Esso S.A.F. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Esso S.A.F. Bundle

Esso S.A.F.'s competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the looming threat of new entrants. Understanding the bargaining power of both buyers and suppliers is crucial for navigating this complex market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Esso S.A.F.’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Esso S.A.F., operating as a refiner and distributor, faces significant influence from global crude oil markets. The bargaining power of its suppliers, predominantly major oil-producing countries and organizations like OPEC+, is substantial. These entities can dictate supply levels and, in turn, global oil prices, directly impacting Esso's operational costs.

OPEC+’s strategic decisions regarding production quotas, such as those made throughout 2023 and early 2024, have a direct and immediate effect on crude oil availability and pricing. For instance, reports indicated that OPEC+ maintained significant production cuts in late 2023 and into 2024, contributing to elevated crude prices, which would have increased Esso's input expenses for refining and distribution.

Geopolitical tensions, like sanctions on Russian oil, significantly disrupt global supply chains, tightening markets. This increases supplier power, forcing companies such as Esso S.A.F. to navigate volatile pricing and supply. For instance, in early 2024, ongoing geopolitical instability in the Middle East contributed to Brent crude oil prices fluctuating around $80-$90 per barrel, directly impacting Esso's procurement costs.

As a subsidiary of ExxonMobil, Esso S.A.F. leverages its parent company's immense global scale, potentially mitigating the bargaining power of external crude oil suppliers through integrated supply chains. However, its sourcing is still dictated by ExxonMobil's overarching strategies and global market fluctuations.

ExxonMobil's 2024 financial reports, which showed substantial upstream segment earnings, highlight the scale of operations influencing internal supply decisions. The recent divestiture of specific Esso S.A.F. assets by ExxonMobil signals a potential realignment of internal supply dependencies, which could alter the bargaining power dynamics with remaining or new suppliers.

Refining Capacity and Logistics

Esso S.A.F.'s Port Jerome refinery remains a key asset, ensuring a consistent supply of fuels and lubricants. This internal capacity grants them a measure of control over their refined product output, potentially lessening immediate reliance on external suppliers for core refining operations.

However, strategic decisions like the divestment of assets such as the Fos-sur-Mer refinery and southern France logistics terminals indicate a focused approach to operations. This streamlining might increase dependence on third-party logistics providers for distribution, potentially impacting negotiations with these service suppliers.

- Refinery Operations: The Port Jerome refinery's ongoing operations provide a baseline of internal supply control.

- Divestment Impact: Sale of Fos-sur-Mer and southern logistics terminals could increase reliance on external logistics partners.

- Supplier Relations: Streamlining may alter bargaining power with specialized logistics and service providers.

Transition to Lower-Carbon Products

Esso S.A.F.'s 2025 investment plans focus on reducing energy use and shifting to lower-carbon products. This transition means new suppliers specializing in areas like renewable energy components and advanced biofuels will become important. For instance, the global market for biofuels is projected to reach over $100 billion by 2027, indicating growth in this supplier segment.

The bargaining power of these specialized suppliers could rise as Esso S.A.F. integrates novel technologies. Companies offering critical components for carbon capture, for example, may find themselves in a stronger negotiating position due to the unique nature of their offerings and the increasing demand for decarbonization solutions.

- New Supplier Landscape: Esso S.A.F.'s move towards lower-carbon products necessitates engagement with suppliers of renewable energy components, advanced biofuels, and carbon capture technologies.

- Increased Supplier Power: The specialized nature of these emerging suppliers, coupled with the strategic importance of their technologies for Esso S.A.F.'s decarbonization goals, is likely to enhance their bargaining power.

- Market Context: The growing global market for sustainable solutions, such as the projected expansion of the biofuels market, underscores the increasing significance and potential leverage of suppliers in these sectors.

Esso S.A.F.'s suppliers, primarily global crude oil producers, hold significant power due to market concentration and production control. Organizations like OPEC+ can influence supply and pricing, directly impacting Esso's input costs. Geopolitical events further amplify this power by creating supply disruptions.

While integration with ExxonMobil offers some leverage, Esso S.A.F. remains exposed to global oil market volatility. The company's strategic shifts towards lower-carbon products also introduce new supplier dynamics, with specialized providers of renewable components and biofuels potentially gaining increased bargaining power.

| Supplier Type | Key Influences | Impact on Esso S.A.F. |

|---|---|---|

| Crude Oil Producers (e.g., OPEC+) | Production quotas, geopolitical stability | Directly impacts procurement costs and supply availability |

| Renewable Energy Component Suppliers | Technological innovation, market demand | Potential for increased bargaining power due to specialized offerings for decarbonization |

| Logistics and Service Providers | Market consolidation, operational efficiency | Asset divestments may increase reliance and alter negotiation leverage |

What is included in the product

This analysis dissects the competitive forces impacting Esso S.A.F., examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the energy sector.

Quickly identify and address competitive threats with a pre-built Esso S.A.F. Porter's Five Forces template, simplifying complex market analysis.

Customers Bargaining Power

Retail consumers at Esso service stations in France demonstrate significant price sensitivity. Fuel is a commodity, meaning there's little to distinguish one brand from another, making price the primary decision factor for many. This is particularly true in France, where taxes make up a substantial portion of the fuel price, amplifying the impact of the base cost.

While Esso offers loyalty programs, their effectiveness is often overshadowed by the ease with which consumers can switch to a competitor offering a lower price per liter. In 2024, average gasoline prices in France fluctuated, with unleaded 95 frequently trading around €1.80 to €1.90 per liter, creating a highly competitive environment where even small price differences matter to the average driver.

The increasing popularity of electric vehicles (EVs) and hybrid cars in France directly amplifies customer bargaining power. This shift means consumers have more readily available alternatives to conventional gasoline, reducing their dependence on fossil fuel providers like Esso S.A.F. In early 2025, France observed a significant drop in the market share of petrol-powered vehicles, a trend that continues to empower consumers to demand better pricing and more sustainable options.

Road fuel consumption in France has been on a downward trajectory, with gas consumption also experiencing a decrease in 2024. This shrinking market intensifies the bargaining power of customers, as companies like Esso S.A.F. vie for a smaller base of traditional fuel buyers.

The declining demand forces Esso S.A.F. to place greater emphasis on customer retention and the development of alternative revenue streams, moving beyond its core fuel offerings.

Bargaining Power of Industrial and Business Clients

Large industrial and business clients, who purchase significant volumes of fuels and lubricants, wield considerable bargaining power. Their substantial order sizes allow them to negotiate more favorable pricing and contract terms, often seeking bulk discounts and tailored service agreements. For instance, in 2024, major fleet operators and industrial manufacturers continued to leverage their purchasing volume to secure competitive fuel prices, impacting margins for suppliers like Esso S.A.F.

These clients can also exert pressure by exploring alternative energy sources or suppliers, especially in a market with diverse energy options. The ability to switch providers or invest in alternative technologies gives them leverage to demand better value and service. This can lead to situations where Esso S.A.F. needs to offer competitive incentives to retain these crucial business relationships.

Key factors influencing their bargaining power include:

- Volume of Purchase: Larger orders translate to greater influence.

- Availability of Substitutes: Access to alternative fuel suppliers or energy types strengthens their position.

- Switching Costs: The ease or difficulty for clients to change suppliers impacts their leverage.

- Client's Profitability: Highly profitable clients may have more resources to negotiate aggressively.

Impact of Energy Efficiency Measures

The bargaining power of customers is significantly influenced by increasing energy efficiency. Government initiatives and growing consumer awareness around energy conservation are leading to reduced overall energy demand. For instance, in 2024, many nations continued to offer incentives for electric vehicle adoption and home energy upgrades, directly impacting the volume of gasoline and diesel fuel purchased.

As both businesses and individuals become more adept at using energy efficiently, the demand for traditional petroleum products can decline. This shift allows customers to become more discerning, potentially seeking out suppliers offering better pricing or more sustainable options. Esso S.A.F. must therefore adapt to these evolving consumption patterns to maintain its market position.

- Reduced Demand: Increased efficiency leads to lower consumption of petroleum products.

- Customer Selectivity: Customers gain more leverage in choosing suppliers.

- Government Influence: Policies promoting efficiency directly impact market dynamics.

- Consumer Awareness: A more informed consumer base drives demand for sustainable solutions.

The bargaining power of customers for Esso S.A.F. in France is substantial, driven by the commoditized nature of fuel and heightened price sensitivity among retail consumers. In 2024, with gasoline prices frequently hovering around €1.80-€1.90 per liter, even minor price variations significantly influence purchasing decisions, especially given the high tax component in France. This price elasticity is further amplified by the growing availability of electric vehicles, offering a viable alternative that diminishes customer reliance on traditional fuel providers.

Large commercial clients, due to their significant purchase volumes, also possess considerable leverage. They can negotiate favorable terms and pricing, and their ability to explore alternative energy sources or switch suppliers intensifies their bargaining power. This dynamic is evident in 2024 as fleet operators continued to secure competitive rates, directly impacting Esso's profit margins.

The overall trend of declining road fuel consumption, exacerbated by increasing energy efficiency measures and government incentives for EVs in 2024, further empowers customers. This shrinking market compels companies like Esso to focus on retention and alternative revenue streams, as customers become more selective and can demand better pricing and sustainable options.

| Customer Segment | Key Bargaining Power Factors | Impact on Esso S.A.F. |

|---|---|---|

| Retail Consumers | Price Sensitivity, Availability of Substitutes (EVs), Low Switching Costs | Pressure on fuel prices, reduced loyalty |

| Large Business/Fleet Clients | Purchase Volume, Availability of Alternative Energy Sources, Negotiating Power | Demand for bulk discounts, tailored contracts, potential loss of major accounts |

| Overall Market Trend | Increasing Energy Efficiency, Declining Fuel Consumption | Need for diversification, focus on customer retention, adaptation to new energy solutions |

Preview Before You Purchase

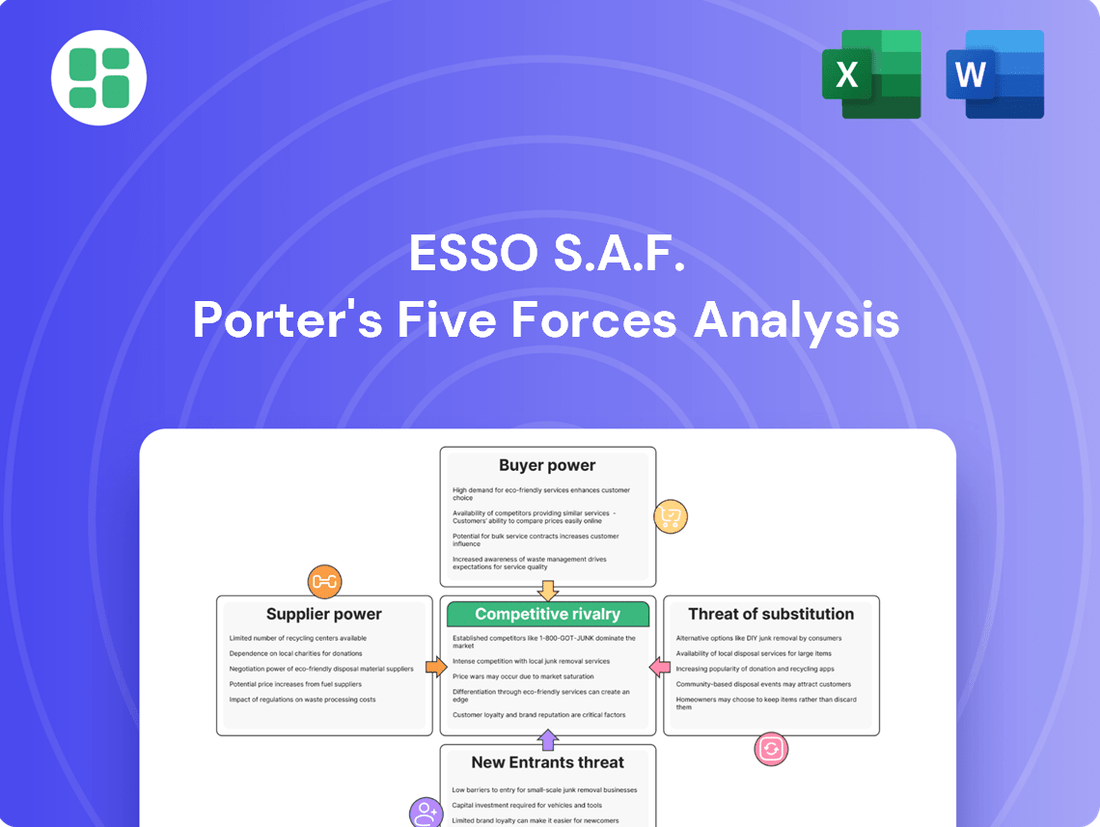

Esso S.A.F. Porter's Five Forces Analysis

This preview showcases the complete Esso S.A.F. Porter's Five Forces Analysis, providing an in-depth examination of the competitive landscape within the industry. What you see here is the exact, professionally formatted document you will receive immediately after purchase, ensuring full transparency and readiness for your strategic planning. This comprehensive analysis is designed to equip you with actionable insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Esso S.A.F.'s operating environment.

Rivalry Among Competitors

The French petroleum market is a mature battleground, with Esso S.A.F. facing off against formidable international rivals like TotalEnergies, Shell, and BP. This intense rivalry, coupled with the presence of numerous independent distributors, means that pricing power is severely constrained, putting constant pressure on profit margins for everyone involved.

Competition in the fuel retail sector, including for Esso S.A.F., largely centers on competitive pricing and the extensive reach and quality of service station networks. Companies also vie for customer loyalty through innovative programs and convenient in-store services.

Esso S.A.F. faces constant pressure to invest in its infrastructure and enhance its customer value proposition to remain competitive. Consumers are particularly attuned to price and the ease of access to fueling facilities.

The company's financial performance in 2024 highlighted these market dynamics, as evidenced by the impact of reduced refining margins on its profitability. This underscores the need for strategic pricing and service excellence.

ExxonMobil, Esso S.A.F.'s parent, has strategically divested substantial assets, including the Fos-sur-Mer refinery and logistics operations, alongside closing chemical units at Gravenchon. This signals a sharpened focus on core, profitable segments within the energy sector. For instance, in 2023, ExxonMobil reported a net profit of $36 billion, underscoring their drive for efficiency and high-margin businesses.

While the Port Jerome refinery remains operational, these divestitures suggest a potential intensification of competitive rivalry in the remaining, more focused market segments. Companies are likely to concentrate their resources and efforts, leading to sharper competition among those players that remain active in these specific areas.

Regulatory and Environmental Pressures

The competitive landscape for Esso S.A.F. is significantly influenced by escalating regulatory and environmental pressures. Stricter emissions standards and the global push for decarbonization are compelling all players, including Esso, to channel substantial investments into cleaner technologies and sustainable operations. This transition creates a dynamic where companies demonstrating agility in adopting lower-carbon solutions gain a competitive edge, while those lagging risk falling behind.

These pressures translate directly into increased rivalry. Companies are not just competing on price or product quality anymore; they are also vying for leadership in environmental stewardship. For instance, the European Union's Fit for 55 package, targeting a 55% reduction in net greenhouse gas emissions by 2030 compared to 1990 levels, mandates significant changes across the energy sector, impacting Esso's operational costs and strategic planning. Failure to adapt can result in penalties and a diminished market position.

- Environmental Regulations: Increasing global and regional regulations, such as the EU's carbon pricing mechanisms, add direct costs and operational constraints for fossil fuel companies.

- Energy Transition: The shift towards renewable energy sources intensifies competition by creating new market entrants and demanding significant capital reallocation for companies like Esso.

- Decarbonization Investments: Companies must invest heavily in carbon capture, utilization, and storage (CCUS), hydrogen, and biofuels to remain competitive, impacting profitability and strategic focus.

- Reputational Risk: Non-compliance or slow adaptation to environmental standards can lead to significant reputational damage, affecting customer loyalty and investor confidence.

Innovation in Retail and Non-Fuel Services

Competitive rivalry in the retail and non-fuel services sector is intensifying as companies like Esso S.A.F. face pressure to innovate. Competitors are actively introducing new offerings, such as electric vehicle (EV) charging stations, enhanced convenience store selections, and diversified food services to draw in customers and capture a larger share of their spending. For instance, by the end of 2023, the number of public EV charging points in the EU had surpassed 500,000, signaling a significant shift in consumer demand that service station operators must address.

Esso S.A.F. must therefore keep pace with these evolving consumer preferences and technological advancements. Failing to adapt its forecourt and retail services could lead to a loss of market appeal. The growing adoption of hybrid and electric vehicles, with EV sales in Europe increasing by approximately 47% in 2023 compared to the previous year, directly influences the types of services consumers expect at fueling locations, pushing for more than just traditional gasoline sales.

- Increased Investment in EV Charging Infrastructure: Competitors are rapidly expanding their EV charging networks, making them more attractive to EV owners.

- Diversification of Retail Offerings: Beyond convenience stores, many are partnering with popular food brands or offering specialized services to enhance customer experience.

- Data-Driven Customer Engagement: Innovations in loyalty programs and personalized offers are being used to retain customers and drive repeat business.

- Focus on Sustainability: Retailers are also highlighting eco-friendly practices and products to appeal to environmentally conscious consumers.

The competitive rivalry for Esso S.A.F. is intense, driven by established global players like TotalEnergies and Shell, alongside a fragmented market of independent distributors. This dynamic severely limits pricing power, forcing companies to focus on operational efficiency and customer value to maintain profitability, as seen in the reduced refining margins impacting the company in 2024.

Companies are increasingly differentiating through service station networks, innovative loyalty programs, and expanded retail offerings, including crucial EV charging infrastructure. The rapid growth in EV adoption, with European EV sales up approximately 47% in 2023, necessitates these adaptations to meet evolving consumer demands and remain competitive in the evolving energy landscape.

| Key Competitor | Market Presence | Key Differentiators |

|---|---|---|

| TotalEnergies | Extensive network in France | Integrated energy solutions, growing EV charging |

| Shell | Global brand recognition, strong retail presence | Convenience store offerings, loyalty programs |

| BP | Significant European operations | Focus on sustainability initiatives, EV charging expansion |

| Independent Distributors | Localized, often price-competitive | Agility, niche market focus |

SSubstitutes Threaten

The most significant substitute threat for Esso S.A.F. stems from the rapid growth of electric vehicles (EVs) in France. Government incentives and expanding charging infrastructure are making EVs increasingly attractive alternatives to internal combustion engine vehicles, directly impacting fuel demand.

In April 2025, battery electric vehicles (BEVs) captured a notable share of the French new car market, demonstrating a clear shift in consumer preference. This trend directly erodes the market for traditional gasoline and diesel fuels, Esso's core products.

The increasing development and adoption of biofuels, including advanced biofuels and renewable gases like biomethane, represent a significant threat of substitution for Esso S.A.F.'s traditional petroleum products. France, for instance, has seen substantial growth in biomethane injection into its gas networks, with a robust and sustained interest from both industrial and transportation sectors. This trend indicates a clear shift towards alternatives that are becoming both economically competitive and environmentally favorable, directly impacting the demand for fossil fuels.

France's strategic push to lead in low-carbon hydrogen production, a key energy carrier, presents a significant long-term threat to traditional petroleum products. This ambition directly targets sectors like industrial processes and heavy-duty transportation, where hydrogen offers a cleaner alternative.

While widespread commercial adoption of hydrogen is still developing, substantial investments are being channeled into its infrastructure and production. For instance, the French government has committed billions of euros to support the hydrogen economy, aiming to decarbonize hard-to-abate sectors.

This growing support and investment landscape make hydrogen an increasingly viable substitute, particularly in applications where direct electrification faces technical or economic hurdles. The momentum suggests a gradual but persistent erosion of demand for fossil fuels in these critical areas.

Improvements in Energy Efficiency and Conservation

Improvements in energy efficiency and conservation present a significant threat of substitutes for Esso S.A.F. Ongoing technological advancements and widespread adoption of conservation practices across industries and by consumers are actively reducing the overall demand for energy. This trend, even in the absence of a direct product alternative, effectively substitutes for volume by lowering consumption, directly impacting Esso's sales potential.

For instance, gas consumption in France experienced a notable decline in 2024, largely attributed to these intensified energy efficiency initiatives. This reduction in demand means that even if no new energy sources emerge, the existing demand for petroleum products is shrinking.

- Reduced Demand: Energy efficiency measures decrease the need for all energy sources, including petroleum.

- Consumer Sobriety: Growing consumer awareness and adoption of conservation habits further curb energy usage.

- Volume Substitute: Lower overall consumption acts as a substitute for sales volume, even without direct product alternatives.

- French Market Impact: In 2024, France saw a significant drop in gas consumption due to these efficiency efforts.

Expansion of Public Transport and Micromobility

The increasing investment in and adoption of public transportation and micromobility options like cycling and electric scooters present a significant threat of substitutes for traditional fuel consumption. These alternatives directly reduce the reliance on private vehicles, impacting demand for Esso's core products. For instance, in 2024, many major cities saw continued expansion of their public transit networks, with some reporting ridership increases of over 10% compared to pre-pandemic levels, particularly in urban cores.

This shift in consumer behavior, driven by environmental concerns and urban congestion, directly challenges the market for gasoline and diesel fuel. The growth of shared mobility services and dedicated cycling lanes, especially in densely populated areas, further entrenches these substitutes. By 2024, urban areas globally were investing billions in sustainable transport infrastructure, aiming to make these alternatives more convenient and accessible than private car ownership.

- Urban Mobility Trends: Cities are prioritizing public transport and micromobility, reducing reliance on personal vehicles.

- Infrastructure Investment: Significant capital is being allocated to expand and improve public transit and cycling infrastructure globally.

- Behavioral Shifts: Growing environmental awareness and a desire to avoid congestion are encouraging a move away from fossil fuel-dependent transportation.

- Market Impact: These trends directly substitute demand for fuels, posing a threat to companies like Esso.

The rise of electric vehicles (EVs) and advancements in biofuels present a significant substitution threat to Esso S.A.F.'s core gasoline and diesel markets. France's commitment to decarbonization, evidenced by substantial investments in hydrogen infrastructure and a growing biomethane sector, further accelerates this trend.

Energy efficiency improvements and increased adoption of public transportation and micromobility are also actively reducing overall fuel demand. In 2024, France experienced a notable decrease in gas consumption due to these efficiency efforts, directly impacting sales volumes for petroleum products.

| Substitute Category | Key Developments | Impact on Esso S.A.F. |

|---|---|---|

| Electric Vehicles (EVs) | Increasing consumer adoption, government incentives, expanding charging infrastructure. | Directly erodes demand for gasoline and diesel. |

| Biofuels | Growth in biomethane injection and advanced biofuels. | Offers a renewable alternative to fossil fuels. |

| Hydrogen | Significant government investment in production and infrastructure. | Targets industrial and heavy-duty transport, a potential long-term threat. |

| Energy Efficiency & Conservation | Technological advancements, consumer awareness. | Reduces overall energy consumption, substituting for sales volume. |

| Public Transport & Micromobility | Expansion of networks, increased ridership, urban infrastructure investment. | Decreases reliance on private, fuel-dependent vehicles. |

Entrants Threaten

The petroleum industry, especially the refining and distribution segments where Esso S.A.F. operates, demands substantial capital outlays. For instance, building a new refinery can cost billions of dollars, a sum prohibitive for most newcomers.

Establishing extensive distribution networks, including storage terminals and a widespread service station footprint, further escalates these entry costs. These infrastructure requirements act as a significant deterrent, limiting the pool of potential competitors.

In 2024, the average cost to build a new, state-of-the-art refinery was estimated to be between $5 billion and $10 billion, a clear indication of the high capital barrier.

The French and European energy markets present formidable barriers to entry due to exceptionally stringent environmental regulations and safety standards. These complex rules, constantly updated to support the energy transition, demand substantial investment and expertise, making it difficult for newcomers to comply and operate efficiently.

Navigating the evolving landscape of climate policies and emissions targets requires significant upfront capital and specialized knowledge, effectively deterring potential competitors. For instance, the European Union's Fit for 55 package, aiming for a 55% reduction in greenhouse gas emissions by 2030, imposes rigorous compliance costs on all energy producers.

Furthermore, France's foreign investment screening mechanisms add another layer of complexity, requiring governmental approval for certain investments in strategic sectors like energy. This process can be lengthy and uncertain, acting as a significant deterrent for new entrants, particularly those from outside the European Union.

Established players like Esso S.A.F. leverage decades of investment in critical infrastructure, including extensive pipeline networks, strategically located terminals, and highly efficient, integrated supply chains. The sheer scale and complexity of replicating this robust operational backbone present a formidable financial and logistical hurdle for any potential new entrant. For instance, the cost to build a comparable national distribution network for refined petroleum products can easily run into billions of dollars, making it a significant barrier.

Brand Recognition and Customer Loyalty

Major incumbent brands, including Esso, have cultivated strong brand recognition and deeply ingrained customer loyalty over decades in the French fuel market. This established presence presents a significant hurdle for any new entrant aiming to penetrate the market.

Newcomers would need to invest heavily in marketing and develop compelling differentiation strategies to even begin challenging these established brands and securing a meaningful share of the customer base. For instance, in 2023, the top three fuel retailers in France, excluding Esso, collectively held over 60% of the market share, underscoring the dominance of incumbents.

- Brand Loyalty: While the overall loyalty in the fuel sector is seeing some erosion due to increasing price sensitivity and the commoditization of fuel, it still remains a critical barrier.

- Marketing Investment: A new entrant would likely need to allocate a substantial portion of its initial capital, potentially tens of millions of euros, to build brand awareness and foster initial customer adoption in France.

- Market Share Challenge: Overcoming the entrenched market positions of brands like Esso, which have long-standing relationships with consumers, requires more than just competitive pricing; it demands a superior value proposition.

Market Saturation and Declining Demand for Fossil Fuels

The French petroleum market is mature, and demand for traditional fossil fuels is projected to decline due to the ongoing energy transition and shift towards alternatives. This shrinking market makes it less attractive for new, large-scale entrants to invest heavily in traditional petroleum infrastructure, as future growth opportunities lie primarily in renewable and low-carbon energy sectors.

For instance, in 2023, France's total energy consumption from petroleum products saw a slight decrease compared to previous years, reflecting the broader European trend. This makes the capital-intensive nature of establishing new refineries or expanding existing ones a significant deterrent for potential new entrants.

The threat of new entrants into the traditional petroleum refining and distribution segment for Esso S.A.F. in France is therefore relatively low. The substantial capital investment required for new facilities, coupled with a declining demand outlook and increasing regulatory pressures favoring cleaner energy sources, creates a formidable barrier to entry.

- Mature Market: The French petroleum market is well-established with limited organic growth potential for traditional fuels.

- Declining Demand: Projections indicate a continued downward trend in fossil fuel consumption, driven by the energy transition.

- High Capital Investment: Building new petroleum infrastructure requires immense financial resources, acting as a significant barrier.

- Regulatory Environment: Increasing environmental regulations and incentives for alternative energy sources further discourage new entrants in the fossil fuel sector.

The threat of new entrants for Esso S.A.F. in the French petroleum market is considerably low. The immense capital required to establish operations, estimated at billions for refineries and extensive distribution networks, acts as a significant deterrent. For instance, building a new refinery in 2024 could cost between $5 billion and $10 billion.

Stringent French and EU environmental regulations, such as the Fit for 55 package, demand substantial investment and expertise, further complicating market entry. Navigating these complex rules and the French government's foreign investment screening adds layers of difficulty and uncertainty for potential newcomers.

Established infrastructure and strong brand loyalty, cultivated over decades by incumbents like Esso, present formidable challenges. New entrants would need to overcome the market dominance of established players, who collectively held over 60% of the market share among the top three (excluding Esso) in 2023, requiring massive marketing investment and a superior value proposition.

The mature nature of the French petroleum market, with declining fossil fuel demand due to the energy transition, makes it less attractive for large-scale new investments in traditional infrastructure. This shrinking market, coupled with increasing regulatory pressure for cleaner alternatives, significantly reduces the appeal for new entrants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Esso S.A.F. is built upon a foundation of robust data, including Esso's annual reports, industry-specific market research from firms like Wood Mackenzie, and relevant regulatory filings from national and international bodies.