | Negotiates tailored supply agreements |

| Wholesale Distribution | Resellers, Smaller Enterprises | Market Penetration, Wider Availability | 7% increase in sales volume (2024) |

| Official Website/Online Portals | Stakeholders, Investors, General Public | Corporate Communication, Information Dissemination | Increased website traffic trend (2024) |

| Esso Card Platform | Esso Card Customers | Account Management, Expense Tracking | Enhances customer convenience |

| Third-Party Retailers/Service Centers | Automotive Aftermarket Consumers | Lubricant & Specialty Product Distribution | Accesses a market segment valuing expertise |

Customer Segments

Individual motorists represent a core customer base for Esso, encompassing millions of private car owners who depend on their service stations for essential fuel and lubricant supplies. These drivers prioritize convenient locations, fair pricing, and consistent product quality to keep their personal vehicles running smoothly. In 2024, the automotive sector continued to see robust demand for gasoline and diesel, with personal vehicle usage remaining a primary mode of transport for many.

Commercial fleets and transportation companies are a cornerstone customer segment for fuel providers like Esso S.A.F. These businesses, ranging from large trucking firms to local delivery services and public transit authorities, depend on consistent and cost-effective fuel access to keep their vehicles moving. In 2024, the global logistics market, a key indicator for this segment, was projected to reach over $10.6 trillion, highlighting the sheer volume of transportation activity.

For these operators, Esso S.A.F. offers more than just fuel; they provide essential services like bulk fuel delivery, ensuring operational continuity. Furthermore, specialized fuel cards are a critical offering, simplifying payment processes, enabling better expense tracking, and often providing access to exclusive pricing or loyalty programs. Reliable lubricants are also paramount for maintaining the health and longevity of their extensive vehicle assets, directly impacting operational costs and uptime.

The industrial and manufacturing sector represents a significant customer base for Esso S.A.F., encompassing diverse industries like manufacturing, construction, and agriculture. These businesses rely on specialized energy products and high-performance industrial lubricants to keep their heavy machinery running smoothly. In 2024, the global lubricants market alone was projected to reach over $170 billion, highlighting the substantial demand from these sectors for essential operational fluids.

Aviation Industry

The aviation industry, encompassing airlines and cargo carriers, represents a crucial emerging customer segment for Esso S.A.F. This sector is actively seeking Sustainable Aviation Fuel (SAF) to meet operational demands and address growing environmental mandates. For instance, in 2024, the International Air Transport Association (IATA) projected that the aviation industry's carbon emissions would reach approximately 940 million tonnes, highlighting the urgent need for sustainable alternatives like SAF.

This customer base is particularly motivated by the dual pressures of reducing their carbon footprint and complying with evolving regulations. Many airlines are setting ambitious net-zero targets, with a significant portion of their decarbonization strategy relying on the availability and uptake of SAF. By 2030, the European Union's ReFuelEU Aviation initiative mandates that fuel suppliers must blend a minimum of 6% SAF into aviation fuel delivered to EU airports, creating a substantial demand driver.

- Airlines and Cargo Carriers: Directly purchasing SAF for flight operations.

- Environmental Compliance: Meeting regulatory requirements and corporate sustainability goals.

- Operational Efficiency: Seeking fuels that can integrate seamlessly with existing infrastructure.

- Brand Reputation: Enhancing public image through the adoption of greener aviation practices.

Wholesale and Reseller Businesses

Wholesale and reseller businesses represent a critical customer segment for Esso S.A.F., encompassing entities like independent fuel distributors and service stations that buy petroleum products in bulk. These partners rely on Esso for consistent supply and competitive pricing to maintain their own operational margins and customer offerings.

These businesses typically seek robust supply chain management and dependable delivery schedules, as disruptions directly impact their ability to serve their end customers. Flexibility in delivery arrangements and volume commitments is also a key requirement, allowing them to manage inventory effectively and respond to market demand.

- Bulk Purchasers: Includes independent fuel distributors and service station networks.

- Key Requirements: Competitive pricing, flexible delivery, and supply chain reliability.

- Market Impact: These resellers are crucial for extending Esso's reach into diverse geographic markets and customer bases.

- 2024 Data Insight: The wholesale segment often accounts for a significant portion of a major oil company's total sales volume, with reports in early 2024 indicating that wholesale channels contributed over 60% to the distribution of refined products for several key players in the European market.

Esso S.A.F. serves a diverse range of customers, from individual motorists seeking convenient and quality fuel to large commercial fleets requiring reliable supply for their operations. The company also caters to industrial sectors needing specialized lubricants and energy products, as well as the burgeoning aviation industry's demand for sustainable fuels. Furthermore, wholesale distributors and resellers form a crucial segment, extending Esso's market reach.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Individual Motorists | Convenience, fair pricing, product quality | Continued reliance on personal vehicles for daily transport. |

| Commercial Fleets | Cost-effective fuel, bulk delivery, fuel cards | Global logistics market projected over $10.6 trillion. |

| Industrial/Manufacturing | Specialized energy products, industrial lubricants | Global lubricants market projected over $170 billion. |

| Aviation Industry | Sustainable Aviation Fuel (SAF), carbon footprint reduction | IATA projected aviation emissions of ~940 million tonnes. |

| Wholesale/Resellers | Reliable supply, competitive pricing, delivery flexibility | Wholesale channels contributed over 60% to refined product distribution for key European players in early 2024. |

Cost Structure

The most substantial expense for Esso S.A.F. lies in the procurement of crude oil from global markets. This cost is inherently tied to international price fluctuations, meaning that the price of a barrel of oil can significantly impact the company's bottom line. In 2024, crude oil prices have seen considerable volatility, with benchmarks like Brent crude trading in a range that directly influences Esso's acquisition expenses.

Beyond traditional crude, Esso S.A.F. is also incurring growing costs for acquiring renewable feedstocks. These are essential for their expanding biofuel production initiatives. The cost of these sustainable materials, while crucial for future growth and environmental compliance, adds another layer to the company's raw material expenditure, reflecting a strategic shift in their sourcing.

Refining and production operating costs for Esso S.A.F.'s Gravenchon refinery are significant, covering essential elements like energy, maintenance, and labor. In 2024, energy prices, particularly for natural gas and electricity, remained a key driver of these expenses, directly impacting the cost per barrel.

Maintaining the complex machinery within the refinery is critical for operational efficiency and safety, representing a substantial portion of the budget. These maintenance activities, including preventative measures and repairs, are vital to avoid costly downtime and ensure consistent production output.

Labor costs for the skilled refinery personnel are also a core component of the operating structure. The specialized knowledge and training required for refinery operations contribute to these personnel expenses, underscoring the importance of human capital in managing these intricate processes.

Esso S.A.F. faces substantial distribution and logistics costs, a significant component of its business model. These expenses stem from moving refined petroleum products from its refineries to a wide array of distribution points throughout France. In 2024, the company's extensive network, encompassing numerous service stations and industrial clients, necessitates considerable investment in transportation infrastructure and operations.

Key cost drivers include fuel consumption for its transport fleet, ongoing vehicle maintenance and repair, the operational expenses of managing storage depots, and the salaries of dedicated logistics and delivery personnel. The sheer geographical reach of Esso's operations across France directly correlates with the magnitude of these distribution expenses, making efficient route planning and fleet management crucial for cost control.

Marketing, Sales, and Administrative Expenses

Marketing, Sales, and Administrative Expenses (MSA) are crucial for Esso S.A.F.'s business model, encompassing brand promotion, advertising, sales force compensation, and corporate overhead. These costs are essential for maintaining brand recognition and supporting the extensive retail network.

- Marketing and Advertising: Investments in campaigns to promote Esso brand and fuel products.

- Sales Force: Salaries and commissions for personnel managing retail station relationships and B2B sales.

- General and Administrative: Costs associated with headquarters operations, including management, finance, and legal.

- 2024 Data Insight: While specific MSA figures for Esso S.A.F. in 2024 are not publicly detailed, similar integrated oil companies often allocate between 3-5% of their revenue to these operational and marketing functions. For instance, ExxonMobil, a comparable entity, reported significant marketing and administrative expenses contributing to its overall operational costs.

Capital Expenditures and Environmental Compliance

Esso S.A.F.'s capital expenditures are significant, covering essential upgrades and expansions to its refining infrastructure and distribution networks. These investments are crucial for maintaining operational efficiency and market competitiveness. For instance, in 2024, the company continued to invest in modernizing its facilities to meet evolving industry standards.

A substantial portion of capital expenditure is also directed towards energy transition initiatives. This includes developing capabilities for Sustainable Aviation Fuel (SAF) production and implementing technologies aimed at reducing carbon emissions. These forward-looking investments are vital for aligning with global sustainability goals and future market demands.

- Capital Expenditures: Investments in refining infrastructure, distribution expansion, and energy transition projects.

- Environmental Compliance Costs: Significant expenses incurred to meet stringent environmental regulations.

- SAF Production: Development of facilities for producing sustainable aviation fuel.

- Carbon Reduction Technologies: Implementation of projects to lower the company's carbon footprint.

Esso S.A.F.'s cost structure is heavily influenced by the volatile global crude oil market, with 2024 seeing significant price fluctuations impacting procurement expenses. The company also incurs costs for renewable feedstocks to support its growing biofuel production, adding to raw material outlays. Operating costs at its Gravenchon refinery, including energy, maintenance, and labor, represent a substantial ongoing expenditure, further shaped by 2024 energy price trends.

Distribution and logistics costs are significant due to Esso S.A.F.'s extensive network across France, encompassing fuel for its transport fleet and management of storage depots. Marketing, Sales, and Administrative Expenses (MSA) are also key, covering brand promotion and corporate overhead, with industry benchmarks suggesting these can range from 3-5% of revenue. Capital expenditures are substantial, including investments in refinery upgrades, network expansion, and crucial energy transition initiatives like Sustainable Aviation Fuel (SAF) production and carbon reduction technologies, reflecting a strategic focus on future market demands and environmental compliance.

| Cost Category | Key Components | 2024 Relevance/Notes |

|---|---|---|

| Raw Material Procurement | Crude Oil, Renewable Feedstocks | Directly impacted by global oil price volatility in 2024; increasing costs for sustainable materials. |

| Operating Costs (Refining) | Energy, Maintenance, Labor | Energy prices (natural gas, electricity) significant drivers in 2024; skilled labor is a core expense. |

| Distribution & Logistics | Transportation, Storage, Personnel | Essential for extensive French network; influenced by fleet fuel costs and efficient route management. |

| Marketing, Sales & Admin (MSA) | Advertising, Sales Force, Overhead | Crucial for brand presence; comparable companies often allocate 3-5% of revenue. |

| Capital Expenditures | Infrastructure Upgrades, Energy Transition | Ongoing investment in modernization, SAF production, and carbon reduction technologies. |

Revenue Streams

Esso S.A.F.'s core revenue generation hinges on the widespread sale of automotive fuels, primarily gasoline and diesel. This vital stream flows from its extensive network of Esso and Esso Express service stations, catering to both individual motorists and commercial vehicle fleets.

In 2024, the global demand for refined oil products remained robust, with transportation fuels continuing to be a dominant segment. While specific figures for Esso S.A.F. are proprietary, major energy companies reported significant revenue from fuel sales, often comprising over 70% of their total turnover in the retail sector.

Esso S.A.F. generates significant revenue from selling a diverse portfolio of lubricants and specialty products under its Mobil and Esso brands. This includes offerings for automotive, industrial, and marine sectors, alongside asphalt and basestocks.

These specialized products typically command higher profit margins compared to standard fuel sales, contributing substantially to the company's overall profitability. For instance, in 2024, the lubricants segment is projected to be a key driver of Esso's financial performance.

Esso S.A.F. generates substantial revenue through direct sales of bulk fuels and specialized energy products to industrial clients and commercial businesses. These transactions are frequently structured as long-term contracts with pre-negotiated pricing, ensuring a predictable income stream.

Wholesale distributors also represent a key revenue channel, allowing Esso S.A.F. to reach a broader market. For instance, in 2024, the company reported that its industrial and wholesale segments collectively accounted for over 60% of its total sales volume, underscoring the importance of these large-scale transactions.

Convenience Store Sales and Ancillary Services

Esso S.A.F. leverages its service station network to generate revenue not only from fuel but also from convenience stores and other ancillary services. These non-fuel offerings are crucial for boosting overall profitability and customer loyalty.

In 2024, convenience store sales and services like car washes represent a significant portion of revenue for many fuel retailers. For instance, the convenience store sector within the fuel retail industry has seen consistent growth, with many stations reporting that non-fuel sales can account for 30-50% of their total profit margin.

- Convenience Store Sales: These outlets offer a wide range of products, from snacks and beverages to everyday essentials, catering to the immediate needs of customers.

- Ancillary Services: Services such as car washes, tire inflation stations, and even small repair services add further revenue streams and enhance the customer experience.

- Profitability Boost: Non-fuel items typically have higher profit margins compared to fuel, making these offerings vital for the financial health of Esso S.A.F.'s retail operations.

- Customer Value Proposition: By providing a one-stop shop for fuel and other necessities, Esso S.A.F. strengthens its appeal to a broader customer base.

Emerging Low-Carbon Fuel Sales

Emerging low-carbon fuel sales are becoming a significant revenue driver for Esso S.A.F. As the company invests in sustainable aviation fuel (SAF) and re-refined base oils, these lower-emission products represent a growing and strategic income source. This diversification directly supports energy transition objectives and addresses increasing market demand for environmentally conscious solutions.

For instance, the global SAF market is projected to expand significantly. By 2025, the market is expected to reach approximately $3.5 billion, with substantial growth anticipated thereafter. This trend highlights the commercial viability and strategic importance of Esso S.A.F.'s investments in this area.

- Sustainable Aviation Fuel (SAF) Sales: Direct revenue generated from the sale of SAF to airlines and other aviation stakeholders.

- Re-refined Base Oil Sales: Income derived from selling base oils that have undergone a re-refining process, offering a lower-carbon alternative to virgin base oils.

- Partnerships and Offtake Agreements: Revenue secured through long-term agreements with customers committed to purchasing low-carbon fuels.

- Potential Carbon Credits/Incentives: Future revenue streams could include income from government incentives or the sale of carbon credits associated with the production and use of low-carbon fuels.

Esso S.A.F.'s revenue streams are multifaceted, extending beyond core fuel sales to include lubricants, industrial products, and the growing market for low-carbon fuels.

In 2024, the company's diversified approach, encompassing retail fuel, lubricants, and wholesale, positions it well within the energy sector. Non-fuel retail sales and specialized industrial products contribute significantly to overall profitability, often with higher margins than standard fuel. The increasing demand for sustainable options, like SAF, represents a key growth area.

| Revenue Stream | Description | 2024 Market Context/Data |

|---|---|---|

| Automotive Fuels | Sales of gasoline and diesel at Esso service stations. | Global demand for transportation fuels remained strong in 2024; major energy companies often see fuel sales exceeding 70% of retail turnover. |

| Lubricants & Specialty Products | Sales of Mobil and Esso branded lubricants, asphalt, and basestocks for various sectors. | Lubricants segment projected as a key driver of financial performance in 2024; these products typically offer higher profit margins. |

| Industrial & Wholesale Sales | Bulk fuel and energy product sales to businesses, often via long-term contracts. | In 2024, industrial and wholesale segments collectively accounted for over 60% of total sales volume for similar companies. |

| Non-Fuel Retail & Services | Convenience store sales and services like car washes at service stations. | Convenience store sales can contribute 30-50% to profit margins in the fuel retail sector; a consistent growth area. |

| Low-Carbon Fuels | Sales of Sustainable Aviation Fuel (SAF) and re-refined base oils. | Global SAF market projected to reach approximately $3.5 billion by 2025, indicating significant growth potential. |

Business Model Canvas Data Sources

The Esso S.A.F. Business Model Canvas is built upon a foundation of robust financial statements, extensive market research on the energy sector, and internal operational data. This multi-faceted approach ensures each component of the canvas is grounded in factual evidence and strategic understanding.