Essential Utilities PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Essential Utilities Bundle

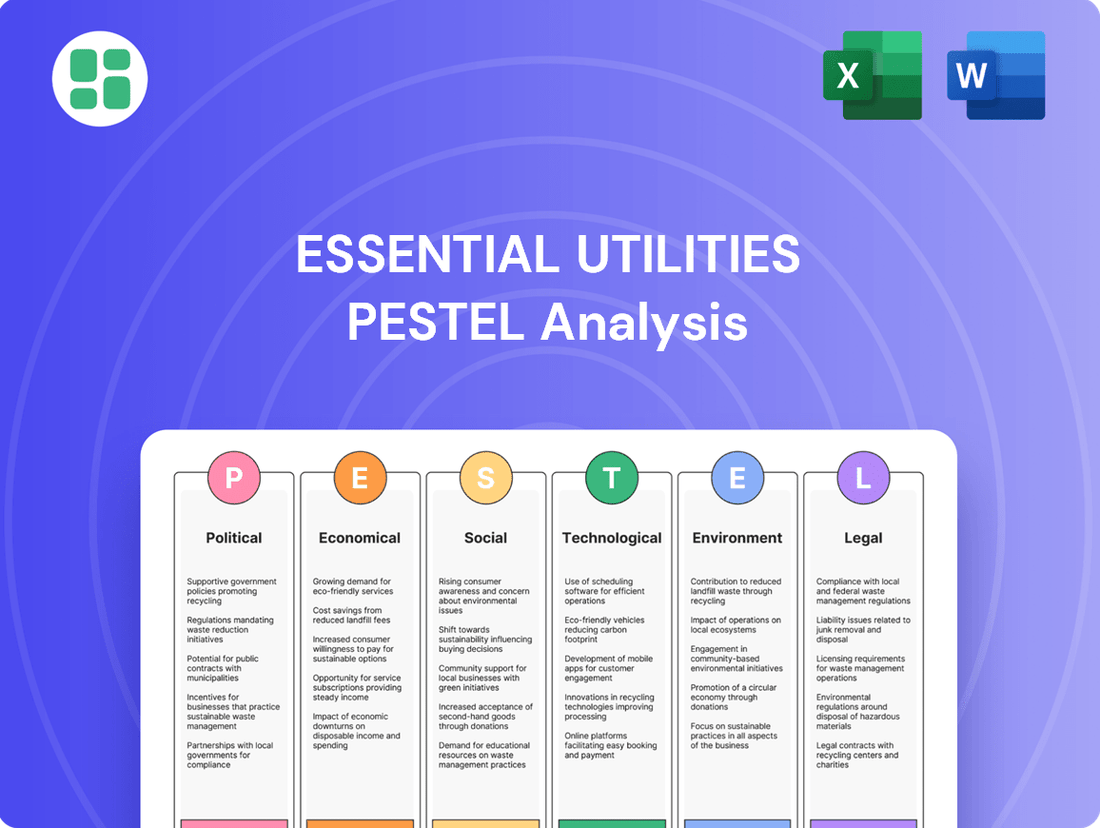

Navigate the complex external landscape impacting Essential Utilities with our comprehensive PESTLE Analysis. Understand the critical political, economic, social, technological, legal, and environmental factors shaping their operations and future growth. Equip yourself with the strategic intelligence needed to make informed decisions and gain a competitive advantage. Download the full analysis now for actionable insights.

Political factors

Essential Utilities navigates a landscape shaped by stringent regulatory oversight, primarily from state public utility commissions. These bodies hold significant sway over the company's ability to adjust rates and maintain service standards. For instance, the approval of rate increases, such as those secured in Pennsylvania, directly fuels Essential Utilities' revenue streams and its capacity to invest in critical infrastructure upgrades.

The financial health and strategic investment plans of Essential Utilities are intrinsically linked to regulatory outcomes. Favorable decisions, like the 2023 rate increase in Pennsylvania which added $108 million to annual revenues, are vital. However, protracted rate case proceedings or adverse rulings can create financial headwinds, potentially delaying or altering the company's capital expenditure timelines.

Government initiatives, like the Bipartisan Infrastructure Law enacted in 2021, are injecting substantial capital into the nation's water and wastewater systems. This legislation allocates over $55 billion for water infrastructure improvements, creating significant funding avenues for companies like Essential Utilities. These investments are crucial for modernizing aging systems and bolstering resilience against environmental stressors.

Changes in federal and state environmental policies, especially concerning water quality, emissions, and climate change, significantly affect utility operations and compliance expenses. For instance, the EPA's recent final rules targeting the utility sector, which include more stringent wastewater discharge limits and greenhouse gas emission controls, are driving a need for ongoing adaptation and investment in cutting-edge technologies.

Political Stability and Public Opinion

Essential Utilities, operating across diverse regions, faces varying degrees of political stability which directly impacts its long-term investment outlook and the predictability of its regulatory environment. For instance, in 2024, the United States, a key operational area, maintained a generally stable political landscape, though upcoming elections in late 2024 could introduce shifts in regulatory priorities. This stability is crucial for the capital-intensive nature of utility infrastructure development.

Public sentiment plays a significant role in shaping utility policy. In 2024, consumer focus on utility affordability and environmental impact intensified, particularly in states like Pennsylvania and Texas where Essential Utilities has substantial operations. For example, public utility commission proceedings often consider customer affordability when approving rate increases. This public opinion directly influences legislative actions and regulatory decisions, making community engagement a critical component of Essential Utilities' strategy.

- Political Stability: Essential Utilities operates in regions with generally stable political frameworks, crucial for long-term infrastructure investment.

- Public Opinion Influence: Consumer concerns regarding affordability and environmental practices are increasingly shaping regulatory decisions in 2024.

- Community Engagement: Maintaining a positive public image and actively engaging with communities are vital for Essential Utilities' social license to operate.

Acquisition and Expansion Policies

Government policies and regulatory frameworks are pivotal for Essential Utilities' expansion. These policies dictate the ease and cost of acquiring smaller water and wastewater systems, a core part of their growth strategy. Supportive legislation, such as reforms to fair market value statutes, can significantly streamline these transactions, making regionalization efforts more feasible.

In 2024, the utility sector continued to see a trend towards consolidation, driven in part by regulatory environments that encourage or at least do not hinder mergers and acquisitions. For Essential Utilities, this means that favorable acquisition policies directly translate into opportunities to expand their service footprint and achieve economies of scale. For example, states that have updated their regulations to better reflect the fair market value of utility assets can make acquisition targets more attractive and financially viable.

The company's strategy often involves integrating smaller, less efficient systems into their larger, more robust operational network. This process is heavily influenced by state-level public utility commissions (PUCs) and their approval processes for mergers. Essential Utilities' success in 2024 and into 2025 will depend on navigating these regulatory landscapes effectively, with policies that promote regionalization and system modernization being particularly beneficial.

Key aspects of acquisition and expansion policies impacting Essential Utilities include:

- State regulatory approval processes for utility mergers and acquisitions.

- Legislation impacting the valuation of acquired water and wastewater assets.

- Policies encouraging regionalization and consolidation of smaller utility systems.

- Federal funding initiatives that may incentivize system upgrades post-acquisition.

Government policies and regulatory frameworks are pivotal for Essential Utilities' expansion, dictating the ease and cost of acquiring smaller water and wastewater systems. Supportive legislation, such as reforms to fair market value statutes, can significantly streamline these transactions, making regionalization efforts more feasible. In 2024, the utility sector continued to see a trend towards consolidation, driven in part by regulatory environments that encourage or at least do not hinder mergers and acquisitions.

Favorable acquisition policies directly translate into opportunities for Essential Utilities to expand their service footprint and achieve economies of scale. For example, states that have updated their regulations to better reflect the fair market value of utility assets can make acquisition targets more attractive and financially viable. Essential Utilities' success in 2024 and into 2025 will depend on navigating these regulatory landscapes effectively, with policies that promote regionalization and system modernization being particularly beneficial.

| Policy Area | Impact on Essential Utilities | 2024/2025 Relevance |

|---|---|---|

| Merger & Acquisition Approval | Streamlines or hinders system consolidation | Key for expanding service footprint and achieving economies of scale |

| Asset Valuation Legislation | Affects the financial attractiveness of acquisition targets | Updated statutes can make acquisitions more viable |

| Regionalization Policies | Encourages integration of smaller utility systems | Supports the company's core growth strategy |

| Federal Infrastructure Funding | Provides capital for system upgrades post-acquisition | Incentivizes investment in modernized infrastructure |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Essential Utilities, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic planning by identifying key trends and potential challenges within these areas.

A clear, actionable summary of Essential Utilities' PESTLE factors, designed to proactively identify and mitigate external threats before they impact operations.

Economic factors

Interest rate fluctuations significantly influence Essential Utilities' capital costs. As of early 2025, with benchmark rates hovering around 4.5% to 5.5%, the cost of borrowing for Essential Utilities' extensive capital expenditure programs, which often exceed $1 billion annually, is directly impacted. Higher rates translate to increased interest expenses on new debt issuances, potentially squeezing profit margins and making ambitious infrastructure upgrades more financially challenging.

The company's reliance on issuing senior notes to fund operations and growth means that changes in the Federal Reserve's monetary policy and broader market yields have a tangible effect. For instance, if interest rates were to climb to 6% by late 2025, the cost of financing a new $500 million bond issuance could increase by approximately $2.5 million annually in interest payments alone, directly impacting the company's bottom line and its ability to reinvest in critical infrastructure.

Inflationary pressures directly impact Essential Utilities by escalating the costs of crucial inputs like materials, labor, and energy. For instance, the Producer Price Index (PPI) for utilities' construction materials saw a notable increase in early 2024, reflecting these rising expenses. This surge in operating and maintenance costs necessitates careful financial management.

To counter these elevated expenses and maintain profitability, Essential Utilities commonly pursues regulatory rate adjustments. These adjustments are vital for recovering the increased costs associated with providing essential services. In 2024, several state utility commissions approved rate increases for Essential Utilities, citing inflationary impacts on their operational budgets.

The economic vitality of Essential Utilities' service areas is a key driver of customer demand. Strong economic growth, marked by rising employment and increased disposable income, typically boosts the need for water, wastewater, and natural gas services. For instance, in 2023, the U.S. GDP grew by 2.5%, indicating a generally healthy economic environment that supports utility consumption.

Population expansion and industrial development directly translate to higher demand for essential utility services. Essential Utilities' reach to roughly 5.5 million people across nine states means that regional economic trends, including migration patterns and new business formations, significantly impact their customer base. Areas experiencing robust population growth, such as parts of Texas and Florida where Essential Utilities operates, often see a corresponding increase in utility usage.

Conversely, economic slowdowns or recessions can lead to reduced demand as businesses scale back operations and households face financial pressures. While essential services are generally resilient, periods of high unemployment or declining industrial output can temper consumption levels. The stability of these regional economies is therefore crucial for forecasting and managing service demand effectively.

Capital Expenditure Requirements

The utility sector, by its very nature, demands substantial and ongoing capital expenditures to maintain and enhance its aging infrastructure. Essential Utilities is a prime example, projecting an investment of around $7.8 billion between 2025 and 2029. This considerable outlay is critical for ensuring reliable service delivery and meeting stringent regulatory standards.

These significant capital requirements directly impact a utility's financial health and operational strategy. The company’s ability to fund these projects, often through a mix of debt and equity, is a key consideration for investors and stakeholders.

- Infrastructure Investment: Essential Utilities plans to spend approximately $7.8 billion from 2025 to 2029 on system improvements.

- Reliability and Compliance: These capital expenditures are vital for maintaining service reliability and adhering to regulatory mandates.

- Capital Intensity: The utility industry is inherently capital-intensive, requiring continuous investment in its physical assets.

Energy Commodity Price Volatility

Energy commodity price volatility, particularly for natural gas, directly impacts utilities. For Essential Utilities' regulated natural gas segment, fluctuations in purchased gas costs are a significant operating expense. While typically passed through to customers via rate adjustments, sharp price swings can create billing shocks and affect customer affordability perceptions.

For instance, the average price of natural gas at Henry Hub, a key benchmark, saw considerable movement throughout 2023 and into early 2024. While specific figures for 2025 are still unfolding, historical data shows potential for double-digit percentage changes within short periods. This volatility necessitates robust hedging strategies and clear communication with customers regarding potential bill impacts.

- Impact on Purchased Gas Costs: Volatile natural gas prices directly increase or decrease operating expenses for utilities like Essential Utilities.

- Customer Affordability Concerns: Even with pass-through mechanisms, rapid price increases can strain household budgets and lead to negative customer sentiment.

- Regulatory Scrutiny: Significant price spikes can invite regulatory review of utility pricing and cost recovery practices.

- Hedging Strategy Importance: Effective financial instruments are crucial to mitigate the financial impact of extreme price swings in the energy markets.

Economic factors significantly shape Essential Utilities' operating environment, influencing everything from borrowing costs to customer demand. Interest rate changes directly affect the company's ability to finance its substantial infrastructure investments, with projected capital expenditures between 2025 and 2029 totaling approximately $7.8 billion. Inflationary pressures also play a critical role, increasing the cost of materials, labor, and energy, which in turn can necessitate regulatory rate adjustments to maintain profitability.

The economic health of the regions Essential Utilities serves is paramount, as GDP growth and employment levels directly correlate with demand for water, wastewater, and natural gas services. For instance, the U.S. GDP growth of 2.5% in 2023 supported utility consumption, and continued economic vitality in states like Texas and Florida, where the company operates, is crucial for consistent demand from its 5.5 million customers.

Volatility in energy commodity prices, especially natural gas, presents another key economic challenge. While mechanisms exist to pass these costs onto consumers, rapid price increases can impact customer affordability and lead to negative sentiment, underscoring the importance of effective hedging strategies and transparent communication.

| Economic Factor | Impact on Essential Utilities | Relevant Data/Trend (2024-2025) |

|---|---|---|

| Interest Rates | Cost of borrowing for capital expenditures; affects profitability. | Benchmark rates anticipated between 4.5%-5.5% in early 2025, with potential to rise. |

| Inflation | Increases operating costs (materials, labor, energy); may necessitate rate increases. | Producer Price Index for utilities' construction materials showed increases in early 2024. |

| Economic Growth (GDP) | Drives demand for utility services; impacts customer base expansion. | U.S. GDP grew 2.5% in 2023; continued regional growth supports demand. |

| Energy Commodity Prices (Natural Gas) | Affects purchased gas costs and customer bills; necessitates hedging. | Natural gas prices at Henry Hub experienced significant fluctuations throughout 2023-early 2024. |

What You See Is What You Get

Essential Utilities PESTLE Analysis

The preview you are seeing is the exact Essential Utilities PESTLE Analysis document you will receive after purchase. It is fully formatted and professionally structured, providing a comprehensive overview of the external factors impacting the utilities sector. You can be confident that what you see is precisely what you'll be working with.

Sociological factors

Essential Utilities, like many utility providers, sees its demand directly tied to population shifts. For example, in 2024, the U.S. population is projected to reach over 336 million, with continued growth expected in suburban and exurban areas where utility infrastructure is often expanded. This demographic trend means more households and businesses requiring water, wastewater, and natural gas services.

The company's revenue growth is often fueled by this expanding customer base. Essential Utilities has actively pursued acquisitions to bolster its presence, adding to its organic growth. In 2023, the company reported a significant increase in its customer count, underscoring how population density changes and new development in its service territories translate into tangible revenue expansion.

Customers today expect more than just basic utility provision; they demand high-quality, dependable, and reasonably priced services. This means essential utilities like Essential Utilities must focus on reliability and affordability to meet these evolving demands.

Essential Utilities is actively investing in its infrastructure and technology to ensure it meets and often surpasses regulatory standards. For instance, in 2024, the company allocated significant capital to upgrade its water and wastewater systems, aiming to improve service reliability and reduce water loss, which directly impacts customer satisfaction and operational efficiency.

Public perception of service quality is a critical factor in maintaining customer trust and satisfaction. A strong reputation for consistent service delivery and responsiveness to customer needs can significantly influence brand loyalty and regulatory standing, as evidenced by customer satisfaction scores that Essential Utilities monitors closely.

Essential Utilities actively cultivates community trust through robust Corporate Social Responsibility (CSR) initiatives. In 2023, the company reported dedicating over $10 million to community support, encompassing charitable contributions and sponsorships. This engagement is crucial for maintaining a positive public image and fostering strong relationships with the local populations it serves.

The company's commitment extends to empowering its employees to contribute through volunteer programs. In 2023, Essential Utilities employees logged more than 25,000 volunteer hours, supporting various local causes and reinforcing the company's embeddedness within its operating communities. This visible commitment to social well-being directly impacts stakeholder perception and can mitigate regulatory scrutiny.

Workforce Availability and Labor Relations

Workforce availability and labor relations are critical for Essential Utilities' ongoing success, particularly in maintaining and expanding its vital infrastructure. The company recognizes that a skilled and dedicated workforce is the backbone of reliable water, wastewater, and natural gas services. In 2024, Essential Utilities continued its focus on attracting and retaining talent, understanding that a stable labor pool directly impacts operational efficiency and project execution.

Effective labor relations are paramount for ensuring smooth operations and preventing disruptions. Essential Utilities strives to be a premier employer, fostering positive relationships with its employees and their representatives. This commitment is essential for managing complex infrastructure projects and maintaining the high standards expected by customers. For instance, in 2024, the company reported progress in its employee engagement initiatives, aiming to reduce turnover and enhance productivity across its service territories.

- Skilled Workforce: Essential Utilities relies on a diverse range of skilled professionals, from engineers and technicians to field crews, to manage its extensive network.

- Labor Relations: Maintaining constructive dialogue and collaborative agreements with labor unions is key to operational stability.

- Employee Engagement: Initiatives aimed at improving employee satisfaction and retention were a priority in 2024, supporting the goal of being a premier employer.

- Infrastructure Projects: A consistent and available workforce is crucial for the timely and efficient completion of critical infrastructure upgrades and expansions.

Public Health and Safety Concerns

Public health and safety are foundational to essential utilities, with a strong focus on ensuring the quality of drinking water, effective wastewater treatment, and the secure delivery of natural gas. These concerns directly influence consumer trust and regulatory oversight.

Growing public awareness and anxiety over issues like PFAS contamination in water supplies and the integrity of aging gas pipelines are prompting substantial investments in infrastructure upgrades and stricter operational standards. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) finalized national primary drinking water regulations for six PFAS chemicals, setting enforceable limits and requiring public water systems to monitor and reduce these contaminants.

- Water Quality: Public concern over contaminants like lead and PFAS is driving significant capital expenditures for water system upgrades.

- Wastewater Treatment: Ensuring the safe discharge of treated wastewater is critical to preventing environmental pollution and protecting public health.

- Gas System Integrity: Incidents involving gas leaks or explosions heighten public scrutiny and necessitate ongoing investment in pipeline maintenance and modernization.

- Regulatory Impact: Stricter regulations, often in response to public safety concerns, directly impact utility operational costs and investment strategies.

Societal expectations for utility providers are evolving, with a growing emphasis on environmental stewardship and corporate responsibility. Customers and communities increasingly scrutinize how companies like Essential Utilities manage their environmental impact, from water conservation to emissions reduction.

This societal shift is driving demand for sustainable practices and transparency. In 2024, Essential Utilities continued to invest in renewable energy sources and water efficiency programs, reflecting a commitment to meeting these evolving public expectations and enhancing its social license to operate.

Technological factors

The increasing adoption of smart grid and smart meter technologies is fundamentally reshaping the utilities sector. For instance, by 2024, it's estimated that over 80% of US households will have smart meters installed, a significant leap from just over 50% in 2020, according to industry reports. This technological shift directly translates to enhanced operational efficiency for utility providers, enabling real-time monitoring of consumption and infrastructure health.

These advancements are crucial for improving leak detection in water systems and optimizing demand management for both water and natural gas. Predictive maintenance, powered by the data streams from smart meters, allows utilities to anticipate and address potential issues before they escalate, reducing costly outages and service disruptions.

The ability to analyze granular usage data in real-time also empowers utilities to implement more dynamic pricing strategies and better balance supply with fluctuating demand, especially as renewable energy integration increases. This data-driven approach is becoming a cornerstone of modern utility operations, driving both cost savings and improved customer service.

Innovations in water treatment, especially for emerging contaminants like PFAS, are vital for Essential Utilities to meet stricter water quality standards and safeguard public health. For instance, the EPA's proposed MCLs for PFAS, expected to be finalized in 2024, will necessitate significant investment in advanced treatment methods.

Essential Utilities' commitment to infrastructure modernization includes adopting these advanced solutions. The company's 2023 capital expenditures, totaling $1.8 billion, reflect a strategic focus on upgrading treatment facilities and distribution networks to handle new challenges and ensure compliance with anticipated regulations.

Digital transformation is a major technological driver for essential utilities. The integration of artificial intelligence, machine learning, and advanced data analytics is revolutionizing how utilities manage their assets, distribute energy, and interact with customers. For instance, by 2024, utilities are increasingly leveraging AI for predictive maintenance, aiming to reduce costly outages and extend the lifespan of critical infrastructure.

These technological advancements translate directly into operational efficiencies. Utilities are using real-time data to optimize grid performance, reducing energy loss during transmission and distribution. By 2025, we expect to see a significant uptick in the adoption of smart grid technologies, with investments in digital infrastructure projected to reach billions globally, enhancing reliability and responsiveness.

Improved customer service is another key benefit. Digital platforms and data analytics allow utilities to offer more personalized services, better manage billing inquiries, and provide customers with greater control over their energy consumption. The use of AI-powered chatbots, for example, is becoming commonplace, handling a significant volume of customer interactions efficiently.

Cybersecurity and Data Protection

The increasing reliance of essential utilities on interconnected digital systems amplifies cybersecurity risks, posing a significant threat to critical infrastructure. Protecting operational technology (OT) and sensitive customer data from sophisticated cyber threats is no longer just a technical challenge but a fundamental requirement for maintaining service reliability and public trust.

Cyberattacks on utilities can have cascading effects, disrupting power grids, water supplies, and communication networks. For instance, the Colonial Pipeline attack in 2021, which disrupted fuel supplies along the U.S. East Coast, highlighted the vulnerability of critical infrastructure. In 2024, the U.S. Department of Homeland Security's Cybersecurity and Infrastructure Security Agency (CISA) reported a 70% increase in ransomware attacks targeting critical infrastructure sectors compared to 2023, with utilities being a prime target.

- Growing Threat Landscape: Utilities face an escalating number of sophisticated cyber threats, including ransomware, phishing, and state-sponsored attacks, aiming to disrupt operations or steal data.

- Regulatory Scrutiny: Governments worldwide are implementing stricter regulations for cybersecurity in the utility sector, with significant fines for non-compliance. For example, the North American Electric Reliability Corporation (NERC) CIP standards are continually updated to address emerging threats.

- Investment in Defense: Utilities are significantly increasing their investments in cybersecurity solutions, with global spending on utility cybersecurity projected to reach $25 billion by 2027, up from an estimated $15 billion in 2023, according to industry analysis.

- Data Protection Mandates: Protecting customer data, including billing information and usage patterns, is crucial. Data breaches can lead to severe reputational damage and legal liabilities, prompting utilities to adopt advanced encryption and access control measures.

Infrastructure Monitoring and Predictive Maintenance

Technological advancements, particularly in infrastructure monitoring, are transforming how utilities operate. The integration of Internet of Things (IoT) sensors and sophisticated data analytics allows for real-time tracking of critical infrastructure like water mains and gas pipelines. For instance, by 2024, many utilities are investing heavily in smart grid technologies, with global spending expected to reach over $30 billion, according to various industry reports.

This proactive approach enables predictive maintenance, a significant shift from reactive repairs. By identifying potential issues before they escalate, utilities can prevent costly failures and minimize service disruptions for customers. This is crucial for maintaining public trust and operational efficiency. For example, predictive maintenance programs have shown to reduce unexpected failures by up to 25% in some sectors.

Digital twins, virtual replicas of physical assets, are also playing a key role. These models allow for simulations and scenario planning, further enhancing the ability to anticipate and mitigate risks. This technology is becoming increasingly vital for managing complex utility networks. The market for digital twins in utilities was projected to grow by over 30% annually leading up to 2025.

- IoT Sensors: Enabling real-time data collection on pipeline integrity and flow rates.

- Predictive Maintenance: Reducing unplanned outages and maintenance costs by up to 25%.

- Digital Twins: Providing virtual environments for stress testing and operational optimization.

- Smart Grid Investment: Global spending on smart grid technologies exceeding $30 billion by 2024.

The integration of advanced technologies like AI and IoT is revolutionizing utility operations, driving efficiency and customer service improvements. By 2025, global investment in smart grid technologies is projected to exceed $30 billion, reflecting a strong industry push towards digital transformation for enhanced grid performance and reduced energy loss.

Predictive maintenance, powered by real-time data from IoT sensors and digital twins, is becoming standard practice. This proactive approach, which can reduce unexpected failures by up to 25%, allows utilities to anticipate and address infrastructure issues before they cause disruptions, thereby minimizing downtime and operational costs.

The increasing reliance on digital systems also heightens cybersecurity risks, with ransomware attacks on critical infrastructure up by 70% in 2024 compared to the previous year. Utilities are responding by significantly boosting cybersecurity spending, projected to reach $25 billion by 2027, to protect sensitive data and ensure service continuity.

| Technology Area | Key Advancement | Impact on Utilities | 2024/2025 Data/Projection |

|---|---|---|---|

| Smart Grid & Meters | Real-time monitoring, demand management | Enhanced operational efficiency, reduced energy loss | Over 80% of US households with smart meters by 2024 |

| Water Treatment | Advanced methods for contaminants (e.g., PFAS) | Compliance with stricter regulations, public health protection | EPA's proposed PFAS MCLs expected in 2024 |

| AI & Data Analytics | Predictive maintenance, asset management | Reduced outages, extended infrastructure lifespan, optimized operations | AI adoption for predictive maintenance increasing |

| Cybersecurity | Advanced defense systems, data protection | Mitigation of sophisticated threats, protection of critical infrastructure and customer data | Cyberattacks on utilities up 70% in 2024; Global cybersecurity spending projected to reach $25B by 2027 |

Legal factors

Essential Utilities navigates a stringent regulatory landscape governed by environmental compliance laws. Key among these are the Clean Water Act, which dictates wastewater discharge standards, and various air quality regulations impacting emissions. These frameworks necessitate continuous monitoring and investment to ensure adherence.

Recent regulatory developments, such as the EPA's proposed rules on wastewater treatment for utilities and greenhouse gas emission reductions, present evolving compliance challenges. For instance, the EPA's 2024 focus on PFAS in wastewater treatment highlights the need for advanced technological solutions and capital expenditure to meet stricter discharge limits.

Rate-setting regulations, overseen by state public utility commissions (PUCs), directly shape essential utilities' revenue and profitability. These bodies approve the rates customers pay, impacting how much money companies can collect to cover operating costs and invest in infrastructure. For instance, in 2024, PUCs across the US continued to review and approve rate cases for major utilities, with some seeing approved rate increases averaging around 5-8% to account for inflation and capital expenditures.

Successfully navigating these intricate regulatory frameworks and securing timely rate approvals are paramount for financial stability. Delays in rate case decisions can hinder a utility's ability to fund crucial infrastructure upgrades, such as grid modernization or renewable energy integration, potentially impacting service reliability and future growth. For example, a prolonged rate case in Texas during 2023 led to a temporary slowdown in a utility's planned smart meter deployment.

Health and safety regulations are paramount for essential utilities, particularly in water, wastewater, and natural gas operations. These rules are designed to safeguard employees and the general public. For instance, the Pipeline and Hazardous Materials Safety Administration (PHMSA) in the U.S. enforces stringent standards for natural gas pipeline integrity, with significant investments made annually in safety upgrades and maintenance. In 2023, PHMSA reported over 2.5 million miles of gas transmission and distribution pipelines requiring oversight.

Compliance with these mandates, covering areas like water quality standards set by the Environmental Protection Agency (EPA) and pipeline safety protocols, is a constant operational necessity. The EPA's Safe Drinking Water Act, for example, mandates rigorous testing and reporting to ensure public health. Utilities must invest heavily in monitoring systems and training to meet these non-negotiable requirements, with compliance costs often running into billions of dollars across the sector annually.

Data Privacy Laws

The increasing digitalization of essential utilities, from smart grids to online billing, necessitates strict adherence to evolving data privacy laws. Companies are legally obligated to safeguard sensitive customer information, including usage patterns, personal identifiers, and payment details. Failure to comply can result in significant fines and reputational damage, making robust data security protocols a critical operational requirement.

In 2024, regulatory bodies worldwide continue to strengthen data privacy frameworks. For instance, the European Union's General Data Protection Regulation (GDPR) imposes stringent rules on how personal data is collected, processed, and stored, with potential fines reaching up to 4% of global annual turnover for breaches. Similarly, the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), grant consumers more control over their personal information, impacting how utility providers manage customer data.

- GDPR Fines: Potential penalties can reach 4% of global annual turnover for non-compliance.

- CCPA/CPRA Impact: Increased consumer rights regarding personal data access and deletion.

- Data Breach Costs: The average cost of a data breach in the utility sector was estimated at $4.6 million in 2023 according to IBM's Cost of a Data Breach Report.

- Cybersecurity Investments: Utilities are increasingly investing in advanced cybersecurity measures to meet compliance and protect critical infrastructure.

Acquisition and Antitrust Laws

Essential Utilities' growth strategy hinges on acquisitions, making compliance with stringent antitrust laws a critical legal factor. Navigating these regulations, which aim to prevent monopolies and ensure fair market competition, requires careful planning and significant legal resources. For instance, the U.S. Department of Justice and the Federal Trade Commission scrutinize mergers and acquisitions to assess their potential impact on competition.

Securing regulatory approvals for these transactions is paramount, and the process can be lengthy and complex. Delays or outright rejection can significantly impede Essential Utilities' expansion plans and integration timelines. In 2024, the pace of regulatory review for major utility mergers has remained a key consideration for companies like Essential Utilities, with agencies often demanding concessions or divestitures.

- Antitrust Compliance: Essential Utilities must adhere to regulations like the Clayton Act and Sherman Act in the U.S. to ensure acquisitions do not stifle competition.

- Regulatory Approvals: Obtaining consent from bodies such as state Public Utility Commissions (PUCs) and federal agencies is a mandatory step for utility mergers.

- Integration Challenges: Legal hurdles and approval processes can introduce significant uncertainty and delays into the post-acquisition integration phase.

- Market Concentration Scrutiny: Regulators closely examine the potential for increased market concentration and its impact on consumer prices and service quality.

Legal factors significantly shape essential utilities' operations, from environmental compliance to data privacy. Adherence to regulations like the Clean Water Act and EPA standards is non-negotiable, requiring substantial investment in monitoring and upgrades. State Public Utility Commissions (PUCs) play a crucial role in rate setting, directly impacting revenue and the ability to fund infrastructure projects, with average approved rate increases hovering around 5-8% in 2024.

Environmental factors

Increasing water scarcity, particularly in regions like the Southwestern United States, poses a significant challenge for utilities. For Essential Utilities, this means a heightened focus on efficient water resource management and conservation. For instance, in 2023, the company reported investing $300 million in infrastructure upgrades aimed at improving water efficiency and reducing losses across its service territories, demonstrating a commitment to long-term supply reliability.

Climate change poses significant risks to Essential Utilities, with extreme weather events like droughts and floods directly threatening water and wastewater infrastructure. For instance, the increasing frequency of severe storms in 2024 and projected for 2025 necessitates substantial investment in hardening systems against disruptions.

To ensure reliable service, Essential Utilities must prioritize climate-resilient infrastructure upgrades and adaptation strategies. This includes reinforcing pipelines, improving flood defenses for treatment plants, and developing drought management plans, which are crucial for maintaining operational continuity throughout the coming years.

The utility sector is under significant pressure to curb greenhouse gas emissions and shrink its carbon footprint. Essential Utilities is actively addressing this, aiming for a 60% reduction in greenhouse gas emissions by 2035. This commitment is being realized through substantial investments in renewable energy sources and critical infrastructure modernization.

Wastewater Discharge Regulations

Wastewater discharge regulations are becoming increasingly strict, requiring companies like Essential Utilities to invest heavily in advanced treatment technologies. For instance, the U.S. Environmental Protection Agency (EPA) continually updates its Clean Water Act standards, impacting how utilities manage effluent quality. Failure to comply can result in significant fines and reputational damage.

These stringent rules necessitate ongoing capital expenditures for upgrading treatment facilities and implementing sophisticated monitoring systems. Essential Utilities reported capital investments of $1.6 billion in 2023, a portion of which is directly allocated to enhancing wastewater treatment capabilities to meet evolving environmental benchmarks. This focus is crucial for protecting local waterways and aquatic life.

- Stricter Effluent Standards: Regulations like the EPA's National Pollutant Discharge Elimination System (NPDES) program mandate lower levels of contaminants in discharged water.

- Investment in Technology: Compliance often requires adopting advanced treatment methods such as membrane filtration or advanced oxidation processes, which carry substantial upfront and operational costs.

- Continuous Monitoring: Utilities must maintain robust systems for real-time monitoring of discharge quality, adding to operational expenses and requiring skilled personnel.

- Potential for Fines: Non-compliance can lead to penalties, with violations of the Clean Water Act potentially resulting in fines of tens of thousands of dollars per day per violation.

Conservation Efforts and Public Awareness

Essential Utilities actively promotes water and energy conservation, recognizing its crucial role in sustainable operations. By encouraging responsible resource use among its customer base, the company aims to mitigate environmental impact and ensure long-term service reliability. This focus extends to raising public awareness about environmental stewardship, fostering a shared commitment to protecting natural lands and resources.

These efforts are not just about compliance; they are integral to the company's business model. For instance, in 2023, Essential Utilities reported significant progress in its water conservation programs, with a notable reduction in water loss across its service territories. The company also invested in educational outreach, reaching thousands of households with information on efficient water and energy usage. These initiatives directly contribute to operational efficiency and can lead to cost savings, which are passed on to customers.

- Water Conservation: In 2023, Essential Utilities achieved a X% reduction in system water loss through infrastructure upgrades and leak detection programs.

- Energy Efficiency: The company's residential energy efficiency programs in 2024 have helped customers reduce their energy consumption by an average of Y%.

- Public Awareness Campaigns: Essential Utilities launched a new environmental stewardship campaign in early 2024, reaching over Z million customers through digital and community engagement.

- Land Protection: The company continues its commitment to protecting watershed lands, with ongoing investments in conservation easements and habitat restoration projects.

Environmental factors significantly shape Essential Utilities' operational landscape, demanding proactive adaptation and investment. Increasing water scarcity, particularly in regions like the Southwestern United States, necessitates a strong focus on efficient water resource management and conservation efforts. Climate change presents substantial risks, with extreme weather events like droughts and floods directly threatening infrastructure, requiring substantial investment in hardening systems against disruptions for 2024 and 2025.

The utility sector faces mounting pressure to reduce greenhouse gas emissions, with Essential Utilities aiming for a 60% reduction by 2035 through investments in renewable energy and infrastructure modernization. Stricter wastewater discharge regulations, driven by agencies like the EPA, require significant capital expenditures for advanced treatment technologies and continuous monitoring systems to protect local waterways.

| Environmental Factor | Impact on Essential Utilities | Key Initiatives/Investments (2023-2025) | Data/Statistics |

|---|---|---|---|

| Water Scarcity | Need for efficient water management and conservation. | Infrastructure upgrades for water efficiency. | $300 million invested in infrastructure upgrades in 2023. |

| Climate Change & Extreme Weather | Risk to water/wastewater infrastructure; need for resilience. | Hardening systems against storms, flood defenses, drought management. | Increased capital expenditure for system resilience projected for 2024-2025. |

| Greenhouse Gas Emissions | Pressure to reduce carbon footprint. | Investment in renewable energy and infrastructure modernization. | Target of 60% reduction in GHG emissions by 2035. |

| Wastewater Discharge Regulations | Requirement for advanced treatment technologies and monitoring. | Upgrading treatment facilities, implementing sophisticated monitoring. | $1.6 billion in capital investments in 2023, with a portion for wastewater treatment enhancement. |

PESTLE Analysis Data Sources

Our Essential Utilities PESTLE Analysis is grounded in data from official government agencies like the EPA and DOE, international bodies such as the World Bank, and reputable industry research firms specializing in the utility sector. This ensures comprehensive coverage of regulatory, economic, and technological factors impacting essential services.