Essent Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Essent Bundle

Essent's competitive landscape is shaped by the interplay of five key forces, revealing the intensity of rivalry and the potential for profitability. Understanding these dynamics is crucial for any stakeholder looking to navigate this market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Essent’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Capital providers, including investors and reinsurers, hold significant bargaining power over Essent. Essent's ability to underwrite policies and comply with regulations like PMIERs hinges on maintaining a robust capital base. The cost and accessibility of this capital directly impact Essent's operational capacity and profitability.

Essent's strategic use of reinsurance, such as the quota share agreements extending into 2025 and 2026, demonstrates its effort to manage risk and enhance capital efficiency. These transactions highlight the ongoing negotiation and reliance on external capital sources, indicating the leverage these providers possess.

Data and analytics service providers hold moderate bargaining power for Essent. Essent's reliance on proprietary credit engines like EssentEDGE® for pricing and risk management suggests a degree of internal capability, potentially reducing dependence on external data vendors. However, the specialized nature of advanced analytics and unique datasets means providers with superior technology could still influence pricing or service offerings.

Technology and software vendors wield significant bargaining power in the insurance sector, as companies like Essent increasingly depend on advanced solutions. The insurance industry's adoption of AI, cloud services, and robust cybersecurity is critical for operational efficiency and customer engagement. For instance, spending on AI in insurance was projected to reach $1.8 billion in 2024, highlighting the reliance on specialized software providers.

Reinsurance Partners

The bargaining power of suppliers, specifically reinsurers, is a significant factor for Essent. Reinsurance is vital for Essent to manage its risk exposure, and the availability and cost of this coverage directly influence its financial stability. A concentrated market of highly rated reinsurers can exert considerable influence over terms and pricing, potentially impacting Essent's ability to deploy capital effectively.

Essent actively manages this by securing reinsurance arrangements. For instance, in 2024, Essent entered into new excess of loss and quota share reinsurance transactions. These agreements, covering the 2025 and 2026 periods, are designed to bolster its risk management framework and provide greater certainty regarding its risk transfer costs.

- Concentration of Reinsurers: A limited number of highly rated reinsurers can dictate terms, increasing costs for Essent.

- Risk Transfer Costs: The price of reinsurance directly affects Essent's profitability and capital requirements.

- Strategic Reinsurance Agreements: Essent's proactive approach, such as the 2025-2026 excess of loss and quota share treaties, aims to mitigate supplier power by securing favorable terms.

Specialized Professional Services

Suppliers of specialized professional services, such as actuarial consulting, legal counsel, and auditing firms, are critical for Essent's smooth operations and adherence to regulatory requirements. These services, while indispensable, are provided by a market that is generally competitive, which tends to moderate the suppliers' ability to exert significant pricing power.

The emphasis for Essent often lies more on the caliber and standing of these service providers rather than their individual negotiating leverage. For instance, the demand for specialized actuarial services, crucial for risk assessment in the mortgage insurance sector, remains robust. In 2024, the global actuarial consulting market was valued at approximately $15 billion, demonstrating a consistent need for these expertise.

- Criticality of Services: Actuarial, legal, and auditing services are foundational for Essent's compliance and risk management.

- Market Competition: The competitive landscape for these professional services generally limits individual supplier bargaining power.

- Reputation Over Price: Essent prioritizes the quality and reputation of service providers, influencing supplier relationships.

- Market Size: The global actuarial consulting market, a key service area, was valued around $15 billion in 2024, indicating significant demand for specialized expertise.

The bargaining power of suppliers, particularly reinsurers, significantly impacts Essent's risk management and profitability. A concentrated market of highly rated reinsurers can dictate terms and pricing, affecting Essent's capital deployment. Essent mitigates this by securing strategic reinsurance agreements, such as the 2025-2026 excess of loss and quota share treaties, to manage risk transfer costs and enhance financial stability.

| Supplier Type | Bargaining Power Level | Key Considerations for Essent |

|---|---|---|

| Reinsurers | High | Concentration of providers, cost of risk transfer, impact on capital requirements. |

| Specialized Professional Services (Actuarial, Legal, Audit) | Moderate | Criticality of services, market competition, emphasis on provider reputation and expertise. |

What is included in the product

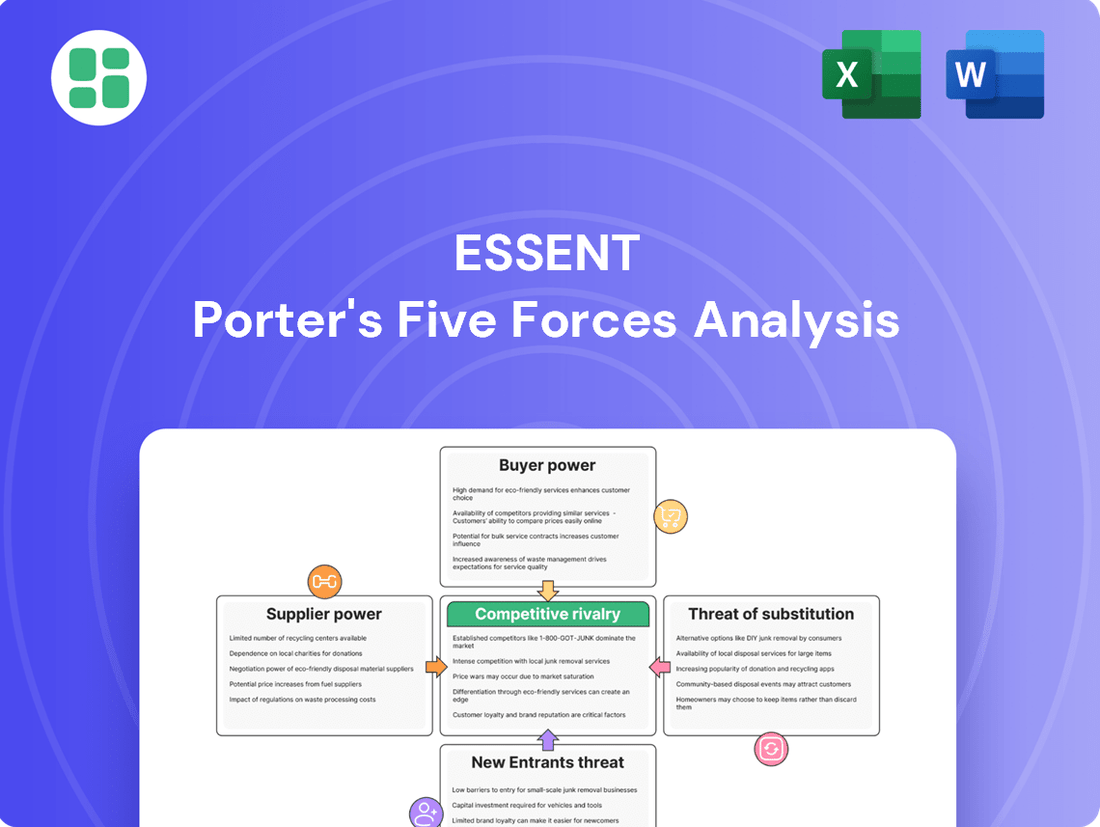

Essent's Porter's Five Forces Analysis dissects the competitive intensity within its industry, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Effortlessly identify and mitigate threats with a visual breakdown of competitive forces, simplifying complex market dynamics for strategic action.

Customers Bargaining Power

Essent's core customers are mortgage lenders and investors, predominantly banks and credit unions. These significant financial players wield considerable bargaining power because private mortgage insurance (PMI) is largely a commoditized service. Their substantial business volume allows them to negotiate favorable terms.

The limited number of approved private mortgage insurers means lenders have fewer options, which can intensify their negotiating leverage. In 2024, the mortgage market saw continued demand, with the Mortgage Bankers Association reporting a significant volume of originations, underscoring the importance of these lender relationships for PMI providers like Essent.

Government-Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac wield considerable influence as indirect customers for private mortgage insurers (MI). They establish the Private Mortgage Insurer Eligibility Requirements (PMIERs), which outline the operational and financial benchmarks that MI companies must meet. These requirements are crucial as they shape product standards and capital adequacy across the entire MI sector.

Essent's adherence to these stringent GSE demands is evident in its strong PMIERs sufficiency ratio. For instance, as of the first quarter of 2024, Essent reported a PMIERs ratio of 173%, significantly exceeding the required threshold and underscoring its robust financial health and operational compliance with GSE expectations.

The private mortgage insurance (PMI) market is characterized by intense competition, making lenders highly sensitive to pricing. This means Essent faces significant pressure to keep its premiums competitive, as lenders can readily switch to alternative providers offering more favorable rates or superior service. For instance, in 2023, the average cost of PMI for a borrower with a 740 credit score and 10% down payment was approximately $100 per month, a figure lenders closely monitor.

With only a handful of major players dominating the PMI landscape, Essent's ability to implement substantial premium increases is constrained. Raising prices too aggressively risks alienating existing customers and losing potential new business to competitors who maintain lower rates. This competitive dynamic directly impacts Essent's pricing power.

Furthermore, the cost of private MI has generally trended downwards in recent years, partly driven by the adoption of risk-based pricing models. This evolution means that premiums are increasingly tailored to the specific risk profile of each loan, further intensifying the focus on competitive pricing across the industry and impacting Essent's pricing flexibility.

Customer Concentration

Customer concentration, even within a broad market like mortgage originations, can significantly influence Essent's bargaining power. If a few major lenders or aggregators account for a substantial portion of Essent's business, these large clients gain leverage. For instance, if the top 10 clients represent over 50% of Essent's premium volume, losing even one could be impactful.

This concentration means that these key customers can negotiate more favorable terms, potentially impacting Essent's profitability and pricing strategies. Essent's strategy must therefore focus on cultivating robust relationships and offering distinct service advantages to mitigate this risk.

- Client Dependence: Essent's reliance on a limited number of large clients increases their bargaining power.

- Impact of Loss: Losing a significant client could have a material negative effect on Essent's revenue.

- Mitigation Strategy: Strong client relationship management and service differentiation are crucial.

- Market Context: While the overall mortgage market is vast, Essent's specific niche can lead to this concentration.

Availability of Multiple MI Providers

The presence of multiple mortgage insurance providers significantly empowers customers, particularly lenders. With six private mortgage insurers approved for Enterprise mortgages in the U.S., lenders have a competitive landscape to choose from. This abundance of alternatives lowers the perceived switching costs for lenders, allowing them to negotiate more favorable terms.

Essent, like its competitors, faces pressure to continuously prove its value proposition. This includes demonstrating consistent financial strength and offering competitive pricing to retain existing clients and attract new ones in a market with readily available substitutes.

- Six active private mortgage insurers approved for Enterprise mortgages in the U.S.

- Reduced switching costs for lenders due to availability of alternatives.

- Increased lender leverage in negotiations with mortgage insurers.

- Essent's need to demonstrate value and strong financial performance to retain clients.

The bargaining power of Essent's customers, primarily mortgage lenders, is substantial due to the commoditized nature of private mortgage insurance (PMI) and the presence of multiple providers. Lenders can readily compare offerings, pushing insurers like Essent to maintain competitive pricing and demonstrate strong value. In 2024, the mortgage industry's volume, as reported by the Mortgage Bankers Association, highlights the critical importance of these lender relationships.

| Factor | Impact on Essent | 2024 Data/Context |

|---|---|---|

| Customer Concentration | High concentration of large clients increases their leverage. | Top 10 clients representing over 50% of premium volume would significantly empower them. |

| Availability of Alternatives | Six active private mortgage insurers provide lenders with choices. | This competition reduces switching costs and intensifies price sensitivity. |

| Pricing Sensitivity | Lenders are highly sensitive to PMI costs, impacting Essent's pricing power. | Average PMI cost in 2023 was ~$100/month for certain borrower profiles. |

| GSE Influence | GSEs like Fannie Mae and Freddie Mac set eligibility requirements. | Essent's Q1 2024 PMIERs ratio of 173% demonstrates compliance and financial strength. |

What You See Is What You Get

Essent Porter's Five Forces Analysis

This preview showcases the complete Essent Porter's Five Forces Analysis, identical to the version you will receive immediately after purchase, ensuring no discrepancies. You are viewing the exact, professionally formatted document, ready for immediate download and application. This means the insights and strategic framework presented here are precisely what you'll utilize to understand Essent's competitive landscape.

Rivalry Among Competitors

The U.S. private mortgage insurance (PMI) market is highly concentrated, with Essent operating alongside a handful of major competitors like MGIC, Radian, National MI, Arch MI, and Enact. This oligopolistic structure means that Essent's strategic moves, such as pricing adjustments or product innovations, can have a ripple effect across the entire industry.

Essent has demonstrated robust financial performance, solidifying its position as a key player. For instance, in the first quarter of 2024, Essent reported a net income of $159 million, showcasing its strong competitive footing and ability to generate significant profits within this concentrated landscape.

Private mortgage insurance is largely a commoditized product, meaning there's very little difference in the actual coverage offered by various companies. This lack of unique features means that competition often comes down to price, with lenders choosing providers based on the rates they offer.

This intense price competition forces companies like Essent to focus on other areas to differentiate themselves. They emphasize strong credit quality in their underwriting and strive for operational efficiency to keep costs down, which in turn allows them to offer competitive pricing.

In 2023, the U.S. private mortgage insurance market saw significant activity, with Essent Guaranty, a major player, reporting a substantial increase in its net premiums earned, reflecting the ongoing demand for its services despite the homogeneous nature of the product.

Competitive rivalry within the mortgage insurance sector is significantly shaped by the broader housing market's vitality. Factors like mortgage origination volumes and prevailing interest rates directly impact how intensely companies compete. When the market faces headwinds, such as the slowdown in originations observed in recent periods due to elevated interest rates, the fight for each new customer can become fiercer.

Despite the challenges, the industry is anticipating a more favorable environment for 2025. For instance, mortgage origination volumes, which were impacted by rising rates, are projected to rebound. This anticipated improvement suggests that while competition remains a factor, the overall market expansion could temper some of the most aggressive rivalries.

High Fixed Costs and Exit Barriers

The mortgage insurance sector, including Essent, is characterized by substantial fixed costs. These stem from stringent regulatory compliance, significant capital requirements mandated by regulators, and the need for advanced underwriting and risk management technology. These ongoing investments create a high cost of doing business.

These substantial fixed costs, coupled with the specialized knowledge and regulatory hurdles inherent in mortgage insurance, erect high exit barriers. Companies find it difficult and costly to leave the market, which naturally intensifies competition as firms are compelled to remain and fight for market share, even when industry conditions are challenging.

Essent's commitment to a robust capital position is crucial in this environment. As of the first quarter of 2024, Essent reported a strong risk-to-capital ratio, demonstrating its ability to absorb potential losses and meet ongoing capital demands. This financial strength is a key differentiator.

- High Fixed Costs: Significant investments in regulatory compliance, capital reserves, and technology are essential for mortgage insurers.

- Exit Barriers: Specialized nature of the business and regulatory oversight make exiting the market difficult and expensive.

- Competitive Intensity: High fixed costs and exit barriers force companies to compete aggressively, even during economic slowdowns.

- Essent's Capital Strength: Essent maintains a strong capital position, evidenced by its robust risk-to-capital ratios in early 2024, enabling it to navigate competitive pressures.

Emphasis on Credit Performance and Service

In the mortgage insurance sector, where the core product can be seen as largely similar, competition intensifies around demonstrating superior credit performance and exceptional customer service. Companies focus on showcasing consistent profitability and robust balance sheets, alongside efficient claims handling, as key differentiators to attract and retain business partners.

Essent has consistently highlighted its strong credit performance. For instance, in 2025, the company reported elevated portfolio persistency, indicating a stable and high-quality loan book. This focus on credit quality is crucial for building trust and securing long-term relationships within the industry.

- Credit Performance Focus: Competition hinges on demonstrating superior credit risk management and consistent underwriting quality.

- Service Differentiation: Exceptional customer service and efficient claims processing become vital for client retention.

- Financial Strength: Companies emphasize strong balance sheets and consistent profitability to attract business.

- Essent's 2025 Performance: Essent reported strong credit performance and elevated portfolio persistency in 2025, underscoring this competitive dynamic.

Competitive rivalry in the U.S. private mortgage insurance (PMI) market is intense, driven by a concentrated industry structure and the commoditized nature of the product. Companies like Essent compete fiercely on price, but also differentiate through superior credit quality and operational efficiency.

The market's concentration means Essent's actions impact rivals, while the lack of product differentiation forces a focus on cost and service. Despite economic headwinds, such as slowed mortgage originations in 2024, the industry anticipates a rebound in 2025, which could moderate some competitive pressures.

High fixed costs associated with regulatory compliance and capital requirements, along with significant exit barriers, compel companies to remain competitive even in challenging times. Essent's strong capital position, as evidenced by its robust risk-to-capital ratios in early 2024, is a key factor in navigating this environment.

Essent's emphasis on strong credit performance, demonstrated by elevated portfolio persistency in 2025, along with efficient claims handling and customer service, are crucial for maintaining its competitive edge.

| Competitor | 2023 Net Premiums Earned (Approx.) | Q1 2024 Net Income (Approx.) |

|---|---|---|

| Essent | $1.3 billion | $159 million |

| MGIC | $1.5 billion | $180 million |

| Radian | $1.2 billion | $150 million |

| National MI | $700 million | $85 million |

SSubstitutes Threaten

Government-backed mortgage insurance, particularly from the Federal Housing Administration (FHA) and Department of Veterans Affairs (VA), presents a substantial threat of substitution for private mortgage insurers like Essent. These programs often cater to borrowers who might otherwise struggle to qualify for conventional loans, offering a lower barrier to entry with less stringent credit score requirements and reduced down payment options.

For instance, FHA loans can be obtained with down payments as low as 3.5%, a significant draw for first-time homebuyers or those with limited savings. This directly siphons demand away from private MI providers who typically require higher credit scores and larger down payments. In 2024, FHA loans continued to be a popular choice for many, underscoring the persistent competitive pressure they exert.

Fluctuations in FHA mortgage insurance premiums (MIPs) or adjustments to eligibility criteria can directly influence the attractiveness of private mortgage insurance. If FHA MIPs become more competitive, or if FHA loan limits are raised, it can further enhance the appeal of these government alternatives, thereby diminishing the market share for private MI. Recent discussions around potential reductions in FHA multifamily MIPs, while specific to a different segment, signal a willingness by government entities to adjust pricing, which could eventually spill over into the single-family market and intensify the substitution threat.

Higher down payments and increased borrower equity act as a significant threat of substitutes for mortgage insurance providers like Essent. Borrowers who can put down 20% or more on a home loan are not required to purchase private mortgage insurance (PMI), essentially choosing to self-insure. This trend is amplified as home prices appreciate, allowing more homeowners to reach equity levels that permit PMI cancellation sooner, thereby shrinking the pool of potential customers for MI companies.

Large financial institutions possess the financial muscle to self-insure a portion of their low down payment mortgages, effectively absorbing potential losses internally. This internal risk management, often achieved through sophisticated portfolio diversification, lessens their dependence on external private mortgage insurance (PMI) providers.

For instance, while specific numbers vary, a significant portion of a large bank's mortgage portfolio might be retained without external insurance if it meets internal risk tolerance thresholds. However, stringent regulatory capital requirements and the pursuit of capital efficiency frequently steer these institutions towards private MI as a more practical and preferred solution for managing risk on a broader scale.

Alternative Credit Enhancement Products

While less common for conventional loans with Loan-to-Value ratios below 80%, alternative credit enhancement products could act as substitutes. These might include structured finance arrangements or direct credit risk transfers with Government-Sponsored Enterprises (GSEs). Essent's involvement in reinsurance also points to its participation in a wider spectrum of risk management solutions.

These alternatives can attract borrowers and lenders seeking different risk-reward profiles or capital efficiency. For instance, the market for credit risk transfer, particularly involving GSEs, has seen significant activity. In 2023, Fannie Mae and Freddie Mac continued to execute substantial credit risk transfer transactions, transferring billions in credit risk to private capital markets.

- Structured Finance: These complex financial products can bundle mortgages and sell them to investors, effectively transferring risk away from the originator.

- Lender-Paid Mortgage Insurance: While not a direct substitute for Essent's core business, it's a mechanism to reduce lender risk on higher LTV loans.

- GSE Credit Risk Transfers: Direct agreements with Fannie Mae and Freddie Mac to share in potential mortgage credit losses.

- Reinsurance: Essent's own offering, which allows other insurers to offload some of their risk, demonstrating an understanding of alternative risk management.

Changes in GSE Requirements or Risk-Sharing Models

Changes in Fannie Mae and Freddie Mac's credit risk transfer programs or their charter requirements could significantly alter the landscape for traditional private mortgage insurance (PMI). For instance, if GSEs expand their own risk-sharing mechanisms or modify rules around mortgage insurance, it could reduce the reliance on private MI, presenting a form of substitution.

While private MI has historically been a cornerstone of credit enhancement, any policy evolution from these government-sponsored enterprises (GSEs) has the potential to introduce alternative credit enhancement structures. The mortgage insurance industry's track record of successfully managing substantial claims for GSEs underscores its established role and perceived value in the market.

- GSE Risk Transfer Evolution: Fannie Mae and Freddie Mac are continuously refining their credit risk transfer (CRT) initiatives, such as the Connecticut Avenue Securities (CAS) and Agency Mortgage-Backed Securities (AMBS) programs. These programs allow private capital to absorb a portion of mortgage credit risk, potentially reducing the need for traditional PMI in certain scenarios.

- Charter Requirement Shifts: Any adjustments to the charters of Fannie Mae and Freddie Mac that alter their requirements for mortgage insurance could directly impact demand. For example, if GSEs were to increase loan-to-value (LTV) thresholds for requiring PMI, or allow alternative credit enhancements, it would create substitutes.

- Industry Claims Data: In 2023, the private mortgage insurance industry paid out over $1.5 billion in claims, demonstrating its capacity to absorb significant losses and its critical function in supporting the housing market, especially for borrowers with lower down payments. This robust performance reinforces its value proposition, but also highlights the potential impact if GSE policies were to shift away from its utilization.

Government-backed mortgage insurance, like that from the FHA and VA, directly competes with private mortgage insurers by offering accessible options for borrowers with lower credit scores or down payments. For example, FHA loans, requiring as little as 3.5% down, continue to be a popular choice in 2024, diverting demand from private MI providers.

Borrowers who can afford larger down payments, typically 20% or more, bypass the need for private mortgage insurance altogether, effectively self-insuring. As home prices rise, more homeowners build equity, enabling them to eliminate PMI sooner, thus shrinking the customer base for Essent.

Alternative credit enhancement structures, such as those offered through GSE credit risk transfers, also serve as substitutes. In 2023, Fannie Mae and Freddie Mac executed billions in these transactions, transferring risk to private capital and potentially reducing reliance on traditional PMI.

| Substitute Type | Description | Impact on Private MI | 2023 Data/Trend |

|---|---|---|---|

| Government Programs (FHA/VA) | Lower down payment and credit score requirements | Reduces demand for private MI | FHA loans remain a significant option for borrowers |

| Higher Down Payments/Equity | Borrowers self-insure by avoiding PMI | Shrinks the pool of eligible customers | Appreciating home prices accelerate equity build-up |

| GSE Credit Risk Transfers | Private capital absorbs mortgage credit risk | Offers alternative risk management | Billions transferred in risk transactions |

Entrants Threaten

High capital requirements present a significant threat of new entrants in the private mortgage insurance (PMI) market. Entering this space demands substantial financial resources to satisfy rigorous regulatory mandates, such as the Private Mortgage Insurer Eligibility Requirements (PMIERs), and to build a cushion against potential mortgage defaults. For instance, as of the first quarter of 2024, Essent Group Ltd. reported total equity of approximately $4.4 billion, demonstrating a robust capital base far exceeding regulatory minimums, which deters less capitalized firms from entering.

The mortgage insurance sector faces intense regulatory scrutiny, acting as a significant barrier to new entrants. Companies must secure extensive licensing and adhere to stringent compliance and oversight from federal and state authorities. For instance, the Federal Housing Finance Agency (FHFA) regularly updates its standards, requiring substantial investment in compliance infrastructure and expertise to navigate these evolving requirements.

Established players like Essent benefit from deeply entrenched relationships with mortgage lenders and originators. These partnerships are vital for market access and effective distribution of private mortgage insurance (PMI). For instance, in 2024, Essent continued to leverage its extensive network, securing a significant portion of new PMI placements through these established channels.

The time and capital required for new entrants to replicate this level of trust and integration with lenders are substantial deterrents. Essent's customer persistency rates, which remained strong through 2024, underscore the loyalty and satisfaction derived from these long-term relationships, making it difficult for newcomers to gain traction.

Economies of Scale and Experience

Incumbent mortgage insurers, like Essent, leverage significant economies of scale in their operations. This includes underwriting, risk management, and claims processing, all of which become more cost-efficient with larger portfolios. New entrants face a considerable hurdle in matching these cost efficiencies without substantial scale and a robust history of data to refine their processes.

Essent's growing insurance-in-force portfolio directly contributes to its competitive advantage derived from scale. As of the first quarter of 2024, Essent reported an insurance-in-force of $227.3 billion, a testament to its expanding market presence and the resulting operational efficiencies.

- Economies of Scale: Essent benefits from lower per-unit costs in underwriting, risk modeling, and claims handling due to its substantial volume of business.

- Experience Curve: Years of operation have allowed Essent to refine its risk assessment models and operational procedures, leading to improved efficiency and profitability.

- Barriers to Entry: New competitors would need to invest heavily to replicate Essent's scale and experience, making market entry challenging and costly.

- Essent's Growth: The company's increasing insurance-in-force, reaching $227.3 billion by Q1 2024, reinforces its scale advantage and ability to absorb fixed costs across a larger base.

Proprietary Risk Management and Technology

Leading mortgage insurance (MI) companies have invested heavily in proprietary risk management and technology, creating substantial barriers to entry. For instance, Essent provides its EssentEDGE® platform, which utilizes advanced analytics for risk assessment and pricing. The development and maintenance of such sophisticated systems demand significant capital and specialized expertise, making it challenging for new players to compete effectively.

These technological capabilities are becoming increasingly crucial. In 2024, the MI industry continued to see a strong emphasis on data analytics and artificial intelligence to refine underwriting processes and identify potential risks more accurately. Companies that have already established robust technological infrastructures are better positioned to adapt to evolving market demands and regulatory landscapes, further solidifying their competitive advantage.

- Proprietary Technology: Companies like Essent leverage platforms such as EssentEDGE® for advanced risk assessment.

- Investment Barrier: Developing comparable technology requires substantial financial commitment and specialized talent.

- AI and Data Analytics: The increasing importance of AI and data analytics in underwriting creates a technological moat.

The threat of new entrants in the private mortgage insurance (PMI) market is significantly mitigated by high capital requirements and stringent regulatory oversight. Companies like Essent Group Ltd. demonstrate this with substantial equity, such as their $4.4 billion in total equity reported in Q1 2024, far exceeding regulatory minimums. Navigating complex licensing and compliance with bodies like the FHFA demands considerable investment, making it difficult for less capitalized firms to enter and compete effectively against established players who have already built robust compliance infrastructures and strong lender relationships.

| Metric | Essent Group Ltd. (Q1 2024) | Significance for New Entrants |

|---|---|---|

| Total Equity | ~$4.4 billion | High capital needed to meet regulatory and risk requirements. |

| Insurance-in-Force | $227.3 billion | Indicates scale advantage and established market presence. |

| Proprietary Technology (e.g., EssentEDGE®) | Advanced analytics for risk assessment | Requires significant investment in specialized technology and expertise. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of diverse data sources, including detailed financial statements, market research reports from leading firms, and publicly available company filings. This comprehensive approach ensures a robust understanding of industry structure and competitive dynamics.