Essex Property Trust PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Essex Property Trust Bundle

Uncover the critical external factors shaping Essex Property Trust's trajectory with our comprehensive PESTLE analysis. From shifting political landscapes to evolving economic conditions and technological advancements, understand the forces that will dictate future success. Download the full analysis now to gain a strategic advantage.

Political factors

Government policies, especially at the state and local levels in California and Washington, significantly shape Essex Property Trust's business. These include urban planning, zoning regulations, and the permitting process for new multifamily developments. For instance, California's housing element law, updated to encourage more housing construction, could positively influence development pipelines.

Changes in these policies can directly impact the availability of new housing supply and, consequently, Essex's growth prospects. In 2024, many California cities are working to meet state-mandated housing production goals, which might streamline development approvals for companies like Essex.

The increasing prevalence of rent control legislation, particularly in key operating states like California and Washington, presents a significant political risk for Essex Property Trust. California's Tenant Protection Act of 2019 (AB 1482), for instance, limits annual rent increases to 5% plus local inflation, or a total of 10%, whichever is lower. This directly impacts Essex's ability to adjust rental income in response to market demand.

Washington State's recent move to implement statewide rent stabilization, capping annual rent hikes at 7% plus inflation or 10% annually, further exacerbates this challenge. These regulations can constrain Essex's revenue growth potential, especially in densely populated, high-demand urban areas where the company has substantial property holdings.

Political pressure to address housing affordability on the West Coast is intensifying, potentially leading to new regulations or incentives for affordable housing construction. For instance, California's 2024 legislative session saw proposals aimed at streamlining approvals for affordable projects and increasing funding.

While Essex Property Trust primarily develops market-rate housing, these political shifts can impact land acquisition costs and the availability of suitable development sites. The competitive environment might also change if more developers pivot towards or are incentivized for affordable housing.

This could necessitate strategic adjustments for Essex, potentially including exploring partnerships or dedicating a portion of future developments to meet these evolving affordability mandates. The company's 2024 guidance noted a continued focus on high-growth markets where such pressures are most pronounced.

Taxation Policies

Changes in property taxes, corporate taxes, and other real estate-specific levies in key markets like California and Washington directly influence Essex Property Trust's profitability. For instance, a favorable property tax environment, which contributed to Essex's Q2 2025 outperformance in Washington, can boost net operating income by reducing operational costs.

Conversely, an escalation in these taxes would likely increase operating expenses, potentially diminishing investor returns. Essex's financial performance is therefore sensitive to shifts in tax legislation across its operating regions.

- Property Tax Impact: Favorable property tax rates in Washington contributed to Essex's Q2 2025 outperformance.

- Corporate Tax Sensitivity: Changes in corporate tax rates can directly affect Essex's net income.

- Operational Expense Increase: Higher property taxes would lead to increased operating expenses, impacting profitability.

Political Stability and Local Governance

Essex Property Trust's operations are significantly influenced by the political stability and effectiveness of local governance in its key markets, primarily California, Washington, and Oregon. Consistent and predictable regulatory environments are vital for the real estate sector. For instance, in 2024, California continued to grapple with housing affordability and regulatory reform, impacting development timelines and costs for companies like Essex.

A stable political landscape with efficient permitting processes fosters a more favorable investment climate. Conversely, political instability or abrupt policy shifts can introduce considerable uncertainty. For example, changes in local rent control ordinances or zoning laws, which can occur with shifts in local leadership, directly affect Essex's operational flexibility and profitability. The 2024 election cycles across these states could bring about policy realignments that influence the multifamily housing sector.

- Regulatory Consistency: Predictable and stable regulations in California, Washington, and Oregon are crucial for Essex's development and operational planning.

- Permitting Efficiency: Streamlined and efficient local government permitting processes directly impact the speed and cost of new construction and renovations.

- Policy Shifts: Potential changes in local rent control, zoning, and taxation policies due to political shifts in 2024 could affect Essex's revenue and investment strategies.

- Local Governance Impact: The effectiveness of local governance in managing urban development and housing supply directly influences the market conditions for Essex's properties.

Government policies at state and local levels in California and Washington significantly influence Essex Property Trust, particularly concerning urban planning, zoning, and permitting for new multifamily developments. California's updated housing element law, designed to boost housing construction, is expected to positively impact development pipelines, with many cities aiming to meet state-mandated production goals in 2024, potentially speeding up approvals.

Rent control legislation, such as California's AB 1482 limiting rent increases, and Washington's statewide rent stabilization capping hikes at 7% plus inflation, directly constrains Essex's revenue growth potential in high-demand urban areas.

Political pressure for housing affordability may lead to new regulations or incentives for affordable housing construction, potentially affecting land acquisition costs and site availability for Essex, which might necessitate strategic adjustments like exploring partnerships for affordable projects. The company's 2024 guidance acknowledges this focus on high-growth markets where such pressures are most acute.

Changes in property and corporate taxes in key markets like California and Washington directly impact Essex's profitability; for instance, favorable property tax rates in Washington contributed to Essex's Q2 2025 outperformance, while higher taxes would increase operating expenses and diminish returns.

What is included in the product

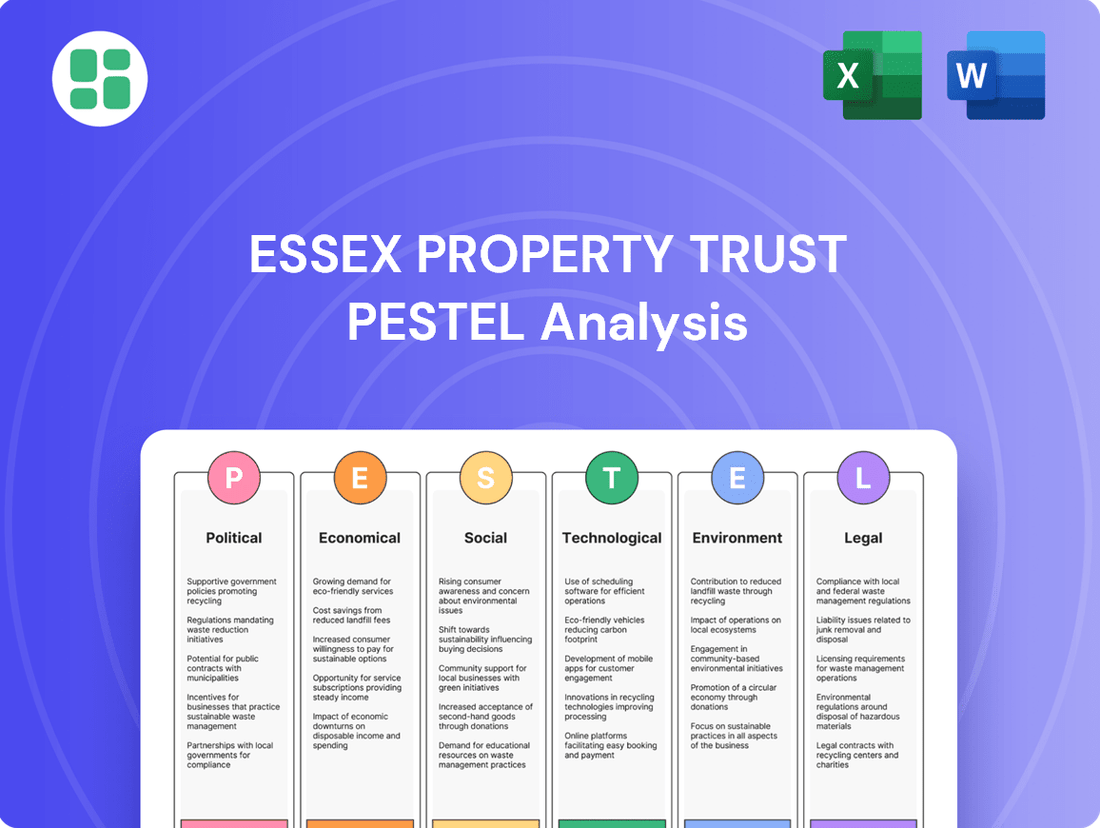

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Essex Property Trust, providing a comprehensive view of its operating landscape.

It offers actionable insights for strategic decision-making by highlighting key external influences and their implications for the company's future growth and stability.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, ensuring stakeholders understand the external factors impacting Essex Property Trust without getting bogged down in excessive detail.

Helps support discussions on external risk and market positioning during planning sessions by highlighting the key Political, Economic, Social, Technological, Legal, and Environmental factors relevant to Essex Property Trust's operations.

Economic factors

Elevated interest rates significantly increase the cost of capital for real estate investment trusts such as Essex Property Trust, directly impacting their financing expenses for both new acquisitions and ongoing development projects. This makes borrowing more expensive.

While the Federal Reserve has signaled potential interest rate cuts for 2025, the persistence of higher rates throughout 2024 and into early 2025 is likely to continue constraining transaction volumes within the real estate market and exerting downward pressure on property valuations. For instance, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through the first half of 2024.

These interest rate dynamics directly influence Essex Property Trust's capacity to implement its strategic growth initiatives, including effective debt management and the pursuit of new investment opportunities. Higher borrowing costs can reduce the profitability of new developments and acquisitions, potentially slowing expansion.

Strong economic growth and low unemployment rates in Essex Property Trust's core West Coast markets are significant tailwinds. For instance, California's unemployment rate hovered around 4.7% in early 2024, and Washington's was even lower at approximately 3.8%, indicating robust labor markets that fuel demand for housing.

These favorable employment conditions, particularly within thriving sectors like technology in cities such as San Francisco and Seattle, directly translate into higher rental income potential for Essex. A consistent inflow of well-compensated renters supports occupancy and allows for competitive rental pricing, boosting the trust's revenue streams.

Conversely, any economic slowdown leading to job losses in these key regions could negatively impact Essex. A weakening job market would likely dampen demand for multifamily units and potentially lead to increased vacancy rates, putting pressure on rental income and profitability.

High home prices on the West Coast, a key market for Essex Property Trust, continue to make homeownership a significant challenge. In May 2024, the median home price in California stood at approximately $830,000, making it difficult for many to enter the market. This persistent affordability gap directly fuels sustained demand for rental housing, a core business for Essex.

This dynamic translates into strong occupancy rates and supports rent growth for Essex. For instance, Essex reported an average occupancy rate of 97.2% in Q1 2024 across its West Coast portfolio. As long as elevated home prices and challenging mortgage rates persist, renting remains a more accessible and attractive option, ensuring stable revenue for the trust.

Inflation and Cost of Operations

Inflationary pressures in 2024 and 2025 are directly impacting Essex Property Trust's (ESS) operating expenses. We've seen a notable uptick in costs associated with property maintenance, utility services, and property taxes, all of which are sensitive to broader economic inflation. While ESS has demonstrated a capacity to manage these rising costs effectively, sustained high inflation could eventually challenge profit margins if not fully offset by revenue growth.

Despite these operational cost increases, inflation also presents an opportunity for ESS to adjust rental income upwards. However, this potential benefit is often tempered by existing rent control and stabilization regulations in key markets like California and Washington. These legislative constraints can limit the extent to which ESS can pass on increased operating costs to tenants through rent hikes.

- Increased Operating Expenses: ESS faces higher costs for maintenance, utilities, and property taxes due to inflation.

- Profit Margin Pressure: Significant increases in operational costs could negatively impact ESS's profit margins if not managed carefully.

- Rent Increase Potential: Inflation allows for potential rent increases, which can help offset rising expenses.

- Regulatory Constraints: Rent control and stabilization laws in key markets limit the ability to fully leverage inflation for rent increases.

Investment Market Dynamics and Capitalization Rates

Changes in capitalization rates are a key indicator of investor sentiment and expected returns within the real estate market. In 2024, elevated interest rates directly contributed to an increase in cap rates, which in turn made the valuation of properties more complex and challenging.

Looking ahead to 2025, there's an expectation of interest rate cuts. These potential reductions in borrowing costs could lead to a decrease in cap rates, making real estate acquisitions more appealing and providing a supportive environment for property valuations for Real Estate Investment Trusts (REITs) like Essex Property Trust.

- 2024 Cap Rate Trend: Elevated interest rates pushed cap rates higher, impacting property valuations.

- 2025 Outlook: Anticipated interest rate cuts are expected to lower borrowing costs.

- Impact on Acquisitions: Lower cap rates could make new property acquisitions more attractive for REITs.

- Valuation Support: A decrease in cap rates can positively influence the overall valuation of real estate assets held by REITs.

Economic factors significantly shape Essex Property Trust's performance. Elevated interest rates in 2024, with the Federal Reserve holding rates between 5.25%-5.50%, increased borrowing costs and constrained market activity. However, anticipated 2025 rate cuts could improve acquisition appeal and valuations.

Strong West Coast employment, with California's unemployment around 4.7% in early 2024, fuels demand for rental housing, benefiting Essex's occupancy and rental income. Persistent high home prices, like California's median of $830,000 in May 2024, further bolster rental demand.

Inflation in 2024 impacted Essex's operating expenses for maintenance and utilities. While rent increases are possible, rent control regulations in key markets like California and Washington limit the ability to fully pass these costs to tenants.

| Economic Factor | 2024 Impact | 2025 Outlook | Essex Specific Data |

| Interest Rates | Increased borrowing costs, constrained transactions. Fed rate 5.25%-5.50% (H1 2024). | Potential rate cuts may lower borrowing costs, improve valuations. | Higher financing expenses, impact on new developments. |

| Employment | Strong labor markets on West Coast support housing demand. CA unemployment ~4.7% (early 2024). | Continued strong employment expected to sustain rental demand. | High occupancy rates (97.2% in Q1 2024), strong rent growth potential. |

| Home Affordability | High home prices make renting more attractive. CA median home price ~$830,000 (May 2024). | Persistent affordability challenges will likely continue to drive rental demand. | Supports stable revenue and occupancy for multifamily units. |

| Inflation | Increased operating expenses (maintenance, utilities). | Potential for rent increases, but limited by rent control. | Pressure on profit margins if cost increases outpace rent adjustments. |

Full Version Awaits

Essex Property Trust PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Essex Property Trust covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping Essex Property Trust's strategy and operations.

Sociological factors

The West Coast, particularly California and Washington, continues to experience robust population growth and urbanization. Millennials and Gen Z, now significant demographic forces, are increasingly opting for rental housing. This preference stems from a combination of lifestyle choices, affordability challenges in homeownership, and a desire for proximity to job hubs.

Essex Property Trust's strategic positioning in these key urban and suburban markets is a direct response to these demographic shifts. For instance, the median age in California was 38.9 years in 2023, with a substantial portion falling within the prime renting years of Millennials and Gen Z. This ongoing influx of younger renters fuels consistent demand for the multifamily properties Essex specializes in.

Modern renters, particularly millennials and Gen Z, are prioritizing lifestyle and convenience. Data from 2024 indicates a growing demand for smart home technology, on-site fitness centers, and co-working spaces. Essex Property Trust needs to ensure its portfolio aligns with these preferences to remain competitive.

Housing preferences are shifting towards flexible living arrangements and community-focused environments. In 2024, surveys showed that over 60% of renters aged 18-34 expressed interest in properties offering a strong sense of community and shared amenities. Essex Property Trust's ability to integrate these features directly impacts tenant attraction and retention.

The ongoing shift towards hybrid and remote work models significantly impacts housing preferences, potentially redistributing demand away from dense urban centers towards more suburban or exurban locations. This trend necessitates careful monitoring by Essex Property Trust regarding tenant demand for specific unit configurations and amenities, such as dedicated home office spaces or enhanced communal work areas.

As of early 2025, a significant portion of the workforce continues to operate under flexible arrangements. For instance, surveys from late 2024 indicated that over 60% of companies offer some form of hybrid work, with many employees preferring at least two days a week working remotely. This sustained preference could lead to increased demand for larger living spaces or units with flexible layouts that can accommodate home offices, potentially affecting rental rates and occupancy in Essex's West Coast portfolio.

Community Engagement and Social Impact

The growing societal focus on corporate social responsibility means that both tenants and investors are increasingly scrutinizing a company's community involvement and its broader social impact. Essex Property Trust's commitment to making a positive difference in the communities where it operates, extending beyond its core housing services, can significantly bolster its brand image and foster greater tenant loyalty.

Essex Property Trust actively engages in community initiatives. For example, in 2023, the company reported investing in affordable housing solutions and forging local partnerships aimed at community development. These efforts are crucial for building trust and demonstrating a commitment to social well-being, which resonates with a growing segment of the market.

- Community Investment: Essex Property Trust's participation in affordable housing projects directly addresses a key societal concern, potentially attracting tenants and investors who prioritize social impact.

- Local Partnerships: Collaborating with local organizations strengthens community ties and enhances the company's reputation as a responsible corporate citizen.

- Tenant Loyalty: Demonstrating a commitment to social good can foster a deeper connection with residents, leading to improved retention rates.

- Brand Reputation: Positive community engagement translates into a stronger brand image, differentiating Essex Property Trust in a competitive market.

Affordability Crisis and Social Equity

The persistent housing affordability crisis on the West Coast, particularly in markets where Essex Property Trust operates, fuels significant social challenges. This situation heightens public scrutiny and intensifies demands for more equitable housing solutions. For instance, in California, median home prices continued to climb through 2024, with the California Association of Realtors reporting a median sale price of $830,000 for existing single-family homes in Q1 2024, a 7.5% increase year-over-year.

While Essex primarily manages market-rate properties, the broader societal context of housing inequality directly impacts public perception and potential political responses. This can translate into increased pressure for rent control measures or inclusionary zoning policies, affecting operating environments. The social license to operate for companies like Essex is therefore intertwined with their perceived contribution to addressing these widespread concerns, even if indirectly.

To navigate this, Essex might consider strategies that acknowledge the social equity dimension of housing.

- Rising Rents: Average rents in major West Coast cities saw increases in early 2024, with San Francisco experiencing a 5% rise in studio apartment rents compared to the previous year, according to rental market data.

- Affordability Gap: The gap between average incomes and housing costs remains a critical issue, with many households spending over 30% of their income on rent.

- Policy Scrutiny: Local governments are increasingly exploring and implementing policies aimed at mitigating the affordability crisis, which could impact property management.

- Community Relations: Proactive engagement with community stakeholders and demonstrating a commitment to responsible development practices can bolster a company's social standing.

Societal trends like the increasing preference for rental housing among younger demographics, particularly Millennials and Gen Z, continue to drive demand for multifamily properties. These groups, now comprising a significant portion of the renter pool, value flexibility, community, and proximity to urban centers. The ongoing housing affordability crisis on the West Coast, with median home prices in California reaching $830,000 in Q1 2024, further solidifies renting as a primary option for many.

Essex Property Trust's success is closely tied to its ability to cater to these evolving tenant needs and societal expectations. For example, the company's focus on amenity-rich properties and community engagement directly addresses the desire for lifestyle convenience and social connection, which are increasingly important to renters. Furthermore, a growing emphasis on corporate social responsibility means that companies like Essex must demonstrate positive community impact to maintain a strong brand reputation and tenant loyalty.

| Sociological Factor | Description | Impact on Essex Property Trust | Relevant Data/Trend (2023-2025) |

|---|---|---|---|

| Demographic Shifts | Growth of Millennial and Gen Z renters | Increased demand for multifamily units, focus on amenities | Median age in California: 38.9 years (2023); >60% of 18-34 renters seek community |

| Lifestyle Preferences | Demand for flexibility, community, and convenience | Need for modern amenities, co-working spaces, pet-friendly policies | Surveys in 2024 show growing demand for smart home tech and fitness centers |

| Housing Affordability | Persistent crisis on the West Coast | Reinforces rental demand, but also increases policy scrutiny | California median home price: $830,000 (Q1 2024); Average rents up 5% in SF (2024) |

| Corporate Social Responsibility | Tenant and investor focus on social impact | Importance of community initiatives and responsible development | Essex reported investing in affordable housing and local partnerships in 2023 |

Technological factors

The multifamily sector is seeing a significant shift with the integration of proptech, enhancing everything from leasing to maintenance. Essex Property Trust can capitalize on AI-driven leasing tools and digital platforms to streamline tenant interactions and streamline property upkeep, boosting efficiency.

Smart building technologies are no longer a novelty but a necessity. The adoption of IoT sensors for optimizing energy consumption and enabling predictive maintenance is crucial for operational savings and improved resident experiences. By 2024, the global proptech market was projected to reach $75 billion, highlighting the rapid growth and investment in these areas.

Advanced data analytics and artificial intelligence (AI) are becoming indispensable for optimizing operations at Essex Property Trust. By leveraging AI, the company can implement dynamic rent pricing strategies, reacting swiftly to market fluctuations and demand. This capability is vital in the current economic climate, where rental markets can shift rapidly.

Furthermore, AI excels at analyzing vast datasets to identify emerging market trends and predict renter behavior, enabling more proactive leasing and retention strategies. For instance, AI-powered tools can help automate lease abstraction and streamline financial management, freeing up valuable human resources for more strategic tasks. Essex Property Trust's adoption of these technologies directly supports its goal of maximizing revenue and operational efficiency.

Technological advancements are reshaping how Essex Property Trust engages with its residents, with digital marketing and tenant experience at the forefront. Virtual tours, for instance, saw a significant surge in adoption during 2023, with many prospective renters preferring this method to initially view properties, impacting lead generation strategies.

Essex is increasingly leveraging online platforms for leasing and resident services, streamlining applications and communication. This digital-first approach is crucial, as a 2024 survey indicated that 70% of renters consider a property's online presence and ease of digital interaction as key decision factors.

The integration of smart home technology and robust digital payment and maintenance request systems are becoming standard expectations. Essex's investment in these areas directly impacts its ability to attract and retain tenants in a competitive market, with properties offering enhanced digital amenities often commanding higher occupancy rates.

Construction Technology and Efficiency

Technological advancements are reshaping the multifamily construction landscape. Innovations like modular and prefabricated building techniques, along with 3D printing, promise to boost efficiency, cut costs, and speed up project completion. For instance, modular construction can reduce on-site labor by up to 50% and shorten build times by 20-40% compared to traditional methods, as reported by industry analyses in early 2024.

While Essex Property Trust's strategy leans heavily on acquisition and redevelopment, these emerging technologies will inevitably impact the broader market. The increasing adoption of these methods by other developers could influence the overall cost of new multifamily supply in key markets like California and Washington, potentially affecting future development decisions and competitive pressures.

Consider the implications for Essex:

- Efficiency Gains: Modular and off-site construction methods are projected to contribute to significant cost savings in labor and materials, potentially reaching 10-20% for new builds in 2024-2025.

- Accelerated Timelines: Faster development cycles enabled by prefabrication can lead to quicker revenue generation for new properties entering the market.

- Market Cost Structure: Widespread adoption of these technologies could lower the barrier to entry for new supply, influencing rental rates and property valuations.

Cybersecurity and Data Privacy

Essex Property Trust's increasing reliance on digital platforms for operations and tenant interaction necessitates strong cybersecurity. The company must safeguard sensitive tenant data, a critical asset in today's digital landscape. Failure to do so can lead to significant financial and reputational damage.

Adherence to evolving data privacy regulations, such as California's Consumer Privacy Act (CCPA), is also a key technological consideration. Compliance ensures legal standing and fosters tenant trust. For instance, CCPA grants California consumers rights regarding their personal information, requiring businesses like Essex to be transparent about data collection and usage.

- Data Security Investment: In 2024, cybersecurity spending globally is projected to reach $221.7 billion, reflecting the growing importance of protecting digital assets.

- Regulatory Compliance Costs: Companies face increasing costs associated with complying with data privacy laws, which can impact operational budgets.

- Smart Building Vulnerabilities: The integration of smart building technologies, while offering convenience, also introduces new potential cybersecurity risks that require constant vigilance and updates.

Technological factors are significantly influencing Essex Property Trust's operational efficiency and tenant engagement. The company is increasingly adopting proptech solutions, including AI-driven leasing and smart building technologies, to streamline operations and enhance resident experiences. For instance, virtual tours saw a substantial increase in use during 2023, with many prospective renters preferring this digital method for initial property viewings.

The rapid growth of the proptech market, projected to reach $75 billion globally by 2024, underscores the importance of these digital integrations. Essex's focus on online platforms for leasing and resident services is critical, as a 2024 survey indicated that 70% of renters consider a property's digital presence a key decision factor.

Furthermore, advancements in construction technology, such as modular building, are impacting the broader multifamily market. While Essex primarily focuses on acquisition and redevelopment, these efficiency-boosting methods, which can reduce on-site labor by up to 50% and shorten build times by 20-40% as reported in early 2024, will influence overall supply costs and competitive dynamics.

Cybersecurity and data privacy are paramount technological considerations for Essex, given its reliance on digital platforms. The company must protect sensitive tenant data and comply with regulations like CCPA, especially as global cybersecurity spending was projected to reach $221.7 billion in 2024. Smart building integrations also introduce new vulnerabilities requiring constant vigilance.

Legal factors

Essex Property Trust operates under a patchwork of landlord-tenant laws across California and Washington, dictating everything from lease terms to security deposit handling. These regulations significantly influence operational flexibility and tenant relations.

California's Assembly Bill 1482, for instance, has strengthened tenant protections by mandating 'just cause' for evictions. This means Essex must have a legally recognized reason to end a tenancy, a departure from more at-will arrangements and impacting their ability to quickly reposition properties or address non-paying tenants.

In 2024, California continued to see robust tenant advocacy, with ongoing discussions around rent control and tenant rights potentially leading to further legislative changes. This evolving legal landscape requires Essex to maintain vigilant compliance and adapt its property management strategies accordingly to avoid penalties and legal disputes.

Zoning and land use regulations in key West Coast markets, where Essex Property Trust primarily operates, significantly impact its development pipeline. For instance, stringent zoning in California cities can limit building height and density, directly affecting the potential return on investment for new multifamily projects. In 2024, many coastal California municipalities continued to grapple with housing shortages, leading to ongoing discussions and potential revisions of existing land use policies, which could either ease or tighten development restrictions.

Essex Property Trust must adhere to a complex web of building codes and safety standards, a legal obligation that directly impacts development and maintenance. These regulations, covering everything from seismic resilience to fire suppression systems and accessibility features, are not static. For instance, California's stringent Title 24 Building Energy Efficiency Standards, continually updated, necessitate significant investment in energy-efficient materials and technologies during new construction and major renovations. Failure to comply can result in substantial fines and project delays.

The financial implications are considerable. In 2024, the average cost to comply with updated building codes, particularly those related to sustainability and energy efficiency, can add an estimated 5-10% to construction budgets. For a large-scale project, this translates into millions of dollars in additional upfront investment. Essex’s ability to anticipate and integrate these evolving requirements efficiently is crucial for managing project costs and timelines effectively, ensuring their properties remain compliant and attractive to a broad resident base.

Environmental Regulations and Disclosure Requirements

Environmental regulations, including those for green building, energy efficiency, and carbon emissions, directly influence Essex Property Trust's operations and development strategies. These legal frameworks necessitate adherence to standards that can impact construction costs and property management practices.

Essex Property Trust's proactive approach is evident in its 2024 Sustainability and Impact Report. The company has established new emissions reduction targets that have been validated by the Science Based Targets initiative (SBTi), demonstrating a commitment to aligning with evolving environmental legal requirements and contributing to broader climate goals.

- Green Building Standards: Compliance with LEED or similar certifications often required for new developments.

- Energy Efficiency Mandates: Regulations dictating minimum energy performance for buildings.

- Carbon Emission Targets: Increasing pressure and potential legal frameworks for reporting and reducing Scope 1, 2, and 3 emissions.

- Water Conservation Laws: Requirements for water-efficient fixtures and landscaping, particularly in drought-prone regions.

Fair Housing Laws and Anti-Discrimination

Essex Property Trust operates under a strict legal framework, requiring unwavering adherence to federal, state, and local fair housing laws and anti-discrimination statutes. These regulations, such as the Fair Housing Act of 1968, prohibit discrimination based on race, color, religion, sex, familial status, national origin, and disability in all housing-related transactions. Failure to comply can result in significant penalties, including substantial fines and damage to the company's reputation.

In 2024, the U.S. Department of Housing and Urban Development (HUD) continues to enforce these protections vigorously. For instance, in early 2024, HUD announced a settlement with a property management company for discriminatory advertising practices, highlighting the ongoing scrutiny faced by the industry. Essex Property Trust's commitment to fair housing is therefore not just a legal obligation but a critical component of its operational integrity and long-term sustainability.

- Federal Mandates: Strict compliance with the Fair Housing Act and its amendments is paramount.

- State and Local Variations: Adherence to potentially broader protections offered by state and local ordinances is crucial.

- Risk Mitigation: Non-compliance can lead to costly litigation, regulatory fines, and severe reputational harm.

- Operational Integrity: Robust training and internal policies are necessary to ensure consistent adherence across all properties.

Essex Property Trust navigates a complex legal environment, heavily influenced by landlord-tenant laws, zoning, and building codes across California and Washington. These regulations, including California's AB 1482 requiring 'just cause' for evictions, directly impact operational flexibility and development strategies. Ongoing legislative discussions in 2024 around rent control and tenant rights in California necessitate continuous adaptation to avoid penalties and legal disputes.

The company must also comply with stringent environmental regulations and evolving green building standards, such as California's Title 24 energy efficiency requirements. These mandates can add an estimated 5-10% to construction budgets in 2024, requiring significant upfront investment for compliance and impacting project timelines.

Fair housing laws, enforced by HUD, are critical, with violations leading to substantial fines and reputational damage. In early 2024, HUD settlements underscored the industry's ongoing scrutiny, making robust training and internal policies essential for Essex's operational integrity.

Environmental factors

Essex Property Trust's West Coast focus exposes it to significant climate change risks. Wildfires, like those experienced in California in recent years, have led to property damage and increased insurance premiums for many real estate owners.

Drought conditions, prevalent across much of the West, can impact landscaping costs and water availability, affecting property desirability and operational expenses. For instance, California has faced severe drought periods, impacting water resource management across the state.

Furthermore, potential sea-level rise poses a long-term threat to coastal properties, potentially leading to increased flood risk, necessitating costly infrastructure upgrades or even relocation in some areas.

The real estate sector is experiencing a significant shift towards environmental sustainability, influenced by investor expectations, stricter regulations, and tenant desires for eco-friendly living spaces. Essex Property Trust is actively engaged in meeting these demands, setting ambitious targets for reducing its environmental footprint.

Essex's commitment is evident in its 2024 Sustainability and Impact Report, which outlines progress in areas like lowering greenhouse gas emissions, energy consumption, water usage, and waste. This report highlights the company's dedication to implementing green building strategies and fostering sustainable operational practices across its portfolio.

Water scarcity, especially in California where Essex Property Trust has a significant presence, poses an environmental challenge for multifamily properties. This necessitates proactive measures to ensure operational continuity and resident satisfaction.

Implementing efficient water management systems, drought-resistant landscaping, and water-saving fixtures are becoming critical for sustainability. These strategies not only conserve a vital resource but also can lead to reduced utility costs for both the company and its residents.

Essex Property Trust has publicly stated goals for reducing whole building water usage, demonstrating a commitment to addressing this critical environmental concern. For instance, their 2023 sustainability report highlighted a 3% reduction in water consumption across their portfolio compared to their 2020 baseline, a testament to their ongoing efforts.

Energy Consumption and Renewable Energy Adoption

Reducing energy consumption and increasing the adoption of renewable energy sources are critical environmental factors for real estate companies like Essex Property Trust. Essex has set ambitious energy reduction goals, actively pursuing initiatives such as rooftop solar installations across its portfolio and piloting electrification projects. These efforts are designed to lessen the company's environmental impact and simultaneously drive down operational expenses.

This strategic focus aligns perfectly with the growing industry-wide emphasis on energy-efficient buildings and the broader transition to clean energy within the real estate sector. For instance, in 2023, Essex reported a reduction in its Scope 1 and 2 greenhouse gas emissions intensity by 13.4% compared to its 2021 baseline. The company continues to expand its solar capacity, with over 60 properties featuring rooftop solar installations as of the end of 2024, contributing to a cleaner energy mix.

- Energy Efficiency Initiatives: Essex is actively investing in energy-efficient upgrades to its properties, including LED lighting retrofits and improved HVAC systems, aiming for significant reductions in overall energy usage.

- Renewable Energy Integration: The company is expanding its rooftop solar program, with a target to install solar panels on an additional 20 properties by the end of 2025, further increasing its renewable energy generation.

- Electrification Pilots: Essex is exploring and piloting electrification of common area heating and cooling systems, a key step towards reducing reliance on fossil fuels and lowering operational carbon footprints.

- Emissions Reduction Targets: The company is committed to achieving its science-based targets for greenhouse gas emission reductions, demonstrating a proactive approach to climate change mitigation.

Waste Management and Circular Economy Principles

Effective waste management, including robust recycling and waste reduction initiatives, is a cornerstone of environmental responsibility for real estate companies. While Essex Property Trust's specific waste metrics aren't always front and center, the industry as a whole is increasingly embracing circular economy principles. This shift aims to significantly cut down on waste generated from both construction phases and ongoing property operations.

Essex's stated commitment to waste reduction aligns with this broader industry trend. For instance, many real estate firms are focusing on diverting construction and demolition debris from landfills, with some aiming for diversion rates exceeding 75% by 2025. This focus on minimizing waste contributes directly to a company's overall environmental performance and can lead to cost savings through reduced disposal fees.

- Industry Trend: Real estate sector increasingly adopting circular economy models to minimize waste.

- Essex Alignment: Commitment to waste reduction aligns with this growing industry focus.

- Impact: Reduced waste contributes to environmental responsibility and potential cost efficiencies.

- Data Point: Many companies target over 75% diversion of construction waste from landfills by 2025.

Environmental factors significantly influence Essex Property Trust's operations, particularly its West Coast portfolio. Climate change risks like wildfires and drought necessitate proactive water and energy management strategies, impacting operational costs and property desirability. The company is actively pursuing sustainability goals, evident in its 2024 Sustainability and Impact Report, which details progress in reducing emissions, energy, and water usage.

Essex is enhancing energy efficiency and integrating renewable sources, with over 60 properties featuring solar installations by the end of 2024. They aim to install solar on an additional 20 properties by the end of 2025. Furthermore, the company is piloting electrification projects to reduce reliance on fossil fuels, aligning with industry-wide shifts towards greener real estate practices.

Waste management is another key environmental consideration, with a growing industry trend towards circular economy principles. Essex's commitment to waste reduction aligns with this, as many firms target over 75% diversion of construction waste from landfills by 2025, contributing to both environmental responsibility and potential cost savings.

| Environmental Factor | Impact on Essex Property Trust | Essex Initiatives/Targets | Relevant Data (2023/2024) |

|---|---|---|---|

| Climate Change Risks (Wildfires, Drought) | Property damage, increased insurance, water scarcity impacting operations and desirability. | Water-efficient landscaping, water-saving fixtures, proactive resource management. | California has faced severe drought periods; 3% reduction in water consumption across portfolio (vs. 2020 baseline). |

| Energy Consumption & Renewables | Operational costs, carbon footprint, tenant and investor expectations for sustainability. | LED retrofits, improved HVAC, rooftop solar expansion, electrification pilots. | 13.4% reduction in Scope 1 & 2 GHG emissions intensity (vs. 2021 baseline); 60+ properties with solar installations (end of 2024); Target: 20 additional solar properties by end of 2025. |

| Waste Management | Disposal costs, environmental impact, regulatory compliance, circular economy adoption. | Waste reduction initiatives, focus on diverting construction debris. | Industry trend: >75% diversion of construction waste from landfills by 2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Essex Property Trust is informed by a robust combination of data from U.S. Census Bureau, Bureau of Labor Statistics, Federal Reserve economic reports, and publicly available company filings. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the real estate sector.