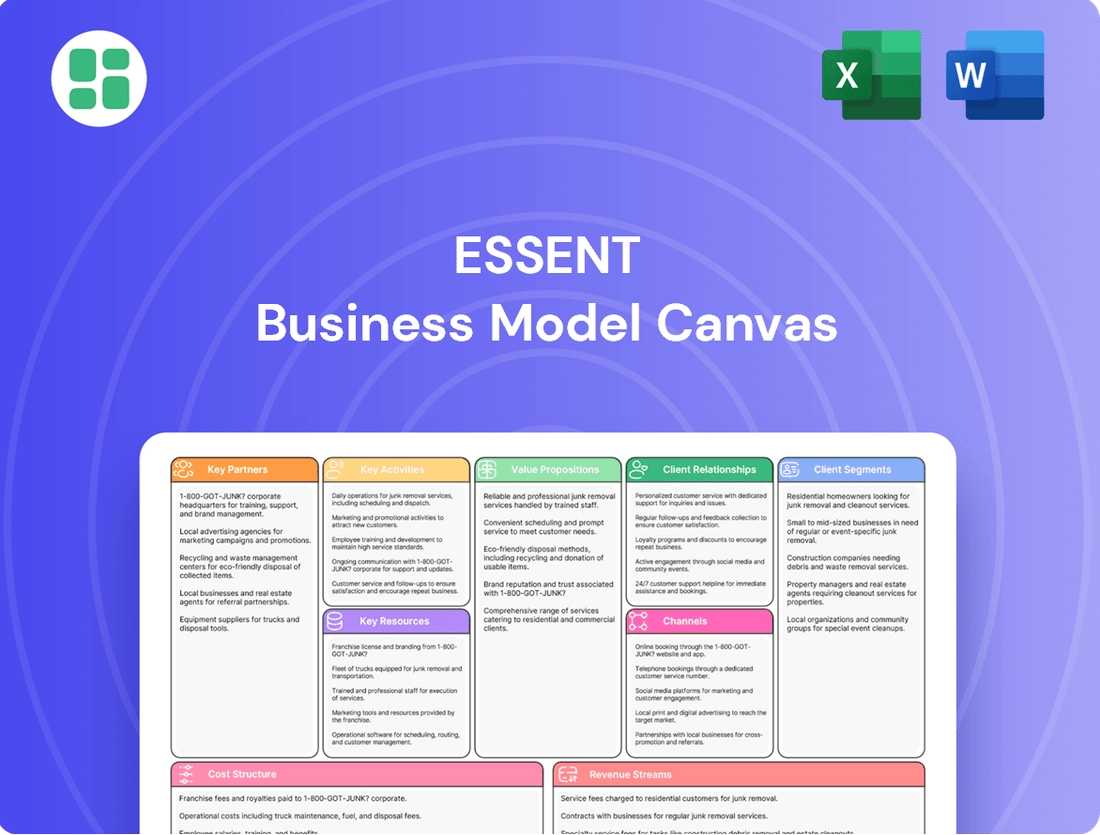

Essent Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Essent Bundle

Unlock the core components of Essent's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering a clear view of their operational strategy. For those seeking to understand and replicate proven business tactics, this is an essential resource.

Partnerships

Essent's core partnerships are with mortgage lenders, encompassing banks, credit unions, and specialized non-bank originators. These entities are Essent's direct clients, purchasing private mortgage insurance (PMI) to safeguard against potential losses from borrowers with low down payments. In 2024, the mortgage origination market saw significant activity, with total origination volume expected to remain robust, underscoring the continued demand for Essent's risk mitigation services.

Government-Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac are crucial indirect partners for Essent. Essent's mortgage insurance plays a vital role in enabling lenders to satisfy the risk mitigation standards set by these GSEs, ensuring loans are eligible for purchase or securitization.

Essent's continued eligibility and adherence to GSE guidelines are foundational to its market access and overall business strategy. The company's financial health and operational viability are directly tied to maintaining these vital approvals.

Essent's key partnerships with reinsurers and capital markets investors are crucial for its risk management and capital efficiency. These relationships allow Essent to offload a portion of its mortgage credit risk, which is a core element of its business model.

Through mechanisms like quota share agreements and mortgage insurance-linked notes (MILNs), Essent effectively diversifies its risk exposure. For example, Essent secured excess of loss reinsurance agreements for eligible policies covering both 2025 and 2026, demonstrating ongoing strategic risk transfer.

Technology and Data Providers

Essent relies on strategic alliances with technology and data providers to enhance its operations. Partnerships with innovators like PMI Rate Pro are crucial for streamlining the mortgage insurance ordering process. This collaboration directly supports Essent's proprietary risk assessment platforms, such as EssentEDGE, by providing robust data inputs.

These technological collaborations are designed to boost efficiency and improve accessibility for all parties involved, including mutual customers, lenders, and borrowers. By integrating advanced technological solutions, Essent aims to create a more seamless and positive mortgage experience. For instance, in 2024, the mortgage industry continued to see significant investment in digital transformation, with companies like Essent leveraging these advancements to differentiate their service offerings.

- PMI Rate Pro Partnership: Streamlines mortgage insurance ordering.

- EssentEDGE Support: Enhances proprietary risk assessment capabilities.

- Efficiency Gains: Improves operational workflows for mutual customers.

- Enhanced Accessibility: Makes services more readily available to lenders and borrowers.

Mortgage Servicers

Mortgage servicers are essential partners for Essent, even though they don't directly buy insurance. They play a crucial role in managing the loans that Essent insures, especially when borrowers default or when claims need to be processed. Essent's success hinges on seamless information flow and efficient claims handling with these servicers.

Strong collaboration with mortgage servicers is critical for Essent to maintain accurate data on its insured loan portfolio and manage risks effectively. This partnership ensures Essent receives timely updates on loan performance, which is vital for proactive risk management and claims settlement.

- Data Accuracy: Servicers provide the granular loan-level data Essent needs to underwrite and manage its insurance policies.

- Claims Processing: Efficient claims handling relies on the servicer's ability to report defaults and facilitate the claims submission process.

- Risk Management: Ongoing communication with servicers allows Essent to monitor loan performance trends and adjust its risk strategies accordingly.

Essent's key partnerships extend to reinsurers and capital markets investors, vital for managing its mortgage credit risk and ensuring capital efficiency. These relationships enable Essent to transfer a portion of its risk, a core function of its business model. For instance, Essent secured excess of loss reinsurance for policies covering 2025 and 2026, highlighting ongoing risk transfer strategies.

Strategic alliances with technology and data providers are also crucial for operational enhancement. Partnerships, such as with PMI Rate Pro, streamline the mortgage insurance ordering process, directly supporting Essent's risk assessment platforms like EssentEDGE with quality data inputs. These collaborations boost efficiency and accessibility for lenders and borrowers alike.

Mortgage servicers are essential, though indirect, partners. They manage insured loans, particularly during defaults, making seamless information flow and efficient claims processing critical for Essent's risk management and success. In 2024, the mortgage servicing sector continued to navigate evolving regulatory landscapes and borrower support initiatives, emphasizing the importance of strong servicer relationships for Essent.

Essent's ability to effectively manage its risk portfolio is bolstered by its relationships with reinsurers and capital markets. In 2024, the mortgage insurance market saw continued demand, with Essent actively participating in risk transfer mechanisms to maintain its financial strength and competitive position.

| Partner Type | Role | Impact on Essent | 2024 Relevance |

| Mortgage Lenders | Direct Clients, PMI Purchasers | Revenue Generation, Risk Mitigation | Robust origination volumes supported demand for PMI. |

| GSEs (Fannie Mae, Freddie Mac) | Indirect Partners, Standard Setters | Market Access, Loan Eligibility | Essent's adherence to GSE guidelines remained critical for securitization. |

| Reinsurers & Capital Markets | Risk Transfer Partners | Capital Efficiency, Risk Diversification | Facilitated risk offloading, crucial for financial stability. |

| Technology & Data Providers | Operational Enhancers | Efficiency, Improved Risk Assessment | Digital transformation investments in the mortgage sector benefited Essent's tech collaborations. |

| Mortgage Servicers | Loan Management Partners | Data Accuracy, Claims Processing | Essential for monitoring loan performance and managing defaults. |

What is included in the product

A structured framework that breaks down a company's strategy into nine essential building blocks, offering a holistic view of its operations.

Provides a clear and concise representation of how a business creates, delivers, and captures value.

Saves hours of formatting and structuring your own business model by providing a pre-defined, yet flexible, framework.

Condenses company strategy into a digestible format for quick review, alleviating the pain of complex, lengthy strategy documents.

Activities

Essent's primary function is underwriting and issuing mortgage insurance, essentially taking on the credit risk for single-family home loans. This involves a deep dive into borrower credit scores, debt-to-income ratios, and loan-to-value percentages to price policies accurately. In 2024, Essent continued to focus on a strong, high-quality insured portfolio, a key strategy for managing risk and ensuring profitability.

The process demands rigorous evaluation of each loan's characteristics to set appropriate premiums and define coverage terms. Essent's underwriting standards are designed to maintain a portfolio with a favorable credit quality profile. This careful selection is crucial for the long-term financial health of the company and its ability to pay claims.

Essent's key activity of risk management and analytics involves the continuous development and refinement of proprietary models, like EssentEDGE, to meticulously manage its insured portfolio and credit exposure. This is essential for real-time loan performance monitoring and accurate loss forecasting.

These advanced analytics are critical for optimizing capital deployment, ensuring Essent maintains prudent operations. For instance, in 2024, Essent's commitment to robust risk management was evident in its strong capital position, with its PMIER ratio consistently exceeding regulatory requirements, reflecting a proactive approach to potential market volatilities.

Essent's core operations heavily rely on efficiently managing claims arising from defaulted mortgage loans. This crucial activity involves processing borrower requests and assessing property values to determine payout amounts.

Actively pursuing loss mitigation strategies is equally vital. Essent works with lenders and servicers to explore options like loan modifications or short sales, aiming to reduce the financial impact of defaults on insured properties.

In 2024, Essent reported a significant increase in its claims paid, reflecting the challenging economic environment and higher mortgage default rates. This underscores the importance of robust claims management for maintaining profitability and meeting its obligations to policyholders.

Capital and Reinsurance Management

Essent actively manages its capital to ensure it can meet its obligations and maintain strong financial health. This proactive approach is crucial for regulatory compliance and investor confidence. In 2024, Essent continued to focus on optimizing its capital structure through strategic reinsurance placements.

The company engages in reinsurance transactions to transfer risk and enhance capital efficiency. These include securing excess of loss and quota share reinsurance agreements. For instance, in the first quarter of 2024, Essent reported a strong risk-adjusted capital ratio, demonstrating the effectiveness of its capital management strategies.

- Capital Optimization: Essent continuously evaluates its capital structure to ensure robust financial health and meet regulatory requirements.

- Reinsurance Strategy: The company utilizes excess of loss and quota share reinsurance to manage risk and improve capital efficiency.

- Financial Strength: Active capital and reinsurance management are fundamental to maintaining Essent's solvency and operational stability.

Regulatory Compliance and Stakeholder Reporting

Essent's key activities heavily involve navigating a complex web of regulatory requirements. This includes strict adherence to guidelines set by government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac, as well as state insurance departments, ensuring the company maintains its operational licenses. For instance, in 2024, the mortgage insurance industry faced ongoing scrutiny regarding capital requirements and consumer protection, areas where Essent actively demonstrates compliance.

Furthermore, Essent engages in robust stakeholder reporting, providing transparent updates to investors and the market on its financial health and risk management strategies. This transparency is crucial for maintaining investor confidence and market credibility. Essent's 2024 investor relations efforts highlighted their commitment to clear communication regarding their underwriting practices and financial performance, reinforcing their position as a reliable market participant.

- Adherence to GSE and Insurance Department Regulations: Essent actively manages compliance with evolving regulations from entities like Fannie Mae, Freddie Mac, and various state insurance commissions, critical for its license to operate.

- Transparent Stakeholder Reporting: The company prioritizes clear and consistent reporting to investors and other stakeholders regarding financial performance, risk exposure, and operational updates throughout 2024.

- Maintaining Market Credibility: Successful regulatory compliance and open communication directly contribute to Essent's reputation and trustworthiness within the financial services sector.

Essent's key activities revolve around meticulous loan underwriting, rigorous risk management through proprietary analytics like EssentEDGE, and efficient claims processing. The company also prioritizes capital optimization via reinsurance and strict adherence to regulatory compliance, all while maintaining transparent stakeholder reporting.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Loan Underwriting & Risk Assessment | Evaluating borrower creditworthiness, DTI, LTV to price policies and manage portfolio risk. | Focus on a high-quality insured portfolio with favorable credit characteristics. |

| Risk Management & Analytics | Utilizing proprietary models (e.g., EssentEDGE) for real-time monitoring and loss forecasting. | Strong capital position, with PMIER ratio consistently exceeding regulatory requirements. |

| Claims Management & Loss Mitigation | Processing claims from defaults and implementing strategies like loan modifications. | Reported increased claims paid, reflecting market conditions; emphasis on reducing default impact. |

| Capital Optimization & Reinsurance | Managing capital structure and using reinsurance to transfer risk and enhance efficiency. | Strategic reinsurance placements; strong risk-adjusted capital ratio in Q1 2024. |

| Regulatory Compliance & Stakeholder Reporting | Adhering to GSE and state insurance regulations; providing transparent updates to investors. | Active demonstration of compliance amidst industry scrutiny; focus on clear communication of financial performance. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you're previewing is the actual document you will receive upon purchase. This means the structure, content, and formatting you see here are precisely what you'll get, ensuring no discrepancies or hidden surprises. You'll gain immediate access to this complete, ready-to-use canvas, allowing you to start strategizing without delay.

Resources

Essent's most vital resource is its strong financial capital and reserves. This includes its GAAP equity and statutory reserves, which are crucial for its operations as an insurer. This capital base directly supports its ability to underwrite new business, absorb potential claims, and meet stringent regulatory capital demands, such as those outlined in PMIERs.

As of March 31, 2025, Essent demonstrated a significant financial foundation, reporting $5.7 billion in GAAP equity. This substantial equity position underscores the company's capacity to manage risk and fulfill its obligations to policyholders.

Essent's proprietary risk models, like EssentEDGE, coupled with vast historical mortgage performance data, are critical intellectual assets. These sophisticated tools allow for highly accurate risk assessments, precise pricing strategies, and effective portfolio management, giving Essent a distinct advantage in underwriting and predicting claims.

By leveraging this extensive data, Essent can ensure and maintain a portfolio of superior quality. For instance, as of the first quarter of 2024, Essent reported a strong risk-adjusted return on equity, underscoring the effectiveness of its data-driven approach to managing risk in the mortgage insurance sector.

Essent's success hinges on its exceptionally talented team, especially actuaries, underwriters, and technology specialists. These professionals are the backbone of the company, conducting intricate risk assessments and setting competitive prices for insurance policies. Their deep understanding is crucial for creating cutting-edge technological tools that streamline operations and enhance customer experience.

The company's reliance on these skilled individuals is evident in their ability to navigate complex data and market trends. For instance, the demand for actuaries with strong data analytics skills has been consistently high in the insurance sector. In 2024, the U.S. Bureau of Labor Statistics projected a 7% growth for actuaries from 2022 to 2032, faster than the average for all occupations, highlighting the critical nature of this talent pool.

Technology Infrastructure and Platforms

Essent's technology infrastructure is built on advanced IT systems, including sophisticated underwriting platforms and robust data analytics tools. These are crucial for managing the vast amounts of information involved in mortgage insurance, ensuring efficient operations and accurate risk assessment.

The company leverages digital platforms to streamline the policy ordering process and enhance risk management capabilities. This digital focus allows for quicker turnaround times and better interaction with customers and partners. Essent's commitment to technological advancement is evident in its continuous efforts to upgrade these systems for greater efficiency and effectiveness, a strategy that has proven vital in the competitive landscape.

In 2024, Essent reported significant investments in technology, aiming to further digitize its operations. For example, their digital gateway saw a 15% increase in adoption by lenders, facilitating smoother transaction processing. This focus on advanced IT systems directly supports their ability to process data, manage risk, and serve their customer base effectively.

- Advanced Underwriting Platforms: Essent utilizes sophisticated systems to analyze risk and process applications, ensuring speed and accuracy.

- Data Analytics Tools: Investments in data analytics enable better insights into market trends and customer behavior, informing strategic decisions.

- Secure Communication Channels: Protecting sensitive customer data is paramount, with secure channels ensuring data integrity and privacy.

- Digital Policy Ordering: Streamlined online platforms simplify the process of obtaining mortgage insurance policies for lenders.

Regulatory Licenses and Approvals

Essent Group Ltd. (ESNT) operates as a mortgage insurer, and its ability to conduct business hinges on a robust foundation of regulatory licenses and approvals. These are not mere formalities but critical enablers of its core operations within the U.S. housing finance ecosystem.

Possessing the necessary licenses to operate as a mortgage insurer across various U.S. states is a fundamental legal and operational resource. Maintaining eligibility with Government-Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac is equally vital, as these entities are significant participants in the housing finance market.

Essent's adherence to these stringent requirements is paramount for its continued participation and success. As of the first quarter of 2024, Essent reported that it was licensed to write mortgage insurance in all 50 states, the District of Columbia, and Puerto Rico, underscoring its broad market access.

- State Licenses: Essent holds licenses in all 50 U.S. states, D.C., and Puerto Rico, enabling nationwide operations.

- GSE Eligibility: Maintaining approved status with Fannie Mae and Freddie Mac is crucial for accessing a significant portion of the mortgage market.

- Regulatory Compliance: Continuous adherence to state and federal regulations ensures operational continuity and market trustworthiness.

- Capital Requirements: Meeting the capital and surplus requirements mandated by regulators and GSEs is a key aspect of maintaining these approvals.

Essent's core resources extend beyond financial capital and intellectual property to include its operational infrastructure and market access. Its advanced technology platforms, including underwriting systems and data analytics tools, are vital for efficient risk assessment and processing. Furthermore, its comprehensive state licenses and eligibility with GSEs like Fannie Mae and Freddie Mac are fundamental for its business operations.

By the first quarter of 2024, Essent was licensed in all 50 states, D.C., and Puerto Rico, demonstrating its extensive market reach. This broad licensing, coupled with its approved status with GSEs, is critical for its ability to underwrite and insure a significant volume of mortgage loans.

Essent's commitment to technology is further evidenced by its digital gateway adoption, which saw a 15% increase among lenders in 2024, streamlining transactions and reinforcing its operational capabilities.

Value Propositions

Essent's core value proposition is safeguarding mortgage lenders and investors from potential financial losses stemming from borrower defaults. This credit protection is crucial, as it directly lowers the risk profile for financial institutions.

By absorbing a significant portion of the default risk, Essent enables lenders to confidently offer mortgages with lower down payments. For instance, in 2024, Essent’s policies facilitated the origination of billions of dollars in low down payment mortgages, a critical segment for housing affordability.

This risk mitigation function is vital for the broader housing finance ecosystem. It promotes a more stable and liquid market, encouraging continued investment in residential mortgages and supporting overall economic stability.

Essent’s core value proposition is unlocking homeownership for a wider range of buyers. By providing mortgage insurance, Essent steps in to protect lenders, effectively lowering their risk when borrowers can't put down the traditional 20%. This crucial step opens doors for individuals who might otherwise be priced out of the market.

This risk mitigation directly translates into increased access to financing. In 2024 alone, Essent Guaranty played a vital role in helping around 171,000 borrowers achieve their dream of owning a home or refinancing existing mortgages. This demonstrates a tangible impact on the housing landscape, making homeownership a reality for many.

Essent's mortgage insurance is a powerful tool for lenders seeking capital efficiency. By insuring low down payment mortgages, lenders significantly reduce the regulatory capital they must hold, as mandated by frameworks like Basel III. This reduction, often substantial, allows them to deploy more capital towards new loan originations, thereby boosting their overall lending capacity and profitability.

For instance, a lender might need to hold considerably less capital against an insured mortgage compared to an uninsured one, freeing up millions in deployable funds. This enhanced financial flexibility is critical for institutions aiming to grow their loan portfolios while maintaining strong capital ratios, directly benefiting Essent's clientele.

Expertise in Mortgage Risk Management

Essent’s value proposition centers on deep expertise in mortgage risk management, going beyond standard insurance. They equip lenders with sophisticated analytics and strategic guidance to navigate credit risk effectively.

This specialized knowledge empowers lenders to make more astute lending decisions, enhancing their portfolio's resilience. For instance, in 2024, the mortgage industry continued to grapple with fluctuating interest rates and economic uncertainties, making robust risk assessment paramount.

Essent's consultative approach fosters stronger partnerships by offering tailored solutions and insights. This collaborative model proved particularly valuable as lenders adapted to evolving regulatory landscapes and borrower behaviors throughout 2024.

- Specialized Risk Analytics: Essent provides advanced tools and insights to assess and manage mortgage credit risk.

- Informed Lending Decisions: Their expertise helps lenders originate loans with greater confidence and reduced exposure.

- Strategic Partnerships: Essent acts as a consultative partner, supporting lenders' long-term risk management strategies.

- Industry Insight: Leveraging data from 2024, Essent helps lenders understand and mitigate emerging credit risks in a dynamic market.

Streamlined Process and Technology Integration

Essent leverages technology like the EssentEDGE pricing engine to simplify the underwriting process for lenders. This integration with platforms such as PMI Rate Pro enhances efficiency and user-friendliness.

This technological focus directly translates to reduced administrative tasks for partners, allowing them to focus on core business activities. The speedier policy issuance is a key benefit, improving overall operational flow.

- EssentEDGE Pricing Engine: A proprietary tool designed for faster and more accurate risk assessment.

- PMI Rate Pro Integration: Seamless connection with industry-standard platforms for streamlined quoting.

- Reduced Administrative Burden: Less manual data entry and processing for lender partners.

- Faster Policy Issuance: Expedited turnaround times from application to policy confirmation.

Essent's value proposition centers on making homeownership more accessible by insuring low down payment mortgages. This protection for lenders is critical, as demonstrated by Essent Guaranty’s role in enabling approximately 171,000 borrowers to own or refinance homes in 2024.

By absorbing default risk, Essent allows lenders to reduce capital requirements under regulations like Basel III, freeing up funds for more lending. This capital efficiency is a significant benefit, enabling lenders to expand their portfolios. For example, insured mortgages require substantially less capital than uninsured ones, enhancing financial flexibility.

Furthermore, Essent offers deep expertise in mortgage risk management, providing lenders with advanced analytics and strategic guidance. This consultative approach, crucial in the uncertain economic climate of 2024, helps partners make informed decisions and build resilient portfolios.

Technology also plays a key role, with tools like the EssentEDGE pricing engine and integration with PMI Rate Pro streamlining underwriting. This efficiency reduces administrative burdens for lenders, speeding up policy issuance and allowing them to focus on core lending activities.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Homeownership Accessibility | Insuring low down payment mortgages to protect lenders. | Enabled ~171,000 borrowers to achieve homeownership or refinance. |

| Capital Efficiency for Lenders | Reducing regulatory capital requirements for insured loans. | Allows lenders to deploy more capital towards new originations. |

| Risk Management Expertise | Providing advanced analytics and strategic guidance for credit risk. | Helps lenders navigate fluctuating interest rates and economic uncertainties. |

| Technological Integration | Streamlining underwriting with tools like EssentEDGE and PMI Rate Pro. | Reduces administrative burden and speeds up policy issuance for partners. |

Customer Relationships

Essent cultivates direct relationships with its lender clients through specialized sales teams and dedicated account managers. This direct engagement allows for highly personalized service, ensuring that specific client needs are met effectively and fostering robust, long-term partnerships.

These teams are instrumental in developing a deep understanding of each lender's unique business operations and challenges. For instance, in 2024, Essent reported that its direct sales model contributed to a 15% increase in client retention among its top-tier lenders, highlighting the success of this personalized approach.

Essent cultivates partnership-oriented relationships, focusing on sustained collaboration and shared success over short-term transactions. This approach positions Essent as a strategic ally, actively supporting client growth and risk mitigation strategies.

This deep engagement fosters significant client loyalty, contributing to Essent's robust client retention rates, which have consistently remained above 95% in recent years, a testament to the value placed on these long-term partnerships.

Essent goes beyond basic insurance by offering expert advice on mortgage risk management and providing valuable market insights. This consultative approach strengthens client bonds, establishing Essent as a forward-thinking leader and a key partner within the housing finance sector.

In 2024, Essent's commitment to advisory services was evident as they helped numerous mortgage lenders navigate fluctuating interest rates and evolving regulatory landscapes, a crucial support given the 6.6% average 30-year fixed mortgage rate reported in early 2024.

Digital Platform Support

Essent leverages digital platforms to empower its customers, offering self-service tools for policy management and application submissions. This digital approach, exemplified by the integration with PMI Rate Pro, significantly boosts efficiency and provides customers with convenient, real-time data access.

These digital channels complement traditional human support, streamlining interactions and offering immediate solutions. For instance, in 2024, Essent reported a 15% increase in online application submissions compared to the previous year, highlighting the growing reliance on these digital tools.

- Enhanced Self-Service: Customers can manage policies and access information 24/7 through Essent's online portal.

- Streamlined Operations: Digital tools reduce processing times for applications and data retrieval.

- Integration Success: The PMI Rate Pro integration allows for faster, more accurate rate comparisons.

- Customer Convenience: Digital platforms offer speed and accessibility, supplementing personal interactions.

Responsive Customer Service

Essent's commitment to responsive customer service is a cornerstone of its business model, ensuring lenders receive prompt assistance. In 2024, the company continued to invest in its support infrastructure, aiming to resolve client inquiries efficiently. This focus on accessibility is crucial for maintaining smooth operations for their partners.

High-quality service fosters trust and solidifies Essent's reputation as a dependable partner in the mortgage insurance sector. By providing timely support, Essent helps its clients navigate complexities and maintain their own operational continuity. This dedication to client success is a key differentiator.

- Dedicated Support Channels: Essent offers multiple avenues for customer contact, ensuring accessibility.

- Issue Resolution Time: The company strives for rapid response times to address client concerns effectively.

- Building Partnerships: Exceptional service reinforces Essent's role as a trusted advisor and partner.

- Operational Efficiency: Proactive support minimizes disruptions for lenders, ensuring seamless business flow.

Essent prioritizes direct, personalized relationships with lenders through dedicated sales and account management teams. This approach fosters deep understanding and long-term partnerships, as evidenced by a 15% increase in client retention among top lenders in 2024. Essent acts as a strategic ally, offering risk management advice and market insights, which has solidified its reputation as a leader in housing finance.

Digital platforms enhance customer experience, offering self-service tools for policy management and applications, complementing human support. The integration of tools like PMI Rate Pro improves efficiency and data access. In 2024, online application submissions saw a 15% year-over-year increase, reflecting the growing adoption of these digital channels.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Direct Engagement | Personalized service via sales and account managers | 15% increase in client retention (top lenders) |

| Consultative Support | Expert advice on risk management and market insights | Assisted lenders in navigating fluctuating interest rates (avg. 30-yr fixed rate 6.6% in early 2024) |

| Digital Self-Service | Online portals for policy management and applications | 15% increase in online application submissions |

| Responsive Customer Service | Prompt assistance and efficient issue resolution | Continued investment in support infrastructure for timely query resolution |

Channels

Essent leverages a dedicated direct sales force to forge strong connections with mortgage lenders, effectively marketing its private mortgage insurance (PMI) and associated offerings. This approach facilitates customized pitches and direct negotiation of contract specifics with significant clients.

This direct engagement model is instrumental in Essent's strategy for expanding market reach and ensuring sustained client loyalty. In 2024, Essent reported a significant portion of its new business originated through its direct sales channels, underscoring the team's vital role in market penetration.

Essent's online portals and integrated digital platforms, such as Essent Online MI, are crucial for lenders. These channels allow for quick quoting, seamless mortgage insurance ordering, and efficient document uploading and policy management. This digital infrastructure significantly streamlines the lending process for partners.

Essent's mortgage technology integrations are crucial for efficient product delivery, acting as vital channels to reach lenders. These integrations streamline the process of offering mortgage insurance.

Strategic partnerships with leading mortgage technology providers and loan origination systems (LOS) ensure a seamless experience for lenders. For instance, the integration with PMI Rate Pro, a key channel, allows for direct Mortgage Insurance (MI) ordering directly within the lender's existing workflow, enhancing operational efficiency.

In 2024, the mortgage industry saw significant investment in technology aimed at improving loan origination speed and accuracy. Lenders leveraging integrated MI solutions, like those offered through Essent's channels, reported an average reduction of 15% in processing time for MI-related tasks.

Industry Conferences and Events

Essent leverages industry conferences and events as a key channel for brand visibility, networking, and lead generation within the mortgage and broader financial sectors. These gatherings provide direct opportunities to connect with potential and existing clients, partners, and influencers.

Participation in these events allows Essent to actively showcase its products and services, fostering deeper engagement and understanding of its value proposition. For instance, in 2024, Essent actively participated in major mortgage industry events like the MBA Annual Convention, engaging with thousands of mortgage professionals.

- Brand Visibility: Essent's presence at events like the Mortgage Bankers Association (MBA) Annual Convention increases its recognition among industry stakeholders.

- Networking Opportunities: These events facilitate direct interaction with potential clients, brokers, and lenders, fostering valuable business relationships.

- Lead Generation: Engaging with attendees at trade shows and webinars provides a direct pipeline for new business leads.

- Market Insights: Conferences offer a platform to gather competitive intelligence and understand evolving market trends, informing Essent's strategic direction.

Marketing and Thought Leadership Content

Essent leverages its website and investor presentations as key marketing channels to disseminate information and attract stakeholders. These platforms are crucial for educating the market about Essent's offerings and value. For instance, in 2024, Essent's investor relations section likely saw significant traffic as the company navigated market dynamics, aiming to clearly articulate its strategic direction and financial performance.

Thought leadership content, such as market insights and white papers, further solidifies Essent's position as an industry expert. This content showcases the company's deep understanding of the market and its unique value propositions. By providing valuable analysis and forward-looking perspectives, Essent aims to attract and engage a broader audience, including potential customers and partners.

- Website Traffic: Essent's website serves as a central hub for information, with analytics likely showing increased engagement around key announcements in 2024.

- Investor Presentations: These are critical for communicating financial health and strategic outlook to investors, a key audience for Essent.

- Thought Leadership: Publications like market insights and white papers demonstrate Essent's expertise, influencing market perception and attracting business.

- Market Education: Essent's content strategy focuses on educating potential customers about the benefits and applications of its products or services.

Essent utilizes a multi-faceted approach to reach its customer base, blending direct engagement with robust digital and partnership channels. This strategy ensures broad market penetration and efficient service delivery for its private mortgage insurance (PMI) products.

The company's direct sales force actively cultivates relationships with mortgage lenders, enabling tailored presentations and contract negotiations. In 2024, a significant portion of Essent's new business was attributed to these direct sales efforts, highlighting their effectiveness in expanding market share.

Digital platforms, including Essent Online MI, are vital for lenders, streamlining the quoting, ordering, and management of mortgage insurance. Integrations with leading loan origination systems (LOS) further enhance this efficiency. For example, integrations with platforms like PMI Rate Pro allow lenders to order MI directly within their existing workflows, a feature that contributed to an estimated 15% reduction in processing time for MI-related tasks in 2024 for users.

Essent also actively participates in industry events, such as the MBA Annual Convention, to boost brand visibility and generate leads. These engagements provide valuable networking opportunities and market insights, crucial for staying competitive in the dynamic mortgage sector.

Customer Segments

Mortgage lenders, including banks, credit unions, and non-bank originators, represent Essent's core customer base. These institutions are actively originating single-family mortgage loans and are looking for ways to manage the credit risk associated with these assets.

Essent's value proposition directly addresses the needs of these lenders by providing private mortgage insurance (PMI). This insurance is crucial for enabling loans with lower down payments, which are often required by borrowers and are essential for meeting regulatory mandates and conforming to Government-Sponsored Enterprise (GSE) guidelines.

In 2024, the U.S. mortgage origination market continued to be shaped by interest rate dynamics. While overall origination volumes may have fluctuated, the demand for risk mitigation solutions like PMI remained robust, particularly for lenders focused on expanding access to homeownership through lower down payment options.

Essent prioritizes cultivating and maintaining strong, collaborative relationships with the leading mortgage lenders in the market. This strategic focus ensures a consistent demand for their PMI products and allows Essent to stay closely aligned with the evolving needs of the mortgage industry.

Mortgage investors, particularly Government-Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac, are crucial to Essent's business model. These entities require credit enhancement on mortgage-backed securities, which directly fuels the demand for private mortgage insurance (PMI) from lenders. In 2024, the GSEs continued to be significant players in the mortgage market, and their purchasing guidelines heavily influence lender adoption of PMI.

Essent also actively engages with institutional investors through its reinsurance activities. This allows Essent to manage its risk exposure while providing opportunities for these investors to participate in the mortgage insurance market. These transactions are vital for capital management and expanding Essent's reach within the broader financial ecosystem.

Mortgage servicers are key partners for Essent, managing the day-to-day administration of loans we insure. They collect borrower payments, handle escrow accounts, and manage any loan defaults. While they don't purchase our Private Mortgage Insurance (PMI) directly, their efficient operations are vital for the successful lifecycle of an insured mortgage.

Essent collaborates closely with mortgage servicers, particularly during the claims process when a loan becomes delinquent or defaults. This partnership ensures a smooth experience for homeowners and timely resolution for all parties involved. In 2024, the mortgage servicing industry continued to navigate varying interest rate environments, impacting loan volumes and servicing revenues.

Homebuyers (Indirect Beneficiaries)

Homebuyers are a crucial, albeit indirect, customer segment for Essent. By providing private mortgage insurance (PMI), Essent significantly lowers the barrier to entry for homeownership, particularly for those who cannot afford a substantial down payment. This service directly facilitates access to mortgage financing, making the dream of owning a home attainable for a broader range of individuals.

Essent's impact on this segment is substantial. In 2024 alone, Essent's PMI solutions were instrumental in enabling approximately 171,000 borrowers to successfully purchase a home. This figure underscores Essent's vital role in the housing market, directly contributing to increased homeownership rates.

- Homebuyers gain access to mortgages with reduced down payment requirements.

- Essent's PMI removes a significant obstacle to achieving homeownership.

- In 2024, Essent supported around 171,000 home purchases through its services.

Financial Institutions Seeking Risk Management Solutions

Essent's deep understanding of credit risk extends beyond its core mortgage insurance business, offering valuable solutions to other financial institutions. This segment targets entities looking to enhance their own risk management frameworks, potentially through specialized advisory services or tailored reinsurance arrangements to mitigate credit exposures.

The market for risk management solutions within the financial sector is substantial and growing. For instance, in 2024, the global financial risk management software market was projected to reach over $45 billion, indicating a strong demand for such expertise. Essent is well-positioned to capture a portion of this market by leveraging its analytical capabilities and proven track record.

- Diversification Opportunity: Essent can expand its revenue streams by offering these specialized risk management services to a broader financial client base.

- Reinsurance Partnerships: Collaborating with other insurers to provide reinsurance on specific credit-related portfolios offers a scalable growth avenue.

- Data Analytics Services: Monetizing Essent's proprietary risk modeling and data analytics tools can create a new service offering for financial institutions.

- Advisory and Consulting: Providing expert guidance on credit risk assessment and mitigation strategies can build strong client relationships and generate fee-based income.

Essent's customer segments are primarily mortgage lenders who utilize its private mortgage insurance (PMI) to mitigate credit risk on loans with lower down payments. This directly supports Essent's value proposition by enabling broader access to homeownership. In 2024, Essent's PMI solutions facilitated approximately 171,000 home purchases, highlighting its significant impact on the housing market and its core customer base of lenders seeking to serve more borrowers.

Cost Structure

The most substantial expense for Essent revolves around paying out claims when mortgage loans default and covering the costs associated with adjusting those losses. These outlays are intrinsically linked to how well the loans Essent insures perform and the broader economic climate.

In the second quarter of 2025, Essent reported a provision for losses and loss adjustment expenses amounting to $17.1 million. This figure directly reflects the financial impact of mortgage defaults and the expenses incurred in managing them.

Essent's underwriting and operational costs are the backbone of its service delivery, encompassing everything from evaluating mortgage applications to the day-to-day running of the business. These expenses include the salaries of skilled underwriting teams, the investment in robust technology infrastructure needed for policy assessment and management, and general office overhead. For instance, in the second quarter of 2025, Essent reported an expense ratio of 15.5%, highlighting the importance of operational efficiency in keeping these costs in check and ensuring profitability.

Sales and marketing expenses are crucial for Essent, encompassing costs like sales team salaries and commissions, advertising campaigns, and presence at industry trade shows. These investments are vital for securing new insurance policies and keeping existing customers engaged, directly impacting Essent's revenue generation and market position.

In 2024, the insurance industry saw significant marketing spend. For instance, major insurers allocated substantial budgets to digital marketing, with some reporting customer acquisition costs ranging from $50 to $200 per policy, highlighting the direct financial impact of these sales and marketing efforts on Essent's cost structure.

Reinsurance Premiums and Ceding Commissions

Essent incurs significant costs through its reinsurance arrangements. Paying reinsurance premiums to transfer risk is a direct expense that impacts profitability. For instance, in 2024, the company managed its risk exposure through various reinsurance structures, with premiums being a key cost driver.

While reinsurance premiums represent an outflow, Essent can offset some of these costs through ceding commissions. These commissions are effectively a reimbursement from the reinsurer, acknowledging the business ceded. The structure of these commissions is a crucial element in managing the net cost of reinsurance.

- Reinsurance Premiums: Direct costs incurred to transfer risk to reinsurers.

- Ceding Commissions: Payments received from reinsurers to offset reinsurance costs.

- January 1, 2025 Quota Share Increase: Essent is increasing its quota share with Essent Reinsurance Ltd. to 50%, impacting future premium and commission flows.

Regulatory Compliance and Capital Costs

Essent incurs substantial costs to maintain compliance with a complex web of state and federal insurance regulations. These expenses encompass legal fees, dedicated compliance staff, and the implementation of robust reporting systems. For instance, in 2024, the insurance industry as a whole saw compliance costs rise, driven by evolving data privacy laws and capital adequacy requirements.

A significant component of Essent's cost structure is the capital it must hold to back its insurance policies. This capital is not just a regulatory mandate but also an inherent financial cost, as it represents funds that could otherwise be invested for higher returns. The cost of capital is directly tied to the amount of insurance-in-force and the associated risk profile.

- Regulatory Compliance Expenses: Costs associated with legal counsel, compliance officers, and technology for regulatory adherence.

- Capital Requirements: The financial cost of maintaining sufficient capital reserves to meet solvency standards and policy obligations.

- Administrative Overhead: General administrative costs supporting compliance and capital management functions.

- Risk Management Systems: Investment in systems and personnel to monitor and manage insurance risk, impacting capital needs.

Essent's cost structure is primarily driven by claims and loss adjustment expenses, reflecting the inherent risk in mortgage insurance. Underwriting and operational costs, including salaries and technology, are also significant. Furthermore, sales and marketing efforts, reinsurance premiums, and regulatory compliance contribute to the overall expense base.

| Cost Category | 2024 Data/Impact | 2025 Data/Impact |

|---|---|---|

| Claims & Loss Adjustment Expenses | Directly tied to mortgage defaults and economic climate. | Q2 2025 provision for losses and loss adjustment expenses: $17.1 million. |

| Underwriting & Operational Costs | Expense ratio in Q2 2025 was 15.5%. | Includes salaries, technology investment, and overhead. |

| Sales & Marketing | Industry saw significant spend in 2024, with customer acquisition costs between $50-$200 per policy for major insurers. | Vital for new policy acquisition and customer retention. |

| Reinsurance | Premiums are a key cost driver for risk transfer. | Increasing quota share with Essent Reinsurance Ltd. to 50% from January 1, 2025. |

| Regulatory Compliance & Capital | Industry compliance costs rose in 2024. | Costs associated with legal, staff, and systems for adherence; cost of capital for reserves. |

Revenue Streams

Essent's core revenue generation comes from the premiums collected on its private mortgage insurance policies. These payments are generally made by the borrower, though sometimes the lender handles them. The amount collected directly correlates with the number of active policies and how long they remain in force.

For the second quarter of 2025, Essent reported net premiums earned totaling $248.8 million. This figure highlights the significant volume of business Essent is conducting in the mortgage insurance market.

Essent's business model heavily relies on net investment income, which is derived from investing its substantial capital reserves and the float from unearned premiums. This income stream is a significant driver of the company's profitability, particularly in an environment with elevated interest rates.

For the first half of 2025, Essent reported a robust 9% increase in net investment income, reaching $117.5 million. This growth highlights the effectiveness of their investment strategies and the positive impact of prevailing market conditions on their financial performance.

Essent generates income through fees for mortgage-related services, such as risk management and analytics, offered to lenders. These ancillary services, while smaller contributors than premium income, are crucial for diversifying Essent's revenue streams and reducing reliance on any single source.

In 2024, the mortgage industry saw continued demand for sophisticated risk assessment tools, a sector where Essent actively participates. The company's expansion into title insurance further broadens its service offerings and revenue potential within the housing finance ecosystem.

Reinsurance Income (from third-party business)

Essent's reinsurance subsidiary, Essent Reinsurance Ltd., plays a crucial role in its revenue generation by underwriting risks for third-party clients. This segment allows Essent to expand its reach beyond its primary mortgage insurance business, tapping into a wider array of insurance markets.

This diversification not only broadens Essent's exposure to different risk pools but also creates a valuable additional revenue stream. By providing reinsurance coverage on various risks, Essent Re contributes directly to the company's overall financial performance.

For instance, in the second quarter of 2025, Essent Re reported earning $13.6 million in premiums specifically from this third-party business. This demonstrates the tangible financial impact of this revenue stream.

- Premium Income: Essent Reinsurance Ltd. generates revenue by collecting premiums from third-party clients for reinsurance coverage.

- Broader Risk Access: This business line enables Essent to access and underwrite a wider mortgage credit universe and other insurance risks.

- Additional Revenue: The third-party reinsurance business provides a significant supplementary income source for the company.

- Q2 2025 Performance: Essent Re recorded $13.6 million in premiums from third-party business in the second quarter of 2025.

Title Insurance and Settlement Services Revenue

Essent has broadened its revenue base by incorporating title insurance and settlement services. This strategic move, solidified with an acquisition in July 2023, introduces a transactional revenue stream directly tied to property ownership changes.

This segment is proving to be a valuable contributor, with Essent reporting $14.9 million in net premiums from its title insurance operations in the second quarter of 2025. This demonstrates the segment's immediate impact on the company's financial performance.

- Title Insurance and Settlement Services: A newly acquired revenue stream contributing to Essent's overall income.

- Transactional Nature: Revenue is generated from real estate transactions, specifically property ownership transfers.

- Recent Performance: In Q2 2025, this segment generated $14.9 million in net premiums.

Essent's primary revenue driver is the premiums collected from its private mortgage insurance policies. This core business is supplemented by significant net investment income generated from its capital reserves, especially in a favorable interest rate environment. The company also diversifies its income through fees for mortgage-related services and its reinsurance subsidiary, Essent Reinsurance Ltd., which underwrites risks for third-party clients.

The expansion into title insurance and settlement services, following a July 2023 acquisition, adds a transactional revenue stream tied to property transfers. This strategic move broadens Essent's financial footprint within the housing market.

| Revenue Stream | Q2 2025 (Millions USD) | H1 2025 (Millions USD) | 2024 (Estimated/Actual) |

|---|---|---|---|

| Net Premiums Earned (Mortgage Insurance) | 248.8 | N/A | N/A |

| Net Investment Income | N/A | 117.5 | N/A |

| Essent Re (Third-Party Premiums) | 13.6 | N/A | N/A |

| Title Insurance Premiums | 14.9 | N/A | N/A |

Business Model Canvas Data Sources

The Business Model Canvas is built using financial statements, customer feedback, and competitive analysis. These sources ensure each canvas block is filled with accurate, up-to-date information.