Essential Utilities SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Essential Utilities Bundle

Essential Utilities, a leader in water and wastewater services, navigates a landscape ripe with opportunities for expansion and innovation. While its stable, regulated business model provides a strong foundation, understanding the nuances of its competitive environment and potential regulatory shifts is crucial for strategic advantage.

Want the full story behind Essential Utilities' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Essential Utilities benefits from a regulated monopoly in its water, wastewater, and natural gas services, ensuring a predictable revenue stream. This structure, with rates set by state commissions, provides stable cash flow and a reliable return on investment, making it appealing for income-focused investors. For instance, in 2023, Essential Utilities reported revenues of approximately $2.1 billion, demonstrating the scale of its operations within these regulated markets.

Essential Utilities boasts a robust, diversified utility portfolio spanning water, wastewater, and natural gas services. This multi-faceted business model significantly reduces dependency on any single utility sector, offering a crucial hedge against sector-specific regulatory shifts or demand volatility. For instance, in the first quarter of 2024, regulated utility revenues contributed approximately 90% of the company's total operating revenue, showcasing the stability derived from its regulated assets.

Essential Utilities provides services that are fundamental to daily life, including clean water, wastewater treatment, and natural gas. The demand for these essential services is largely inelastic, meaning it remains consistent regardless of economic downturns. This non-discretionary nature ensures a resilient customer base, with the company serving approximately 5 million customers across eight states as of early 2024.

Consistent Capital Investment

Essential Utilities demonstrates a consistent commitment to capital investment, regularly allocating substantial funds to maintain and enhance its extensive infrastructure. This includes significant spending on water and wastewater treatment plants, as well as the crucial pipe networks that ensure reliable service delivery.

These ongoing capital expenditure programs are vital for service reliability and directly contribute to the expansion of the company's rate base. For instance, in 2023, Essential Utilities reported capital expenditures of approximately $1.9 billion, a significant portion of which was dedicated to infrastructure improvements. This strategic investment allows the company to seek necessary rate increases, thereby supporting earnings growth and long-term asset value appreciation.

- Infrastructure Upgrades: Essential Utilities consistently invests in modernizing its water and wastewater systems.

- Rate Base Growth: Capital spending directly fuels the expansion of the company's regulated asset base.

- Service Reliability: Ongoing investments ensure the dependable delivery of essential utility services.

- Financial Health: This disciplined approach to capital expenditure supports stable earnings and shareholder returns.

Strong Geographic Footprint

Essential Utilities boasts a robust geographic footprint, serving a diverse customer base across numerous states, primarily in the Mid-Atlantic, Midwest, and Texas. This wide reach, encompassing approximately 5 million customers as of early 2024, diversifies revenue streams and insulates the company from localized economic shocks. For instance, their operations in Pennsylvania, a key state, provide a stable foundation, while expansion into growing areas like Texas offers avenues for future growth.

This extensive geographic presence translates into several key strengths:

- Diversified Customer Base: Serving millions across multiple states reduces reliance on any single region's economic health.

- Risk Mitigation: Geographic spread mitigates risks from localized regulatory changes or environmental events.

- Operational Efficiencies: Established infrastructure and experienced local teams contribute to efficient service delivery.

- Growth Opportunities: Presence in growing markets allows for organic expansion and potential acquisitions within existing service territories.

Essential Utilities' regulated monopoly status provides a predictable revenue stream, as rates are set by state commissions, ensuring stable cash flow and reliable returns. The company's diversified utility portfolio, covering water, wastewater, and natural gas, hedges against sector-specific risks. Services are fundamental and inelastic, ensuring a resilient customer base of approximately 5 million customers across eight states as of early 2024.

The company's consistent capital investment, with approximately $1.9 billion spent on infrastructure in 2023, supports service reliability and rate base growth. This strategy allows for rate increases, fostering earnings growth and asset value appreciation.

| Strength | Description | Supporting Data (as of early 2024/2023) |

|---|---|---|

| Regulated Monopoly & Stable Revenue | Predictable cash flow due to state-set rates. | 2023 Revenues: ~$2.1 billion. |

| Diversified Utility Portfolio | Reduces reliance on any single utility sector. | Regulated utility revenues ~90% of total operating revenue (Q1 2024). |

| Essential & Inelastic Services | Consistent demand regardless of economic conditions. | Serves ~5 million customers across eight states. |

| Consistent Capital Investment | Maintains and enhances infrastructure, driving rate base growth. | 2023 Capital Expenditures: ~$1.9 billion. |

| Robust Geographic Footprint | Diversifies revenue and mitigates localized risks. | Serves ~5 million customers across multiple states. |

What is included in the product

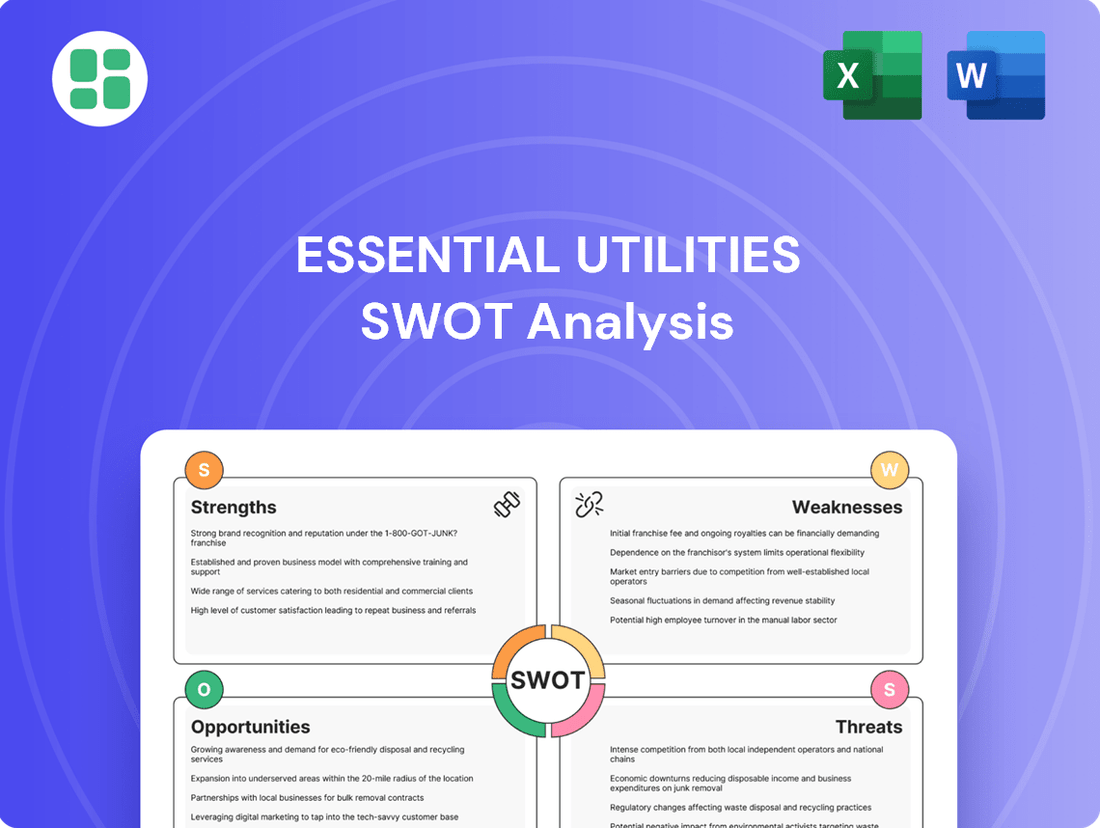

Delivers a strategic overview of Essential Utilities’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex utility challenges by clearly identifying actionable strategies for improvement.

Weaknesses

Essential Utilities faces a significant weakness in its capital-intensive operations. Maintaining and upgrading its vast water, wastewater, and natural gas networks demands substantial and ongoing capital expenditures. For instance, in 2023, the company reported capital expenditures of approximately $1.6 billion, a figure expected to continue in the coming years to support infrastructure renewal and growth projects.

This heavy reliance on capital investment can strain financial resources, often necessitating frequent access to capital markets for debt or equity financing. Such financing needs can impact the company's leverage ratios and overall financial flexibility. Furthermore, the substantial upfront and ongoing investment required for infrastructure projects can place pressure on free cash flow generation, particularly in the short to medium term, as funds are diverted to these essential, but costly, upgrades and expansions.

As a regulated utility, Essential Utilities' financial health hinges on securing approvals for rate increases and recovering capital investments. This process can be drawn-out and politically charged, potentially stifling revenue expansion or capping profitability. For instance, in 2024, the company navigated several rate case filings across its service territories, with outcomes directly influencing its ability to fund infrastructure upgrades and maintain earnings growth.

Essential Utilities faces significant headwinds due to its operation within a heavily regulated environmental landscape. The company must navigate complex rules governing water quality, wastewater discharge, and emissions from natural gas operations.

Staying compliant with these ever-changing environmental standards demands considerable investment in monitoring systems, advanced treatment technologies, and necessary infrastructure enhancements. For instance, in 2024, the EPA continued to emphasize stricter PFAS regulations, which could require substantial capital outlays for water treatment facilities across Essential Utilities' service areas.

Failure to adhere to these regulations carries the risk of substantial financial penalties, legal repercussions, and damage to its public image, presenting an ongoing operational hurdle.

Aging Infrastructure Challenges

Essential Utilities faces the pervasive challenge of aging infrastructure, a common issue across the U.S. utility sector. A significant portion of their water and wastewater systems requires ongoing maintenance, repair, and eventual replacement, leading to substantial operational costs. For instance, the American Society of Civil Engineers' 2021 report card highlighted that the U.S. drinking water infrastructure alone needs an estimated $451 billion investment over the next two decades, underscoring the scale of this problem.

This aging network presents a direct risk of service disruptions. Leaks, main breaks, and equipment failures can lead to water quality issues, service interruptions, and costly emergency repairs. These incidents not only impact operational efficiency but also directly affect customer satisfaction and trust. In 2023, Essential Utilities reported capital expenditures of approximately $1.8 billion, a portion of which is dedicated to system upgrades and replacements, reflecting the continuous investment needed to mitigate these risks.

- Aging Systems: A substantial percentage of Essential Utilities' water and wastewater pipes and treatment facilities are nearing or have surpassed their expected lifespans.

- Increased Maintenance Costs: Older infrastructure necessitates more frequent and costly repairs, diverting resources from other strategic initiatives.

- Risk of Disruptions: The probability of leaks, main breaks, and service interruptions is higher with aging assets, impacting reliability and customer experience.

- Capital Investment Needs: Modernizing these systems requires significant, long-term capital investment, potentially impacting financial flexibility.

Limited Organic Growth Potential

Essential Utilities may face challenges with organic customer growth in its existing, mature service areas. This is often due to slower population increases and less new housing development in these established territories. For instance, in 2024, many of its core utility operations serve regions with aging demographics, which naturally limits the influx of new residential customers.

Consequently, substantial revenue expansion for Essential Utilities often hinges on securing regulatory approvals for rate adjustments or gaining authorization for significant capital improvement projects. Strategic acquisitions also play a crucial role in expanding its reach and customer base, as organic customer acquisition alone can be a more gradual process.

- Mature Service Territories: Many of Essential Utilities' established operational areas exhibit slow organic customer growth due to demographic trends and limited new construction.

- Reliance on Rate Increases and Acquisitions: Significant revenue acceleration is more dependent on approved rate hikes and strategic M&A activity rather than a rapidly expanding customer base.

- Constrained Internal Expansion Pace: The inherent nature of providing essential services in mature markets can place a ceiling on the speed of internal, customer-driven expansion.

Essential Utilities' reliance on capital-intensive infrastructure is a significant weakness, demanding substantial and continuous investment. In 2023, capital expenditures neared $1.6 billion, a figure projected to persist for necessary upgrades and expansion, potentially straining financial flexibility and free cash flow.

The company's financial performance is also constrained by its regulated environment, where rate increase approvals can be slow and politically influenced, impacting its ability to recover investments and grow earnings. Navigating multiple rate cases in 2024 highlighted this dependency.

Furthermore, aging infrastructure presents a constant risk of service disruptions and necessitates increased maintenance costs. The American Society of Civil Engineers' 2021 report estimated a $451 billion need for U.S. drinking water infrastructure, a challenge Essential Utilities directly faces, with around $1.8 billion allocated to system upgrades in 2023.

Finally, mature service territories limit organic customer growth, pushing Essential Utilities to rely more heavily on rate adjustments and acquisitions for revenue expansion, as internal customer acquisition is a slower process.

Preview Before You Purchase

Essential Utilities SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed breakdown of Essential Utilities' strengths, weaknesses, opportunities, and threats is ready for immediate use. Unlock the full report to gain comprehensive strategic insights.

Opportunities

The fragmented nature of the water and wastewater utility sector, with many smaller, less efficient municipal and private systems, offers a prime opportunity for Essential Utilities to pursue strategic acquisitions. This inorganic growth path is crucial for expanding its operational reach and customer base, ultimately growing its rate base and earnings.

Investing in smart utility technologies, like advanced metering infrastructure (AMI), presents a prime opportunity. For instance, by 2025, the global smart utility market is projected to reach over $100 billion, driven by the need for efficiency. This adoption can significantly boost operational efficiency and lower costs for essential utilities.

Modernizing aging infrastructure with new materials and data-driven approaches is another key opportunity. Utilities can leverage technologies to improve asset management, aiming to reduce water loss, which can often exceed 20% in older systems. This proactive approach enhances service reliability and resource management.

Furthermore, these technological advancements empower better resource management and customer engagement. Utilities can utilize real-time data from smart grids to optimize energy distribution and water usage, leading to more sustainable operations and improved customer satisfaction.

Essential Utilities can capitalize on the growing demand for cleaner energy by investing in renewable natural gas (RNG) and hydrogen blending. This strategic move aligns with global decarbonization efforts and offers a pathway to new revenue streams beyond traditional natural gas. For instance, the RNG market is projected to grow significantly, with some estimates suggesting it could reach tens of billions of dollars annually by 2030, presenting a substantial opportunity for early movers.

By actively participating in the energy transition, Essential Utilities can enhance its environmental, social, and governance (ESG) profile. This is particularly appealing to a growing segment of investors who prioritize sustainability. Companies with strong ESG credentials often see improved access to capital and potentially lower borrowing costs, reflecting a positive market sentiment towards environmentally conscious operations.

Population Growth in Service Territories

Essential Utilities is well-positioned to benefit from population growth in its service territories. For instance, in Pennsylvania, a key state for Essential Utilities, projections indicated continued population increases in suburban and exurban areas throughout the early 2020s, driving demand for water and wastewater services. This organic expansion of its customer base offers a direct opportunity to increase revenue through higher consumption and new connections.

The company's strategic investments in infrastructure upgrades within these burgeoning regions are designed to accommodate this influx of new residents and businesses. By ensuring reliable service delivery, Essential Utilities can effectively capture this growth. For example, in 2024, the company continued its capital improvement plans, with a significant portion allocated to expanding capacity in areas experiencing notable demographic shifts.

This demographic trend translates into tangible financial opportunities:

- Increased Customer Density: Growing populations lead to more households and businesses requiring essential utility services, directly boosting customer numbers.

- Higher Revenue Potential: More customers mean greater demand for water, wastewater, and natural gas, resulting in higher sales and revenue.

- Infrastructure Utilization: Investments in expanding service to growing areas ensure that new infrastructure is utilized efficiently, maximizing return on capital.

- Market Share Expansion: By proactively serving growing communities, Essential Utilities can solidify and expand its market share against potential competitors.

Leveraging ESG Investment Trends

Essential Utilities is well-positioned to benefit from the growing investor demand for Environmental, Social, and Governance (ESG) factors. Many investors are actively seeking companies with strong sustainability practices, especially within the utility sector.

The company can leverage this by emphasizing its dedication to key ESG areas. This includes its ongoing efforts in water conservation, maintaining high standards for wastewater treatment, ensuring the safety of its natural gas pipelines, and actively engaging with the communities it serves.

Demonstrating robust ESG performance can attract a broader base of socially responsible investors. This increased investor interest can lead to a lower cost of capital for Essential Utilities, ultimately boosting long-term shareholder value.

- Investor Focus on ESG: A significant portion of institutional investors, estimated to be over 80% by some reports in late 2024, are integrating ESG criteria into their investment decisions.

- Capital Cost Advantage: Companies with strong ESG ratings have shown a tendency to experience a lower cost of debt and equity compared to their peers with weaker ESG profiles.

- Attracting Responsible Capital: Essential Utilities' commitment to water stewardship and safe operations aligns with the core values of many ESG-focused funds, potentially opening new avenues for capital.

The company can also capitalize on regulatory trends that favor infrastructure investment and modernization. Many jurisdictions are encouraging utility upgrades to improve resilience and efficiency, creating a favorable environment for Essential Utilities to seek rate increases to fund these necessary projects. For example, in 2024, several states saw regulatory bodies approve significant capital investment plans for water and wastewater systems, recognizing the critical need for upgrades.

Furthermore, the increasing focus on water scarcity and quality presents an opportunity for Essential Utilities to offer advanced water treatment and conservation solutions. As climate change impacts water availability, demand for these specialized services is expected to rise, allowing the company to diversify its revenue streams and enhance its value proposition.

The company is also positioned to benefit from the ongoing consolidation within the water and wastewater utility sector. As smaller, less efficient systems struggle to meet regulatory demands and capital needs, Essential Utilities can step in as a consolidator, acquiring these entities and integrating them into its more robust operational framework. This strategy not only expands its footprint but also allows for economies of scale and improved service delivery across a wider geographic area.

The drive towards sustainability and renewable energy sources offers a significant avenue for growth. Essential Utilities can explore opportunities in areas like biogas capture from wastewater treatment facilities or the integration of solar power for its operations, aligning with broader environmental goals and potentially unlocking new revenue streams or cost savings.

Threats

Essential Utilities, like other utility companies, faces significant risks from fluctuating interest rates. Their business model is heavily reliant on debt to fund massive infrastructure upgrades, meaning higher borrowing costs directly impact their bottom line. For instance, a sustained rise in rates could significantly increase the cost of Essential's ongoing capital expenditures, potentially straining their ability to maintain service quality and invest in future growth.

An increasingly challenging regulatory landscape, especially concerning rate approvals and environmental standards, presents a significant threat to Essential Utilities. For instance, in 2024, the utility sector faced heightened scrutiny over pricing, with some states proposing or implementing rate freezes that could impact revenue recovery. This pressure to maintain low rates makes it harder for companies like Essential Utilities to secure a fair return on essential infrastructure investments, potentially hindering future growth and modernization efforts.

Essential Utilities faces significant threats from the physical impacts of climate change. Prolonged droughts can strain its water supply operations, while severe storms pose a risk to its extensive infrastructure, potentially causing costly damage and service interruptions. For instance, the company's 2023 annual report highlighted increased capital expenditures related to weather resilience following a series of severe weather events in its service territories.

Technological Disruption & Decentralized Solutions

While regulated utilities are somewhat shielded from immediate disruption, the long-term threat of technological advancements is significant. Innovations like advanced on-site water recycling systems, distributed energy generation such as solar and microgrids, and highly efficient water-saving technologies could gradually erode demand for traditional centralized utility services.

These shifts challenge the established utility business model by offering alternatives that reduce reliance on central infrastructure. For instance, the growth in distributed solar generation, which saw a substantial increase in installations in 2024, directly impacts the demand for electricity from traditional power grids.

- Technological Disruption: On-site recycling, microgrids, and water-saving tech pose long-term demand risks.

- Distributed Energy: Solar and microgrids are reducing reliance on central gas and electricity networks.

- Model Challenge: These innovations could fundamentally alter the traditional utility revenue streams.

- Adaptation Need: Continuous monitoring and strategic adaptation are crucial for utilities to remain competitive.

Public Opposition to Rate Increases

Essential Utilities, as a provider of essential services like water and wastewater, frequently encounters public and political resistance when proposing rate adjustments. This opposition, even when tied to necessary infrastructure upgrades or increasing operational expenses, can significantly hinder financial performance. For instance, in 2023, the company faced scrutiny over rate hike requests in several states, with consumer advocacy groups actively campaigning against them.

Such strong public pushback can lead to delays or even reductions in the approved rate increases. This directly impacts Essential Utilities' financial stability and its capacity to fund critical capital improvement projects. The company's ability to maintain aging infrastructure and invest in new systems relies heavily on timely and adequate rate recovery.

To navigate this challenge, Essential Utilities must prioritize building and maintaining public trust. This involves transparent communication about the necessity of rate adjustments, clearly demonstrating the value delivered through service improvements and infrastructure investments. For example, in their 2024 investor presentations, the company highlighted specific projects funded by past rate increases, such as water main replacements in Pennsylvania, aiming to show tangible benefits to customers.

- Public Opposition Impact: Delays and reductions in rate increases can negatively affect Essential Utilities' financial health and capital investment plans.

- Regulatory Hurdles: Rate hike proposals are subject to rigorous review by state public utility commissions, where public sentiment plays a significant role.

- Communication Strategy: Proactive and transparent communication is vital for Essential Utilities to justify rate increases and garner public support for necessary infrastructure investments.

The utility sector is inherently capital-intensive, making it vulnerable to rising interest rates. Essential Utilities, like its peers, relies on debt to finance significant infrastructure upgrades. An increase in borrowing costs directly impacts profitability and the ability to fund necessary investments. For example, if benchmark rates rise by 1%, Essential Utilities' annual interest expense could increase by tens of millions of dollars, affecting its earnings per share.

Essential Utilities operates within a heavily regulated environment where rate adjustments are subject to approval by public utility commissions. These commissions often face political pressure to keep consumer costs low, which can lead to delayed or denied rate increases, impacting the company's revenue recovery and return on investment. In 2024, several states saw increased regulatory scrutiny on utility pricing, with some proposing rate freezes that could limit Essential Utilities' ability to recoup costs for essential infrastructure improvements.

Climate change presents a tangible threat through extreme weather events that can damage infrastructure and disrupt services, leading to increased repair costs and potential service interruptions. For instance, the company's 2023 capital expenditure reports noted an increase in spending allocated to weather resilience measures following a series of severe storms impacting its service areas.

Technological advancements, such as distributed generation and on-site water treatment, pose a long-term threat by potentially reducing demand for traditional centralized utility services. The growing adoption of residential solar, which saw significant growth in 2024, exemplifies how alternative solutions can lessen reliance on established utility grids.

| Threat Category | Specific Risk | Potential Impact | 2024/2025 Data/Trend |

|---|---|---|---|

| Interest Rate Volatility | Increased borrowing costs for capital expenditures | Reduced profitability, strained investment capacity | Federal Reserve interest rates remained elevated through early 2025, increasing debt servicing costs. |

| Regulatory Environment | Delayed or denied rate increases, stricter environmental standards | Lower revenue recovery, higher compliance costs | Increased public and political pressure on utility rates observed in several states during 2024. |

| Climate Change Impacts | Damage to infrastructure from extreme weather | Increased repair costs, service disruptions | Continued trend of more frequent and severe weather events impacting utility infrastructure nationwide. |

| Technological Disruption | Erosion of demand for traditional services | Reduced revenue streams, need for business model adaptation | Growing consumer interest and adoption of distributed energy resources and water-saving technologies. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Essential Utilities' official financial filings, comprehensive market research reports, and expert analyses of the utility sector's competitive landscape.