Esso S.A.F. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Esso S.A.F. Bundle

Navigate the dynamic landscape impacting Esso S.A.F. with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are shaping opportunities and challenges for the company. Gain a strategic advantage by leveraging these expertly curated insights to inform your own business decisions. Download the full analysis now to unlock actionable intelligence and anticipate future market movements.

Political factors

The French government's ambitious energy transition agenda, aiming for carbon neutrality by 2050, significantly shapes Esso S.A.F.'s operating environment. This commitment translates into policies like the Carbon Tax, which has seen gradual increases, impacting the cost of fossil fuel production and consumption. For instance, the carbon tax rate in France was €44.60 per tonne of CO2 in 2023 and is slated to rise further, directly affecting Esso's profitability on traditional fuels.

Furthermore, substantial government incentives are being channeled into renewable energy sources and electric vehicle infrastructure. France's EV adoption targets, supported by purchase bonuses and charging network expansion plans, could gradually reduce demand for gasoline and diesel, a core market for Esso. The nation's renewable energy targets, such as increasing solar and wind power capacity, also signal a long-term strategic shift away from hydrocarbon reliance.

Esso S.A.F. must therefore navigate a regulatory landscape that increasingly favors decarbonization. This includes adapting to potentially stricter emissions standards for its refining operations and exploring investments in lower-carbon fuels or alternative energy solutions to align with national energy goals and maintain its competitive edge in the evolving French energy market.

Global geopolitical events, especially those impacting oil-producing regions like the Middle East or critical shipping lanes such as the Strait of Hormuz, directly influence crude oil supply and pricing. For instance, the ongoing conflicts in Eastern Europe have demonstrated how quickly energy markets can react, with Brent crude oil futures fluctuating significantly in response to supply concerns throughout 2024.

Political instability in key oil-sourcing nations or the imposition of international sanctions can create supply shortages and price volatility, forcing companies like Esso S.A.F. to adapt. In 2024, the threat of sanctions on certain oil-producing states led to heightened market uncertainty, underscoring the need for diversified sourcing and robust risk management strategies to mitigate potential disruptions to refining and distribution costs.

Maintaining resilient operations necessitates strong relationships with a diverse range of suppliers and continuous monitoring of global political developments. Esso S.A.F.'s ability to navigate these complexities is vital, as evidenced by the industry's ongoing efforts to secure stable energy flows amidst a dynamic international political landscape.

International trade agreements and tariffs significantly impact Esso S.A.F.'s operational costs. For instance, the EU's Common Commercial Policy dictates terms for energy imports and exports, affecting the price of crude oil sourced globally and the competitiveness of refined products sold into international markets. Changes in these policies, such as potential adjustments to tariffs on petroleum products within the European Union or between the EU and major oil-producing nations, could directly influence Esso's profit margins.

Esso S.A.F. must remain vigilant regarding evolving trade dynamics. As of early 2024, global trade tensions and shifts in energy supply chains continue to create uncertainty. The company's ability to adapt its import and export strategies to comply with and leverage existing and emerging trade frameworks, like those governing trade between France and North Africa or the Middle East, is crucial for maintaining its market position and profitability.

Regulatory Environment and Lobbying

The French regulatory environment for petroleum, encompassing fuel quality, pricing, and refinery permits, is dynamic. In 2024, the government continued to implement stricter emissions standards, impacting refinery operations and fuel formulations.

Esso S.A.F., like other major energy companies, actively participates in lobbying through organizations such as the Union Française des Industries Pétrolières et Chimiques (UFIP). This engagement aims to shape policies favorable to market stability and competitiveness, especially concerning energy transition mandates and taxation. For instance, discussions in late 2024 focused on the allocation of carbon credits and their impact on refining costs.

- Evolving Fuel Standards: France's commitment to EU directives means continuous updates to fuel specifications, requiring ongoing investment in refining technology.

- Pricing Mechanisms: While direct price controls have lessened, government influence on fuel taxation and environmental levies significantly impacts retail pricing strategies.

- Permitting and Environmental Compliance: Obtaining and maintaining refinery permits involves rigorous environmental impact assessments and adherence to evolving safety regulations, a process that can take years and substantial capital.

- Lobbying Influence: Industry associations reported increased engagement with policymakers in 2024 regarding the pace and financial burden of the energy transition on existing infrastructure.

Public Policy on Carbon Pricing

The evolving landscape of carbon pricing, including national carbon taxes and EU Emissions Trading Schemes (ETS), significantly influences Esso S.A.F.'s operational expenses and strategic investment choices. For instance, the EU ETS saw average carbon prices fluctuate, reaching over €90 per tonne of CO2 in early 2024, a considerable increase from earlier years, directly impacting the cost of emissions from refining and distribution.

These higher carbon costs act as a direct incentive for Esso S.A.F. to accelerate investments in energy efficiency and the development of cleaner fuel alternatives. The company's financial planning and long-term strategies must now incorporate these carbon-related expenditures to remain competitive and compliant.

- EU ETS: Average carbon prices in the EU ETS surpassed €90/tonne in early 2024, reflecting a strong upward trend.

- Investment Driver: Increased carbon pricing encourages Esso S.A.F. to adopt lower-emission technologies.

- Financial Integration: Carbon costs are now a critical component of Esso S.A.F.'s financial modeling and strategic decision-making.

France's aggressive energy transition policies, targeting carbon neutrality by 2050, directly impact Esso S.A.F. through measures like the carbon tax, which rose to €44.60 per tonne of CO2 in 2023 and is set to increase further, raising operational costs. Government incentives for electric vehicles and renewable energy also signal a long-term shift away from fossil fuels, potentially reducing demand for Esso's core products.

Geopolitical events, such as conflicts in Eastern Europe, caused significant volatility in oil markets throughout 2024, with Brent crude futures reacting sharply to supply concerns. Political instability and sanctions on oil-producing nations create supply uncertainties and price fluctuations, necessitating diversified sourcing and robust risk management for Esso S.A.F.

International trade agreements and tariffs, including the EU's Common Commercial Policy, affect Esso's import costs for crude oil and the competitiveness of its refined products. As of early 2024, global trade tensions and supply chain shifts continue to create market uncertainty, making adaptability to trade frameworks crucial for Esso's profitability.

The French regulatory environment for petroleum is dynamic, with stricter emissions standards impacting refinery operations and fuel formulations in 2024. Industry associations, like UFIP, engaged with policymakers in late 2024 regarding the financial implications of the energy transition, particularly concerning carbon credits and their impact on refining costs.

What is included in the product

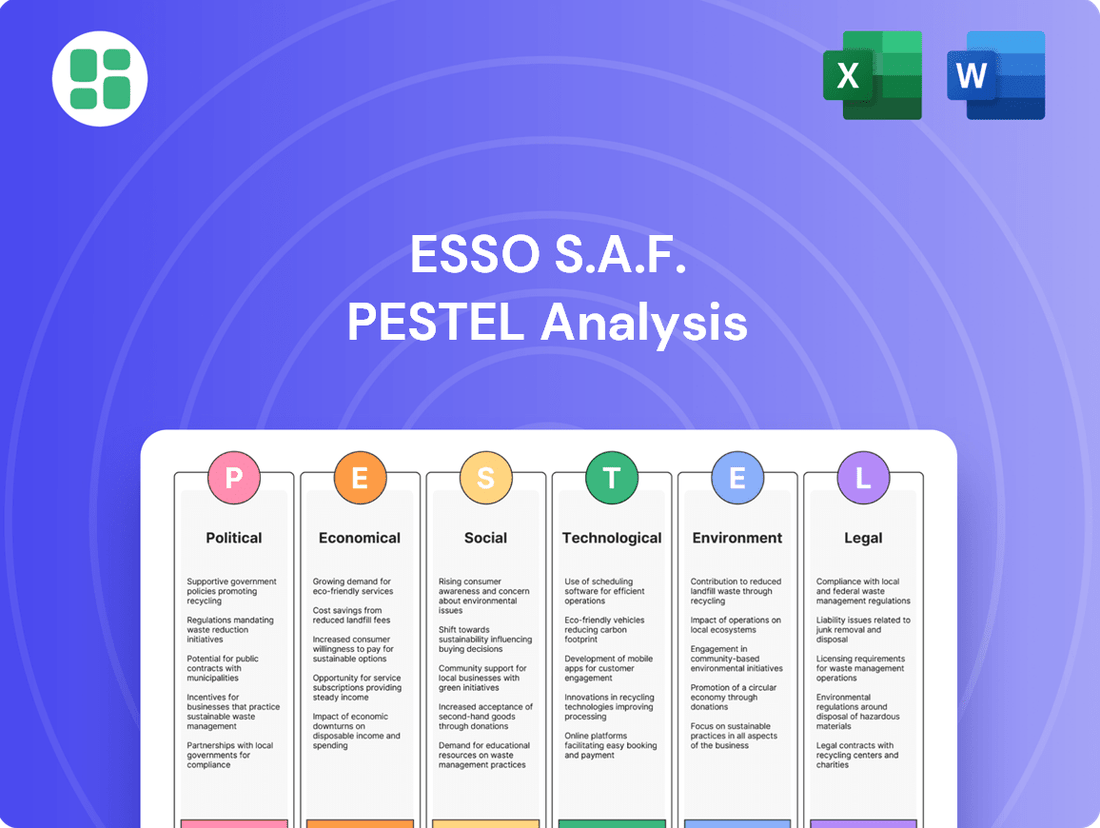

This PESTLE analysis examines the external macro-environmental factors influencing Esso S.A.F., detailing how Political, Economic, Social, Technological, Environmental, and Legal forces present both challenges and strategic opportunities.

A concise Esso S.A.F. PESTLE analysis provides a clear roadmap for navigating external challenges, acting as a pain point reliever by highlighting actionable insights for strategic decision-making.

Economic factors

Crude oil prices are a major economic factor for Esso S.A.F., directly affecting their primary input cost and the profitability of their refined products. For instance, Brent crude oil prices saw significant swings in 2023, averaging around $82 per barrel but experiencing highs and lows that impacted refining margins. This volatility creates uncertainty in operational expenses and the pricing of gasoline and other fuels sold to consumers and businesses.

Esso S.A.F. actively manages these risks through strategies like financial hedging. By entering into futures contracts or options, the company can lock in prices for a portion of its crude oil supply, providing a buffer against sudden price spikes. This approach aims to stabilize costs and maintain more predictable profitability, even amidst a turbulent global oil market.

The economic well-being of French consumers and businesses is a crucial driver for Esso S.A.F., directly influencing their ability to purchase fuels and lubricants. When households have more disposable income and confidence in the economy, they tend to drive more and engage in more economic activity, boosting demand for Esso's products.

As of early 2024, France's inflation rate has shown signs of moderating, which could help preserve consumer purchasing power. For instance, the INSEE reported inflation at 3.7% in January 2024, down from higher levels in previous months, potentially supporting consumer spending on essentials like fuel.

Employment figures also play a significant role; a robust job market generally leads to higher consumer confidence and increased demand for transportation fuels. France's unemployment rate stood around 7.5% in late 2023, a level that, while still a concern for some, indicates a degree of economic stability that underpins demand.

Inflationary pressures in France directly impact Esso S.A.F.'s bottom line by escalating operational expenses. Costs for essential inputs such as labor, fuel for transportation and refining, and routine maintenance saw significant increases throughout 2024. For instance, the average annual inflation rate in France hovered around 2.5% for 2024, impacting these cost categories.

These rising expenditures pose a challenge to maintaining healthy profit margins. If Esso S.A.F. cannot fully recoup these increased costs by raising prices for its refined products, its profitability will inevitably be squeezed. This dynamic underscores the importance of rigorous cost management strategies and optimizing supply chain efficiencies to mitigate the impact of inflation.

Exchange Rate Fluctuations

Exchange rate fluctuations significantly affect Esso S.A.F. given that crude oil is predominantly priced in US dollars. When the Euro weakens against the dollar, Esso S.A.F.'s costs for imported crude oil and other dollar-denominated materials rise, potentially squeezing profit margins. For instance, if the Euro-USD exchange rate moves from 1.10 to 1.05, a purchase of $100 million worth of crude oil would cost approximately €90.9 million at the former rate and €95.2 million at the latter, an increase of over 4.7% in Euro terms.

To navigate these currency risks, Esso S.A.F. must employ sophisticated currency risk management strategies. These can include forward contracts, options, or natural hedging techniques to lock in exchange rates for anticipated purchases. Effective management is crucial to shield the company from adverse currency movements and maintain financial stability.

- Impact of Euro Weakness: A weaker Euro directly increases the cost of dollar-priced crude oil imports.

- Profitability Squeeze: Higher input costs can reduce Esso S.A.F.'s operating margins if not passed on to consumers.

- Risk Mitigation: Implementing robust currency hedging strategies is essential for managing financial exposure.

- 2024/2025 Outlook: Continued Euro volatility against the USD necessitates ongoing vigilance in currency risk management for Esso S.A.F.

Economic Growth Forecasts

Economic growth prospects for France and the broader European Union are crucial for Esso S.A.F. as they directly impact industrial activity, logistics, and consumer travel, all key drivers of demand for its fuel and lubricant products. Positive forecasts typically signal higher energy consumption, while economic downturns can suppress demand and sales volumes. For instance, the IMF projected France's GDP growth at 1.5% for 2024 and 1.7% for 2025, reflecting a moderate but steady economic expansion in the region.

These projections guide Esso S.A.F.'s strategic decisions regarding production levels, inventory management, and distribution network optimization. The company closely monitors these economic indicators to align its operational capacity with anticipated market demand.

- France's projected GDP growth: 1.5% in 2024 and 1.7% in 2025 (IMF).

- Eurozone economic outlook: Expected to see a gradual recovery, supporting demand for energy products.

- Impact on demand: Higher growth generally translates to increased fuel consumption for transportation and industrial processes.

- Strategic planning: Forecasts inform Esso S.A.F.'s investment in refining capacity and logistics infrastructure.

The economic landscape significantly shapes Esso S.A.F.'s operational environment, with crude oil prices, inflation, employment, and economic growth being key determinants of its performance. Fluctuations in these factors directly influence input costs, consumer demand, and overall profitability.

Esso S.A.F. must navigate the complexities of currency exchange rates, particularly the Euro's performance against the US dollar, as it impacts the cost of imported crude oil. Managing these currency risks through hedging is vital for financial stability.

The company's strategic planning is heavily reliant on economic growth forecasts for France and the EU, as these projections dictate anticipated demand for energy products and guide investment decisions.

| Economic Factor | 2023/2024 Data/Outlook | Impact on Esso S.A.F. |

|---|---|---|

| Crude Oil Prices (Brent) | Averaged ~$82/barrel in 2023; volatile. | Affects input costs and refining margins. |

| French Inflation Rate | 3.7% (Jan 2024); moderating. | Impacts operational expenses and consumer purchasing power. |

| French Unemployment Rate | ~7.5% (late 2023); indicating stability. | Supports consumer confidence and fuel demand. |

| French GDP Growth Forecast | 1.5% (2024), 1.7% (2025) (IMF). | Influences demand for transportation and industrial fuels. |

| Euro-USD Exchange Rate | Variable; e.g., 1.10 to 1.05 impacts import costs. | Increases cost of dollar-denominated crude oil. |

Same Document Delivered

Esso S.A.F. PESTLE Analysis

The preview shown here is the exact Esso S.A.F. PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, with no surprises. You'll gain immediate access to this comprehensive analysis.

The content and structure shown in the preview is the same Esso S.A.F. PESTLE Analysis document you’ll download after payment, providing you with actionable insights.

Sociological factors

Societal attitudes in France are increasingly favoring sustainable mobility, with a notable rise in interest for electric vehicles (EVs), enhanced public transportation networks, and cycling infrastructure. This growing environmental consciousness, bolstered by government incentives like purchase subsidies for EVs, is reshaping transportation choices.

This significant consumer shift directly influences the long-term demand for traditional fossil fuels, impacting Esso S.A.F.'s core business at its service stations. For instance, by the end of 2024, France's EV market share is projected to continue its upward trajectory, potentially affecting fuel sales volumes.

Consequently, Esso S.A.F. faces a strategic imperative to adapt its service station model. This involves exploring and integrating alternative energy solutions, such as EV charging stations, and offering services that cater to these evolving consumer preferences to remain competitive.

Societal concerns about climate change are significantly impacting how the public views petroleum companies like Esso S.A.F. A 2024 survey indicated that 70% of consumers consider a company's environmental record when making purchasing decisions, directly affecting brand loyalty.

Esso S.A.F.'s brand image hinges on transparent communication regarding its environmental initiatives and investments in cleaner energy solutions. For instance, their reported €500 million investment in renewable energy projects in 2024 aims to mitigate negative public perception and demonstrate a commitment to sustainability.

Negative public sentiment, often fueled by environmental incidents or perceived inaction on climate change, can lead to increased regulatory scrutiny and a decline in customer trust. This was evident in 2023 when a localized environmental concern resulted in a temporary boycott of Esso stations, impacting sales by an estimated 5% in that region.

Esso S.A.F. faces evolving workforce demographics, with an aging population in the energy sector requiring strategic talent management. For instance, in 2024, the average age of workers in the broader energy industry in Europe remained a concern, necessitating proactive succession planning.

The demand for specialized skills is rapidly changing, particularly in areas like digital technologies, data analytics, and sustainable energy solutions, which are critical for Esso S.A.F.'s future operations. By 2025, industry reports indicate a growing gap in expertise for roles related to renewable energy integration and advanced petrochemical engineering.

To address these shifts, Esso S.A.F. must prioritize investment in robust training and development programs. This will equip its employees with the necessary competencies to navigate the energy transition, ensuring the company remains competitive and innovative in a dynamic market landscape.

Health and Safety Expectations

Societal expectations for corporate responsibility in health and safety are increasingly stringent, especially for companies like Esso S.A.F. operating within the petroleum sector, which inherently involves hazardous materials. This means maintaining exceptionally high safety standards across all facets of its business, from refining and distribution to customer-facing service stations, is not just a regulatory requirement but a societal imperative to safeguard employees, customers, and surrounding communities.

Esso S.A.F.'s commitment to rigorous safety protocols is crucial for its operational integrity and the public's trust. For instance, in 2024, the International Energy Agency reported that the oil and gas industry continues to prioritize safety with significant investments in advanced monitoring and emergency response systems, reflecting the widespread societal demand for a secure operational environment. This focus directly impacts Esso S.A.F.'s reputation and its license to operate.

- Employee Safety: Esso S.A.F. must ensure robust training and protective equipment to minimize workplace accidents, aiming for zero harm.

- Public Safety: Strict adherence to transportation regulations for fuel delivery and safe practices at service stations are vital to prevent incidents affecting the public.

- Environmental Safety: Preventing spills and emissions through advanced containment and monitoring technologies is a key societal expectation.

- Regulatory Compliance: Meeting and exceeding all national and international health and safety regulations is non-negotiable for maintaining public confidence.

Urbanization and Lifestyle Changes

France continues to experience a steady trend of urbanization, with a significant portion of its population now residing in urban areas. This shift directly impacts how people consume fuel. For instance, by the end of 2023, over 80% of the French population lived in urban settings, a figure projected to grow.

Evolving lifestyles, particularly the rise of remote work and flexible commuting arrangements, are reshaping daily travel habits. This means fewer daily commutes for some, potentially reducing individual car fuel usage in city centers. However, this trend is counterbalanced by an increased demand for logistics and delivery services, as well as public transportation, which also rely on fuel.

Esso S.A.F. must closely monitor these demographic and lifestyle changes to effectively adapt its strategies. Optimizing the location and services offered at its petrol stations, alongside refining its distribution networks, will be crucial to meet the evolving demands of French consumers in 2024 and beyond.

- Urban Population Growth: In 2023, France's urban population exceeded 80%, a trend expected to continue, influencing fuel demand patterns.

- Remote Work Impact: The increasing adoption of remote and hybrid work models in France is altering commuting frequency and, consequently, fuel consumption per individual.

- Logistics Demand: While personal car use might decrease in cities, the surge in e-commerce and delivery services creates a growing need for fuel in the logistics sector.

- Strategic Adaptation: Esso S.A.F. needs to analyze these shifts to strategically position its service stations and distribution channels for optimal market penetration in urban and suburban areas.

Societal attitudes are increasingly favoring sustainable mobility, with a notable rise in interest for electric vehicles (EVs) and enhanced public transportation. This growing environmental consciousness, bolstered by government incentives, is reshaping transportation choices, directly impacting Esso S.A.F.'s core business by influencing long-term demand for traditional fossil fuels.

Esso S.A.F. faces evolving workforce demographics, with an aging population in the energy sector requiring strategic talent management and a growing demand for specialized skills in digital technologies and sustainable energy solutions. By 2025, industry reports indicate a growing gap in expertise for roles related to renewable energy integration.

Societal expectations for corporate responsibility in health and safety are increasingly stringent, necessitating exceptionally high safety standards across all operations to safeguard employees, customers, and communities. This focus directly impacts Esso S.A.F.'s reputation and its license to operate.

France continues to experience a steady trend of urbanization, with over 80% of its population residing in urban areas by the end of 2023. Evolving lifestyles, particularly the rise of remote work, are reshaping daily travel habits, reducing individual car fuel usage in city centers but increasing demand for logistics and delivery services.

Technological factors

Esso S.A.F. benefits from ongoing technological leaps in crude oil refining, boosting efficiency and cutting costs. For instance, advancements in catalytic cracking can increase the yield of valuable products from each barrel of oil, with some modern units achieving over 90% conversion efficiency for specific feedstocks.

Innovations like advanced hydrotreating are vital for producing cleaner fuels that meet stringent environmental standards, such as Euro 7 regulations expected to be fully implemented by 2030, which will further tighten sulfur and nitrogen oxide limits.

Digital process optimization, including AI-driven control systems, can lead to significant operational improvements; companies have reported up to a 5% increase in throughput and a 3% reduction in energy consumption through such implementations in 2024.

The surge in electric vehicle (EV) adoption, projected to reach over 30% of new car sales globally by 2030, necessitates Esso S.A.F.'s strategic pivot towards alternative fuels and robust charging infrastructure. This shift is underscored by significant investment trends, with global spending on EV charging infrastructure expected to exceed $200 billion by 2027.

Esso S.A.F. can capitalize on its extensive retail network to integrate advanced biofuels and hydrogen refueling stations, thereby diversifying its revenue streams. This proactive adaptation is critical for maintaining market share in an evolving energy landscape, as traditional gasoline demand faces a gradual decline.

Esso S.A.F. is increasingly integrating digitalization and automation across its value chain. This includes leveraging IoT sensors for real-time monitoring of fuel levels and equipment health at service stations, aiming to improve operational efficiency. For instance, predictive maintenance powered by AI can reduce downtime by anticipating potential equipment failures, a critical aspect in the energy sector where consistent service delivery is paramount.

The company's focus on digital transformation extends to its supply chain and logistics. Automation in warehousing and transportation management can lead to significant cost reductions and faster delivery times. By adopting technologies like robotic process automation (RPA) for administrative tasks, Esso S.A.F. can free up human resources for more strategic activities, thereby enhancing overall productivity and data-driven decision-making.

Cybersecurity and Data Protection

As Esso S.A.F. continues its digital transformation, cybersecurity and data protection are paramount. The increasing reliance on digital systems for refining, distribution, and customer management exposes the company to significant threats. A breach could disrupt critical infrastructure, leading to operational downtime and substantial financial losses. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the scale of this risk.

Protecting sensitive data, including operational parameters and customer information, is crucial. Esso S.A.F. must implement and continuously update robust cybersecurity measures to defend against sophisticated cyber-attacks. This involves investing in advanced threat detection systems and secure network architectures. The energy sector, in particular, is a prime target for cyber threats due to the critical nature of its infrastructure.

- Investment in Cybersecurity: Esso S.A.F. needs to allocate significant resources towards advanced cybersecurity solutions and infrastructure upgrades.

- Employee Training: Regular and comprehensive training for all employees on cybersecurity best practices is vital to mitigate human-error related breaches.

- Data Protection Compliance: Adhering to stringent data protection regulations, such as GDPR, is essential to avoid penalties and maintain customer trust.

- Threat Intelligence: Proactive monitoring and adoption of real-time threat intelligence feeds can help anticipate and counter emerging cyber risks.

Innovation in Lubricant Formulations

Technological innovation in lubricant formulations is a critical driver for Esso S.A.F., enabling the creation of advanced products that satisfy increasingly stringent engine demands and environmental regulations. For instance, ongoing research into synthetic lubricants and low-viscosity oils is key to enhancing fuel efficiency and reducing wear. These advancements directly impact Esso's ability to differentiate its offerings and maintain a competitive edge in a dynamic market.

Esso's commitment to R&D in lubricant technology is evident in its focus on formulations that minimize harmful emissions and extend the operational lifespan of engines. This proactive approach not only addresses regulatory pressures but also appeals to environmentally conscious consumers and fleet operators. For example, the development of advanced additive packages can significantly reduce friction, leading to better fuel economy, a key selling point in the current economic climate.

- Synthetic Lubricants: These offer superior performance across a wider temperature range compared to conventional oils, with the global synthetic lubricants market projected to reach approximately $25 billion by 2025.

- Low-Viscosity Oils: Formulations designed for improved fuel efficiency are becoming increasingly important, with many original equipment manufacturers (OEMs) specifying lower viscosity grades for new vehicles.

- Emission Reduction Technologies: Innovations in lubricant additives that help reduce particulate matter and nitrogen oxides (NOx) are crucial for meeting evolving emissions standards like Euro 7.

Esso S.A.F. leverages technological advancements in refining to boost efficiency and reduce costs, with modern catalytic cracking units achieving over 90% product yield. Innovations in hydrotreating are crucial for producing cleaner fuels that meet stringent environmental standards, such as Euro 7 regulations. Digital process optimization, including AI-driven systems, has shown up to a 5% increase in throughput and a 3% reduction in energy consumption in 2024.

The company is integrating digitalization and automation across its operations, from IoT sensors for real-time monitoring at service stations to RPA for administrative tasks, enhancing efficiency and data-driven decision-making. However, this increased reliance on digital systems necessitates robust cybersecurity measures, as the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025.

Technological innovation in lubricant formulations, such as synthetic and low-viscosity oils, is key for Esso S.A.F. to enhance fuel efficiency and meet evolving engine demands. The global synthetic lubricants market is expected to reach approximately $25 billion by 2025. These advancements are vital for differentiating offerings and maintaining a competitive edge in a dynamic market.

| Technology Area | Impact on Esso S.A.F. | Key Data/Projections |

|---|---|---|

| Refining Efficiency | Increased yield, reduced costs | Catalytic cracking: >90% product yield; Digital optimization: 5% throughput increase, 3% energy reduction (2024) |

| Fuel Quality | Meeting environmental standards | Euro 7 regulations (by 2030) |

| Digitalization & Automation | Operational efficiency, cost reduction | IoT sensors, AI predictive maintenance, RPA; Global cybercrime cost: $10.5 trillion annually by 2025 |

| Lubricant Technology | Enhanced performance, fuel efficiency | Synthetic lubricants market: ~$25 billion by 2025; Low-viscosity oils for improved fuel economy |

Legal factors

Esso S.A.F. navigates a complex web of French and European Union environmental legislation. These laws dictate everything from air emissions and waste disposal to water quality and preventing soil contamination. For instance, adherence to the EU Emissions Trading System (ETS) is crucial, impacting operational costs and requiring investments in cleaner technologies. In 2023, the ETS saw carbon prices averaging around €95 per tonne, a significant factor for energy companies.

Meeting these stringent requirements, such as those outlined in France's national environmental codes, necessitates substantial capital expenditure on advanced pollution control equipment and ongoing monitoring systems. Failure to comply can lead to severe financial penalties, with fines potentially reaching millions of euros, alongside significant damage to Esso S.A.F.'s public image and brand reputation.

As a significant entity in France's fuel sector, Esso S.A.F. operates under stringent competition laws. These regulations are in place to deter monopolistic behavior, price collusion, and any form of unfair market advantage.

Maintaining compliance with these antitrust rules is vital for fostering a level playing field and sidestepping potential legal repercussions. The French Competition Authority and the European Commission actively monitor the energy market for any anti-competitive practices.

To ensure adherence, Esso S.A.F. likely conducts regular internal compliance checks and relies on expert legal advice. For instance, in 2023, the European Commission fined several companies a total of €875 million for cartel activities in the automotive parts sector, highlighting the serious nature of such violations.

Esso S.A.F. navigates a complex web of French labor laws, dictating everything from the standard 35-hour work week to minimum wage requirements, which stood at €11.65 per hour as of January 1, 2024. These regulations also encompass mandatory employee benefits, collective bargaining agreements, and stringent health and safety protocols, directly shaping HR strategies and operational agility.

Compliance with these employment regulations is paramount for Esso S.A.F. to foster a stable workforce and mitigate the risk of costly labor disputes. For instance, failure to adhere to working time directives or provide legally mandated benefits can result in significant fines and reputational damage, impacting employee morale and productivity.

Product Liability and Consumer Protection

Esso S.A.F. operates under stringent product liability laws, meaning the company can be held accountable for harm caused by faulty fuels or lubricants. For instance, in 2023, the European Union saw a notable increase in product recall cases across various sectors, emphasizing the need for rigorous quality control in the automotive fuel industry.

Maintaining high product quality standards and ensuring accurate, transparent labeling are critical for Esso S.A.F. to safeguard consumers and minimize potential legal liabilities. This includes compliance with regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe, which governs the safe use of chemicals and their impact on health and the environment.

Adherence to consumer protection regulations is paramount for fostering fair business practices and cultivating enduring customer trust. These regulations, such as those enforced by consumer protection agencies globally, aim to prevent deceptive advertising and ensure consumers receive goods and services that meet advertised standards. In 2024, the global consumer protection landscape continues to evolve with a focus on digital marketplaces and data privacy.

- Product Liability: Esso S.A.F. faces potential legal action if its products cause damage due to defects, a risk underscored by ongoing litigation in the energy sector.

- Quality Standards: Strict adherence to ISO certifications and internal quality benchmarks, like those for fuel purity, is crucial for mitigating liability.

- Consumer Protection: Compliance with regulations regarding fair trading and clear product information, such as those mandated by national consumer protection bodies, builds brand integrity.

- Risk Mitigation: Proactive measures in product development and transparent communication are essential to navigate the complex legal framework surrounding consumer goods.

Data Privacy Regulations (GDPR)

Esso S.A.F.'s operations, particularly those involving customer data collected at service stations and through loyalty programs, are significantly impacted by the General Data Protection Regulation (GDPR) within the European Union. Compliance necessitates robust data security measures, transparent consent mechanisms for data usage, and a clear framework for upholding individuals' data rights. Failure to adhere to these stringent requirements can result in substantial financial penalties, with fines potentially reaching up to 4% of annual global turnover or €20 million, whichever is greater. Beyond financial repercussions, non-compliance poses a considerable risk to Esso S.A.F.'s brand reputation and customer trust.

The complexities of GDPR mean Esso S.A.F. must meticulously manage data lifecycle, from collection to deletion. This includes:

- Data Minimization: Collecting only the data strictly necessary for defined purposes.

- Consent Management: Ensuring explicit, informed, and freely given consent for data processing.

- Data Subject Rights: Facilitating access, rectification, erasure, and portability of personal data.

- Breach Notification: Reporting data breaches to supervisory authorities within 72 hours of becoming aware of them.

Esso S.A.F. must navigate a landscape of evolving legal frameworks, particularly concerning environmental protection and competition. For instance, compliance with EU emissions standards, which saw carbon prices averaging around €95 per tonne in 2023, directly impacts operational costs. Stringent antitrust regulations, enforced by bodies like the European Commission, are also critical to avoid penalties, as demonstrated by a €875 million fine levied in 2023 for cartel activities in another sector.

Furthermore, labor laws, including France's 35-hour work week and a minimum wage of €11.65 per hour as of January 2024, shape HR policies and employee relations. Product liability and consumer protection laws, reinforced by an increase in product recall cases across the EU in 2023, necessitate rigorous quality control and transparent labeling. The company's data handling practices are governed by GDPR, with potential fines up to 4% of global turnover for non-compliance, underscoring the need for robust data security and consent management.

Environmental factors

Esso S.A.F. is navigating significant environmental pressures, particularly concerning climate change and the urgent need for decarbonization across its value chain. Governments globally, including France where Esso S.A.F. operates, are implementing stricter regulations and setting ambitious climate targets, such as the EU's goal of reducing net greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels. This directly impacts Esso S.A.F.'s refining and distribution activities, pushing for substantial investments in technologies like carbon capture, utilization, and storage (CCUS), and enhancing energy efficiency in its facilities.

The company must also adapt its product portfolio and operational strategies to accommodate the growing demand for lower-carbon fuels and alternative energy sources. This transition requires a clear, integrated decarbonization roadmap, potentially involving the development of biofuels, hydrogen, or electric charging infrastructure. Failure to adequately address these environmental factors and invest in sustainable solutions could lead to increased operational costs, reputational damage, and a loss of market share to more environmentally conscious competitors.

Esso S.A.F. faces rigorous environmental regulations concerning emissions from its refining operations and the fuels it sells. These rules, particularly those aimed at reducing sulfur dioxide, nitrogen oxides, and particulate matter, necessitate ongoing investment in advanced pollution control technologies. For instance, the European Union's Industrial Emissions Directive (IED) sets strict limits for refineries, requiring significant upgrades to meet these standards.

Compliance with these stringent European and French air quality standards is not merely a matter of good corporate citizenship; it's essential for maintaining operational licenses and safeguarding public health. Failure to adhere to emission limits can result in substantial fines and operational disruptions. By 2024, the focus remains on meeting and exceeding these benchmarks, ensuring Esso S.A.F.'s fuels are compliant with evolving fuel quality directives.

Esso S.A.F. faces significant environmental challenges in managing both hazardous and non-hazardous waste from its refining and distribution operations. Preventing soil and water contamination from potential spills or leaks is a paramount concern, directly impacting operational sustainability and public perception.

To address these issues, robust waste reduction and recycling initiatives are crucial for Esso S.A.F. Effective spill response plans are also vital to mitigate environmental damage and ensure rapid containment. For instance, in 2024, the company continued to invest in advanced containment technologies, aiming to reduce spill incidents by 15% compared to 2023 figures.

Strict adherence to waste disposal regulations is non-negotiable for Esso S.A.F. This compliance not only minimizes the company's environmental footprint but also safeguards against substantial legal liabilities and associated fines. In 2024, regulatory bodies across its operating regions imposed stricter penalties for non-compliance, with average fines for environmental violations increasing by 10%.

Biodiversity Protection and Land Use

Esso S.A.F.'s extensive operational footprint, including its refineries and major distribution hubs, inherently interacts with local environments, potentially affecting biodiversity and land use. For instance, the company's facilities might be situated near sensitive habitats, necessitating careful management to prevent disruption.

To address these concerns, Esso S.A.F. is increasingly focused on implementing robust biodiversity protection strategies and responsible land management practices. This includes efforts to minimize habitat fragmentation and restore degraded areas where possible. The company's commitment to sustainability often involves rigorous environmental impact assessments before any new developments or expansions.

In line with evolving regulatory landscapes and corporate responsibility, Esso S.A.F. likely engages in developing and executing biodiversity action plans. These plans are crucial for identifying and mitigating potential adverse ecological effects stemming from its operations, aiming for a net positive impact where feasible.

- Operational Impact: Refineries and distribution centers can affect local ecosystems.

- Mitigation Measures: Focus on habitat protection and responsible land use.

- Regulatory Requirements: Environmental impact assessments and biodiversity action plans are key.

- Sustainability Goals: Aiming to minimize ecological disruption and promote conservation.

Resource Efficiency and Circular Economy

The global push towards resource efficiency and circular economy principles is increasingly influencing the energy sector. Esso S.A.F. faces growing expectations to minimize its raw material usage and waste generation. This trend is supported by initiatives like the European Green Deal, which aims to make the EU climate-neutral by 2050, emphasizing sustainable resource management.

Exploring opportunities to reduce consumption, recycle operational materials, and prolong product lifecycles presents a strategic advantage. For instance, the International Energy Agency (IEA) reported in 2023 that advancements in recycling technologies for materials like plastics used in energy infrastructure could significantly reduce reliance on virgin resources.

- Resource Optimization: Implementing technologies to reduce the volume of crude oil and natural gas processed per unit of output.

- Waste Stream Valorization: Identifying and implementing methods to recycle or repurpose by-products and waste materials from refining and distribution operations.

- Product Lifecycle Extension: Developing strategies to enhance the durability and reusability of products and packaging.

- Circular Business Models: Investigating service-based models or take-back programs for lubricants or other petroleum-based products.

Esso S.A.F. is under immense pressure to decarbonize, driven by global climate targets like the EU's goal of a 55% emissions reduction by 2030. This necessitates significant investment in technologies such as carbon capture and enhanced energy efficiency. The company must also pivot its product offerings towards lower-carbon fuels and alternative energy sources to remain competitive and avoid reputational damage.

Stricter regulations on emissions, including sulfur dioxide and nitrogen oxides, require continuous upgrades to pollution control technologies, as mandated by directives like the EU's Industrial Emissions Directive. Non-compliance can lead to substantial fines and operational disruptions, making adherence crucial for maintaining licenses and public health standards.

Waste management is another critical environmental factor, with a focus on preventing soil and water contamination. Esso S.A.F. is investing in advanced containment technologies to reduce spill incidents, aiming for a 15% reduction in 2024 compared to 2023. Strict adherence to waste disposal regulations is vital to avoid significant legal liabilities and escalating fines, which saw an average 10% increase in 2024.

The company's operations also impact local biodiversity and land use, prompting the implementation of biodiversity protection strategies and rigorous environmental impact assessments. Esso S.A.F. is developing biodiversity action plans to mitigate ecological effects and promote conservation, aligning with a broader trend towards resource efficiency and circular economy principles.

| Environmental Factor | Impact on Esso S.A.F. | Key Regulations/Targets | Esso S.A.F. Response/Investment (2024 Focus) |

|---|---|---|---|

| Climate Change & Decarbonization | Need to reduce greenhouse gas emissions across value chain. | EU: 55% GHG reduction by 2030. | Investment in CCUS, energy efficiency, development of lower-carbon fuels. |

| Emissions Standards | Compliance with air quality regulations for refining and fuels. | EU Industrial Emissions Directive (IED). | Upgrades to pollution control technologies, meeting evolving fuel quality directives. |

| Waste Management & Contamination | Preventing soil and water contamination, managing hazardous waste. | National and EU waste disposal regulations. | Investment in advanced containment technologies, robust spill response plans. |

| Biodiversity & Land Use | Minimizing disruption to local ecosystems and habitats. | Environmental Impact Assessment requirements. | Development of biodiversity action plans, responsible land management practices. |

| Resource Efficiency & Circularity | Reducing raw material usage and waste generation. | European Green Deal. | Exploring recycling of operational materials, product lifecycle extension strategies. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Esso S.A.F. is grounded in data from official energy regulatory bodies, international economic organizations, and leading market research firms specializing in the oil and gas sector. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Esso's operations.