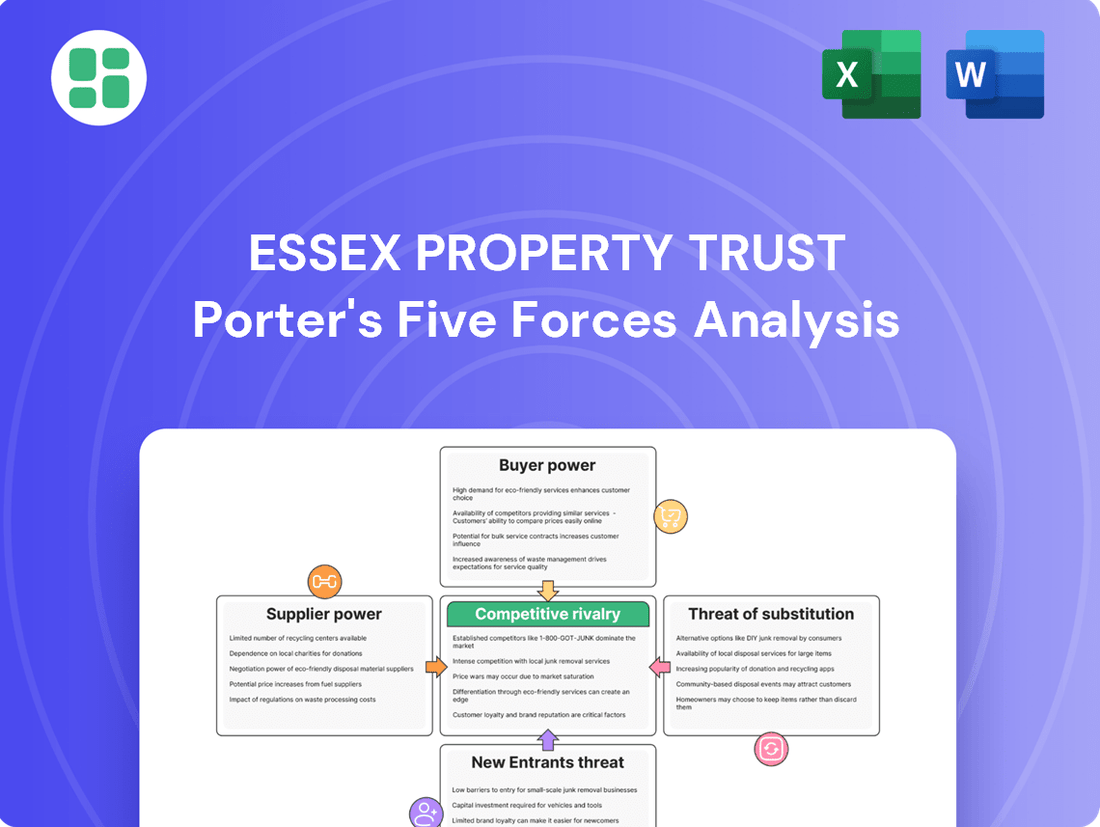

Essex Property Trust Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Essex Property Trust Bundle

Essex Property Trust operates in a dynamic real estate market shaped by several key forces. Understanding the bargaining power of buyers and suppliers, alongside the threat of new entrants and substitutes, is crucial for strategic planning. The intensity of rivalry within the apartment REIT sector also significantly impacts profitability and growth.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Essex Property Trust’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The cost of essential construction materials like lumber, steel, and concrete directly influences Essex Property Trust's (ESS) development and redevelopment expenses. While 2024 saw some easing of construction cost inflation, projections for 2025 indicate ongoing price hikes. This upward trend could be amplified by potential tariffs on imported materials, leading to increased overall project expenditures for ESS.

A shortage of skilled construction workers and property management staff, particularly in high-demand West Coast markets where Essex Property Trust operates, can significantly increase labor costs and extend project timelines. This scarcity inherently shifts bargaining power towards the labor force, potentially driving up wages and impacting operational efficiency for the company.

The limited availability and escalating cost of developable land in key West Coast urban and suburban areas, where Essex Property Trust concentrates its investments, significantly bolsters the bargaining power of landowners. This scarcity directly influences acquisition expenses and the viability of undertaking new development ventures.

In 2024, the median price for developable land in select California markets, a core region for Essex, continued its upward trajectory, with some areas experiencing year-over-year increases exceeding 10%. This trend underscores the leverage held by land sellers, directly impacting Essex's ability to secure sites at favorable terms for its growth strategies.

Technology Providers

The bargaining power of technology providers for Essex Property Trust is growing as smart home technology and sophisticated property management systems become crucial for tenant attraction and retention. Essex's reliance on these solutions to boost tenant experience and streamline operations means that providers can potentially command higher service fees. For instance, in 2023, the multifamily housing sector saw significant investment in proptech, with companies like RealPage reporting strong revenue growth, indicating increasing demand and pricing power for these essential services.

Key factors influencing this leverage include:

- Increasing demand for integrated smart home features: Tenants expect amenities like smart locks, thermostats, and lighting, driving adoption of these technologies.

- Reliance on advanced property management software: Efficient leasing, rent collection, and maintenance tracking depend heavily on specialized software.

- Limited switching costs for critical systems: While some software can be swapped, core integrated platforms can present significant disruption and cost if changed.

Utility Providers

Utility providers, often operating as regional monopolies, wield considerable bargaining power over property owners like Essex Property Trust. This inherent market structure limits Essex's ability to negotiate favorable rates for essential services such as electricity, water, and gas. Consequently, these utility costs represent a significant and often inflexible component of Essex's operating expenses.

For example, in 2024, the average residential electricity rate in California, a key market for Essex, remained elevated. Data from the U.S. Energy Information Administration indicated that California’s average retail price for electricity for residential consumers was approximately $0.29 per kilowatt-hour. This reflects the limited competitive pressure utility companies face, directly impacting Essex's cost of doing business.

- Monopolistic Structure: Utility companies typically have exclusive service territories, reducing competition and enhancing their negotiating leverage.

- Essential Services: The indispensable nature of electricity, water, and gas means property owners cannot easily substitute providers, further strengthening supplier power.

- Cost Impact: For Essex Property Trust, utility expenses are a substantial operating cost, and the inability to negotiate lower rates directly affects profitability.

The bargaining power of suppliers for Essex Property Trust is a significant factor, particularly concerning construction materials, skilled labor, and developable land. In 2024, while some construction material costs saw minor easing, projections for 2025 suggest continued price increases, exacerbated by potential tariffs on imports. Skilled labor shortages in key West Coast markets also drive up wages and extend project timelines, shifting power to workers. Furthermore, the limited availability and rising costs of land in prime locations grant landowners considerable leverage, directly impacting Essex's acquisition expenses and development viability.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Essex Property Trust (ESS) | 2024/2025 Data/Trends |

|---|---|---|---|

| Construction Materials | Tariffs, supply chain disruptions, demand fluctuations | Increased development and redevelopment costs | Projected price hikes for lumber, steel, concrete in 2025. Potential for tariffs on imported materials. |

| Skilled Labor | Shortages in high-demand markets, unionization efforts | Higher labor costs, extended project timelines, potential impact on operational efficiency | Scarcity of skilled construction and property management staff on the West Coast. |

| Developable Land | Limited availability in urban/suburban areas, zoning regulations | Higher acquisition expenses, reduced development opportunities | Median price for developable land in select California markets increased over 10% year-over-year in parts of 2024. |

| Technology Providers (Proptech) | Increasing tenant demand for smart features, reliance on integrated software | Potential for higher service fees, reliance on critical systems | Multifamily sector investment in proptech grew significantly in 2023, indicating rising demand and pricing power for these services. |

| Utility Providers | Monopolistic structure, essential nature of services | Inflexible operating expenses, limited ability to negotiate rates | Average residential electricity rates in California remained elevated in 2024, around $0.29 per kilowatt-hour. |

What is included in the product

Tailored exclusively for Essex Property Trust, this analysis dissects the competitive forces impacting its operations, including buyer bargaining power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry.

Instantly identify and mitigate competitive threats within the multifamily real estate sector, allowing Essex Property Trust to proactively adjust strategies and maintain market leadership.

Customers Bargaining Power

High housing costs on the West Coast, coupled with shifting interest rates, significantly impact tenants' choices between renting, owning, or moving. In 2024, the median home price in California, while projected for moderate increases, remains a substantial barrier to entry for many, potentially sustaining rental demand but also driving some to seek more budget-friendly locations.

Vacancy rates are a key indicator of tenant leverage. In California and Washington, while many markets remain tight, some areas are seeing a slight uptick in vacancies. For instance, certain Southern California submarkets and parts of Seattle are experiencing mild increases in available units due to new construction. This rise in supply, even if modest, offers tenants more choices and thus strengthens their bargaining position.

Tenant switching costs for Essex Property Trust are influenced by the financial and logistical hurdles of moving, including security deposits, moving expenses, and the effort involved in finding a new residence. These factors generally make tenants less inclined to switch properties, thus bolstering Essex's bargaining power. For instance, in 2024, the average cost of moving within a metropolitan area can range from $1,000 to $5,000, depending on distance and the volume of belongings.

Despite these inherent costs, the rental market is seeing a trend where landlords are offering incentives and more flexible lease agreements to retain existing tenants. This strategy aims to mitigate potential tenant churn and suggests that while switching costs exist, there's a degree of elasticity in tenant willingness to move, especially when attractive renewal offers are presented.

Market Demand vs. Supply

The bargaining power of customers, in this case tenants, is directly influenced by the interplay of market demand for multifamily housing and the availability of new supply. When demand outstrips supply, tenants have less leverage. Conversely, an increase in available units can shift power towards renters.

In 2024 and looking into 2025, the West Coast multifamily market generally sees robust demand. However, specific submarkets are experiencing significant new construction. For instance, Seattle, a key market for Essex Property Trust, is projected to see a substantial increase in multifamily units delivered. This surge in supply, estimated to be among the highest in recent years for certain submarkets, could create a temporary imbalance, potentially softening rent growth and giving tenants more negotiating power.

- Tenant Leverage: Increased new supply in key markets like Seattle in 2024-2025 can empower tenants by offering more choices and potentially leading to more favorable lease terms.

- Rent Sensitivity: A high volume of new units coming online can put downward pressure on rents, making tenants less willing to accept rent increases.

- Market Specifics: While overall West Coast demand remains strong, localized oversupply situations can significantly alter the tenant's bargaining position.

Rent Control Regulations

Rent control regulations significantly bolster the bargaining power of customers for Essex Property Trust. Existing and potential rent control measures in key operating states like California and Washington directly constrain the company's ability to adjust rental rates, effectively giving tenants more leverage. For instance, Washington's statewide rent cap, set to take effect in 2025, limits annual rent increases to 10%, a direct constraint on revenue growth potential and a clear empowerment of tenant negotiation power.

These regulations can directly impact Essex's pricing strategies and overall profitability. By limiting how much rent can be raised, tenants gain a predictable cost of living, reducing their need to accept unfavorable lease terms. This regulatory environment shifts the balance, making it harder for Essex to capitalize on market demand through aggressive rent hikes.

- Washington's rent cap, effective 2025, limits annual rent increases to 10%.

- California has various local rent control ordinances that restrict rent increases.

- These regulations reduce Essex's pricing flexibility.

- Tenant bargaining power is enhanced due to predictable rental costs.

The bargaining power of Essex Property Trust's customers, primarily tenants, is a dynamic factor influenced by market conditions and regulatory environments. While tenant switching costs and the general demand for West Coast multifamily housing offer some leverage to Essex, increasing supply in certain submarkets and stringent rent control regulations in California and Washington significantly empower tenants.

In 2024, the interplay of housing affordability and rental market dynamics continues to shape tenant decisions. For instance, while median home prices in California remain high, impacting potential buyers, the rental market in areas like Seattle is experiencing a notable influx of new units. This increased supply can lead to more competitive rental pricing and a greater ability for tenants to negotiate terms, especially when facing potential rent increases.

Furthermore, regulatory measures such as Washington's statewide rent cap, set to take effect in 2025, limiting annual rent increases to 10%, directly enhance tenant bargaining power by providing cost predictability. Similarly, various local rent control ordinances in California restrict Essex's pricing flexibility, reinforcing the tenant's position.

| Factor | Impact on Tenant Bargaining Power | Supporting Data/Context (2024-2025) |

|---|---|---|

| New Supply in Key Markets | Increases tenant choices and negotiation leverage. | Seattle submarkets projected to see significant multifamily unit deliveries, among the highest in recent years. |

| Rent Control Regulations | Limits rent increases, enhancing tenant cost predictability. | Washington's rent cap (effective 2025) limits annual increases to 10%; California has various local ordinances. |

| Tenant Switching Costs | Generally reduces tenant willingness to move, strengthening landlord leverage. | Moving costs can range from $1,000 to $5,000 within metropolitan areas. |

| Overall Demand | Strong demand typically favors landlords, but localized supply can shift power. | West Coast multifamily market generally sees robust demand, but localized oversupply creates exceptions. |

Full Version Awaits

Essex Property Trust Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Essex Property Trust, providing a detailed examination of industry competitiveness. The document you see is the exact, professionally formatted report you will receive immediately after purchase, ensuring complete transparency and immediate usability.

Rivalry Among Competitors

Essex Property Trust faces a robust competitive environment, particularly on the West Coast, where it primarily operates. The market includes major publicly traded Real Estate Investment Trusts (REITs) such as AvalonBay Communities and Equity Residential, which possess significant scale and resources.

Beyond these large players, Essex also contends with a multitude of smaller, private real estate developers and property owners. This fragmented competitive landscape, with both substantial and niche participants, demands that Essex maintain a strategic edge through differentiation and operational excellence to capture market share.

The West Coast multifamily market is characterized by a fragmented competitive landscape, meaning no single entity holds a dominant market share. Essex Property Trust, while a substantial player, actively contends with numerous other established Real Estate Investment Trusts (REITs) and local developers for market share. This dynamic directly influences pricing strategies and the array of amenities offered to attract and retain tenants.

Essex Property Trust faces stiff competition as rivals like Equity Residential and AvalonBay Communities aggressively pursue growth. These competitors are simultaneously engaged in new development projects, strategic acquisitions of existing properties, and significant redevelopment initiatives, mirroring Essex's own expansion tactics.

This parallel pursuit of growth, especially in rapidly expanding urban and suburban markets, creates a heightened competitive environment. For instance, in 2024, several major apartment REITs announced substantial development pipelines, with some exceeding $1 billion in new construction, directly competing for prime land and development opportunities that Essex also targets.

The intensified competition for both desirable properties and high-quality tenants means that pricing power and occupancy rates can be pressured. Rivals' active acquisition strategies, often involving large portfolio purchases, can also significantly alter market dynamics, forcing Essex to be highly strategic in its own property sourcing and tenant retention efforts.

Pricing Strategies & Concessions

Competitive rivalry within the multifamily real estate sector, particularly for Essex Property Trust, frequently manifests as aggressive pricing strategies and concessions. Rivals often use reduced rents, move-in specials, or waived fees to secure new tenants or prevent existing ones from leaving. This dynamic intensifies when new supply enters a market or when overall rental demand weakens.

Essex must remain acutely aware of these competitor tactics. For instance, in markets like Southern California, where new apartment deliveries can be substantial, Essex's pricing decisions are directly influenced by how aggressively its peers are discounting. A proactive approach involves continuous market analysis to understand the prevailing concession levels and to adjust Essex's own pricing and incentive structures to maintain occupancy and revenue without unduly eroding net effective rents.

- Intensified Price Competition: Rivals frequently offer rent discounts and move-in bonuses to attract and retain tenants, especially in markets with high vacancy rates or significant new construction.

- Market Monitoring is Crucial: Essex Property Trust needs to closely track competitor pricing and concession packages to ensure its own rental rates remain competitive.

- Impact of Supply and Demand: In areas experiencing increased apartment supply or softening rental demand, pricing pressure intensifies, forcing operators to be more strategic with their pricing.

- Maintaining Occupancy and Revenue: The goal is to balance competitive pricing with the need to maintain healthy occupancy levels and optimize rental income.

Differentiation and Amenities

Competitors in the multifamily real estate sector, including Essex Property Trust, actively differentiate their properties through an extensive array of amenities and services. These can range from modern smart home technology and well-equipped fitness centers to organized community events and specialized pet-friendly accommodations. For instance, many properties now offer package lockers, coworking spaces, and enhanced security features to attract and retain residents.

To maintain a competitive edge, Essex Property Trust, like its peers, must consistently invest in upgrading its properties and enhancing its service offerings. This continuous improvement is crucial for standing out in a crowded market. In 2024, the demand for premium amenities remains high, with renters often willing to pay a premium for features that improve their quality of life and convenience.

- Smart Home Integration: Many new developments and renovated units now include features like smart thermostats, keyless entry, and integrated lighting systems.

- Wellness Facilities: Access to state-of-the-art fitness centers, yoga studios, and even on-site spas is becoming a standard expectation.

- Community Engagement: Properties that foster a sense of community through resident events, social lounges, and communal workspaces tend to have higher retention rates.

- Pet-Centric Services: With a growing number of pet owners, amenities like dedicated dog parks, pet washing stations, and pet-sitting services are significant differentiators.

Essex Property Trust operates in a highly competitive multifamily market, particularly on the West Coast, facing rivals like AvalonBay Communities and Equity Residential. These major players, alongside numerous smaller private developers, vie for market share through aggressive development, acquisition, and redevelopment strategies.

This intense rivalry often leads to price competition, with concessions like rent discounts and move-in bonuses becoming common, especially in markets with high new supply or softening demand. For instance, in 2024, several large REITs announced development pipelines exceeding $1 billion, directly competing for prime locations and resources.

To stand out, Essex and its competitors focus on differentiating through enhanced amenities and services, such as smart home technology, advanced fitness facilities, and community-building events, as renters increasingly seek convenience and lifestyle improvements.

| Competitor | 2024 Development Pipeline (Est. Value) | Key Amenities Focus |

|---|---|---|

| AvalonBay Communities | $2.5 Billion+ | Smart home tech, coworking spaces, pet amenities |

| Equity Residential | $2.0 Billion+ | Wellness centers, package lockers, resident events |

| Essex Property Trust | $1.5 Billion+ | Modern finishes, fitness facilities, community lounges |

SSubstitutes Threaten

The high cost of West Coast homeownership, even with moderating price growth, still presents a significant barrier for many individuals seeking alternatives to renting. While the median home price in California remained elevated in early 2024, hovering around $800,000, this makes renting a more practical option for a larger segment of the population.

However, a projected decrease in mortgage rates, potentially falling to around 5.5% by mid-2025, could make purchasing a home more attainable. This shift might divert some renters, particularly those with stable incomes, back into the ownership market, thereby impacting demand for rental properties.

The rise of single-family rentals (SFRs) is a notable threat to multifamily apartment operators like Essex Property Trust. These homes, often found in suburban locations, cater to renters seeking more space and a distinct lifestyle, directly competing for the same tenant pool. This trend gained considerable traction in 2024, with the SFR market seeing robust demand.

For instance, the National Association of Realtors reported that the median existing single-family home price increased by 5.0% year-over-year in Q1 2024, indicating strong buyer interest which translates to rental supply. This growing availability of SFRs offers an alternative for individuals and families who might otherwise consider multifamily units, potentially fragmenting the rental market and increasing tenant acquisition costs for apartment REITs.

Co-living and micro-apartments present a growing threat of substitutes for traditional apartment rentals, particularly for younger renters and those prioritizing affordability in urban markets. These alternatives often bundle utilities and services, creating a different cost structure and value proposition compared to Essex Property Trust's offerings.

For instance, the co-living market saw significant growth, with companies like Common reporting a substantial increase in occupancy and expansion into new cities. In 2024, the demand for flexible and community-focused living arrangements continues to rise, especially in high-cost urban areas where micro-apartments can offer a more accessible entry point.

Relocation to Lower-Cost Regions

The ongoing high cost of living in key Essex Property Trust markets like California and Washington presents a threat of substitution. Residents facing affordability challenges may choose to relocate to states with lower living expenses, directly impacting the demand for rental units in Essex's portfolio. This migration trend can effectively reduce the pool of potential tenants.

For instance, data from the U.S. Census Bureau for 2023 indicated continued net outmigration from California, with many individuals citing cost of living as a primary driver. This external pressure can diminish the overall demand for housing in high-cost areas, indirectly serving as a substitute for Essex's properties by offering more affordable alternatives elsewhere.

- Relocation Impact: High living costs in California and Washington can push residents to more affordable states, reducing the tenant pool for Essex.

- Demand Reduction: This external factor acts as an indirect substitute by lowering the overall demand for housing in expensive regions.

- 2023 Migration Trends: U.S. Census data showed continued net outmigration from California in 2023, with cost of living being a major factor.

Extended-Stay Hotels/Short-Term Rentals

Extended-stay hotels and short-term rentals, like Airbnb, present a nuanced threat to Essex Property Trust. While not a direct substitute for long-term residential living for most, they cater to specific needs, offering flexibility that traditional apartment leases may not. This is particularly relevant for transient workers or individuals navigating life changes, who might opt for these options for periods ranging from a few weeks to several months. In 2024, the short-term rental market continued to expand, with platforms reporting significant growth in bookings, indicating a persistent demand for flexible accommodation solutions.

These alternatives can siphon off demand from Essex's rental pool, especially in urban markets where short-term stays are more prevalent. For instance, a company relocating employees might choose a block of extended-stay hotel rooms over individual apartment leases for a transitional period. This competitive pressure is amplified by the growing acceptance and integration of short-term rental platforms into the broader accommodation landscape.

- Market Share: While precise data for extended-stay hotels directly competing with apartment rentals is scarce, the overall short-term rental market saw an estimated 15% year-over-year growth in bookings globally through early 2025.

- Demographic Appeal: Certain demographics, such as business travelers on longer assignments or individuals between permanent residences, find these flexible options more appealing than signing a 12-month lease.

- Pricing Flexibility: Extended-stay hotels and short-term rentals often offer dynamic pricing, allowing them to adjust rates based on demand, potentially undercutting traditional apartment rental pricing for shorter, flexible commitments.

- Service Offerings: Many extended-stay options include amenities like kitchenettes and housekeeping, mimicking some aspects of apartment living while retaining a hotel service model, blurring the lines of substitution.

The threat of substitutes for Essex Property Trust is moderate, primarily influenced by the housing market's affordability and evolving consumer preferences. While homeownership remains a significant alternative, its accessibility is directly tied to mortgage rates and home prices. For instance, in early 2024, with median home prices in California around $800,000, renting was a more feasible option for many. However, projections of mortgage rates dropping to approximately 5.5% by mid-2025 could shift this balance, potentially drawing renters back to ownership.

The increasing popularity of single-family rentals (SFRs) and co-living/micro-apartments presents a more direct competitive challenge. SFRs offer an alternative lifestyle, and in Q1 2024, the median existing single-family home price rose 5.0% year-over-year, signaling robust demand that could translate into more rental supply. Co-living spaces, meanwhile, appeal to younger demographics seeking affordability and community, with companies like Common reporting strong occupancy growth in 2024.

| Substitute Type | Key Characteristics | Impact on Essex | 2024/2025 Data/Trends |

|---|---|---|---|

| Homeownership | Affordability driven by mortgage rates and home prices | Moderate; potential diversion of renters if rates fall significantly | California median home price ~ $800k (early 2024); projected mortgage rates ~5.5% (mid-2025) |

| Single-Family Rentals (SFRs) | More space, suburban lifestyle | Moderate to High; directly competes for renters | Median existing SFR price increased 5.0% YoY (Q1 2024) |

| Co-living/Micro-apartments | Affordability, flexibility, bundled services | Moderate; appeals to younger demographics in urban markets | Strong growth in co-living occupancy and expansion (2024) |

| Extended-Stay Hotels/Short-Term Rentals | Flexibility, shorter commitments | Low to Moderate; niche appeal for transient needs | Global short-term rental bookings grew ~15% YoY (early 2025) |

Entrants Threaten

The substantial capital needed to acquire land, construct new multifamily properties, and manage them effectively, particularly in expensive regions like the West Coast, presents a significant barrier. For instance, in 2024, the average cost to build a new apartment unit in major West Coast cities often exceeded $400,000, a figure that immediately deters smaller or less capitalized entrants.

The threat of new entrants for Essex Property Trust is significantly mitigated by the substantial regulatory hurdles and zoning complexities inherent in its operating markets, primarily California and Washington. Navigating these intricate laws, securing necessary permits, and adhering to a multitude of state and local regulations represent a time-consuming and capital-intensive undertaking. For instance, the average time to obtain a building permit in California can extend well over a year, with associated costs often running into tens of thousands of dollars per unit, effectively acting as a substantial barrier to entry for smaller or less capitalized competitors.

The scarcity of desirable land and existing prime properties in Essex Property Trust's target urban and suburban West Coast markets presents a significant barrier for new entrants. Acquiring suitable locations is exceptionally difficult and costly, especially in areas with high demand and limited supply. For instance, in 2024, the average price per acre for developable land in key West Coast metropolitan areas remained exceptionally high, making it prohibitive for smaller, less capitalized new entrants to compete for prime sites.

Brand Reputation and Tenant Base

Essex Property Trust benefits significantly from its strong brand reputation and a well-established tenant base, making it challenging for new entrants to compete effectively. Newcomers would face substantial hurdles in replicating Essex's operational expertise and attracting a comparable pool of reliable tenants.

Building a comparable brand and securing a large, stable tenant base requires considerable investment in marketing, property management, and tenant relations. For instance, Essex reported a robust occupancy rate of 97.2% across its portfolio as of the first quarter of 2024, highlighting the loyalty and satisfaction of its existing tenants.

- Strong Brand Recognition: Essex's reputation for quality properties and tenant services acts as a significant barrier.

- Established Tenant Base: A large, loyal tenant pool provides consistent revenue and reduces churn risk.

- High Entry Costs: New entrants must invest heavily in marketing and operational infrastructure to match Essex's market presence.

- Operational Expertise: Years of experience in property management and development create efficiencies difficult for new firms to replicate.

Operational Expertise and Scale

Successfully managing a substantial portfolio of multifamily properties demands considerable operational expertise. This includes proficiency in leasing, property maintenance, and effective community management, all of which contribute to tenant retention and property value.

Established Real Estate Investment Trusts (REITs) like Essex Property Trust leverage significant economies of scale. Their sophisticated operating platforms, built over years, offer efficiencies in procurement, technology, and staffing that are challenging for new entrants to quickly replicate, creating a substantial barrier.

For instance, in 2024, Essex Property Trust managed a portfolio of approximately 63,000 apartment homes. The sheer volume of units allows for centralized purchasing power and the implementation of advanced property management software, driving down per-unit operating costs compared to smaller, less integrated operations.

- Operational Expertise: Essex's established track record in leasing and maintenance efficiency directly impacts profitability.

- Economies of Scale: Larger portfolios enable cost savings through bulk purchasing and optimized resource allocation.

- Technology Adoption: Significant investment in property management technology enhances operational effectiveness and tenant experience.

- Brand Reputation: Years of consistent performance build a strong brand, attracting both tenants and investors.

The threat of new entrants for Essex Property Trust is largely contained due to the immense capital required for land acquisition and construction, especially in high-cost West Coast markets where building a single apartment unit can exceed $400,000 in 2024. Regulatory complexities and zoning laws in California and Washington further erect significant barriers, with permit acquisition alone potentially taking over a year and costing tens of thousands per unit. The scarcity of prime locations and the established brand loyalty that Essex enjoys, evidenced by its 97.2% occupancy rate in Q1 2024, make it exceptionally difficult for newcomers to gain traction.

| Barrier Type | Description | 2024 Impact Example |

|---|---|---|

| Capital Requirements | High costs for land and construction. | Average new apartment unit construction cost >$400,000 in West Coast cities. |

| Regulatory Hurdles | Complex zoning, permitting, and compliance. | California building permits can take over a year and cost tens of thousands per unit. |

| Land Scarcity | Limited availability of desirable locations. | High per-acre land prices in key West Coast metro areas. |

| Brand & Tenant Loyalty | Established reputation and strong tenant base. | Essex's 97.2% portfolio occupancy rate (Q1 2024). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Essex Property Trust leverages data from their annual reports, SEC filings, and investor presentations to understand internal strategies and financial health. We also incorporate industry research from reputable sources like NAREIT and real estate market analysis firms to gauge external competitive pressures and market trends.