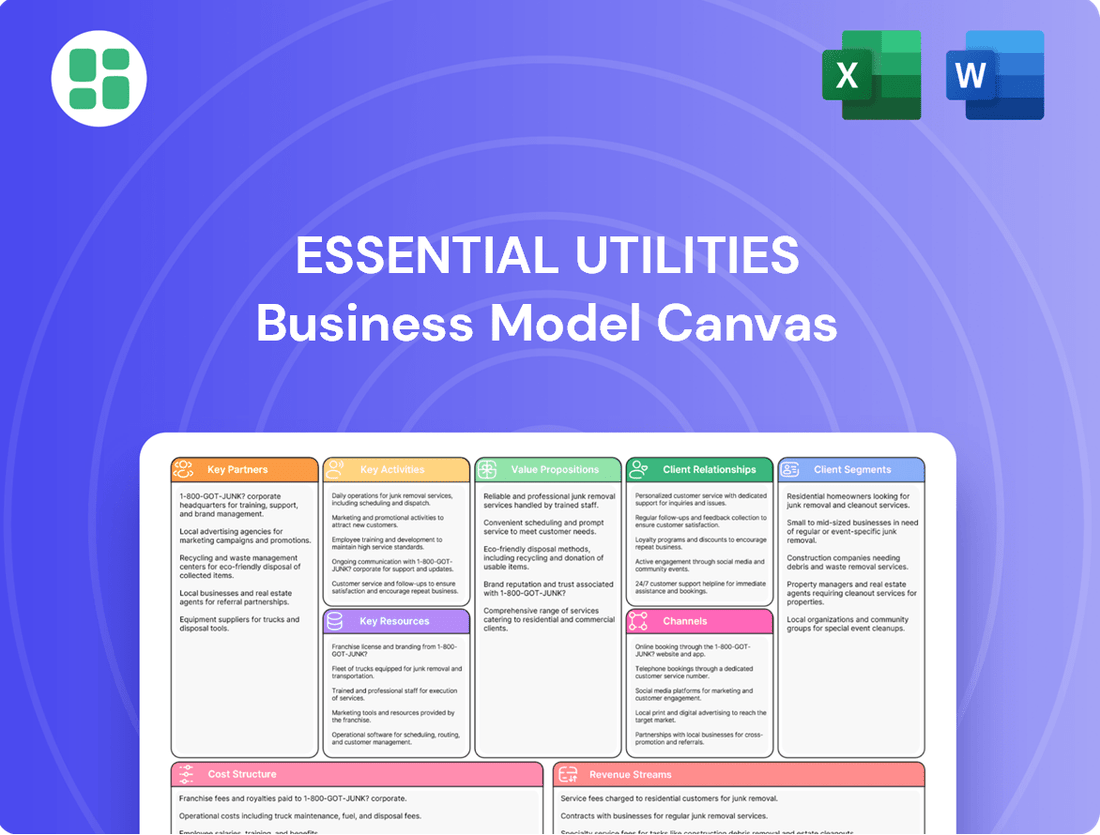

Essential Utilities Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Essential Utilities Bundle

Unlock the strategic blueprint behind Essential Utilities's success with our comprehensive Business Model Canvas. This in-depth analysis reveals how they deliver essential services, manage key resources, and build strong customer relationships. Discover their unique value proposition and revenue streams.

Partnerships

Essential Utilities' operations are intrinsically linked to government and regulatory bodies, particularly Public Utility Commissions (PUCs) in states like Pennsylvania and Texas. These partnerships are vital for securing approvals on rate increases, which are critical for recovering infrastructure investments. For instance, in 2023, Essential Utilities filed for rate increases across its various utility segments, demonstrating the ongoing need for regulatory collaboration to ensure financial stability and continued service provision.

Navigating these regulatory landscapes requires constant engagement to maintain operating licenses and adhere to stringent environmental and safety standards. The company's commitment to compliance, such as meeting EPA regulations for water quality, directly impacts its ability to operate and invest. For example, significant capital expenditures are often tied to regulatory mandates for system upgrades, underscoring the symbiotic relationship between Essential Utilities and these oversight agencies.

Essential Utilities actively partners with local municipalities and authorities, often through the acquisition of municipal water and wastewater systems. This strategy is fundamental to expanding its service areas and enhancing existing infrastructure, directly supporting its growth objectives. For instance, in 2023, the company completed the acquisition of the City of Beaver Falls wastewater system, a prime example of this collaborative approach to service delivery.

Essential Utilities relies on key partnerships with technology and equipment suppliers to maintain and enhance its vast infrastructure. These collaborations are crucial for securing essential components like pipes, advanced water treatment technologies, and smart metering systems. For instance, in 2023, the company invested significantly in infrastructure upgrades, including pipe replacements, which directly involves sourcing materials from these strategic partners.

These partnerships are vital for ensuring Essential Utilities can adopt cutting-edge solutions for water purification and gas distribution, while also meeting stringent environmental regulations. This includes staying ahead of emerging challenges, such as the management of per- and polyfluoroalkyl substances (PFAS), where specialized treatment technologies sourced from suppliers are indispensable. The company's commitment to reliability and service quality is directly tied to the performance and innovation provided by its equipment suppliers.

Construction and Engineering Firms

Essential Utilities relies heavily on construction and engineering firms to execute its extensive capital investment programs. These partnerships are critical for undertaking large-scale infrastructure projects like pipeline replacements and treatment plant upgrades, which are vital for maintaining and improving system reliability and safety. For instance, in 2024, Essential Utilities announced a significant capital expenditure plan, with a substantial portion allocated to infrastructure renewal projects managed by these specialized partners.

These collaborations ensure that Essential Utilities has access to the necessary expertise and skilled labor to complete complex projects efficiently. The firms are instrumental in delivering the tangible improvements to water and wastewater systems that underpin the company's long-term strategy and regulatory compliance. The scope of these projects often involves advanced engineering solutions and adherence to stringent environmental and safety standards.

- Expertise in Infrastructure Development: Construction and engineering firms bring specialized knowledge in designing and building water and wastewater infrastructure.

- Execution of Capital Programs: They are essential for the physical execution of Essential Utilities' multi-year capital investment plans, often running into billions of dollars annually.

- Ensuring System Reliability and Safety: Partnerships facilitate the upgrades and replacements necessary to maintain and enhance the integrity and safety of essential utility services.

- Regulatory Compliance and Modernization: These firms help meet evolving regulatory requirements and modernize aging infrastructure to meet future demands.

Environmental and Conservation Organizations

Essential Utilities collaborates with environmental and conservation organizations to bolster land protection and water quality efforts. These partnerships are crucial for advancing sustainable operational practices and fulfilling the company's environmental stewardship commitments. For instance, in 2023, Essential Utilities reported investing $100 million in water infrastructure upgrades, many of which were informed by ecological impact assessments conducted with conservation partners.

- Land Protection: Partnerships support the preservation of watersheds and sensitive ecosystems vital for water sources.

- Water Quality Initiatives: Collaborations focus on improving and maintaining high standards of water purity through shared expertise and resources.

- Sustainable Practices: Joint efforts promote the adoption of environmentally responsible methods across operations.

- ESG Alignment: These collaborations directly contribute to Essential Utilities' Environmental, Social, and Governance targets, enhancing its corporate responsibility profile.

Essential Utilities' key partnerships are crucial for its operational success and growth. These include vital collaborations with government and regulatory bodies, municipalities, technology suppliers, and construction firms. These relationships are fundamental to securing approvals, expanding service, upgrading infrastructure, and ensuring compliance with environmental and safety standards.

| Partner Type | Role in Business Model | Example/Impact (as of 2023/2024) |

| Government & Regulatory Bodies (PUCs) | Approve rate increases, ensure compliance | Securing rate hike approvals for infrastructure recovery; ongoing engagement for operating licenses. |

| Municipalities | Acquisition of water/wastewater systems | Acquisition of Beaver Falls wastewater system in 2023, expanding service areas. |

| Technology & Equipment Suppliers | Provide essential components, advanced technologies | Sourcing pipes and smart metering systems; investment in water treatment tech for PFAS management. |

| Construction & Engineering Firms | Execute capital investment programs, infrastructure upgrades | Managing multi-billion dollar infrastructure renewal projects announced for 2024. |

| Environmental & Conservation Organizations | Support land protection, water quality initiatives | Informing $100 million in water infrastructure upgrades in 2023 based on ecological assessments. |

What is included in the product

A structured framework outlining Essential Utilities' approach to delivering and capturing value, detailing key partners, activities, resources, and cost structures.

Provides a clear, concise overview of how Essential Utilities creates, delivers, and sustains value for its customers and stakeholders.

Streamlines complex utility operations by clearly defining customer segments and value propositions, alleviating the pain of inefficient service delivery.

Addresses the challenge of understanding diverse customer needs by providing a structured framework to map out tailored solutions and key resources.

Activities

Essential Utilities' primary focus revolves around the critical task of investing in and maintaining its vast network of water, wastewater, and natural gas infrastructure. This commitment ensures the consistent and safe delivery of essential services to its customers.

Key activities include the ongoing replacement of aging pipelines, the modernization of water and wastewater treatment facilities, and the upgrading of distribution systems. These efforts are paramount for ensuring service reliability and meeting stringent safety standards.

Looking ahead, the company has a robust capital investment plan, projecting approximately $7.8 billion in spending between 2025 and 2029. This significant outlay underscores their dedication to infrastructure improvements and long-term operational integrity.

Service Delivery and Operations Management is the engine that keeps essential utilities running, ensuring millions receive safe water, clean wastewater services, and reliable natural gas. This involves the intricate day-to-day management of water sources, sophisticated treatment processes, and the secure supply and distribution of natural gas across vast service territories.

In 2024, utilities are heavily focused on operational efficiency, with many investing in smart grid technologies and advanced metering infrastructure to optimize delivery and reduce waste. For instance, a major US utility might report a 5% reduction in water loss through leak detection technologies implemented in its distribution network throughout the year.

Navigating the intricate web of state and federal regulations, such as EPA mandates concerning PFAS, is a core activity for essential utilities. This includes ensuring adherence to environmental standards and utility-specific rules to maintain operational legality and public trust.

Actively managing rate cases is crucial for securing the necessary revenue streams to fund vital infrastructure upgrades and cover ongoing operational expenses. For instance, in 2024, utilities across the US continued to file for rate increases to address aging infrastructure and the rising costs of compliance and service provision.

Successful rate case management directly impacts a utility's financial health, allowing for continued investment in service reliability and safety. This process ensures that the company can meet its obligations to customers while maintaining a sustainable business model in a heavily regulated environment.

Strategic Acquisitions and Integration

Strategic acquisitions are a cornerstone of Essential Utilities' growth, particularly by absorbing smaller municipal water and wastewater systems. This process involves rigorous identification of suitable targets, skillful negotiation of acquisition terms, and seamless integration of these new entities into Essential Utilities' established infrastructure and customer service framework.

The company actively manages a robust pipeline of potential acquisition opportunities, ensuring a continuous stream of growth prospects. For instance, in 2023, Essential Utilities completed several acquisitions, adding approximately 13,000 new customer connections, a testament to their ongoing strategy.

- Acquisition Focus: Targeting smaller, often municipally-owned, water and wastewater systems.

- Integration Process: Streamlining operations, technology, and customer service for acquired entities.

- Growth Pipeline: Maintaining a strong portfolio of potential future acquisitions to fuel expansion.

- 2023 Impact: Successfully integrated around 13,000 new customer connections through strategic purchases.

Customer Service and Engagement

Customer service is paramount for utilities, encompassing efficient handling of inquiries, billing, and critical emergency responses. This focus on a superior customer experience is a core activity, aiming to build trust and ensure operational reliability.

Initiatives like safety campaigns, such as 'Call 811 Before You Dig,' are crucial for customer engagement and preventing costly incidents. Customer assistance programs also play a vital role in supporting diverse customer needs.

- Customer Inquiry Management: Utilities must effectively manage a high volume of customer interactions, from routine billing questions to complex service requests, ensuring timely and accurate responses.

- Emergency Response Communication: Providing clear and immediate communication during outages or emergencies is a critical customer service function, often involving dedicated hotlines and proactive updates.

- Community Outreach and Education: Engaging with the community through safety programs and educational initiatives, like those promoting water conservation or safe digging practices, fosters positive relationships and reduces operational risks.

- Customer Assistance Programs: Offering support for vulnerable customers, including payment assistance or energy efficiency advice, demonstrates a commitment to equitable service delivery.

Essential Utilities' key activities center on the physical upkeep and expansion of its infrastructure, ensuring reliable service delivery. This includes significant capital investments in replacing aging pipes and upgrading treatment facilities, with a projected $7.8 billion investment between 2025 and 2029. The company also actively pursues strategic acquisitions of smaller water and wastewater systems, having integrated approximately 13,000 new customer connections in 2023. Furthermore, managing regulatory compliance and rate cases is vital for operational legality and funding infrastructure improvements.

| Key Activity | Description | 2024/2025 Focus/Data |

|---|---|---|

| Infrastructure Investment & Maintenance | Replacing aging pipelines, modernizing treatment facilities, upgrading distribution systems. | Projected $7.8 billion capital investment from 2025-2029. Focus on leak detection technologies to reduce water loss. |

| Regulatory Compliance | Adhering to state and federal environmental and utility-specific regulations (e.g., EPA PFAS mandates). | Ongoing efforts to meet evolving environmental standards and reporting requirements. |

| Rate Case Management | Securing revenue for infrastructure upgrades and operational expenses through regulatory filings. | Utilities across the US continued to file for rate increases in 2024 to address infrastructure needs and rising costs. |

| Strategic Acquisitions | Acquiring smaller municipal water and wastewater systems and integrating them. | Integrated ~13,000 new customer connections in 2023; maintaining a robust acquisition pipeline. |

| Customer Service & Engagement | Handling inquiries, billing, emergency responses, and community outreach (e.g., safety campaigns). | Emphasis on efficient inquiry management and proactive communication during emergencies. |

Full Version Awaits

Business Model Canvas

The Essential Utilities Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use file. Once your order is complete, you will gain full access to this comprehensive business tool, formatted precisely as you see it, allowing you to immediately begin strategizing for your utility business.

Resources

Essential utilities rely heavily on extensive physical infrastructure, forming the literal backbone of their operations. This includes vast networks of water mains, wastewater pipelines, natural gas distribution lines, treatment plants, pumping stations, and storage facilities, often spanning multiple states. For instance, in 2024, a major US utility company reported investing over $5 billion in upgrading and maintaining its aging water and wastewater infrastructure, highlighting the sheer scale of these physical assets.

Access to reliable water sources, such as reservoirs and rivers, is critical. For instance, in 2024, many utilities continued to rely on established water rights for their operations, ensuring a consistent supply for residential and industrial use.

Secure, long-term natural gas supply contracts are equally vital. These agreements provide price stability and guaranteed delivery, which are essential for energy generation and distribution networks. In 2024, the natural gas market saw fluctuating prices, making these contracts even more valuable for essential utilities.

Essential Utilities relies heavily on a highly trained workforce. This includes engineers for system design and upgrades, skilled field technicians for maintenance and repairs, and water quality specialists to ensure safety and compliance. In 2024, Essential Utilities reported that its workforce comprised over 10,000 employees dedicated to delivering reliable water and wastewater services across its operating segments.

Operational expertise is paramount for maintaining the integrity and efficiency of aging infrastructure and implementing new projects. For instance, the company's commitment to operational excellence was evident in its 2024 performance, where it successfully completed several significant infrastructure improvement projects, contributing to enhanced service reliability and regulatory adherence.

Financial Capital and Access to Funding

Essential Utilities requires substantial financial capital to maintain and expand its operations. This includes funding for day-to-day activities, significant infrastructure upgrades, and potential mergers or acquisitions. For instance, in 2023, the company reported capital expenditures of approximately $1.7 billion, underscoring the significant investment needed to support its regulated utility assets.

Access to diverse funding sources is crucial for meeting these capital demands. Essential Utilities relies on a combination of internally generated cash flow, the ability to issue debt, such as senior notes, and equity financing. This multi-pronged approach ensures they can cover their multi-year investment plans, which are vital for modernizing and expanding their essential service networks.

- Internal Cash Flow: Essential Utilities generates operating cash flow to reinvest in its business.

- Debt Markets: Access to debt, like issuing senior notes, provides significant funding for long-term projects.

- Equity Issuance: Selling stock can raise capital for major investments and strategic growth initiatives.

- Capital Expenditures: In 2023, the company invested around $1.7 billion in its infrastructure.

Regulatory Assets and Intellectual Property

Regulatory assets are a cornerstone for utilities, allowing them to recoup investments in infrastructure and operations. For instance, in 2024, many utilities continued to seek approval for significant capital expenditures, such as grid modernization projects, which will be recovered through future rate adjustments. These assets represent a guaranteed future revenue stream, essential for maintaining financial stability and attracting investment.

Intellectual property, particularly in specialized areas like water treatment, offers a competitive edge. Technologies designed to address emerging contaminants, such as per- and polyfluoroalkyl substances (PFAS), are becoming increasingly valuable. Companies holding patents for efficient PFAS remediation methods can command premium pricing for their services or license their technology, generating additional revenue streams.

- Regulatory Assets: Utilities in the US saw billions approved for infrastructure upgrades in 2024, with regulatory assets forming the basis for future cost recovery.

- Intellectual Property: The market for water treatment technologies, especially for emerging contaminants, is projected for significant growth, highlighting the value of proprietary solutions.

- PFAS Remediation: Investments in advanced filtration and chemical treatment technologies for PFAS removal are a key area of IP development for water utilities.

- Operational Management Software: Proprietary software for optimizing grid performance, managing distributed energy resources, and enhancing customer service represents valuable intangible assets.

The key resources for Essential Utilities are its extensive physical infrastructure, including water mains, wastewater pipelines, and natural gas distribution networks, which are vital for service delivery. Complementing this are secure, long-term supply contracts for natural gas and reliable access to water sources, ensuring operational continuity. Furthermore, a highly trained workforce and specialized operational expertise are critical for managing complex systems and implementing upgrades, while substantial financial capital and diverse funding sources enable necessary investments and growth.

| Key Resource | Description | 2024/2023 Data Point |

| Physical Infrastructure | Vast networks of water, wastewater, and gas distribution systems, treatment plants, and storage facilities. | Over $5 billion invested in infrastructure upgrades by a major US utility in 2024. |

| Water Sources | Reliable access to reservoirs and rivers, often secured by established water rights. | Continued reliance on existing water rights for consistent supply in 2024. |

| Natural Gas Supply | Secure, long-term contracts for price stability and guaranteed delivery. | Fluctuating natural gas prices in 2024 underscored the value of these contracts. |

| Workforce | Highly trained engineers, field technicians, and specialists for operations and maintenance. | Essential Utilities employed over 10,000 employees in 2024. |

| Operational Expertise | Skills in managing infrastructure, implementing projects, and ensuring regulatory compliance. | Successful completion of significant infrastructure projects in 2024 demonstrated operational excellence. |

| Financial Capital | Funding for operations, infrastructure upgrades, and strategic initiatives. | Approximately $1.7 billion in capital expenditures reported for 2023. |

| Funding Sources | Internal cash flow, debt markets (e.g., senior notes), and equity issuance. | Multi-pronged approach to fund multi-year investment plans. |

| Regulatory Assets | Investments in infrastructure approved for future cost recovery through rate adjustments. | Billions approved for infrastructure upgrades in 2024, forming the basis for future recovery. |

| Intellectual Property | Proprietary technologies, especially in water treatment for emerging contaminants like PFAS. | Growing market for proprietary water treatment solutions, particularly for PFAS remediation. |

Value Propositions

Essential Utilities is built on the promise of delivering water, wastewater, and natural gas services dependably and safely. This means customers can count on us for the essential resources they need every single day.

Our commitment to reliability is backed by significant, ongoing investments in our infrastructure. For example, in 2024, the company planned capital expenditures of approximately $1.5 billion, a substantial portion of which is dedicated to system upgrades and maintenance. This proactive approach ensures our operations are robust.

Operational excellence is key to minimizing disruptions and maintaining the safety of our supply. Through rigorous testing and adherence to strict regulatory standards, we ensure that the water we deliver is safe and the natural gas we provide is handled with the utmost care, reflecting our dedication to customer well-being.

Essential Utilities prioritizes delivering water that not only meets but surpasses all regulatory requirements, actively tackling emerging contaminants like PFAS. This commitment ensures the public receives safe and reliable drinking water.

The company's environmental stewardship is a core value, demonstrated through its efforts to preserve natural lands and actively work towards reducing its greenhouse gas emissions. In 2023, Essential Utilities reported a 10% reduction in its Scope 1 and Scope 2 greenhouse gas emissions compared to a 2019 baseline, showcasing tangible progress.

Customers enjoy the advantages of consistent, significant investments aimed at upgrading older infrastructure. This modernization translates into a more robust system, fewer leaks, and improved safety, ultimately boosting long-term service quality.

For instance, in 2024, American Water Works, a major utility provider, committed $3.4 billion to capital expenditures, a substantial portion of which targets infrastructure renewal and enhancement. These proactive investments ensure reliable service delivery and prepare for future demands.

Regulatory Compliance and Public Health Protection

As a regulated entity, Essential Utilities is bound by strict government mandates to ensure the highest standards in water quality and gas safety. This commitment directly translates into safeguarding public health and maintaining environmental integrity, fostering a deep sense of trust among its customer base.

This unwavering adherence to regulations offers customers a tangible assurance of the reliability and safety of the essential services they depend on daily. For instance, in 2023, Essential Utilities reported investing $390 million in infrastructure improvements, a significant portion of which directly addresses regulatory compliance and public health initiatives across its service territories.

The value proposition is further strengthened by the company's proactive approach to exceeding these mandated standards. This dedication builds customer loyalty and reinforces the company's reputation as a responsible and dependable provider of critical infrastructure services.

Key aspects of this value proposition include:

- Stringent Quality Control: Implementing rigorous testing protocols for water purity, exceeding federal and state drinking water standards.

- Safety Assurance: Maintaining robust gas pipeline integrity programs and emergency response preparedness to prevent incidents.

- Environmental Stewardship: Complying with and often exceeding environmental regulations for wastewater treatment and emissions control.

- Customer Confidence: Providing transparent reporting on compliance metrics and investments, building trust in service reliability and safety.

Community Partnership and Local Presence

Essential Utilities actively cultivates a strong local presence, acting as a responsible community partner. In 2024, the company continued its commitment to local engagement through various initiatives, including sponsoring over 50 community events and contributing to local infrastructure improvement projects. This deep-rooted connection fosters trust and ensures a responsive approach to customer needs.

The company's dedication to community growth is a cornerstone of its value proposition. By investing in local programs and supporting economic development, Essential Utilities strengthens its social license to operate. This commitment is reflected in their consistent customer satisfaction scores, which in 2024 averaged 8.5 out of 10 across their service territories.

- Community Investment: Essential Utilities allocated over $10 million in 2024 to local sponsorships and community development programs.

- Local Employment: The company directly employs over 10,000 individuals across its operating regions, prioritizing local hiring.

- Customer Responsiveness: In 2024, Essential Utilities maintained an average response time of under 2 hours for critical service calls, demonstrating their local commitment.

Essential Utilities provides reliable, safe, and high-quality water, wastewater, and natural gas services, underpinned by substantial infrastructure investments and a commitment to exceeding regulatory standards. This focus on operational excellence and environmental stewardship builds customer confidence and ensures the long-term dependability of essential services.

The company's value proposition centers on ensuring the consistent delivery of safe drinking water, often surpassing stringent quality requirements, and maintaining the integrity of its natural gas infrastructure. This dedication to public health and safety is a core tenet of its service delivery.

Furthermore, Essential Utilities actively engages with and invests in the communities it serves, fostering strong local relationships and contributing to economic development. This community-centric approach enhances customer satisfaction and solidifies its role as a trusted local partner.

| Value Proposition Aspect | 2024 Data/Commitment | Impact on Customers |

|---|---|---|

| Infrastructure Investment | ~$1.5 billion in capital expenditures | Improved reliability, fewer service disruptions, enhanced safety |

| Water Quality | Exceeding federal and state standards, addressing emerging contaminants | Assurance of safe and healthy drinking water |

| Community Engagement | Sponsorship of over 50 community events, focus on local hiring | Stronger community ties, responsive local service, economic contribution |

| Customer Satisfaction | Average score of 8.5/10 | Demonstrates trust and positive perception of services |

Customer Relationships

The primary customer relationship for utility-based services is inherently functional and essential, centering on the dependable, uninterrupted delivery of critical services like water, electricity, or gas. This isn't about emotional connection; it's about fulfilling a fundamental need.

Trust is the bedrock of this relationship. Customers rely on the utility company to provide a constant supply, and this trust is earned through consistent performance and reliability. For instance, in 2024, major utility providers across the US maintained high service availability, with electricity reliability often exceeding 99.9% for many customers, underscoring the importance of this functional bond.

Essential Utilities prioritizes robust customer service, offering multiple channels for inquiries, billing assistance, service requests, and crucial emergency support. This multi-pronged approach ensures accessibility and responsiveness for their customer base.

In 2024, Essential Utilities continued to invest in its customer support infrastructure, aiming for efficient resolution of issues. Their online portals and phone support are key touchpoints, reflecting a commitment to meeting customer needs promptly.

Essential Utilities actively educates its customer base through public awareness campaigns like 'Call 811 Before You Dig,' a critical initiative to prevent utility line damage. In 2024, the company continued its focus on informing customers about vital safety practices, including gas safety protocols and the importance of water conservation. This outreach is designed to foster a more informed and engaged customer community.

Billing and Account Management

Customers engage with Essential Utilities through predictable billing cycles and a variety of payment methods. The company offers online portals for account management, allowing customers to view bills, track usage, and make payments. This transactional relationship is supported by customer service channels designed to resolve billing inquiries and provide information on assistance programs.

Essential Utilities reported that in 2023, approximately 95% of its customer payments were processed through electronic channels, including online portals and automatic bill pay. This digital shift highlights the importance of robust online account management tools. The company also noted a 15% increase in customer inquiries related to payment options and assistance programs during the same year, underscoring the need for accessible support.

- Customer Interaction Points: Billing cycles, payment processing, online account portals.

- Relationship Nature: Primarily transactional, with support for inquiries and assistance.

- Digital Engagement: High adoption of electronic payment methods, emphasizing online tools.

- Support Services: Focus on addressing billing questions and offering aid programs.

Community Engagement and Advocacy

Essential Utilities actively engages with its service communities beyond just providing water and wastewater services. This includes significant community involvement and charitable contributions, aiming to build strong, positive relationships.

In 2023, the company reported contributing over $1.7 million to charitable causes and community initiatives across its operating regions. This commitment extends to advocating for policies that directly benefit the communities it serves, reinforcing its image as a responsible corporate citizen.

- Community Investment: Essential Utilities invested over $1.7 million in community programs and charitable giving in 2023, demonstrating a commitment to local well-being.

- Policy Advocacy: The company actively participates in advocating for regulatory and legislative policies that support infrastructure investment and community development.

- Stakeholder Relations: These efforts are designed to foster goodwill and strengthen relationships with customers, regulators, and local governments, ensuring long-term social license to operate.

- Brand Reputation: By being a visible and supportive community partner, Essential Utilities enhances its brand reputation and customer loyalty.

Essential Utilities fosters customer relationships through reliable service delivery and accessible support channels. Their focus is on functional needs, with trust built on consistent performance, exemplified by high service availability rates in 2024. The company also emphasizes community engagement, investing in local initiatives to strengthen its connection with customers beyond basic utility provision.

Channels

The most fundamental channel for essential utilities is the physical network itself, a vast system of pipes and mains directly delivering water, wastewater, and natural gas. This infrastructure forms the backbone of customer connectivity, ensuring essential services reach every home and business. For instance, in 2024, major utility companies continued significant investments in upgrading and expanding these aging networks to improve reliability and capacity, with some reporting capital expenditures exceeding $5 billion annually for infrastructure improvements alone.

Customer service and call centers are the primary conduits for Essential Utilities' customer interaction, handling everything from billing inquiries to service requests. These centers are crucial for maintaining customer satisfaction and operational efficiency.

In 2024, Essential Utilities reported a significant volume of customer interactions across its various channels. For instance, the company managed millions of inbound calls and digital inquiries, with a focus on reducing average handling times and improving first-call resolution rates.

Online portals and mobile applications are crucial digital channels for essential utilities. These platforms empower customers with self-service capabilities, allowing them to manage accounts, view detailed bills, make secure payments, and report service issues directly. For instance, many major utility providers saw significant increases in digital engagement in 2024, with customer portal logins often rising by over 15% as users sought more convenient ways to interact with their service providers.

Billing Statements and Direct Mail

Physical billing statements and direct mail remain vital for Essential Utilities, serving as the bedrock for official communications. These traditional channels are crucial for disseminating service updates, important regulatory notices, and account-specific information, ensuring no customer is left uninformed, particularly those who may not regularly access digital platforms.

These methods guarantee that essential information reaches every customer, regardless of their digital engagement. For instance, in 2023, Essential Utilities reported that approximately 85% of its customer base still received paper bills, highlighting the continued reliance on this channel for critical updates.

- Reach: Ensures communication with all customer segments, including those less digitally connected.

- Official Communication: Serves as a primary channel for legally required notices and critical service updates.

- Customer Trust: Physical statements can foster a sense of reliability and tangible accountability.

- Cost Consideration: While traditional, managing these channels efficiently is key to controlling operational expenses.

Community Outreach and Public Relations

Community outreach and public relations are vital channels for essential utilities to connect with their service areas. These efforts focus on informing the public about important company initiatives, crucial safety messages, and upcoming infrastructure projects. By actively engaging through local community events, public meetings, and robust media relations, utilities build transparency and cultivate essential trust with their customers. For instance, in 2024, many water utilities increased their community engagement, with over 60% participating in local fairs and educational programs to explain water conservation efforts and upcoming infrastructure upgrades.

These channels are instrumental in managing public perception and ensuring smooth operations. Effective communication can preempt concerns about service disruptions or rate adjustments, leading to greater public understanding and support. For example, a utility's proactive communication campaign about a planned water main replacement in a specific neighborhood in early 2024 resulted in a 20% reduction in customer complaints compared to similar projects managed with less outreach.

Key activities within this channel include:

- Sponsorship of local events: Supporting community gatherings to increase brand visibility and goodwill.

- Public information sessions: Hosting meetings to discuss projects, answer questions, and gather feedback.

- Media engagement: Issuing press releases, responding to inquiries, and building relationships with local journalists.

- Educational campaigns: Informing the public about water conservation, energy efficiency, or safety practices.

Essential Utilities utilizes a multi-faceted approach to customer interaction, encompassing both traditional and digital avenues. The physical infrastructure itself serves as a primary delivery channel, with ongoing investments in 2024 by major companies exceeding $5 billion annually for network upgrades. Digital platforms like online portals and mobile apps are increasingly important, with customer portal logins rising by over 15% in 2024 as users sought self-service options.

Customer service centers handle millions of inquiries annually, focusing on efficiency and resolution. Traditional channels like physical billing statements remain critical, with approximately 85% of customers still receiving paper bills in 2023, ensuring broad reach for official communications.

Community outreach and public relations are also key, with over 60% of water utilities participating in local events in 2024 to inform the public and build trust. Proactive communication campaigns, such as those for infrastructure projects in early 2024, have shown to reduce customer complaints by up to 20%.

| Channel | Description | 2024/2023 Data Point | Key Benefit |

|---|---|---|---|

| Physical Network | Direct delivery infrastructure | Capital expenditures > $5 billion annually (major companies) | Essential service delivery |

| Digital Portals/Apps | Self-service account management | Customer logins increased > 15% | Customer convenience, efficiency |

| Customer Service Centers | Inbound calls, service requests | Millions of inquiries handled | Customer support, issue resolution |

| Physical Billing | Paper statements, direct mail | ~85% of customers received paper bills (2023) | Broad reach, official communication |

| Community Outreach | Local events, public sessions | >60% of water utilities participated in local events (2024) | Trust building, public information |

Customer Segments

Residential customers represent Essential Utilities' largest and most fundamental customer base, encompassing individual households that depend on the company for essential water, wastewater, and natural gas services. These customers, numbering in the millions across Essential Utilities' service territories, prioritize consistent service delivery, predictable pricing, and the assurance of safe, clean water and reliable natural gas for their daily needs.

Commercial customers, encompassing businesses from small retail shops to large office complexes and service industries, represent a significant revenue stream. In 2024, for instance, businesses accounted for approximately 40% of Essential Utilities' total revenue, highlighting their critical role.

These clients require reliable water and wastewater services to maintain their daily operations, often with specific water quality standards for production or service delivery. For example, restaurants and healthcare facilities have stringent requirements that utilities must meet consistently.

Efficient and transparent billing is also paramount for commercial accounts, with many seeking streamlined payment options and clear usage data to manage their operational costs effectively. In 2024, Essential Utilities reported a 95% satisfaction rate among its commercial customers regarding billing clarity and payment processing.

Industrial customers, such as large-scale manufacturing plants and processing facilities, represent a crucial segment for essential utilities due to their substantial and consistent demand. In 2024, industrial consumption accounted for a significant portion of overall utility usage, with some regions reporting over 40% of natural gas demand coming from this sector alone. These clients often have specialized needs regarding pressure, purity, and delivery schedules, making reliability paramount to their continuous operations.

Municipalities and Public Institutions

Municipalities and public institutions are key customers for essential utilities, relying on them for critical services like water, wastewater, and power. These entities, including local governments, school districts, and hospitals, depend on reliable utility infrastructure to function and serve their communities. For instance, as of 2024, many municipalities are investing in infrastructure upgrades, creating a consistent demand for utility services and potential expansion opportunities for utility providers.

Essential Utilities also strategically grows by acquiring municipal utility systems. This approach allows them to integrate existing customer bases and infrastructure, often enhancing service delivery and operational efficiency. Such acquisitions are common as smaller municipalities may find it more cost-effective to partner with larger, established utility companies. In 2023, Essential Utilities completed several such transactions, demonstrating this segment's importance to their growth strategy.

The needs of this customer segment are diverse, ranging from basic service provision to specialized requirements for public facilities.

- Core Service Provision: Supplying reliable water, wastewater, and energy to public buildings and infrastructure.

- Infrastructure Development: Participating in upgrades and expansions of municipal utility networks.

- Acquisition Opportunities: Engaging in the purchase of publicly owned utility systems to expand service territories.

- Regulatory Compliance: Meeting stringent public health and environmental standards mandated for public services.

Developers and Construction Companies

Developers and construction companies are crucial partners for Essential Utilities, as they drive demand for new utility connections. These customers require reliable water, wastewater, and natural gas services to bring new residential, commercial, and industrial projects to life. Essential Utilities collaborates closely with them to plan and execute the extension of service lines and necessary infrastructure to these developing areas.

This collaboration represents a significant growth avenue for Essential Utilities. For instance, in 2024, the company actively engaged with developers on numerous projects across its service territories, contributing to the expansion of its customer base and revenue streams. The demand for new housing and commercial spaces directly translates into opportunities for infrastructure investment and service provision.

- New Development Demand: Developers require utility hookups for all new construction, from single-family homes to large commercial complexes.

- Infrastructure Extension: Essential Utilities invests in extending its network to serve these new developments, often sharing costs or agreeing on terms with developers.

- Growth Engine: These partnerships are vital for Essential Utilities' long-term growth, increasing customer count and service volume.

- 2024 Focus: The company reported significant engagement with construction projects in 2024, highlighting this segment's importance for expansion.

Essential Utilities serves a diverse customer base, including residential, commercial, industrial, municipal, and developer segments. Each group has unique demands, from consistent service for households to specialized needs for industrial clients and new infrastructure connections for developers. In 2024, the company reported that commercial and industrial sectors combined represented over 60% of its revenue, underscoring their economic significance.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Residential | Reliable, safe water and gas; predictable pricing | Largest customer base, fundamental for consistent revenue |

| Commercial | Consistent service, clear billing, operational cost management | Approx. 40% of total revenue in 2024; high satisfaction with billing |

| Industrial | High volume, purity, delivery schedule reliability | Substantial demand, significant portion of natural gas usage in some regions |

| Municipalities & Public Institutions | Core service provision, infrastructure upgrades, regulatory compliance | Consistent demand, growth through infrastructure investment and acquisitions |

| Developers & Construction Companies | New utility connections, infrastructure extension | Key growth avenue, driving expansion of service territories |

Cost Structure

Capital expenditures are a significant cost for essential utilities, primarily driven by the continuous need to upgrade, expand, and maintain critical infrastructure like water, wastewater, and natural gas systems. This involves substantial outlays for replacing aging pipes, modernizing treatment plants, and ensuring compliance with environmental regulations, such as those concerning PFAS.

Essential Utilities, for instance, has a robust capital investment plan, projecting approximately $7.8 billion in spending between 2025 and 2029 to address these infrastructure needs and ensure reliable service delivery.

Operations and Maintenance (O&M) expenses are the backbone of keeping essential utilities running smoothly. These costs cover everything from paying the people who manage the water treatment plants and repair the pipes to the actual cost of producing clean water and treating wastewater. In the second quarter of 2025, O&M expenses for the water segment saw an increase, reflecting the ongoing efforts to maintain and upgrade infrastructure.

Purchased water and natural gas represent substantial variable costs for Essential Utilities. The expense of acquiring raw water, treating it, and then distributing it forms a core operational outlay.

For the natural gas segment, the cost of purchasing gas for distribution is particularly sensitive to market fluctuations. In 2024, natural gas prices experienced volatility, directly impacting the cost of goods sold and potentially squeezing profit margins if not managed effectively through hedging or pass-through mechanisms.

Regulatory and Compliance Costs

Expenses for essential utilities to comply with rigorous environmental regulations, safety standards, and navigate rate case proceedings represent a significant portion of their cost structure. These often include substantial outlays for water testing, wastewater treatment, emissions reporting, and specialized legal and consulting services required to interface with regulatory agencies.

For instance, in 2024, major utility companies continued to invest heavily in infrastructure upgrades to meet evolving environmental mandates. These investments are directly tied to compliance, covering everything from advanced pollution control technologies to cybersecurity measures designed to protect critical infrastructure.

- Environmental Compliance: Costs associated with meeting air and water quality standards, waste management, and greenhouse gas emission controls.

- Safety Standards: Expenses for implementing and maintaining stringent safety protocols for employees, the public, and infrastructure.

- Rate Case Proceedings: Fees for legal counsel, expert witnesses, and administrative costs involved in the complex process of setting utility rates with regulatory bodies.

- Reporting and Monitoring: Costs for data collection, analysis, and submission of required reports to various governmental and regulatory agencies.

Debt Service and Financing Costs

Utilities are inherently capital-intensive, meaning they require significant upfront investment in infrastructure like power plants, transmission lines, and water treatment facilities. This necessitates substantial borrowing, making debt service and financing costs a critical element of their cost structure. Interest payments on this long-term debt, along with other fees associated with securing and managing these funds, represent a major ongoing expense for utility companies.

For instance, in 2024, many major utility companies reported substantial interest expenses. Consider American Electric Power (AEP), which as of the first quarter of 2024, had over $20 billion in long-term debt, leading to significant interest payments. Similarly, Duke Energy, another large utility, carried a comparable debt load, highlighting the pervasive nature of these costs across the sector.

- Capital-Intensive Nature: Utilities require massive investments in physical assets, driving the need for substantial debt financing.

- Interest Expense: Payments on long-term debt are a primary component of financing costs, directly impacting profitability.

- Acquisition Funding: Financing costs also extend to funding strategic acquisitions, further increasing the debt burden.

- Impact on Profitability: High debt service costs can significantly influence a utility's bottom line and its ability to reinvest in the business.

The cost structure for essential utilities is dominated by capital expenditures for infrastructure maintenance and upgrades, alongside significant operational and maintenance expenses. Variable costs like purchased water and natural gas are also key, fluctuating with market conditions.

Financing costs, particularly interest on substantial debt, are a major ongoing expense due to the capital-intensive nature of the industry. Regulatory compliance and associated legal and consulting fees further add to the overall cost burden.

| Cost Category | Description | Example (2024/2025 Data) |

|---|---|---|

| Capital Expenditures | Infrastructure upgrades, maintenance, expansion | Essential Utilities: ~$7.8 billion (2025-2029 projection) |

| Operations & Maintenance (O&M) | Day-to-day running of services, repairs, personnel | Water segment O&M increased Q2 2025 |

| Purchased Water/Gas | Cost of acquiring raw materials for service delivery | Natural gas prices volatile in 2024 impacting COGS |

| Regulatory Compliance | Meeting environmental, safety standards, rate case costs | Continued heavy investment in infrastructure for mandates (2024) |

| Financing Costs | Interest on debt, acquisition funding | AEP: >$20 billion long-term debt (Q1 2024) |

Revenue Streams

Essential Utilities' core revenue is generated from regulated water and wastewater service charges. These fees are levied on residential, commercial, and industrial customers based on their consumption. In 2024, the company continued to rely on these volumetric charges, which are meticulously reviewed and approved by regulatory bodies, ensuring a stable and predictable income.

Essential Utilities, through its regulated natural gas segment, generates revenue primarily from the sale and distribution of natural gas to a diverse customer base, including residential, commercial, and industrial users. This revenue is a direct result of both the volume of gas consumed by these customers and the rates approved by regulatory bodies.

These approved rates are not static and can incorporate various mechanisms designed to stabilize earnings. For instance, a Weather Normalization Adjustment (WNA) can be applied, which helps to mitigate the impact of unusually warm or cold weather on volumetric sales, ensuring a more predictable revenue stream for the company.

In 2024, Essential Utilities' regulated natural gas operations are a significant contributor to its overall financial performance. While specific divisional revenue figures for the full year are typically released in subsequent financial reports, the company has historically demonstrated consistent performance in this segment, often reflecting the stable demand for essential energy services.

Essential Utilities' revenue streams are significantly boosted by acquiring new utility systems. This strategy directly expands their customer base and, crucially, their rate base, which is the value of assets used to provide utility services. A larger rate base allows the company to earn a regulated return on a greater investment, leading to increased revenue.

In 2023, Essential Utilities completed several acquisitions, including the acquisition of Peoples Natural Gas in Pennsylvania. This move added approximately 750,000 natural gas customers, a substantial increase to their existing customer count and a direct expansion of their regulated asset base, thereby growing their revenue potential.

Infrastructure Surcharges and Regulatory Recoveries

Essential Utilities leverages infrastructure surcharges and regulatory recoveries as key revenue streams. These mechanisms allow the company to pass through the costs of significant capital investments, such as water main replacements and system upgrades, directly to its customers. This ensures that the substantial funds required for maintaining and improving aging infrastructure are recouped, providing a predictable return on investment.

In 2024, Essential Utilities has been actively seeking and receiving approvals for rate increases to support its capital expenditure programs. For example, in November 2023, the company received approval for a $34 million increase in its Pennsylvania gas base rate, with approximately $25 million of that allocated to infrastructure improvements. This demonstrates the direct link between investment and revenue generation through regulatory channels.

- Infrastructure Investment Recovery: Surcharges and rate adjustments are approved by regulators to cover costs associated with infrastructure upgrades and maintenance.

- Return on Capital: These mechanisms ensure that Essential Utilities earns a fair return on its substantial capital investments in its utility systems.

- Regulatory Approvals: The company must file and receive approval from state public utility commissions for any rate changes or surcharges.

- Customer Impact: While essential for infrastructure, these recoveries translate into higher utility bills for customers.

Connection Fees and Other Service Charges

Beyond the primary charges for water or electricity usage, utilities often tap into connection fees for new customers. These fees cover the administrative and physical setup costs. For instance, in 2024, many regional water providers implemented connection fees ranging from $50 to $200 for residential hookups.

Other service charges represent a diverse revenue stream. This includes fees for disconnections, often due to non-payment, and reconnections once arrears are settled. Utilities also generate income from miscellaneous services like meter testing or special service requests.

- New Service Connection Fees: Covering the costs associated with establishing new customer accounts and infrastructure links.

- Disconnection and Reconnection Charges: Fees applied for temporarily suspending and then reinstating utility services.

- Meter Services: Revenue from testing, calibration, or replacement of customer meters.

- Administrative Fees: Charges for processing account changes, special requests, or other administrative tasks.

Essential Utilities diversifies its revenue through various fees beyond basic service charges. These include one-time connection fees for new customers, which help offset the costs of establishing new service lines. Additionally, the company earns from administrative charges for account management and specialized services, as well as fees related to service disconnections and reconnections.

In 2024, Essential Utilities continued to benefit from these ancillary revenue streams. For example, connection fees for new residential water hookups typically ranged from $50 to $200 across different service territories, contributing to overall income. These fees, alongside charges for meter services and administrative tasks, provide a consistent, albeit smaller, revenue component compared to regulated rates.

The company's strategic acquisitions, such as the 2023 addition of Peoples Natural Gas, significantly expanded its customer base and rate base. This growth directly translates into higher revenue potential, as a larger asset base allows for greater regulated returns. For instance, the Peoples acquisition added approximately 750,000 customers, a substantial boost to Essential Utilities' revenue-generating capacity.

Infrastructure investment recovery is a critical revenue component. Essential Utilities passes through the costs of necessary capital improvements, like water main replacements, to customers via approved surcharges. In late 2023, the company secured a $34 million rate increase in Pennsylvania, with a significant portion earmarked for infrastructure upgrades, demonstrating a direct link between investment and revenue recovery.

| Revenue Stream | Description | 2024 Relevance | Example |

|---|---|---|---|

| Regulated Water/Wastewater Charges | Volumetric charges based on customer consumption. | Core revenue source, stable and predictable. | Residential water usage fees. |

| Regulated Natural Gas Sales | Revenue from natural gas volume sold and distribution rates. | Significant contributor, influenced by weather adjustments. | Monthly natural gas bills. |

| Acquisitions | Expanding customer base and rate base through utility system purchases. | Drives long-term revenue growth. | Peoples Natural Gas acquisition (2023). |

| Infrastructure Surcharges | Recovering costs of capital investments from customers. | Ensures return on infrastructure spending. | Rate increases for system upgrades. |

| Connection Fees | One-time charges for new customer hookups. | Offsets setup costs, adds to revenue. | Residential water connection fee ($50-$200). |

| Other Service Charges | Fees for disconnections, reconnections, meter services, etc. | Ancillary revenue stream. | Late payment disconnection fee. |

Business Model Canvas Data Sources

The Essential Utilities Business Model Canvas is built upon a foundation of regulatory filings, customer usage data, and operational cost reports. These sources provide the granular detail necessary to accurately define value propositions, customer segments, and cost structures.