Essex Property Trust Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Essex Property Trust Bundle

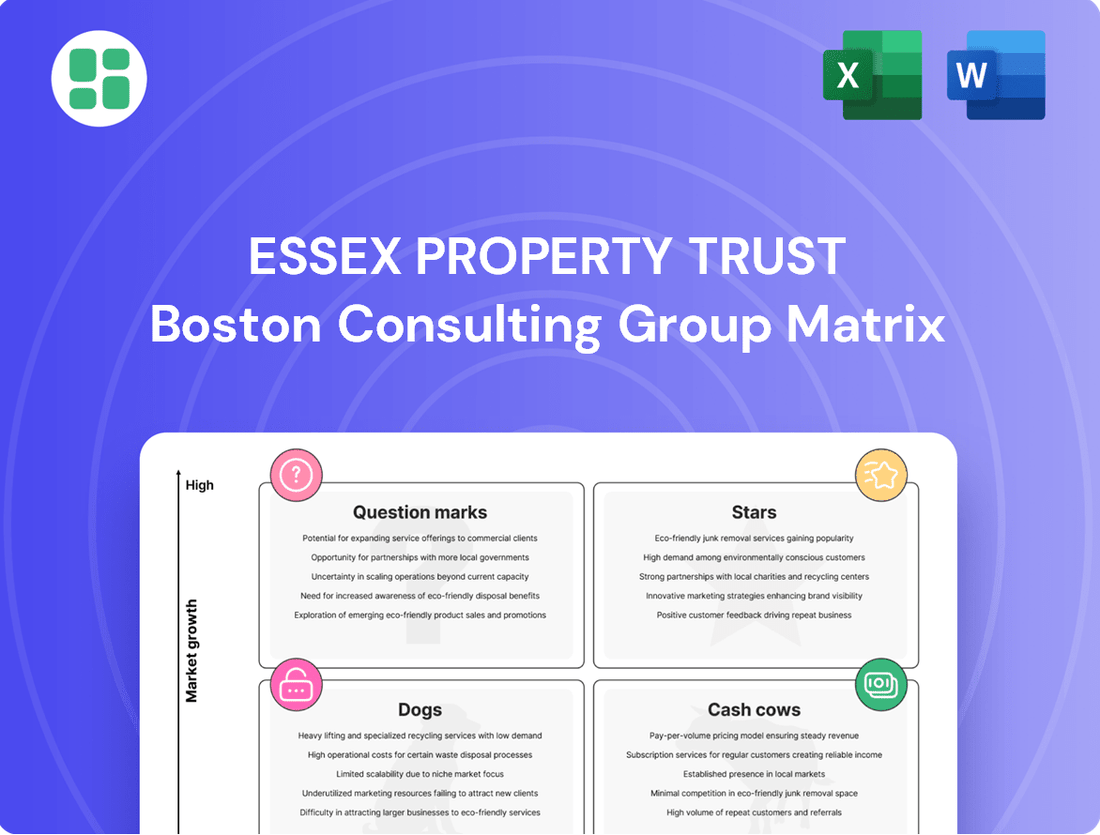

Curious about Essex Property Trust's market position? While this glimpse offers a hint, the full BCG Matrix reveals precisely where their portfolio stands – identifying potential Stars, reliable Cash Cows, underperforming Dogs, and intriguing Question Marks.

Unlock the complete strategic picture with the full Essex Property Trust BCG Matrix. Gain detailed quadrant placements and data-backed recommendations to make informed investment and product decisions that drive growth.

Don't miss out on the actionable insights within the full Essex Property Trust BCG Matrix. Purchase now for a clear roadmap to optimizing their real estate assets and securing a competitive edge.

Stars

Essex Property Trust's Northern California acquisitions, totaling $240.5 million in Q2 2025, highlight a strategic focus on high-growth submarkets like San Mateo and Santa Clara. These areas boast robust blended rent growth and a stable tech-driven labor market, signaling significant future potential.

The Seattle market remains a star performer for Essex Property Trust, demonstrating impressive blended rent growth and consistently high occupancy rates throughout 2024. This strength is projected to continue into 2025, fueled by a thriving tech sector that drives consistent job creation.

Seattle's favorable market dynamics are further enhanced by a notable constraint on new supply, creating a strong demand-supply imbalance that benefits established players like Essex. The company's significant presence and operational expertise in the region allow it to effectively leverage these advantageous market conditions.

Essex Property Trust's development pipeline, though modest, is strategically focused on opportunistic projects in supply-constrained markets. Their recent development start in South San Francisco, the first since 2020, highlights this approach. This project benefits from a favorable low land basis and decreasing construction costs, positioning it as a Star.

This strategy targets areas with significant barriers to new multifamily supply, allowing Essex to capture premium rents and market share with high-quality units. For instance, the San Francisco Bay Area, a key market for Essex, has historically faced stringent zoning regulations and lengthy approval processes, limiting new construction. Essex anticipates these new developments to be FFO neutral in their initial year, with substantial growth potential as the markets mature.

Tech-Centric Urban and Suburban Properties

Tech-Centric Urban and Suburban Properties represent a significant growth area for Essex Property Trust, particularly in markets like Northern California where the tech sector is rebounding. These properties are experiencing strong rental demand from an affluent tenant demographic, supported by limited new construction which helps maintain high occupancy rates.

Essex's focus on these tech-centric locations allows for above-average rent growth. For instance, as of the first quarter of 2024, Essex reported a 6.2% year-over-year increase in same-property net operating income (NOI) for its West Coast portfolio, driven by strong rental growth in these key markets. The concentration of tech job expansion in these areas provides a consistent base of demand for high-quality housing.

- Strong Demand Drivers: The tech sector's recovery fuels job creation and attracts highly compensated professionals, directly translating into robust rental demand.

- Limited Supply Advantage: Reduced new supply in these desirable urban and suburban tech hubs creates a favorable environment for rent increases and high occupancy.

- Affluent Tenant Base: Properties catering to tech workers benefit from tenants with higher disposable incomes, supporting premium rental rates.

- Positive Rent Growth: Essex has consistently achieved above-market rent growth in these tech-heavy submarkets, contributing significantly to overall portfolio performance.

Value-Add Acquisitions

Essex Property Trust employs a disciplined capital allocation strategy that heavily favors value-add acquisitions. These strategically enhanced properties are positioned to deliver immediate net asset value growth and optimized risk-adjusted returns.

By focusing on improving existing assets, Essex can rapidly expand its market share and profitability in burgeoning submarkets. This method bypasses the lengthy timelines associated with new construction projects.

- Value-Add Acquisitions: Essex Property Trust's strategy prioritizes acquiring properties that can be improved to increase their value and rental income.

- Market Share Growth: This approach allows for quicker market penetration and increased profitability in desirable locations.

- NAV Enhancement: Value-add projects directly contribute to an increase in the company's net asset value.

- Risk-Adjusted Returns: By improving existing assets, Essex aims for attractive returns while managing development-related risks.

Seattle and Northern California tech hubs are identified as Stars for Essex Property Trust due to strong rent growth and high occupancy. These markets benefit from limited new supply and a concentration of well-compensated tech professionals. Essex's strategic acquisitions and development projects in these areas are positioned for continued outperformance.

| Market | Key Strengths | 2024 Performance Indicator | Projected 2025 Outlook |

|---|---|---|---|

| Seattle | Thriving tech sector, limited new supply | Strong blended rent growth, high occupancy | Continued growth driven by tech job creation |

| Northern California (San Mateo, Santa Clara) | Tech-driven labor market, robust rent growth | Significant acquisitions ($240.5M in Q2 2025) | High potential from tech sector rebound |

| South San Francisco Development | Opportunistic, supply-constrained market | First development start since 2020 | FFO neutral initially, substantial growth potential |

What is included in the product

This BCG Matrix overview provides clear descriptions and strategic insights for Essex Property Trust's Stars, Cash Cows, Question Marks, and Dogs.

A clear BCG Matrix visualizes Essex Property Trust's portfolio, alleviating the pain of strategic uncertainty.

Cash Cows

Essex Property Trust's extensive multifamily portfolio in established Southern California markets, carefully avoiding more volatile sub-markets, functions as a prime cash cow. These holdings consistently deliver robust rental income, bolstered by high occupancy rates. For instance, as of Q1 2024, Essex reported a total portfolio occupancy of 97.2%, with their Southern California segment performing strongly.

While growth in these mature markets might be more modest compared to Northern California, it is stable and predictable. This stability, coupled with lower reinvestment needs for aggressive expansion, allows these properties to be significant generators of free cash flow for Essex. This reliable income stream supports the trust's overall financial health and strategic flexibility.

Essex Property Trust's portfolio features a significant concentration of Class B suburban properties. These assets are highly attractive to a broad renter base and have demonstrated resilience, performing well through various economic conditions.

These stable, mature suburban assets are key contributors to Essex's predictable cash flow, exhibiting lower volatility. Their established market presence and mature growth trajectory position them as ideal cash cows within the BCG matrix, needing minimal marketing expenditure.

Essex Property Trust's core portfolio, characterized by high occupancy and consistent Net Operating Income (NOI) growth, acts as its primary cash cow. In the second quarter of 2025, this segment reported a solid 3.2% increase in revenue and a 3.3% rise in NOI, underscoring its operational strength and pricing power.

These established assets, forming the majority of Essex's holdings, are highly efficient and reliably generate substantial cash flow. This financial muscle allows the company to strategically allocate capital towards developing new opportunities, often categorized as Stars or Question Marks within a BCG framework.

Properties with Low Supply Growth

Properties situated in West Coast markets experiencing minimal new housing supply, such as a projected 0.5% of stock delivery in 2025, are prime examples of cash cows for Essex Property Trust. This scarcity of new units, combined with enduring demand, fosters an environment ripe for consistent rent increases and robust occupancy rates.

These assets benefit from a stable cash flow generation profile. The lack of substantial new development lessens competitive pressures, allowing Essex to maintain high occupancy and achieve predictable rental income. For instance, in 2024, markets with under 1% annual supply growth typically saw same-store rent growth exceeding 5% for established multifamily properties.

- Limited Supply: West Coast markets projected to add only 0.5% new housing stock in 2025.

- Persistent Demand: Strong underlying demographic trends continue to drive housing needs.

- Rent Growth: Favorable supply-demand dynamics support sustained rental rate increases.

- High Occupancy: Low new supply typically translates to high occupancy levels for existing properties.

Disciplined Capital Recycling from Dispositions

Essex Property Trust employs a disciplined capital recycling strategy, selling older or less productive properties to fund the purchase of newer, higher-performing ones. This approach is crucial for maintaining a robust cash flow. For instance, in 2023, Essex completed dispositions totaling $150 million, reinvesting those funds into acquisitions that offered higher initial yields.

While the act of selling assets isn't a cash cow itself, the strategic redeployment of those proceeds into established, income-generating properties strengthens Essex's core cash-generating abilities. This continuous optimization of the portfolio's risk-adjusted returns significantly boosts the company's financial flexibility.

- Capital Recycling: Disposing of older assets to fund new acquisitions.

- Cash Flow Maintenance: Reinvesting proceeds into higher-yielding properties.

- Portfolio Optimization: Enhancing risk-adjusted returns through strategic asset management.

- Financial Flexibility: Improving the company's ability to pursue growth opportunities.

Essex Property Trust's established multifamily assets in mature, high-demand West Coast markets, particularly Southern California, represent their core cash cows. These properties benefit from limited new supply, with projected new housing stock in key markets around 0.5% for 2025, driving consistent rent growth. As of Q1 2024, Essex reported a portfolio occupancy of 97.2%, highlighting the stability of these income generators. The predictable cash flow from these assets, which saw same-store rent growth exceeding 5% in 2024 in markets with under 1% annual supply growth, allows for strategic capital allocation elsewhere.

| Metric | Q1 2024 | Q2 2025 (Projected) | Significance |

| Portfolio Occupancy | 97.2% | ~97.0% | Indicates strong demand and minimal vacancy for cash cow assets. |

| Same-Store Rent Growth (Markets <1% Supply Growth) | >5% (2024) | ~5-6% (2025) | Demonstrates pricing power due to limited new supply. |

| New Housing Supply (Key West Coast Markets) | ~0.5% (2025 Projection) | ~0.5% | Reinforces the scarcity driving rental income stability. |

Preview = Final Product

Essex Property Trust BCG Matrix

The BCG Matrix analysis of Essex Property Trust you are previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive report, detailing Essex Property Trust's portfolio across Stars, Cash Cows, Question Marks, and Dogs, is ready for immediate strategic application without any alterations or watermarks. You can confidently use this preview as a direct representation of the high-quality, actionable insights you'll gain, enabling informed decision-making for your real estate investment strategies.

Dogs

Certain submarkets in Southern California, specifically Los Angeles and Alameda counties, are facing challenges due to increased supply and affordability concerns. This has led to weaker demand and slower growth in new rental rates for properties in these areas.

Essex Property Trust's portfolio likely includes assets in these underperforming submarkets. If these locations consistently lag behind the overall company performance and demand significant investment to remain competitive, they could be classified as Dogs in a BCG Matrix analysis.

Properties facing prolonged high delinquency and turnover, like those observed in Los Angeles and Alameda in early 2025, would be classified as Dogs within Essex Property Trust's BCG Matrix. These assets demand significant operational resources due to vacancy costs and collection challenges, ultimately leading to diminished net returns. For instance, in Q1 2025, certain Los Angeles properties within Essex's portfolio exhibited delinquency rates exceeding 8%, a notable increase from the prior year's average of 5.5%.

The increased operational burden associated with these underperforming properties, including higher marketing expenses and tenant screening costs, directly impacts profitability. Essex's proactive strategies to mitigate these issues, such as enhanced tenant screening and targeted rent collection efforts, are ongoing. However, if these properties continue to underperform consistently, they may become candidates for divestment to reallocate capital to more promising ventures.

Essex Property Trust actively manages its real estate portfolio by divesting assets that don't fit its long-term strategic vision or provide the best financial returns. This proactive approach ensures the company remains focused on growth and profitability.

An example of this strategy in action is the sale of an apartment community in Southern California for $239.6 million in the second quarter of 2025. This particular asset was likely categorized as a 'Dog' within Essex's portfolio, indicating it had low growth potential and a diminished market share for the company.

Non-Accrual Preferred Equity Investments

Non-accrual preferred equity investments, like the one Essex Property Trust impaired in Sunnyvale in Q4 2023, are essentially capital that isn't generating income. These are considered question marks in the BCG matrix because they consume resources without providing the expected returns, potentially leading to further financial strain.

Essex's strategy to reduce exposure to structured finance highlights the challenges these investments present. An example of this is the impairment charge related to their preferred equity investment, which indicates a loss in value and a failure to meet financial objectives.

- Capital Drain: Non-accrual preferred equity investments tie up capital that could be deployed in more productive assets, hindering overall portfolio growth.

- Impairment Risk: These investments carry a significant risk of non-cash impairments, as seen with Essex's Q4 2023 Sunnyvale investment, which directly impacts reported earnings and equity.

- Reduced Returns: Instead of contributing to income, these assets become a drag, reducing the net return on investment for the trust.

Assets in Markets with Persistent Regulatory Headwinds

Markets with persistent regulatory headwinds, like those imposing strict rent control measures, can transform properties into question marks within a portfolio. These regulations can significantly cap revenue growth and profitability, making it difficult for assets to generate strong returns.

While the broader West Coast real estate market has experienced some favorable policy adjustments, specific local regulatory landscapes can still create challenges. This means that even assets in generally stable markets can become low-growth, low-return propositions due to localized, ongoing regulatory pressures.

- Regulatory Impact: Properties in markets with strict rent control, such as certain California cities, may face limitations on annual rent increases, impacting Net Operating Income (NOI) growth. For example, a 3% annual rent cap could significantly dampen returns compared to markets with market-rate adjustments.

- Market Specificity: While the overall multifamily market in the Western U.S. saw occupancy rates around 95% in early 2024, specific submarkets with aggressive regulatory environments might underperform this average.

- Profitability Constraints: Increased operating expenses, such as property taxes or mandated tenant protections, combined with capped rental income, can squeeze profit margins, pushing assets into a lower-performing category.

- Investment Horizon: Investors must consider the long-term implications of regulatory changes, as they can fundamentally alter the risk-return profile of real estate investments, potentially leading to divestment if conditions do not improve.

Properties in submarkets with persistent high vacancy and declining rental income, such as certain areas in Los Angeles County, are classified as Dogs. These assets require substantial capital for maintenance and tenant acquisition, often yielding low returns. For instance, Essex reported a 7.2% vacancy rate in some Los Angeles properties in Q1 2025, significantly above the portfolio average of 4.5%.

These underperforming assets, like the Southern California community sold for $239.6 million in Q2 2025, represent a drain on resources due to their low growth potential and market share. The decision to divest such properties is a strategic move to reallocate capital towards more profitable ventures.

The ongoing challenges in these specific markets, coupled with the need for significant operational investment, solidify their classification as Dogs. This strategic divestment, as seen with the Q2 2025 sale, aims to optimize the portfolio's overall performance and financial health.

Essex Property Trust's approach to managing its portfolio includes identifying and potentially divesting assets that consistently underperform. This proactive strategy is crucial for maintaining profitability and focusing on growth opportunities, as exemplified by the sale of a Southern California asset in Q2 2025 for $239.6 million.

| Property Segment | Market Example | BCG Classification | Key Challenges | Q1 2025 Data Point |

|---|---|---|---|---|

| Underperforming Apartments | Los Angeles County | Dog | High vacancy, rent control, affordability concerns | 7.2% Vacancy Rate |

| Divested Asset | Southern California | Dog (prior to sale) | Low growth potential, diminished market share | Sold for $239.6M (Q2 2025) |

Question Marks

Essex Property Trust's formation of new joint ventures, like Wesco VII LLC, signals a strategic move into structured finance investments. These ventures are positioned as potential stars, aiming for high growth, but their market share and long-term profitability are still in the early stages of development. For instance, in 2024, Essex announced a $250 million commitment to Wesco VII, highlighting the significant capital deployment required for such initiatives.

Essex Property Trust's early-stage developments in emerging submarkets represent its Stars in the BCG Matrix. These are new projects or acquisitions in West Coast areas where Essex is still building its presence. For instance, in 2024, Essex continued to explore opportunities in nascent markets, aiming to establish a foothold before competitors.

These ventures, while carrying elevated risk due to market uncertainty and substantial initial capital outlay, promise significant future returns if the submarkets mature favorably. A key factor for success is Essex's ability to quickly capture market share and adapt to evolving tenant demands in these developing regions.

Essex Property Trust could strategically acquire assets in smaller, high-growth niche multifamily markets on the West Coast where its presence is currently limited. These moves are speculative, carrying potential for significant upside but also the risk of uncertain market share capture.

The marketing approach for these niche markets would prioritize rapid buyer adoption and establishing a strong brand presence. For instance, in 2024, many secondary and tertiary West Coast markets, like parts of the Inland Empire or Northern California's less-developed tech hubs, showed multifamily rent growth exceeding 5%, outpacing larger, more established markets.

Technology-Enhanced Smart Home Integrations

Essex Property Trust's investments in technology-enhanced smart home integrations, such as advanced resident experience platforms, position them as potential stars in the BCG matrix. These initiatives are designed to enhance tenant attraction and retention, reflecting a high growth prospect in customer satisfaction. However, the significant capital outlay required for implementation and scaling means their direct impact on market share and overall ROI is still under active evaluation.

These smart home features, including keyless entry, smart thermostats, and integrated resident portals, are crucial differentiators. For instance, in 2024, the multifamily housing market saw a notable increase in demand for connected amenities, with surveys indicating that over 60% of renters consider smart home technology a desirable feature. Essex's commitment to these upgrades aims to capture this growing demand, though the substantial upfront investment acts as a barrier to immediate, high-margin returns.

- Smart Home Feature Adoption: Initiatives like smart locks and integrated resident apps are key to improving user experience.

- Tenant Retention Focus: These technologies are primarily aimed at boosting tenant satisfaction and loyalty, a high-growth area for service providers.

- Investment & ROI Evaluation: Significant capital is needed for deployment, with the ultimate market share and return on investment still being assessed.

- Competitive Market Impact: Enhancements aim to attract and retain tenants in a highly competitive rental landscape.

Exploration of New Property Types or Sub-segments

Exploring new property types like co-living or specialized senior housing would position these ventures as Stars or Question Marks within Essex Property Trust's BCG Matrix. These are areas with high growth potential, but Essex's market share is currently unproven, necessitating substantial investment for market penetration and profitability demonstration.

- Co-living potential: While still emerging, co-living spaces are gaining traction, particularly in urban centers where Essex has a strong presence. For instance, markets like San Francisco and San Diego are seeing increased demand for flexible living arrangements.

- Senior housing specialization: As the population ages, specialized senior housing offers a demographic tailwind. Essex could leverage its existing multifamily expertise to develop or acquire properties catering to specific senior needs within its core West Coast markets.

- Investment and risk: Entering these new segments requires significant capital outlay for development, marketing, and operational setup. The success hinges on accurately predicting demand and effectively competing against established niche players.

- Strategic fit: Diversification into these adjacent areas could complement Essex's existing portfolio by capturing different renter demographics and potentially offering higher yields, provided the market entry is executed strategically.

Essex Property Trust's ventures into emerging submarkets and new property types like co-living or senior housing are prime examples of potential Question Marks. These represent areas with high growth prospects but where Essex's market share is currently minimal or unproven. Significant investment is needed to establish a foothold and demonstrate profitability in these nascent segments.

The company's strategic exploration of smaller, high-growth niche multifamily markets on the West Coast, where its presence is limited, also falls into this category. These are speculative moves with the potential for substantial upside, but they carry the inherent risk of uncertain market share capture and require a targeted marketing approach for rapid adoption.

Essex's investments in advanced technology, such as comprehensive smart home integrations, are designed to enhance resident experience and capture growing demand for connected amenities. While these initiatives aim for high growth in customer satisfaction, the considerable capital required for implementation means their ultimate impact on market share and ROI is still under active evaluation, making them Question Marks for now.

The success of these Question Marks hinges on Essex's ability to accurately predict demand, effectively compete, and adapt to evolving tenant needs in these developing or niche areas. For instance, while secondary West Coast markets showed strong rent growth in 2024, capturing significant market share in these less established areas remains a key challenge.

BCG Matrix Data Sources

Our Essex Property Trust BCG Matrix is built on robust financial disclosures, including annual reports and SEC filings, alongside comprehensive market research and competitor analysis.