Essential Utilities Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Essential Utilities Bundle

Essential Utilities operates within a regulated environment, which significantly shapes the intensity of competitive rivalry and the threat of new entrants. Understanding the nuances of these forces is crucial for grasping the company's strategic positioning.

The full Porter's Five Forces Analysis delves deeper, revealing the precise impact of supplier power, buyer bargaining, and the threat of substitutes on Essential Utilities. Gain a comprehensive understanding of the competitive landscape and unlock actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Essential Utilities depends on specialized chemicals for water purification and specific producers for natural gas. If these suppliers are few in number, they can exert considerable influence over pricing and terms. For instance, in 2024, the global market for certain water treatment chemicals saw a notable consolidation, with a few key players dominating supply, potentially increasing their leverage.

Suppliers of highly specialized infrastructure components, like advanced water purification systems or smart grid technology, hold significant sway. The proprietary nature of these essential items often means limited options for Essential Utilities, driving up costs and dictating terms. For instance, the global market for smart grid technology, a key area for utility modernization, was projected to reach $112.7 billion in 2024, highlighting the substantial investment and reliance on these niche providers.

The availability of skilled labor, such as engineers and technicians, significantly influences the bargaining power of suppliers in the utility sector. A tight labor market for these essential roles can empower labor providers and drive up wage demands, directly impacting Essential Utilities' operational costs.

In 2024, the U.S. Bureau of Labor Statistics reported a shortage in several key utility occupations. For instance, demand for electrical power-line installers and repairers was projected to grow 7.4% through 2032, indicating a competitive environment for recruiting and retaining qualified field operators, which can translate to higher labor expenses for Essential Utilities.

Regulatory and Compliance Service Providers

Suppliers of regulatory and compliance services wield considerable influence over Essential Utilities due to the utility sector's highly regulated environment. Companies like Essential Utilities must navigate a complex web of environmental, safety, and operational regulations, making specialized expertise from these providers essential for continued operation. In 2024, the global regulatory compliance market was valued at over $50 billion, indicating the significant investment companies make in this area.

The indispensable nature of these services, which include environmental consulting and legal counsel, grants these suppliers strong bargaining power. Their specialized knowledge is critical for Essential Utilities to avoid penalties and maintain its license to operate. For instance, compliance with the EPA's Clean Water Act, a significant regulatory burden, often requires specialized engineering and legal consultation, driving up demand and cost for such services.

- High Demand for Specialized Expertise: The utility sector's adherence to stringent regulations creates consistent demand for niche compliance and environmental consulting services.

- Cost of Non-Compliance: The potential for substantial fines and operational disruptions due to regulatory violations strengthens the negotiating position of compliance service providers.

- Limited Substitutes: For critical regulatory functions, there are often few, if any, viable substitutes for qualified and experienced service providers.

- Supplier Concentration: In certain specialized areas of utility regulation, the market for service providers may be concentrated, further enhancing supplier power.

Energy Market Volatility for Natural Gas

Essential Utilities faces significant bargaining power from natural gas producers and transporters, a situation exacerbated by the inherent volatility of the energy market. For instance, in 2024, natural gas prices experienced considerable swings, driven by factors such as robust industrial demand and fluctuating global supply. This unpredictability directly affects Essential Utilities' cost of acquiring natural gas.

The company's purchased gas costs are a direct reflection of these market dynamics. When natural gas prices surge due to supply constraints or increased demand, Essential Utilities' expenses rise. While regulatory mechanisms often allow for the pass-through of these increased costs to customers, the timing and extent of such adjustments can still impact the company's profitability and cash flow in the interim.

- Natural Gas Price Volatility: In early 2024, benchmark natural gas prices, such as Henry Hub futures, saw periods of significant upward movement, sometimes exceeding $3.00 per MMBtu, influenced by factors like colder-than-expected winter demand and reduced storage injections.

- Supplier Concentration: The natural gas supply chain can be concentrated in certain regions, giving key producers and pipeline operators more leverage in price negotiations with utilities.

- Regulatory Pass-Through Mechanisms: While Essential Utilities can typically recover increased gas costs through Purchased Gas Adjustment (PGA) clauses, the lag time in these adjustments can create short-term margin pressures.

- Impact on Operating Costs: Fluctuations in natural gas prices directly impact Essential Utilities' cost of goods sold, a critical component of its operating expenses.

Suppliers of specialized chemicals for water treatment and components for infrastructure modernization can wield significant bargaining power. In 2024, the consolidation within the water treatment chemical market meant fewer suppliers, potentially increasing their leverage over pricing. Similarly, the high demand and proprietary nature of smart grid technology, a market projected to reach $112.7 billion in 2024, give these specialized providers considerable influence.

| Supplier Type | Reason for Bargaining Power | Example Data/Trend (2024) |

|---|---|---|

| Water Treatment Chemicals | Market consolidation, few dominant players | Increased leverage for remaining suppliers due to fewer alternatives. |

| Smart Grid Technology | Proprietary nature, high investment | Market valued at $112.7 billion, indicating reliance on specialized providers. |

| Skilled Labor (Utilities) | Labor shortages in key roles | Projected 7.4% growth in demand for electrical power-line installers and repairers, driving up labor costs. |

What is included in the product

Uncovers the five forces shaping Essential Utilities' competitive environment, including the threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and industry rivalry.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, enabling proactive strategy adjustments.

Customers Bargaining Power

The bargaining power of Essential Utilities' customers is considerably weakened because the water, wastewater, and natural gas sectors are heavily regulated. State regulatory commissions, not market forces, determine the prices customers pay. This means individual customers have little to no leverage to negotiate lower rates.

Furthermore, within their designated service areas, customers generally lack the option to switch to a different utility provider. This lack of choice effectively eliminates a key avenue for customers to exert bargaining power, as they are essentially captive to the services provided by Essential Utilities.

For Essential Utilities, the bargaining power of customers is significantly limited due to extremely high switching costs. Customers are geographically bound to the existing infrastructure for essential services like water, wastewater, and natural gas. This means there are practically no viable alternatives for consumers to switch to a different provider for these fundamental needs.

The essential nature of services like water, wastewater, and natural gas significantly limits customer bargaining power. Demand for these utilities is largely inelastic; customers can't easily cut back on usage or simply stop consuming them, giving them little leverage to negotiate prices or terms. While conservation initiatives can influence consumption volumes, the fundamental need for these services remains, anchoring their pricing power.

Customer Base Fragmentation

Essential Utilities serves a vast and diverse customer base, encompassing millions of residential, commercial, and industrial clients spread across various states. This broad reach is crucial in mitigating the bargaining power of individual customers.

The sheer fragmentation of its residential customer base is a key factor. No single household or even a small cluster of households possesses the purchasing volume necessary to significantly influence Essential Utilities' pricing or service terms. This diffusion of demand limits the leverage any individual customer can wield.

For instance, as of early 2024, Essential Utilities reported serving approximately 5 million customers across its regulated utility operations. This scale means that even large commercial clients represent a relatively small percentage of the total customer accounts, further diluting their individual bargaining power.

- Customer Reach: Essential Utilities serves over 5 million customers across multiple states.

- Residential Fragmentation: The residential customer base is highly dispersed, preventing individual influence.

- Limited Leverage: No single customer or small group can dictate terms due to low individual volume.

- Commercial Impact: Even significant commercial accounts are a small fraction of the overall customer base.

Public and Political Pressure

While individual customers of Essential Utilities possess limited bargaining power, collective public and political pressure can significantly impact the company. Consumer advocacy groups and elected officials often act as conduits for this pressure, influencing regulatory decisions. For instance, in 2023, the average residential utility bill in the United States saw an increase, prompting public outcry and increased scrutiny from state regulators, which can indirectly constrain Essential Utilities' ability to implement rate hikes.

This external pressure can manifest in various ways, affecting Essential Utilities' operational flexibility and profitability. Decisions on rate increases or mandated service quality improvements, often influenced by public sentiment, directly shape the company's financial outlook. For example, a proposed rate increase by Essential Utilities in a specific service territory might face intense opposition from local community leaders and consumer groups, potentially leading to protracted review processes or outright rejection by regulatory bodies.

- Public Scrutiny: Increased media attention and public discourse around utility pricing and service can amplify customer concerns.

- Regulatory Influence: Consumer advocacy groups lobby state Public Utility Commissions (PUCs) to limit rate increases, impacting Essential Utilities' revenue potential.

- Political Intervention: Elected officials may intervene on behalf of constituents, leading to investigations or moratoriums on price adjustments.

- Service Mandates: Political pressure can result in requirements for service upgrades or investments that may not align with the company's immediate financial priorities.

The bargaining power of Essential Utilities' customers is notably low, primarily due to the regulated nature of its services and the inherent lack of viable alternatives. Customers are geographically bound to Essential Utilities' infrastructure for essential services like water, wastewater, and natural gas, making switching costs prohibitively high. The demand for these utilities is also inelastic, meaning customers cannot easily reduce their consumption without significant hardship, further limiting their leverage.

Essential Utilities' vast customer base, exceeding 5 million across its regulated operations as of early 2024, dilutes the influence of individual consumers. The residential customer base is highly fragmented, meaning no single household or small group of households possesses the purchasing volume to impact pricing or service terms. Even large commercial clients represent a small fraction of the total customer accounts, diminishing their individual bargaining power.

| Factor | Impact on Customer Bargaining Power | Supporting Data (as of early 2024) |

|---|---|---|

| Regulation | Lowers power; prices set by commissions. | State regulatory commissions determine rates, not market forces. |

| Switching Costs | Very high; customers are geographically bound. | Infrastructure dependency for water, wastewater, and natural gas. |

| Demand Elasticity | Inelastic; essential services cannot be easily forgone. | Customers require these utilities for daily life. |

| Customer Base Size | Over 5 million customers across regulated operations. | High number dilutes individual customer influence. |

| Customer Fragmentation | Residential base is highly dispersed. | No single customer or small group has significant volume. |

Preview Before You Purchase

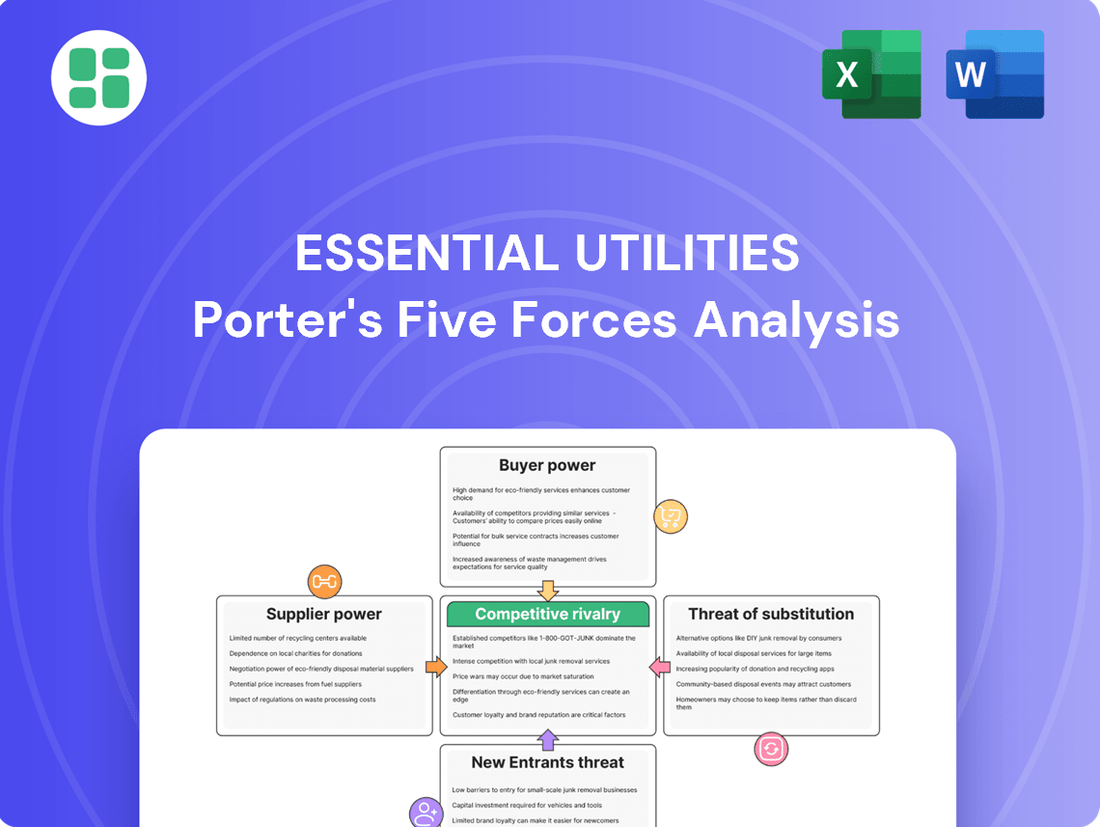

Essential Utilities Porter's Five Forces Analysis

This preview showcases the complete Essential Utilities Porter's Five Forces Analysis, offering a detailed examination of the industry's competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring you get precisely what you need for your strategic planning. This comprehensive analysis is ready for immediate download and use, providing valuable insights without any placeholders or generic content.

Rivalry Among Competitors

Competitive rivalry for Essential Utilities is generally low within its regulated service territories. This is primarily because utility operations, particularly for water, wastewater, and natural gas distribution, often function as natural monopolies or duopolies. In these scenarios, direct competition from other utility providers serving the exact same customer base is exceptionally rare, as duplicating infrastructure is cost-prohibitive.

Essential Utilities operates in a sector with exceptionally high barriers to entry, a significant factor in its competitive landscape. The sheer scale of capital needed for infrastructure development, such as water treatment plants and distribution networks, often runs into billions of dollars. For instance, in 2023, Essential Utilities reported capital expenditures of approximately $1.6 billion, highlighting the substantial investment required to maintain and expand operations.

Furthermore, navigating the intricate web of regulatory approvals and securing necessary land rights and permits presents another formidable hurdle for potential new entrants. These processes are often lengthy and resource-intensive, effectively deterring smaller or less capitalized companies from entering the market. This regulatory complexity, combined with the upfront capital demands, significantly curtails the number of direct competitors that Essential Utilities faces.

State and federal regulatory bodies, such as the Federal Energy Regulatory Commission (FERC) and state Public Utility Commissions (PUCs), play a crucial role in shaping the competitive landscape for utilities. These agencies grant utilities exclusive service territories, effectively limiting direct head-to-head competition within a given geographic area. In 2024, this structure continues to be a cornerstone of the industry, ensuring a baseline level of service provision.

This regulatory framework exchanges exclusivity for stringent oversight on pricing and service quality. Utilities are generally prohibited from raising rates without demonstrating the need to their respective regulatory bodies, a process that can be lengthy and complex. This oversight is designed to protect consumers from potential monopolistic abuses and ensure the delivery of essential services, even in less profitable areas.

Consequently, the primary competitive pressure for utilities often comes not from direct rivals within their service territory, but from the regulatory process itself and the threat of regulatory intervention. For instance, a utility's return on equity (ROE) is typically set by regulators, and deviations from this allowed ROE can lead to rate adjustments or other penalties. In 2023, average allowed ROEs for electric utilities in the US hovered around 9.5%, indicating the direct financial impact of regulatory decisions.

Focus on Acquisitions for Growth

For Essential Utilities, competitive rivalry isn't typically about undercutting prices for existing customers in the regulated utility space. Instead, growth and market share are often gained through acquiring other utility systems. This merger and acquisition (M&A) activity represents a significant form of competition.

In 2023, the utility sector saw continued M&A activity, with companies like Essential Utilities actively seeking opportunities to expand their service territories. For example, Essential Utilities completed the acquisition of Peoples Gas System in Florida during 2023, adding approximately 400,000 customers and significantly increasing its footprint.

- Acquisitions as a Growth Driver: Essential Utilities, like many in the regulated utility sector, prioritizes acquisitions to expand its customer base and service area.

- M&A as Rivalry: The competition for acquiring smaller, often municipal or private, utility systems is a primary form of rivalry, rather than direct competition for existing customers.

- 2023 Acquisition Example: Essential Utilities' acquisition of Peoples Gas System in Florida in 2023 demonstrates this strategy, adding a substantial number of new customers.

Industry Stability and Predictable Returns

Competitive rivalry within the essential utilities sector is generally subdued due to the industry's inherent stability and heavily regulated nature. This environment fosters predictable, albeit often capped, returns on investment, which in turn discourages aggressive price wars among established players. Instead of battling for market share through price cuts, utility companies typically focus their competitive efforts on infrastructure upgrades, operational efficiency improvements, and demonstrating the need for rate base growth to regulatory bodies.

The regulated returns, often tied to specific performance metrics and approved capital expenditures, mean that profitability is less about outmaneuvering competitors on price and more about effectively managing operations and navigating the regulatory landscape. For instance, in 2024, many utility companies are prioritizing investments in grid modernization and renewable energy integration, which are often supported by regulatory frameworks designed to incentivize such developments. This strategic focus shifts the competitive dynamic away from direct price competition and towards operational excellence and strategic regulatory engagement.

- Low Price Competition: Regulated pricing structures limit the ability of utilities to engage in aggressive price-cutting strategies to gain market share.

- Focus on Infrastructure: Competition often centers on the ability to secure regulatory approval for capital investments in infrastructure, such as grid upgrades and clean energy projects.

- Operational Efficiency: Companies compete by demonstrating superior operational efficiency, which can lead to cost savings that are then shared with customers or reinvested, subject to regulatory approval.

- Rate Base Growth: A key competitive arena involves demonstrating to regulators the necessity of expanding the rate base through new investments, thereby securing future revenue streams.

Competitive rivalry for Essential Utilities is notably low within its established, regulated service areas. The significant capital investment required for infrastructure, coupled with stringent regulatory approvals, creates exceptionally high barriers to entry, effectively limiting direct competition. For example, in 2023, Essential Utilities invested approximately $1.6 billion in capital expenditures, underscoring the substantial financial commitment needed to operate in this sector.

Instead of price wars, competition in the utility sector, and for Essential Utilities, primarily manifests through mergers and acquisitions. Companies actively compete to acquire smaller utility systems to expand their reach and customer base. This was evident in 2023 when Essential Utilities acquired Peoples Gas System in Florida, adding around 400,000 customers and demonstrating a key growth strategy.

The regulatory environment, overseen by bodies like state Public Utility Commissions, grants exclusive service territories, further reducing direct rivalry. These regulators also dictate pricing and service quality, meaning competition often revolves around operational efficiency and demonstrating the need for rate base expansion rather than price undercutting. In 2024, utilities are focusing on infrastructure upgrades and grid modernization, areas often supported by regulatory incentives.

| Competitive Factor | Description | Relevance to Essential Utilities |

|---|---|---|

| Barriers to Entry | High capital requirements, regulatory hurdles, land rights. | Significantly limits new entrants, protecting Essential Utilities' market position. |

| Acquisition Activity | Competition to acquire existing utility systems. | Primary growth strategy and competitive arena for Essential Utilities. |

| Regulatory Oversight | Price and service quality control by government agencies. | Shapes profitability and operational strategy, acting as a form of indirect competition. |

| Infrastructure Investment | Competition to secure approval for capital projects. | Key focus for growth and demonstrating value to regulators. |

SSubstitutes Threaten

For essential services like potable water and wastewater treatment delivered through a centralized system, direct substitutes are scarce for most residential and commercial users. While bottled water can replace tap water for drinking, it's not a practical or cost-effective substitute for all household or industrial water requirements, such as sanitation or irrigation.

The threat of substitutes is particularly pronounced for natural gas, especially in residential and commercial heating applications. Customers can readily switch to alternatives like electricity, which powers heat pumps, or to propane and heating oil. In 2024, the increasing efficiency and decreasing costs of electric heat pumps, coupled with government incentives for electrification, are accelerating this shift, particularly in regions with mild winters.

Beyond traditional alternatives, the growing adoption of renewable energy solutions like solar thermal for water heating and geothermal systems for space conditioning further erodes natural gas demand. These options offer long-term cost savings and environmental benefits, making them increasingly attractive to consumers and businesses alike, even with the upfront investment.

The increasing adoption of energy-efficient appliances and improved building insulation directly impacts essential utilities by reducing overall service consumption. For instance, in 2024, the U.S. Department of Energy reported that ENERGY STAR certified appliances use, on average, 9% less energy than standard models, a trend that continues to grow.

Water conservation practices also act as a threat, diminishing demand for water utility services. By 2023, many municipalities saw a noticeable decrease in per capita water usage due to drought awareness campaigns and the promotion of low-flow fixtures, with some areas reporting a 5-10% reduction in residential water demand compared to previous years.

While these conservation efforts do not replace the fundamental need for utility services, they effectively lower the revenue generated per customer. This shift necessitates utility providers to explore new revenue streams or focus on operational efficiencies to maintain profitability in the face of declining consumption.

Decentralized Water/Wastewater Solutions

The threat of substitutes for Essential Utilities' core water and wastewater services is generally low, particularly in its established urban and suburban service areas. However, in certain niche contexts, alternatives can emerge.

In specific rural or isolated industrial settings, decentralized solutions can indeed act as substitutes. These might include private wells for water supply and septic systems for wastewater disposal. For industrial operations, on-site water treatment and reuse systems can also reduce reliance on municipal services. For instance, a large manufacturing plant might invest in advanced water recycling technologies to minimize its wastewater output and associated costs.

However, for the vast majority of Essential Utilities' customer base, these decentralized options are either impractical or outright prohibited. Stringent regulations in most urban and suburban municipalities mandate connection to public water and sewer systems for public health and environmental reasons. The capital investment and ongoing maintenance required for individual, compliant decentralized systems often make them economically unfeasible compared to shared utility infrastructure. For example, the U.S. Environmental Protection Agency (EPA) sets strict standards for drinking water quality and wastewater discharge, which can be challenging and costly for individual systems to consistently meet.

- Limited Applicability: Decentralized water and wastewater solutions are primarily viable substitutes in rural or specific industrial contexts, not in Essential Utilities' core urban and suburban markets.

- Regulatory Barriers: Urban and suburban areas typically have regulations requiring connection to public water and sewer systems, effectively eliminating many potential substitutes.

- Economic Viability: The cost and complexity of maintaining compliant individual water and wastewater systems often make them less attractive than utility services for the majority of customers.

Policy-Driven Transition to Renewables

Government policies and incentives are a significant driver for the transition to renewable energy sources, directly impacting the demand for natural gas. For instance, in 2024, many nations continued to offer tax credits and subsidies for solar and wind power installations, making them increasingly competitive with traditional energy sources. This policy-driven substitution presents a long-term threat to the natural gas sector, compelling utilities to re-evaluate their investment strategies and explore diversification into cleaner energy alternatives.

The accelerating shift towards electrification, spurred by government mandates and consumer demand for electric vehicles and appliances, further diminishes the role of natural gas. In 2024, several regions saw increased adoption of electric heating systems and EV charging infrastructure, supported by public funding. This trend directly substitutes natural gas usage in residential and commercial sectors, forcing utilities to adapt their business models to remain relevant.

- Policy Support for Renewables: Government incentives like production tax credits (PTCs) and investment tax credits (ITCs) for renewable energy projects in 2024 made solar and wind power more economically viable, directly competing with natural gas.

- Electrification Mandates: Policies promoting electric vehicle adoption and the phasing out of natural gas appliances in new constructions, observed in various cities and states throughout 2024, reduce future demand for natural gas.

- Carbon Pricing Mechanisms: The implementation or expansion of carbon taxes or cap-and-trade systems in 2024 increased the operational cost of natural gas power plants, making renewable energy a more attractive substitute.

- Grid Modernization Investments: Government funding for grid upgrades in 2024 facilitated the integration of intermittent renewable sources, enhancing their reliability and further displacing the need for natural gas as a baseload power source.

For essential utilities like water and wastewater, direct substitutes are generally limited, especially in established urban areas. While bottled water serves as a drinking substitute, it's not a viable alternative for sanitation or industrial uses. Decentralized systems like private wells and septic tanks can be substitutes in rural or specific industrial settings, but regulatory requirements and costs often make them impractical for most customers.

The threat of substitutes is more significant for natural gas, particularly in heating. Consumers can switch to electricity (heat pumps), propane, or heating oil. In 2024, the increasing efficiency and decreasing costs of electric heat pumps, supported by government incentives, are accelerating this trend. Furthermore, renewable energy solutions like solar thermal and geothermal systems are gaining traction, reducing reliance on natural gas for heating and hot water.

| Utility Sector | Substitute | Threat Level (2024) | Key Factors |

|---|---|---|---|

| Water/Wastewater | Bottled Water (Drinking) | Low | Impractical for non-drinking uses, higher cost. |

| Water/Wastewater | Private Wells/Septic Systems | Low to Medium (Niche) | Viable in rural/industrial areas; regulatory hurdles and maintenance costs in urban/suburban settings. |

| Natural Gas (Heating) | Electricity (Heat Pumps) | High | Increasing efficiency, government incentives, falling costs, electrification push. |

| Natural Gas (Heating) | Propane/Heating Oil | Medium | Availability and price fluctuations compared to natural gas. |

| Natural Gas (Heating/Hot Water) | Solar Thermal/Geothermal | Medium | Growing adoption due to long-term cost savings and environmental benefits, despite upfront investment. |

Entrants Threaten

The threat of new companies entering the essential utilities sector, particularly water, wastewater, and natural gas, is remarkably low. This is primarily due to the staggering capital investment needed to establish the necessary infrastructure. For instance, building a new natural gas distribution network or a water treatment facility can easily run into hundreds of millions, if not billions, of dollars. In 2024, major utility capital expenditure plans reflect this reality, with companies like NextEra Energy announcing billions in infrastructure upgrades and expansions, signaling the immense financial barrier to entry.

The utility sector is heavily regulated, presenting a formidable barrier to new entrants. Companies must navigate a labyrinth of state and federal regulations, a process that can take years and require significant investment in legal and compliance expertise. For instance, securing necessary licenses and permits for operations, including approved service territories, is a crucial yet resource-intensive step that deters many potential competitors.

Established utilities like Essential Utilities benefit from substantial economies of scale, making it difficult for new entrants to compete on cost. For instance, Essential Utilities' extensive water and wastewater infrastructure, built over decades, allows for lower per-unit operating costs compared to a new company needing to build from scratch. In 2023, Essential Utilities reported capital expenditures of $1.7 billion, a significant investment that creates a high barrier to entry.

Network effects also play a crucial role. The more customers a utility serves, the more valuable its network becomes, and the more efficient its operations can be. A new entrant would face the challenge of acquiring a critical mass of customers to offset the high fixed costs of building and maintaining a comparable network, a hurdle that is particularly steep in the highly regulated utility sector.

Difficulty in Acquiring Service Territories

New entrants would find it incredibly difficult to secure existing service territories, as these are often already controlled by incumbent utilities or governed by municipal franchises. This presents a significant barrier, as acquiring these established networks is a complex and often impossible task for newcomers.

The opportunities for organic growth into undeveloped service areas are also limited and demand substantial capital investment. For instance, in 2024, the average cost to connect a new residential customer for water utilities could range from $5,000 to $15,000, highlighting the high upfront expenses involved in expanding infrastructure.

- Geographic Concentration: Service territories are often geographically defined and regulated, making it hard for new companies to establish a foothold without acquiring existing assets.

- Capital Intensity: Building new infrastructure from scratch to serve new areas requires immense capital, deterring potential entrants.

- Regulatory Hurdles: Obtaining necessary permits and approvals to operate in new territories can be a lengthy and costly process, favoring established players with existing relationships.

Public Trust and Brand Recognition

The threat of new entrants for utilities is significantly dampened by the critical need for public trust and established brand recognition. Essential Utilities, for instance, has cultivated decades of reliability, a factor that new competitors would find immensely challenging to replicate quickly. In 2024, the average customer satisfaction score for major utility providers remained high, underscoring the value of this established trust.

Building this trust from the ground up is a formidable barrier. A new entrant would face immense scrutiny, especially given the severe public health and safety implications of any service disruption. Utilities are inherently linked to essential services, making reliability not just a business metric but a public mandate.

- Public Trust as a Barrier: New entrants must overcome a significant hurdle in establishing credibility in a sector where reliability is paramount.

- Brand Recognition Advantage: Established utility companies benefit from long-standing reputations, making it difficult for newcomers to gain market acceptance.

- Consequences of Failure: Service disruptions in the utility sector carry severe public health and safety risks, increasing the stakes for new entrants.

- Customer Satisfaction Data: In 2024, high customer satisfaction scores for existing utilities reflect the deep-seated trust that new companies must work to achieve.

The threat of new entrants into the essential utilities sector, like water and natural gas, is exceptionally low. This is primarily due to the massive capital required for infrastructure, stringent regulatory approvals, and established economies of scale enjoyed by incumbents. For example, in 2024, building new utility infrastructure can cost hundreds of millions, if not billions, a prohibitive sum for most newcomers.

| Barrier Type | Description | 2024 Data/Example |

|---|---|---|

| Capital Requirements | Extremely high initial investment for infrastructure. | Building new natural gas lines or water treatment plants costs hundreds of millions to billions. |

| Regulatory Hurdles | Complex and lengthy process for permits and licenses. | Securing approved service territories and operational permits is a significant, time-consuming barrier. |

| Economies of Scale | Incumbents operate at lower per-unit costs due to size. | Essential Utilities' extensive infrastructure built over decades offers cost advantages over new entrants. |

| Network Effects | Value increases with customer base, making it hard for new entrants to gain critical mass. | New utilities struggle to achieve operational efficiency without a large, established customer network. |

| Service Territory Control | Existing territories are often franchised or controlled by incumbents. | Acquiring established service areas is complex and often impossible for newcomers. |

| Public Trust & Brand Recognition | Decades of reliability and trust are hard to replicate. | High customer satisfaction scores in 2024 for established utilities highlight the trust barrier. |

Porter's Five Forces Analysis Data Sources

Our Essential Utilities Porter's Five Forces analysis is built upon a foundation of robust data, including company annual reports, regulatory filings from agencies like the EPA and state utility commissions, and industry-specific market research from firms like IBISWorld and S&P Global Market Intelligence.