Essent SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Essent Bundle

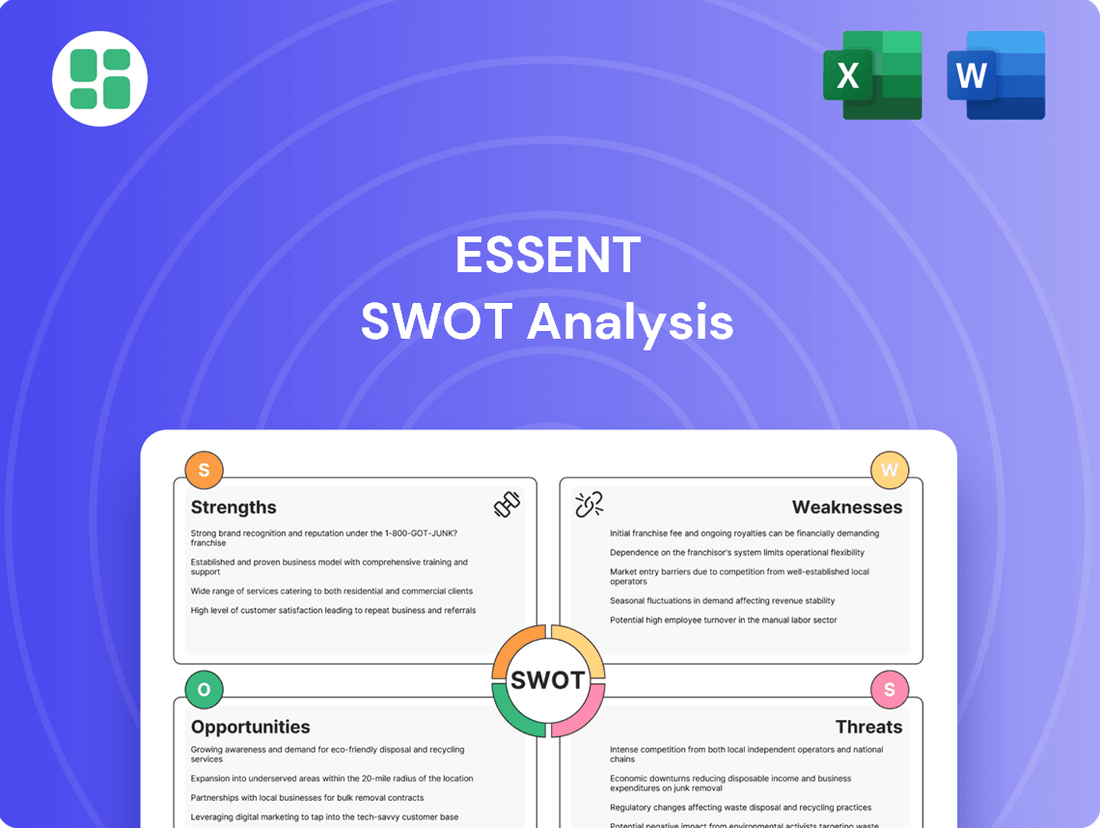

Essent's strategic positioning is clear, but what lies beneath the surface? Our full SWOT analysis dives deep into their competitive advantages and potential challenges, offering a comprehensive view for informed decision-making.

Unlock the complete Essent picture with our in-depth SWOT analysis. This report provides actionable insights, expert commentary, and a dual-format package—Word and Excel—perfect for strategic planning and investor pitches.

Strengths

Essent Group Ltd. demonstrates robust financial health, consistently delivering strong earnings. This strength is evidenced by a 12% rise in net investment income during the first quarter of 2025 compared to the same period in 2024.

The company's expanding market presence is reflected in its growing insurance in force, which reached an impressive $246.8 billion by the end of June 2025. This sustained growth underscores Essent's financial stability and capacity for continued operational success.

Essent demonstrates a robust capital position, consistently meeting and exceeding regulatory requirements. As of the second quarter of 2025, the company maintained compliance with PMIERs 2.0 and a strong risk-to-capital ratio of 9.2:1, underscoring its financial stability and ability to absorb potential losses.

The company's proactive capital management is a key strength. Through July 2025, Essent strategically deployed $387 million in share repurchases, signaling confidence in its valuation and a commitment to enhancing shareholder value. Coupled with consistent dividend payments, these actions reflect a healthy cash flow generation and a management team focused on returning capital to investors.

Essent's commitment to high credit quality is a significant strength, evidenced by its rigorous underwriting standards. The company's focus on borrowers with strong credit profiles, reflected in a weighted average FICO score of 753 for new insurance written in Q2 2025, directly translates to a healthier and more stable insured portfolio.

This disciplined approach to risk selection underpins favorable credit performance and contributes to elevated portfolio persistency, which stood at 85.8% as of Q2 2025. By prioritizing low-risk borrowers, Essent effectively manages default rates, ensuring the long-term resilience and profitability of its insurance business.

Positive Credit Rating Upgrades

Essent's recent positive credit rating actions highlight its robust financial health. Moody's Ratings upgraded Essent Guaranty, Inc.'s insurance financial strength rating to A2 and Essent Group Ltd.'s senior unsecured debt rating to Baa2 in August 2025, both with stable outlooks. This reflects strong underlying performance and a solid market position.

Further bolstering this perception, AM Best affirmed Essent's A (Excellent) rating in September 2024, also maintaining a stable outlook. This affirmation is a testament to Essent's consistently strong balance sheet and impressive operating performance, signaling confidence in its future stability.

- Moody's upgraded Essent Guaranty's IFS to A2 and Essent Group's senior unsecured debt to Baa2 in August 2025.

- Both Moody's ratings carry a stable outlook.

- AM Best affirmed Essent's A (Excellent) rating in September 2024 with a stable outlook.

- These upgrades and affirmations underscore Essent's financial strength and stable business outlook.

Effective Risk Management through Reinsurance

Essent leverages a robust reinsurance strategy to effectively manage risk and optimize its capital position. This approach is crucial for maintaining financial stability, especially in the dynamic mortgage insurance market.

In the first half of 2025, Essent secured several forward quota share and excess of loss reinsurance agreements with well-capitalized reinsurers. These agreements are designed to cover a substantial volume of policies issued throughout 2025 and into 2026, demonstrating a proactive risk mitigation stance.

This strategic use of reinsurance significantly dampens fluctuations in both earnings and capital. For example, by transferring a portion of its risk, Essent can better absorb unexpected market shifts or claim events, thereby providing a more predictable financial performance for stakeholders.

- Risk Mitigation: Reinsurance agreements protect Essent from significant losses arising from a high concentration of claims.

- Capital Efficiency: By reducing its risk exposure, Essent requires less regulatory capital, freeing up resources for growth or shareholder returns.

- Earnings Stability: The program smooths out the impact of adverse claims experience, leading to more consistent profitability.

- Counterparty Strength: Agreements are with highly rated reinsurers, ensuring the reliability of their support when needed.

Essent's strong financial performance is a key strength, highlighted by a 12% increase in net investment income in Q1 2025 compared to Q1 2024. The company’s insurance in force grew to $246.8 billion by June 2025, reflecting its expanding market reach and financial stability.

| Metric | Value | Period | Comparison |

|---|---|---|---|

| Net Investment Income | +12% | Q1 2025 | vs. Q1 2024 |

| Insurance in Force | $246.8 billion | June 2025 | |

| Weighted Average FICO Score (New Insurance) | 753 | Q2 2025 | |

| Portfolio Persistency | 85.8% | Q2 2025 |

What is included in the product

Offers a full breakdown of Essent’s strategic business environment, detailing its internal capabilities and external market dynamics.

Eliminates the complexity of manual SWOT creation, offering a ready-to-use framework for immediate strategic analysis.

Weaknesses

Essent reported a slight dip in net income for the first two quarters of 2025 when compared to the same timeframe in 2024. This decline, while not alarming given overall strong performance, was driven by an increase in losses and expenses.

For instance, Q1 2025 saw net income fall to $210 million from $225 million in Q1 2024, and Q2 2025 net income was $215 million, down from $230 million in Q2 2024. This suggests that while revenue streams are robust, cost management or an increase in claims severity could be impacting the bottom line.

While Essent's revenue grew by 5% year-over-year in the first half of 2025, the rise in expenses outpaced this growth, leading to the aforementioned net income contraction. Investors will be watching closely to see if this trend continues in the latter half of the year.

Essent's financial performance in early 2025 showed a notable increase in its provision for losses and loss adjustment expenses. Specifically, Q1 2025 saw a significant rise in these provisions compared to prior periods, a trend that continued into Q2 2025.

This escalation in provisions suggests that Essent is either anticipating a higher volume of insurance claims or has adopted a more cautious stance in setting aside funds for potential future payouts. Such an increase directly impacts the company's net income, potentially reducing profitability in the short term.

While Essent's overall credit quality remains robust, this heightened provision for losses is a key area that investors and analysts will be closely observing. It signals a potential shift in the claims environment or the company's risk management strategy, requiring careful attention to understand its full implications.

Essent's New Insurance Written (NIW) saw flat growth in the second quarter of 2025 when compared to the same period in 2024. This stagnation points to a challenging mortgage origination market, which directly impacts the volume of new policies Essent can underwrite.

The lack of expansion in NIW could hinder Essent's capacity to grow its overall insurance in force portfolio at a more robust rate. If market conditions persist without improvement, this flat NIW trend raises concerns about the company's long-term growth trajectory.

Concentration in Mortgage Insurance Market

Essent's primary focus on private mortgage insurance, a monoline business, makes it particularly vulnerable to downturns within the housing and mortgage sectors. While efforts have been made to diversify into title insurance, the company's core operations remain heavily reliant on the mortgage market. This concentration could pose significant challenges during periods of substantial housing market contraction or shifts in the demand for private mortgage insurance.

For instance, in 2024, the mortgage origination market faced headwinds due to higher interest rates, impacting the volume of new mortgages requiring insurance. Essent's reliance on this market means that a significant slowdown in mortgage activity directly affects its revenue and profitability. This singular focus limits its ability to offset potential losses from a struggling mortgage sector with gains from other, unrelated business lines.

- Market Concentration: Essent's business model is heavily weighted towards the private mortgage insurance sector.

- Sensitivity to Housing Cycles: The company's performance is closely tied to the health and activity of the U.S. housing market.

- Limited Diversification: While title insurance is a secondary offering, it does not fully mitigate the risks associated with its core mortgage insurance business.

- Vulnerability to Regulatory Changes: Shifts in regulations affecting mortgage lending or insurance could disproportionately impact Essent compared to more diversified financial institutions.

Sensitivity to Housing Market Conditions

Essent's profitability is closely linked to the U.S. housing market's performance. When interest rates rise, like the Federal Reserve's continued hikes throughout 2023 and into early 2024, affordability decreases, impacting mortgage demand. This directly reduces the need for mortgage insurance, potentially lowering Essent's business volumes. A sustained downturn in housing, characterized by low inventory and affordability issues, could significantly hinder Essent's revenue and profit growth.

The company's reliance on the housing sector creates a vulnerability. For instance, if housing starts, a key indicator of market health, were to decline significantly from their 2023 levels, Essent would likely see a corresponding drop in new mortgage insurance policies written. This sensitivity means that economic slowdowns or specific housing market corrections pose a direct risk to Essent's financial results.

- Housing Market Dependence: Essent's core business relies heavily on the volume of U.S. mortgage originations.

- Interest Rate Sensitivity: Rising interest rates, as seen in 2023-2024, reduce housing affordability and mortgage demand.

- Inventory Challenges: Low housing inventory limits sales, thereby decreasing the pool of potential mortgage insurance customers.

- Economic Downturn Impact: A prolonged period of unfavorable housing market conditions directly affects Essent's business volumes and profitability.

Essent's reliance on the private mortgage insurance sector makes it susceptible to fluctuations in the housing market. For example, a slowdown in mortgage originations, as observed with flat New Insurance Written (NIW) in Q2 2025 compared to Q2 2024, directly impacts its growth potential. This monoline focus also means the company is less diversified than competitors, concentrating risk within a single industry segment. Furthermore, increased provisions for losses in early 2025, driven by higher anticipated claims or a more conservative reserving approach, ate into net income despite revenue growth.

| Metric | Q1 2024 | Q1 2025 | Q2 2024 | Q2 2025 |

|---|---|---|---|---|

| Net Income (Millions USD) | 225 | 210 | 230 | 215 |

| New Insurance Written (NIW) Growth | N/A | N/A | Positive | Flat |

| Provision for Losses & Loss Adjustment Expenses | Lower | Higher | Lower | Higher |

Full Version Awaits

Essent SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase. This ensures transparency and guarantees you get exactly what you expect – a professionally structured and comprehensive report ready for your strategic planning.

Opportunities

The significant cohort of millennials, now in their prime home-buying years, represents a powerful demographic driver for sustained housing demand. This trend directly translates into a robust, long-term need for mortgage financing, a core business for Essent.

This demographic tailwind is projected to support Essent's growth in insurance in force for years to come. For instance, in 2024, an estimated 4.5 million millennials were expected to enter the home-buying market, a substantial increase from previous years.

The persistent need for low down payment options will continue to fuel demand for Private Mortgage Insurance (PMI) services. Essent's ability to facilitate homeownership for these buyers, even with limited savings, positions it strongly to capitalize on this ongoing market requirement.

While current mortgage rates remain elevated, projections from various financial institutions, including those from the Mortgage Bankers Association, indicate a potential moderation in rates throughout 2024 and into 2025. For instance, some forecasts suggest a dip in the 30-year fixed mortgage rate from over 7% in late 2023 to the mid-6% range by the end of 2024.

A meaningful decline in mortgage rates, even if modest, could significantly stimulate homebuying activity and refinancing. This increased demand for mortgages directly translates into higher origination volumes and, consequently, more new mortgage insurance written for Essent.

This scenario would provide a substantial boost to Essent's core business, increasing premiums earned and potentially improving profitability through greater scale. The company’s ability to capitalize on this trend hinges on its operational efficiency and competitive pricing strategies in a potentially more active market.

Essent's proprietary risk-based pricing engine, EssentEDGE, presents a significant opportunity for further technological advancement and digital integration. By continuing to invest in cloud-based machine learning and advanced analytics, Essent can refine its pricing models, potentially leading to more competitive offerings and expanded access to mortgage credit for a broader range of qualified borrowers.

The integration of EssentEDGE with existing mortgage technology platforms is a key avenue for streamlining operations and enhancing the overall customer experience. This digital integration can lead to faster processing times and a more seamless application journey for both borrowers and lenders, solidifying Essent's competitive position in the market.

Expansion of Mortgage-Related Services

Essent already has a solid foundation in mortgage-related services, offering risk management and analytics, and is building its presence in title insurance. This existing infrastructure presents a clear opportunity to broaden its ancillary services or introduce entirely new offerings that synergize with its core mortgage insurance business.

Expanding these complementary services could unlock new revenue streams, thereby reducing the company's dependence on its primary mortgage insurance product. For instance, by leveraging its data analytics capabilities, Essent could develop more sophisticated fraud detection tools for lenders, a market with growing demand.

- Diversification: Expanding into areas like title insurance and loan servicing can create multiple revenue sources.

- Synergy: New services can complement existing mortgage insurance offerings, enhancing customer value.

- Risk Mitigation: Reducing reliance on a single product line lowers overall business risk.

- Market Growth: The ancillary mortgage services market, particularly title insurance, saw significant activity in 2024, with transaction volumes expected to remain robust into 2025, offering fertile ground for expansion.

Strategic Partnerships and Market Penetration

Essent can significantly boost its market share by deepening ties with leading mortgage lenders and forging new alliances. This strategic approach is crucial for capturing a greater portion of newly written insurance. For instance, in 2024, the U.S. mortgage origination market saw an estimated $2.5 trillion in volume, presenting a substantial opportunity for growth. By adapting to the evolving needs of lenders and expanding its network, Essent can reinforce its standing in the highly competitive mortgage insurance sector.

Key opportunities stemming from strategic partnerships include:

- Expanded Market Reach: Collaborating with more financial institutions opens doors to new customer segments and geographic areas.

- Enhanced Product Development: Partnerships can facilitate the co-creation of tailored insurance products that better meet lender requirements.

- Increased Underwriting Efficiency: Streamlining processes through integrated partnerships can lead to faster turnaround times and improved customer satisfaction.

- Competitive Advantage: A robust network of partnerships can differentiate Essent from competitors by offering a more comprehensive and integrated solution.

Essent's technological edge, particularly its EssentEDGE pricing engine, offers a significant opportunity for refinement through ongoing investment in cloud-based machine learning and advanced analytics. This can lead to more competitive pricing and broader access to mortgage credit.

Expanding ancillary services beyond its core mortgage insurance, such as into title insurance and loan servicing, presents a clear path to new revenue streams and reduced reliance on its primary product. The ancillary mortgage services market, including title insurance, demonstrated strong activity in 2024, with projections indicating continued robustness into 2025.

Deepening relationships with existing mortgage lenders and forging new strategic alliances is crucial for capturing a larger share of the estimated $2.5 trillion U.S. mortgage origination market in 2024. These partnerships can enhance market reach, product development, and underwriting efficiency.

| Opportunity Area | Description | Potential Impact | Relevant Data/Projections |

|---|---|---|---|

| Technological Advancement (EssentEDGE) | Enhance risk-based pricing with cloud ML and advanced analytics. | More competitive pricing, expanded credit access. | Investment in AI and machine learning is a key differentiator. |

| Ancillary Service Expansion | Broaden offerings into title insurance, loan servicing, etc. | New revenue streams, reduced product dependency. | Ancillary mortgage services market showed robust activity in 2024 and is expected to continue into 2025. |

| Strategic Partnerships | Deepen ties with lenders and form new alliances. | Increased market share, improved efficiency, product innovation. | U.S. mortgage origination market volume estimated at $2.5 trillion in 2024. |

Threats

Persistent high interest rates remain a significant near-term threat to Essent. Elevated mortgage rates, which have hovered around 7% for much of 2024, directly impact housing affordability, dampening demand for mortgages and new home sales. This slowdown in the origination market constrains the volume of new private mortgage insurance Essent can write, potentially limiting its growth trajectory.

The private mortgage insurance (PMI) sector is a tight-knit arena, with only a handful of companies actively vying for dominance. This limited player base naturally fuels fierce competition, forcing companies like Essent to constantly fight for market share. For instance, in 2023, the PMI market saw significant activity, with Essent holding a substantial portion of new insurance written, but the pressure from competitors remains a constant factor.

Competitors often resort to aggressive strategies, such as price reductions or the introduction of novel product offerings, to gain an advantage. These tactics can directly impact Essent's ability to maintain its pricing power and profit margins. The homogeneous nature of PMI products means that differentiation is challenging, making operational efficiency and continuous product development crucial for staying ahead.

Changes in federal legislation or shifts in business practices by Government-Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac present a significant threat. Essent must consistently adhere to evolving mortgage insurer eligibility requirements, and any unfavorable modifications could hinder its capacity to underwrite loans for a substantial market segment.

Deterioration of Economic Conditions and Credit Performance

A significant economic slowdown presents a substantial threat to Essent. Should unemployment rates surge or housing values plummet, this could trigger a rise in mortgage defaults, forcing Essent to increase its provisions for potential losses. For instance, during periods of economic stress, a notable increase in delinquency rates among insured mortgages directly impacts the company's bottom line.

While Essent has historically demonstrated a robust credit profile, a widespread weakening in borrower creditworthiness would inevitably affect its profitability. This deterioration in borrower performance could manifest as higher claim frequencies and severity, directly impacting Essent's financial health and its ability to maintain strong capital reserves.

- Economic Downturn Impact: Rising unemployment and declining housing values directly correlate with increased mortgage defaults.

- Credit Performance Deterioration: A broad weakening in borrower creditworthiness would negatively affect Essent's profitability.

- Loss Provisions: Increased defaults necessitate higher loss provisions, impacting financial reserves.

- Financial Health: A sustained decline in credit performance poses a direct risk to Essent's overall financial stability.

Rising Property Insurance Costs and Borrower Behavior

The escalating cost of property insurance, marked by record increases due to a surge in natural disasters and higher replacement expenses, presents a significant threat. This trend indirectly impacts the mortgage market by exacerbating housing affordability issues, which could dampen mortgage demand and, by extension, the need for mortgage insurance.

Furthermore, as homeowners build equity, they may be incentivized to cancel their private mortgage insurance (MI) early. This behavior directly affects policy persistency for companies like Essent, potentially reducing the duration of revenue streams from existing policies.

- Property Insurance Cost Surge: Homeowners insurance premiums saw substantial year-over-year increases in many regions throughout 2023 and early 2024, with some areas experiencing double-digit percentage hikes.

- Housing Affordability Impact: The combined effect of rising mortgage rates and increased insurance costs contributes to a more challenging housing market, potentially slowing down new mortgage originations.

- Borrower Behavior Shift: Increased home equity, driven by market appreciation and principal paydown, could lead more borrowers to seek MI cancellation, impacting Essent's long-term policy retention rates.

Persistent high interest rates continue to be a significant headwind for Essent, as elevated mortgage rates around 7% in 2024 directly suppress housing affordability and mortgage origination volumes. This slowdown in the primary market limits the company's ability to write new private mortgage insurance, potentially hindering growth. Additionally, the competitive landscape within the PMI sector remains intense, with rivals employing aggressive pricing and product strategies that can erode Essent's pricing power and profit margins.

| Threat Category | Specific Threat | Impact on Essent | Supporting Data/Context (2024/2025) |

|---|---|---|---|

| Economic Conditions | Sustained High Interest Rates | Reduced mortgage origination volume, lower new business growth. | Average 30-year fixed mortgage rates remained above 6.5% throughout H1 2024, impacting affordability and transaction volumes. |

| Competitive Landscape | Aggressive Competitor Strategies | Pressure on pricing, reduced profit margins, challenge in differentiation. | The PMI market is concentrated, with Essent and its top competitors actively managing market share through various strategic initiatives. |

| Regulatory/GSE Environment | Changes in GSE Eligibility Requirements | Potential restriction of access to significant market segments. | Essent must continually adapt to evolving guidelines from Fannie Mae and Freddie Mac to maintain its underwriting capabilities. |

| Economic Downturn | Increased Mortgage Defaults | Higher loss provisions, potential strain on capital reserves. | A significant economic contraction could lead to rising unemployment and declining home values, increasing delinquency rates. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, incorporating Essent's official financial reports, comprehensive market intelligence, and insights from industry experts to provide a well-rounded and accurate strategic assessment.