Essex Property Trust Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Essex Property Trust Bundle

Unlock the core of Essex Property Trust's operational success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they expertly manage their extensive portfolio of West Coast apartment communities, focusing on key customer segments and value propositions. Discover their strategic approach to revenue streams and cost structures.

See how Essex Property Trust leverages key partnerships and resources to maintain its market leadership. Our full Business Model Canvas provides a clear, actionable blueprint of their customer relationships and channels, essential for anyone studying real estate investment or business strategy.

Ready to gain a competitive edge? Download the complete Essex Property Trust Business Model Canvas to understand their unique competitive advantages and future growth strategies, making it an invaluable tool for investors and business strategists alike.

Partnerships

Essex Property Trust frequently collaborates with prominent construction and development companies to erect new apartment buildings and revitalize existing ones. This strategic approach is vital for growing their property holdings, guaranteeing superior build quality, and completing projects efficiently and cost-effectively.

These partnerships allow Essex to tap into specialized skills and assets necessary for substantial real estate ventures. For instance, in 2024, Essex continued its development pipeline, with projects like The Verve in San Jose, California, showcasing the importance of these construction relationships in bringing complex, high-quality residential communities to fruition.

Essex Property Trust maintains robust relationships with a diverse array of financial institutions and lenders. These strategic alliances are fundamental to securing the substantial capital required for acquiring new properties, funding development pipelines, and managing day-to-day operations. For instance, in 2024, Essex successfully accessed various debt markets to support its strategic objectives.

These partnerships grant Essex crucial access to debt financing, revolving credit facilities, and other essential financial instruments. Such backing is indispensable for a real estate investment trust (REIT) that operates in a capital-intensive sector. The trust's ability to secure favorable terms from lenders directly impacts its liquidity and its capacity to pursue growth opportunities effectively.

Essex Property Trust actively collaborates with technology and PropTech providers to boost operational efficiency and enhance the resident experience. These partnerships are crucial for integrating smart home features and advanced property management systems. For instance, in 2024, Essex continued to invest in digital platforms aimed at streamlining leasing, maintenance requests, and resident communication, reflecting a broader industry trend where technology adoption is directly linked to competitive advantage and attracting tech-savvy renters.

Brokerage and Real Estate Agencies

Essex Property Trust leverages key partnerships with brokerage and real estate agencies to drive its portfolio strategy. These relationships are crucial for both acquiring new assets and divesting existing ones, ensuring a dynamic and optimized property portfolio. In 2024, Essex continued to rely on these networks for market intelligence and deal flow.

These partnerships provide Essex with invaluable access to off-market opportunities and deep local market insights. Brokers and agencies act as vital conduits, facilitating transactions and offering expertise that aids in strategic investment decisions and efficient pipeline management.

- Property Acquisition & Disposition: Brokers facilitate the identification and negotiation of purchase and sale agreements for new developments and existing properties.

- Market Intelligence: Agencies provide crucial data on local market trends, rental rates, and competitive landscapes, informing strategic decisions.

- Transaction Facilitation: These partners streamline the complex processes involved in buying, selling, and leasing real estate assets.

- Access to Off-Market Deals: Strong relationships often grant Essex early access to investment opportunities before they are publicly listed.

Local Government and Regulatory Bodies

Essex Property Trust actively engages with local government and regulatory bodies to ensure smooth operations and development. This collaboration is vital for navigating complex zoning laws and securing necessary permits for new construction and renovations. For instance, in 2024, the company continued its efforts to obtain approvals for several key development projects across its West Coast portfolio, emphasizing compliance with local housing regulations.

These partnerships are foundational for Essex's ability to expand and maintain its property portfolio. By fostering strong relationships with municipal planning departments and housing authorities, Essex can more effectively address community needs and integrate its developments responsibly. This proactive approach helps mitigate potential delays and ensures adherence to all relevant building codes and environmental standards.

- Zoning Compliance: Ensuring all development plans meet local zoning ordinances.

- Permitting Process: Streamlining the acquisition of building and occupancy permits.

- Regulatory Adherence: Maintaining compliance with housing, safety, and environmental regulations.

- Community Relations: Building trust and cooperation with local governing bodies.

Essex Property Trust's key partnerships are crucial for its operational success and growth. These include collaborations with construction firms for development, financial institutions for capital, and technology providers for efficiency. Furthermore, relationships with brokerage agencies are vital for property acquisition and disposition, while engagement with local governments ensures smooth development processes.

| Partnership Type | Role in Business Model | Example/Focus Area (2024) |

|---|---|---|

| Construction & Development Firms | Building new properties, revitalizing existing ones, ensuring quality and efficiency. | Projects like The Verve in San Jose, California, highlighting complex residential community development. |

| Financial Institutions & Lenders | Securing capital for acquisitions, development funding, and operational management. | Accessing various debt markets to support strategic objectives and maintain liquidity. |

| Technology & PropTech Providers | Enhancing operational efficiency, integrating smart home features, improving resident experience. | Investing in digital platforms for streamlined leasing, maintenance, and resident communication. |

| Brokerage & Real Estate Agencies | Facilitating property acquisition and disposition, providing market intelligence, and deal flow. | Leveraging networks for off-market opportunities and local market insights. |

| Local Government & Regulatory Bodies | Ensuring zoning compliance, navigating permitting processes, and adhering to regulations. | Obtaining approvals for key development projects and maintaining community relations. |

What is included in the product

This Business Model Canvas provides a strategic overview of Essex Property Trust's operations, detailing its focus on acquiring, developing, and managing multifamily apartment communities in the Western United States.

It outlines key customer segments, value propositions, and revenue streams, reflecting the company's established market position and growth strategies.

Essex Property Trust's Business Model Canvas acts as a pain point reliever by clearly mapping out their strategy for acquiring, developing, and managing apartment communities, offering a structured approach to navigating the complex real estate market.

Activities

Essex Property Trust actively seeks out and purchases apartment buildings in key West Coast locations like California and Washington. This process includes thorough research into the property, its market, and its financial potential to make sure it fits their investment plans and can be profitable.

In 2024, Essex continued this strategy, focusing on markets with strong job growth and demand for housing. For example, their acquisition activity in the San Francisco Bay Area and Southern California remains a cornerstone of their growth, aiming to enhance their portfolio with properties that offer stable rental income and appreciation potential.

Essex Property Trust actively engages in developing new apartment communities and redeveloping existing ones. This encompasses the full project lifecycle, from initial planning and design through construction and the crucial lease-up phase. For instance, in 2024, the company continued to advance its development pipeline, a core strategy for expanding its portfolio and enhancing asset value.

These development and redevelopment efforts are vital for Essex's portfolio growth. By modernizing amenities and improving living spaces, these projects allow Essex to capture additional value, making properties more attractive to renters. This strategic focus ensures the company’s assets remain competitive and generate stronger returns.

Essex Property Trust actively manages its vast residential portfolio, handling everything from routine maintenance and repairs to security and ensuring a top-notch living experience for its residents.

In 2024, efficient operations are paramount; for instance, maintaining properties well directly impacts tenant satisfaction and retention rates, which are key drivers of consistent revenue streams.

The trust's commitment to operational excellence helps preserve and enhance property values, a critical factor in its long-term financial health and ability to attract new tenants.

Leasing and Tenant Relations

Essex Property Trust's key activities center on attracting and keeping residents. This involves smart marketing, efficient leasing, and building solid relationships with tenants. They process applications, handle lease agreements, and work to keep people happy in their homes, which is crucial for keeping apartments full and ensuring steady rent payments.

Maintaining high occupancy rates is a direct result of these efforts. For instance, in the first quarter of 2024, Essex reported a same-property occupancy rate of 97.1%. This strong performance underscores the effectiveness of their leasing and tenant relations strategies in generating consistent revenue.

- Attracting and Retaining Residents: Implementing targeted marketing campaigns and streamlined leasing processes to attract new tenants and encourage lease renewals.

- Lease Administration: Efficiently managing all aspects of lease agreements, from initial application processing to renewals and terminations.

- Tenant Relationship Management: Fostering positive and responsive relationships with current residents to enhance satisfaction, reduce turnover, and maintain high occupancy.

- Occupancy Rate Maintenance: Consistently achieving high occupancy rates, such as the 97.1% recorded in Q1 2024, directly supports stable rental income streams.

Capital Allocation and Investor Relations

Essex Property Trust's capital allocation and investor relations activities are central to its operational success. They focus on the strategic deployment of financial resources, encompassing both debt and equity financing, to fuel growth and maintain financial stability. This includes making informed decisions on property acquisitions, development projects, and capital expenditures.

Transparent and consistent communication with investors is paramount. Essex Property Trust provides regular updates on its financial performance, operational highlights, and strategic direction, ensuring stakeholders are well-informed. This commitment to clear communication builds trust and supports access to capital markets.

- Capital Allocation Strategy: Essex Property Trust actively manages its balance sheet, strategically allocating capital towards accretive acquisitions and development opportunities within its core West Coast markets.

- Investor Communications: The trust prioritizes transparent and timely disclosure of financial results and strategic updates to its investor base.

- Access to Capital: Maintaining strong investor relations facilitates efficient access to both debt and equity capital markets, crucial for funding growth initiatives.

- Financial Risk Management: Key activities include managing debt levels, interest rate exposure, and overall financial risk to preserve capital and enhance shareholder value.

Essex Property Trust's key activities are multifaceted, encompassing property acquisition, development, and robust portfolio management. They strategically acquire apartment buildings in high-demand West Coast markets, focusing on areas with strong economic fundamentals and population growth. In 2024, this included continued investment in the San Francisco Bay Area and Southern California, aiming for stable rental income and capital appreciation.

Furthermore, Essex actively pursues new development and redevelopment projects, managing the entire lifecycle from planning to lease-up. This strategy is crucial for expanding their portfolio and increasing asset value, as seen with ongoing advancements in their development pipeline throughout 2024. Operational excellence is also a core activity, ensuring properties are well-maintained to boost tenant satisfaction and retention, thereby securing consistent revenue streams.

Attracting and retaining residents through effective marketing, leasing, and tenant relationship management is paramount. This focus is demonstrated by their consistently high occupancy rates, with Q1 2024 reporting a notable 97.1%. Lastly, capital allocation and investor relations are vital, involving strategic financial resource deployment and transparent communication to fuel growth and maintain financial stability.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Property Acquisition | Purchasing apartment buildings in key West Coast locations. | Continued focus on San Francisco Bay Area and Southern California markets with strong job growth. |

| Development & Redevelopment | Building new communities and modernizing existing ones. | Advancing development pipeline to expand portfolio and enhance asset value. |

| Portfolio Management | Overseeing maintenance, repairs, and resident experience. | Maintaining properties to ensure high tenant satisfaction and retention. |

| Resident Attraction & Retention | Marketing, leasing, and tenant relationship management. | Achieved 97.1% same-property occupancy rate in Q1 2024. |

| Capital Allocation & Investor Relations | Strategic financial management and stakeholder communication. | Prioritizing transparent disclosure of financial performance and strategic updates. |

What You See Is What You Get

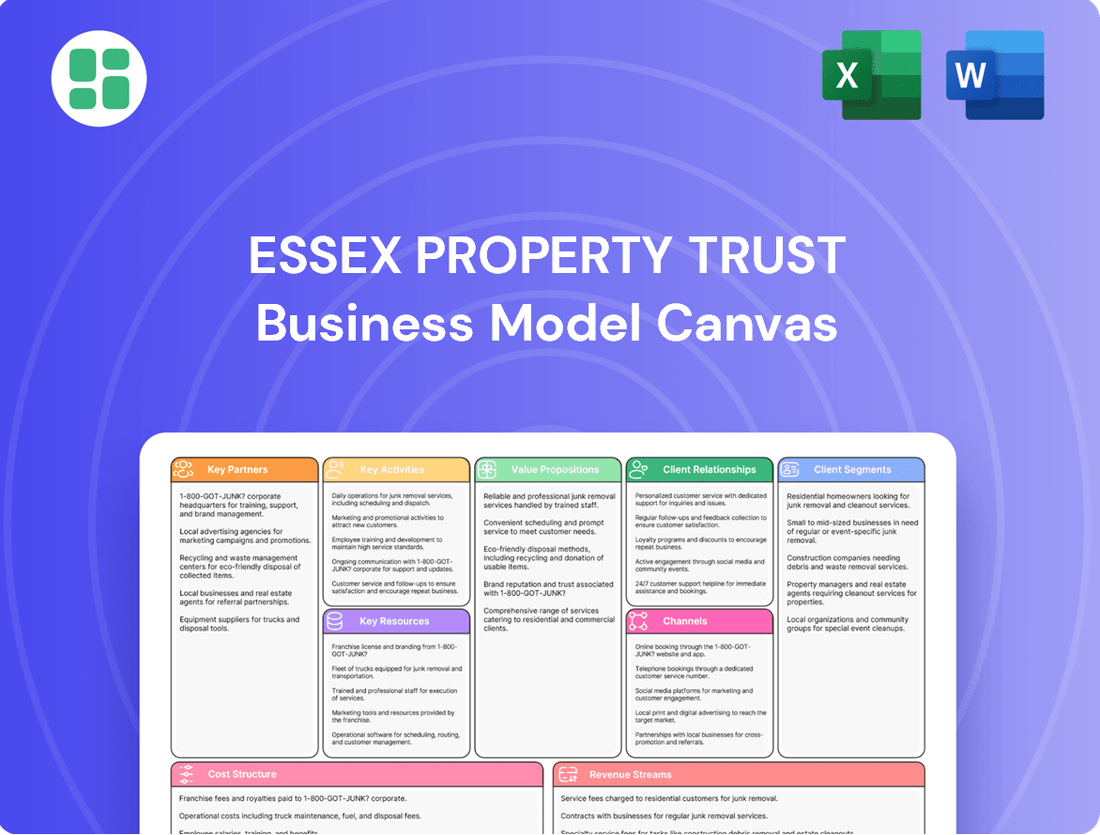

Business Model Canvas

The Business Model Canvas you are previewing for Essex Property Trust is the exact document you will receive upon purchase. It provides a comprehensive overview of their strategic approach, detailing key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. This means you'll gain immediate access to a fully realized and professionally structured analysis, ready for your use.

Resources

Essex Property Trust's most significant asset is its substantial collection of apartment buildings, primarily situated in sought-after areas along the West Coast of the United States. This extensive real estate holdings form the bedrock of their operations, directly translating into rental income.

As of the first quarter of 2024, Essex owned or had an interest in 249 apartment properties, comprising 62,458 apartment homes. The quality and prime locations of these properties are fundamental to their success, enabling them to attract and retain tenants.

Essex Property Trust's financial capital is a cornerstone, allowing for strategic property acquisitions and development projects. This includes substantial equity raised from a diverse investor base and robust access to debt markets, crucial for funding its extensive portfolio. In 2024, Essex continued to demonstrate its financial strength, enabling consistent growth and operational stability.

The trust's capacity to efficiently raise and deploy capital directly fuels its expansion and maintains its competitive edge. This financial agility is paramount for a Real Estate Investment Trust (REIT) like Essex, ensuring it can capitalize on market opportunities and weather economic downturns. A healthy balance sheet, evident in its 2024 performance, underpins its ability to secure favorable financing terms.

Essex Property Trust’s experienced management team and human capital are foundational to its success. This team, comprising seasoned professionals in real estate investment, property management, and market analysis, guides strategic decisions and ensures operational efficiency. Their deep understanding of the West Coast multifamily market is a critical asset.

In 2024, Essex continued to leverage its human capital, with a management team that has an average tenure of over 15 years within the company and the industry. This stability fosters continuity and allows for the effective execution of long-term growth strategies, including identifying and capitalizing on new development and acquisition opportunities.

Proprietary Data and Technology Systems

Essex Property Trust's proprietary data and technology systems are foundational to its operational success. These systems provide unparalleled access to market data and advanced analytics, which are critical for informed decision-making across property management, leasing, and financial reporting.

The company leverages these sophisticated technology platforms to optimize operational efficiency, from tenant acquisition to ongoing property maintenance. This technological infrastructure directly contributes to an enhanced tenant experience, a key differentiator in the competitive real estate market.

By harnessing the power of technology, Essex Property Trust gains a significant competitive edge in managing its extensive and varied portfolio of residential properties. This data-driven approach allows for agile responses to market dynamics and maximizes the performance of each asset.

- Proprietary Market Data: Access to real-time and historical rental rates, vacancy trends, and demographic information for its key West Coast markets.

- Advanced Analytics: Tools for predictive modeling of rent growth, tenant churn, and operational cost optimization, informed by data gathered throughout 2024.

- Property Management Technology: Integrated systems for online rent collection, maintenance requests, and resident communication, streamlining daily operations.

- Financial Reporting Systems: Robust platforms for accurate and timely financial analysis, enabling efficient capital allocation and performance tracking.

Brand Reputation and Industry Relationships

Essex Property Trust's strong brand reputation as a premier West Coast multifamily real estate investment trust (REIT) is a cornerstone of its business model. This established image cultivates significant trust among investors, tenants, and industry partners, streamlining operations and attracting skilled professionals. For instance, as of the first quarter of 2024, Essex reported a portfolio occupancy rate of 97.4%, underscoring tenant confidence and demand for their properties.

These deep-seated industry relationships are equally vital, offering Essex access to proprietary market intelligence and a consistent pipeline of potential acquisition and development opportunities. Such connections are crucial for navigating the competitive real estate landscape and identifying value-adds. In 2023, Essex successfully completed $378.4 million in development projects, a testament to their ability to leverage these relationships for growth.

- Brand Reputation: Essex is recognized as a top-tier multifamily REIT, fostering investor confidence and tenant loyalty.

- Industry Relationships: Strong connections provide access to market insights, deal flow, and strategic partnerships.

- Tenant Trust: High occupancy rates, like the 97.4% reported in Q1 2024, reflect tenant satisfaction and brand appeal.

- Development Success: $378.4 million in completed development projects in 2023 highlights the effectiveness of their industry network.

Essex Property Trust's key resources are its extensive portfolio of high-quality apartment properties strategically located on the West Coast, its strong financial backing enabling acquisitions and development, and its experienced management team with deep market knowledge. Proprietary data and technology systems further enhance operational efficiency and decision-making, while a robust brand reputation and strong industry relationships provide a competitive edge.

| Key Resource | Description | 2024 Relevance/Data Point |

|---|---|---|

| Real Estate Portfolio | 62,458 apartment homes across 249 properties (Q1 2024) | Core revenue-generating asset, prime West Coast locations. |

| Financial Capital | Access to equity and debt markets | Funds acquisitions, development, and ensures operational stability. |

| Human Capital | Experienced management team | Average tenure over 15 years, guiding long-term growth strategies. |

| Proprietary Data & Technology | Advanced analytics and property management systems | Optimizes operations, enhances tenant experience, provides market insights. |

| Brand Reputation & Relationships | Premier West Coast multifamily REIT status | Fosters tenant loyalty (97.4% occupancy Q1 2024), attracts talent, secures deal flow. |

Value Propositions

Essex Property Trust focuses on providing residents with high-quality apartment communities that are consistently well-maintained. This dedication to upkeep ensures comfortable and modern living spaces, fostering a desirable environment for tenants.

The company's emphasis on property maintenance and amenities directly translates into enhanced resident satisfaction. For instance, in the first quarter of 2024, Essex reported a 97.5% occupancy rate across its portfolio, underscoring the appeal of its well-kept properties.

Essex Property Trust's prime value proposition lies in its strategically chosen locations within high-growth West Coast markets. These urban and suburban areas are characterized by limited new housing supply, making Essex's existing and future properties highly desirable.

Residents benefit from convenient access to major employment hubs, efficient transportation networks, and a wealth of amenities, attracting a diverse range of tenants. This focus on prime real estate is a cornerstone of Essex's strategy to ensure sustained asset value appreciation.

As of the first quarter of 2024, Essex's portfolio is concentrated in markets like Southern California and the San Francisco Bay Area, regions known for robust economic activity and population growth. For instance, the average rent for a one-bedroom apartment in San Francisco remained significantly higher than the national average in early 2024, underscoring the inherent value of these locations.

Essex Property Trust's commitment to professional and responsive property management directly translates into enhanced resident satisfaction. In 2024, their focus on efficient maintenance and clear communication is designed to foster a positive living environment, which is crucial for retaining tenants. This dedication to service helps build a strong community atmosphere within their properties.

Stable Income and Capital Appreciation for Investors

Essex Property Trust offers investors a dual benefit: consistent income through reliable dividend payments, fueled by predictable rental income, and the prospect of long-term capital growth from its strategically located West Coast multifamily properties. For instance, Essex reported a net income of $763.9 million for the fiscal year ending December 31, 2023, demonstrating its ability to generate substantial returns for its shareholders.

This value proposition is particularly attractive to those seeking stability and growth in their portfolios. The trust's focus on the dynamic West Coast real estate market provides exposure to a region known for its strong demographic trends and high demand for housing. As of the first quarter of 2024, Essex maintained a portfolio occupancy rate of 96.4%, highlighting the consistent demand for its rental units.

- Stable Income: Consistent dividend payouts derived from predictable rental revenue.

- Capital Appreciation: Potential for long-term growth in real estate asset values.

- Market Exposure: Access to the robust West Coast multifamily real estate market.

- Financial Strength: Demonstrated ability to generate profits, as shown by $763.9 million net income in 2023.

Modern Amenities and Community-Focused Living

Essex Property Trust distinguishes itself by offering modern amenities that go beyond basic housing, creating a desirable living environment. These often include well-equipped fitness centers, convenient co-working spaces for remote professionals, and inviting communal areas designed to foster resident interaction and a sense of belonging. For instance, in 2024, Essex continued to invest in enhancing these shared spaces across its portfolio, recognizing their importance in resident satisfaction and retention.

This focus on community-building and enhanced lifestyle features serves as a key value proposition, setting Essex properties apart in competitive rental markets. By providing a comprehensive living experience rather than just a place to reside, Essex aims to attract and retain residents who value convenience, social connection, and a high quality of life. This strategy directly contributes to higher occupancy rates and stronger rental income streams.

- Modern Amenities: Fitness centers, co-working spaces, and communal lounges are standard offerings.

- Community Focus: Events and shared spaces are designed to encourage resident interaction.

- Enhanced Living Experience: These features contribute to resident satisfaction and loyalty.

- Market Differentiation: Modern amenities and community living provide a competitive edge.

Essex Property Trust provides investors with a compelling opportunity for both consistent income and long-term capital appreciation. The trust’s portfolio, concentrated in high-growth West Coast markets, offers exposure to a region with strong demographic trends and persistent housing demand. For example, Essex reported a net income of $763.9 million for the fiscal year ending December 31, 2023, showcasing its robust financial performance and ability to generate shareholder value.

| Financial Metric | 2023 (FY) | Q1 2024 (Est.) |

|---|---|---|

| Net Income | $763.9 million | $190-200 million (guidance) |

| Occupancy Rate | 96.4% (average for 2023) | 97.5% (reported for Q1 2024) |

| Dividend Payout | Consistent, reflecting stable rental income | Consistent, reflecting stable rental income |

Customer Relationships

Essex Property Trust emphasizes dedicated on-site property management teams at each of its communities. This structure fosters direct, personalized relationships with residents, with these teams serving as the primary point of contact for all inquiries and needs.

These localized teams are responsible for day-to-day operations, including handling maintenance requests and organizing community events. This hands-on approach ensures responsive service and cultivates strong rapport with tenants, contributing to resident satisfaction and retention.

Essex Property Trust enhances customer relationships through robust online tenant portals and digital communication platforms. These tools offer residents easy access to services, rent payment options, and the ability to submit maintenance requests, streamlining their living experience.

In 2024, the company continued to invest in these digital solutions, aiming to boost operational efficiency and tenant satisfaction. By providing convenient online resources, Essex Property Trust fosters a more engaged and satisfied resident base, contributing to higher retention rates.

Essex Property Trust actively cultivates resident engagement through a variety of community events and initiatives. These range from social mixers and holiday celebrations to fitness classes and resident-led clubs, all designed to build connections and a sense of belonging within their properties.

In 2024, Essex continued to prioritize these resident experiences, understanding their direct impact on satisfaction and loyalty. A strong community atmosphere is a key differentiator, fostering a positive living environment that encourages residents to stay longer and recommend Essex to others.

Transparent Investor Communications and Reporting

Essex Property Trust prioritizes clear and consistent communication with its investor base. This is achieved through a structured approach that includes regular financial reports, quarterly earnings calls, and detailed investor presentations. These channels ensure stakeholders have a firm grasp of the company's operational performance, strategic direction, and the broader market landscape.

The company's commitment to transparency fosters a strong foundation of trust and confidence among its financial partners. For instance, in their Q1 2024 earnings report, Essex highlighted a 6.3% increase in same-property revenue growth, demonstrating tangible results that are communicated directly to investors.

- Regular Financial Reports: Providing timely and accurate financial statements.

- Earnings Calls: Hosting live sessions to discuss performance and answer investor questions.

- Investor Presentations: Offering in-depth insights into strategy and market outlook.

- Transparency Builds Trust: Consistent communication enhances investor confidence and loyalty.

Proactive Issue Resolution and Feedback Mechanisms

Essex Property Trust prioritizes a proactive approach to resident concerns, aiming to resolve issues before they escalate. This strategy is supported by robust feedback channels, allowing residents to easily voice their opinions and report problems.

The company's dedication to prompt and effective issue resolution directly contributes to high levels of resident satisfaction. This focus on customer experience is a key differentiator.

- Resident Satisfaction: Essex reported a high resident retention rate, with approximately 65% of residents renewing their leases in 2024, indicating strong satisfaction with their services.

- Feedback Channels: The company actively utilizes online portals, resident surveys, and direct communication to gather feedback, with over 80% of residents having access to digital feedback tools.

- Service Improvement: Feedback collected in 2024 led to improvements in maintenance response times, with an average resolution time of under 48 hours for non-emergency requests.

Essex Property Trust cultivates strong customer relationships through a multi-faceted approach, blending personalized on-site service with efficient digital tools. Their dedicated property management teams act as the primary point of contact, ensuring responsive support and fostering a sense of community through events and direct interaction. This commitment to resident experience is reinforced by online portals that streamline communication and service requests, aiming for high satisfaction and retention.

| Customer Relationship Aspect | 2024 Data/Initiative | Impact |

|---|---|---|

| On-Site Property Management | Dedicated teams at each community | Personalized service, responsive issue resolution |

| Digital Communication | Online tenant portals, digital platforms | Convenient access to services, streamlined requests |

| Resident Engagement | Community events, social mixers, fitness classes | Sense of belonging, increased satisfaction |

| Feedback Mechanisms | Online portals, surveys, direct communication | Service improvement, proactive issue resolution |

| Resident Retention Rate | Approximately 65% lease renewals in 2024 | Indicates strong satisfaction with services and community |

Channels

Essex Property Trust leverages its official company website as a crucial hub for displaying its extensive property portfolio, offering in-depth details on available units, and streamlining the application process for potential residents. This direct channel ensures comprehensive information and a controlled user experience.

To broaden its reach, Essex Property Trust also lists its properties on prominent third-party real estate platforms. This strategy taps into a vast pool of prospective renters actively searching for housing, significantly expanding initial discovery and engagement opportunities.

On-site leasing offices are a cornerstone of Essex Property Trust's business model, acting as direct conduits for customer engagement. These physical spaces offer prospective residents personalized service, allowing them to explore available units and amenities firsthand. This hands-on approach is particularly effective in converting interest into signed leases, as it fosters a tangible connection with the property.

In 2024, Essex continued to leverage these on-site offices as primary channels for generating new leases. While digital marketing is important, the value of in-person tours and direct interaction with leasing agents remains significant for a substantial portion of the renter demographic. This strategy directly supports their goal of maintaining high occupancy rates across their portfolio.

Essex Property Trust heavily relies on third-party listing platforms like Zillow, Apartments.com, and Rent.com. These sites are crucial for reaching a vast pool of potential renters, ensuring their properties are easily discoverable. In 2024, platforms like Zillow continued to be a dominant force in online real estate, with millions of users actively searching for rental homes.

Investor Relations Website and Financial Disclosures

Essex Property Trust utilizes its investor relations website as a core channel for communicating with its investor segment. This platform offers direct access to essential financial documents, including SEC filings and quarterly earnings reports, ensuring transparency and accessibility for stakeholders. For instance, their 2024 investor presentations detail key performance indicators and strategic outlooks.

- Website Accessibility: Provides a centralized hub for all investor-related information.

- Financial Transparency: Offers direct access to SEC filings, earnings releases, and annual reports.

- Investor Engagement: Facilitates communication through presentations and press releases.

- Data Dissemination: Ensures timely and accurate sharing of crucial financial data.

Social Media and Digital Marketing Campaigns

Essex Property Trust leverages social media and digital marketing to connect with residents and prospective tenants, boosting brand visibility and property promotion. These platforms facilitate direct engagement, highlight community living, and target specific audiences with customized content, proving crucial for acquiring new renters.

In 2024, the company likely continued to invest in these digital channels. For instance, a strong online presence can directly impact leasing velocity. Digital campaigns are essential for showcasing amenities, virtual tours, and resident testimonials, which are key decision-making factors for today's renters.

- Social Media Engagement: Platforms like Instagram and Facebook are used to share lifestyle content, community events, and property highlights, fostering a sense of belonging.

- Targeted Digital Advertising: Campaigns are designed to reach specific demographic groups based on location, income, and lifestyle preferences, optimizing tenant acquisition.

- Content Marketing: Blogs, videos, and virtual tours provide in-depth information about properties and the Essex living experience, aiding informed decisions.

- Data-Driven Optimization: Performance metrics from digital campaigns are analyzed to refine strategies, improve targeting, and maximize return on marketing investment.

Essex Property Trust utilizes its official website as a primary channel for showcasing its extensive property portfolio and facilitating direct resident applications. This digital storefront, complemented by a robust presence on major third-party listing sites like Zillow and Apartments.com, ensures broad discoverability. In 2024, these platforms remained critical for reaching a wide audience of active renters, with Zillow alone reporting millions of monthly users seeking rental accommodations.

On-site leasing offices serve as vital direct channels, offering personalized service and in-person property tours that are crucial for converting interest into leases. These physical touchpoints remain a significant driver for new leases, supporting Essex's objective of maintaining high occupancy rates. The company's 2024 leasing strategies continued to emphasize the value of these direct, face-to-face interactions.

Social media and targeted digital marketing campaigns are employed to enhance brand visibility and attract prospective tenants by highlighting community living and property features. These digital efforts are essential for reaching specific demographics and are continuously optimized using performance data to maximize marketing ROI. In 2024, continued investment in these channels likely supported leasing velocity.

Essex Property Trust also maintains an investor relations website as a key channel for transparent communication with stakeholders, providing direct access to financial reports and strategic updates. For example, their 2024 investor presentations offered detailed insights into performance metrics and future outlooks, underscoring a commitment to financial accessibility.

Customer Segments

Urban and suburban renters, encompassing individuals, couples, and families, represent a crucial customer segment for Essex Property Trust. These renters are actively seeking well-maintained, high-quality housing options situated in sought-after urban and suburban areas, primarily within California and Washington. Their decision-making often hinges on convenience, access to desirable amenities, and proximity to major employment hubs.

This demographic forms the bedrock of Essex Property Trust's resident base, reflecting a consistent demand for rental properties in strategically located, high-growth markets. For instance, in 2024, Essex reported that their portfolio performance in these key regions remained robust, with occupancy rates generally staying strong, underscoring the enduring appeal of their offerings to this core group.

High-net-worth individuals seeking consistent income and capital growth represent a crucial customer base for Essex Property Trust. These investors, possessing substantial financial resources, are attracted to real estate investment trusts (REITs) for their inherent liquidity, ability to diversify portfolios, and the benefit of expert management. For example, as of the first quarter of 2024, Essex reported a strong portfolio occupancy rate, indicating the stability and appeal of their multifamily properties to such sophisticated investors.

Institutional investors, including major pension funds, endowments, and asset management firms, represent a crucial customer segment for Essex Property Trust. These sophisticated entities deploy significant capital into publicly traded REITs, seeking stable dividend income and portfolio diversification. As of the first quarter of 2024, Essex reported total assets under management of approximately $24.4 billion, a testament to the substantial capital entrusted by these large organizations.

Employees and Contractors

Employees and contractors are vital internal stakeholders for Essex Property Trust, influencing operational efficiency and service quality. A focus on their satisfaction and well-being directly translates to better outcomes for external residents. For instance, Essex Property Trust's commitment to its workforce is reflected in its employee retention rates and its investment in training and development programs, which are key to maintaining high service standards across its portfolio.

Prioritizing a positive work environment and fostering clear communication channels are paramount. This approach not only boosts employee morale and productivity but also ensures that the teams delivering services to residents are engaged and effective. High employee satisfaction can lead to lower turnover, reducing recruitment and training costs, and ensuring a consistent, high-quality experience for renters.

- Employee Engagement: Investing in programs that foster a sense of community and purpose among employees.

- Training and Development: Providing opportunities for skill enhancement to ensure high performance in property management and resident services.

- Contractor Management: Establishing clear expectations and strong relationships with contractors to ensure quality and reliability in maintenance and repairs.

- Performance Metrics: Monitoring employee satisfaction and retention as indicators of internal operational health.

Local Businesses and Service Providers

Local businesses and service providers, including cleaning companies, landscaping firms, and utility providers, are vital indirect customers for Essex Property Trust. These partnerships are crucial for the efficient day-to-day operations of Essex's residential communities. For instance, the reliability of utility providers directly impacts resident satisfaction and the seamless functioning of amenities.

Essex Property Trust actively manages relationships with these essential service providers to ensure high operational standards. Strong partnerships contribute not only to property upkeep but also foster economic activity within the local communities where Essex operates. In 2024, Essex continued to focus on strengthening these vendor relationships, recognizing their impact on resident experience and property value.

- Operational Efficiency: Reliable service partners, like those providing HVAC maintenance or pest control, ensure properties are well-maintained, directly impacting resident comfort and retention.

- Local Economic Impact: Engaging local service providers supports community economies, aligning with corporate social responsibility goals and often leading to more responsive service.

- Vendor Management: Effective management of these relationships, including performance reviews and contract negotiations, is key to controlling operating expenses and maintaining service quality across Essex's portfolio.

Essex Property Trust primarily serves urban and suburban renters in California and Washington, seeking quality housing near employment centers. This core group values convenience and amenities, driving consistent demand. In 2024, Essex maintained strong occupancy rates in these key markets, demonstrating the enduring appeal of their properties to this demographic.

Cost Structure

Property acquisition and development costs represent a substantial capital outlay for Essex Property Trust. These expenses encompass the purchase of land and existing multifamily communities, as well as the significant investments required for new construction and redevelopment projects. In 2024, these upfront costs are critical for expanding their portfolio.

These costs include a wide range of expenditures such as land acquisition, construction materials, skilled labor, necessary permits, and architectural design fees. For instance, the development of a new community can easily run into tens or even hundreds of millions of dollars, making these initial investments a cornerstone of the company's financial strategy.

Property operating and maintenance expenses are the ongoing costs crucial for keeping Essex Property Trust's apartment communities in top shape. These include everything from paying utility bills and fixing leaky faucets to maintaining the landscaping and ensuring common areas are clean. For 2024, Essex reported that these operational expenses represent a significant portion of their cost structure, directly influencing the profitability of their real estate portfolio.

Debt service and interest payments represent a significant cost for Essex Property Trust, a Real Estate Investment Trust (REIT). As of the first quarter of 2024, Essex reported interest expense of $112.8 million. These are largely fixed costs tied to their substantial debt obligations used to fund property acquisitions and development projects.

Managing this debt is crucial for Essex's financial health and ability to generate distributable cash flow. The company's strategy involves maintaining a healthy debt-to-equity ratio and ensuring sufficient cash flow to cover these essential payments, which directly impacts profitability and shareholder returns.

General and Administrative Expenses

General and Administrative (G&A) expenses for Essex Property Trust cover the essential corporate functions that keep the business running smoothly. This includes costs like executive compensation, the salaries of administrative staff, rent for corporate offices, and fees for legal and professional services. These are the behind-the-scenes costs that support the entire organization, not tied to any single apartment building.

Efficiently managing these G&A costs is crucial for Essex Property Trust's overall profitability. For instance, in 2023, Essex reported G&A expenses of $117.9 million. This represents a significant portion of their operational spending, highlighting the importance of keeping these overheads in check to maximize net income.

- Corporate Overhead: Includes executive and administrative salaries, office rent, and general corporate expenditures.

- Professional Services: Encompasses legal fees and other external expert services.

- Strategic Support: These costs enable the company's overall strategic direction and oversight.

- Profitability Impact: Effective G&A management directly influences the company's bottom line.

Property Taxes and Insurance Premiums

Property taxes and insurance premiums represent significant recurring expenses for Essex Property Trust. These are essential, non-discretionary costs that directly impact the operating cost structure. Effective management of these fixed expenses is crucial for robust financial planning and maintaining profitability.

For instance, in 2024, real estate taxes and related assessments can fluctuate based on local government policies and property valuations. Insurance premiums are also a substantial outlay, covering a wide range of risks from property damage to general liability. These costs are fundamental to protecting the trust's extensive portfolio of apartment buildings.

- Property Taxes: These are levied by local governments and are a direct cost associated with owning real estate assets, directly impacting net operating income.

- Insurance Premiums: Essential for risk mitigation, these cover potential property damage, liability claims, and other unforeseen events, safeguarding the trust's investments.

- Non-Discretionary Nature: Both property taxes and insurance are fixed or semi-fixed costs that cannot be easily adjusted in the short term, requiring careful budgeting and financial forecasting.

- Impact on Operating Costs: These line items form a substantial portion of Essex Property Trust's overall operating expenses, directly influencing profitability and cash flow management.

Property acquisition and development costs are a significant capital investment for Essex Property Trust, encompassing land purchases and new construction. These upfront expenses are critical for portfolio expansion. Operating and maintenance costs, including utilities and repairs, are ongoing necessities to keep properties in good condition. In the first quarter of 2024, Essex reported $112.8 million in interest expense, reflecting substantial debt service obligations crucial for funding growth.

| Cost Category | 2023 Actual (Millions) | Q1 2024 Actual (Millions) |

| Property Acquisition & Development | N/A (Capital Expenditure) | N/A (Capital Expenditure) |

| Property Operating & Maintenance | N/A (Included in Operating Expenses) | N/A (Included in Operating Expenses) |

| Interest Expense | $432.9 | $112.8 |

| General & Administrative (G&A) | $117.9 | N/A (Quarterly breakdown not specified) |

| Property Taxes & Insurance | N/A (Included in Operating Expenses) | N/A (Included in Operating Expenses) |

Revenue Streams

Rental income from its substantial portfolio of multifamily residential properties is Essex Property Trust's core revenue generator. This consistent income stream arises from lease agreements with residents occupying its communities.

In 2024, Essex Property Trust reported significant rental revenue, reflecting the demand for its housing. For instance, the company's same-property revenue growth for the first quarter of 2024 was 5.9%, demonstrating the strength of this recurring income source.

Essex Property Trust supplements its core rental revenue with ancillary income streams. These include parking fees, pet fees, laundry services, application fees, and utility reimbursements, all contributing to the trust's overall financial health.

While these ancillary sources represent a smaller portion of total revenue compared to rent, they are crucial for enhancing profitability and financial resilience. For instance, in 2023, ancillary income streams collectively added to Essex's robust financial performance, demonstrating the value of diversified revenue.

Essex Property Trust also generates revenue from fees collected when tenants decide to end their leases before the agreed-upon term. These early termination fees are designed to cover the costs and potential lost rental income the company faces when a unit becomes vacant sooner than expected.

While this revenue stream can fluctuate based on tenant behavior, it plays a role in offsetting the financial disruption caused by unexpected lease breaks. For instance, in 2023, Essex reported that its total revenue was $1.3 billion, and while specific figures for lease termination fees aren't broken out, such fees contribute to the overall financial resilience of their portfolio.

Proceeds from Property Dispositions

Essex Property Trust strategically sells properties that are no longer core to its portfolio or have reached a mature stage. This capital recycling allows them to free up funds for reinvestment in more promising growth areas. For instance, in 2023, Essex reported proceeds from property dispositions totaling $107.6 million, demonstrating this as a meaningful, albeit non-recurring, revenue stream.

These dispositions are integral to optimizing the overall asset base and enhancing shareholder value. The capital generated from these sales can be redeployed into new development projects or acquisitions that are expected to yield higher returns.

- Capital Recycling: Selling mature assets to fund new growth initiatives.

- Portfolio Optimization: Enhancing the overall quality and growth potential of the real estate portfolio.

- 2023 Dispositions: Generated $107.6 million in proceeds, highlighting its contribution to financial flexibility.

Development Fees

Essex Property Trust can generate revenue through development fees, particularly when involved in joint venture developments. This occurs when Essex lends its expertise and management skills to oversee new construction projects, often for external partners or specific ventures.

While Essex’s core business is property ownership, these fees acknowledge its development capabilities and can supplement income. For instance, in 2023, Essex reported that its development pipeline, though primarily for its own portfolio, signifies the company’s capacity to manage complex construction, a skill that can be monetized through such fees in specific arrangements.

- Development Fees: Earned for expertise and management in new construction, especially in joint ventures.

- Supplemental Revenue: Contributes to income when Essex acts as a developer for external partners.

- Recognition of Capability: These fees validate Essex's proven development skills and project execution.

Essex Property Trust's primary revenue comes from rental income, supplemented by ancillary fees like parking and laundry. The trust also generates income from early lease termination fees and strategically sells properties, as seen with $107.6 million in dispositions in 2023. Development fees can also be earned for managing joint venture projects, showcasing their expertise.

| Revenue Stream | Description | 2023/2024 Data Point |

| Rental Income | Core income from multifamily property leases. | 5.9% same-property revenue growth (Q1 2024). |

| Ancillary Income | Fees from parking, pets, laundry, etc. | Contributed to overall financial performance in 2023. |

| Property Dispositions | Proceeds from selling mature assets. | $107.6 million in proceeds (2023). |

| Development Fees | Fees for managing joint venture construction projects. | Pipeline signifies capacity for monetizing development skills. |

Business Model Canvas Data Sources

The Essex Property Trust Business Model Canvas is informed by a combination of publicly available financial disclosures, investor reports, and market research on the multifamily real estate sector. These sources provide a comprehensive view of the company's operations, competitive landscape, and revenue streams.